Contents

In summary

What you get

Our verdict

In detail

Costs and payouts

Terminal features

Square Terminal vs Reader

Hardware integration

Reporting

Who is it for?

Customer service

Getting started

We have tested and photographed Square Terminal on different occasions for a genuine assessment of the product. We’ll begin with a summary of the package, followed by our detailed findings and opinions on it.

Looking for the Irish or Australian review?

Accepted cards

Unlike traditional card machines, Square Terminal handles more than card payments. You can, for example, accept gift cards and edit your product library on the terminal.

The card machine comes with the Square Point of Sale software, navigated on the touchscreen. Customers enter their PIN on the touchscreen too. The terminal also integrates with the Square for Restaurants, Retail or Appointments POS systems to supplement their payment flows smoothly.

Transactions and activities on the terminal are connected with your backend Square account where more features, ecommerce tools and integrations are available.

Photo: Emily Sorensen (ES), Mobile Transaction

PIN on glass (on the touchscreen of an industry-approved terminal like Square Terminal) is highly secure.

The payment terminal needs to be connected to the internet via WiFi. Optionally, you can purchase a Hub for Square Terminal that allows you to connect via Ethernet cable. It does not work with 4G or other mobile network connections, but accepts chip and PIN offline as long as it is back online within 24 hours.

Square Terminal can be linked with the Point of Sale app on an iPad, iPhone or Android device, providing a distance between the till screen and card machine. It’s also possible to connect the Square Virtual Terminal with the card machine, in this way creating transactions on a laptop to be paid by chip or tap in person.

Square Terminal only works with WiFi and broadband, not 4G since there is no SIM slot. I wouldn’t use it on the road because of that, only around fixed premises.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

Our experience and view

If you’re looking for a compact, affordable point of sale without lock-in or complicated fees, we think Square Terminal is a strong contender. The sleek payment terminal fits nicely in a small shop, receipts are detailed, the battery life is great (one whole day!) and the offline mode helps when the internet goes awry.

There are also plenty of add-ons like an online store builder, invoicing, phone payments and connecting with a wide range of business tools. Some of these have different charges, but using the Terminal only costs the transaction fee.

Square Terminal’s 24/7 support and 2-year warranty also ease concerns about durability when competing card machines by Zettle and SumUp only offer a 12-month warranty and limited support hours. With the monthly instalments, you don’t even need to pay for it in full upfront.

The main downside is its lack of mobile connectivity when out and about.

Summary of our Square Terminal ratings:

| Criteria | Verdict |

|---|---|

| Product Payments: Good / Excellent Hardware: Good / Excellent Software: Excellent |

Good / Excellent |

| Cost and fees | Good / Excellent |

| Value-added services | Good / Excellent |

| Contract | Excellent |

| Sign-up and transparency | Excellent |

| Customer service | Good |

| FINAL RATING | [star rating=”4.5″ numeric=”no”] [4.5/5] |

Bottom line: Square Terminal is overall excellent value for a small shop that doesn’t want monthly fees or commitment.

Fees and payouts

A major upside to Square is its simple costs. You just pay for the terminal, then a fixed transaction rate for any debit and credit cards processed.

There is no minimum sales volume required, payout fees or contract lock-in. Unless you have opted to pay for the terminal over a number of months, there are no fixed monthly costs either.

The Square card machine costs £149 + VAT upfront. Alternatively, you can choose to pay in instalments of 3, 6 or 12 interest-free monthly payments (subject to credit check and approval). If you pay over 6 months, the monthly instalment is £25 – an attractive option for many startups. The repayments are handled internally by Square, not by a third-party provider, and the first payment is taken when you place the order.

| Charges | |

|---|---|

| Square Terminal price | Upfront: £149 + VAT Instalments: £25 x 6 months |

| Hub for Square Terminal (optional) | £39 + VAT |

| Shipping | Free |

| Chip, contactless card rate | 1.75% |

| Keyed card rate | 2.5% |

| Ecommerce transaction fees | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

| Settlement | 1-2 business days: Free Instant: 1.5% extra fee |

| Refunds | Original transaction fee is retained |

| Chargebacks | Free |

If you’re connecting the terminal to other hardware, you’ll need the Hub for Square Terminal costing £39 + VAT. Many other compatible accessories are available through Square’s website.

Transactions cost a fixed rate, 1.75%, for all chip, contactless and swipe card payments through the terminal regardless of card brand, country of issue or whether it is premium.

All key-in payments through the terminal, invoices or virtual terminal cost 2.5% per transaction. Ecommerce transactions via the online store or payment links cost 1.4% + 25p for European cards and 2.5% + 25p for any other cards.

If your customer wants a refund, the fee charged from you for the original transaction will be retained by Square while the customer gets the full refund. Chargebacks incur no admin fees and include free payment dispute support from the Square team.

Transactions are automatically cleared – free – in your bank account within 1-2 working days. If you want the money faster, you can activate Instant Transfers in your account and a 1.5% transaction fee will be added to the card rate. You then receive the money in your bank account nearly instantly (within a couple of minutes or hours). For example, for chip and PIN cards, you pay 3.25% per transaction with Instant Transfers.

Best Square Terminal offer

Buy Square Terminal for £149 + VAT or pay interest-free instalments for 3, 6 or 12 months. No ongoing fees or lock-in. Free delivery in 2-3 working days.

Mobile Transaction is an independent payment industry resource trusted by over a million small businesses per year.

We allow solution providers to offer product discounts for the benefit of our readers, which do not influence our reviews. Ratings are based on full retail price. (Policy)

Hardware

Physically, it’s a bit heavier than a traditional Ingenico card machine (417 g versus circa 300 g) due to the large screen, compared with the small screen of a mainstream terminal with push-buttons. Two rubber strips underneath keep it stable on a desk, and a hole allows you to screw the terminal to a surface.

The battery can last all day without a charge – impressive given the large, energy-consuming touchscreen. But we found that leaving it on standby drains the battery completely by the next day.

Photo: ES, Mobile Transaction

Underneath the terminal.

Therefore, we recommend switching it off completely when you don’t plan on using it to avoid having to recharge it first the next time you need it.

Photo: ES, Mobile Transaction

The power cable socket and power/standby button are on the left side of the terminal.

Because it runs on a local, secured WiFi connection, it can be used across your premises, for example for payments at the customer’s table. The Ethernet connection through the Hub could be necessary if your WiFi is unreliable, but then you have to keep the Terminal connected at the till point.

It’s possible to accept chip and PIN, Apple Pay and Google Pay offline, but not contactless cards, as long as you get back online within 24 hours to finish processing the payment through the internet.

| Tech specs | |

|---|---|

| Dimensions | 142.2 (L) x 86.4 (W) x 63.5 (H) mm |

| Screen size | 139.7 mm (5.5″) |

| Weight | 417 g |

| Data | WiFi (secured network only), Ethernet via Hub (extra cost) |

| Card technology | EMV (chip), NFC (contactless), swipe |

| Battery life | All day from full charge |

| Built-in receipt printer | Uses 57 mm (width) x 35 mm (diameter) thermal receipt paper |

| Accessories included | Square Terminal, power adaptor, receipt paper roll, ‘accepted cards’ decals |

Software

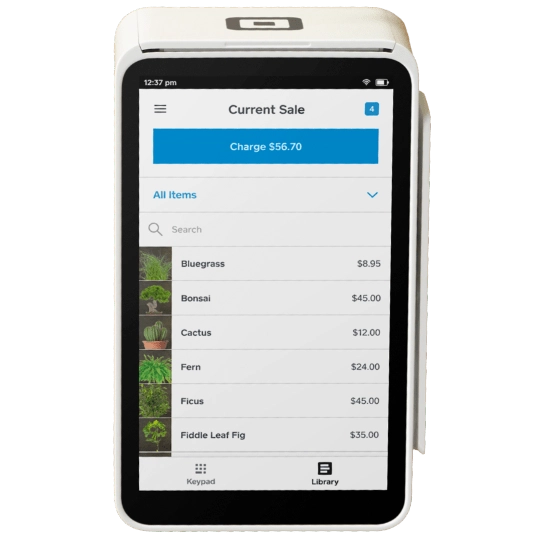

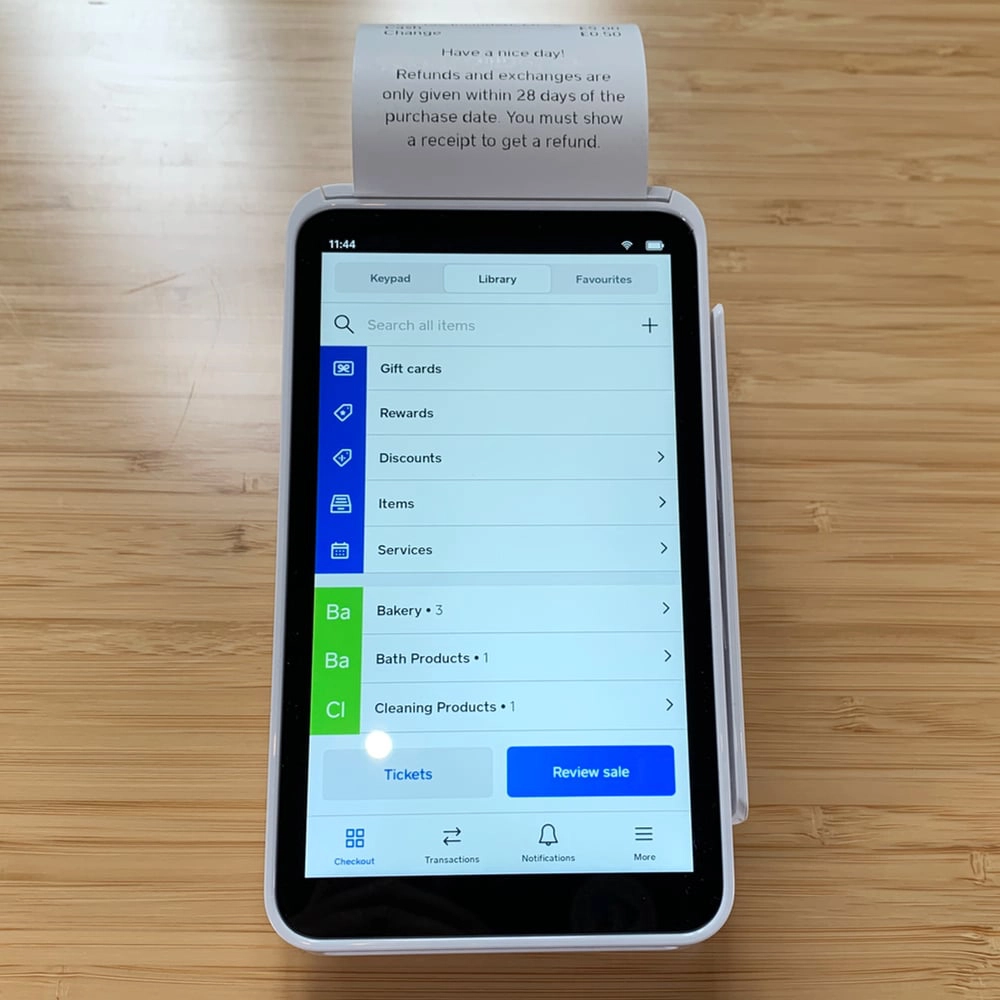

The default software is basically the Square Point of Sale app (downloadable on a mobile device as well).

It has a highly adaptable interface:

- Add to the shopping cart by entering price amounts manually or tapping to add products from the library or the ‘favourites’ grid.

- You can create open tickets straight from the checkout screen and save them for quick access.

- You can customise the bottom menu to include the functions you use the most, e.g. reports.

- The checkout flow and products can be edited on the terminal – no need to log in on a computer to do it.

Enter an amount to add to the bill.

Product menu as the checkout screen.

Add product variants like size and colour and enable the Eat-in, Takeaway, Delivery or Pickup options if you’re a café, for selecting during the checkout flow.

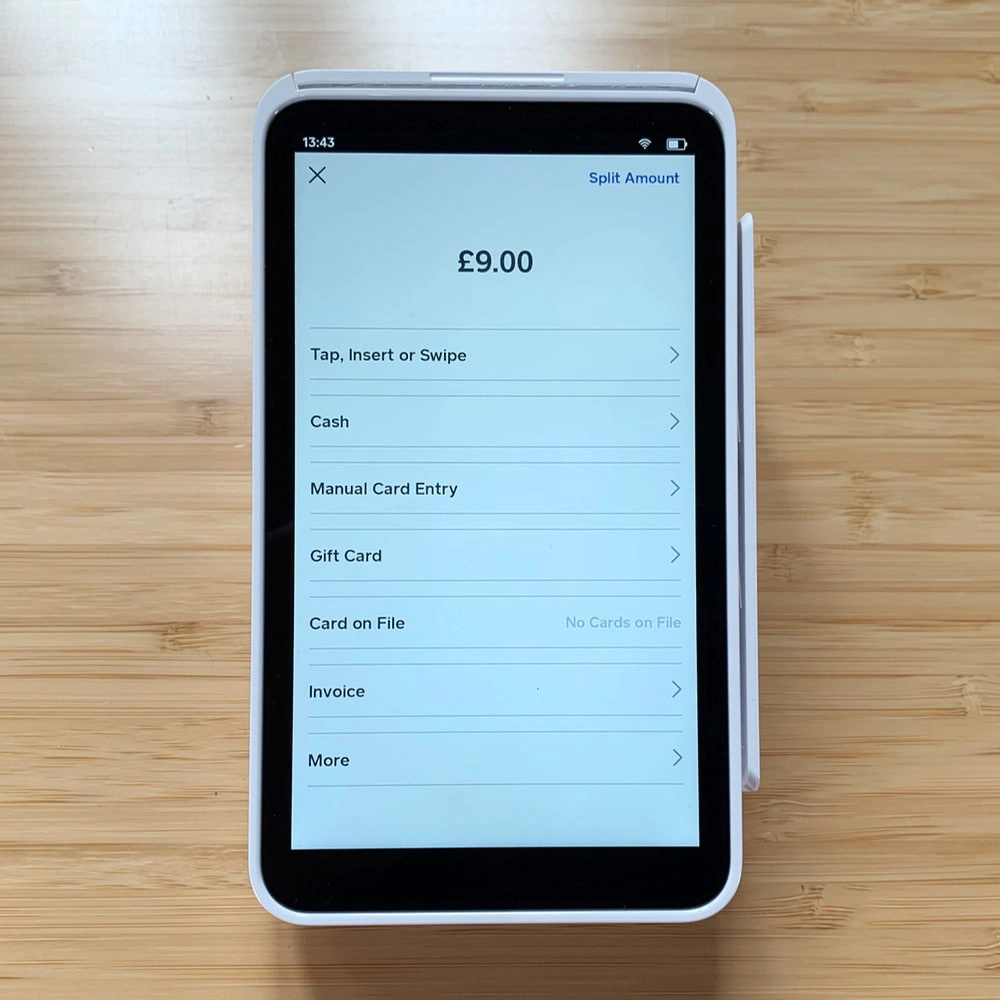

What about payment options? You can accept:

- Cash

- Debit and credit cards and mobile wallets

- Online payments via links or QR code

- Cards on file (saved in the customer library)

- Electronic gift cards (issued from the terminal too)

- Invoice payments

- Manually-entered card details

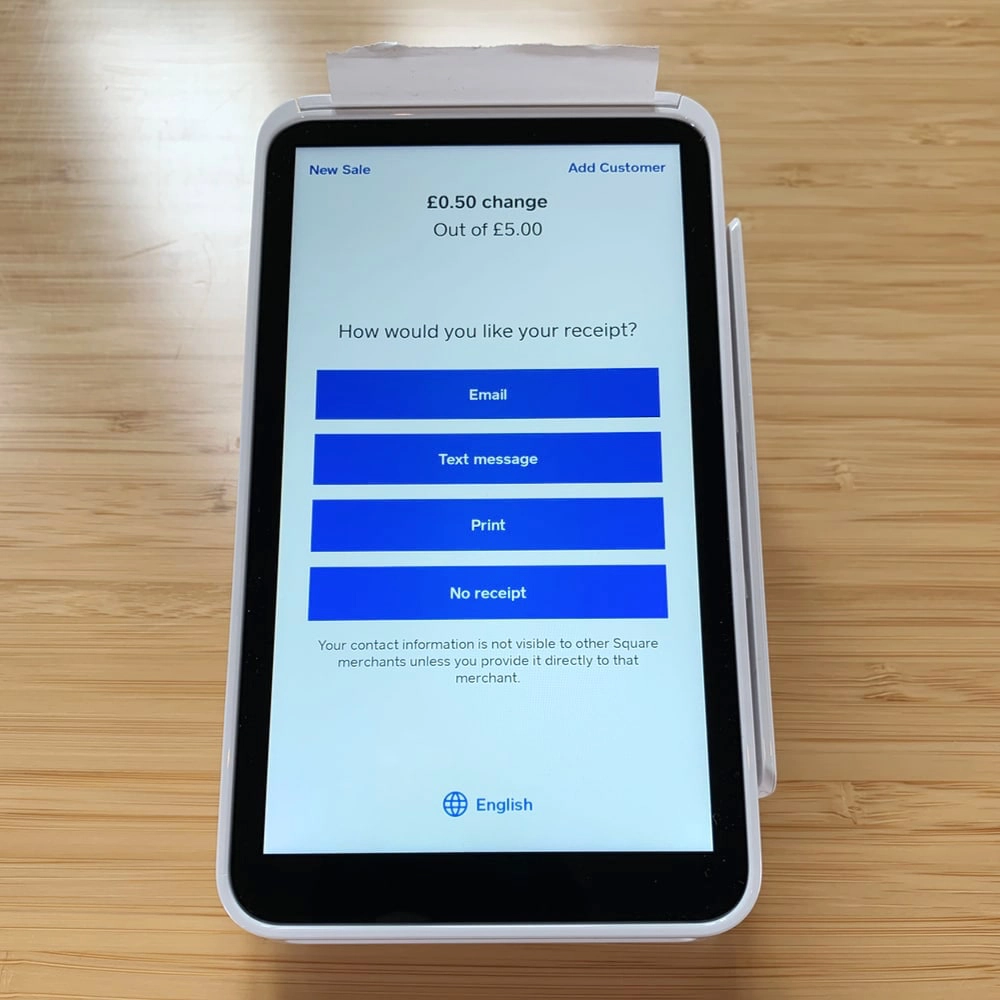

The fact you can split the tender and add custom or preset tips makes it even more flexible. Once the transaction is complete, you get the choice between printing, emailing or texting the receipt.

Payment methods.

Receipt options after a transaction.

The customer library enables you to add a person to the invoice rather than entering recipient details manually. You can create and send Square Invoices directly on the terminal, accessed from the side menu. Over-the-phone payments are also possible – just add products or enter an amount on the regular checkout screen and choose manual card payment as the payment method.

If you use the browser-based Virtual Terminal, transactions can be sent from your computer to Square Terminal for a chip or contactless payment. As long as the card payment was completed by contactless or chip and PIN, the fee is 1.75% (less than if it’s accepted remotely).

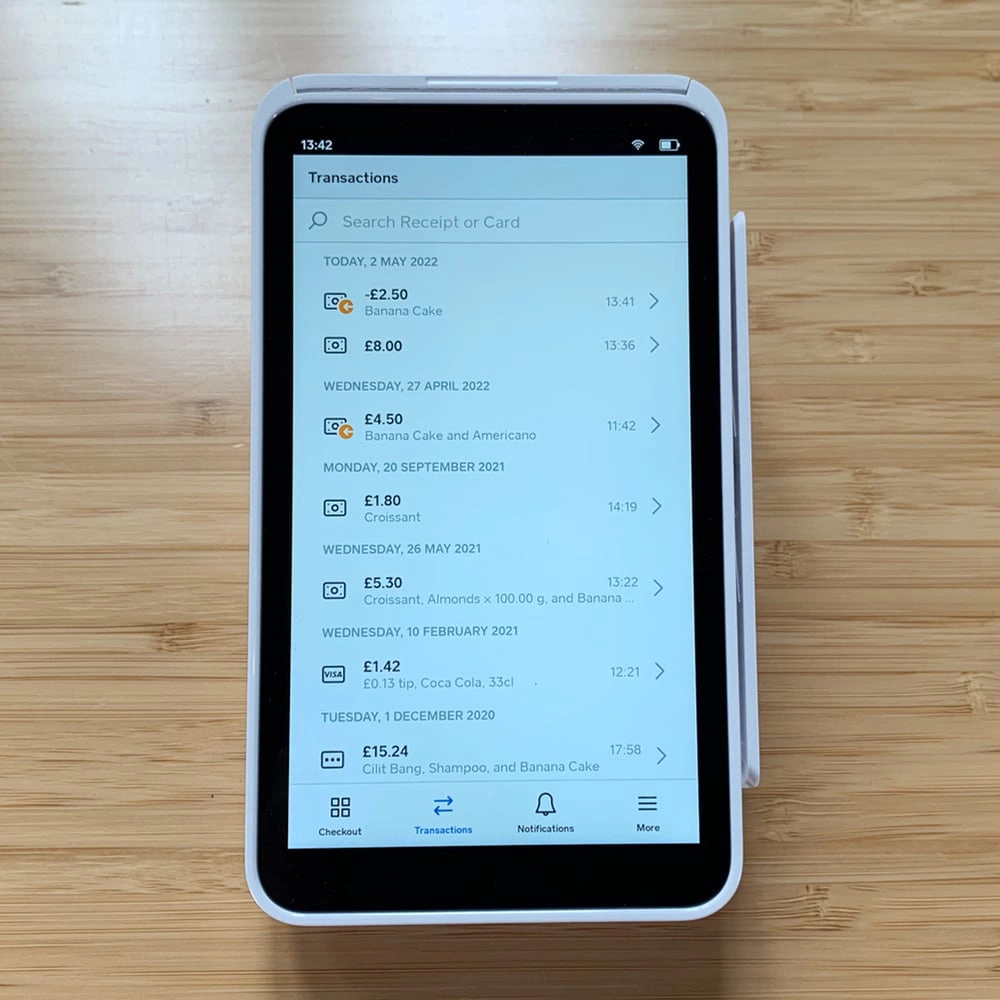

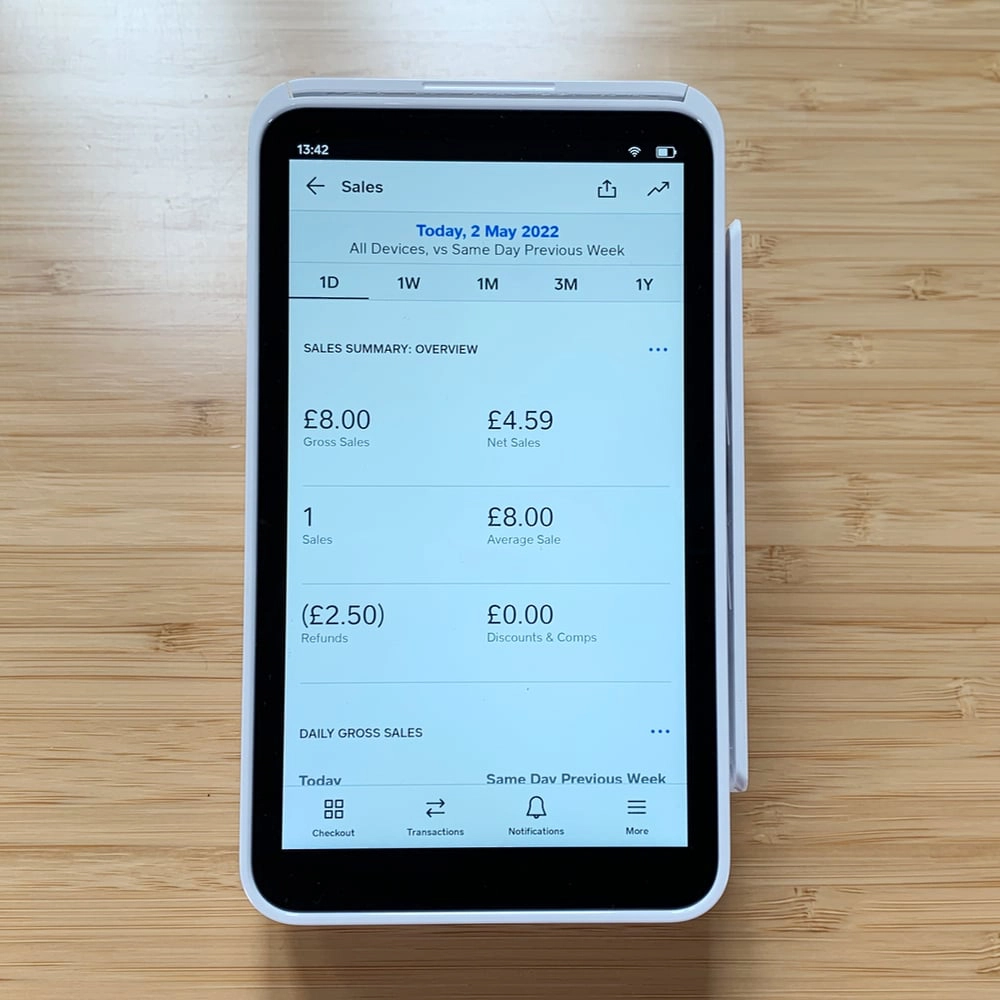

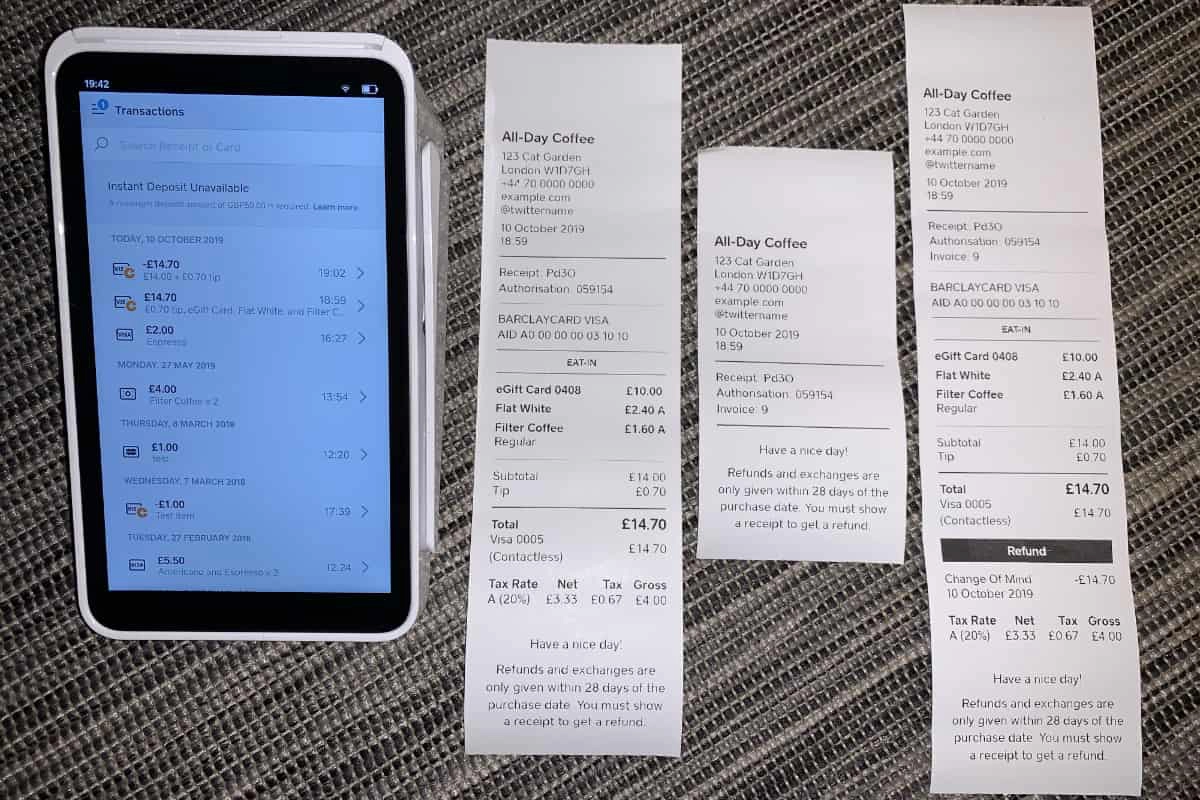

Transactions, sales history and reports are viewable on the terminal. In fact, you go to Transactions to process a refund (itemised or custom amount) or resend a receipt via email or text. Receipts are customisable, and food places can set the terminal to print order tickets.

Pickup and delivery orders paid for online can be managed on the terminal, which we found very handy for order fulfilment.

Transactions overview.

Sales summary.

The QR code and payment link options weren’t accessible on the terminal just a couple of years ago, so it’s good to see Square is actively developing the product.

Your choice of iPad, iPhone or Android device can connect with Square Terminal as long as it’s through one of Square’s POS apps. There will always be more Square features on the tablet or smartphone, but at least the terminal works in sync with the booking, retail or hospitality system for table-side payments, stock take, till transactions or other purposes.

Photo: ES, Mobile Transaction

Square’s built-in receipt printer produces itemised and customised receipts, as opposed to traditional card machines that only display transaction totals.

The software is updated automatically daily when the Terminal is connected to the internet. So prepare to wait for the update to process when you switch on the terminal every day (it took minutes on most days we tested it).

For increased security, we recommend setting the terminal to require a password (can be reset) every time someone wants to log in.

The software is updated automatically daily when the Terminal is connected to the internet. So prepare to wait for the update to process when you switch on the terminal every day (it took minutes on most days we tested it).

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

Square Terminal vs Square Reader

Given how cheap the Square card reader is, you may be wondering why there’s a big price difference.

Put simply, Square Terminal is a premium, self-sufficient card machine from Square, while Square Reader has no screen, no PIN pad, no receipt printer and no app features on the card reader itself. The Reader is fully dependent on the Square POS app on a connected smartphone, iPad or Android tablet.

Another major difference is connectivity. Square Reader uses Bluetooth to connect to a mobile device running the POS app, and it is the mobile device that connects to the internet through its SIM card (using 3G or 4G) or WiFi. Square Terminal directly connects to the internet without the need for a phone or tablet, but then it cannot use a 3G/4G network, deeming it useless in places with no secured WiFi or fixed Ethernet setup with Square Hub.

Photo: ES, Mobile Transaction

Square Terminal prints detailed receipts and has swipe card functionality, unlike Square Reader.

On a practical level, Square Reader is tiny compared to the Terminal, so it’s very convenient on the go. Of course, this requires using both the card reader and phone or tablet, and some customers may be hesitant entering their PIN on your mobile screen.

Square Terminal’s PIN entry is more practical since it happens on the terminal directly, although you do have to create the transaction first before handing the terminal to the customer. But if you connect Terminal with the Square POS app on a mobile device, you can leave the card machine facing the customer while you use the POS screen on a different device.

Hardware integration

If you wonder “how does this work with the rest of the POS system”, we should emphasise the terminal is the POS system.

That said, you can still connect it to up to three hardware pieces through the optional Hub for Square Terminal (purchased separately for £39 + VAT). The Hub connects to the terminal via a cable and has three USB ports for POS hardware and one Ethernet socket for internet.

Photo: Square

Square Terminal Hub has three USB ports for optional POS accessories.

Compatible till equipment is plugged into the Hub’s USB ports (Bluetooth not accepted) and includes:

- Receipt printers

- Kitchen ticket printers

- Kitchen display

- Cash drawers

- Barcode scanners

You may alternatively just use Terminal for the card acceptance part, allowing distance between you and customers. This requires a tablet or smartphone with Square Point of Sale in the vicinity or a computer with Square Virtual Terminal open (can be placed remotely). A connected Terminal could then be fixed to your countertop.

It’s perfectly possible to run the Square POS system separately on a tablet at the till with Terminal taking payments independently elsewhere, as long as they’re connected to the same Square account.

Reporting

On the card machine, you can view sales history, generate custom reports, track cash drawer activity and sales by team member.

Square users have backend (browser) access to sales reports sorted by date, location, time period and more, and reports can be exported to Excel. There are lots of other free analytics on gift cards, popular sales categories, sales trends, transaction status, discounts, employee sales, etc. Custom reports can also be created.

If these are not enough, you can integrate your Square sales with more advanced accounting and reporting tools including QuickBooks, Enterpryze, KashFlow, Shogo, Xero and Zoho Books.

Who is Square best for?

If you’re a small shop, café, hairdresser or any type of merchant who doesn’t require massively complicated POS features, Square Terminal will save you counter space and money because you don’t need to buy a receipt printer, tablet or touchscreen monitor. And if you’re cashless, the terminal would be all you need.

If your sales are primarily online, but you also have a brick-and-mortar store, the simple Square Terminal checkout could be what you need to connect those sales without superfluous equipment to fill your face-to-face shop.

It works best in locations with a fixed WiFi connection or a till point with an Ethernet cable. We would not recommend it for use on the go where WiFi networks can’t be depended on (since it lacks a 4G connection), but you can always accept chip and PIN and mobile wallets offline.

Of course, if you’re already using Square Reader, there’s no faff changing over to Square Terminal. It is only if you require more custom features that we recommend looking for a card machine that connects with advanced POS software.

Customer service and user reviews

Square provides 24/7 support over the phone exclusively for Square Terminal users. This is more than what’s available with Square Reader that only entitles you to weekday support during work hours. There’s a very helpful Support Centre on the website, which answers most questions.

Furthermore, you get a two years’ warranty on the terminal and 30-day cooling-off period during which you can get a full refund if you don’t like the product.

Customer reviews in the UK are generally very good, implying the service works smoothly. Occasionally, users complain about sudden account closures and funds being held by Square, which is a security mechanism designed to weed out high-risk transactions or business sectors that Square considers high-risk.

The pricing is already set since it is the same for everyone, in contrast to many payment companies that like to get on a call to get business information before giving you a quote.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

How to get started

Getting started with Square could hardly be any easier. The pricing is already set and the same for everyone, in contrast to many payment companies that require a call to get your business details before giving a quote.

Square just requires you to complete a short sign-up form with basic business and personal information. They will assess the information and check the validity of your bank account, but you are able to start selling straight after sign-up through the complimentary online invoicing tool, payment links and virtual terminal.

Photo: ES, Mobile Transaction

Square Terminal comes in a sturdy, white box (looks like an Apple product) containing the terminal, power cable, decals and ‘get started’ booklet.

It takes 2-3 days for your terminal to arrive after placing the order. The card machine is so intuitive that you don’t need a manual to set it up – just make sure your WiFi is working.

Your bank account can take around 4 days before it is properly set up to receive payouts. Any transactions accepted by then will just be held by Square until they can clear in your bank account.