At Mobile Transaction, we’ve spent the last decade testing mobile card readers to help you make an informed decision.

And I’m happy to say that the terminals I’ve tested and reviewed are more affordable and run smoother than the ones I used in retail years ago.

There’s now a good selection of contract-free, inexpensive card readers that work with an Android or iPhone app (all in this comparison work with both).

We like this setup because the app often offers more features than traditional card machines – it’s a more flexible solution.

How card readers work:

The card readers don’t typically have monthly fees, lock-in or complicated fees. Instead, you purchase it upfront and pay a fixed fee per transaction.

We know this is attractive for merchants who cannot commit to ongoing costs, and perfect for new businesses looking to start up quickly.

We also look at the app that comes with the card reader, as it may serve as your main point of sale (POS) system. Some card readers for phones only have a basic payment app, while others go beyond that with a product library, staff logins, payment links, etc.

So the best card reader is not just about build quality – we also test the app, compare costs and see if it integrates with other tools.

If you want to accept contactless payments directly on your phone without a card reader, see our comparison of Tap to Pay solutions.

Compare card readers in the UK:

| Card reader | Pricing | Advantages | Website |

|---|---|---|---|

| SumUp Air |

Price: £19* Rates: 1.69% or 0.99%-1.99% |

|

>>SumUp |

| Square Reader |

Price: £19* Rate: 1.75% |

|

>>Square |

| Revolut Reader |

Price: £49* Rates: 0.8%-2.6% + 2p |

|

>>Revolut |

| Zettle Reader |

Price: £29–£69* Rate: 1.75% |

|

>>Zettle |

| Shopify WisePad 3 |

Price: £59* Rates: 1.5%-5% |

|

>>Shopify |

| Elavon MobileMerchant |

Price: £29* Rates: 1.75%-2.5% |

|

>>Elavon |

| Smartpay Anywhere |

Price: £29* Rate: 1.6% |

|

>>Barclaycard |

*Prices exclude VAT.

For independent terminals, see:

Card machines for small businesses in the UK

Pros:

Cons:

What I like most about SumUp Air is probably how easy it is to keep clean – the flat glass PIN pad just needs a quick wipe. It also has a long battery life, so I rarely needed to charge it.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

SumUp Air is a beautiful card reader for iPad, iPhone and Android devices.

The card reader has a smooth glass surface over its PIN pad, which we found easy to wipe clean. It accepts contactless and chip payments from most card brands and mobile wallets.

Photo: Emily Sorensen (ES), Mobile Transaction

The card reader costs £19 + VAT and has no monthly fees or contractual commitment. All you pay is a fixed 1.69% per transaction for any type of card, or 0.99% for domestic cards (1.99% for international and commercial cards) with a £19/month subscription.

Buying it as a bundle with a stand costs £49 + VAT.

Air works with SumUp App, a simple POS system with a product library, user accounts, sales overview, payout reports and online payment options.

SumUp users can send email invoices or payment links, set up a basic online store from the app, display or print QR codes for payments and accept telephone payments through the in-app virtual terminal. You can also sell digital gift cards that can be accepted through the app.

Accepted cards

What’s more, the free SumUp Mastercard links with your very own online Business Account with access to transactions the day after, weekends included. Alternatively, payouts can reach your bank account within 2-3 working days.

For a more complex till, the Air reader can be used with the SumUp Point of Sale software for full-fledged retail or hospitality functions. SumUp integrates with Xero and Sage for accounting and Wix, PrestaShop and WooCommerce for ecommerce.

Customer support is available on weekdays between 8am and 7pm and weekends between 7am and 5pm. Signing up and ordering the card reader is easy and quick through the website.

Pros:

Cons:

Square Reader is so small and inconspicuous you can actually lose it easily if it’s not placed in a stand. But that’s a good thing if you need things minimal.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

Square Reader is an inconspicuous, square-shaped card reader without a PIN pad. Compatible with iPhone, iPad and Android devices, it takes chip (with PIN entry on your mobile device) and contactless payments.

It’s the smallest and lightest terminal on this list, but its app, Square Point of Sale, is the most comprehensive of them all.

Photo: ES, Mobile Transaction

Square Reader only costs £19 + VAT, and the pay-as-you-go transaction rate is 1.75% for all card payments. There are no monthly fees or contract lock-in to worry about.

You can get a charging dock for £29 + VAT too, and connect the hardware with receipt printers, kitchen printers, cash drawers and barcode scanners.

The free Point of Sale app has enough features to serve most small businesses. Its inventory library tracks stock, and the till menu shows various product options and the ability to mark transactions for eat-in, eat-out, delivery or pickup.

You can schedule staff shifts, track breaks, export payroll data and analyse employee sales, and the app Square Team lets staff log their own hours. More employee features cost £20/month per location.

Accepted cards

There are also customer lists, sales reports, order management, invoicing and more in the app. Electronic gift cards can be sold and accepted, payment links created, QR codes generated for contactless selling, and any payment method accepted including Clearpay (buy now, pay later).

Square’s browser dashboard has a free virtual terminal for telephone payments, an online store builder, detailed reports and options to subscribe to POS systems for retail, restaurants and a scheduling system. Square also integrates with much external software for e.g. accounting, online ordering and ecommerce.

Payouts reach your bank account in 1-2 working days, but there’s an instant transfer option (not available to all) for an extra fee of 1.5%.

Square’s customer support is available on weekdays between 9am and 5pm. You sign up online through a simple form, order the card reader and wait 3-5 working days for the delivery.

Pros:

Cons:

I’d only go for Revolut Reader if I actively used the Revolut Business account. The card reader feels a bit cheap, and the app is not really designed for point of sale transactions.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

Revolut Reader is a contactless and chip card reader that Revolut Business account holders can purchase. Transactions clear within 24 hours, which is super-fast, ready to spend with the complimentary debit card.

Fees are low for domestic, consumer Visa and Mastercard transactions (0.8% + £0.02), but high for all other cards (2.6% + £0.02). The terminal costs £49 + VAT excluding a compulsory £5 shipping charge. You can choose to use a free Revolut Business account or upgrade to a subscription with more business (not POS) tools.

To get started, you need to sign up for a Business account, then apply for a separate Merchant Account to accept cards online and through the card reader.

Photo: ES, Mobile Transaction

We don’t recommend buying the card reader before your Merchant Account has been completely approved. We did the mistake of ordering it after the immediate, automatic approval of it, only to have the account on hold in the following days while Revolut requested more information.

The keypad-less card reader looks functional and akin to a retro pocket gaming device in its plastic casing. We had some technical issues with it, but it was eventually resolved and we received a free replacement.

Accepted cards

We tried the chat support available to all account users, but the support agents were rarely able to help. It took several days or weeks to fix any issue. Still, the app is regularly updated and bugs fixed, which can’t be said of certain competitors.

Overall, Revolut Reader could be a nice extra for those who need simple in-person payments in addition to payment links and a business account. New features are gradually added, for example a product catalogue for itemising bills and Tap to Pay in the iPhone app.

The new Revolut POS iPad app also integrates with Revolut Reader. We tried it and can say it’s mainly sufficient for small cafés with its simple table plans, food menus and service charges.

Pros:

Cons:

Zettle Reader is a perfect palm size with an accessible PIN pad. It’s a shame Zettle has stopped adding features the app – it feels like PayPal is neglecting the product.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

The most popular card reader in the UK has been iZettle Reader (now Zettle Reader without the “i”) for some years, but SumUp and Square have overtaken it. It was one of the first to introduce an inexpensive, contract-free reader without monthly costs.

The first card reader machine costs £29 + VAT upfront (following ones are £69 + VAT) and then you pay 1.75% per transaction for any card.

Photo: Emmanuel Charpentier, Mobile Transaction

When testing it, we found the latest version (Zettle Reader 2) ergonomic, small, lightweight and sturdy. It comes in white or black and can connect with a till drawer, barcode scanner and receipt printer. The optional charging stand (Zettle Dock) keeps it in place on a countertop.

Zettle Reader works with the free app Zettle Go on most tablets and smartphones. It has a product library, transactions overview, basic sales reports and acceptance of cards, cash, payment links and gift cards.

Accepted cards

The card reader works with other POS systems like Lightspeed, Epos Now and Tabology, and integrates with Xero and QuickBooks for accounting and Shopify, BigCommerce and PrestaShop for ecommerce.

Transactions automatically clear in your bank account within 1-2 working days.

But Zettle’s app has hardly been developed further since PayPal took over Zettle – features like invoicing and PayPal QR codes have actually been removed.

The lack of investment in the product means we can’t recommend it as a solution that will definitely continue for years, unless you’re happy with it for your current situation.

Zettle only provides customer support on weekdays between 9am-5pm via telephone, email and chat. To sign up, you submit a short registration form online and order the card reader.

Pros:

Cons:

Shopify’s card reader immediately feels like good quality, but the PIN pad is small for people with larger hands.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

Best known for its ecommerce software, Shopify also has a card reader to go with a POS app. It’s called WisePad 3 Reader (£59 + VAT) and works with the Shopify payment system that’s part of the ecommerce subscriptions.

The card reader works with a POS app on your iPhone, iPad and Android devices.

Photo: Mobile Transaction

The cheapest subscription you can have with WisePad 3 is Starter for £5 + monthly for a few online selling tools. This has the high rate of 5% per card reader transaction.

The full-fledged online store plans (£19-£344 + VAT/month) have lower rates between 1.5%-1.7%. Annual contracts are cheaper per month.

A limited version of the Shopify POS app (POS Lite) is included on all plans, but you can upgrade to Shopify Retail (with POS Pro) for £69 + VAT monthly per location. This has a chip and tap card rate of 1.7% and many features for unifying online with in-store sales, for instance a smooth Click & Collect system.

Because of the ongoing monthly cost, the card reader is only really worth it if you’re also using Shopify for an online store.

Accepted cards

The POS app has genuinely good features for e.g. product and order management, customer profiles, staff accounts and integration with receipt printers, cash drawers and barcode scanners. POS Lite is recommended for on-the-go sales, whereas POS Pro is better for a full setup in a retail shop.

Transactions are settled in your bank account within 6 working days, which is the slowest in this comparison. All subscriptions include 24/7 customer support and online help guides.

Pros:

Cons:

Compared with the other models we’ve tested, Elavon MobileMerchant looks more dated. It gives off a calculator feel, but the buttons are at least very easy to use.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

A big acquiring bank, Elavon, has a MobileMerchant card reader that costs £29 + VAT.

As with others, it has no monthly fee or contractual commitment. It just has a transaction fee dependent on the card accepted: 1.75% for Visa and Mastercard, 1.9% for American Express and 2.5% for Diners Club, Discover and JCB cards.

The card reader has a PIN pad, looks like a calculator and accepts contactless payments and chip and PIN. What’s more, Elavon MobileMerchant does not connect with a cash drawer, barcode scanner or receipt printer, so it is purely for mobile transactions.

In the MobileMerchant app, you need to enter the transaction amount with an item description. It’s possible to add a tip, discount and VAT, accept cash and send e-receipts, but that’s about it. There’s no product library or other advanced features.

The app is rarely developed and actually had year-long breaks between updates (not to add features, only fix issues). Evidently, Elavon does not prioritise this service.

A healthy card reader app should be updated regularly to fix bugs and keep up with iOS and Android software. Unsurprisingly, users complain of technical issues preventing them from using the card reader.

Accepted cards

Elavon merchants have a free virtual terminal in the web dashboard to accept over-the-phone payments for a higher transaction cost. They also benefit from fast settlement – one working day – but this is not guaranteed.

Customer support is provided 24/7 for merchants, which is a luxury for a pay-as-you-go credit card reader.

Signing up is more tedious, though – you complete an online form (takes around 15 minutes) and have to submit various documents for verification. Once onboard, you can order the card reader.

Pros:

Cons:

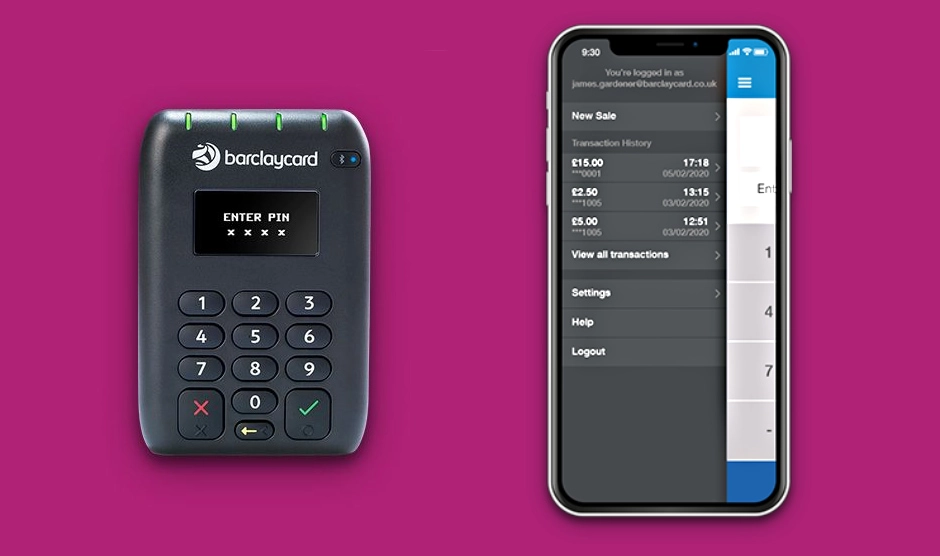

The card reader Barclaycard sells is an old model that used to be popular over a decade ago. I wouldn’t pick it today, especially with the unreliable app it’s supposed to connect with.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

Barclaycard Business’ card reader, Smartpay Anywhere, comes without contract lock-in or monthly fees, just the price of £29 + VAT upfront.

We don’t think the model (Miura M010) is bad per se, but it is an old card reader with a problematic app for iOS and Android devices.

The card reader doesn’t work with receipt printers, cash drawers or barcode scanners, but it does take swipe cards on top of contactless and chip cards. In addition, the trusted ‘Barclaycard’ logo on the terminal may put some customers at ease.

You’d think a banking giant like Barclays would only have amazing products, but the latest app is poorly designed and looks neglected. There’s a product library, refunds, digital receipts and a transactions overview, but these features are standard elsewhere.

What’s more, the app was last updated over half a year ago, which means it is buggy. User ratings frequently mention bugs, connectivity issues and a lack of customer service when they report the issues.

Accepted cards

However, you can’t fault the low transaction fee of 1.6% for Visa, Mastercard or JCB cards. This is the lowest fixed rate available for an app-based reader, except for the high subscription tiers with Shopify’s card reader (where the fee is 1.6% or 1.5%) and Revolut for domestic cards.

Standard payouts take between 2 working days and a week, but next-day settlement is available for some users.

To register, you complete an online application, which should take about 15 minutes. But beware – your chance of approval “depends on financial circumstance and borrowing history”, which is stricter than elsewhere.

Card reader apps compared

Square comes away with the best and widest range of point of sale (POS) features in its choice of free apps.

Where others lack features, Square provides free inventory tracking, split bills, many different payment methods and team management tools.

SumUp comes second with its online payments and complimentary business account in the card reader app. SumUp App is, however, very basic and only for simple stores that don’t need stock control or integrations.

Revolut only has a few POS features like a basic product library in the business account app, but offers a separate POS app for small food-and-drink. We’ve found Revolut generally adds new features quicker than other solutions.

The Zettle Go app is easy to use, but lacks developments from PayPal. Zettle’s online payment tools are very basic, but there are slightly more checkout features than in SumUp App.

| App | Product library |

Online payment tools |

App updates | Integrations |

|---|---|---|---|---|

| SumUp | Yes | Many | Regular | Some |

| Square | Yes | Many | Regular | Many, various |

| Revolut | Yes | Some | Regular | Some |

| Zettle | Yes | Few | Regular | Some |

| Shopify | Yes | Few | Regular | Many, various |

| Elavon | No | Few | Rare | None |

| Barclaycard | Yes | None | Rare | None |

| App | Product library |

Online payment tools |

App updates |

Integrations |

|---|---|---|---|---|

| SumUp | Yes | Many | Regular | Some |

| Square | Yes | Many | Regular | Many, various |

| Revolut | Yes | Some | Regular | Some |

| Zettle | Yes | Few | Regular | Some |

| Shopify | Yes | Few | Regular | Many, various |

| Elavon | No | Few | Rare | None |

| Barclaycard | No | None | Rare | None |

The Shopify POS app is excellent for managing retail inventory across sales channels. It has good customer relationship management tools, promotional features and a customisable display.

The apps from Barclaycard and Elavon are more basic, rarely updated and less reliable than Zettle, SumUp, Square, Shopify and Revolut who regularly update and improve their apps.

In addition, Elavon and Barclaycard do not integrate with external software for accounting and ecommerce, nor do they offer payment links. Elavon is slightly better than Barclays for its complimentary virtual terminal and online reports.

Compare card reader pricing

Prices and fees of app-based card readers tend to be similar given the healthy market competition, but you don’t get the same value or quality for the money.

The cheapest card reader is Square Reader, sometimes rivalled by SumUp Air when that’s on offer. Only the first Zettle Reader is cheap (£29 + VAT), and then it’s £69 + VAT for extras. After purchase, you own them.

Barclaycard advertises a low “one-off device rental fee”, so you don’t actually own the card reader despite the lack of subscription. The card readers from Shopify, Elavon and Revolut are yours to keep.

| Card reader | Price* | Monthly fee* | Transaction fee |

|---|---|---|---|

| SumUp | £19 | From £0 | Pay-as-you-go: 1.69% £19/mo: 0.99%-1.99% |

| Square | £19 | None | 1.75% |

| Revolut | £49 | From £0 | 0.8% or 2.6% + 0.02% |

| Zettle | £29–£69 | None | 1.75% |

| Shopify | £59 | From £5 | 1.5%-5% |

| Elavon | £29 | None | 1.75%-2.5% |

| Barclaycard | £29 | None | 1.6% |

*Excl. VAT.

| Card reader | Price* | Monthly fee* |

Transaction fee |

|---|---|---|---|

| SumUp | £19 | From £0 | Pay-as-you-go: 1.69% £19/mo: 0.99%-1.99% |

| Square | £19 | None | 1.75% |

| Revolut | £49 | From £0 | 0.8% or 2.6% + 0.02% |

| Zettle | £29–£69 | None | 1.75% |

| Shopify | £59 | From £5 | 1.5%-5% |

| Elavon | £29 | None | 1.75%-2.5% |

| Barclaycard | £29 | None | 1.6% |

*Excl. VAT.

Only Shopify requires a monthly fee for an ecommerce plan. This includes a basic retail POS app that can be upgraded for £69 + VAT monthly.

Revolut also requires an account subscription, which includes Revolut POS. Square and SumUp have their own advanced EPOS at various price points.

Zettle’s and Square’s fixed rate is only marginally higher than SumUp’s pay-as-you-go fee. Barclaycard’s 1.6% is the lowest rate applicable to all cards. You can get a similarly low rate with Shopify, but only with a pricey online store plan.

Elavon differentiates between Visa and Mastercard (1.75%) and other cards (1.9% or 2.5%). Accordingly, it’s expensive dealing with tourists or business clients with corporate or premium cards.

Revolut has the lowest rate for domestic Visa and Mastercard transactions, but highest for other cards, plus a small fixed fee.

Other credit card readers

A few services have gone out of business: WorldPay Zinc, Worldpay Reader, Payatrader and Intuit Pay. PayPal Here was discontinued and replaced with Zettle Reader (PayPal owns Zettle).

The European neobank Viva Wallet offers a Mini Card Reader that works with its app, and this is available for UK merchants.

Then there’s a Stripe card reader for existing platform users. Card machines by Stripe can be more complicated, as they need to be programmed by a developer.

You sometimes see other UK options, but without the tech funding to update software and adapt the product quickly, these card readers do not get good reviews. In the end, the fittest survive – which is good news for small businesses.

Summary

| Card reader | Advantage | Website |

|---|---|---|

|

Great features for simple shops that sell remotely too | |

|

Most POS features in an app, many extra features available | |

|

Business account features and low rate for UK cards | |

|

Best card reader design with user-friendly app | |

|

Advanced integration with Shopify ecommerce | |

|

24/7 customer support, but buggy app | |

|

Lowest fixed rate, but buggy app |

| Card reader | Advantage |

|---|---|

|

Great features for simple shops that sell remotely too |

|

Most POS features in an app, many extra features available |

|

Business account features, low rate for UK cards |

|

Best card reader design with user-friendly app |

|

Advanced integration with Shopify ecommerce |

|

24/7 customer support, but buggy app |

|

Lowest fixed rate, but buggy app |