It’s easier than ever to accept credit and debit cards. Forget the costly card machines of yore. Today’s contactless card readers come out-of-the-box with every tool needed to sell in person, remotely and online.

Zettle was long the best-known brand in the UK, but SumUp and Square have taken over as strong alternatives. All famous for card readers that process payments with a smartphone or tablet through easy-to-use, free point of sale (POS) apps, they now offer much more.

All of these companies offer standalone, portable touchscreen terminals that work without a phone. If that’s not enough, their apps have now started accepting contactless cards directly on your phone.

Cost-conscious startups often prefer SumUp’s lowest transaction fee, while Square has the most superior free app. Zettle Reader used to be the most popular card reader, but the company has not really developed their offering for quite a while.

|

|

|

|

|---|---|---|---|

| Square review | SumUp review | Zettle review | |

| Products |

|

|

|

| Terminal price | £19–£149 + VAT | £49–£129 + VAT | £29–£199 + VAT |

| Transactions | 1.75% | 1.69% | 1.75% |

| Lock-in | None | None | None |

| Monthly fee | None | None | None |

| Min. sales volume | None | None | None |

| Payouts | 0-2 working days | 1-3 working days | 1-3 working days |

| Use abroad | |||

The three systems share characteristics that make them very attractive to small businesses. Setup costs are very low, and there are no fixed, monthly fees and no minimum transaction volume required. Plus: there’s no contractual commitment with any of these companies.

SumUp, Zettle and Square are therefore suitable both for infrequent use and processing many transactions daily as your primary POS solution.

Cards, payouts and charges

Unlike a traditional card reader machine with a contract, you purchase mobile card readers for a low price with no rental charges or lock-in.

Zettle and SumUp accept the most payment cards. On top of Visa, Mastercard and American Express accepted by Square, both SumUp and Zettle can handle Diners Club, JCB, Discover and UnionPay as well.

Only Zettle accepts PayPal in person via a QR code that merchants display in the Zettle Go app. The customer has to be a PayPal user to pay this way, though.

|

|

|

|---|---|---|

| Accepted cards | ||

| Accepted digital wallets | ||

Zettle and Square charge a fixed percentage (1.75%) for all chip and contactless card transactions, but SumUp offers the lowest card rate at a fixed 1.69%, beating Zettle and Square by 0.06 percentage points. All of these fees apply to any credit and debit cards, including foreign-issued and premium brands like Amex.

|

|

|

|

|---|---|---|---|

| Card readers | From £19* | From £49* | From £29* |

| Best deal | |||

| Chip, tap payments | 1.75% | 1.69% | 1.75% |

| Online store payments | 1.4% + 25p–2.5% + 25p | 2.5% | n/a |

| QR code payments | 1.4% + 25p–2.5% + 25p | 2.5% | 1.75% (via PayPal) |

| Payment links | 1.4% + 25p–2.5% + 25p | 2.5% | 2.5% |

| Invoice transactions | 2.5% | 2.5% | n/a |

| Keyed transactions | 2.5% | 2.95% + 25p | n/a |

| Monthly fee | None | None | None |

| Min. sales volume | None | None | None |

| Payouts | Free, 1% for instant | Free | Free |

*Excluding VAT. Offers apply to the first card reader purchased.

|

|

|

|---|---|---|

| Card readers from £19* (offer) | Card readers from £49* (offer) | Card readers from £29* (offer) |

| Chip, tap payments | ||

| 1.75% | 1.69% | 1.75% |

| Remote transaction fee | ||

| Links, online store: European cards: 1.4% + 25p Intl. cards: 2.5% + 25p Virtual terminal, keyed, invoice: 2.5% |

Links, invoice, online store: 2.5% Virtual terminal, keyed: 2.95% + 25p |

Links: 2.5% QR code: 1.75% (via PayPal) |

| Monthly fees | ||

| None | None | None |

| Minimum sales volume required | ||

| None | None | None |

| Payouts | ||

| Free, 1% for instant | Free | Free |

|

|

|

*Excluding VAT. Offers apply to the first card reader purchased.

With SumUp, settlement takes up to three working days. Zettle and Square deposit funds in your bank account slightly faster, within one or two working days.

In addition, Square offers Instant Transfers, a voluntary setting that clears transactions in your bank account within 20 minutes at an additional cost of 1% per transaction. To compete, SumUp Business Account (with a prepaid Mastercard) gives you free access to transactions within 24 hours, even on weekends.

Card readers and point of sale apps

The cheapest card readers of the three companies are:

- Square Reader: £19 + VAT

- SumUp Air: £49 + VAT

- Zettle Reader: £29–£59 + VAT

They cost less than other card machines because they require a Bluetooth connection with an iPad, iPhone or Android tablet or smartphone.

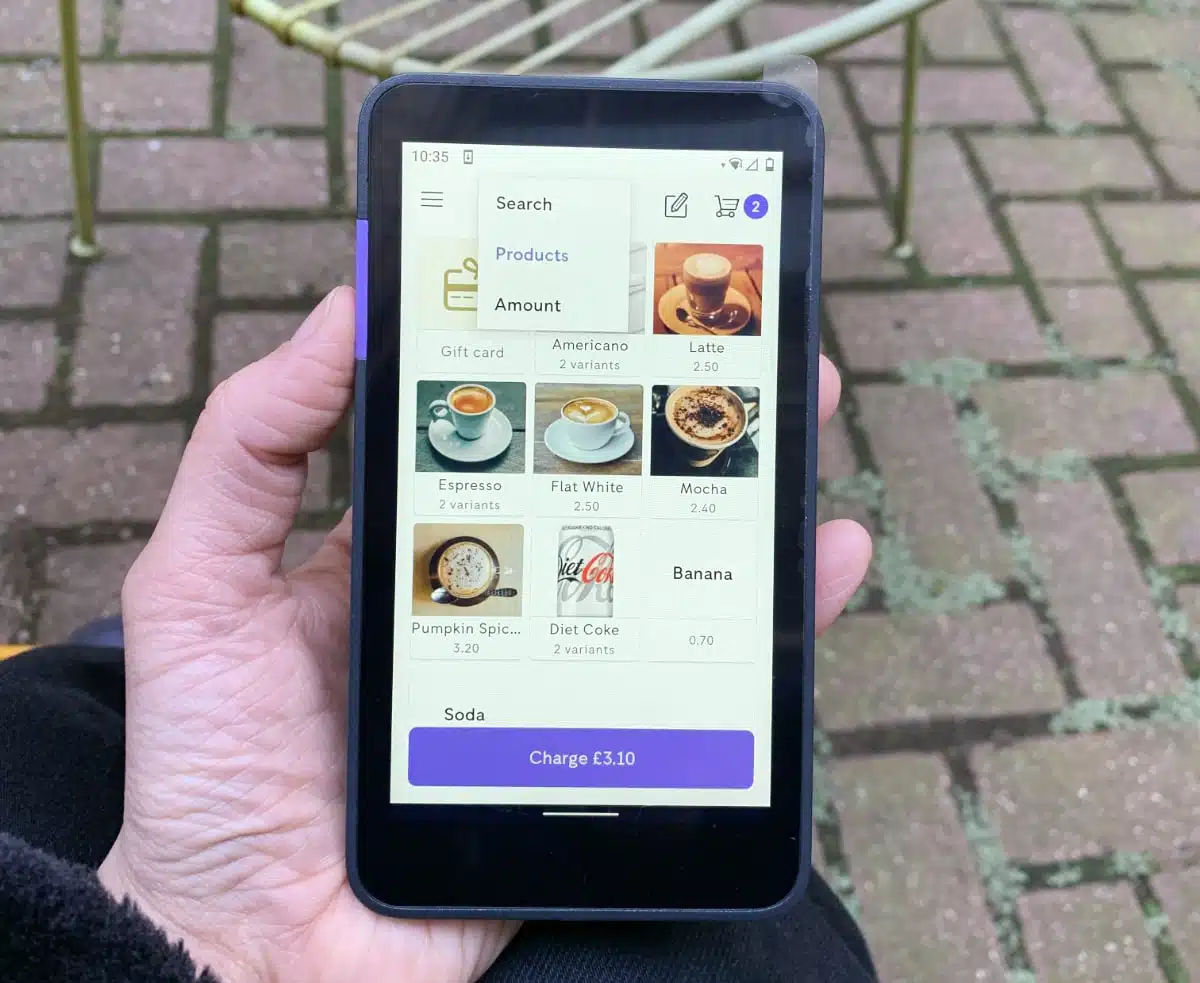

The inventory libraries in each app look neat with images and product information so you can sell different sizes and types of each item. Square’s app, called Point of Sale, beats Zettle and SumUp with additional features like split bills, custom employee permissions (costing extra) and much more.

Photo: Emmanuel Charpentier, Mobile Transaction

Square Reader and SumUp Air are affordable and easy to use with a mobile device.

Zettle’s POS features come at a close second, with physical gift card options, stock counts, barcode scanning via the phone camera, and more. The SumUp app has slightly fewer POS features, but many more remote payment methods.

You can use any of the card readers with more complex POS software so you are not limited to the free apps.

Square users can subscribe to Square for Retail, Square for Restaurants or Square Appointments for advanced till features. Several other excellent till systems, like Vend and TouchBistro, can be integrated too.

SumUp merchants can upgrade to SumUp Point of Sale, a user-friendly POS system where you can add modules of specialised features to suit any type of business.

Zettle doesn’t have its own more professional POS system, but Zettle Reader is compatible with other leading POS systems.

What are the alternatives? See all app-based card readers in the UK

A more recent addition to all the platforms is Tap to Pay on iPhone or Android; the ability to accept contactless cards or mobile wallets directly on your smartphone, without a separate card reader.

Square and Zettle’s tap-on-phone feature works only in their Android app, whereas SumUp users can activate it on either iPhone or Android smartphones.

Standalone terminals available

If card readers for phones are not for you, Square, Zettle and SumUp offer card terminals that work independently. These have exactly the same transaction fees, no monthly costs and no contractual commitment.

One is Square Terminal with a built-in receipt printer and touchscreen with POS features similar to the Square Point of Sale app. It works with secured WiFi connections only, so is best at a fixed location, but can be carried around for table-service around your premises.

|

|

|

|---|---|---|

| Card reader with app | ||

| Square Reader: £19* |

SumUp Air: £49* |

Zettle Reader 2: £29–£59* |

| Standalone card machine | ||

| Square Terminal: £149* |

SumUp Solo: £79* SumUp Solo & Printer: £139* |

Zettle Terminal without barcode scanner: £149* Zettle Terminal with barcode scanner or printer: £199* |

*Excluding VAT. Free shipping included.

|

|

|

|---|---|---|

| Card reader with app | ||

| Square Reader: £19* |

SumUp Air: £49* |

Zettle Reader 2: £29–£59* |

| Standalone card machine | ||

| Square Terminal: £149* |

SumUp Solo: £79* SumUp Solo & Printer: £139* |

Zettle Terminal without barcode scanner: £149* Zettle Terminal with barcode scanner or printer: £199* |

*Excluding VAT. Free shipping included.

SumUp Solo, on the other hand, doesn’t just work with WiFi – it also works with GPRS, EDGE and 4G through its SIM card that comes with unlimited free data. It has very simple features – basically, it just accepts cards or mobile wallets and refunds payments. Alternatively, you can purchase Solo with a unique receipt printer doubling as a portable charging dock.

The pricier Zettle Terminal comes with the Zettle POS app built in and looks a lot like a smartphone. It works directly with WiFi, 3G or 4G (SIM card with unlimited data is included). It can be purchased with or without a built-in barcode scanner and/or a receipt printer dock.

Photo: Emily Sorensen, Mobile Transaction

Zettle Terminal has almost exactly the same POS features as the Zettle Go app.

Free online payment tools included

Square users get most options for keyed and online payments: a free virtual terminal for telephone payments, e-gift cards, digital invoices (with invoice app), online store builder, payment links, QR codes for touch-free payments, and the ability to manually enter card details in the POS app.

| Remote payment |  |

|

|

|---|---|---|---|

| Payment link | |||

| QR code | |||

| E-gift card | |||

| Email invoice | |||

| Telephone payment | |||

| Online store | |||

| Click & collect |

|

|

|

|---|---|---|

| Payment links | ||

| QR codes | ||

| E-gift cards | ||

| Email invoices | ||

| Telephone payments | ||

| Online store | ||

| Click & collect | ||

In second place, SumUp offers complimentary payment links to share via QR code, social apps or text, digital gift cards, email invoices and a basic online store created through the app in a few simple steps. A basic virtual terminal can also be activated for most users, including manual card entry at the POS checkout.

Zettle only offers gift cards, payment links and QR code payments via PayPal. The platform used to include email invoicing, but new users are instead encouraged to download the PayPal Business app for invoicing now. You can nevertheless integrate Zettle with ecommerce platforms like Shopify and PrestaShop.

Many of these online payments were introduced as a response to the Covid-19 pandemic, and they are definitely handy for remote payments and online orders, but only Square and SumUp support a click-and-collect service.

They’re complete business solutions

Square, Zettle and SumUp are not just about card readers. Common to them all is their broad offering of integrated business tools connected to the same account, so you can get more done with less effort.

All of them have inventory management features for both retail and hospitality, the most advanced coming from Square.

Analytics and sales reports are included by all, with options to export data – or in the case of Square and Zettle, integrate with accounting software like Xero and QuickBooks. SumUp cannot integrate with accounting software.

Square is constantly expanding its own (paid or free) business tools, such as the email marketing and customer loyalty features built into the platform. Users can also connect with lots of external software for things like ecommerce, marketing, food delivery and inventory management.

Zettle only connects with a few accounting systems and ecommerce builders. SumUp has a closed system relying on its own features instead of integrations.

No matter which platform you choose, you benefit from a lack of contract obligations, monthly fees or complicated terms. Instead, you get simple fees and a trusted payment system designed to help your business grow – it doesn’t get simpler than that.