PayPal Business is an e-money account with a wide umbrella of payment features.

Not only does it allow sellers to accept payments in online shops, by links, email invoices, over the phone, even face-to-face – it also has the advantage of being a two-decades-old brand famous for its security and convenience. Buyers only need to log in with an email address and password to make a payment online, instead of entering card details on every checkout page.

Whereas individuals only need a PayPal Personal account to make payments, transfer money or sell casually (i.e. not for business), registered businesses, freelancers and self-employed users need to sign up for a PayPal Business account to use features related to their business.

Apart from international payments and money transfers, PayPal Business offers cash advances, a Debit Mastercard, seller and buyer protection and strict fraud protection measures.

eBay used to require a PayPal account to make and receive transactions, which had a huge impact on initial growth. PayPal has since expanded its reach to 377+ million active users – at least 24 million of these are Business accounts.

Fees and costs

Common to all PayPal Business services is the lack of contractual commitment and setup fee. It doesn’t cost anything to create a PayPal Business account, nor is there any charge for closing the account. The Business account and optional Mastercard have no monthly fees.

Of the payment tools, only the Virtual Terminal, advanced checkout solution (Website Payments Pro) and subscription payments have a monthly charge on top of transaction fees, while others only have pay-as-you-go fees.

| PayPal Business service | Monthly fee |

|---|---|

| Pay buttons integrated on website | None |

| Simple checkout on website (PayPal Checkout) | None |

| Email invoices | None |

| Payment links (PayPal.Me) | None |

| QR codes | None |

| Subscription payments | None |

| Customisable website checkout (Website Payments Pro) | £20/month |

| Virtual terminal | £20/month |

| PayPal Business service |

Monthly fee |

|---|---|

| Pay buttons integrated on website | None |

| Simple checkout on website (PayPal Checkout) | None |

| Email invoices | None |

| Payment links (PayPal.Me) | None |

| QR codes | None |

| Subscription payments | None |

| Customisable website checkout (Website Payments Pro) | £20/month |

| Virtual terminal | £20/month |

That being said, transaction costs vary a lot in complexity. Some of PayPal’s fees look deceptively simple, but a deep look at the fine print reveals different transaction fees depending on the merchant’s agreement with PayPal and the payment method. Let’s look at the features with no monthly fees first.

| PayPal Business services | Fees |

|---|---|

|

2.9% + 30p per transaction + 0.5%-2% cross-border fee applies to non-UK cards + 2.5% fee applies to currency conversion |

| Chargebacks | £14 each if not covered by Seller Protection |

| PayPal Business services |

Fees |

|---|---|

|

2.9% + 30p per transaction + 0.5%-2% cross-border fee applies to non-UK cards + 2.5% fee applies to currency conversion |

| Chargebacks | £14 each if not covered by Seller Protection |

Invoicing, PayPal.Me, subscriptions, pay buttons and PayPal Checkout have the same fees: 2.9% + 30p + currency conversion and cross-border fees where applicable. For any of these services, you can apply for custom fees (called “Advanced Credit and Debit Card Payments”) if your monthly turnover is over £50k.

PayPal QR code transactions have lower rates: 2% + 5p for amounts up to £10 and 1.5% + 10p for amounts above.

All these rates are for domestic cards in GBP currency only. Accepting other currencies incurs a currency conversion fee of 2.5% above the base exchange rate in addition to a 0.5%-2% cross-border fee (percentage depends on country of issue) if it’s a foreign card.

Virtual Terminal and Website Payments Pro

The Virtual Terminal and PayPal Website Payments Pro have the most complicated costs and are subject to an application, eligibility and approval by PayPal. In fact, you may apply for a different fee structure in relation to these services.

The Virtual Terminal on its own costs £20 per month (cancellable any time) with a standard transaction rate of 2.9% + 30p using domestic payment cards.

You can choose a Blended Pricing Fee Structure, where you pay 1.2% + 30p per domestic card payment via the Virtual Terminal, or an Interchange Plus Fee Structure that costs an interchange fee (0.2%-2% depending on card) + 1.2% + 30p per transaction.

The two latter fee structures only apply to Visa, Mastercard and Maestro payments, not American Express.

It is also required to complete the necessary PCI-DSS compliance paperwork and pay annual fees for that, which PayPal can help set up. PCI costs vary, as there are several ways to set this up.

Some of PayPal’s services look deceptively simple, but a deep look at the fine print reveals different transaction costs depending on the merchant’s agreement with PayPal and the payment method.

Website Payments Pro has similar fee structures. Firstly, the package has a monthly cost of £20 which includes a Virtual Terminal alongside premium online checkout and fraud prevention tools. The standard transaction rate is, by default, 2.9% + 30p for domestic payment cards.

The Blended Pricing Fee Structure for Pro is more costly, though: you pay 3.4% + 30p per domestic card payment. Furthermore, the Interchange Plus Fee Structure charges an interchange fee (0.2%-2% depending on card) + 2.9% + 30p per Pro transaction for domestic cards.

For both Virtual Terminal and Website Payment Pro, a cross-border fee applies only to the Standard and Blended Pricing fees, not the Interchange Plus fees. The 0.2%-2% interchange rate basically replaces the cross-border fee in the latter case.

Which other online payment systems have better fees?

Compare PayPal alternatives for online payments

Other PayPal Business fees

PayPal recently implemented a £9 inactivity fee that will be deducted from your PayPal account if you have not logged in or used PayPal in the past 12 months.

Businesses normally accepting transactions below £5 can apply for the Micropayments rate of 5-6% + 5p. The lower fixed fee will greatly reduce the overall proportion of the transaction fee.

It doesn’t cost anything to transfer (‘withdraw’) money from the PayPal Business account to your UK payment card or bank account associated with the PayPal account, though currency conversion fees apply if the transfer is from a non-GBP balance.

In all cases where your balance or received transaction is converted into a different currency, a currency conversion fee of 2.5% above the base exchange rate is applied.

For outgoing payments, the currency conversion fee is 3.75-4% (depending on recipient currency) above the base exchange rate.

The £14 chargeback fee can also be applied to any business transaction disputed by the buyer, unless covered by Seller Protection.

The only costs associated with the PayPal Business Debit Mastercard is a £1 cash withdrawal fee. It has no monthly fees. You also earn 0.5% cash back on every purchase made with the card, plus there are no foreign exchange fees on international payments in different currencies.

The PayPal Working Capital cash advance only costs a fixed fee deducted from future PayPal transactions alongside the advance repayments.

Account

PayPal Business is an online account that merchants can use for sending and receiving payments internationally as part of their business.

The account can store money (electronic money or ‘e-money’), which can be withdrawn to a bank account or credit/debit card that must be in your – or your company’s – name. Once attached, you can transfer money from one of your associated cards or bank accounts to the PayPal account.

Type of account

PayPal has alternative banking licences suitable for e-money institutions. It is not a full-fledged bank account, nor can it function as a standalone business bank account. Instead, it is a multi-functional payment platform for managing ecommerce, invoices and in-person payments under one roof.

Whichever way you transfer, this must be done manually in the PayPal account, so payouts from online and in-person transactions cannot clear in your bank account automatically.

Therefore, if you need payouts settle in your bank account directly, this is not the solution.

Unlike a traditional bank account, PayPal Business does not have an IBAN, so other people cannot transfer money from their bank account to your PayPal account.

However, others are able to transfer money from their own PayPal account to yours using just your email address. You can also transfer internationally to other PayPal users via just their email address.

What are the best alternatives?

Online business account comparison UK

PayPal Business debit card

The PayPal Business Debit Mastercard is a debit card that allows you to spend money straight from the online account. You are only allowed to use it for business expenses – it is not for personal use. The card can be used anywhere that accepts Mastercard, whether online or in stores.

Given the fact that transactions received in the PayPal account arrive almost immediately after a payment, you’ll be able to access money quickly, even over a weekend where traditional banks do not normally process payouts.

Credit: PayPal

The Mastercard-branded PayPal Business card is free.

If the PayPal account runs out of a positive balance, it will use money from your primary payment card or bank account when you spend money with the Debit Mastercard without having to top up this balance manually.

The card is an attractive option for those travelling or purchasing stock from abroad, because it does not charge cross-border or currency conversion fees, plus it avoids the hassle of choosing which card to use for the most favourable fees.Ecommerce

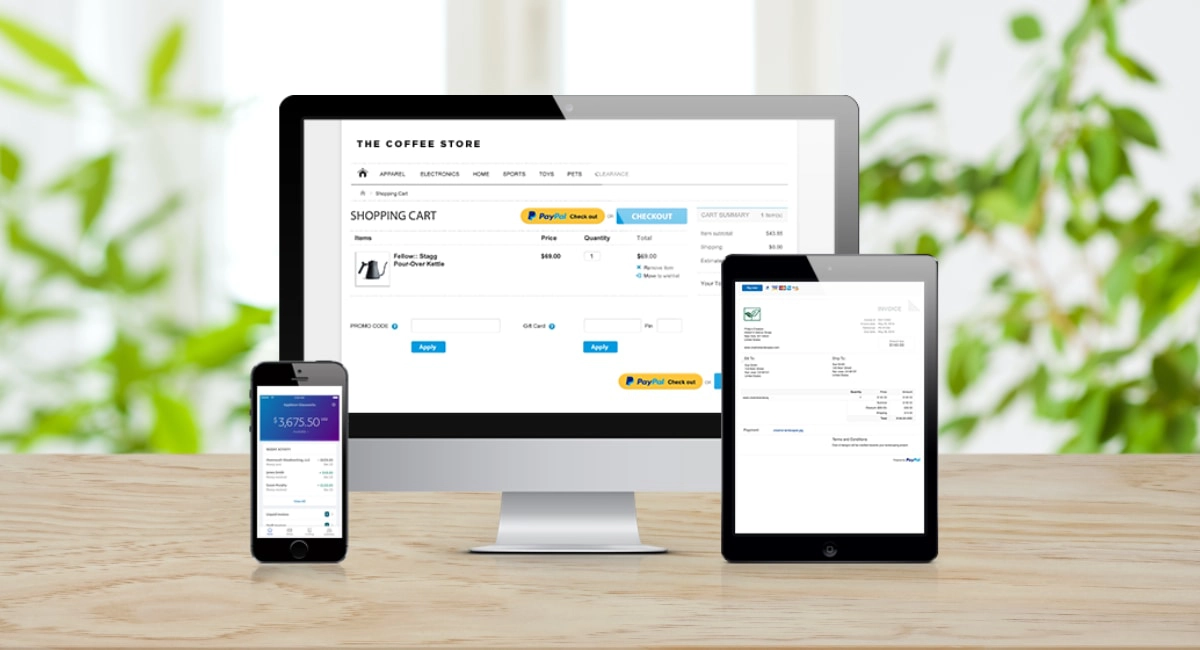

PayPal is known for online payments, so it is unsurprising to learn there are several types of ecommerce payments with PayPal, grouped into the following three solutions.

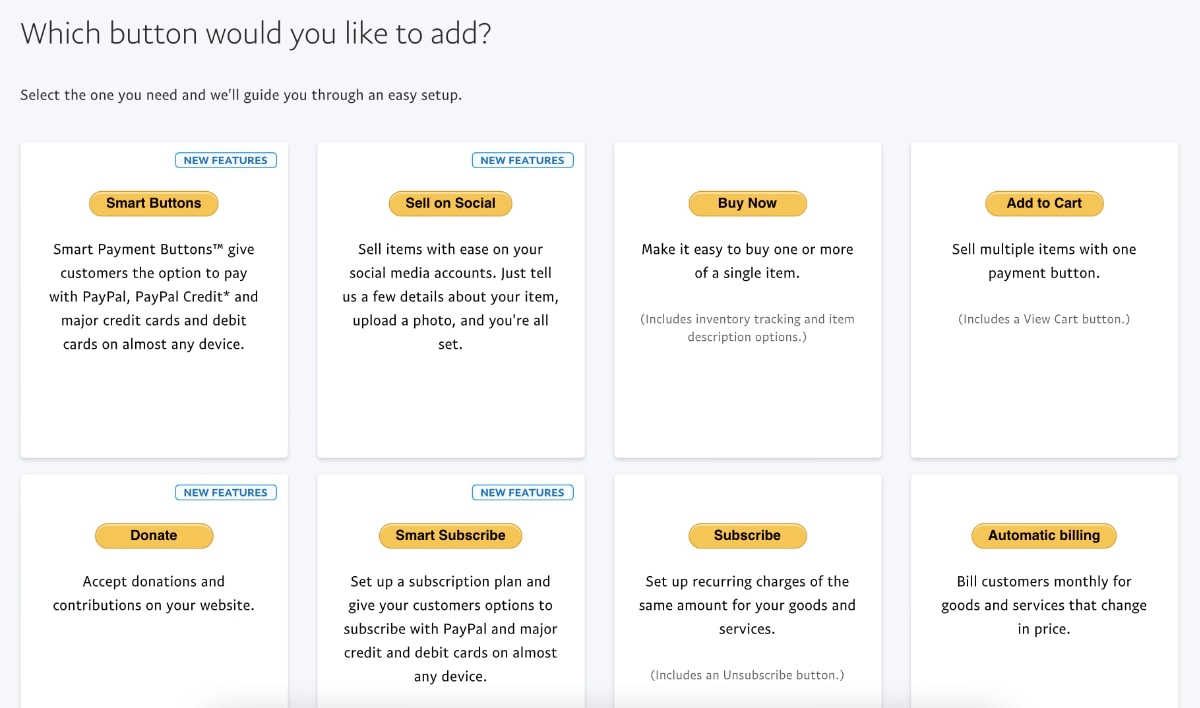

Most basic solution: PayPal Buttons

Customise PayPal Buttons from your PayPal account, copy the HTML code and add it to your online shop. Some website builders allow you to edit the buttons from their platform directly.

There are buttons for different purposes including one-off transactions, subscriptions, automatic billing, donations and “add to cart” buttons.

Payment flow: These integrated buttons, displayed at your online store checkout, will open a pop-up window where the customer can log in to their PayPal account to finalise the transaction. After a successful payment, the customer is led back to the order confirmation page on your website.

Selection of payment buttons that can be customised and pasted in to your online store.

Popular solution: PayPal Checkout

Create a faster, more seamless payment flow in your website by placing PayPal Checkout buttons directly on your product pages. You can also implement One Touch which enables customers to pay without logging in to their PayPal account or without filling in billing details at checkout.

Buyer and Seller Protection are applicable with PayPal Checkout, apart from being fully PCI-compliant.

Payment flow: Customers can choose to pay from the shopping cart page or directly from the product page. A secure pop-up window opens, where the customer reviews the payment details before confirming everything. PayPal will automatically pass the relevant shipping and contact information to your order management system so you can handle the rest.

Most advanced solution: Website Payments Pro (previously Web Payments Pro)

Package includes Express Checkout, Direct Payments API, Fraud Management Filters and Virtual Terminal. Optional add-ons include Fraud Protection, Advanced Fraud Management Filters and Recurring Payments Tool.

Customise your checkout experience with the help of a developer, or choose an ecommerce platform where Website Payments Pro is already integrated for easy customisation. Manage all your online transactions through any payment method in one PayPal account – even receive debit and credit card transactions within minutes directly in your PayPal account instead of your bank account.

Card security is also enhanced on this plan, where 3D Secure with Verified by Visa and Mastercard SecureCode are included alongside address verification checks and advanced fraud management filters.

Payment flow: Whether customers pick ‘credit or debit card’ or ‘PayPal’ at checkout, they can complete the payment on your website directly, not in a pop-up window. Pages, look and information can be personalised to suit your business.

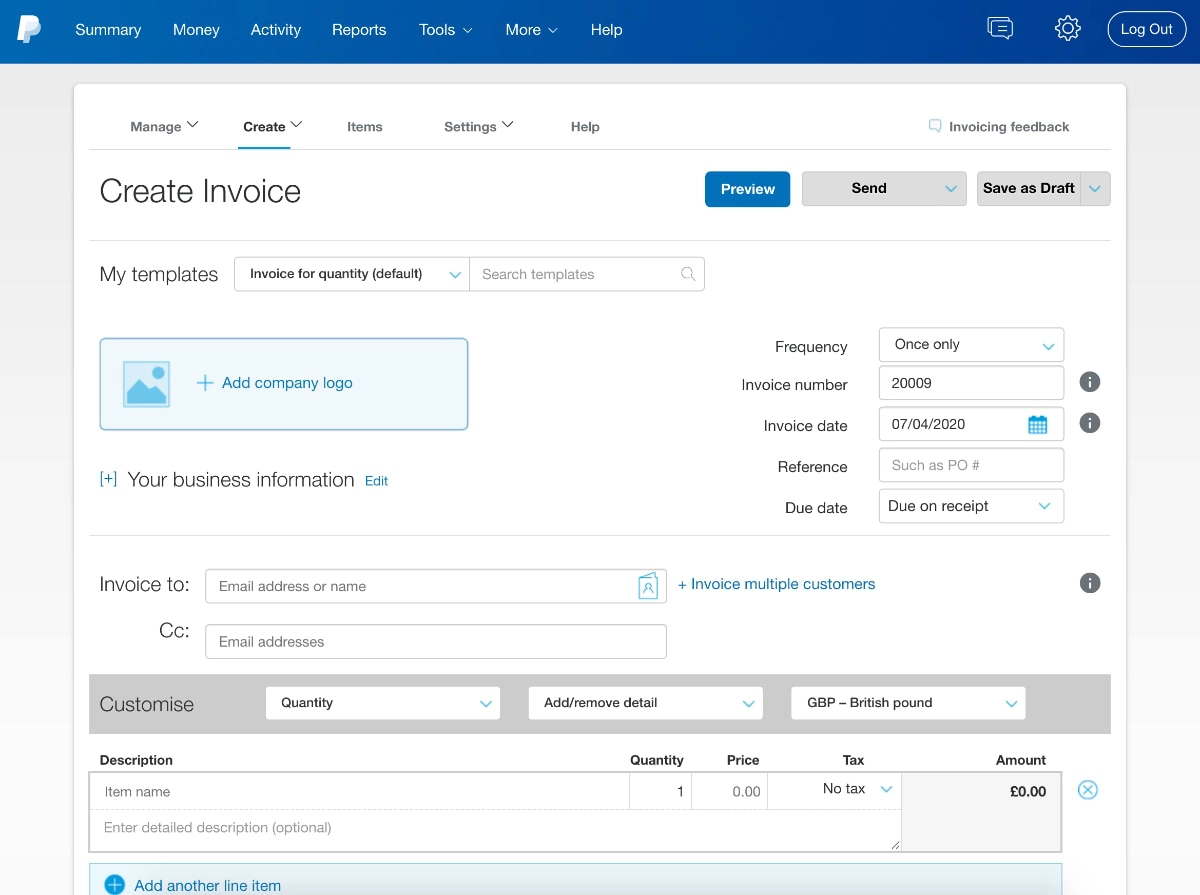

Email invoices

A popular payment method for freelance professionals is email invoicing. With a PayPal Business account, you can create and send personalised invoices over email, which the client can pay for through either their PayPal email address or by entering their credit card information on a secure payment page.

Customisation options in a PayPal email invoice draft.

There are quite a few customisation options to ensure the merchants can include all the legally required information, but also extras like automating invoices to send out at any frequency, options for partial payment, estimates, leaving a tip, invoicing multiple customers and attaching a personal memo to each invoice.

The PayPal Business app can send invoices from your phone, making it easy for professionals on the road to charge clients.

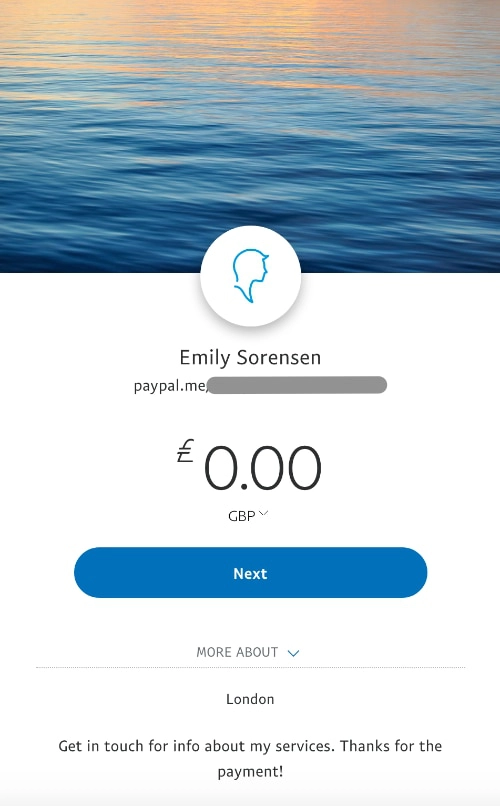

PayPal.Me payment links

Anyone with a PayPal account can create their own PayPal.Me link to use permanently for sending to others who need to pay you any amount. With a PayPal Business account, you get to use these buttons for business purposes.

Example of a PayPal.Me link.

The links are in a paypal.me/yourchosenname format, where the last part could be your business name. This URL will lead to a checkout page where anyone can enter any amount to pay in to your PayPal account using their own PayPal login as confirmation.

If you add a number at the end of the URL, the recipient will see a checkout page with that amount pre-specified to pay (e.g. “paypal.me/yourchosenname/40” for a £40 bill).

The links are ideal for mobile payments over text, email, social media or messaging apps like WhatsApp. The fact that others can enter any amount to pay makes them great for a website or page where donations are requested, whether for charity or fundraising purposes.

Virtual terminal

PayPal’s Virtual Terminal is for payments over the phone or by mail order. It is not available by default in the Business account – you have to speak to a sales rep on the phone to have it set up. Upon approval, it will be added to your account.

The virtual terminal is basically a web page where payment details are entered manually by the merchant whilst he or she talks to the customer on the phone. If using mail order, the merchant will process transactions using the card details noted by the customer in writing.

The details on the virtual terminal page include basic transaction information, customer and card details. PayPal has an edge over many other virtual terminals in that you can choose the currency of the transaction – handy if your customer base is international, but also expensive if you accept many foreign cards as they incur cross-border and currency conversion fees.

This is one of the few services with a monthly fee as well as the requirement to set up PCI-DSS compliance to ensure you are following security protocols as you are handling the customer’s sensitive card details.

Alternative solutions:

Leading virtual terminals for small businesses

Card reader with point of sale (POS) app

Apart from all the online payment options, PayPal Business users can buy an app-based card reader for in-person card payments.

PayPal used to promote its own PayPal Here card reader that worked with a PayPal Here mobile app.

This has, however, been discontinued (only certain eligible merchants like taxi drivers can still request it).

Instead, PayPal now promotes Zettle Reader (PayPal owns Zettle) to connect with your PayPal Business account. Alternatively, you can buy Zettle Reader directly for £29 + VAT and connect it to your bank account.

The card reader works with the Zettle Go app on a compatible iPhone, iPad or Android smartphone or tablet via Bluetooth. Together, they accept cards using the network or WiFi connection of the phone or tablet.

PayPal Here has been replaced with Zettle Reader (pictured).

The app has enough point-of-sale (POS) features to function as a simple till in a small shop, as well as on the go for entering transactions in the app followed by a contactless tap or chip card confirmed via the card reader PIN pad.

Alternatives: Best card machines for small UK businesses

Seller vs. Buyer Protection, security and chargebacks

A big draw for customers on the internet is PayPal’s Buyer Protection. In essence, the Buyer Protection ensures that customers can get a refund if the purchased item wasn’t delivered or it didn’t match the merchant’s product description. The buyer would need to file a dispute within 180 days of the transaction to be considered for the refund.

At the other end, we have the PayPal Seller Protection Policy. This is supposed to protect the Business account holder from unauthorised payments, or deceptive claims that the buyer did not receive their purchased goods. The problem we’ve seen from many user reviews, however, is that PayPal tends to favour the buyer’s side, meaning the seller protection has limited value compared to the buyer’s protection.

The problem we’ve seen from many user reviews, however, is that PayPal tends to favour the buyer’s side, meaning the seller protection has limited value compared to the buyer’s protection.

Not all things purchased through PayPal qualify for these protections. For example, ‘intangible’ things like professional services or digital products do not, and any payment where the buyer used their card details directly (e.g. Virtual Terminal, Zettle Reader and Website Payment Pro) instead of their PayPal account are not eligible either.

In all cases, transactions are monitored 24 hours a day by PayPal through sophisticated algorithms.

If potentially fraudulent activities are noticed, the Business account may be frozen, but the merchant has the chance to complain if the account closure was unjustified.

If a customer disputes a transaction that isn’t covered by the Seller Protection, it results in a chargeback. This puts the payment amount on hold until the dispute is settled between the customer, merchant and card issuer (PayPal’s role is to gather information to facilitate the resolution process). In addition, a non-refundable £14 chargeback fee is deducted from the merchant.

Invoicing: Create and send invoices directly from the app. View drafts, unpaid and paid invoices and edit or follow up on the unpaid ones.

Send money: Send money to any PayPal user by entering their PayPal email address. It is even possible to send money to up to 5,000 users at a time (called Mass Payments), but this is subject to approval by PayPal.

Sales insights: View basic sales analytics in the app across all PayPal sales channels. View monthly, quarterly and yearly sales (or year to date), and compare it to the previous year.

Orders list: View your list of ready-to-ship orders in need of tracking information, then enter or scan the tracking number.

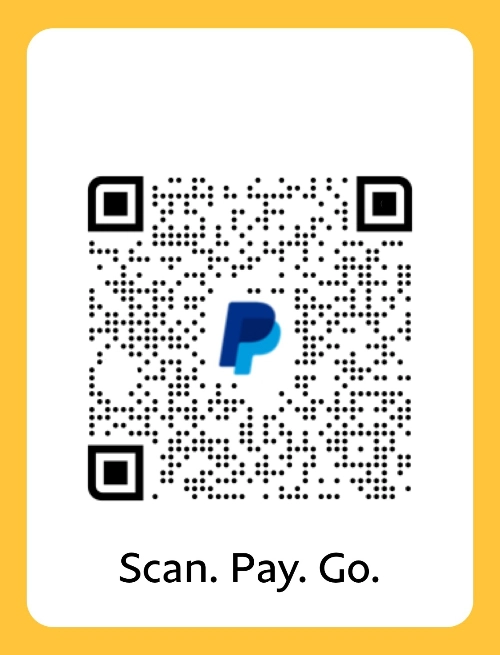

QR code for receiving PayPal payments.

QR codes: Access a QR code that customers can scan with their PayPal app to pay with their PayPal account. A Tip Jar QR Code an also be generated for tips collection, and you can order hard copies to display for touch-free payments.

The app is really simple, and an invaluable asset for the Business account holder who wants a quick glance at sales and invoices especially. It was only recently that QR code payments were added – a nice bonus if your customers are frequent PayPal users.

PayPal Business loan

After three months of regular transactions through PayPal, you may be eligible for a cash advance loan called PayPal Working Capital. This could be very useful for struggling startups needing capital now, but expecting to earn money in the upcoming months that can go towards repayment.

When you earn little, the repayment amount is low, since it is a percentage instead of fixed monthly instalment.

It works like this: you apply for the business funding through a short application form where you specify a desired cash advance amount and repayment percentage (proportion of future incoming transactions through PayPal). The maximum loan amount is based on your account history and PayPal sales. If approved, you get the cash advance almost immediately. Applying does not affect your credit score.

Once approved, PayPal will automatically be paid back through that percentage + a fixed PayPal fee added for the privilege of getting a cash advance. No interest or early repayment fees are charged, but a minimum payment of up to 10% of the advance is required every 90 days.

Cash advances are convenient for those with unpredictable sales. When you don’t earn anything, you don’t pay anything. When you earn little, the repayment amount is low, since it is a percentage instead of fixed monthly instalment. Similarly, if you earn more than expected, you will pay it off sooner to PayPal.

Customer service and reviews

One thing that’s rarely offered with no-contract payment services is 24/7 support – but PayPal offers this. You can either drop them an email or chat with customer service while logged in to your Business account. Emails tend to take up to 24 hours for a reply, so the messaging chat is a faster way to sort out issues.

There is also a PayPal Community section where merchants can ask questions that other PayPal users can respond to. In many cases, you can find answers there if the question has already been answered in a post.

If a transaction is withheld, you’ll need to respond promptly with the required documentation.

While all this sounds fabulous, there have been many complaints by users dissatisfied with account holds due to PayPal’s strict security algorithms. If the payment system identifies a potential problem, or suspects you fall under a restricted business category, your account may be frozen until you have proven the legitimacy of the relevant payments. This has resulted in some merchants having to wait for weeks to access their hard-earned money.

Another common theme in the negative reviews is the high fees – PayPal’s transaction fees are higher than pretty much all alternatives. The quality of the customer service, on the other hand, seems to be high. It may take a little work to get through on the line, but the support team tends to really address merchants’ problems.

PayPal Business sign-up

It’s very easy to create a PayPal Business account – no phone call is needed. Simply click the ‘Sign Up’ button on the PayPal website and choose the Business account type (instead of Personal).

Then answer how much you expect to earn through PayPal, expected sales channels (e.g. email invoicing, website, in person), email address and business information. You will also need to register a bank account for transfers between the e-account and business current account.

Some of the services mentioned above – e.g. email invoicing, the app, international transfers – are available by default without further communication with PayPal. The virtual terminal requires a phone call with the company before it is activated in your account, and PayPal even helps with the PCI-DSS compliance in connection with this. Moreover, certain fee structures require an application and approval process by PayPal.

Our verdict

The PayPal Business account is not meant to be a substitute for a business bank account, but can prove an invaluable hub for online payments management. The platform allows you to pick and choose payment tools suitable for your business, with the added bonus of instant access to the PayPal balance with the Debit Mastercard.

How do you know if PayPal Business is for you? If you have an online shop or send invoices, it’s likely that PayPal will be good asset in the long run.

If you’re selling in person, it’s worth looking at card readers elsewhere first.

Customers are most likely to complete a sale remotely if their preferred method of payment is available, and you can’t get around the fact that millions of people across the world have a PayPal account, many of whom will be familiar with the benefits of Buyer Protection.

The PayPal Business account is not meant to be a substitute for a business bank account, but can prove an invaluable hub for online payments management.

Consider this: have you purchased something on eBay from an unknown seller that you wouldn’t have purchased without PayPal’s seal of protection? There’s a lot of value in that for the customer, but risk for the seller if your products aren’t up to scratch or a customer decides to take advantage of payment disputes, resulting in withheld funds.

That being said, only some sales have Buyer or Seller Protection, so it needn’t make much difference.

The lack of contract and monthly fees for core services make it very easy to try the payment tools with your customer base. If it doesn’t add any value to your business, there’s no loss. On the other hand, fees are not easy to get your head around for certain payment methods, so you may end up spending a great deal of time clarifying costs – or applying for non-Standard rates – with the PayPal team.

The transaction fees in particular are some of the highest for this kind of service in the UK, so you don’t pick PayPal to save money. Rather, it is a service that can add value to a small business benefitting from a pay-as-you-go solution that perhaps supplements another payment setup.