Taking phone payments allows you to close sales on a call, accept orders for pick-up, process deposits and ship products ordered by mail, among other things.

But what steps do you need to take to accept payments over the phone? Before you can start, you need to 1) set up a virtual terminal, and 2) check you are PCI-compliant. Only then can you 3) accept a virtual terminal payment.

Let’s go through the steps.

1. Choose a virtual terminal provider

Before you can take phone payments, the first thing you should set up is a virtual terminal.

In the UK, quite a few payment providers accept ‘card not present’ transactions, which is what over-the-phone and mail order payments are sometimes called. They will usually call it ‘virtual terminal’ or ‘MOTO’ (Mail Order/Telephone Order) payments, but you sometimes see it grouped with other ‘online’ payment options.

The virtual terminal providers offer different pricing and sign-up procedures, which are rarely transparent until you contact them. Large providers like Sage Pay and Worldpay offer telephone payments along with other services, often for a monthly fee in addition to transaction charges.

Let’s compare some of the popular virtual terminals:

| Provider | Virtual terminal | Link |

|---|---|---|

|

No monthly fee. No contract. 2.5% card rate. Quickest sign-up. Easy to use. | |

|

£9.95 + VAT monthly fee. 30-day rolling contract. Rates subject to turnover and card. | |

| £20 monthly fee. 2.9% + 30p per transaction. Payouts in PayPal account. | ||

|

Subject to application and approval. No monthly fee. 2.95% + 25p card rate. | |

|

Monthly or annual fee and contract. First 350 transactions/mo. free, then 10p per transaction. |

| Provider | Virtual terminal |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You can read more about these options in our overview of virtual terminals here.

All the above providers offer card machines (Takepayments, Worldpay) or app-based card readers (Square, PayPal, SumUp) too.

The virtual terminals are typically marketed openly, but SumUp is more secretive about theirs because it is subject to an application whereas other payment methods are available as standard. If you pass their internal checks and turnover requirements, SumUp may then activate the virtual terminal in your account.

No monthly fees, PCI compliance included, fixed transaction rate, very easy to use:

Square offers the simplest phone payments

2. Make sure you are PCI DSS-compliant

When you’ve chosen a virtual terminal, it’s time to put measures in place to ensure your payments are secure. That is: we highly encourage you to comply with the Payment Card Industry Data Security Standard (PCI DSS) when handling confidential data.

Why? Because phone payments are often the most vulnerable to fraud compared to card machine payments where the customer is present.

It is really useful to choose a provider that is able to support you in meeting the strict PCI compliance rules protecting your business and customers.

Each virtual terminal provider has their own recommendations and systems in place. In some cases, you pay extra for it, but other providers don’t charge for it and instead carry that burden for you. Others leave the risk and compliance totally in your hands, as seen in the overview below.

| Virtual terminal | PCI compliance |

|---|---|

|

No paperwork required. Security steps encouraged during payments instead. |

|

Paperwork required. Costs of compliance depend on package. |

| You’re responsible for the paperwork (required). Recommended to achieve it through partner (costs vary). |

|

|

No paperwork required. Security steps encouraged instead. |

|

Paperwork required. Monthly fee + optional annual fee if you want help. |

| Virtual terminal |

PCI compliance |

|---|---|

|

No paperwork required. Security steps encouraged instead. |

|

Paperwork required. Costs of compliance depend on package. |

| You’re responsible for the paperwork (required). Recommended to achieve it through a partner (costs vary). |

|

|

No paperwork required. Security steps encouraged instead. |

|

Paperwork required. Compulsory monthly fee + optional annual fee for assistance. |

It is generally recommended that small merchants fill in a PCI Self-Assessment Questionnaire and follow the steps recommended by PCI to maintain secure payment processes.

If in doubt, your chosen virtual terminal provider can guide you in what to do.

Need to accept payments between mobile phones?

Compare pay-by-link solutions for phones

3. Taking the payment

When you have a virtual terminal and are set up for secure payments, you can take a phone payment following these steps.

1. Go to web page

Log in to your payment system account and select the correct option for this type of payment. What it is called will vary depending on your provider. It’s often called “Virtual Terminal”.

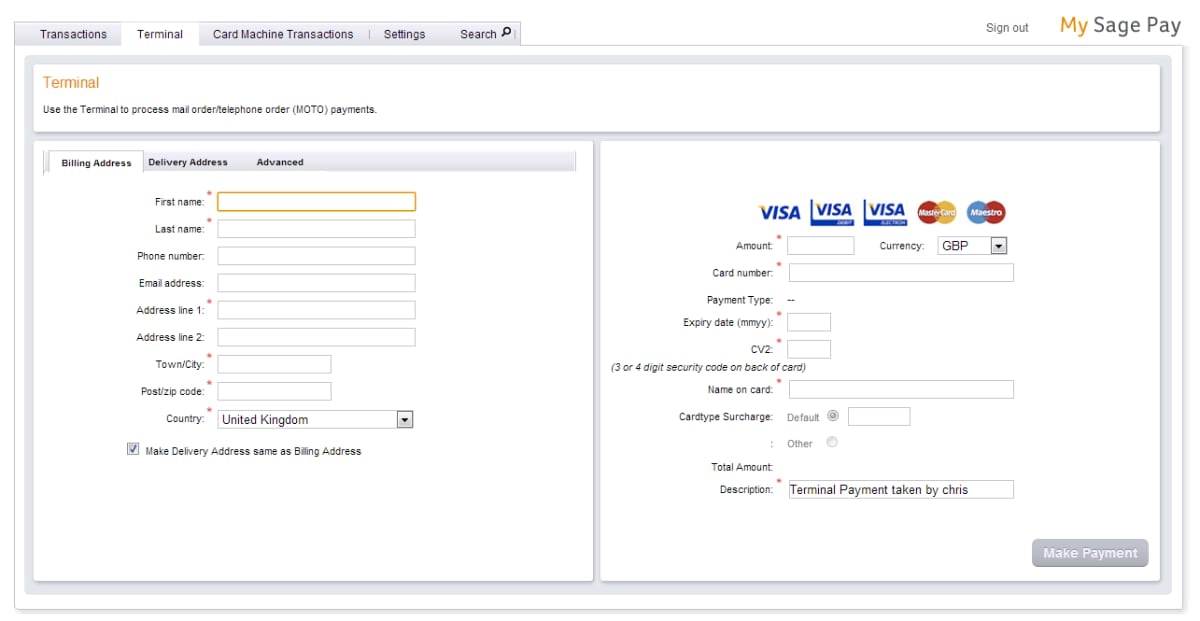

2. Enter card and transaction details

Follow the on-screen prompts. Required information usually includes the long card number, card expiration date and card security code. The three-digit security code can be found on the signature strip on the reverse side of the card.

Example of a detailed virtual terminal page, viewed in a desktop web browser. Image: Sage Pay

3. Enter security information

Because the cardholder is not present for the transaction, you will be unable to enter a PIN. Instead, you may be required to provide additional security information which may consist of:

- The cardholder name as written on the card

- The cardholder’s postcode

- The door number of the cardholder’s address

4. Wait until transaction is finalised

Submit the information for processing using the ‘Submit’, ‘Complete Transaction’ or similarly-worded button. It’s important to keep the customer on the phone while the transaction is being processed. You can use this time to get any other customer information which may be useful, for example an email address or full postal address.

5. Send a receipt

Once the payment has gone through, you will be able to ask the customer how they would like to receive their receipt. Many payment providers give the option to email the receipt to the customer. If you’re shipping a product, you may wish to include it in the parcel. Make sure you remember to write ‘paid by phone’ on your copy of the receipt in case you need to refer to it at a later time.

That’s it – simple. This is how you take payments over the phone, boosting your sales in no time.

Compare the most affordable virtual terminals: