Overview

In summary

What is it?

Our opinion

In detail

Card machines

Contract

Pricing

Transfers and loans

Remote payments

Alternatives to Dojo

Eligibility and sign-up

Service and reviews

Mobile Transaction has tested the Dojo Go terminal and used the service in different shops. Our opinions are based on our personal experience, communications with Dojo and how it all compares with other card machine providers.

| Dojo Go |  |

|---|---|

| Price | Rental: From £15 + VAT/mo Purchase: From £179 + VAT |

| Contract | Monthly rolling, or 12 months followed by monthly |

| Transaction fees | Fix plan: £39.99/mo (covers transactions up to £3,999/mo) 1% for transactions from £4k/mo Flex plan: Custom fees |

| Other charges | Mix of ongoing and pay-as-you-go fees |

| Website |

What is Dojo? How does it work?

Dojo (sub-company of Paymentsense) is a merchant service provider that only just arrived in late 2020.

Its main product is a touchscreen card machine (pictured below) that can be used on the go, at the till or around premises. It accepts contactless and chip card payments of the brands Visa, Mastercard, Discover, Diners Club and American Express and the mobile wallets Apple Pay, Google Pay and Samsung Pay.

Photo: Emily Sorensen (ES), Mobile Transaction

Box contents of our Dojo Go package.

The terminal software is quite basic, but accepts chip and PIN or contactless payments very reliably.

Our unintegrated terminal allowed us to enter transaction amounts and process cards, but you can choose to integrate it with a POS system of your choice to avoid entering an amount manually.

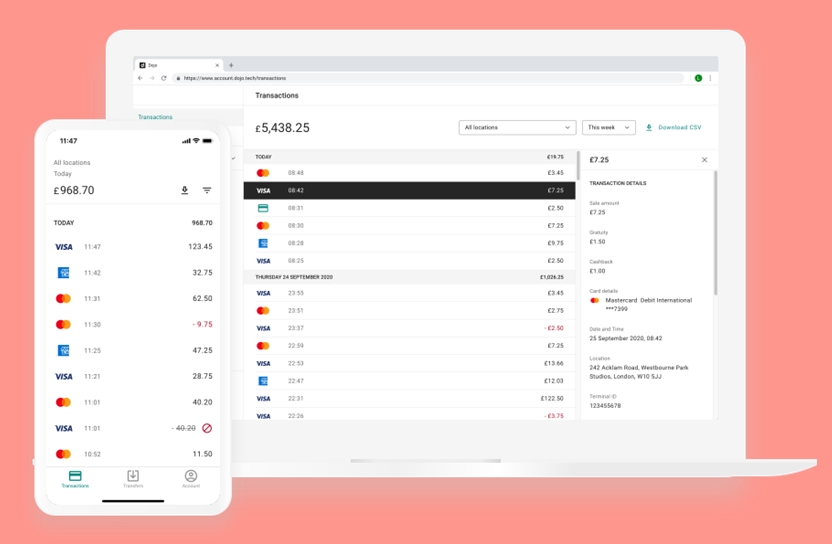

Through a merchant web portal or the Dojo app on your phone, payouts and sales are shown in real time – this can also be exported for bookkeeping.

In the past, the only accounting software we’ve found that Dojo integrates with is QuickBooks, but their website no longer states this, so you’ll need to confirm this directly with Dojo. It is in any case possible to integrate with accounting solutions through an EPOS integration.

Merchants can check transactions and payouts through the Dojo app or web portal.

In contrast with many card machine providers, Dojo has a commitment-free plan for businesses with an annual card turnover above £100k with a monthly platform fee, tailored transaction fees and additional service fees where relevant.

Otherwise, you sign up to a 12-month contract with one fixed fee per month that covers transactions, whether you accept payments or not.

Our opinion: mostly positive

We think Dojo is a reasonable deal for small shops and hospitality businesses with a consistent sales volume of over £8.5k monthly. Restaurants, pubs, bars and food trucks benefit from tipping and a possible EPOS integration with the flexibility to carry Dojo Go around premises and beyond.

The PAX terminal has a long battery life and impressive technical specs, but using it independently was a bit frustrating for me when I couldn’t add a description to individual transactions.

The Dojo app feels like a joy for checking transactions, but the limited accounting integrations could be a hindrance for some.

“I think Dojo’s 12-month contracts for a highly rated terminal is a great deal, considering the fact 18 months is the typical contract length for card machines in the UK.”

– Emily Sorensen, Senior Editor, Mobile Transaction

We really like the fact that if you’re stuck in a pricey, inflexible card machine contract, Dojo offers to buy you out of it.

Dojo is less appealing for below-£100k/year-turnover merchants who must go for a 12-month contract with a minimum monthly fee of £39.99 covering transactions up to £3,999. Although this would make precisely £3,999’s worth of transactions cost only 1%, accepting less would make the average rate higher.

Next-day payouts into a bank account are a real benefit in our view, but the monthly fee for transactions could be too much for seasonal and low-volume businesses.

Instead, you can save money by choosing a wholly pay-as-you-go solution (like Square or SumUp) without a monthly cost. Dojo fees could generally be more transparent, so we recommend being on the lookout for hidden costs when signing up.

| Criteria | Verdict |

|---|---|

| Product Payments: Good Hardware: Good Software: Good |

Good |

| Cost and fees | Good |

| Value-added services | Passable / Good |

| Contract | Passable / Good |

| Sign-up and transparency | Good |

| Customer service | Good / Excellent |

| FINAL RATING | [4/5] |

Card machines: selection of 3

Dojo’s main card machine is Dojo Go, which is a beautiful, mobile PAX A920 smart POS terminal with a touchscreen.

On our ventures in shops across the UK, we know this is a very popular model now. It stands out from traditional push-button terminals that fewer people find attractive nowadays (however functional they are).

But the company also offers two other models: a stationary Dojo Wired card machine with push-buttons and portable Dojo Pocket that’s the size of a smartphone.

Dojo Go – very functional

The card machine is WiFi-enabled and connects with 4G through the built-in SIM card with unlimited, free data. During our tests, this allowed us to accept cards anywhere through the mobile network. We also love the fact that the 4G connection is there as a backup if the local WiFi stops working.

Tech specs of Dojo Go

The battery life is pretty good at up to 10 hours’ from a full charge, which is more than many terminals we’ve had our hands on.

Photo: ES, Mobile Transaction

Dojo Go is a handheld, portable terminal that worked well for us and looks good.

Whether you use Dojo Go on the go, for table-service, queue-busting or at a till point, multiple terminals can be added to the same Dojo account.

The terminal can be used independently or integrated with a compatible point of sale (POS) system. Currently, over 600 POS providers can connect with Dojo.

With a POS integration, transactions on the till communicate smoothly with the PAX terminal to accept payments at the right time. In addition, POS systems automatically register Dojo card payments in their sales reports.

For bookkeeping, Dojo used to integrate with QuickBooks directly, which was set up through the Dojo app – but this may no longer be available. Alternatively, your POS system can integrate with a different accounting system, where Dojo transactions then feed into it through the POS software.

My experience of the card machine

I received a new Dojo Go terminal well-packaged in a hard cardboard box. It comes with a USB charging cable, wall adaptor, charging dock and decals to show what cards you accept. To me, it was really easy to set up. The booklet included showed exactly how to do it in a few steps.

To take a payment in standalone mode, I just entered a transaction amount. After this, the customer can add a tip if they want on the screen, followed by the on-screen prompt to tap a contactless card/mobile device or insert a chip card (the PIN pad is displayed on the screen).

Photo: ES, Mobile Transaction

Our Dojo Go checkout screen.

Photo: ES, Mobile Transaction

Tipping options on Dojo Go.

As I tried the card machine, I frustratingly found out there is no option to add a transaction description to say what is sold. If you need this for reporting, then Dojo Go in standalone mode isn’t going to work. Integrating with a POS system allows you to link transactions with products, though.

The payment process is fairly fast on PAX A920, ending with a clearly displayed green tick to show the transaction is complete. We could then choose whether to print a receipt through its heat-based thermal receipt printer.

As a customer in different shops across London, I have, however, experienced seconds-long delays in processing contactless taps – which feels a bit confusing as it’s not immediately clear whether a card has been accepted. It’s unclear whether that’s because of a poor internet connection or slowing terminal technology.

Pocket-sized and wired terminals available

If you have a fixed checkout, it’s often cheapest to choose a stationary card machine.

Dojo used to sell a package for this called Dojo One, but this has been replaced with Dojo Wired, a white card machine with push-buttons. It integrates with many POS systems, but the company isn’t transparent about which ones.

Businesses may also want the portable Dojo Pocket for table-side transactions. This used to only be available to merchants with at least one Dojo Go terminal per premise, but again – Dojo isn’t transparent about this.

Dojo Pocket literally fits in your pocket.

Dojo Pocket is intended for hospitality businesses who prefer a lightweight card terminal that fits in their waiters’ pockets. It integrates with EPOS systems, so the table service payments are registered on the same system as your main till payments.

The main downside of Pocket is its lack of receipt printing – the consequence of having a small device. With a full EPOS integration, though, you should be able to print a receipt at the main till.

Merchants could also just use Tap to Pay on iPhone, which is a feature of the Dojo app that turns your iPhone into a card reader for contactless payments. This is suitable for retailers, mobile merchants and other trades that might not qualify for the Dojo Pocket terminal.

Contract: monthly or annual

If you’re switching from another merchant service provider, Dojo can pay most of your exit fees from the old contract you were locked into. This could be up to £3,000.

Dojo advertises “no long-term commitment” with a Flex plan, but only for businesses accepting over £100,000 annually in card payments.

If your business is making less than than, you get a 12-month contract. Cancelling before the end of this period incurs an early termination fee equivalent to the remaining costs of the contract. Without a cancellation, the contract will continue on a monthly rolling basis after the 12 months are up.

Dojo fees

Dojo has simplified its pricing over the past year.

Firstly, merchants choose how to pay for a terminal of choice:

- Pay monthly: From £15 + VAT per month (only for merchants accepting more than £100k annually)

- Pay once: From £179 + VAT, no ongoing costs

Then you choose how to pay for transactions:

- Fix plan: One fixed fee covering any amount of transactions up to £3,999 per month

- Flex plan: Rates tailored around your card turnover (only for merchants accepting more than £100k annually)

On top of that, service-related charges may apply that you will have to enquire about while signing up, as not all fees are disclosed openly.

| Dojo pricing | |

|---|---|

| Contract length | Fix plan (card turnover below £100k/yr): 12 months Flex plan (card turnover above £100k/yr): Monthly or 12 months |

| Setup fee | None |

| Terminal cost | Fix plan (for below £100k/yr card turnover): From £179 + VAT upfront (no rental fee) Flex plan (for over £100k/yr turnover): From £15 + VAT/mo, or from £179 + VAT upfront (no rental fee) |

| Transaction fees | Fix plan: £39.99 fixed fee/mo for transactions up to £3,999, 1% for transactions above £3,999 Flex plan: Custom transaction fees according to turnover + £10/mo platform fee per location |

Merchants with an annual card turnover of less than £100,000 (£8,333 per month) have to pay upfront for each card machine, starting from £179 + VAT depending on the model. There is then no rental fee after that.

Those with an annual card turnover higher than £100,000 pay a rental fee from £15 + VAT/month and personalised rates only disclosed at sign-up. Companies making over £1 million annually get the lowest tailored rates.

These fees are based on your type of business, card turnover, how you took the payment and the type of card (request details here).

Dojo may apply additional fees to cards issued outside the UK, like +0.05% if issued in the EEA or +0.95% if issued outside the EEA.

Miscellaneous fees explained

As with other card machine contracts, other fees may apply. Here are some of Dojo’s past fees that may still apply (check your fee schedule closely for them).

| Dojo fees | |

|---|---|

| Refunds | 50p per refund |

| Chargebacks | £28 + VAT |

| Paper billing | £3.50 + VAT/mo |

| PCI compliance | Free if compliant £15 + VAT/mo if non-compliant |

| Early termination fee | Equivalent to cost of remaining contract |

| Dojo fees | |

|---|---|

| Refunds | 50p per refund |

| Chargebacks | £28 + VAT |

| Paper billing | £3.50 + VAT/mo |

| PCI compliance | Free if compliant £15 + VAT/mo if non-compliant |

| Early termination fee | Equivalent to cost of remaining contract |

There used to be a monthly minimum fee of £24.95 for months when there transaction fees are less than that, but this has been replaced with Fix plan’s fixed monthly fee for transactions. On the Flex plan, look out for this fee.

When ordering the card machine, you get “free next-day delivery”. This is actually misleading because it applies to the moment they approve your application (before 4pm), which can take a few working days. So in reality, shipping may take a little less than a week from the point of signing the contract.

We have been assured that the next-day terminal replacement is free, but the official fee schedule has indicated it can cost up to £400 + VAT per machine. This if you damage or lose the terminal. Technical faults outside of your control that can’t be fixed over the phone will result in a free terminal replacement.

PCI-DSS compliance is free as long as certain paperwork is completed by the deadline. Otherwise, it may cost £15 + VAT monthly for as long as you are non-compliant.

Other fees apply to add-on features, services and account extras. These are not disclosed until you speak to a Dojo representative, but may include e.g. POS integrations and online payments.

Fast payouts and extra business funding

Dojo transactions settle in your bank account the next day from 10am, even on weekends and Bank Holidays, for no additional cost. It just has to be a bank account linked to your business.

“Dojo’s next-day funding 7 days of the week is pretty good in the industry, in our experience.”

– Emily Sorensen, Senior Editor, Mobile Transaction

If extra business funding is needed at any point, Dojo offers a cash advance powered by YouLend (subject to terms, turnover and credit history). This is repaid through a percentage of your card takings, with only a fixed fee added on top of the Dojo loan.

Remote and online transactions

Dojo is not limited to in-person payments. The company offers a few ways to accept payments remotely as well without an additional monthly fee.

In the Dojo browser account, you can easily create and share payment links via messaging apps, email or text. The recipient can then pay online on their smartphone or computer.

Dojo can also activate a virtual terminal on their card machines for taking card payments on behalf of customers over the phone. You just enter a transaction amount on the touchscreen, tip (if applicable) and card details to complete the transaction.

In our experience as reviewers, these options are standard for a modern merchant service provider, but they are nonetheless useful.

Photo: ES, Mobile Transaction

Dojo card machine at Franze & Evans Cafe Hackney, which we visited.

Dojo compared with market alternatives

Among the card machine options in the UK, we’ve been impressed by how popular Dojo has been in the last couple of years. It’s one of the card machines I see most across London in small shops and food businesses, so Dojo is doing something right to attract and retain its merchants.

We know Dojo’s Fix plan can be a good deal if you accept at least £2.5k per month per card machine, and it’s an even better deal with a card turnover of at least £8.33k monthly so you can get custom fees.

Alternatives like SumUp and Square don’t have monthly fees, just a competitive pay-as-you-go rate of 1.69%-1.75%. Even newcomer Teya with a similar card machine and monthly fee has lower costs.

Takepayments is a contender similar to Dojo, with monthly and annual contracts suitable for merchants with a card turnover as low as £2k monthly. That’s because the rates are personalised even at that sales volume, and the monthly cost could work out cheaper if your average transaction value is high enough.

Although Dojo has a great, easy-to-understand package, we are surprised that not more people opt for Takepayments, given its excellent, personal service and value.

Regarding integrations and online features for ecommerce and accounting, Dojo doesn’t have much to offer. Square’s platform has a lot more in that area without a contract, such as a free website builder, many remote payment tools and integrations with accounting, marketing, scheduling and other software.

Eligibility and sign-up

As with many other uncomplicated card machine contracts, only certain types of businesses are accepted. For example, high-risk businesses like travel agencies, adult entertainment and vape shops may be rejected. Charities and trusts are not accepted, but social enterprises are.

We know Dojo accepts small shops and food and drink, and not necessarily hairdressers with high transaction sizes. Businesses with lots of high-value transactions may be referred to Paymentsense for a longer-term contract with other card machines.

So how do you get started with Dojo? You’ll need to fill in a web form for a quote, then a Dojo team member will get in touch within a working day to discuss your options and request documentation. Only after Dojo has received everything required from you will they provide a quote and share an agreement.

After signing the contract, Dojo will check and approve it and then send the card machine on the same day if it’s before 4pm, or the working day after.

All in all, you should be ready for your first card machine payment within a week.

During onboarding, Dojo requires that you read some PCI-DSS compliance documents about card payment security, then answer a few questions about it. This is actually a simple version of setting up PCI-DSS compliance, so it’s not so bad.

Sole trader or new business? Compare SumUp, Zettle and Square readers

Customer service and reviews

All Dojo customers can call the main support team with general queries seven days a week between 8am and 6pm.

Tech support can be reached until late in the evening every day (8am-11pm), which is particularly important for off licences, bars and restaurants. Dojo can log into devices remotely if an urgent card machine issue needs fixing.

From our look at Dojo reviews, the service has received a large amount of positive user reviews. We think this is due to Dojo’s ongoing push to get customers to review its product, but it seems people genuinely have a positive experience.

“From my countless taps and chip-and-PIN payments on a Dojo terminal in shops, I’ve only seen cashiers who are more than happy to use it rather than ask for cash.”

– Emily Sorensen, Senior Editor, Mobile Transaction

As a newcomer to the market, it’s obvious that Dojo should put more effort into customer service. It will be interesting to see if they can keep it up in the long term, though it looks like it really has succeeded in that regard.