Contents

In summary

What is it?

Our opinion

In detail:

Costs and fees

Checkout features

Tech specs

Zettle Terminal or Reader?

Integrations

Customer support

MobileTransaction’s editors tested Zettle Terminal at home and at local businesses, so we could give honest ratings of the product. Opinions and photos are our own.

What is Zettle Terminal?

Zettle by PayPal launched a new, unique card machine called Zettle Terminal on 27 October 2021, which we managed to get our hands on then. It is an all-in-one card payment terminal allowing you to run your business from the same portable device.

Instead of connecting with the Zettle Go app on an external phone or tablet like Zettle Reader does, the Terminal is a standalone card machine with user-friendly POS software built in. Due to its touchscreen interface, you navigate the checkout features directly on the terminal like you would on a smartphone.

Emily Sorensen (ES), MobileTransaction

Zettle Terminal unboxing by the reviewer.

Zettle Terminal comes in two versions: with (more expensive) or without a built-in barcode reader. The card machine can also be bought on its own or as a bundle with a docking station that keeps the terminal charged all day and prints paper receipts.

The terminal connects with the internet via WiFi or 3G/4G through its built-in SIM card that comes pre-loaded with unlimited data at no extra cost.

Accepted cards

It accepts a very wide range of debit and credit card brands and mobile wallets (see above) through chip and PIN or contactless taps. Funds are automatically transferred to your chosen bank account within 1-2 working days, or in minutes to a PayPal Business account.

Our opinion: strong entry, a bit pricey

We think Zettle Terminal is a welcome addition to the company’s easy payment solutions for small businesses. It works without a smartphone or tablet connected and has been built to a high standard to suit what merchants need today.

It’s a fairly versatile card machine catering to both in-person payments (cards, cash) and remote payments (payment links). It can be used for table service, on the go, at a small till point – anywhere the customer is.

The printer dock completes the setup at a much lower cost than getting a standard printer separately, which would cost £150-£400 just for the printer. The model with barcode scanning can save a ton of time when processing transactions at checkout.

“In terms of sector, we strongly recommend the terminal with a barcode scanner for retail shops, while food-and-drink businesses can do without scanning. But I’d say it’s only very small businesses that benefit, since you can’t upgrade the POS system.”

– Emily Sorensen, Senior Editor, MobileTransaction

On the whole, Zettle Terminal stands out with its:

- SIM-enabled mobile connectivity, which the closest competitor Square Terminal doesn’t have

- Easy-to-hold smartphone feel

- Good amount of POS features to suit almost any situation

For some, the cost can be a hindrance, but not if this package is all the hardware you need.

| Criteria | Verdict |

|---|---|

| Product Payments: Good / Excellent Hardware: Good / Excellent Software: Good / Excellent |

Good / Excellent |

| Cost and fees | Good |

| Value-added services | Passable / Good |

| Contract | Good / Excellent |

| Sign-up and transparency | Good / Excellent |

| Customer service | Passable |

| FINAL RATING | [4/5] |

Costs and fees

Zettle Terminal can be purchased on its own for £149 + VAT without a barcode scanner or £199 + VAT with a barcode scanner.

If you buy it as a bundle with a receipt printer and charging station, it costs for £199 + VAT without barcode scanning or £249 when barcode scanning is included.

Purchasing the Printer & Dock separately costs £89 (excl. VAT), so you save £39 by buying the Terminal at the same time.

This all includes a 12-month product warranty and free shipping.

“Zettle Terminal’s prices feel a bit high compared with Square Terminal £149 + VAT), SumUp Solo (£125 + VAT and myPOS Go Combo (£179 + VAT) that all come with a receipt printer. But all of these models have different shortcomings.”

– Emily Sorensen, Senior Editor, MobileTransaction

A SIM card with unlimited data is included in the terminal for free, so you never need to worry about paying for 3G or 4G connectivity.

| Zettle price | |

|---|---|

| Zettle Terminal | Without barcode reader: £149 + VAT With barcode reader: £199 + VAT |

| Zettle Terminal + Printer & Dock | Without barcode reader: £199 + VAT With barcode reader: £249 + VAT |

| Printer & Dock (on its own) | £89 + VAT |

| SIM card & data for Terminal | Included free with Terminal purchase |

| Shipping | Free |

| Zettle price | |

|---|---|

| Zettle Terminal | Without barcode reader: £149 + VAT With barcode reader: £199 + VAT |

| Zettle Terminal + Printer & Dock | Without barcode reader: £199 + VAT With barcode reader: £249 + VAT |

| Printer & Dock (on its own) | £89 + VAT |

| SIM card & data for Terminal | Included free with Terminal purchase |

| Shipping | Free |

There is no monthly fee or contractual commitment, and you own the hardware outright.

Chip and contactless card payments, including through a mobile wallet, cost 1.75% per transaction regardless of the card brand, country of issue, or whether it is a premium, corporate or personal card.

Transactions accepted through payment links cost 2.5% each.

| Zettle Terminal fee | |

|---|---|

| Monthly fee | None |

| Contract lock-in | None |

| Chip & contactless card transactions | 1.75% |

| Payment link transactions | 2.5% |

| Refund processing | Free |

| Chargebacks | £250 chargebacks/mo. covered free |

There is no monthly minimum sales requirement, so you can use it as little or much as required and only pay for transactions accepted.

Payouts settle directly in your bank account within 1-2 working days at no cost.

Refunds are free, so the full transaction amount is returned to the cardholder and the merchant is not charged for this. You do need enough money in the Zettle balance (where transactions are processed before a completed payout) to initiate a refund, though.

There is no chargeback fee within a £250 monthly transaction limit, should a customer dispute a payment.

Checkout experience

To operate the terminal, it needs to be switched on, charged, connected to the internet and you need to be logged into the Zettle app on the screen.

The built-in POS software is basically the Zettle Go app, with a few shortcomings we noticed – more on that below.

You can either pick the items for a bill from your product library (if you’ve added products) or manually enter an amount to pay. Discounts and tips can be added, and VAT is included if you’ve added that in settings.

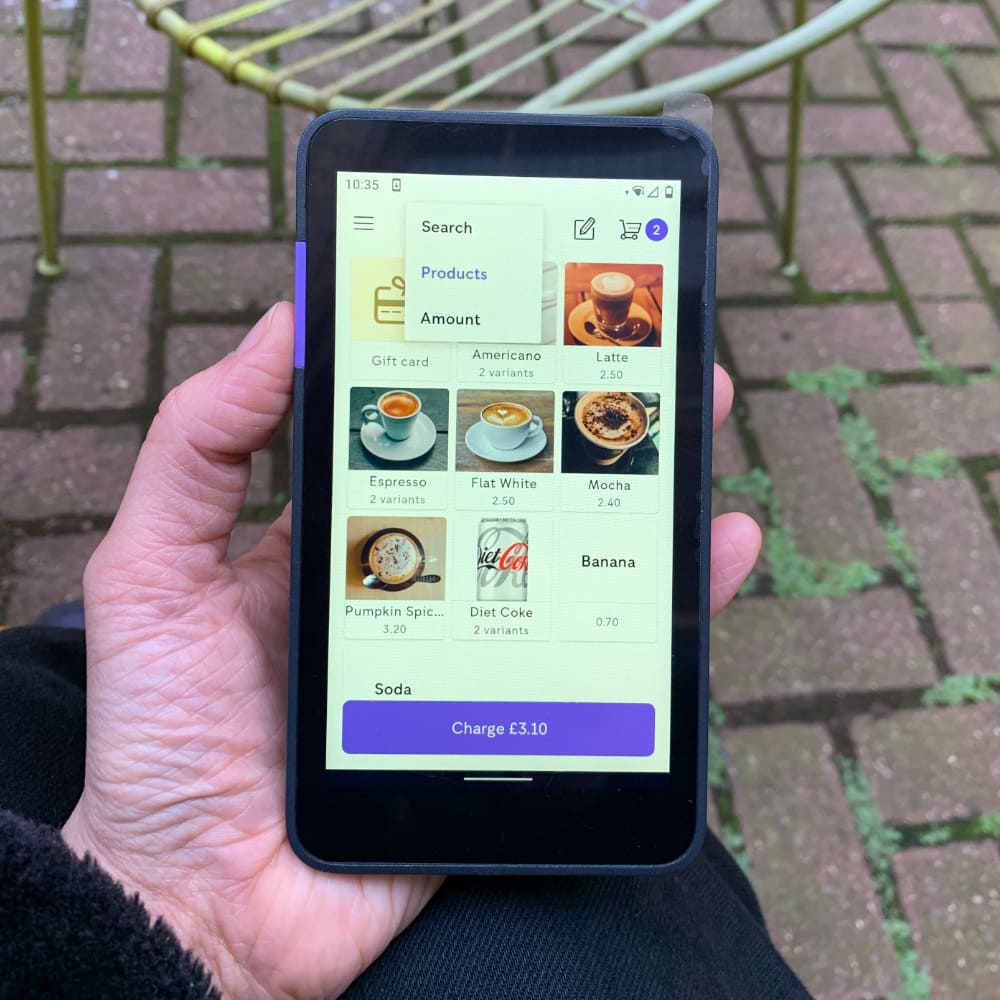

ES, MobileTransaction

Items library on Terminal.

Then you have a choice of payment methods:

Cards: Either tap the card or mobile wallet above the screen or insert a chip card into the bottom slot of the Terminal, followed by PIN entry on the virtual keypad.

Cash: Enter the cash amount received, and it calculates what to give back. If a cash drawer is connected, it will open automatically.

ES, MobileTransaction

Payment methods on Terminal.

ES, MobileTransaction

PIN on glass.

ES, MobileTransaction

Ready for a contactless payment.

Payment links: Send a payment link via SMS or email. The recipient then finalises the payment in their phone browser.

Zettle used to include PayPal QR codes and email invoicing in the terminal app, but PayPal has phased those out for new users. Merchants are instead encouraged to access those features in the PayPal Business app on a smartphone.

Receipts can be emailed, texted or printed from the payment confirmation screen. To print out of the Dock and Printer, the terminal needs to be (magnetically) placed in it. It’s extremely easy to peel off receipts from the rear of the dock, and changing the paper roll only takes a few pull/drop/push steps.

Photo: ES, MobileTransaction

The receipt printer is handy for on-the-go printing or on a countertop.

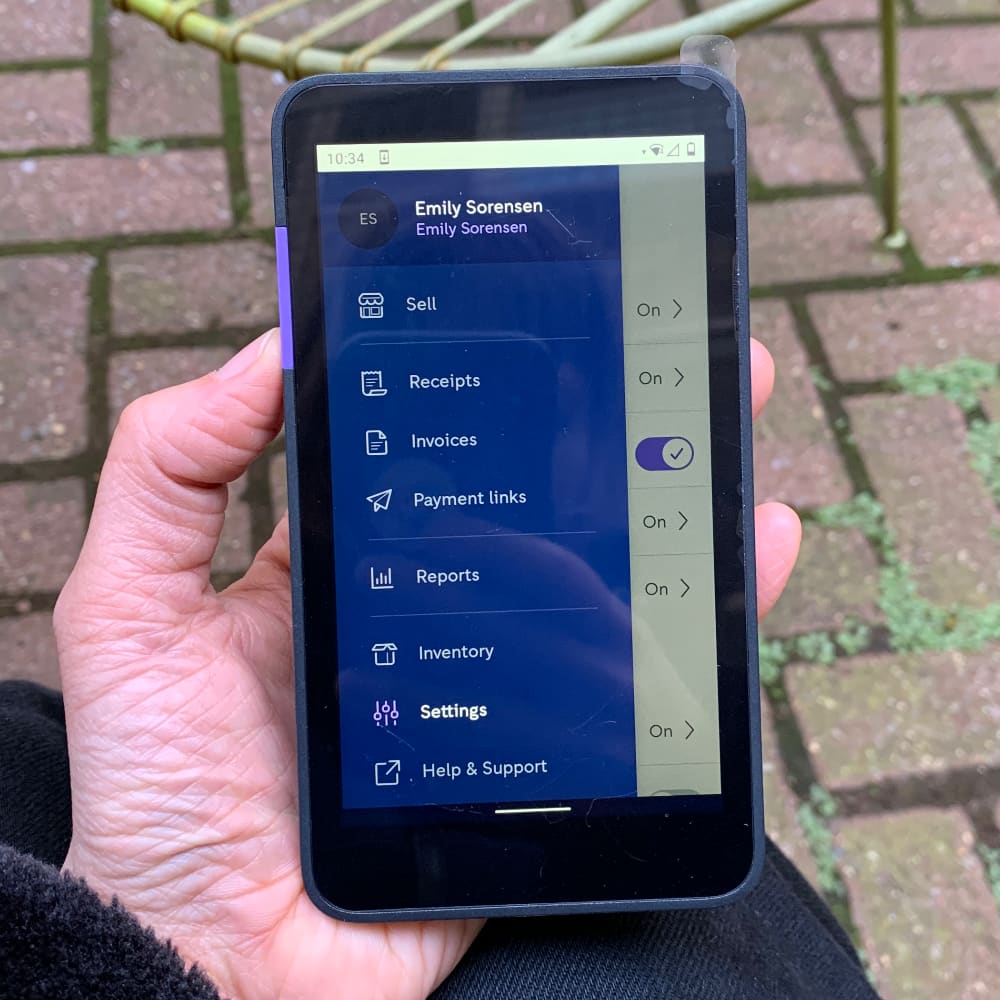

The POS app has a side menu for accessing sales reports, transactions (where you do refunds), inventory, payment links and app settings. The app has changed its layout a bit in the last few years, so some of these sections could change more.

ES, MobileTransaction

Side menu in POS app.

ES, MobileTransaction

It’s like a smartphone, but with a card slot.

There are just enough features for managing your business on the go, but more settings and information can be accessed on a computer (web browser) or mobile device.

We should emphasise that the Go POS app on the terminal is similar to the Android app, not the iPhone app which has extras like a gift card section, search function for transactions and additional settings. This means merchants may experience some shortcomings they didn’t have with Zettle Reader paired with the iOS app.

The model with a barcode reader lets you scan products from your inventory library, either for a faster checkout or to check stock levels. It also scans Zettle gift cards.

If you’re adding new inventory to your product library, the scanner is also an excellent shortcut compared with manually entering the code. All you have to do is scan any new barcode and add product details, then it saves it in your product library.

Credit: ES, MobileTransaction

Zettle Terminal scanning a barcode.

Tech specs

We’ve been told by the company that Zettle Terminal was developed by Zettle with a manufacturing partner, so it is completely unique.

I think the card machine looks very much like a phone in terms of size and feel. It is a bit thicker than a smartphone, but otherwise smaller than an iPhone 12 with a length of less than 14 cm and width just below 8 cm. It weighs 205 g, which feels lighter than an iPhone of a similar size, probably because most of the casing is a lightweight type of hard plastic.

Although easily wipeable with a damp cloth, the device should not be exposed to wet conditions. If you’re outside a lot, it means you’ll need to protect it from the elements, for example with a protective case.

The card machine accepts contactless (NFC) and chip (EMV) card payments with a reliability of 500,000 chip card cycles. Together with its PCI PTS 5.1 certification, this is a highly secure and reliable card machine.

ES, MobileTransaction

Back of the terminal.

ES, MobileTransaction

The power button is on the top side.

The terminal has a 5-inch touchscreen and runs on an Android 10 operating system with the Zettle POS app pre-installed. Apart from this, we could access Settings, Updates and Tips sections from the home screen, but not a web browser.

“The touchscreen has a split second’s time lag after tapping a button, which feels a bit tedious when you’re used to the immediate responses on a smartphone. But such a time lag is fairly common on card terminals with a touchscreen, like on Dojo’s PAX A920.”

– Emily Sorensen, Senior Editor, MobileTransaction

ES, MobileTransaction

The screen is bright enough in the sun.

ES, MobileTransaction

Device settings menu.

We don’t like that you can’t use any other POS software than Zettle Go, but all sales and changes made on the terminal are synced in the cloud and connected with your main account. This means you can connect other Zettle terminals to use simultaneously between different employees.

Its rechargeable battery can last about 12 hours with average use or 4-6 hours if used a lot. When we set the screen brightness to maximum, however, the battery was being drained a lot faster, so you do have to keep the screen on a darker setting if you want it going for longer.

We like that Terminal has some accessibility settings for font and display sizes, but our package didn’t have a tactile PIN cover for people who need more than just visual adjustments.

| Zettle Terminal specifications | |

|---|---|

| Dimensions | 13.8 x 7.6 x 1.5 cm |

| Weight | 210 g |

| Connectivity | WiFi, 3G, 4G, GSM, LTE (Truphone, O2, Three, Vodafone, Everything Everywhere) |

| Data | Unlimited with Zettle SIM card (included) |

| Screen | Colour capacitive 5″ touchscreen, 720 x 1280 resolution |

| Accessories included | USB-C multi-voltage power adapter, 1.7 m USB-C charging cable |

| Battery | Rechargeable lithium-Polymer 3.7V, 2200 mAh |

| Payment technology | EMV (chip), NFC (contactless) |

| Receipts | Email, text, paper receipts (with Printer & Dock or compatible Bluetooth/LAN model) |

| Zettle Terminal specifications | |

|---|---|

| Dimensions | 13.8 x 7.6 x 1.5 cm |

| Weight | 210 g |

| Connectivity | WiFi, 3G, 4G, GSM, LTE (Truphone, O2, Three, Vodafone, Everything Everywhere) |

| Data | Unlimited with Zettle SIM card (included) |

| Screen | Colour capacitive 5″ touchscreen, 720 x 1280 resolution |

| Accessories included | USB-C multi-voltage power adapter, 1.7 m USB-C charging cable |

| Battery | Rechargeable lithium-Polymer 3.7V, 2200 mAh |

| Payment technology | EMV (chip), NFC (contactless) |

| Receipts | Email, text, paper receipts (with Printer & Dock or compatible Bluetooth/LAN model) |

With the optional Printer & Dock, you can place the terminal in there to keep it charged all day and print receipts. The dock comes with 5 receipt paper rolls to get you started. You can leave the Printer & Dock on a small countertop or carry it around with you to enable receipt printing on the go.

Photo: Emmanuel Charpentier (EC), MobileTransaction

Bottom of the printing dock.

Photo: EC, MobileTransaction

The Terminal Dock prints receipts.

It’s possible to integrate the card machine with a selection of compatible Bluetooth or LAN receipt printers from Star Micronics. A cash drawer can only be connected through the Star MC2 or MC3 printers.

Zettle Terminal automatically connects with WiFi (this is a must the first time you use it!), but uses the SIM card to function over the mobile network if there’s no WiFi. You need an ongoing internet connection to operate the software – there is no offline mode, which is something Square Terminal can offer.

What about the barcode scanner model? Is it different in any way?

The model with a barcode reader has the same technical specifications as above, plus the built-in barcode scanner.

To use the scanner, you hold down the purple button on the terminal’s right side (not on the model without a scanner), which causes a light/laser beam to appear in the front. As soon as the light is turned towards a valid barcode and registers it, it beeps.

Photo: ES, MobileTransaction

Zettle Terminals with and without a scanner.

Photo: ES, MobileTransaction

The barcode scanner button is on the side.

Since the scanner is located above the screen, you can hold the terminal naturally like a smartphone.

It’s not possible to connect either of the terminal models with external scanners.

Zettle Terminal or Zettle Reader?

You might wonder whether to buy the cheaper Zettle Reader or go for Terminal, but their fundamental differences may help you decide.

Firstly, the card reader can connect to an iPad or Android tablet for a bigger touchscreen interface than Zettle Terminal’s. If you need more advanced POS software like Tabology or Lightspeed Retail, the Reader also connects to those.

There are slightly fewer features on Zettle Terminal, such as the inability to search through receipts easily, so this might factor into your decision too.

Photo: EC, MobileTransaction

Zettle Terminal doesn’t need a mobile device like the smaller card reader does.

Zettle Terminal, on the other hand, requires less counter space overall, as you do not need a separate printer or stand for an iPad till screen. Terminal can make your counter look tidier, especially as you can just shove it under the table or in your pocket while not in use.

| Zettle Terminal | Zettle Reader | |

|---|---|---|

|

|

|

| Price | £149–£199 + VAT | £29 + VAT |

| Works without phone/tablet | ||

| Connectivity | LTE, GSM, 3G, 4G, WiFi | Uses phone’s 3G, 4G, WiFi |

| Size | 13.8 x 7.6 x 1.5 cm | 11 x 7 x 1.5-2 cm |

| Battery life | 4-12 hours | 8 hours (average) |

| POS integrations | None | Loyverse, Tabology, Lightspeed Retail |

| Receipt printing | Yes, with Zettle Printer & Dock, or compatible Bluetooth or LAN printers | Yes, with compatible Bluetooth or LAN printers |

| Zettle Terminal | Zettle Reader |

|---|---|

|

|

| £149–£199 + VAT | £29 + VAT |

| Works without app on mobile device | |

| Connectivity | |

| LTE, GSM, 3G, 4G, WiFi | Uses phone’s 3G, 4G, WiFi |

| Size | |

| 13.8 x 7.6 x 1.5 cm | 11 x 7 x 1.5-2 cm |

| Battery life | |

| 4-12 hours | 8 hours (average) |

| POS integrations | |

| None | Loyverse, Tabology, Lightspeed Retail |

| Receipt printing | |

| Yes, with Zettle Printer & Dock, or compatible Bluetooth or LAN printers | Yes, with compatible Bluetooth or LAN printers |

Some merchants do not like having to use a commercial smartphone or tablet together with a card reader, in which case Terminal is also ideal. When you serve customers on a shop floor or at tables, an all-in-one card machine is the most convenient choice.

Any choice of Zettle devices can be combined in your business setup, since they use the same account and app software.

Integrations with EPOS, accounting and ecommerce

A general selling point of Zettle is that you can easily integrate with other business tools to save time and money.

For example, Starling Bank can be connected to provide a detailed overview of sales, payouts and other data automatically fed to your Starling account on a daily basis. Accounting software QuickBooks, ANNA and Xero also integrate fully with Zettle, with automatic imports of daily sales, fees and payments data.

Zettle does not offer its own ecommerce software, but integrates with the popular platforms Shopify, BigCommerce, PrestaShop and WooCommerce.

For many small businesses, the free Zettle app provides enough features to function as a point of sale system. For those with complex retail inventory, Lightspeed Retail is a popular EPOS that integrates with Zettle Reader (not Zettle Terminal).

Customer support: limited

Zettle users can contact customer support on weekdays only, between 9am and 5pm. You have the options to phone, email or chat with a team member. Calling them is the fastest way to get a response, as it can otherwise take a few days to get a reply.

The website Help Centre gives you answers to most questions. There is a selection of guides about the card terminal, and you can expect more to be added down the line. We’ve certainly seen the guides change in the last two years with PayPal tweaking Zettle’s features and even the logo.

Historically, the company has been well-regarded for its user-friendly products at a low cost, but recent reviews show a string of negative experiences from users.

Some merchants have issues getting Zettle Terminal to work and getting a free replacement, while others complain of very slow customer service when trying to resolve payment issues.

We haven’t had issues with the terminal ourselves after multiple tests in the UK and France, but it’s worth being aware that not everyone has a smooth experience.