Cashplus and Starling are both banks with accounts managed online.

Not keen on high street banks? A viable alternative is a business account at Cashplus or Starling Bank.

How are these business bank accounts different? Which is the best one?

To answer the questions, we compare account features, pricing, banking apps and service.

|

|

|

|---|---|---|

| Link | ||

| Service |

Bank account with Debit Mastercard |

Bank account with Prepaid Mastercard |

| Fixed ongoing fee | Free, extra features at cost | £69/yr. |

| Eligibility | UK-registered/-based companies & sole traders | UK-registered/-based companies & sole traders |

| Sign-up | Entirely through app | Through app or web |

| UK payments |

Bank transfers, Direct Debits, standing orders | Bank transfers, Direct Debits, standing orders |

| International transfers | Through workaround | |

| IBAN | ||

| EUR & USD accounts | ||

| Business loans | ||

| Business overdrafts | ||

| Team access | With co-directors |

|

|

|---|---|

| Service | |

| Bank account with Debit Mastercard |

Bank account with Prepaid Mastercard |

| Fixed ongoing fee | |

| Free | £69/yr. |

| Eligibility | |

| UK-registered/-based companies & sole traders | UK-registered/-based companies & sole traders |

| Sign-up | |

| Entirely through app | Through app or web |

| UK payments | |

| Bank transfers, Direct Debits, standing orders | Bank transfers, Direct Debits, standing orders |

| International transfers | |

| Through workaround | |

| IBAN | |

| EUR & USD accounts | |

| Business loans | |

| Business overdrafts | |

| Team access | |

| With co-directors | |

|

|

Main features of Starling vs Cashplus Bank

Starling Bank has since its beginning in 2014 steadily grown in popularity among the new generation of bankers who prefer online accounts. Then again, Cashplus was founded in 2005 with a wealth more experience on the credit management side. In 2021, Cashplus became Cashplus Bank with a full bank licence as well.

So how do their business accounts differ now that they are both business bank accounts?

Signing up – Applying for a business account is done easily through a web form online (in Cashplus’ case) or mobile app (in Starling’s case). There are not too many questions to answer, but you do need a photo ID and possibly proof of your address.

Starling Bank performs a soft credit check at sign-up, but Cashplus does not do any credit checks, which is pretty attractive for those with a poor (or no) credit history.

However, Cashplus applicants cannot use their account for payments before they receive a card (within 3-5 working days).

Image: Cashplus Bank

Cashplus banking app looks traditional.

With Starling, you can use the account as soon as it is verified, usually within a day from sign-up.

Bank account managed online – Both banks give you a UK bank account number and sort code, but only Starling provides a unique IBAN for international money transfers.

Starling actually has two business accounts: one for sole traders (Sole trader account) and another for companies (Business account), whereas Cashplus just calls it a Business account regardless of the type of user. Starling’s Sole trader account requires you to create a Personal account first, but that’s not the case with their company account.

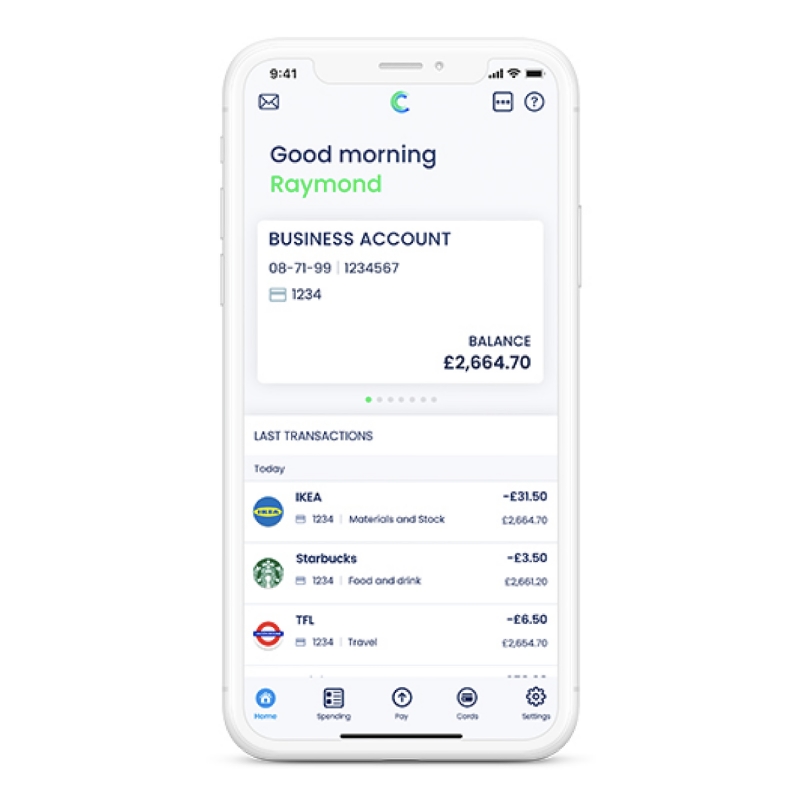

Image: Starling Bank

Starling banking app looks modern.

The accounts can be managed through a mobile app or online banking portal through the website of either bank.

Cashplus does not yet have a way to send money abroad, but there is an option to receive money from abroad through a central account managed by Cashplus. With Starling, you can both send and receive money internationally directly from your account in the app.

Up to £85,000 of your money is protected by the Financial Services Compensation Scheme (FSCS) at Cashplus and Starling – same as with other banks.

Cash and cheques – Cash can be deposited into any of the accounts, and withdrawn from cashpoints. But only Starling lets you deposit cheques. This is done very easily, in fact, through the app.

Euro and US dollar accounts – In direct competition, Starling and Cashplus both provide separate accounts for euro and USD balances. This allows you to avoid currency conversion fees when spending and receiving money in these currencies.

Payment cards – The first Business Mastercard is provided free of charge, but Starling’s is better since it’s a Debit Mastercard. Cashplus only has a Prepaid Mastercard, which is sometimes not accepted online, e.g. with Google Ads, or in certain physical stores.

You can add Starling Bank’s Business Mastercard to your mobile wallet on iPhone or Android, but Cashplus does not have that option.

If you get a Euro or USD account at Starling, the same Business Debit Mastercard is used. That is, the card will automatically spend the euros or dollars with your main business card, as long as this setting is switched on in the app.

At Cashplus, you get a separate card for the Euro and USD accounts for when you or your team go abroad.

Starling Bank Business cards versus Cashplus Business cards.

Loans and overdrafts – Cashplus has long been a provider of credit cards and overdrafts with a limit of up to £2,000, with a cash advance option through its partner Liberis Finance. At the moment, however, only the overdraft option is available.

Starling normally offers a business overdraft and business loans, but they have been on hold since the pandemic started. Instead, you can apply for the latest government-backed Covid-19 support schemes through Starling Bank (Cashplus does not offer this). This currently includes the Recovery Loan Scheme (RLS). The deadline for the Coronavirus Business Interruption Loan Scheme (CBILS) has passed.

Costs and fees

No account registration fee applies when you sign up for a Starling or Cashplus Business account.

The main Business and Sole Trader accounts at Starling have no monthly or annual fees either. At Cashplus, however, you do need to pay an annual fee of £69 upfront, but then there are no monthly fees.

|

|

|

|---|---|---|

| Account creation | Free | Free |

| Account fee | Business account: Free Sole trader account: Free Business Toolkit: £7/mo. Euro account: £2/mo. USD account: £5/mo. |

£69/year (~£5.75/mo.) |

| Debit card | First one free, £5 per replacement | First one free, £5.95 per replacement |

| UK payments and bank transfers | Free | First 3/mo. free, then 99p each |

| Cash withdrawals | Free in UK & abroad | £2 each in UK £3 each abroad |

| Cash deposits | 0.3% (min. £3) of deposit amount at Post Office | 0.3% (min. £2) of deposit amount at Post Office |

| Cheque deposits | Free via app (2 working days’ processing) | n/a |

| Registration |

|

|

|---|---|

| Account creation | |

| Free | Free |

| Monthly fee | |

| Business account: Free Sole trader account: Free Business Toolkit: £7 Euro account: £2 USD account: £5 |

£69/year (~£5.75/mo.) |

| Debit card | |

| First one free, £5 per replacement | First one free, £5.95 per replacement |

| UK payments and bank transfers | |

| Free | First 3/mo. free, then 99p each |

| Cash withdrawals | |

| Free in UK & abroad | £2 each in UK £3 each abroad |

| Cash deposits | |

| 0.3% (min. £3) of deposit amount at Post Office | 0.3% (min. £2) of deposit amount at Post Office |

| Cheque deposits | |

| Free via app (2 working days’ processing) | n/a |

| Registration | |

Starling’s main bank account (whether it’s a Business or Sole trader account ) has no monthly fees. You can add a module called Business Toolkit for £7 per month, which is a set of additional features mostly relevant for freelancers.

At Cashplus, you don’t pay a thing to open a Euro or US dollar account, and monthly fees do not apply to them either. They do cost at Starling, though: £2 monthly for the Euro account and £5 monthly for the USD account.

Domestic payments like Faster Payments, standing orders, Direct Debits and transfers between bank accounts in the UK are free indefinitely with Starling. Cashplus does not charge for the first three of such payments a month, but thereafter it’s £0.99 per UK payment. This does not apply to purchasing things with the Mastercard, though – GBP card transactions have no fees for neither bank.

Depositing cash in a UK Post Office has the same fee, 0.3% of the total deposit amount, though Starling requires a minimum of £3 where Cashplus only requires £2 as the minimum cash deposit fee.

Cash withdrawals are totally free with a Starling account, in the UK and abroad. You can’t say that about Cashplus – in the UK, cash withdrawals are £2 and abroad, they are £3 plus a currency conversion fee of 2.99% if a different currency was taken out.

International transfers and use abroad

Out of the two, Starling’s business account is definitely better for international payments. You get your own IBAN and BIC for receiving money from abroad, and there is only a 0.4% currency fee on top of the real exchange rate for any payments, transfers or withdrawals where a conversion takes place.

The only exception is when someone sends euros to your main business (GBP) account – then a 2% fee gets added to the exchange rate. You can get around this by subscribing to the Euro account for £2, receive euros in there, and then transfer that money to your GBP account for a 0.4% fee.

|

|

|

|---|---|---|

| Cash withdrawal in other currency | Free | £3 per withdrawal abroad + 2.99% if in other currency than your card’s |

| Inbound international transfers | Euros to GBP account: 2% on top of exchange rate Payments received in same currency as account: Free |

£15 per incoming transfer through shared account |

| Outbound international transfers | 0.4% currency conversion + £5.50 SWIFT fee + £0-£0.90 local network fee |

n/a |

| Card payments in foreign currency | Free | 2.99% fee |

| Exchange rate | Real exchange rate | Mastercard wholesale rate |

|

|

|---|---|

| Cash withdrawals in other currency | |

| Free | £3 per withdrawal abroad + 2.99% if in other currency than your card’s |

| Inbound international transfers | |

| Euros to GBP account: 2% on top of exchange rate Payments received in same currency as account: Free |

£15 per incoming transfer through shared account |

| Outbound international transfers | |

| 0.4% currency conversion + £5.50 SWIFT fee + £0-£0.90 local network fee |

n/a |

| Card payments in foreign currency | |

| Free | 2.99% fee |

| Exchange rate | |

| Real exchange rate | Mastercard wholesale rate |

Cashplus is the most limiting business account for international payments. For a start, the currency conversion fee is 2.99% for any payments in a foreign currency.

Secondly, account holders do not get their own IBAN. Instead, you can receive transfers from abroad in a shared, central account managed by NatWest for £15 per incoming transfer (no currency conversion fee applies here). Once received, Cashplus will initiate the payment to your Cashplus GBP account.

If you receive euros or US dollars, however, you can just add those accounts for free and receive payments there. Just beware that a currency conversion fee of 2.99% applies when transferring between your currency accounts, whereas Starling only charges 0.4% on top of the real exchange rate for that.

Thirdly, it is not possible to send money abroad from your Cashplus Business account. From the Starling business account, however, you can transfer money to up to 38 countries in 20 different currencies right from the banking app. This costs £5.50 (SWIFT fee), plus a small local network fee where applicable, and 0.4% on top of the exchange rate.

Compare other options: Best online business accounts in the UK

Which has the best app features?

Cashplus has offered a banking app for over a decade now, so it is definitely the senior option. That said, Starling became a bank sooner and has from the start fine-tuned their products thoroughly – the app included.

The Cashplus and Starling apps both work on Android, iPhone and iPad. You can manage all the main account features directly from the apps, but a web portal is available for those who prefer banking on a computer.

How do the business banking features differ?

Multi-user access – Only co-directors of your company can access your Starling Business account apart from the business owner. Cashplus, on the other hand, does not allow users other than the business owner to manage the account. You can distribute expense cards to staff members, but they won’t have access to the account personally.

Payments and spending – Cashplus and Starling let you categorise transactions for an easier overview and turn on push notifications to monitor account activities.

Cashplus’ ‘Spending Insights’ lets you monitor in-person payments in case you need to track expense cards. In the Starling Bank app, you get a prettier overview of transactions and incoming payments through a visually pleasing pie chart (Cashplus has a more basic-looking overview).

Put money aside for goals – Starling has ‘spaces’, a section in the app that lets you put money into savings pots for different goals. The money you transfer into these pots is not shown in the main account balance, but money can be moved back to the main balance any time.

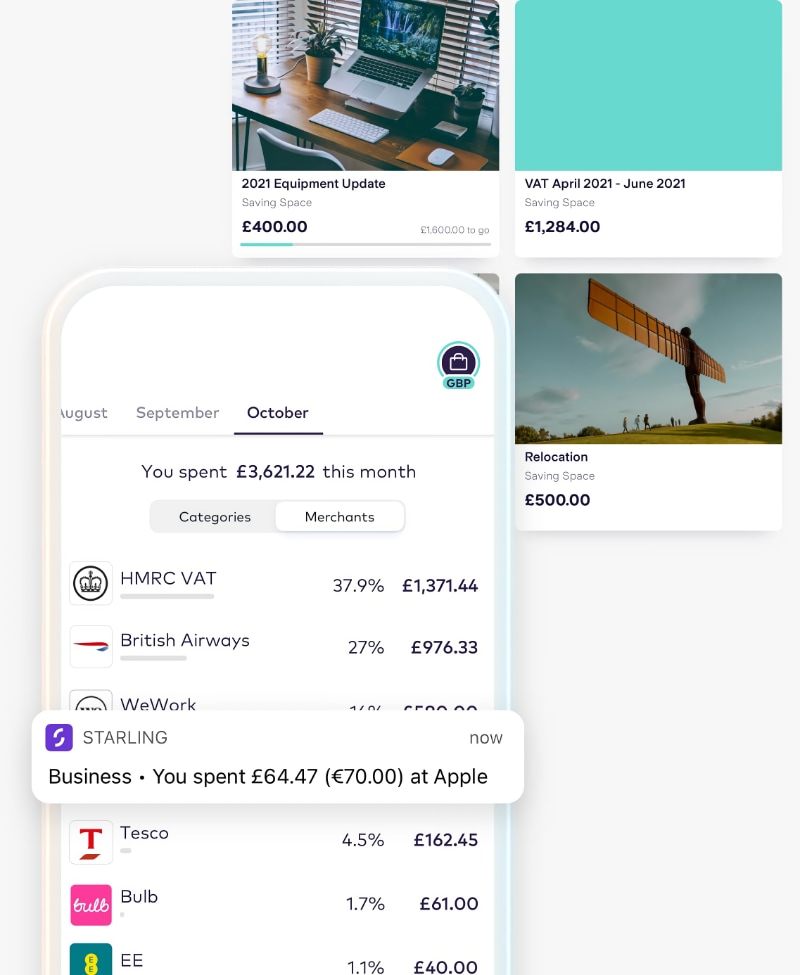

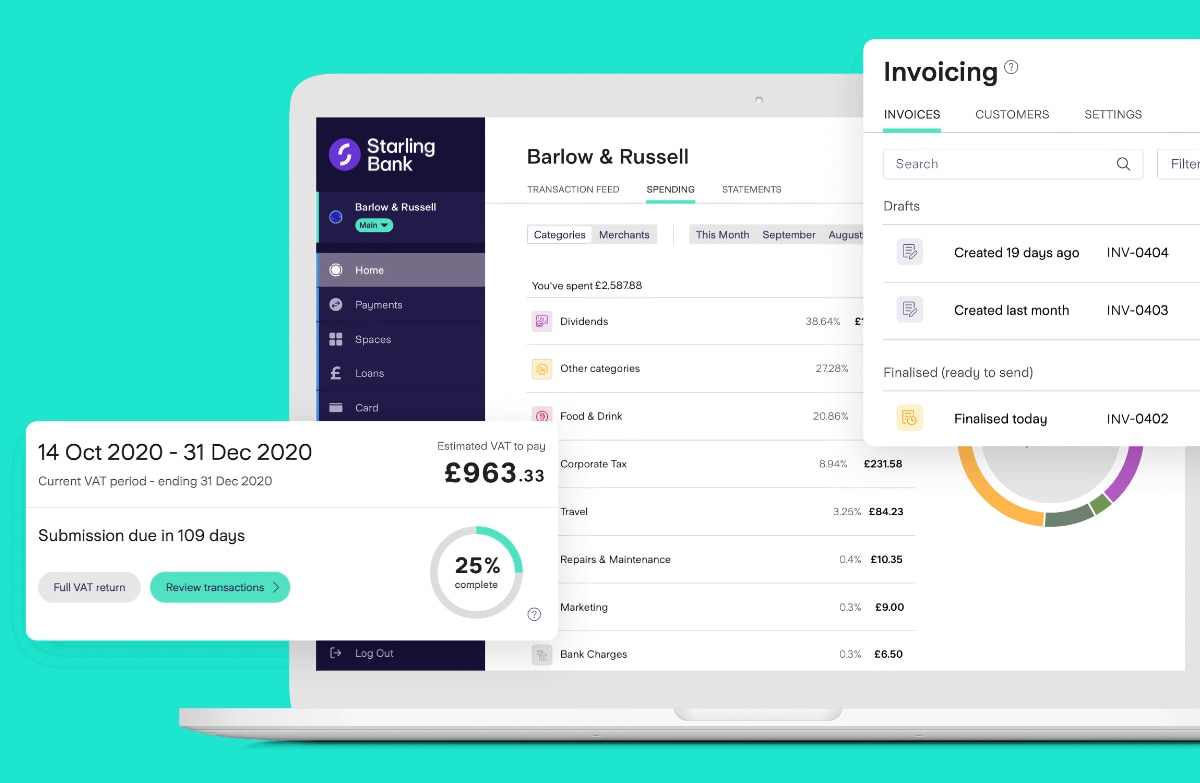

Image: Starling Bank

Monitor spending and save money into pots in the Starling Bank app.

We’ve found this a genuinely valuable feature for managing money. Cashplus does not have such a savings feature.

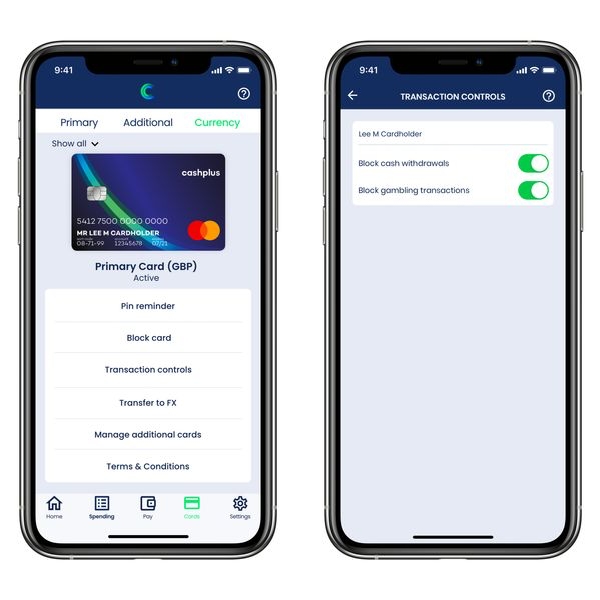

Card controls – Both apps allow you to restrict, block or order new cards. Cashplus lets you order up to 20 extra Cashplus Business cards for staff – something Starling does not allow. PINs can also be viewed in both apps, if you forget it.

Cashplus and Starling both allow you to block gambling transactions and cash withdrawals, but Starling has more controls, such as blocking online or mobile wallet payments. You can also unblock your Starling Business PIN directly in the app, should it be blocked after failed attempts to enter the PIN.

Image: Cashplus Bank

Cashplus Business card controls.

Accounting and invoicing – Cashplus can integrate with “most major accountancy software providers” – the problem is, we don’t know which providers because they are not listed on the Cashplus website. Starling Bank takes a more transparent approach by stating they integrate with FreeAgent, QuickBooks and Xero.

No matter the bank, you can just export bank statements to a PDF or CSV file.

Cashplus does not offer any invoicing features, but Starling does through its add-on module Business Toolkit. While on this subscription, you can send and manage invoices through the Starling web portal only.

Other bookkeeping features on the Business Toolkit subscription include VAT records and Making Tax Digital submissions, bills management, sole trader tax estimates and accounting to-do lists. Cashplus can only do these things via external accounting software that can be connected.

Expense management – In both banking apps, you can take pictures of expense receipts and attach them to transactions. With Starling’s Business Toolkit subscription, transactions would automatically go into suitable expense categories, to help you sort what’s an allowed expense vs. non-expense.

Image: Starling Bank

Starling Business Toolkit is an add-on subscription for web-based bookkeeping features.

What do customers say about the banks?

In terms of popularity, Starling Bank takes the lead. It has won awards including ‘Britain’s Best Business Banking Provider 2020′ and fares highly in independent customer surveys of UK banks. Cashplus hasn’t got the same customer approval, but some people do want a business account with a credit card option such as Cashplus’.

Starling customer support can be contacted by chat, email or telephone 24/7. Cashplus, on the other hand, is only available by phone on working days between 8am-8pm and Saturdays between 8am-4pm – so not on Sundays or evenings.

Customer complaints about Cashplus are about slow or unhelpful responses when contacted for support. We have also seen a lot of reports about the Cashplus app which does not have that many features and can be buggy. Very slow money transfers are also reported, and sudden account holds.

Complaints about Starling are more varied, which is normally a good sign that there are no major issues. Some people have not been accepted for a Sole trader account, without getting an explanation as to why. Others have had funds frozen or got a poor customer service response, and there are users who request features not yet offered by Starling (such as credit cards or tweaks to the app).

Cashplus or Starling – which is better for businesses?

From our research and own experience, Starling Bank comes out as the best business bank account. It simply has more features, lower costs and better options for international payments. You can also apply for government-backed Covid schemes through Starling, while Cashplus users cannot.

Cashplus can work for those with a poor credit history, since there is no credit check as sign-up. The business credit card option is also unique for Cashplus – you don’t really get that option from other online accounts. Additional expense cards for staff is another extra that Starling Bank does not offer.

If you want to test out the accounts, you can only do that with Starling since it is free to sign up and use the main business account. Cashplus makes the decision harder by charging £69 upfront for an annual subscription.

Although Cashplus has been around for years longer, it has not been as popular or advanced in banking features as Starling Bank. Despite the annual charge, you still have to pay fees for basic things like electronic UK transfers beyond the small free quota on the Cashplus Business plan. Most of Starling’s basic features are free, and when there are fees, they are quite low or at least reasonable for what you get.