Contents

In summary

How it works

Verdict

In detail

Fees and contract

POS features

Card reader and payments

POS hardware

Integrations

Service and reviews

MobileTransaction trialled Revolut POS on iPad and communicated with Revolut for a true impression of the product. Images and opinions are our own.

What is Revolut POS? Who is it for?

Revolut POS is a new point of sale (POS) app for iPad.

The software is a version of Nobly, a now-defunct café POS app Revolut acquired in the last few years. This is reflected in the fact that Revolut POS’s features are mostly geared towards food and drink, although small retail businesses could use it too.

In order to use the software, you must be a Revolut Business account holder with an approved Merchant account for card payment processing. The registration for these accounts can be a bit more cumbersome than, say, Square’s or SumUp’s sign-ups, and usually require more submitted documents.

The only card machine that works with Revolut POS is Revolut Reader, which we also tested.

The big advantage of the EPOS is its integration with all of Revolut Business’ features like multi-currency accounts, online payment methods, invoicing, fast payouts, expense management and much more.

Our experience and opinion: off to a good start

Revolut POS is an iPad app aimed for small hospitality, just like the old Nobly software it’s based on. But since it has only just been launched, I noticed important features still missing such as no exportable sales reports with a breakdown of cash and card sales.

The EPOS itself is fairly basic at this point, comparable in extent of features to the free Square for Restaurants plan. But Revolut is still noteworthy because its features are enough to run a coffee shop or small food venue with a kitchen, without a subscription. For comparison, Square users don’t get a table plan on the free plan, but Revolut users do. Then again, Square offers advanced reports and many little extras even with the free software.

“I was reassured by Revolut POS’s customer service manager that many more features will be added over the next months, including reports. I doubt it will be an extensive EPOS or that retail-specific features will be prioritised, though.”

– Emily Sorensen, Senior Editor, MobileTransaction

Another main advantage is the low transaction rate for domestic consumer cards. If most of your customers pay with a personal Visa or Mastercard from the UK, you can save money per transaction compared with the likes of Zettle and SumUp.

A downside could be how the checkout looks in person. It’s not a problem getting a sturdy iPad holder, but there’s no dedicated stand for Revolut Reader, and so far, only a few printers and cash drawers work with it. But for a mobile checkout, that’s probably not a problem.

So before you opt for Revolut, just try it out if you already have a business account. You’ll need a merchant account too for payment acceptance, but it’s okay to hold off buying the card reader until you’re confident the POS system meets your needs.

Bottom line: Revolut POS would appeal to small food venues on a tight budget and who like to use Revolut for their business account.

| Criteria | Verdict |

|---|---|

| Product | Good |

| Cost and fees | Good / Excellent |

| Value-added services | Good |

| Contract | Good / Excellent |

| Sign-up and transparency | Good |

| Customer service | Passable / Good |

| FINAL RATING | [4.1/5] |

Fees and contract

Revolut POS does not cost anything in the UK. It has no fixed monthly fee and is cancellable any time.

Instead, you may pay for a Revolut Business subscription, which varies in price between £0 and £100 monthly depending on the plan you’re on.

The Merchant Account necessary for accepting payments is free, but requires a separate registration through the Revolut Business app. Once accepted (this may take a few days), you can accept card transactions online or through Revolut Reader.

The card reader costs £49 + VAT and has to be ordered through the account as well.

| Revolut fees | |

|---|---|

| Revolut POS system | Free |

| Revolut Business account | £0-£100/mo (monthly or annual plan) |

| Merchant account for payment processing | Free |

| Revolut Reader purchase | £49 + VAT + £5 shipping charge |

| Contactless, chip card transactions | UK consumer cards: 0.8% + 2p Non-UK and commercial cards: 2.6% + 2p |

| Refunds | Original transaction fee is retained |

| Chargebacks | £15 each |

| Payouts within 24 hours | Free |

The good thing about the Revolut card reader is its low domestic rate: 0.8% + 2p per transaction when a consumer card is used for chip and PIN or contactless. If someone with a commercial, premium or business credit or debit card from the UK transacts, you will pay the high rate of 2.6% + 2p, though – same for international cards.

Higher fees apply to payment links, invoice and QR code payments, but those are not shown as payment options in the POS app.

Another good thing about the POS being linked with the Revolut Business account is its fast transfers. Card payments accepted via Revolut Reader should arrive in your Revolut account within 24 hours, even on weekends.

To delete Revolut POS from your account after using it, just contact support to request it. They will then do it for you by the next month, as long as the request is before the last two working days of the current month.

POS features: enough for a simply-run café

When I started testing Revolut POS, I was initially surprised at how super-basic it all looked. I saw very few features during setup, but as I added more products, created floor plans and explored all the settings, I discovered quite a few features important for small food-and-drink business.

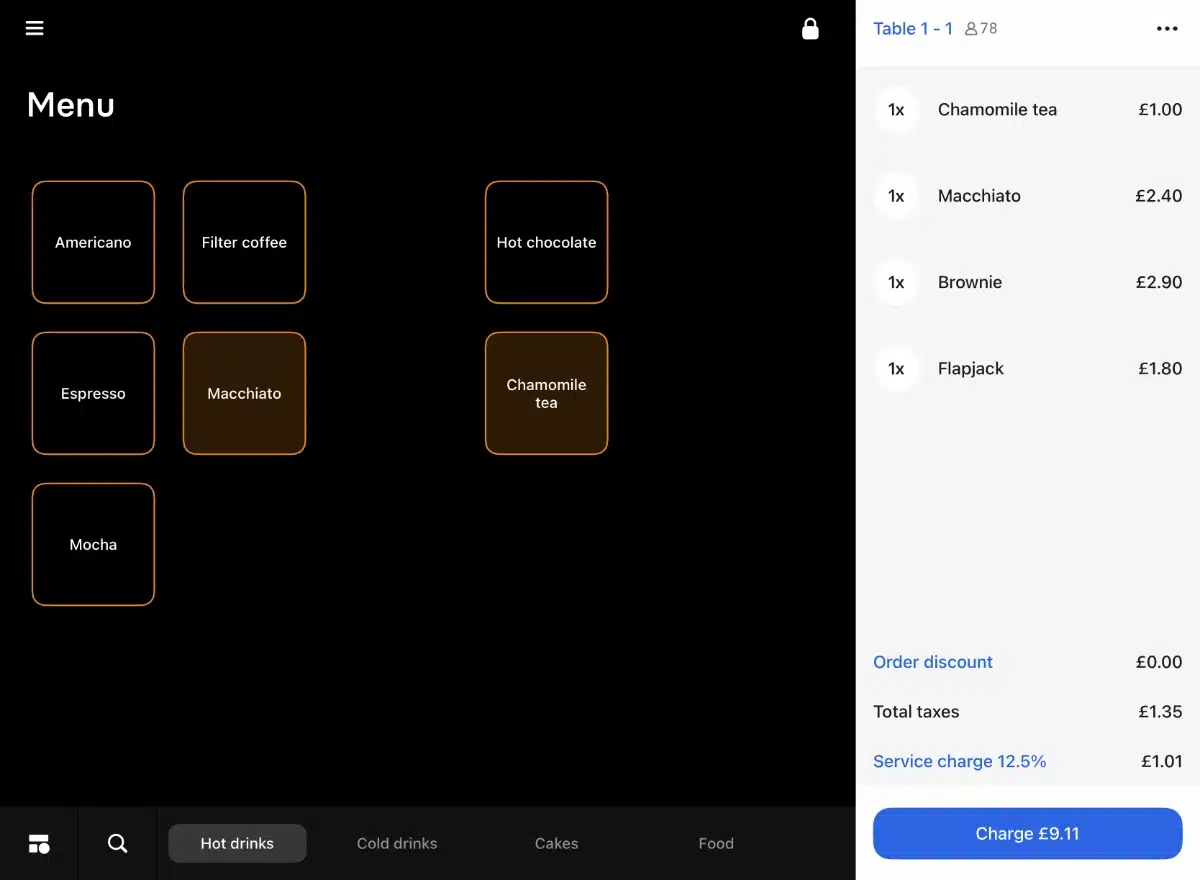

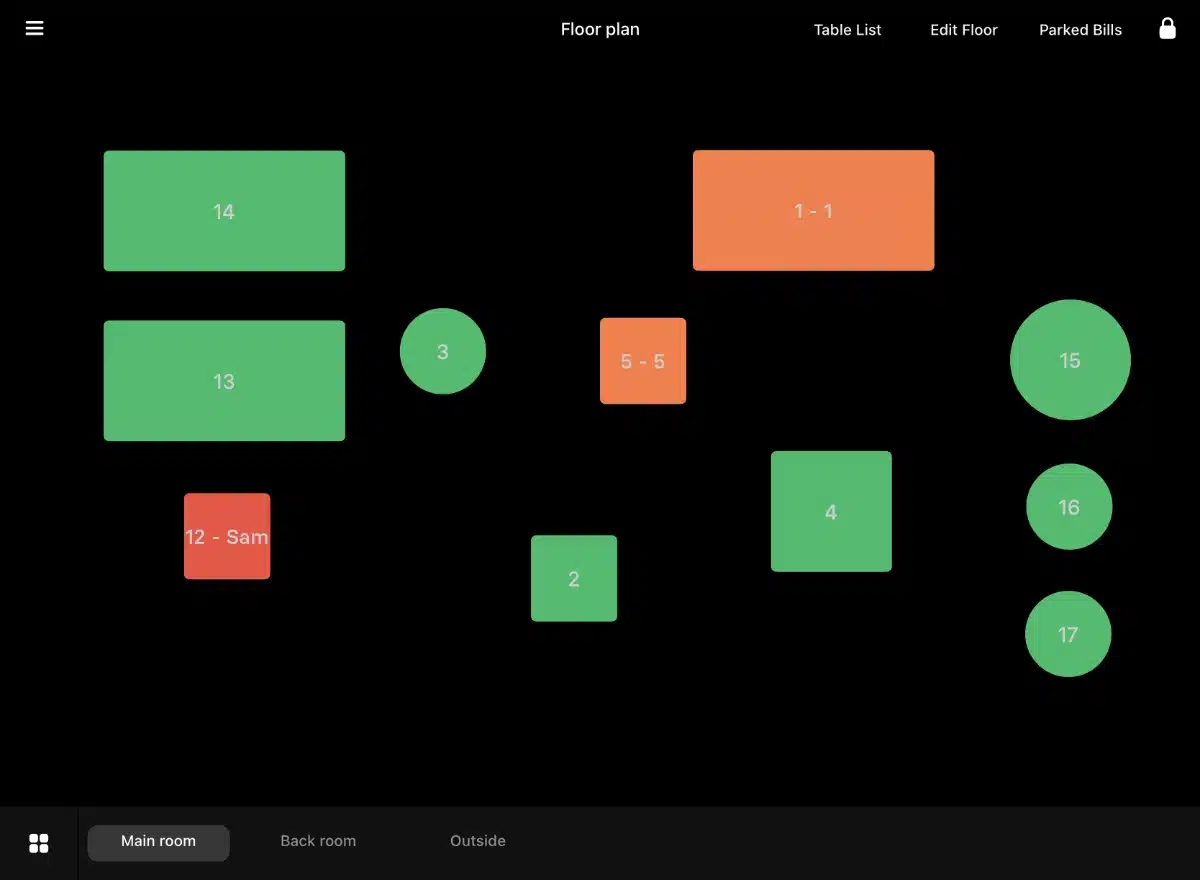

Image: MobileTransaction

Merchants get to decide how the register menu is structured. We created a café menu in our test.

To start with the basics, users can create:

- Food menus with categories, variants, modifiers and units (grams, litres, etc.)

- Floor and table plans for keeping tab on open orders

- Different VAT rates, service charge and eat-in/takeaway options

- Staff users with different permissions and app logins

- Custom discounts, tips and items to add to bills

To use the Revolut POS app for the first time, business owners are guided to the browser POS dashboard first. Here, we received clear prompts to add new products, design the till layout (via an easy drag-and-drop editor), order the card reader and download the app on iPad.

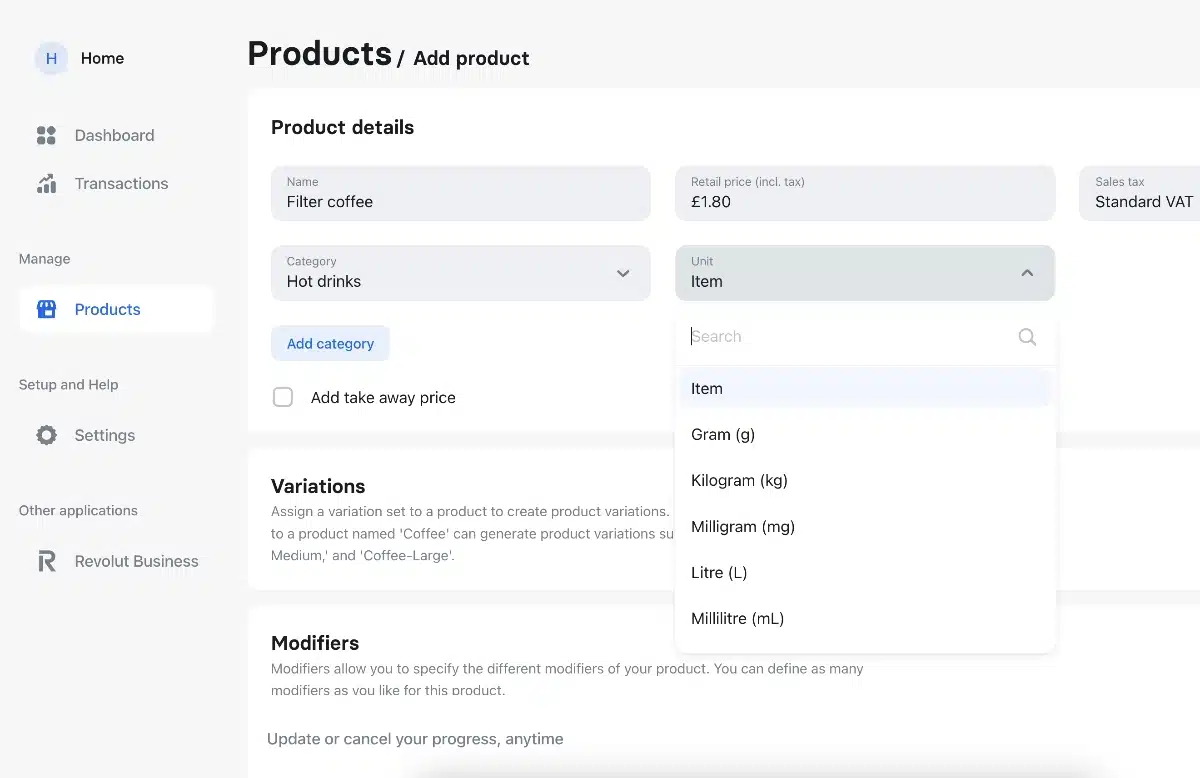

Image: MobileTransaction

This is where you create a product in the Revolut POS dashboard.

These steps are made really simple, but as we discovered, more personalised settings become apparent later on.

For example, the custom-created variants and modifiers are manually applied to each product that needs it. You can add countless of characteristics like toppings, sizes, types of milk and side dishes, each with their own prices, to different products.

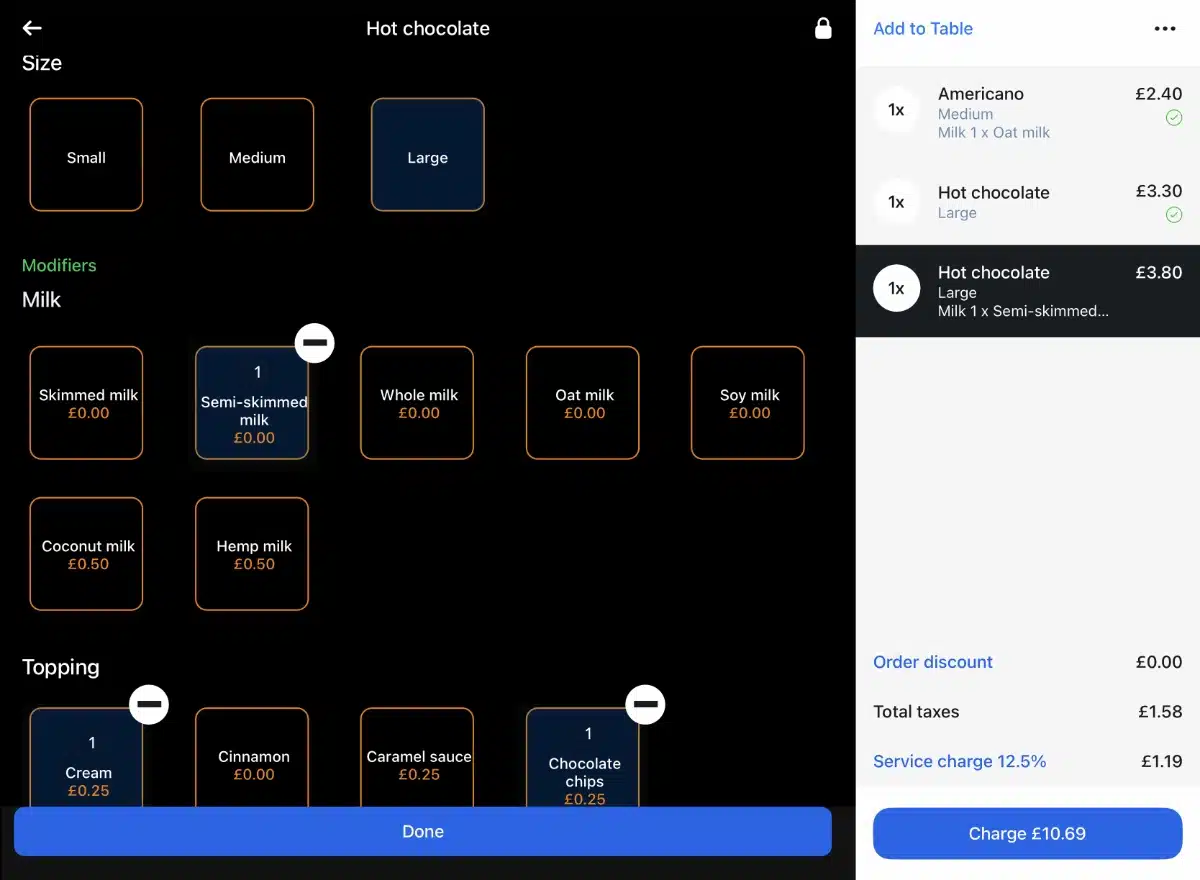

Image: MobileTransaction

Variants and modifiers for a cup a hot chocolate in the Revolut POS app.

The modifiers aren’t that relevant for retailers, but variants are. For example, a clothes shop might sell size small, medium and large (variant types) t-shirts. Revolut’s discounts also allow adjustments to prices, which anyone could use.

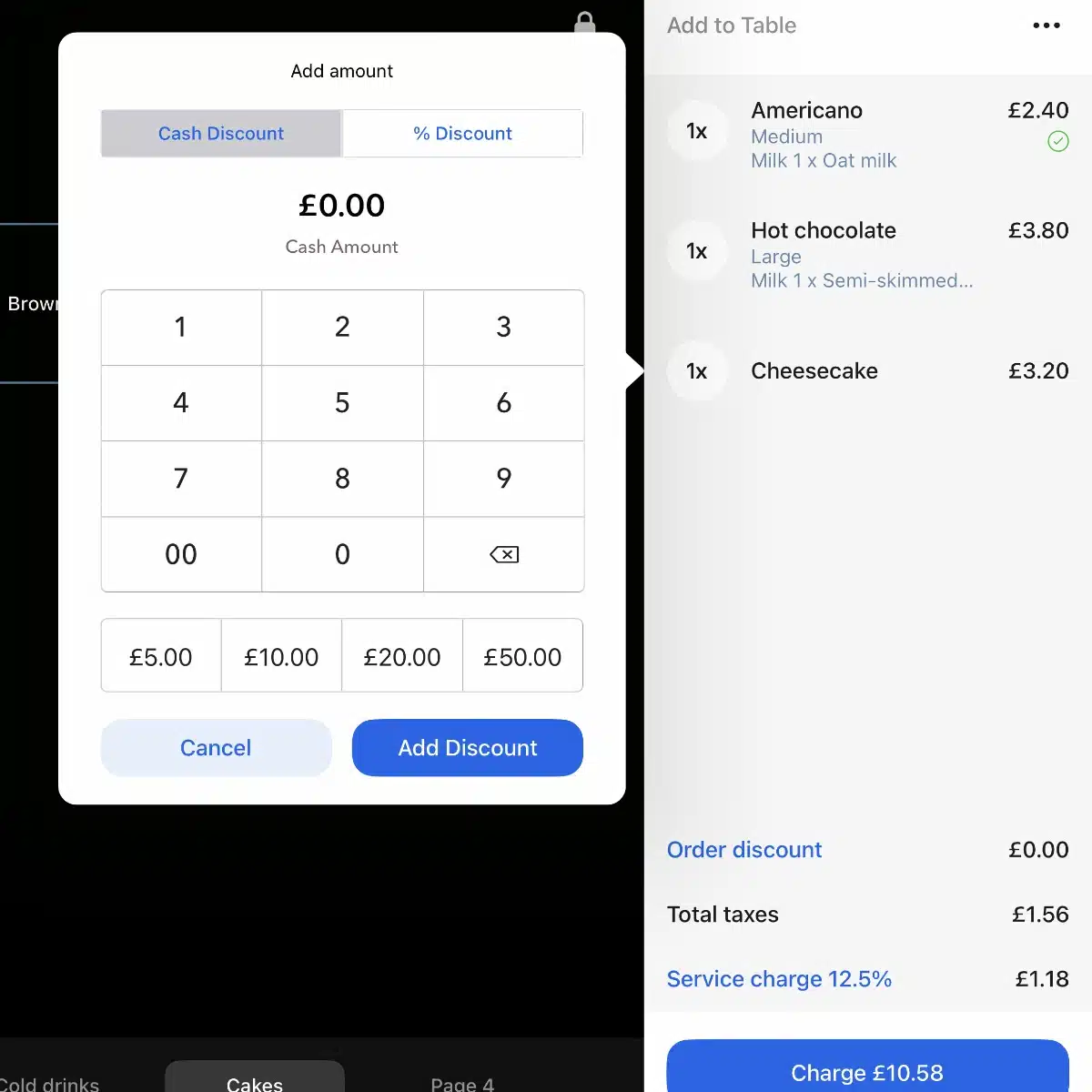

Image: MobileTransaction

Discount options in the POS app.

That said, most of the special extra features relate to hospitality, such as service charges, floor plans, eat-in or takeaway orders, and open orders attached to customers at a table. If these are the main things you need for a small food venue, you might be able to get by.

Image: MobileTransaction

Table and floor plan in the Revolut POS app.

There isn’t anything like ingredient-tracking, stock counts or allergen information, though. On the other hand, the option to send orders to the kitchen could be just the minimum you’d need to run a busy (but small) establishment.

More features will be aded in future iterations of the software, but if it is to remain free, you probably can’t expect much more complexity in the EPOS.

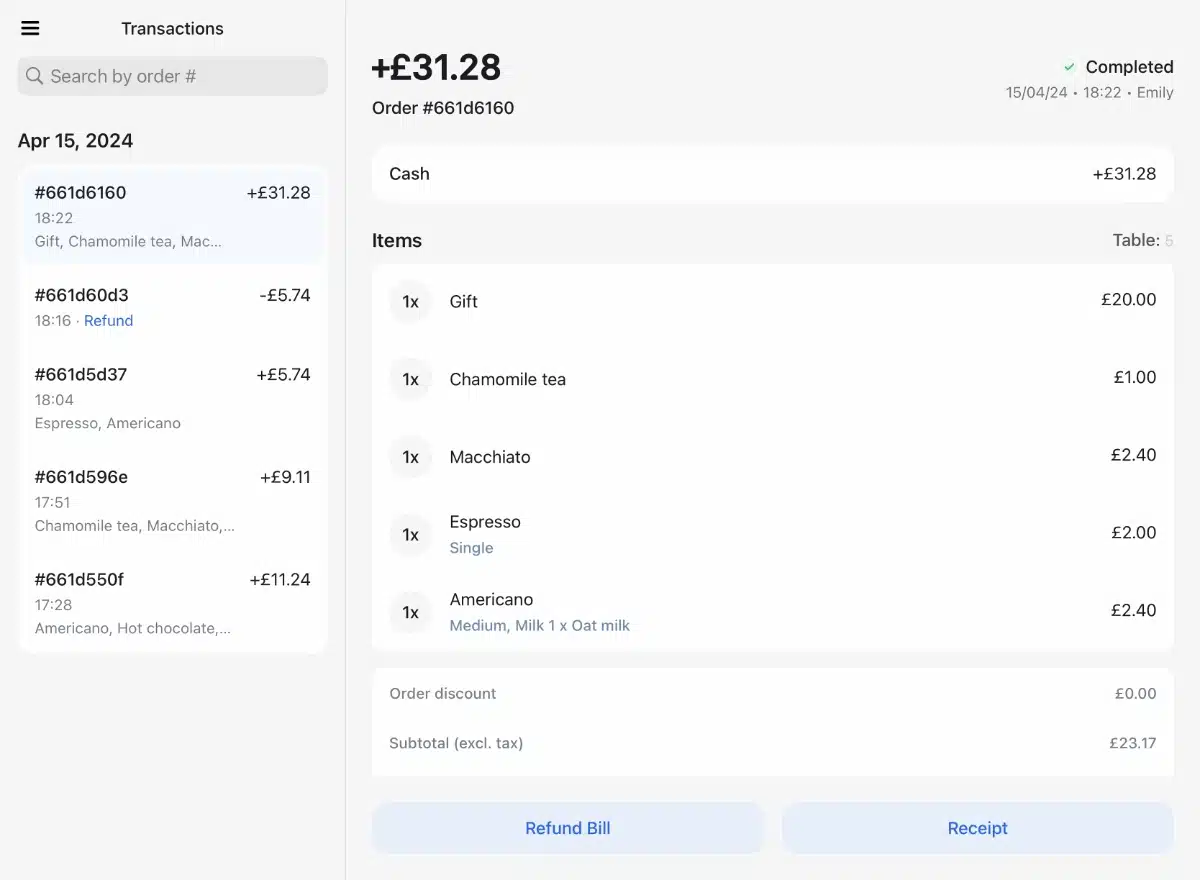

Image: MobileTransaction

Transactions overview in the EPOS app.

What are the main limitations?

- It’s possible to log into the iPad app and navigate the app offline, but you can’t accept payments, view transactions etc. until the app is back online.

- Inventory management features are lacking, such as stock level counts and ingredient-tracking.

- Payment options are limited – just cash or card are accepted, not vouchers, over-the-phone payments, bank transfers, etc.

- No export of sales reports, so it would be difficult to cash up or back up sales data for bookkeeping.

- No integration with online orders.

Card reader, payments and payouts

Revolut POS must be used with the Revolut card reader to accept card payments – there’s no way around it. This allows Revolut to earn a commission on transactions, and ensures that funds always go directly into the Revolut Business account within 24 hours.

The card reader is a curious design with a basic, pixellated touchscreen showing when it’s ready to accept a contactless tap or chip card insertion. If a PIN code is required, a virtual PIN pad will show on the screen. I think the white plastic casing of the card reader feels a bit cheap, and there’s no countertop stand for it either.

Photo: MobileTransaction

Revolut Reader looks like a 1990s gaming device, and ours sometimes disconnects from the app.

I’ve also experienced some bugs while trying to connect it with the app, but it generally does what it’s meant for: process cards in person when it is connected.

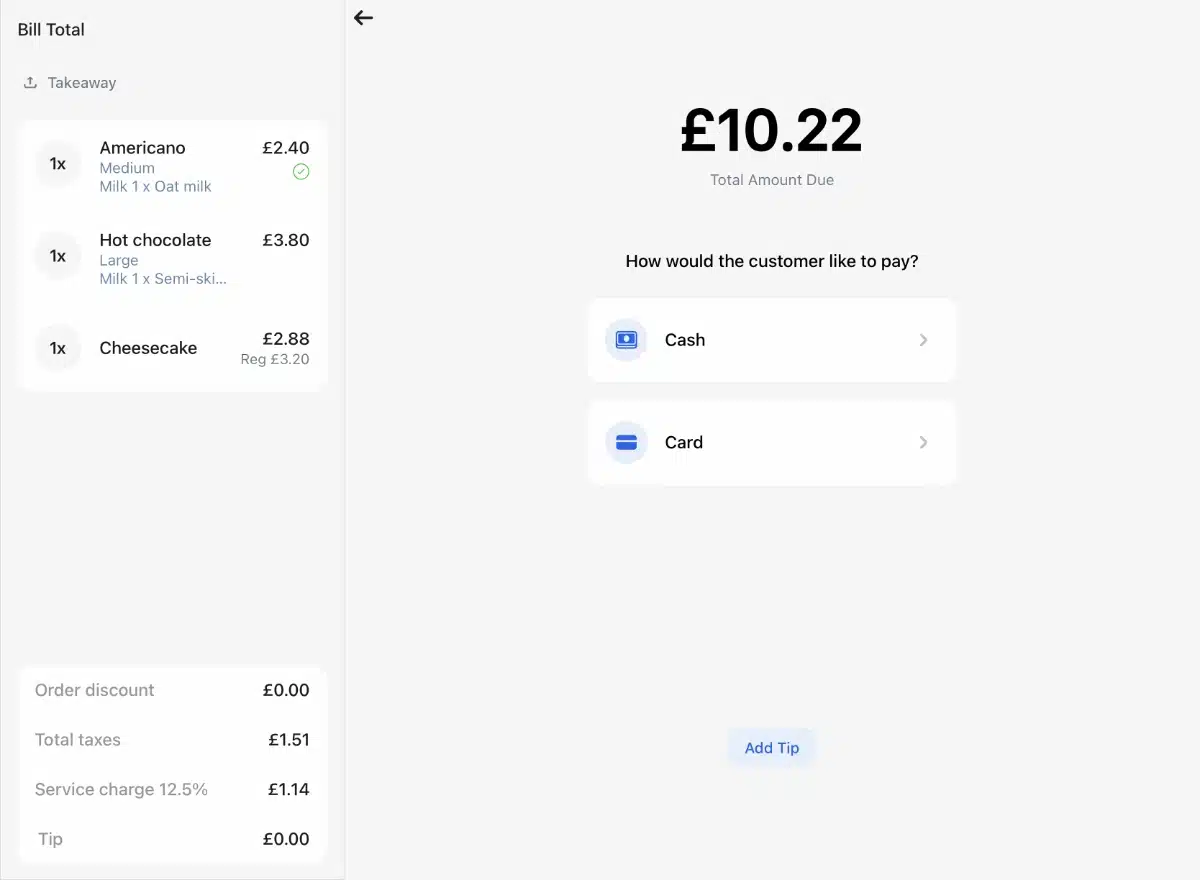

The only other payment method in the POS app is cash. Revolut has made it clear that it’s your responsibility to record and count the change correctly. The cash option only records the cash exchange for easier bookkeeping. If a cash drawer is connected via a compatible receipt printer, it’s much easier to manage this.

Image: MobileTransaction

Revolut POS lets you accept cards (via Revolut card reader) and cash – nothing else.

What about other POS equipment? Since the product was launched recently, Revolut has only verified that the EPOS works with these receipt printers via Bluetooth, USB, WiFi or LAN connections:

- Star TSP100III

- Star TSP143III

No other compatible hardware is mentioned in the Revolut help guides.

Still, I noticed the POS app referencing cash drawer functions, kitchen printers and a kitchen buzzer, so these would be compatible too. Cash drawers are linked to your receipt printer of choice, which you can see under printer settings where a toggle asks if you want the cash drawer to open when a receipt is printed.

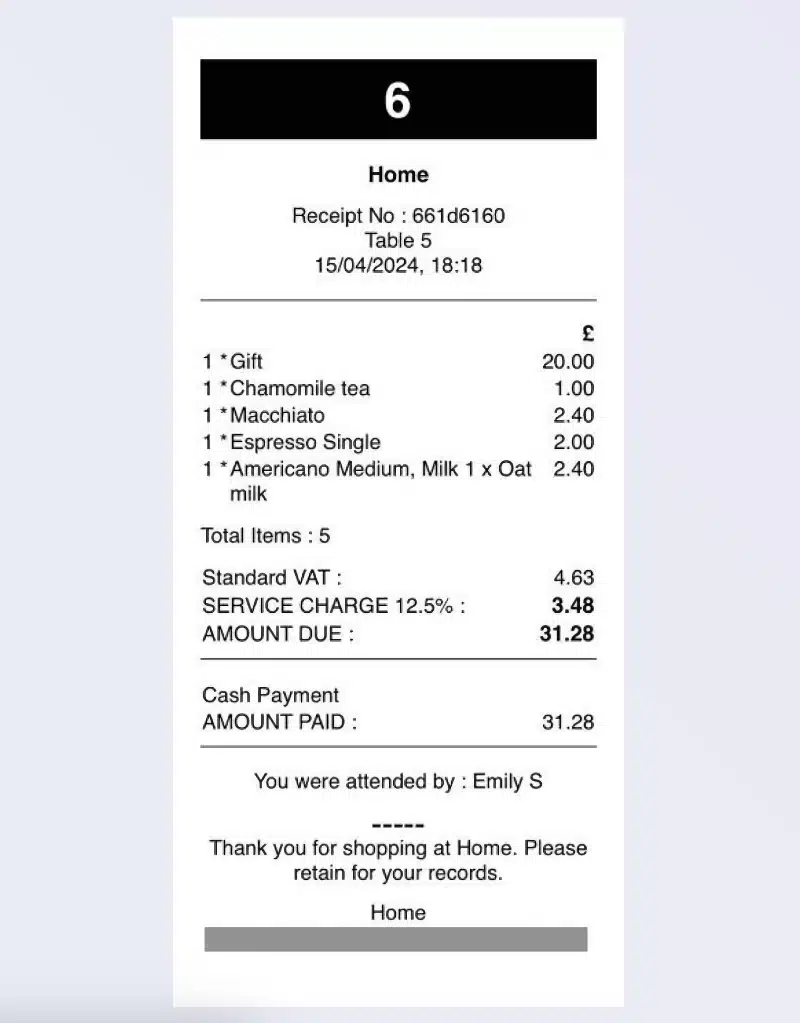

Photo: MobileTransaction

Example of a Revolut POS receipt. A logo, contact details and note can be added too.

Clearly, this is a POS system primarily for hospitality, since kitchen printers/buzzers are part of the settings and there’s no sign of barcode scanning capabilities.

Integrations

The POS system does not directly integrate with other software, but the Revolut Business account does.

The most relevant integrations are probably the accounting programmes Xero, Sage, FreeAgent and Quickbooks. Annoyingly, only card transactions registered in Revolut POS can auto-feed into these systems, not cash transactions. That’s because the integration is with the Merchant account processing card transactions, not the POS app recording the cash payments.

“The lack of accounting integration for cash payments could be a deal-breaker for many businesses who need all payments recorded in their books, especially since there’s not even an option for exporting sales reports to a spreadsheet from the POS system.”

– Emily Sorensen, Senior Editor, MobileTransaction

Other software tools integrate, such as ecommerce platforms (Shopify, WooCommerce, OpenCart) and automation tools (Zapier, Slack), but these are mainly for online businesses.

Customer service and reviews

All Revolut users get 24/7 customer support via an in-app chat and email. We’ve had some frustrating experiences with that in the past, as we were commonly referred to different support members over days, delaying any resolution to issues.

But there is a team dedicated to the POS product, and I found the proactiveness of this service team encouraging. I was called up by a customer support manager the day after I properly started testing the POS software, which allowed me ask questions directly without the pressure of being sold the product. It’s free anyway to get started with it, so there was never any sales pressure to begin with.

After the call, I was sent an email with a direct telephone number for the POS support line for next time I needed help or answers.

But since this product is tied with the Revolut payment system, you can’t avoid having to deal with the Revolut Business support if there’s a payment issue, and this department gets lots of complaints for being inadequate. Some users (including myself when testing over time) have also had to reverify their account several times if there’s been a period of inactivity – or just at random points – which would freeze payment features until resolved.

The POS system is still so new that very few customer reviews have talked about it. It remains to be seen how popular this product will be over the next year.