Payment links are an easy way to accept payments online without customers having to use a card machine. They are, for example, handy for impromptu sales on the phone, social media, online and in person – and you don’t even need a website.

Depending on the merchant provider, you may be able to send a pay button via email, text message or social media. Fees for these transactions are higher than for card terminal sales, as card details are entered manually rather than confirmed physically in a card reader.

There’s still a big difference in the kinds of costs involved in pay links. Pay-by-links (different term, same thing) also work slightly differently with each provider, as we shall see below.

Compare payment links for small businesses in the UK:

| Payment link | Transaction & monthly fee | Best for | Offer |

|---|---|---|---|

| Revolut | 1%-2.8% + 20p From £0/mo |

Cheap, with multi-currency account | |

| Takepayments | Custom rates and plans | Competitive, good in-browser features | |

| Square | 1.4%-2.5% + 25p No monthly fee |

Many free payment link features | |

| Monzo | 1.5%-3.25% + 20p, or free From £0/mo |

Accepts easy bank transfers and cards | |

| Worldpay | Custom rates £9.95 + VAT/mo |

Desktop users who use Worldpay | |

| SumUp | 2.5% No monthly fee |

Versatile links managed from app | |

| Tide | 1.5%-2.5% From £0/mo |

Lowest rate without fixed fee added | |

| PayPal | From 2.9% + 30p No monthly fee |

Reusable links for simple purposes | |

| Airwallex | 1.3%-3.15% + 20p No monthly fee |

International account features with links |

| Payment link |

Transaction & monthly fee |

Best for | Offer |

|---|---|---|---|

| Revolut | 1%-2.8% + 20p From £0/mo |

Cheap, with multi-currency account | |

| Take- payments |

Custom rates and plans | Competitive, good in-browser features | |

| Square | 1.4%-2.5% + 25p No monthly fee |

Many free payment link features | |

| Monzo | 1.5%-3.25% + 20p, or free From £0/mo |

Accepts easy bank transfers and cards | |

| Worldpay | Custom rates £9.95 + VAT/mo |

Desktop users who use Worldpay | |

| SumUp | 2.5% No monthly fee |

Versatile links managed from app | |

| Tide | 1.5%-2.5% From £0/mo |

Lowest rate with fixed fee added | |

| PayPal | From 2.9% + 30p No monthly fee |

Reusable links for simple purposes | |

| Airwallex | 1.3%-3.15% + 20p No monthly fee |

International account features with links |

Our opinion of the payment links

MobileTransaction has tested the payment links on this list, so we can vouch for their validity and trustworthiness.

Apart from the clunky, web-based pay-by-links of traditional card processors (Worldpay and Takepayments), we’ve seen a clear shift from soulless, basic payment links in apps to more nuanced link options. For instance, several providers now offer “easy bank transfers” as well as card payments.

“The best payment link is the one that your client will use to pay you through. I can’t tell you which is best for that – you have to pick the one you find most accessible, affordable and appropriate for your needs. And look out for fixed transaction fees – they make small transactions expensive.”

– Emily Sorensen, Senior Editor, MobileTransaction

Here are the some of the leading options we can recommend:

Cheapest payment links: Revolut only charges 1% + 20 for online payments with a domestic consumer Visa card or Mastercard – the lowest rate on this list (but other cards cost 2.9% + 20p).

Best payment links acepting bank transfers: Monzo’s easy bank transfers are free to accept until 2025 and work well.

Best links for open amounts and donations: Square has the best features for tailoring and monitoring online donation links, but the fixed 25p fee alongside the percentage transaction rate can make it expensive for small donation amounts.

Best for fast transfers: Again, Square is best for instant bank account payouts, but it costs 1% per transaction to activate this setting. Next-day transfers are available from SumUp, and PayPal receives transfers directly in its online account.

More ways to accept payments:

Best online payment systems for small businesses

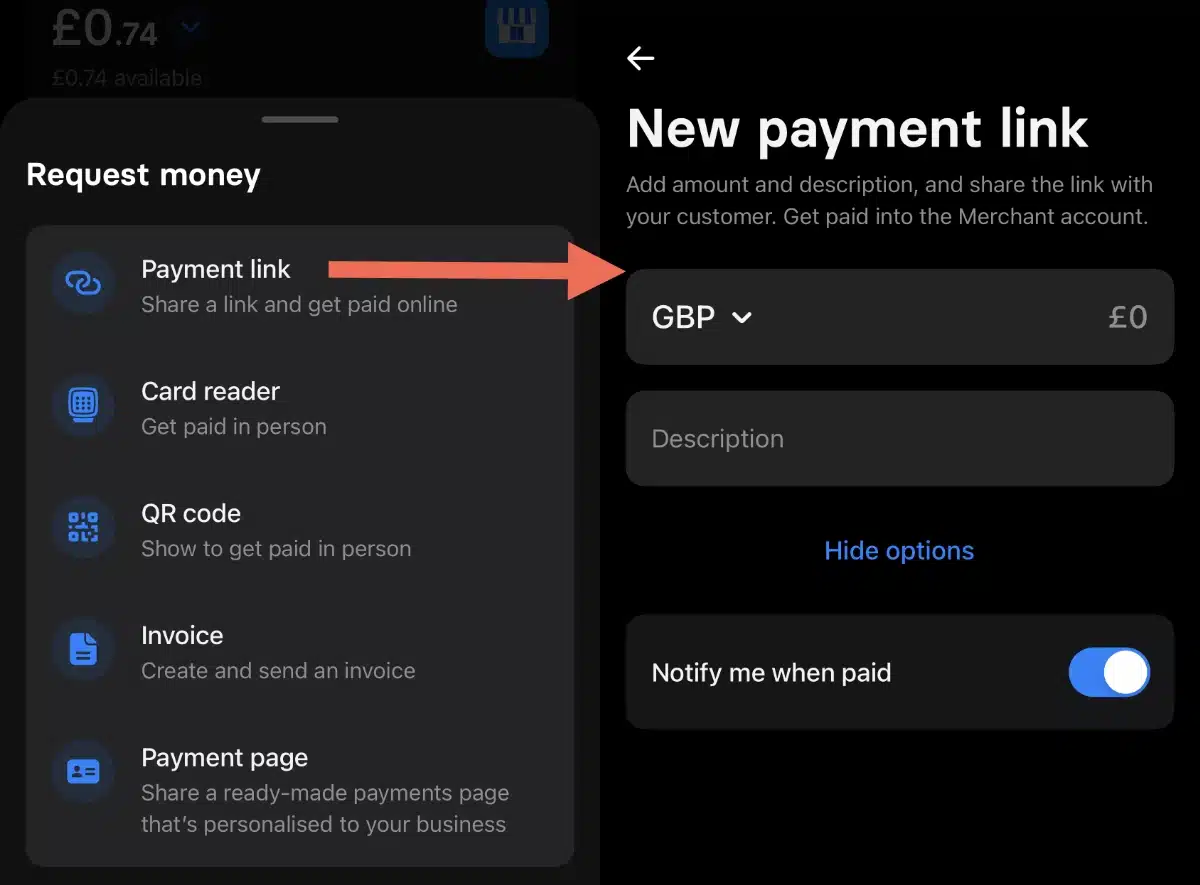

Revolut payment requests – low fee for domestic cards

If you sign up for a Revolut Business account, you can set up online payments acceptance as well by applying for a Merchant Account. This gives you these features:

- Payment links (“payment requests”) sent from the Revolut app by text or email

- QR code payments displayed in app for contact-free payments

- Online payment gateway for website

- Simple invoicing

- Personalised payment page to share

You can choose between 28 different currencies for the payment link amount. Since you can hold multiple different currency accounts with Revolut (GBP, EUR, USD etc.), payments can settle in the matching account to avoid currency conversion fees. Payouts only take a day to reach your Revolut account.

Image: MobileTransaction

The online payment features are available even with a free Revolut Business plan, as long as you also qualify for the Merchant Account.

Bank transfers, Revolut Pay and UK consumer debit or credit cards incur a low fee of 1% + 20p per transaction, while all other payment cards cost 2.8% + 20p. Only Visa and Mastercard are accepted.

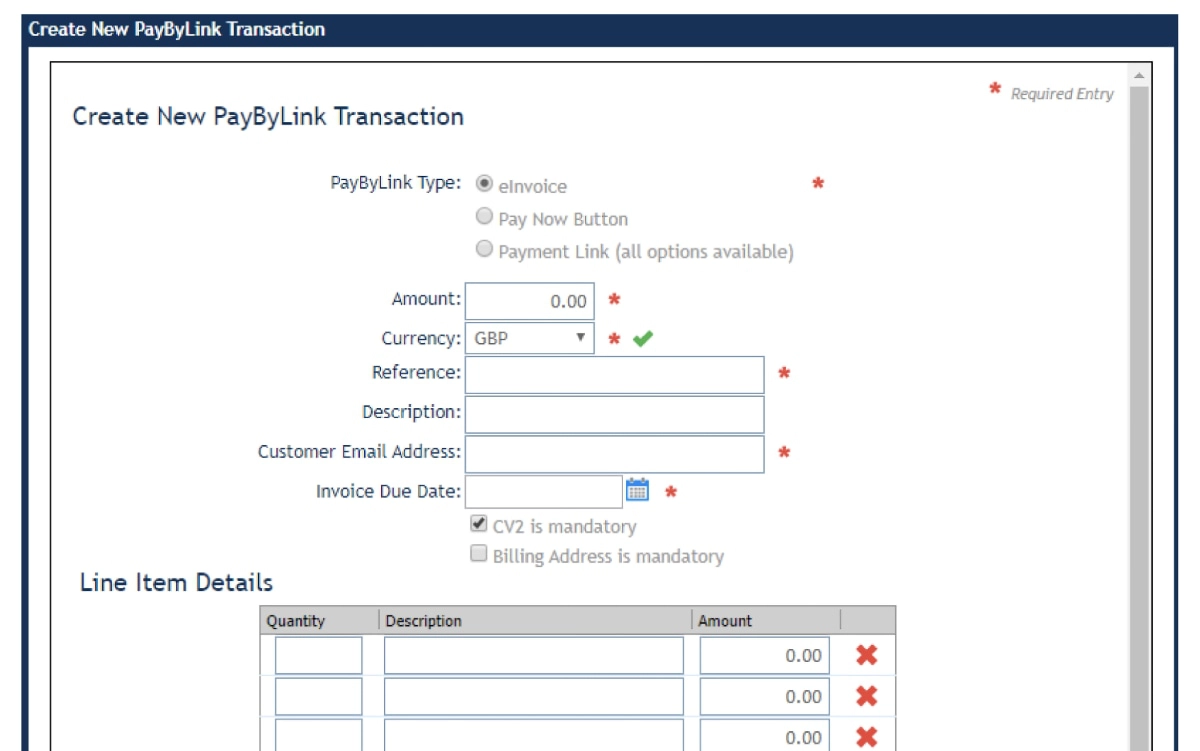

Takepayments Pay by Link – good link features

Takepayments (formerly Payzone) also offers payment links, but only for sending over email. As with Worldpay, you’re able to customise the email to include your own logo and text together with a ‘Pay Now’ button, or you can copy and paste the pay button into a pre-written email. You also have the option to create and send electronic invoices with a payment button.

The links are created in your Merchant Management System account accessed from any web browser on a computer or mobile device.

Image: MobileTransaction

Where Takepayments differs on this shortlist is the fact that you enter into a 12-month contract to use payment links. If you don’t cancel your contract with enough notice, you will roll into a further 12-month contract term, or you can cancel early for a termination fee.

Transaction rates will be given during sign-up as they will be tailored around your business and typical turnover. Generally, Takepayments rates will only really be competitive with a consistent pay-by-link turnover of over £2k-£3k monthly.

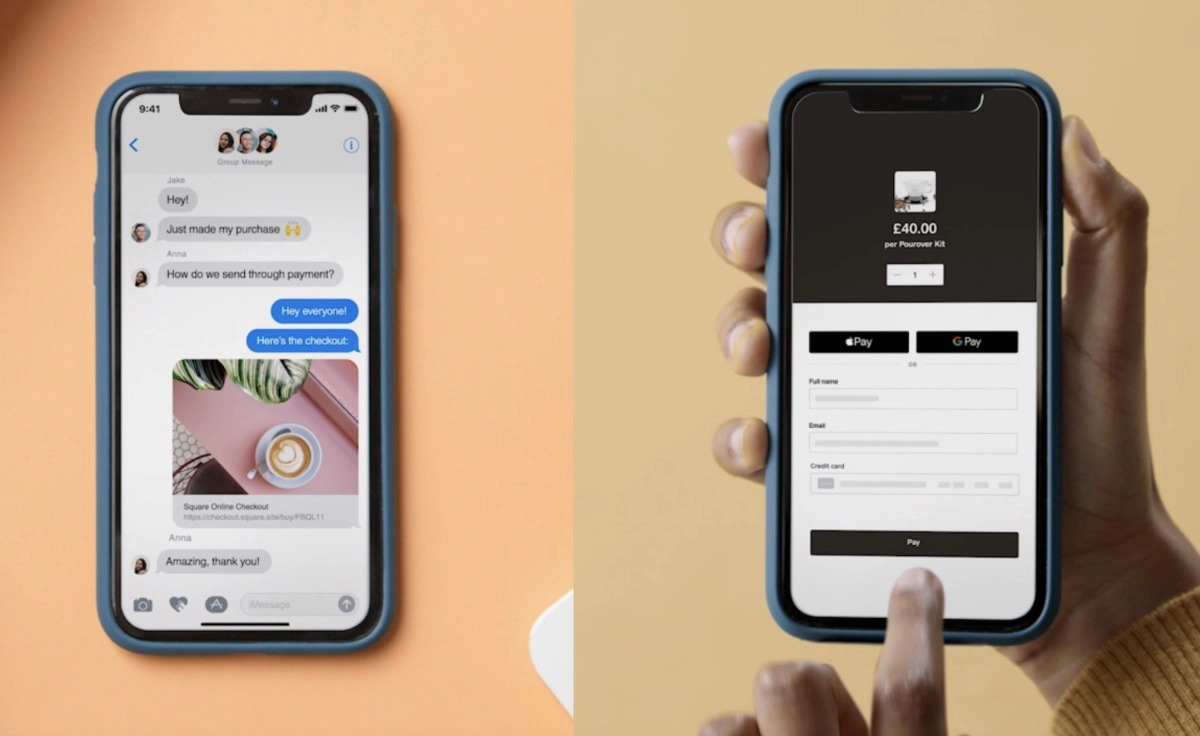

Square Online Checkout – versatile payment links

Square Online Checkout is probably the most versatile payment link solution without monthly fees or a contract. Rather than generating links for a specific POS transaction, individual links are created for individual products or donations with fixed or open amounts.

You can then share these links via a social app or copy and paste the URL where needed. For example, you go to the Online Checkout menu in the Square POS app and pick the link for a certain sandwich, then send it to the customer who wants to buy it. You can also show or print a QR code to display at your business. Embed codes can even be generated for embedding pay links on your website.

In the Square Dashboard (browser), you can then see how many transactions have been accepted through the different links.

The customer opening the links will only need to enter their name, email address and card details for completing the transaction. If they access a link with an open amount, they will also enter the amount to pay.

Square has a simple sign-up form on their website, requiring you to connect a bank account for receiving the payouts. The only cost is a transaction fee of 1.4% + 25p for UK cards and 2.5% + 25p for all non-UK payment cards.

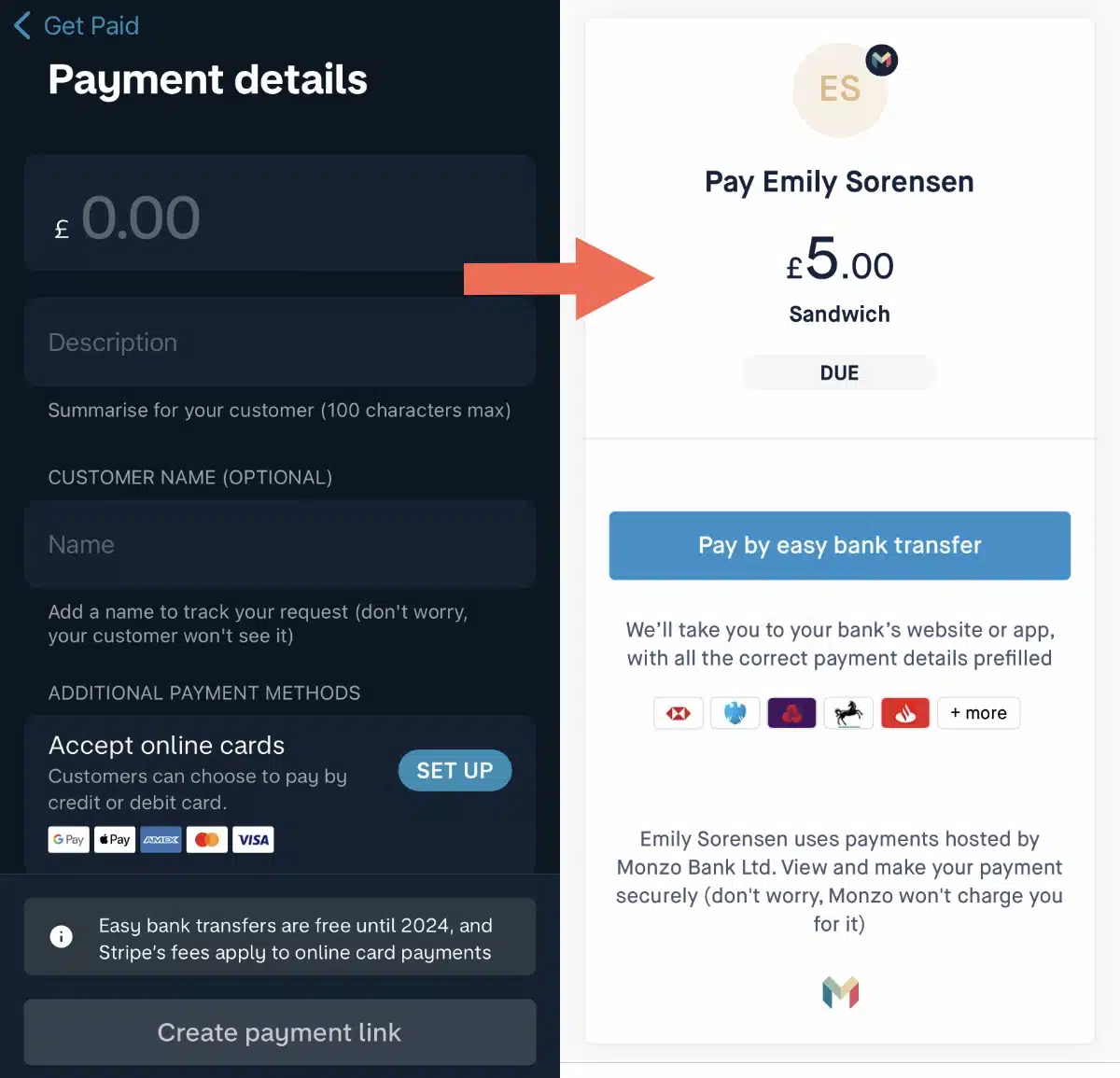

Monzo Business – with instant bank payments

With a Monzo Business account and app, you can send payment links from your smartphone, both on the free and paid (£5/month) plan. The great thing about Monzo’s links is that they accept account-to-account transfers as well as card payments and mobile wallets.

To accept cards, you must sign up for Stripe first, since that is the card processor. This is done easily by following the links from the Monzo app. The account is already set up for the “easy bank transfers” enabling payers to transfer the amount in just a few steps with their banking app on their phone.

Image: MobileTransaction

Stripe’s transaction fees are 1.5% + 20p for UK standard cards, 1.9% + 20p for UK premium cards, 2.5% + 20p for EEA cards and 3.25% + 20p for all other cards. These rates apply to Visa, Mastercard or American Express card, and the mobile wallets Apple Pay or Google Pay. Monzo does not add any extra fee on top.

Card payment funds are normally settled in your Monzo account within a couple of working days.

The bank transfer option incurs no transaction fee until year 2025. It uses the Faster Payments Scheme, which also ensures funds land in the Monzo account straight away (or within 24 hours at the latest).

Worldpay Pay by Link – traditional email invoicing

Worldpay’s Pay by Link allows you to send a Pay Now button in an email or embed it in a digital document for the customer. You can use it for creating email invoices, request deposits, finalise a booking or send a quote payable on a web page.

The service is best for those with a consistent monthly turnover because you have to pay a fixed monthly fee of £9.95 + VAT on top of transaction fees. Pay by Link is on a rolling, 30-day contract that can be cancelled with a month’s notice to Worldpay any time.

You get custom transaction fees based on sales volume, which is most competitive for a monthly sales volume above £2,000. UK-issued debit cards have the lowest rates and credit cards higher, while foreign, premium and corporate cards cost more to process.

Though it comes at a monthly cost, a Worldpay link does have some nice features. For example, you can set payment due dates to help chase up late payments, send payment reminders and customise emails with a pay button, logo and personalised message. A downside is that you have to log into an internet browser to send the links from a computer or tablet – it’s not recommended to use a browser on your phone.

SumUp Payment Links – handy features on the go

Without monthly fees or a contract, merchants can send SumUp Payment Links directly from an app to customers.

All it requires is to sign up online, order a card reader (SumUp is, after all, primarily aimed at face-to-face merchants) and start using the SumUp App. Funds either land in your complimentary Business Account the next day (incl. weekends), or you receive payments directly in your bank account after 1-3 working days.

The only thing you’re paying is a fixed rate of 2.5% per transaction.

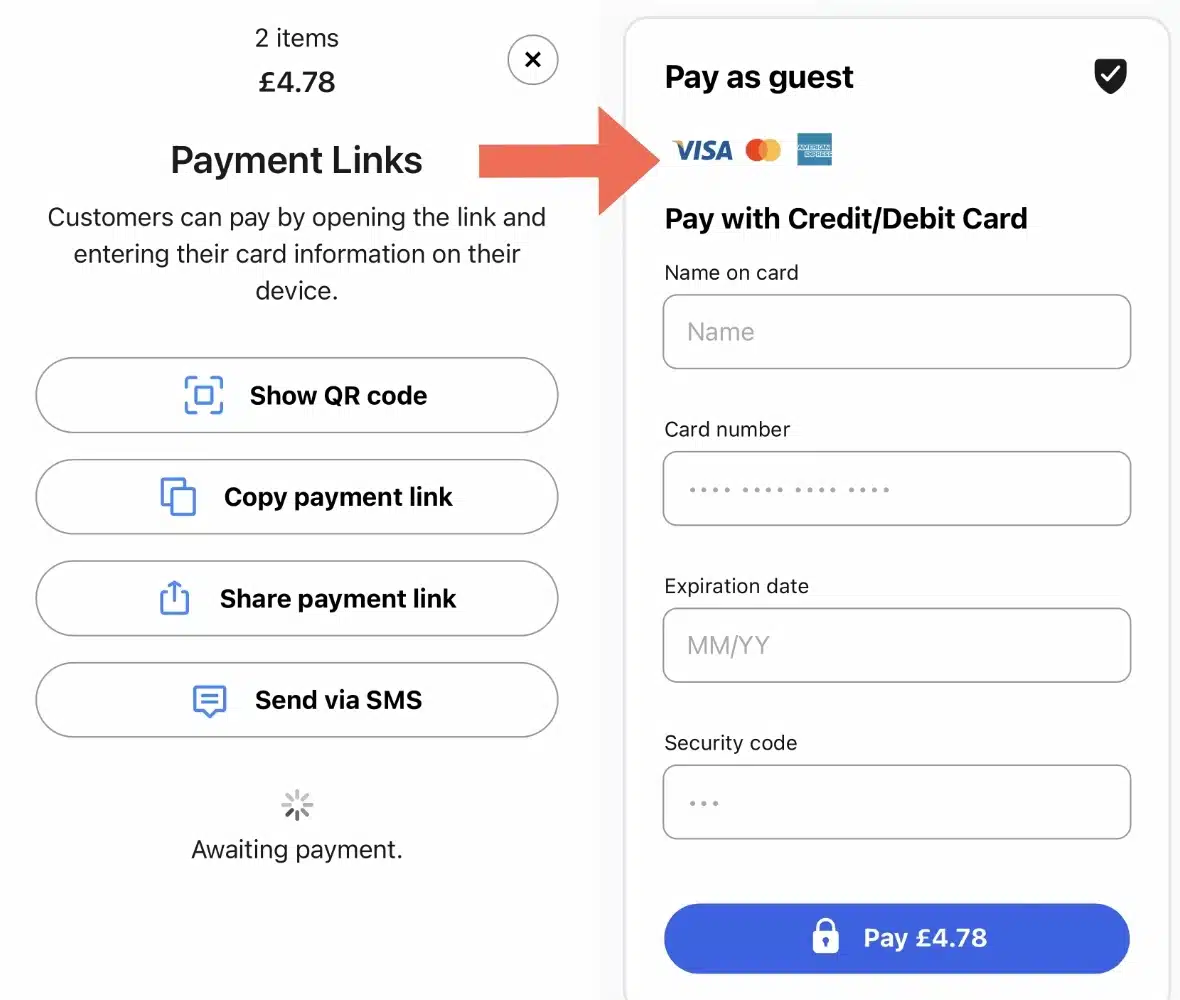

Image: MobileTransaction

You can add products to the bill for itemised receipts or just set a pound total for the transaction before sending a link. There are actually several ways you can use SumUp Payment Links:

- Send it via SMS

- Share it through a social app on your mobile device

- Copy the link to paste it into a message elsewhere

- Show a QR code to the customer on your screen or print it for a sign

The customer can then pay on the checkout page that opens from the link. If scanning a QR code with their phone, the customer can pay through SumUp Pay or by entering card details in their mobile browser.

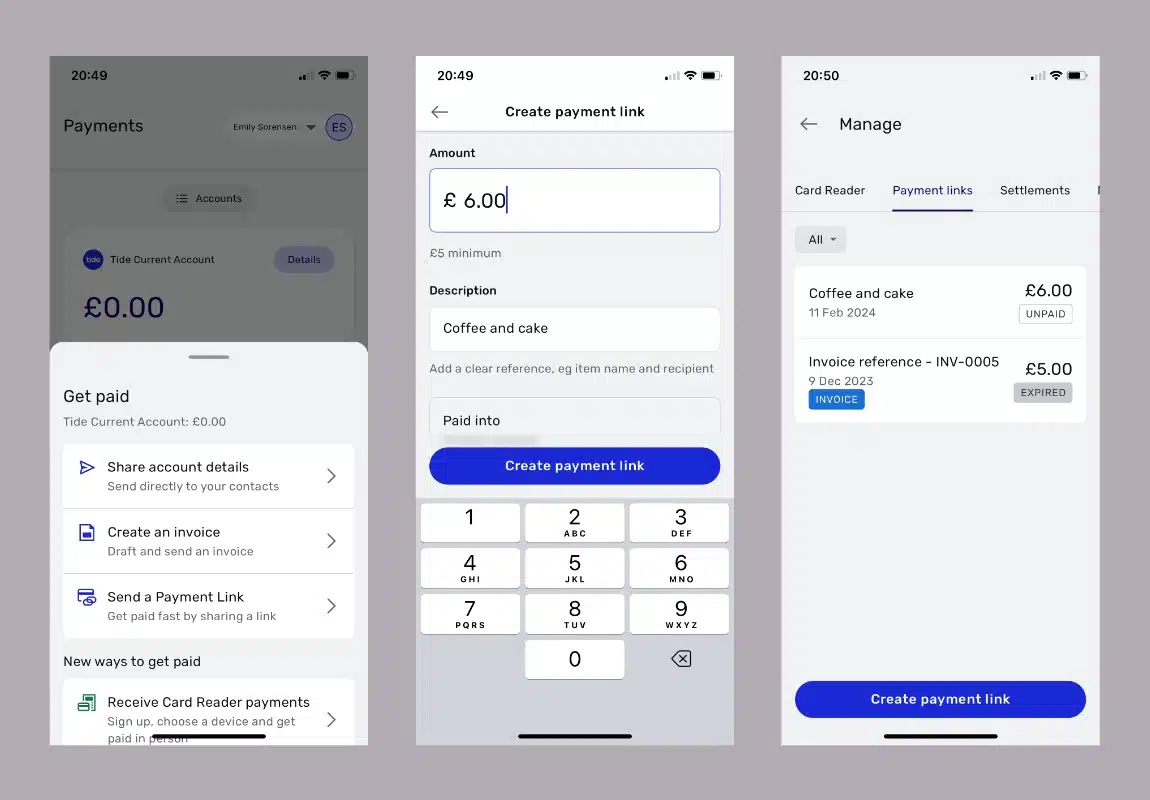

Tide Payment Links – lowest rate without a fixed fee

Tide business account have a good deal: they can send payment links directly from the banking app for a low rate.

The downside? It takes up to 3 working days to receive funds in the Tide account after the cardholder has paid. This is slower than most other options on this list, but that’s the cost of a lowered rate of 1.5% per transaction for UK consumer Mastercard or Visa cards. All other cards – i.e. business/corporate, premium and non-UK – cost 2.5%.

Image: MobileTransaction

The Tide app gives an overview of all the payment links you’ve sent along with “paid” and “unpaid” labels and whether they were sent on a Tide email invoice. When the recipient has paid, you also receive a phone notification.

To access all this, you do need to subscribe to a Tide Business Account, but there’s a free plan as well as paid ones with better customer support.

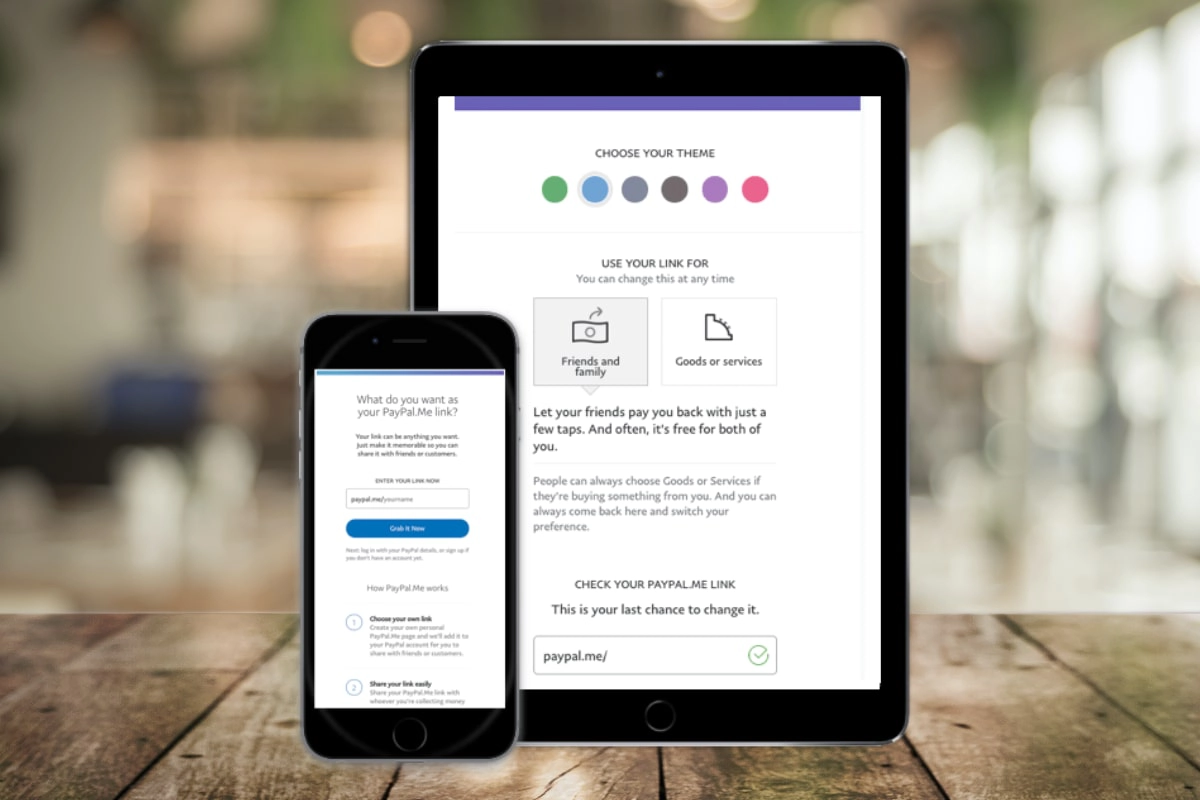

PayPal.Me – reusable links for PayPal transactions

PayPal offers a very convenient service where businesses can create a pay link for free through the PayPal.Me service. It has no contractual commitment, no monthly fees, and payouts appear in the online PayPal account almost immediately after each transaction. If you need the money in your bank account, however, you will need to manually transfer it to your linked bank account, but even that is quick (a few hours).

It costs 2.9% + £0.30 to receive a domestic PayPal payment link transaction, which is not that cheap, so it might be best suited for occasional or limited sales. Additional fees are added to non-domestic card payments.

The links work like this: create a link URL in the format “paypal.me/yourbusiness” – this will be yours to use indefinitely. When you want to get paid, you send this link to the payer who will be able to enter an amount manually to pay, or you can pre-specify an amount for the recipient by adding the number at the end of the payment link (“paypal.me/yourbusiness/30” goes to a payment page for a £30 bill).

You can send the link in any context online, e.g. by text, chat message, email or any social media channel. Clients can pay through their own PayPal account (with Buyer Protection) in any of 25 different currencies.

The fact you can choose not to specify a transaction amount for the customer means that PayPal’s payment links are great for donations, while also suitable for any other business payments.

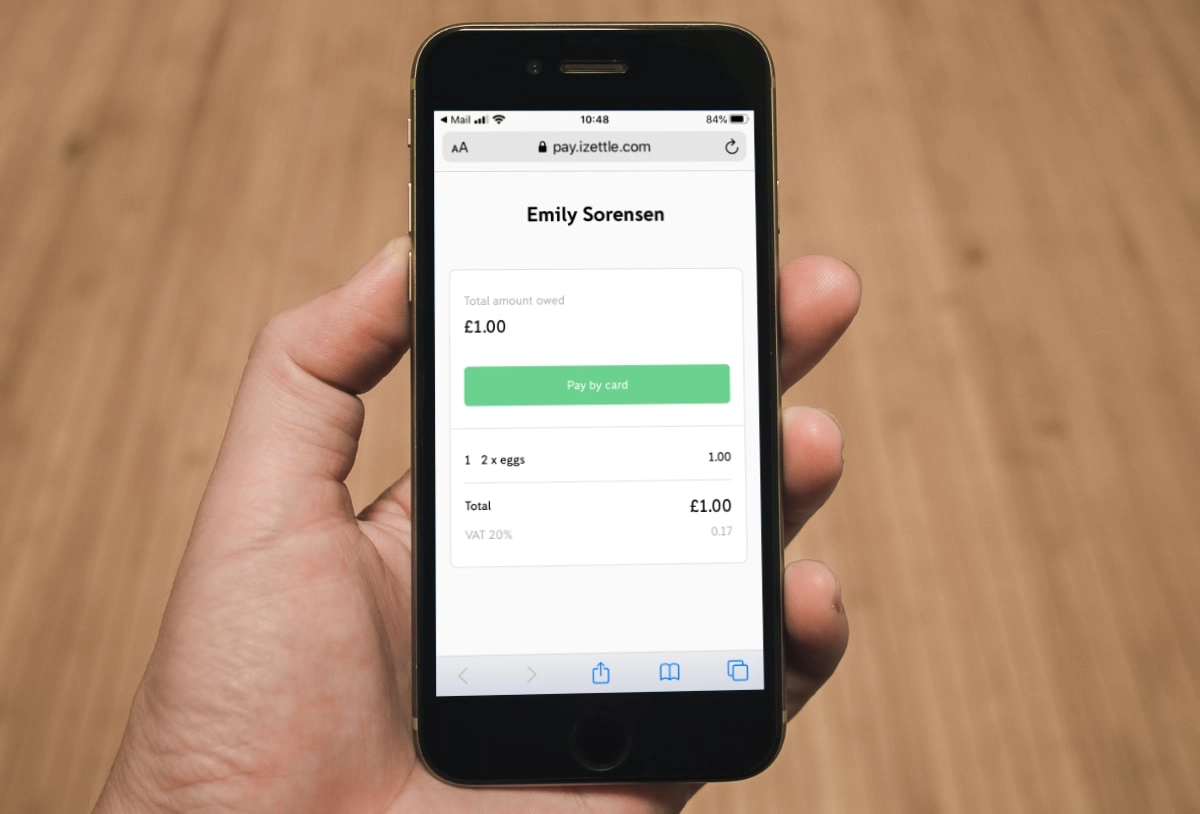

See also: Zettle Payment Links

PayPal owns Zettle (previously iZettle), but the payment links available in the app connected with Zettle Reader has a different fee: 2.5% per transaction.

We think it’s worth mentioning Zettle Payment Links because they have no fixed fee, just the fixed percentage rate, so they are cheaper for lower transaction amounts than PayPal.Me.

Sending a pay link from the Zettle app is extremely simple: enter a transaction total with a description (or add items from the product library), recipient, and choose whether to send the link by SMS or a social app on your phone including email.

When we tested copying a link, however, it didn’t just copy the URL, it copied a whole message, which was frustrating when you just want to share the link in another app. If you want to customise the message that comes with the link, you can do that after adding it to an email or message draft.

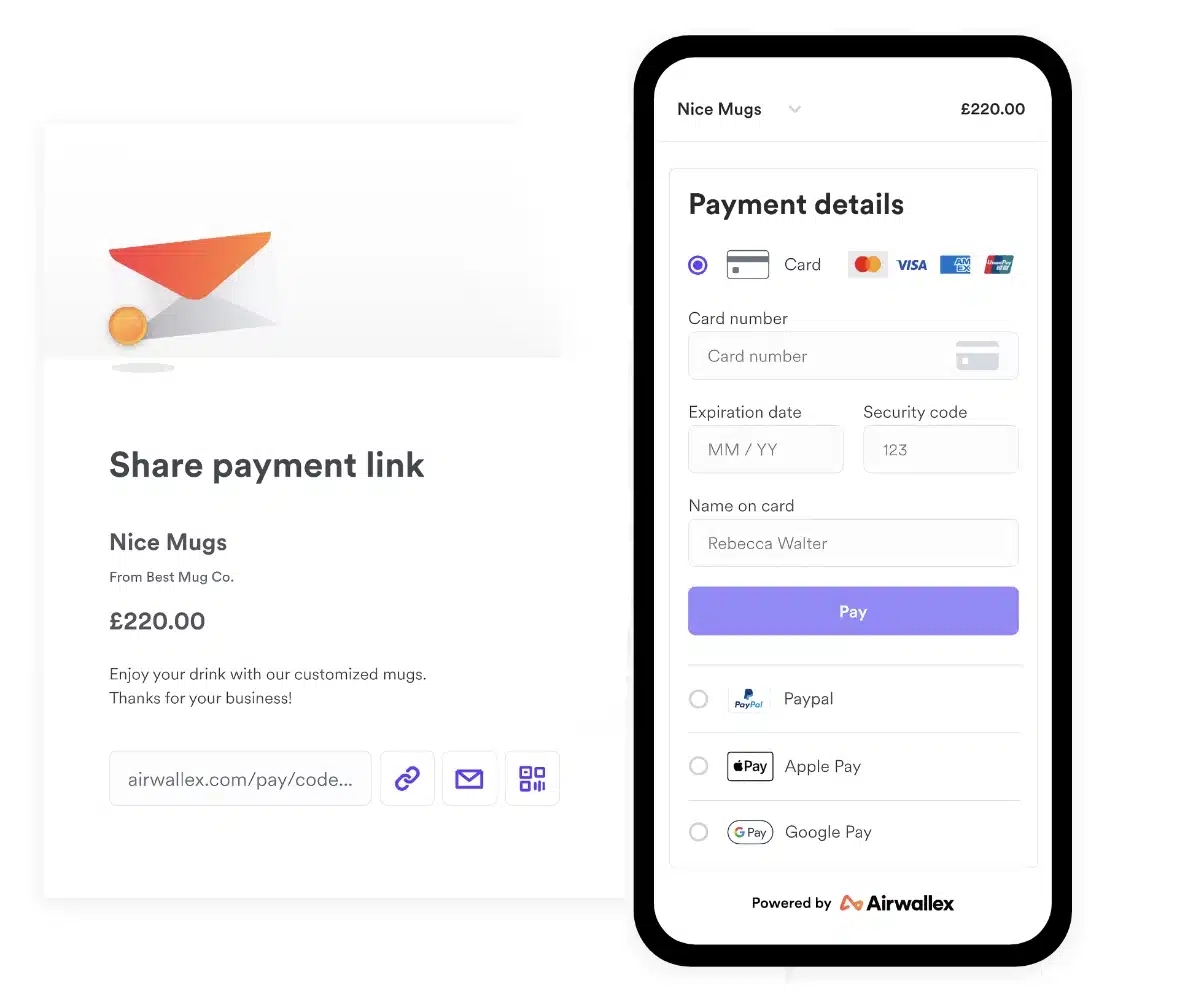

Airwallex – accepts 170+ currencies

Airwallex offers global business accounts with certain payment features for cross-border merchants. This includes payment links that can be sent from the web dashboard (no mobile app is yet available for it).

The unique selling point of Airwallex is its acceptance of over 170 currencies that can settle in 8 different currency accounts. The platform’s exchange rates are quite good, but vary according to the type of currency exchange. In any case, it’s a great choice for international transactions on a regular basis.

The one-time and multi-use links can be shared via text, email invoice or anywhere you can paste the URL online. The web portal gives an overview of transactions, and email notifications tell you when someone has paid.

There’s no monthly fee or contract lock-in, but the platform can be a bit strict with who it accepts as users.

Transaction fees are 1.3% + 20p for UK Visa and Mastercard, 2.4% + 20p for EEA Visa and Mastercard, and 3.15% + 20p for all other cards including UnionPay. It does take 3-5 working days to receive funds in your Airwallex account – not exactly fast.

Have you considered email invoices?

Best invoicing apps for small UK businesses

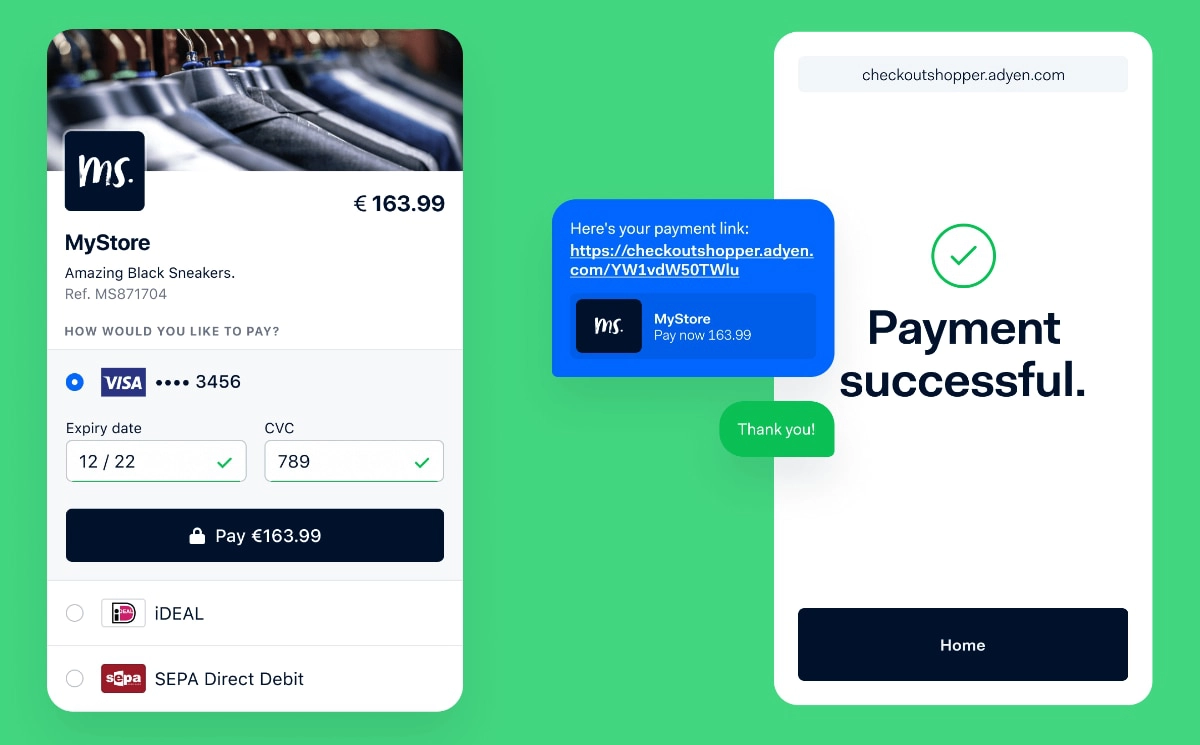

Honourable mention for high-volume businesses: Adyen

Adyen is a renowned online payments provider offering international card acceptance mostly for medium-to-large businesses. It is intended for businesses transacting at least £1.5-£2 million annually, and who would like to consider Adyen as their payment platform for all sales channels, not just payment links.

Adyen Pay by Link transactions cost a 10p gateway fee plus the interchange rate of the payment card which can be anything from 0.2% to 3% (e.g. domestic debit cards cheapest, foreign premium cards on the high side). This is good value for merchants accepting mostly UK-issued debit cards for transaction amounts averaging over £15.

There’s no setup, closure or monthly fees, but Adyen requires a minimum invoice of €100/US$120 monthly. Opening an account requires a minimum deposit of 500 EUR, which is returned when the account is closed. To make this worthwhile, your card turnover through Adyen Pay by Link should be at least £20k monthly, in most cases significantly more.

Adyen accepts many payment methods globally. The links can be sent via any channel online in various currencies and can be time-limited. The built-in payment security tools such as ‘3D Secure 2’ make Adyen more advanced than most payment links on the market. You can also customise the checkout page, create a QR code for the link and create open amount links.

Which provider to choose?

If you receive many small amounts (below £10), it’s cheapest to go for an option with just a fixed percentage rate per transaction, i.e. Tide, SumUp or Zettle. All other options incur a fixed fee on top of a percentage rate, which makes the overall fee too high for low transaction values.

Other cost-saving options are Revolut with its low domestic rate and Monzo with its free instant bank transfers.

Revolut and Monzo business account holders benefit from easy access to payment links from a banking app, so they’re ideal if you want a business account too.

Square, SumUp, Tide, Monzo and Revolut also let you easily send and copy links through a mobile app, rather than having to log into a web portal on a computer. Their links can typically be used on social media like WhatsApp, Messenger, Facebook, emails, texts and anywhere else you want to get paid online.

With Square and SumUp, you can even print QR codes for specific links to display on your premises.

If cash flow is important, Revolut’s settlement takes just one day whereas PayPal.Me receives transactions directly in an online account. Monzo’s direct bank payments settle immediately. With SumUp Business Account and its debit card (free), you receive funds the next day. But Square takes the prize with its Instant Transfers in your bank account, if you can stomach an additional 1% fee.

Need to take payments over the phone?

5 best virtual terminal providers in the UK

Merchants with a consistent turnover of at least £2,000-£3,000 per month might prefer Worldpay or Takepayments; the only options with a monthly fee required. Both offer rolling contracts, though Worldpay’s is easier to swallow with its 30-day commitment compared with Takepayments’ 12 months. Transaction rates and overall value of the two are similar.

Cross-border businesses who benefit from multi-currency accounts and favourable currency exchange rates should check out Airwallex and Revolut that both excel in that area.

Adyen could be used for medium, big and enterprise businesses with a pay-by-link transaction volume of at least £20k per month. Above this threshold, the variable interchange rates on payment cards will save you money compared with more fixed rates from e.g. Worldpay.

| Provider | Costs | Website |

|---|---|---|

|

£0+/mo, no contract 1% + 20p for consumer UK cards 2.8% + 20p for all other cards |

|

|

Negotiable monthly fees 12-month contract Custom transaction rates |

|

|

£0/mo, no contract 1.4% + 25p for UK cards 2.5% + 25p for non-UK cards |

|

|

£0+/mo, no contract 1.5-1.9% + 20p for UK cards 2.5% + 20p for EEA cards 3.25% + 20p for other cards Free bank transfers |

|

|

£9.95 + VAT/mo 30-day rolling contract Custom transaction rates |

|

|

£0/mo, no contract 2.5% per transaction |

|

|

£0+/mo, no contract 1.5% for UK consumer cards 2.5% for all other cards |

|

| £0/mo, no contract 2.9% + 30p per domestic transaction Additional fees for non-UK payments or 2.5% per transaction (via Zettle by PayPal) |

||

|

£0/mo, no contract 1.3% + 20p for UK cards 2.4% + 20p for EEA cards and Amex 3.15% + 20p for all other cards |

| Provider | Costs | Site |

|---|---|---|

|

£0+/mo No contract 1% + 20p for consumer UK cards 2.8% + 20p for all other cards |

|

|

Negotiable monthly fees 12-month contract Custom rates |

|

|

£0/mo No contract 1.4% + 25p for UK cards 2.5% + 25p for non-UK cards |

|

|

£0+/mo No contract 1.5-1.9% + 20p for UK cards 2.5% for EEA cards 3.25% + 20p for other cards Free bank transfers |

|

|

£9.95 + VAT/mo 30-day rolling contract Custom transaction rates |

|

|

£0/mo No contract 2.5% per transaction |

|

|

£0+/mo, no contract 1.5% for UK consumer cards 2.5% for all other cards |

|

| £0/mo No contract 2.9% + 30p per domestic transaction Additional fees for non-UK payments or 2.5% per transaction (via Zettle by PayPal) |

||

|

£0/mo No contract 1.3% + 20p for UK cards 2.4% + 20p for EEA cards and Amex 3.15% + 20p for all other cards |