- Pros: Sales synced across channels. Custom checkout. No lock-in. Pre-certified terminals reduce hassle.

- Cons: Requires development resources. Can’t be integrated with many existing POS systems. Long payouts.

- Best for: Online-first businesses with a developer to customise the ideal in-person checkout.

Looking for the Australian review?

Contents

In summary

How it works

Our opinion

In detail

Costs and fees

Terminal features

POS integration

Reporting

Customer service

How does it work?

Stripe Terminal is primarily for online-first businesses using Stripe. The solution is built with developers in mind, as it is necessary to use a software development kit (SDK) and application programming interfaces (APIs) to integrate the terminal with your own web app or mobile app, or compatible point of sale (POS) software.

The Stripe Terminal solution consists of:

- Your mobile or web-based application

- Your Stripe backend

- Card terminal

- Terminal SDK

In the UK, you can choose between a few card machines, including a small card reader with a PIN pad, which we tested.

The pre-certified card machines are set up to work smoothly with Stripe’s payments system, but it is expected you implement code – guided by Stripe’s documentation – in order to connect and personalise it with your POS software.

That said, the Stripe card readers can connect with a few third-party payment apps without code, usually for an additional fee per transaction.

The card terminals accept Visa, Mastercard, American Express, Discover, Diners Club, Apple Pay, Google Pay and Samsung Pay.

Our opinion: only recommended if using Stripe online

Stripe Terminal is primarily for merchants already using Stripe for some sort of online payments. Adding a Stripe reader helps consolidate online with in-person payments without the hassle of a card machine contract, PCI-DSS compliance and other necessary arrangements for card processing at a physical location.

“The card reader is actually good, despite the plain look. I think there’s value in push-buttons for a PIN pad where other card readers are touchscreen nowadays. But Stripe Terminal isn’t suited for merchants who want an easy solution.”

– Emily Sorensen, Senior Editor, MobileTransaction

| Stripe Terminal criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.8 | Good |

| Costs and fees | 3.7 | Passable/Good |

| Transparency and sign-up | 3.8 | Good |

| Value-added services | 3.8 | Good |

| Service and reviews | 3.7 | Passable/Good |

| Contract | 4.8 | Excellent |

| OVERALL SCORE | 3.8 | Good |

Stripe Terminal is also one of the easier ways (with your own developers) to customise a unique point-of-sale experience in your own POS application, whether that is an app uniquely created for your business or third-party POS software compatible with Stripe.

But for those selling primarily in person, Stripe Terminal is not the most cost-effective, nor beneficial, payment solution you should be looking at. Payouts are slow, and non-technical merchants without a budget for developers have only few no-code POS options.

We recommend looking at alternatives to know what you’re up against.

| Stripe charges | |

|---|---|

| Mobile card reader (BBPOS WisePad 3) | £49 + VAT |

| Portable touchscreen terminal (BBPOS WisePOS E) | £179 + VAT |

| Mobile touchscreen terminal (Stripe Reader S700) | £279 + VAT |

| Setup fee | None |

| Monthly fee | None |

| Terminal transaction fee | UK & EEA cards: 1.4% + 10p Non-EEA cards: 2.9% + 10p |

| Currency conversion (+ transaction fee) | 1% |

| Refund processing | Original transaction fee is retained |

| Chargebacks | £20 each |

| Instant payouts (optional) | 1% per payout |

There are no monthly costs, contract lock-in, setup fees or complicated rates – you just pay the same transaction rates per successful transaction: 1.4% + 10p for standard UK and EEA-issued cards or 2.9% + 10p for non-EEA cards. If you choose to accept a payment in a different currency than the cardholder’s, a currency conversion fee of 1% is added on top.

When a refund is processed, the transaction fee is retained by Stripe – no additional refund fee is added.

Chargebacks incur £20 each. If the cardholder’s bank resolves the disputed payment in your favour, you get this fee back.

With Stripe’s Instant Payouts, you can receive transactions immediately for an additional 1% of the transaction total. Otherwise, it can take about 7 calendar days to receive payouts in your bank account.

Card machines

“Stripe Terminal” suggests there is only one card terminal, but Stripe actually offers the following choice of card machines in the UK:

- Stripe Reader S700 – Standalone, handheld smart POS terminal with touchscreen and card reading capabilities

- BBPOS WisePad 3 – Pocket-sized, push-button card reader that connects with an app

- BBPOS WisePOS E – Touchscreen card terminal that works independently or with an app on a counter or portably

In addition, startups can integrate Tap to Pay on iPhone or Android as part of the solution.

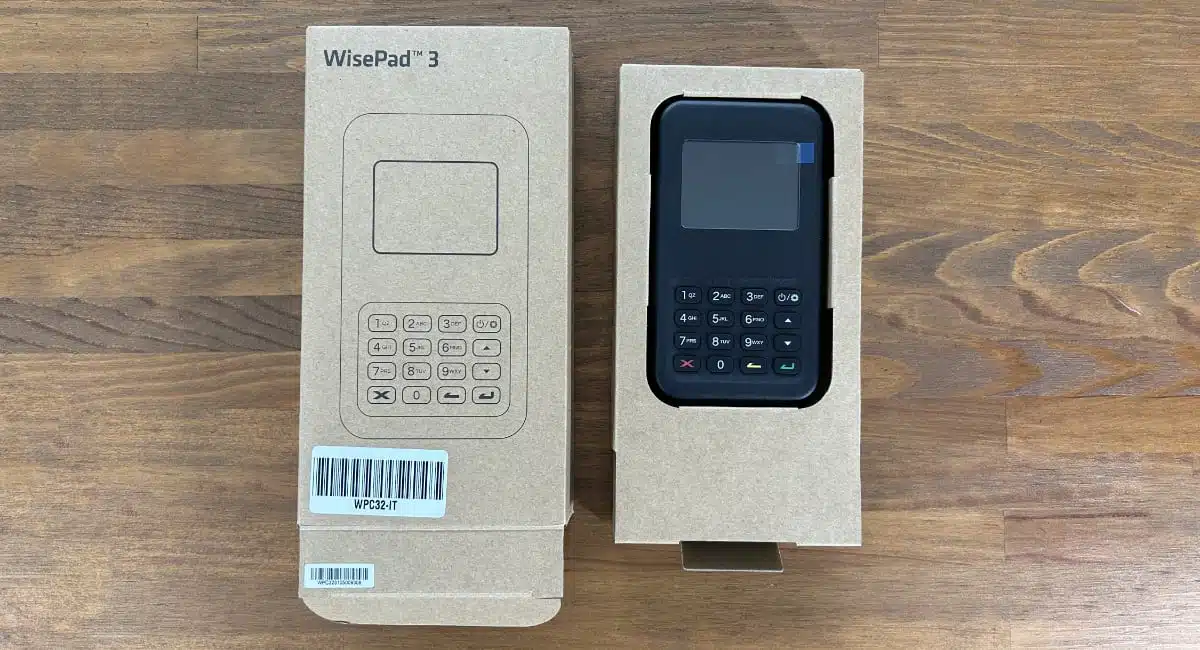

We’ll focus on the BBPOS WisePad 3 since we’ve tested that, and it is the most affordable option for a small business.

BBPOS WisePad 3:

- Mobile card reader with a push-button PIN pad

- Must be connected with a mobile app to accept payments

- For on-the-go payments using a phone’s or tablet’s WiFi or GPRS/3G/4G

- Colour display

- Accepts chip, contactless and magnetic stripe cards

- Compatible with iOS and Android SDKs

Photo: MobileTransaction

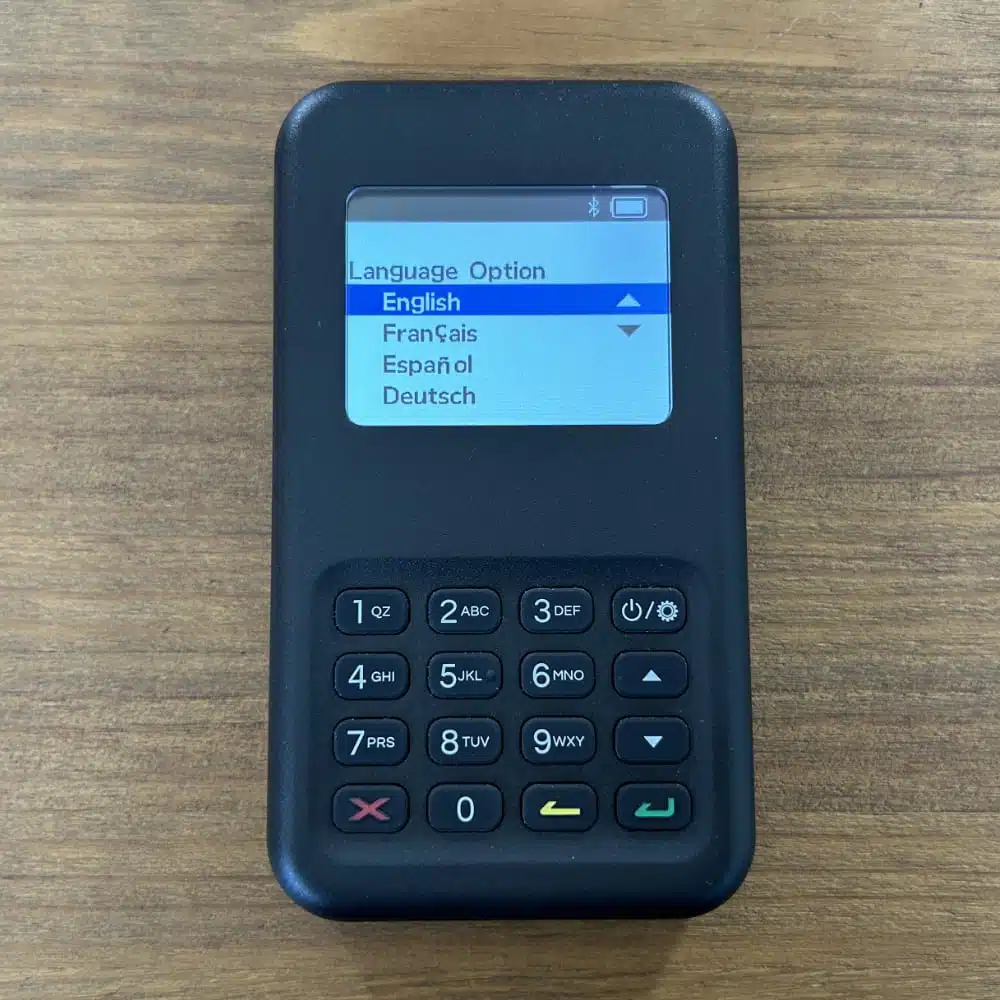

Users can select a card reader language.

Photo: MobileTransaction

Stripe’s BBPOS WisePad 3 is compact.

Our own experience of WisePad 3 (based on first-hand testing) is that it’s easy to hold, manoeuvre and shove in a pocket. It’s smooth and lightweight, but the buttons definitely feel too small for some users.

BBPOS WisePOS E:

- Handheld and countertop card machine

- WiFi connectivity or Ethernet through optional dock

- 5″ colour touchscreen

- Battery-powered or plugged in

- Accepts chip, contactless and magnetic stripe cards

- Compatible with iOS, Android and JavaScript SDKs

Photo: Stripe

Stripe’s touchscreen terminal is a BBPOS WisePOS E model.

The card machines come pre-certified and are PCI-compliant. To start using any of them, you must first connect it with your POS application through the Stripe Terminal SDK.

Integrations with third-party POS with no (or little) code

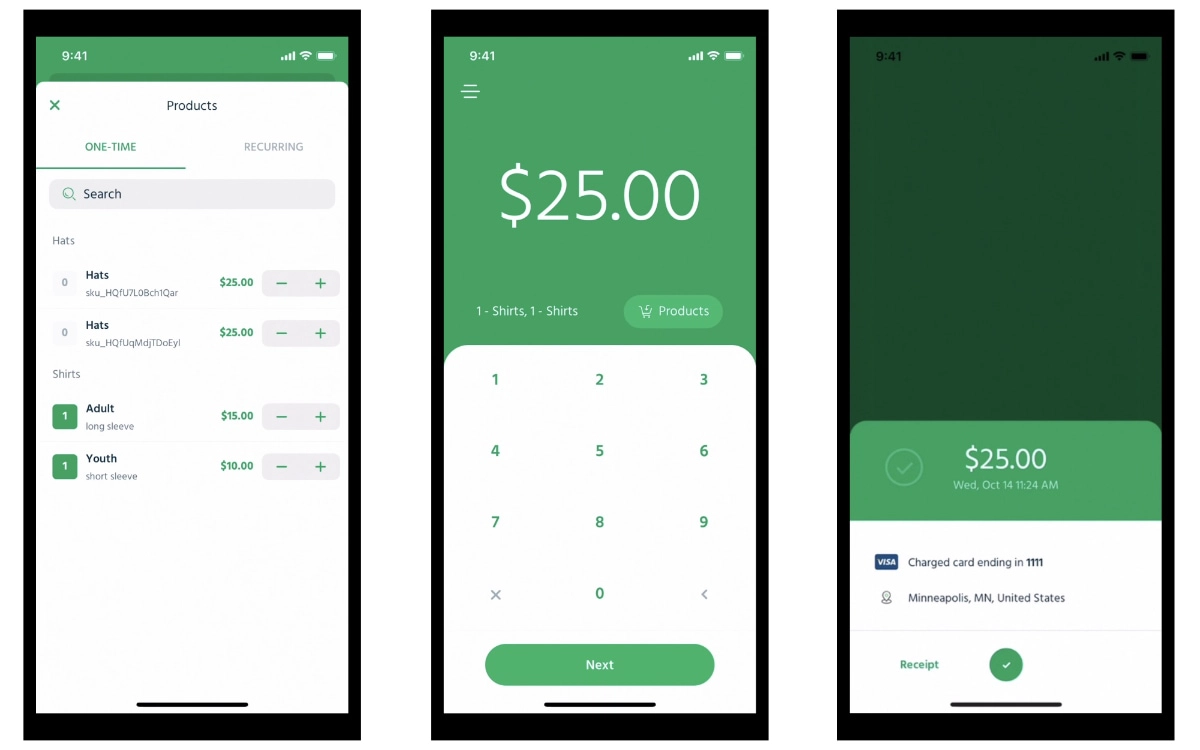

What if you use Stripe online payments with an ecommerce platform and don’t have the budget to hire a developer to set up a POS solution for the Stripe terminal? Then you have a few options that connect with a Stripe reader.

Big Cartel app: The Big Cartel ecommerce platform is popular with artists. If you’re already using Stripe for a Big Cartel online store, downloading this payment app would be the simplest way to accept in-person payments through Stripe Terminal.

Krossroads POS: Full-featured point of sale app for Android devices only. Free and paid plans available. Works with BBPOS WisePad 3 and BBPOS WisePOS E card readers.

M&M POS: Free POS system (iOS, Android, macOS or Windows) with various payment methods like invoicing, subscriptions and card reader payments through BBPOS WisePOS E. No monthly fee, but a 1% transaction fee is added to Stripe’s own rates.

‘Payment’ app on iPhone has only basic features, but it works with Square Terminal.

Payment: There’s a payment app for Stripe Terminal aptly called ‘Payment’. It costs 1% on top of Stripe’s transaction fee, with no monthly fee or commitment.

Terminal for Stripe and WooCommerce, by Arcane Strategies: Plugin for WooCommerce merchants for accepting in-person payments through BBPOS WisePOS E without an app or BBPOS WisePad 3 with a mobile app.

Other Stripe-compatible apps from third parties appear to work with Stripe Terminal, but sometimes only a US card reader model.

Apart from that, popular POS systems may also integrate with Stripe Terminal, so it’s worth checking with your POS provider if they can set this up for you.

Reports and admin features

A major part of Stripe is its backend management and report functions. It is here you manage online payments such as subscriptions, online bookings and ecommerce transactions, as well as chargebacks, customers and other business functions related to payments.

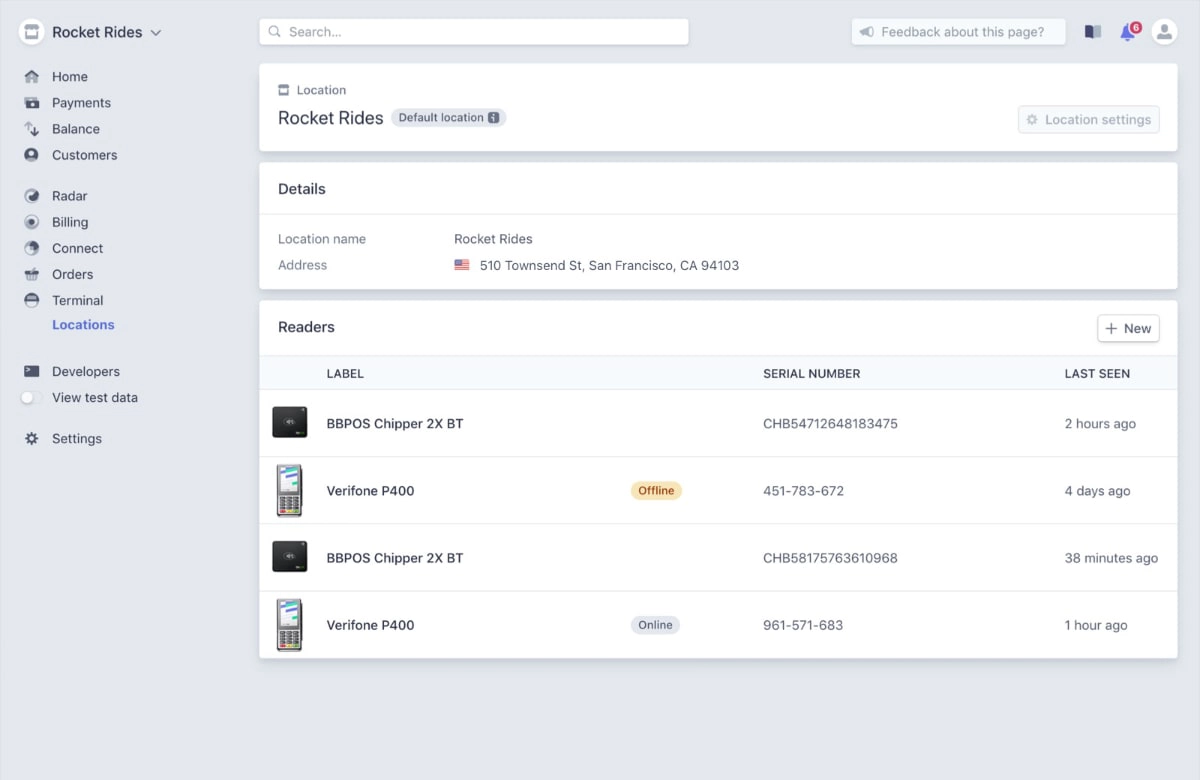

In the case of Stripe Terminal, you have a fleet management section where you can monitor and manage all your Stripe Terminals remotely. If you have several physical locations, you can determine location-specific settings for the card readers and view when individual terminals were last active.

Overview of terminal fleet as seen in the Stripe dashboard.

An obvious benefit is that Stripe payments across all channels are consolidated in the backend. This simplifies sales reports so you at all times have an overview of total sales as well as individual transactions however way they were accepted.

Customer reviews and support

All Stripe users are offered 24/7 customer support by email, chat or telephone. There are also plenty of well-written resources and step-by-step guides in Stripe’s help section.

Customer reviews indicate a mixed experience of the company. Many users mention account closures out of the blue, with payments refunded to their customers or held for various reasons. Upon contacting Stripe, users don’t get satisfactory or even rational responses.

It appears you have to fight hard to win chargeback claims, even with strong documentation to show you are on the right side of the argument.

Furthermore, Stripe is strict in regards to high-risk business. If you fall under a prohibited business area (if in doubt, contact Stripe), your account may be suspended even if you were initially accepted and started receiving payments.

Other users praise the support, with emphasis on a positive onboarding experience.