- Highs: Easy online interface. Competitive fees. Can cancel the contract any time with 30 days’ notice.

- Lows: Lack of pricing transparency. Poor customer reviews. PCI compliance extra cost.

- Choose if: You’re confident about your sales volume and can use this to negotiate rates with Worldpay.

This review

Lowdown

Signing up

Fees & costs

Payouts

How it works

Customer service

Verdict

Lowdown

Worldpay – now owned by FIS – is the biggest payment processor in the UK, particularly among small and medium-sized businesses. The company offers a wide breadth of merchant services including a Virtual Terminal for MOTO (Mail Order/Telephone Order) payments.

You can subscribe to the virtual terminal as a standalone service or use it in conjunction with Worldpay’s other products (e.g. card machines).

There is a monthly fee for the virtual terminal, and card rates depend on your sales volume and the types of cards accepted. The fees are quite competitive for debit cards, particularly UK-issued Mastercard and Visa cards.

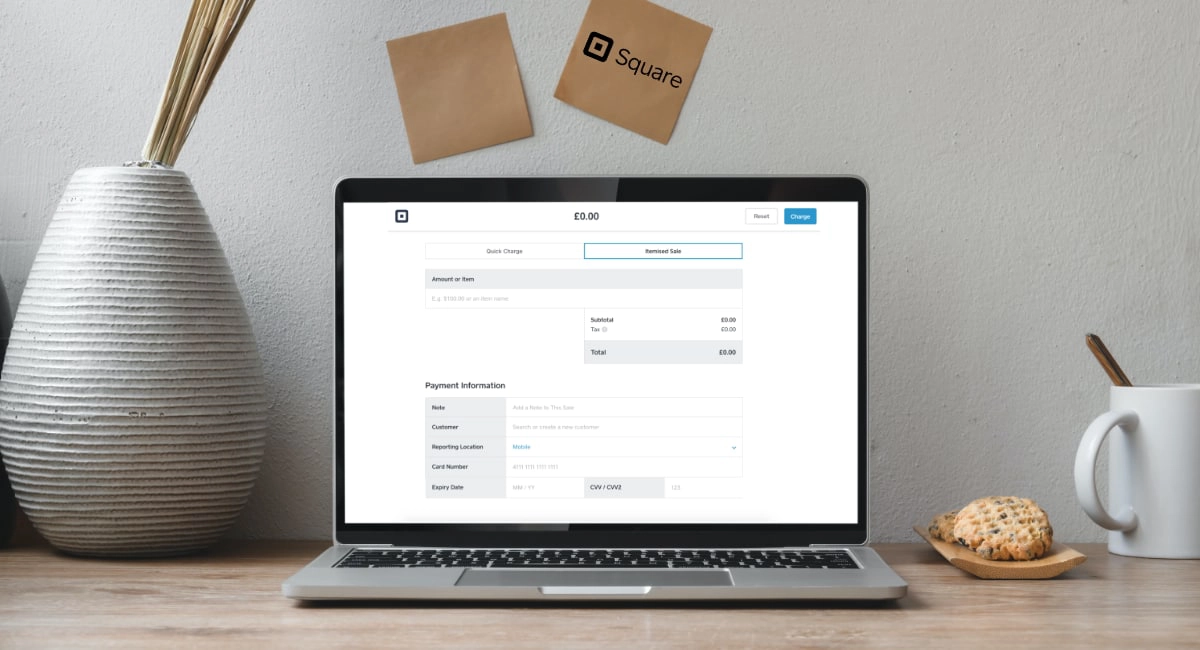

That being said, competitors like Square and PayPal offer easier sign-ups and simpler contracts for virtual terminals, so Worldpay increasingly has to justify its market position. Firstly, let us look at what it takes to set up the Worldpay Virtual Terminal.

Let customers pay directly: Worldpay Pay by Link for remote payments

Cards accepted

Enquirers should request a callback from one of Worldpay’s representatives who would want to hear about your business and payment processing requirements. Worldpay will then provide a quote based on expected card turnover and the needs of your business.

Needless to say, this approach isn’t popular with everyone, such as those who fear getting a hard sell from the sales rep (ever been to a timeshare presentation?) or just happen to prefer open and transparent pricing they can peruse and compare on their own.

But if you don’t mind dealing with a Worldpay rep over the phone, it could prove a good choice for your business.

Worldpay Virtual Terminal fees

Despite the lack of published information around Worldpay charges, there are some things we know.

First of all, the virtual terminal has a rolling 30-day contract that can be cancelled any time with 30 days’ notice. The monthly cost of the virtual terminal plan is £9.95.

| Virtual Terminal | Simplicity | Custom |

|---|---|---|

| Monthly fee* | £9.95 | £9.95 |

| Card rate | Fixed rate (e.g. 2.75%) | Varying rate (e.g. 0.95% for debit, 2.75% for credit cards) +10p or 20p |

| PCI compliance | Extra cost. Non-compliance fees apply | Extra cost. Non-compliance fees apply |

| Best for | Seasonal businesses, low volume of phone payments | Over £2,000 in monthly phone payment sales |

* Not including VAT.

| Costs | Simplicity | Custom |

|---|---|---|

| Monthly fee* | £9.95 | £9.95 |

| Card rate | Fixed rate (e.g. 2.75%) | Varying rate (e.g. 0.95% for debit, 2.75% for credit cards) +10p or 20p |

| PCI compliance | Extra cost. Non-compliance fees apply | Extra cost. Non-compliance fees apply |

| Best for | Seasonal businesses, low volume of phone payments | Over £2,000 in monthly phone payment sales |

* Not including VAT.

There’s a choice between two transaction fee structures: Simplicity flat-rate pricing and Custom varying pricing.

Simplicity charges a fixed transaction rate applicable to all cards. This fixed rate is determined by Worldpay based on your type of business, typical cards accepted and monthly over-the-phone payments turnover.

Custom‘s transaction charges are typically a flat fee 10p or 20p plus a percentage based on the type of card being processed. American Express and Diners Club will incur higher rates (e.g. 2.75%) than debit Mastercard and Visa cards issued in the UK (e.g. 0.95%). Foreign cards are usually more expensive than domestic cards, and premium, corporate and credit cards have higher fees as well compared to personal debit cards.

If your average transaction size is low, for instance £20 or less, it is best to negotiate a lower flat fee such as 10p. The %-rate charged will be based on the card accepted, so think about your customer base and the cards they would typically use.

On both plans, it is essential to pay for PCI-DSS compliance (card industry’s security standards for merchants) which can have annual and monthly fees. If you fail to return the required PCI documentation, you can expect to pay a monthly non-compliance fee. Worldpay offers a PCI-DSS management programme called SaferPayments. It is a kind of support portal with a choice of a basic and Plus plan depending on your preferred level of service (different costs apply).

All the costs and fees are given to you personally by Worldpay so we recommend you get an offer from the company for the full picture.

The monthly cost makes Worldpay Virtual Terminal better for merchants with a consistent sales volume above £2k a month, in which case the Custom plan can get you good transaction fees. The 30-day rolling contract makes it easy to commit to Worldpay’s £9.95 monthly cost, as the option is always there to cancel if you regret subscribing to it.

Looking for a secure system where customers enter card details themselves?

Check out the best payment link solutions

How long will it take to receive funds?

Payouts are initiated to your bank account after each transaction.

Debit card payments typically take just one working day to reach your bank account, while credit cards usually take longer to process. How long depends on the card in question, so make sure to ask the sales rep about that if fast settlement is important for your cash flow.

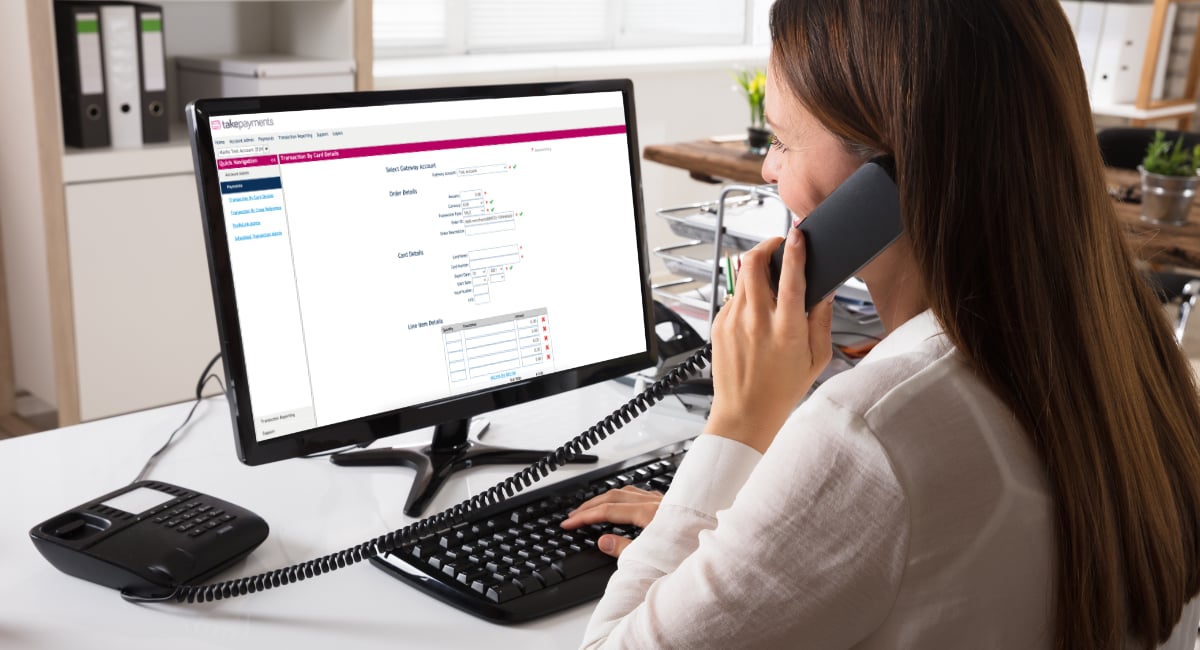

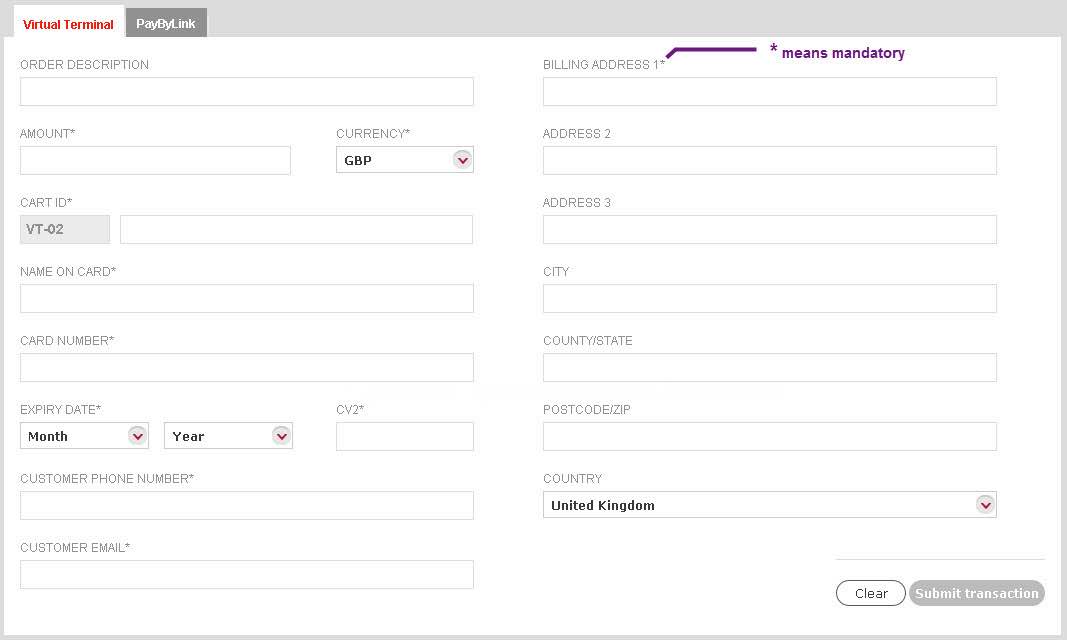

How the virtual terminal works

You only need a computer or tablet and an internet connection to take payments. You can ask the customer for credit card details over the phone, or acquire the details in writing if using mail orders, and complete the payment on the virtual terminal page.

With no technical setup required and minimal training, just log into the Worldpay Business Manager account in a browser and enter customer details, card information and order details to process the transaction.

The interface itself isn’t the most attractive design on the market, and it’s definitely not as user-friendly as some of its competitors.

Image: Worldpay

Worldpay Virtual Terminal could look more modern, but it does the job well.

There are a few useful features, though:

The virtual terminal accepts all major cards including Visa, Mastercard, Maestro, American Express and Diners Club.

Worldpay support is not always helpful, but the company is trusted by many UK businesses.

Customer reviews and support

Worldpay offers 24/7 telephone support for customers. Social media engagement is okay, but we’ve noticed from Facebook and Twitter comments that quite a few users did not get the help they needed over the phone, causing them to reach out on social media as a last resort.

Customer reviews on TrustPilot UK have improved in the past year, but there are still enough negative reviews for us to urge you to check all the contract details and charges before signing on. Review websites often have incentivised feedback, which appears to be the case with Worldpay’s page on TrustPilot, so you cannot trust all the positive ratings.

Running themes in user reviews include poor customer support, high termination fees and other unexpected charges, and overly eager sales reps signing them on too quickly before passing security checks (resulting in account freezes and transaction money held by Worldpay).

Our verdict

If you would like a virtual terminal from a British company with a big UK support team, Worldpay certainly fits the bill. But although Worldpay is trying to become leaner, less bureaucratic and offer more flexible packages, it’s clear from customer reviews that there is still a long way to go. Compared to past packages, the virtual terminal offerings have got more attractive for some customers.

For most businesses, it would make sense with the Custom plan, especially if the monthly sales volume is above £2k in phone payments and you mainly accept UK-issued cards and not many Amex or foreign cards. Merchants with a low sales volume or primarily international clients might be better off going for another provider with no monthly fees.