The bank offers Personal and Business current accounts, both operating in GBP currency. There are two tiers of Business accounts:

- Lite: £0/month

- Pro: £5/month

They are for companies and sole traders alike, the only difference being the plan features (Pro is better for limited companies). In any case, you get a Debit Mastercard.

A Personal account must be created before a Monzo Business account, so you actually end up having both.

Monzo is a full-fledged bank authorised by the Prudential Regulation Authority (PRA) that also regulates it alongside Financial Conduct Authority (FCA). Up to £85,000 is protected by the FSCS (if eligible) – similar to high street banks.

Our experience and opinion about Monzo Business

Monzo is one of the better challenger banks in the UK, based on my own testing and what I’ve heard from long-term customers.

We especially like the simple usefulness of the money pots, where you can organise savings and auto-deduct taxes from incoming payments. Monzo is in fact great for managing budgets, savings and payments, but limited companies lack the loan and overdraft options available to sole traders.

Most of the previous shortcomings (e.g. overdraft, loan, savings account, payment acceptance) have been added in recent years, but the customer service is still struggling to address issues promptly when you try to get in touch with them.

The fast sign-up and lack of monthly fees (for the Lite account) are attractive considering the value of getting a real business bank account. The Pro account benefits from invoicing, accounting integration and multi-user access for a company team for the very sensible amount of £5 monthly.

Pros

Cons

Who can open a Monzo Business account?

To open a Monzo Business account, you need to be a limited company (Ltd) or sole trader based, registered and a tax resident in the UK. If you pay taxes in another country, you cannot have a Monzo account.

Limited companies should also have an active status on Companies House, active company director, at least one person of significant control listed on Companies House, and have no corporate directors or corporate persons of significant control.

Most of your money should be made from selling goods or providing services rather than from investment income or interest.

These businesses aren’t accepted by Monzo

Monzo does not accept:

- Partnerships incl. limited liability partnerships (LLP)

- Limited companies by guarantee, public limited companies (PLC)

- Charities, community interest companies (CIC)

- Trusts or funds

- Clubs or other non-registered organisations

- Other registered business types like unlimited companies (Unltd), industrial and provident societies (IPS) and royal charters (RC)

There’s a whole list of industries not accepted by Monzo as they are considered high risk, such as legally dubious/illegal trades, sales of precious jewellery and financial services.

Costs and fees

It’s free to open an account with Monzo and there’s no minimum contract.

There are two Business accounts: Lite with no monthly fees and Pro for £5 per month. You can switch between them any time, so neither choice is set in stone. However, the Pro subscription fees already charged would be non-refundable if switching from that to the free plan.

| Business account | Charges |

|---|---|

| Account creation | Free |

| Monthly fee | Lite plan: £0 Pro plan: £5 |

| Card payments in GBP (anywhere) | Free |

| Card payments in other currency (anywhere) | Uses Mastercard’s wholesale rate with nothing added on top |

| Bank transfers (UK) | Free |

| ATM withdrawals | In UK and EEA: Free All other countries: First £200 during 30-day period is free, above costs 3% of withdrawal amount |

| Cash deposits | £1 each |

| Cheque deposits | Free (via Freepost) |

| Receiving transfers from a different currency | 1% currency conversion fee |

| Sending international payments | Variable Wise transfer fees |

| Business account |

Charges |

|---|---|

| Account creation | Free |

| Monthly fee | Lite plan: £0 Pro plan: £5 |

| Card payments in GBP (anywhere) | Free |

| Card payments in other currency (anywhere) | Uses Mastercard’s wholesale rate with nothing added on top |

| Bank transfers (UK) | Free |

| ATM withdrawals | In UK and EEA: Free All other countries: First £200 during 30-day period is free, above costs 3% of withdrawal amount |

| Cash deposits | £1 each |

| Cheque deposits | Free (via Freepost) |

| Receiving transfers from a different currency | 1% currency conversion fee |

| Sending international payments | Variable Wise transfer fees |

Apart from the monthly Pro fee, there aren’t actually that many fees to speak of, because Monzo doesn’t deal with international transfers, interest rates, overdrafts or loans for business users.

UK bank transfers are free to process, debit card payments anywhere in the world incur no fees and cashpoint withdrawals are free in the UK and within the EEA. Outside the UK and EEA, the first £200 taken out from an ATM during a 30-day period is free; above that, it costs 3% of the withdrawal amount.

Cash deposits are £1 each, deducted from the cash you hand in at the PayPoint. Cheques are free to process, provided they are sent by Freepost.

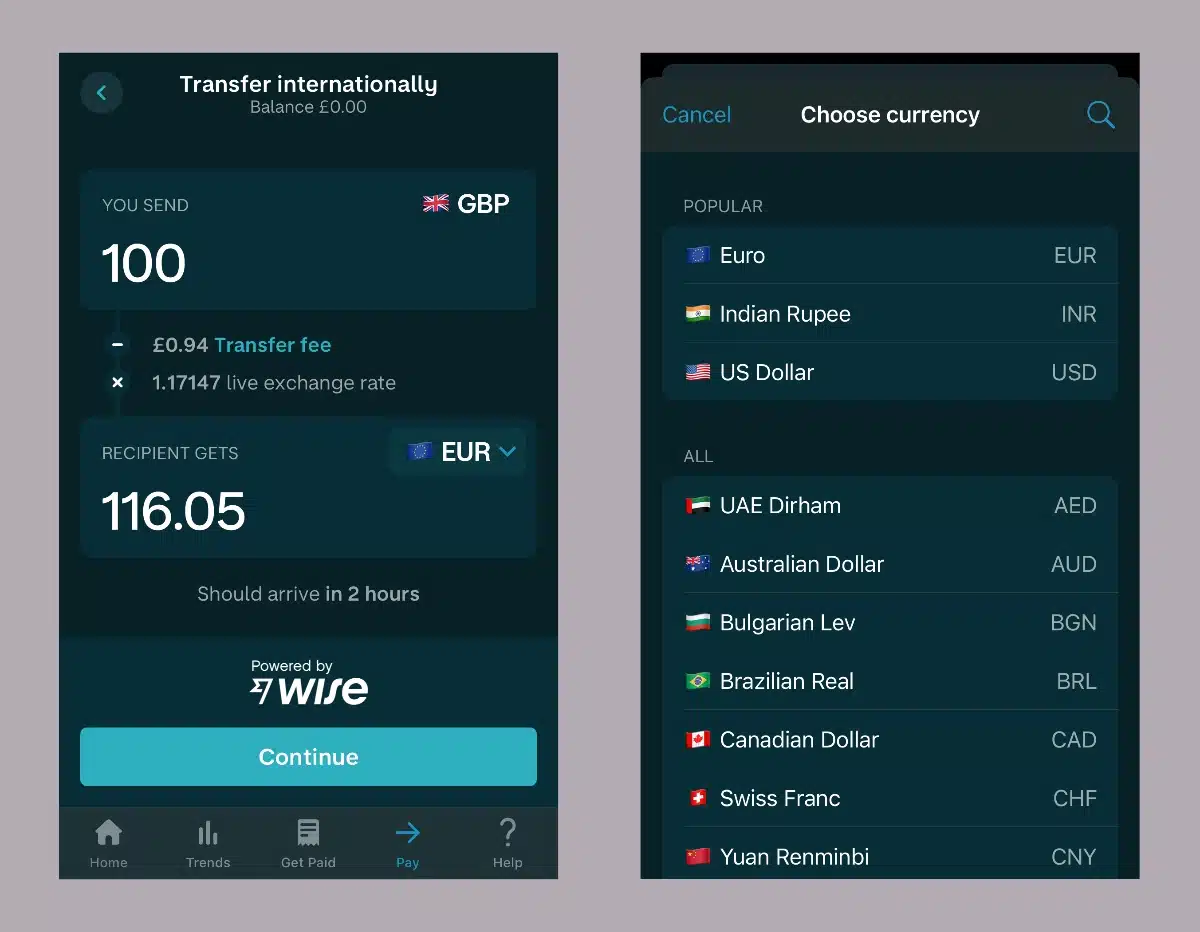

International payments

Monzo’s current accounts come with a bank account number, sort code and IBAN for international transfers.

There is no option to store any other currency than British pounds, like with Revolut. If someone send you money from abroad in a different currency, Monzo will convert the foreign currency into GBP for a 1% fee.

Wise is conveniently integrated in the Monzo for sending transfers internationally. It’s a reliable platform that handles currency exchanges and payments for low fees. To use it, you must sign up with Wise, which is easily done through the Monzo app.

Image: MobileTransaction

International transfer in app.

Just pick the option for international payments and fill in the details for the transfer, including the recipient’s currency or country. You will be shown the transfer fee upfront during this process, as well as the amount the recipient will receive after the currency exchange rate and fees are factored in.

The Business Debit Mastercard can be used abroad in any foreign currency. Monzo uses the Mastercard wholesale rate with no markup on the exchange rate, which gives you the best possible rate.

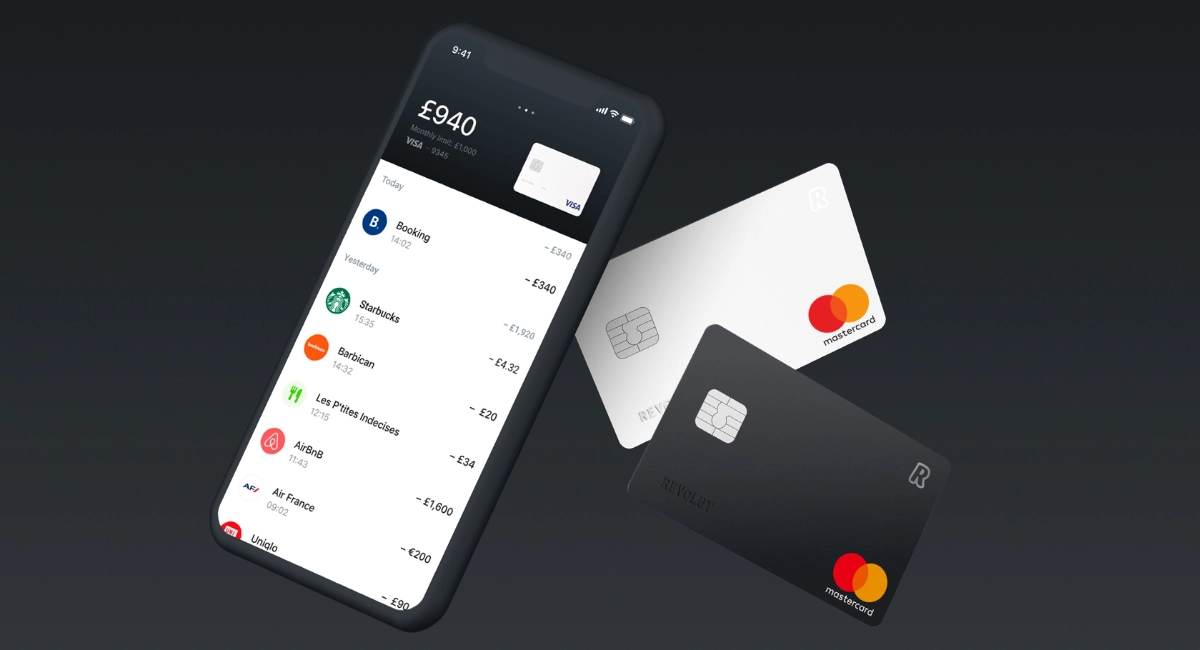

Card, cash and cheques

With every Monzo Business account comes a Debit Mastercard with chip, contactless and swipe facility (Monzo does not offer credit cards). You can add this to the Apple Pay or Google Pay wallet. It has the card number, expiry date and cardholder name embossed just like debit cards from the high street banks, which cannot be said of the cards that most online banks have.

The card can be used anywhere Mastercard is accepted, but the website states there are “occasional issues” using it in certain countries including Bulgaria, Portugal and Cuba. Monzo also writes that merchants not keeping their systems up to date can lead to situations where the card is not recognised.

You can withdraw cash for free at any ATM accepting Mastercard, but as with any bank, there are cash withdrawal limits:

- Daily: £400

- Over 30 days: £5,500

- Fee-free outside EEA over 30 days: £200

What about cash deposits? At any PayPoint in the UK, you can deposit between £5 and £300 in one go for £1. Just give the PayPoint assistant your Monzo card and the cash, and they will process the card and hand you a receipt when done. Cash deposits take up to 10 minutes to appear in your bank account.

You can deposit max. £1,000 in cash every six months, which is really not much, so cash-heavy businesses such as retail shops should probably not go for Monzo.

Cheques can be deposited via Freepost for free, but some merchants feel better using tracked postage instead which would cost money. We’ve seen some merchants complaining that their cheques were taking a long time to show in their Monzo account, so the paid method may be wise for reassurance. Note that Monzo does say it takes 2-3 weeks for cheques to clear in your account.

No credit card, but overdraft and loan possible

Monzo does not offer credit cards, but they have options for a loan and overdraft in the business account. This applies to both the free and Pro plans.

Only eligible sole traders can apply a loan, not limited companies, and only one loan is granted per person across the Personal and Business accounts.

Eligible sole traders (again, this is not for limited companies) can also apply for a business overdraft of up to £2,000.

It would’ve been good if companies could apply for loans or credit too, but maybe this will be added in the future.

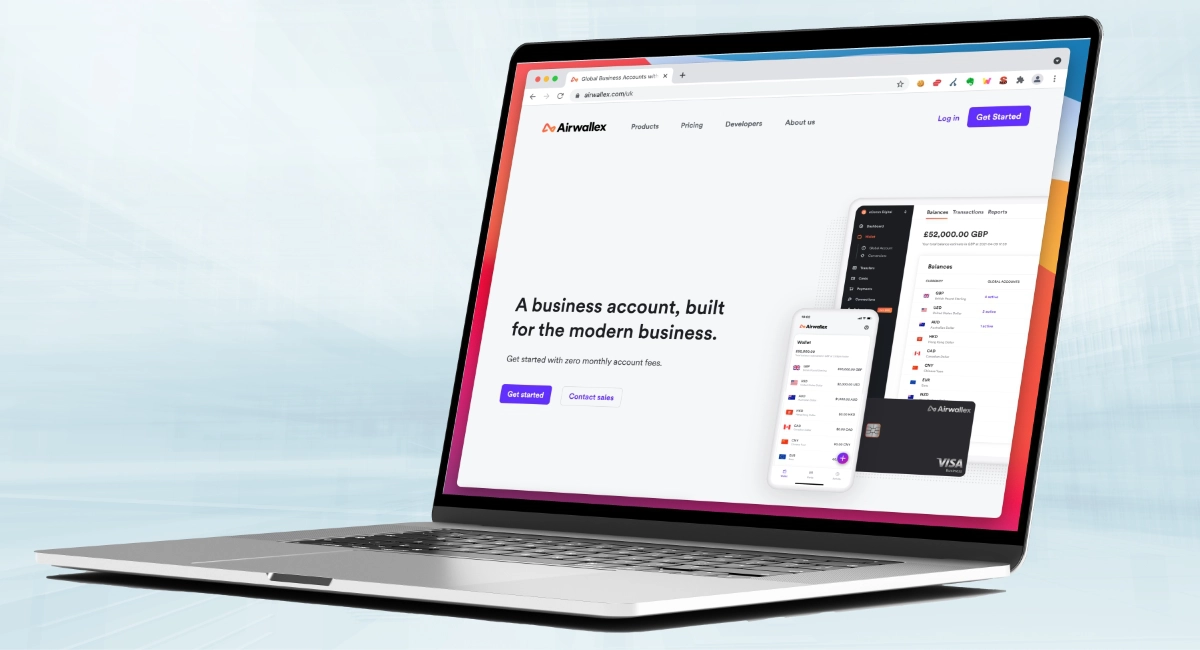

Monzo app

As an online-only bank, it’s important the Monzo app gives the smooth experience expected from a serious bank – and it does.

“I tested the Monzo app over the last several years and can confirm I much prefer the version now. It runs smoother, has more features, and the business account doesn’t feel left behind like it used to be.”

– Emily Sorensen, Senior Editor, MobileTransaction

The app can be downloaded on iPhone and Android devices. You can log into your account in an internet browser, but Monzo does not recommend this unless you’ve lost your phone or for emergency reasons, since the web account doesn’t have all the features of the mobile app.

You can switch between personal and business accounts in the app. There are slightly different features for the accounts, e.g. options for a joint account on Personal.

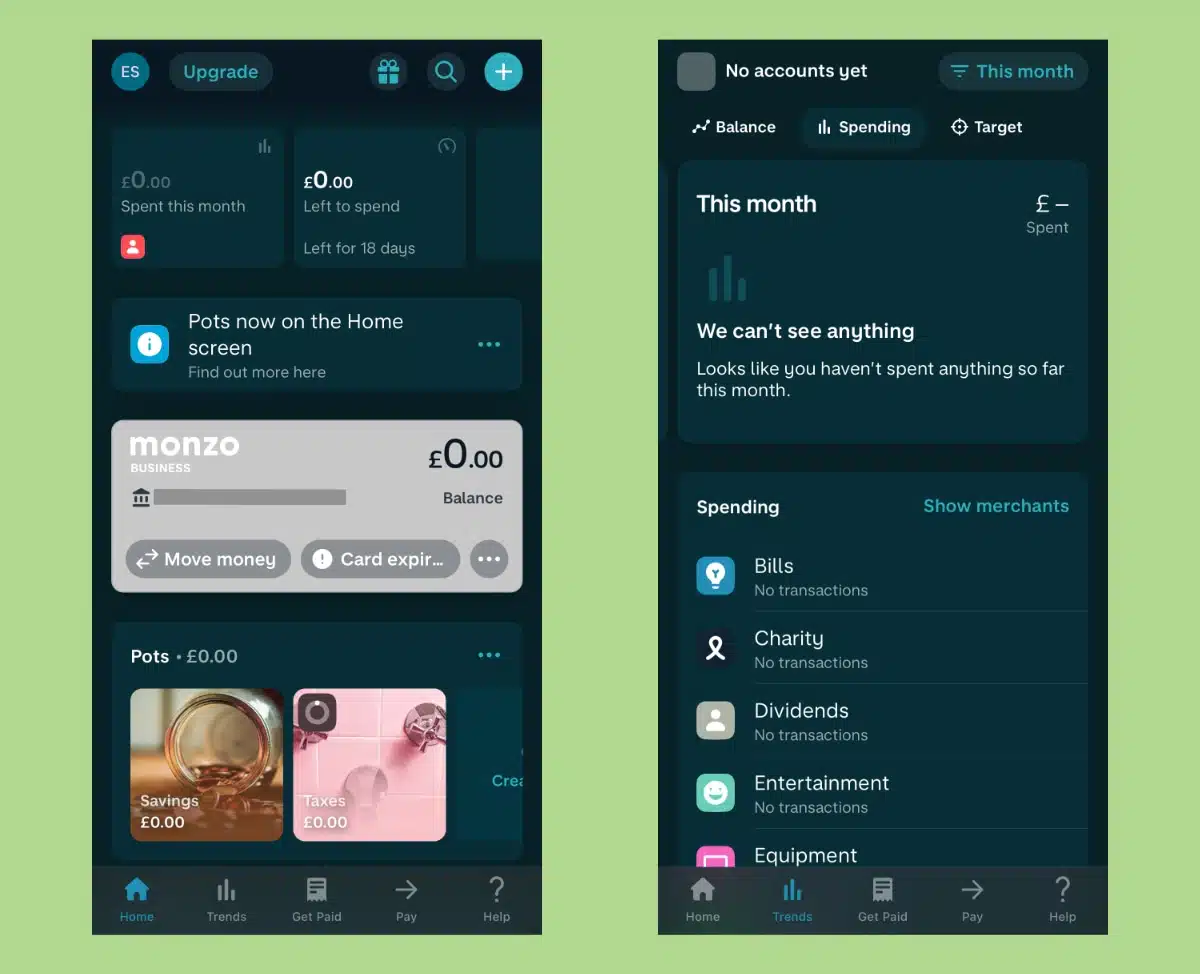

All Business account holders can:

Image: MobileTransaction

The Monzo app is easy to navigate and lets you track transactions, savings and more.

We particularly like the saving pots to help you manage money. Apart from setting a goal amount for each pot, you can lock it until a certain date (though it is possible to unlock it, should you need the money earlier).

The money set aside in the pots is not spent when using the debit card or current account for payments, so it is truly kept separate until you manually transfer the money back to the main account. You can also schedule ingoing and outgoing transfers from the pots to your main account instead of manually moving between them.

The budgeting section is another excellent way to see whether you’ve spent too much on certain things. If you’ve gone overboard in an area, the visual representation will make that clear. The budget is repeated every month (unless you edit it every time period) and you can set the date it resets.

On the Pro plan, companies are allowed to have more than one user managing the Monzo Business account. Just beware that all users have full access to all features, as there are no options to limit permissions.

Pro users can create a special Tax Pot that automatically deducts a percentage of your income so you don’t have to work this out manually.

Getting paid through links, invoices and contactless

Like other app-based business accounts during these digital times, Monzo Business has opened up a few ways to accept card payments through the app:

- Payment links: Send payment links via text, email, social app or other message.

- QR codes: Share or display a QR code on the phone screen for customers to scan and pay through.

- Invoicing: Send email invoices with a due payment date and client details.

- Tap to Pay on iPhone or Android: Phones with NFC (near-field communication) can accept contactless payments.

Invoicing is only possible on the Pro plan, but the other features above are available for all business account users. Stripe handles the card processing for all of these payment methods, so you do have to sign up and link your Stripe account with Monzo to make any of it possible.

The transaction fees are determined by Stripe – they depend on the payment method and range between 1.5%-3.25% + 20p.

Accounting integrations

The Free business account does not let you integrate with any external apps.

But if you upgrade to Business Pro, you can sync account activities with the external accounting solutions FreeAgent, QuickBooks or Xero. If you don’t need an integration, Pro also lets you auto-export transactions, bank statements and paid invoices to a Google spreadsheet.

Monzo Pro users also get special deals from select software partners, such as the first 6 months of a Xero subscription free (if they are a new Xero user).

Customer service and Monzo reviews

Monzo offers 24/7 customer support to all business account holders via in-app messaging, email and over the phone. Email and chat support give the slowest replies, so we recommend calling them.

A Monzo community forum is also available, though Monzo seems to have stopped answering queries here. But you can find peers’ answers for common queries particularly for the things people are really frustrated with – it gives a good idea of where Monzo is lacking at the moment.

“I used to think Monzo’s slow responses were because they can’t keep up with the growing user base, but years after I first tested it, Monzo’s in-app chat support is still lacking. I do think the business account works well, but maybe only until you run into an urgent issue that gets ignored by customer service.”

– Emily Sorensen, Senior Editor, MobileTransaction

On desktop, the help section on the website does not have a search button to quickly find specific answers, which can be really frustrating as it means you have to sift through different sections to find a particular question.

In the app, there’s a search field for queries, so it is much faster to use this.

Customer reviews on TrustPilot are good on average, so it appears most people have no issues with Monzo. But there is a suspicious amount of overly positive reviews, which usually means the company incentivises these (i.e. they’re not true).

If you look at the bad reviews, you see many have complained about frozen accounts without explanation, followed by significant delays of retrieving the money stuck in it. This was confirmed by Watchdog five years ago, and it is still an issue users are experiencing regularly.

The other main complaint is a poor customer service and difficulties getting through to a real person on the messaging chat. You see a lot of automated replies and a reluctance from Monzo to help unless you call them.

Signing up

Creating a Monzo account is done almost entirely through the mobile app. You go to the App Store (on iPhone) or Google Play (on an Android phone) and download the app, then start the sign-up by submitting your email address. A verification email is sent where you need to click a link to continue answering questions about your personal and financial details.

At some point, you verify your mobile number through a text code, accept terms and conditions, take a photo of a valid photo ID and record a short video of yourself talking to your phone camera. This is a normal step for online banks to verify your identity. A ‘soft search’ check will be performed on your credit file during sign-up, which won’t affect chances of getting credit elsewhere.

After submitting everything, it usually takes between 5 and 60 minutes for Monzo to accept your application (it took a few minutes for us). After the approval, you can order the debit card for the personal current account that was just created.

You don’t have the option to only create a Business account, so first, you are actually completing the sign-up for a personal Monzo account. Afterwards, you can add a Business account from the app menu.

If you want to switch entirely from a previous bank account to Monzo, the Current Account Switch Service in the app lets you do that in a few taps. This will close your old bank account, move all its money to Monzo and redirect any future payments to Monzo.