Starling Bank and Monzo have made it easy to open a business account online in the UK.

Both offer full-fledged bank accounts, have no physical bank branches and are managed through a mobile app.

So what are the differences between the business accounts? Which is best?

We compare the two business accounts in terms of features, costs and services.

|

|

|

|---|---|---|

| Link | ||

| Service |

Current account with Debit Mastercard | Current account with Debit Mastercard |

| Monthly fee for business account | Main account: Free Business Toolkit: £7 |

Lite plan: £0 Pro plan: £5 |

| Eligibility | UK-registered/-based companies & sole traders | UK-registered/-based companies & sole traders |

| Sign-up | Entirely through app | Entirely through app |

| Account no. & sort code included? | ||

| IBAN included? | ||

| UK payments |

Bank transfers, Direct Debits, standing orders | Bank transfers, Direct Debits, standing orders |

| International transfers | ||

| Euro & USD account options | ||

| Business loans | Via third-party lender | |

| Business overdrafts | ||

| Team access | Only with co-directors | Yes, on Pro plan |

|

|

|---|---|

| Service | |

| Current account with Debit Mastercard | Current account with Debit Mastercard |

| Monthly fee for business account | |

| Main account: Free Business Toolkit: £7 |

Lite plan: £0 Pro plan: £5 |

| Eligibility | |

| UK-registered/-based companies & sole traders | UK-registered/-based companies & sole traders |

| Sign-up | |

| Entirely through app | Entirely through app |

| Account no. & sort code included? | |

| IBAN included? | |

| UK payments | |

| Bank transfers, Direct Debits, standing orders | Bank transfers, Direct Debits, standing orders |

| International transfers | |

| Euro & USD account options | |

| Business loans | |

| Via third-party lender | |

| Business overdrafts | |

| Team access | |

| Only with co-directors | Yes, on Pro plan |

|

|

Main features of Monzo and Starling Bank

Both are popular UK-based banks for both personal and business users, but when it comes to business accounts, they are not equal. Let us look at the main characteristics of the Monzo and Starling Bank business account.

Current account managed online – A clear strength of the platforms is that they are both fully-fledged bank accounts managed online through a mobile app, or browser app with somewhat fewer features. That doesn’t mean there is no human support team behind it. The customer service team can be contacted 24/7 by telephone, chat or email in both cases.

To create a Monzo Business account, you actually have to create a personal current account before adding the business account. In Starling’s case, you don’t need a Personal account if you’re a company, but a Personal account is required first to apply for a Sole Trader account.

Once you have a Starling Business account, you can add a ‘Euro’ account containing EUR currency or US dollar account (the others are for GBP currency only). The Euro and USD accounts have monthly fees.

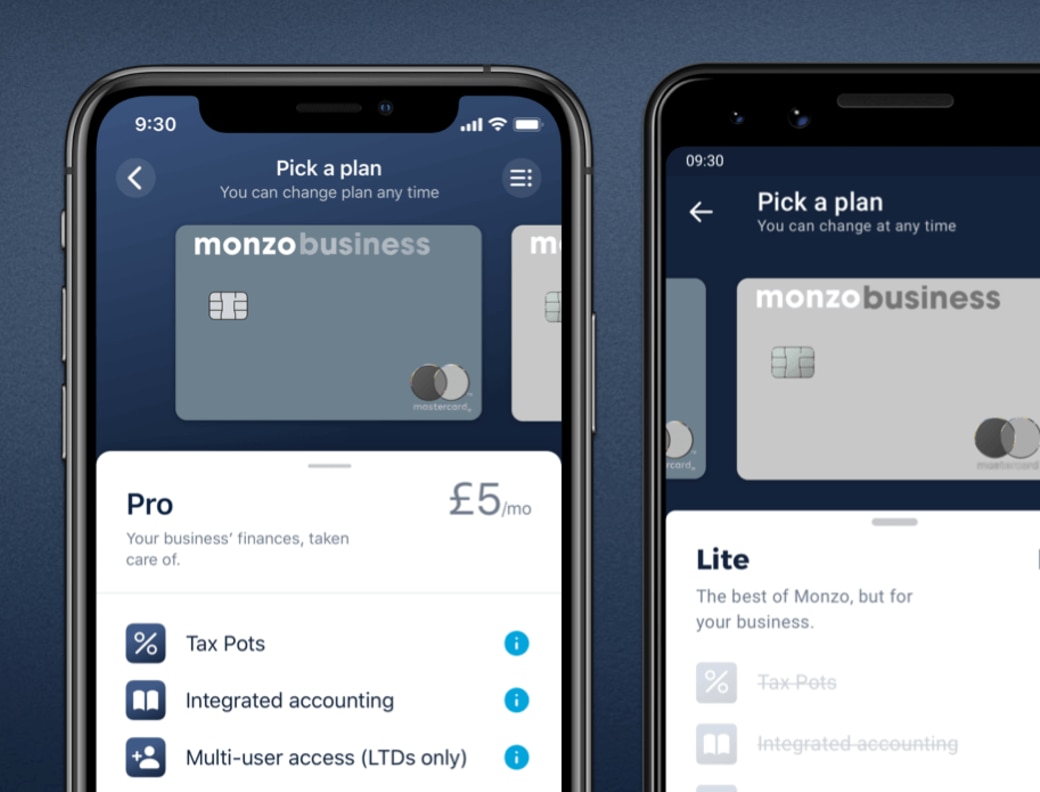

Monzo only has one ‘Business’ account for sole traders and registered companies alike, but there’s a choice between two account tiers: Business Lite (free) and Business Pro (£5 monthly) plans. They differ in the amount of features, i.e. Lite’s limited features are better suited for sole traders while Pro is better for companies with more to manage.

Payment cards – Both offer a Debit Mastercard for business account holders. This is better than most challenger banks in the UK that only have prepaid Mastercards, which are not as readily accepted as a full debit card. There is no credit card option from these banks.

IBAN and international transfers – Only Starling’s business accounts come with their own IBAN so you can send and receive payments internationally. No Monzo accounts have an IBAN, so you cannot send or receive international payments. Personal Monzo accounts are integrated with Wise (previously called TransferWise), allowing you to send money abroad from the app via Wise’s transfer network, but this does not apply to the business account.

Loans and overdrafts – Only Starling offers overdrafts and loans for businesses, including the Recovery Loan Scheme (RLS). Monzo works with a third-party lender offering business loans for Monzo Business account holders, but this doesn’t include Covid loan schemes. There is no overdraft facility with Monzo Business, only for Personal account holders.

Costs and fees

Monzo and Starling business accounts are pretty good value with their free standard account options. Charges for UK payments are the same: free.

Starling Bank has more paid account options, though: USD-currency (£5/month) and Euro-currency (£2/month) accounts and the feature-rich Business Toolkit add-on for £7 monthly.

Monzo, on the other hand, only offers an upgrade to Business Pro (£5/month) with a few more features than the free plan, but still lacking international payments.

|

|

|

|---|---|---|

| Account creation | Free | Free |

| Monthly fee | Business account: Free Sole trader account: Free Business Toolkit: £7 Euro account: £2 USD account: £5 |

Lite account: Free Pro account: £5 |

| Debit card | Free | Free |

| UK payments | Free | Free |

| Transfers between same-bank accounts | Free | Free |

| Cash withdrawals | Free in UK & abroad | Free in UK & EEA First £200/mo free outside EEA, then 3% of withdrawal amount |

| Cash deposits | 0.3% (min. £3) at Post Office | £1 at PayPoint |

| Cheque deposits | Free via app (2 working days’ processing) | Free via Freepost (2-3 weeks’ processing) |

| Registration |

|

|

|---|---|

| Account creation | |

| Free | Free |

| Monthly fee | |

| Business account: Free Sole trader account: Free Business Toolkit: £7 Euro account: £2 USD account: £5 |

Lite account: Free Pro account: £5 |

| Debit card | |

| Free | Free |

| UK payments | |

| Free | Free |

| Transfers between same-bank accounts | |

| Free | Free |

| Cash withdrawals | |

| Free in UK & abroad | Free in UK & EEA First £200/mo free outside EEA, then 3% of withdrawal amount |

| Cash deposits | |

| 0.3% (min. £3) at Post Office | £1 at PayPoint |

| Cheque deposits | |

| Free via app (2 working days’ processing) | Free via Freepost (2-3 weeks’ processing) |

| Registration | |

There is no setup fee og cost for the business debit card. Domestic payments in pounds sterling are free and so are ATM withdrawals from within the UK.

It is possible to deposit cash into the business accounts, costing £1 per PayPoint deposit with Monzo and 0.3% of the deposit amount (min. £3) at the Post Office with Starling Bank. Cheques are free to deposit via the Starling app and they only take two days to clear. With Monzo, you send cheques to the company via Freepost, taking 2-3 weeks to clear.

Alternatives: Wise vs. PayPal – cross-border transfers compared

International transfers and use abroad

Monzo is better suited for businesses with UK clients only because the account lacks the direct capacity for international transfers, except for if you use an IBAN generator (a workaround solution that is not recommended).

However, you can use the Monzo debit card abroad or for payments in any currency. Within the EEA, cash withdrawals are free. Outside the EEA, the first £200 cash that’s withdrawn every month is free, but Monzo charges 3% of the cash amount above this amount. Any currency conversions incur Mastercard’s wholesale rate with nothing added on top.

|

|

|

|---|---|---|

| Cash withdrawal in other currency | Free | In EEA: Free Outside EEA: First £200 during 30-day period is free, above costs 3% of withdrawal amount |

| Inbound international transfers | Euros to GBP account: 2% on top of exchange rate Payments received in same currency as account: Free |

Not possible |

| Outbound international transfers | 0.4% on top of exchange rate + £5.50 delivery fee + 30p (w/local partner) | Not possible |

| Card payments in foreign currency | Free | Free |

| Exchange rate | Real | Mastercard |

|

|

|---|---|

| Cash withdrawals in other currency | |

| Free | In EEA: Free Outside EEA: First £200 during 30-day period is free, above costs 3% of withdrawal amount |

| Inbound international transfers | |

| Euros to GBP account: 2% on top of exchange rate Payments received in same currency as account: Free |

Not possible |

| Outbound international transfers | |

| 0.4% on top of exchange rate + £5.50 delivery fee + 30p (w/local partner) | Not possible |

| Card payments in foreign currency | |

| Free | Free |

| Exchange rate | |

| Real | Mastercard |

Cash withdrawals abroad from a Starling Bank account are all free, using the real exchange rate rather than Mastercard’s. You can also send and receive international SWIFT transfers with a Starling business account.

Receiving a transfer from abroad in the same currency as the Starling account (whether it’s the main GBP account, USD or EUR account) is free. The exception is if a euro payment goes to your GBP account: this costs 2% on top of the real exchange rate. The Euro account costs £2 monthly and the USD account £5 per month.

Sending a SWIFT payment costs 0.4% of the transfer amount on top of the real exchange rate + £5.50 delivery fee + 30p if using a local partner for the transfer method.

Starling Bank offers Euro and USD accounts to business users for a monthly fee each.

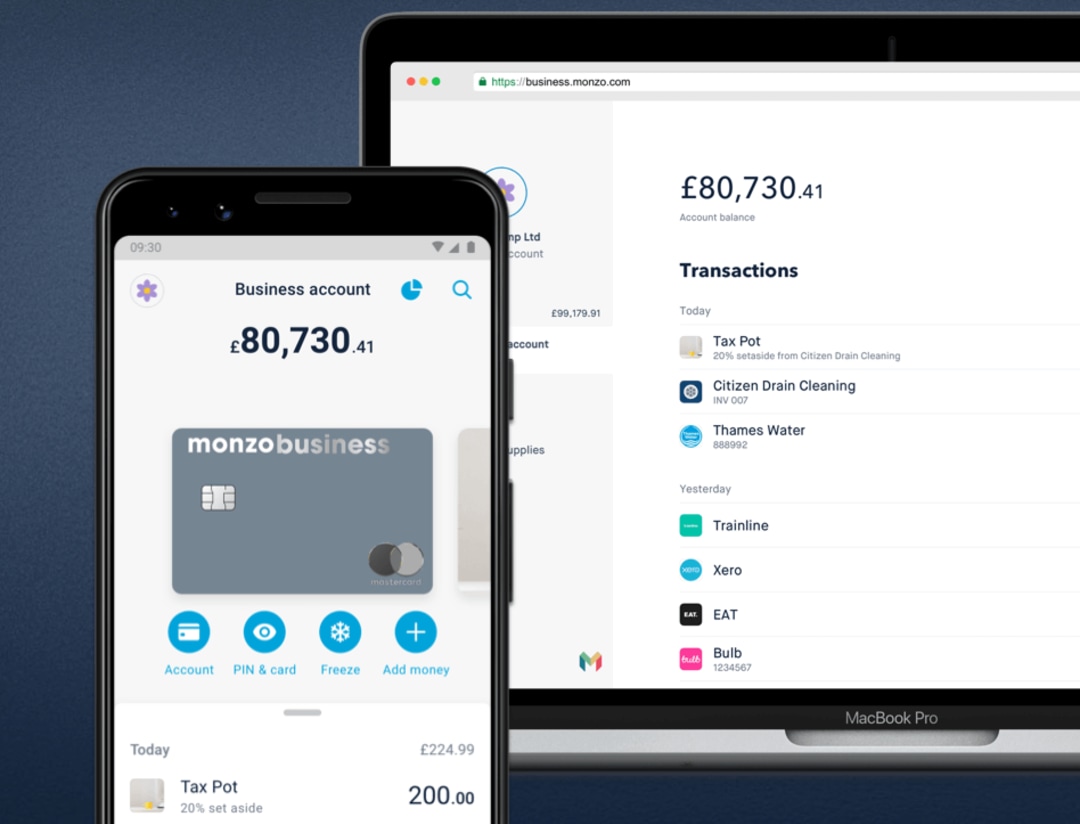

Which has the best app features?

Since these are online banks, you should expect a decent range of app features to manage your business account entirely from the mobile app. Both offer desktop access too, but account features are different or more limited there.

The banks have the following app features in common.

Manage payments – Send money, set up Direct Debits, subscriptions and standing orders, view subscriptions. Only Starling allows SWIFT payments from the app.

Monitor spending – Categorise payments into colour-coded topics for e.g. office rent, utility bills and wages. Get push notifications every time money is spent so you know what’s going on with the account. Monzo also lets you set spending limits for different categories set for specific time periods, making it easier to stay on budget.

Image: Monzo

Monzo Business account viewed in the mobile and web app.

Put money aside for goals – Starling calls it “spaces” and Monzo calls it “saving pots”, but they are basically the same thing: from within your account, allocate money into ring-fenced spaces to reserve it for a dedicated purpose such as HMRC taxes, a new computer, business trip etc. Money placed in these pots does not form part of the main account balance but can freely be transferred back to the main balance when needed.

Starling lets you auto-save money from the main balance to allocated spaces from rounding up transaction amounts automatically. Monzo, on the other hand, lets you schedule outgoing and ingoing transfers between pots and the main balance, or lock pot balances to a certain date to deter you from using it.

Card controls – Order, cancel, freeze and unfreeze your debit card, or block swipe and gambling payments from the app. Starling excels with more detailed controls such as prohibiting ATM withdrawals and card machine or online payments.

Invoices – Both banks have invoicing features, but only on a paid plan. Monzo Pro subscribers can send and manage email invoices from the Monzo app or online, whereas Starling’s Business Toolkit add-on lets you manage invoicing from the Starling web dashboard (not the app).

Multiple users – Co-directors can access the Starling Business account apart from the original account user. Monzo allows more than one person from the same company to use the same account on the Pro plan only. All authorised Monzo account users can access all information and perform all functions, i.e. there are no permissions settings.

Accounting integration – Export bank statements to a PDF file from the mobile or web app. All of Starling Bank’s business accounts can be integrated with external accounting programmes for a smooth bookkeeping system. In contrast, accounting integrations are only possible on the Monzo Pro plan, not the free Lite plan.

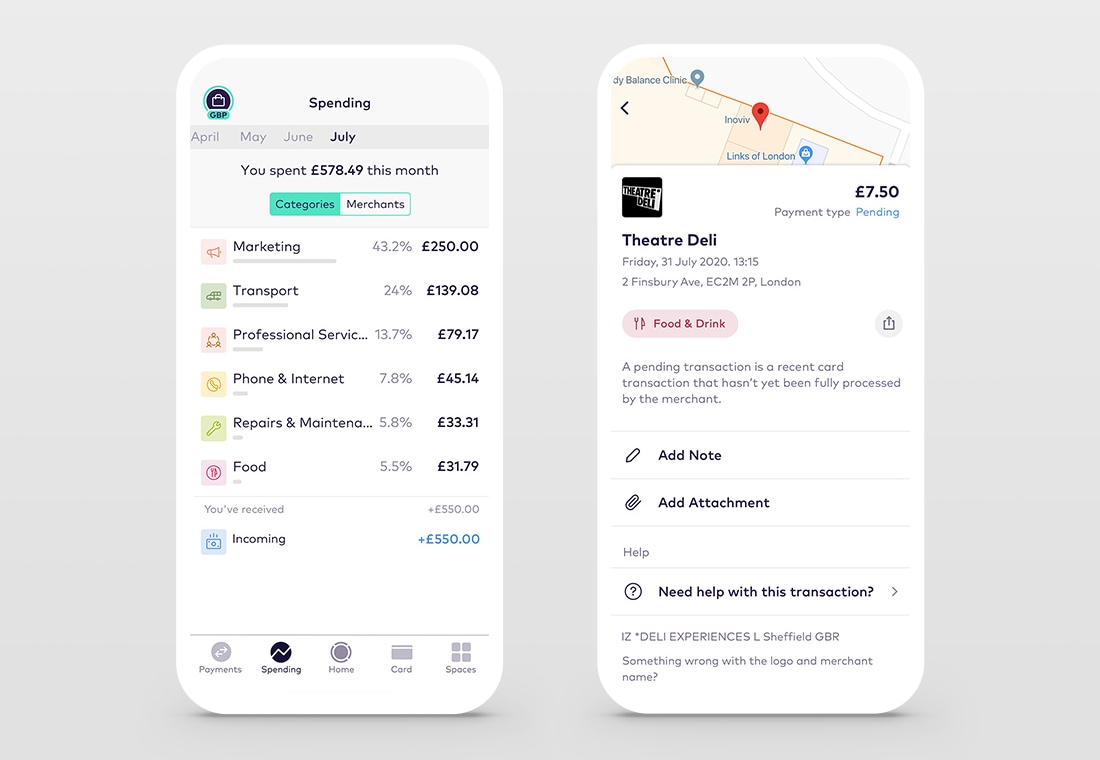

Image: Starling Bank

The Starling Business app lets you organise payments and export statements.

The banks each have some unique business functions too.

Starling: With the Business Toolkit add-on, you get a range of business management functions designed for freelancers. This includes (among other things):

- Payment scheduling

- Recording and submitting VAT information for HMRC (via Making Tax Digital)

- Self-assessment tax estimations

- Bookkeeping to-dos

- Expense tracking

- Email integrations

These functions are accessed through the web dashboard.

Monzo: Monzo Business doesn’t really have many special features compared to Starling, but a new payment link feature allows all users to send payment requests online, processed and charged for by Stripe.

The Pro plan also allows you to:

- Automatically deduct taxes into a special tax pot

What do customers say about the banks?

Monzo and Starling provide round-the-clock customer support through in-app messaging, email and over the phone.

There are, however, significant differences in the quality of service. Starling Bank has won awards for being the best British bank in 2020, which is in line with the majority of customer reviews online. Some users complain of certain support queries being lengthy or unnecessarily tedious, which was the case for the application process for the Business Bounce Back Loan (no longer offered). Many other users praise the service and account features.

Monzo, on the other hand, has had issues with account holds, where funds and transactions are held for a long time for no clear reason, causing a lot of stress and financial hardship for the account holder. BBC Watchdog has confirmed the amount of frozen accounts was greater than at all other British banks around year 2019/2020, but it may have improved since. The quality of customer support is not as highly regarded as with Starling.

Image: Monzo

The paid Monzo Pro subscription is better for companies, while Lite can suit sole traders.

Monzo vs. Starling – which to choose?

In many ways, Starling and Monzo banks are similar, but after testing both, we consistently felt that Starling was more polished and complete than Monzo business accounts. The Starling app felt more professional and customer support very friendly, while the free Monzo business account was more basic in features and piggybacking on other platforms to provide e.g. loans.

Starling Bank stands out with their own loans, business overdrafts, Euro and USD accounts, SWIFT transfers, advanced debit card controls and the most available features without a monthly cost. Starling Business Toolkit does require a monthly fee, but then you get comprehensive accounting tools for a sole trader.

Several important Monzo features are only available on the pay-monthly Pro subscription, including accounting integration, invoicing and multi-user access. That said, the payment requests and online Stripe payments are handy options enjoyed on even the free account.

A few of the Monzo-only features are genuinely useful for some businesses, such as the additional settings for savings pots and budgeting features. Monzo’s Personal account features are more comprehensive than the Business account, though, including the Wise integration for international payments.

It seems as though Monzo has prioritised personal users over business accounts, whereas Starling Bank has clearly honed their business features over a long time.