- Pros: Competitive rates. Quality card machines. Popular acquiring bank. Help with PCI-DSS compliance.

- Cons: 12-18 months’ commitment. Customer service issues. Software not great. Hidden costs. Fast payouts require Barclays bank account. Web dashboard not for all users.

- Best for: Barclays account holders who want standard card machines from the same bank.

Overview

In brief

What is it?

Our opinion

In detail

Card machines

Pricing and contract

Online payments

Service and reviews

What is Barclaycard Business?

Barclaycard Business is a major acquirer and payment processor in the UK that caters to any size business, small or large.

Several merchant service providers actually offer card machine contracts with Barclaycard handling the card processing behind the scenes. But Barclaycard also offers contracts directly without the overly-eager sales tactics seen elsewhere.

The card machines include mobile, portable and stationary models with a contract of 12 or 18 months, depending on the model. There is also an app-based card reader, but this is functionally different and with pay-as-you-go fees. In addition, you can add a virtual terminal and online payment gateway.

The contract includes a merchant account, terminal rental and optional merchant agreement for American Express acceptance. The application’s approval is subject to your financial circumstances and borrowing history. Some small, new or/and higher-risk businesses may be rejected.

To receive payouts from in-store card payments, you need a business bank account in your name from any bank, so you don’t necessarily have to bank with Barclays to qualify for a merchant agreement. However, settlement time will be faster with a Barclays account (1-3 working days) compared with other banks (up to 7 working days).

Our opinion: better for Barclays customers

We think you need to be a stable business to benefit from a Barclaycard agreement, because you’re committing to 12 or 18 months and card rates are better with a large turnover. It’s also beneficial to bank with Barclays, as payouts are faster with an in-house bank account.

Over the past year, we haven’t seen any new products or features launched by Barclaycard Business. What’s more, its software and user interface are still inferior to tech-driven companies like Square, Dojo and SumUp.

“The rented Barclaycard payment terminals are good quality, but they come with unhelpful support and slow-to-develop software. We’re not convinced this is the best service unless you’re a high-turnover business who’s loyal to the bank.”

– Emily Sorensen, Senior Editor, Mobile Transaction

New and small businesses shouldn’t be afraid to contact the bank, as they are relatively upfront about terms. But we’ve seen it being stricter than other payment providers about accepting high-risk business types and startups with an uncertain future. Fees and onboarding are not geared towards very small businesses either.

That being said, Barclaycard offers great anti-fraud measures, complete terminal packages with a full-fledged merchant account, and remote payments combined with the card machines. But main competitor Worldpay has more in the way of online payments and integration options.

Barclaycard does charge a setup fee, though, and all the little fees for refunds, PCI compliance etc. add up.

| Criteria | Verdict |

|---|---|

| Product | Good |

| Cost and fees | Good |

| Value-added services | Passable / Good |

| Contract | Passable / Good |

| Sign-up and transparency | Passable |

| Customer service | Bad / Passable |

| FINAL RATING | [3.6/5] |

Card terminals

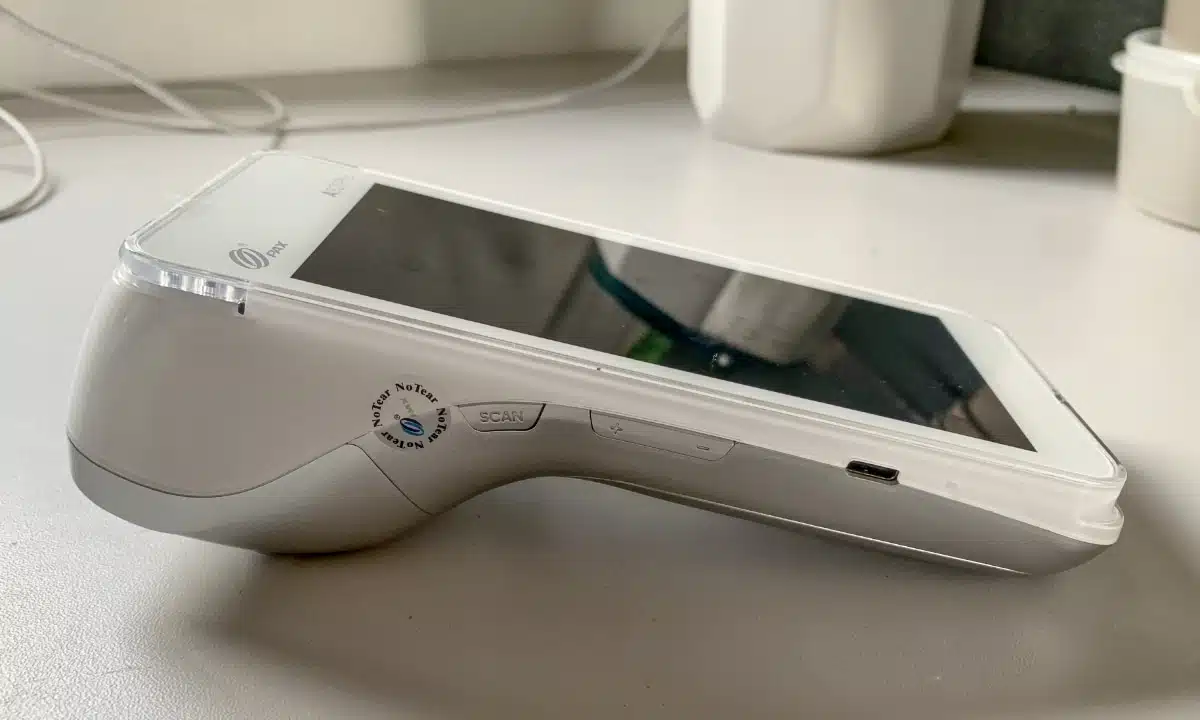

Barclaycard card machines are either Ingenico models or a PAX A920 model, both commonly seen in shops around the UK.

They accept Visa, Mastercard, Diners Club and Discover, but American Express requires a separate agreement. They also accept all common card technologies including chip and PIN and contactless (NFC) cards as well as mobile wallets like Apple Pay and Google Pay.

Let us have a look at the main differences.

Smartpay Touch

The PAX A920 card machine we tested. Photo: Mobile Transaction

We’ve used PAX A920 extensively in shops and for testing and haven’t got any real issues with it. The card machine works well for card transactions, it’s comfortable in the hand, and the large touchscreen is good quality.

The only potential downside is Barclaycard’s own software installed on it – it could look more modern and have better features.

Mobile card machine

The mobile terminal is an Ingenico Move 5000 model. Photo: Barclaycard

Although not advertised on the website any more, Barclaycard can also offer a desktop card machine or other models to suit your till setup. However, the Ingenico Move/5000 and PAX machine above are the most popular, and flexible, ones.

It may be possible to set up a POS integration with some of these card machines, but only a few of our most recommended EPOS work with Barclaycard, such as TouchBistro.

Barclaycard doesn’t have a web portal for viewing sales remotely from the Move/5000 card machine, but now offers a FreshBooks accounting integration to bridge that gap. Smartpay Touch has a web dashboard where sales and transactions are viewable, which makes sense because it has more POS features generally.

There is also a mobile card reader connected to a mobile app, which is for merchants who only need a basic, commitment-free solution for payments on the go. To read more about this, see our Smartpay Anywhere review.

Barclaycard card machine fees and contract

Barclaycard merchant services give you a standard merchant account, card processing agreement and terminal rental in one package.

The contract length is 12 or 18 months, depending on the card terminal package, starting with a hidden £150 setup fee.

If you decide to leave the service before the contract is up, an early cancellation charge of £115 + VAT may apply. This isn’t actually bad compared to other traditional terminal providers that typically ask the merchant to pay the remaining fees of the contract to leave early. But it is bad when Barclaycard publicly advertises there is no fee for cancelling – so do ask specifically about this when signing up.

| Barclaycard pricing | |

|---|---|

| Contract length | Smartpay Flex: 18 months Smartpay Touch: 12 months |

| Setup fee | Up to £150 |

| Terminal rental per month | Smartpay Flex (mobile terminal): £15 + VAT Smartpay Touch (smart POS terminal): £29 + VAT |

| Transaction rates | 1.6% for small or new businesses Custom rates for larger businesses |

| Monthly minimum charge | Depends on contractual agreement |

| Early termination fee | Up to £115 + VAT |

| Refunds | Fixed fee |

| Chargebacks | Fixed fee |

| PCI-DSS compliance | Costs depends on your circumstances |

The card machines cost a fixed monthly fee to rent, sometimes at a reduced cost for new sign-ups.

The touchscreen terminal (Smartpay Touch) is priciest at £29 + VAT monthly, but that’s because it doubles as a mini POS terminal with more than basic checkout features. The mobile and portable Move/5000 terminal (Smartpay Flex) is half the cost at £15 + VAT per month because it’s just a basic card machine.

Like most card processing contracts, you are charged a monthly minimum fee if you do not make above a certain threshold during a month. The minimum sales volume limit is based on your turnover.

Transaction fees

Small or new businesses sign up for a fixed 1.6% card transaction rate, which is lower than the fixed rates of Square, SumUp and Zettle that don’t charge monthly fees.

“Barclaycard certainly has a low fixed rate across card types compared with pay-as-you-go card readers from elsewhere, but you also pay monthly rental. And look out for hidden fees like a monthly minimum sales charge and PCI-DSS compliance.”

– Emily Sorensen, Senior Editor, Mobile Transaction

On a custom contract for bigger businesses with a previous sales history, transaction fees vary according to the card brand, type (e.g. debit, credit, business), your sales volume and type of business.

The only way to know the precise rates is to request a quote from Barclaycard directly. They will ask questions about your requirements and business before you are presented with fees. In some cases, they can buy you out of an existing card machine contract if thinking about switching.

Average card rates tend to be 1.5%-2.5% + fixed fee for a small business, but Barclaycard Business tends to offer lower rates than most merchant service providers. Debit card rates can go as low as 0.6% for personal debit cards and above 3% for premium cards.

Accepting American Express requires a separate merchant account with Amex, which Barclaycard can help with. Amex rates are typically high, around 2%-3%.

Refunds cost a fixed fee each, and so do chargebacks. There are likely to be other costs associated with the service.

“We recommend close-reading the fee tables before committing to Barclaycard, as it is common with unexpected charges in merchant contracts.”

– Emily Sorensen, Senior Editor, Mobile Transaction

PCI-DSS compliance is not free

Then you have PCI-DSS compliance with a whole separate cluster of charges depending on the complexity of your business.

Barclaycard automatically enrols you on a portal called Data Security Manager that helps you set up PCI compliance for a monthly fee (from £2.50). The portal determines what steps are required for you to become compliant. Expect to pay fees for an application and then the annual renewal of the PCI-DSS status.

You have 90 days to achieve full PCI-DSS compliance. If you don’t, you are moved to a different portal called Proactive Security Service (PSS) for a higher monthly cost.

If you opt out of PSS and choose not to use a third-party supplier instead, Barclaycard will charge non-compliance fees in the form of a % rate per transaction (unless you are considered compliant in your circumstances).

In other words, card security comes at a cost – whether you are taking the compliance route or not.

Online payments

Businesses can also add a virtual terminal for over-the-phone payments. This comes at a monthly cost covering a number of transactions a month. Up to 5 users can process virtual terminal transactions at the same time on the web, tablet or phone. For an additional cost, you can also accept multiple currencies.

You can also add a payment gateway for your website, called “ePDQ”. Again, this comes at a monthly cost and may also require some work on your website to implement.

The Barclaycard online checkout page can be customised for your brand and comes with a fraud prevention tool that reduces cart abandonment. It can accept the major credit and debit cards as well as PayPal.

None of these online and remote payment options are unusual for a payment processor. They’re the bare minimum of what businesses can expect from an established merchant service provider.

Customer service and reviews: mostly bad

A major downside of Barclaycard is its poor service. Trustpilot rates Barclaycard 1.3 out of 5, but this includes a majority of personal credit card users. The card machine users commonly complain of:

- not being about to get through to support

- archaic registration processes

- outdated software

Merchants can contact customer support by phone, email or contact form, but the website doesn’t make it easy to find an email address. Instead, you’re encouraged to find answers yourself from their limited online resources or call during the limited hours of 8am-6pm on weekdays only.

What’s more, onboarding can be a challenge for enquiring small businesses, who need to provide documents and detailed business information over a period of time. The only way to get started is via a phone call where it’s easy to gloss over important contract information.

“Barclaycard’s customer service and pre-sales are a mixed bag for small companies. It’s not really set up to onboard the smallest businesses, so many of these merchants go to Takepayments or Dojo instead.”

– Emily Sorensen, Senior Editor, Mobile Transaction

You can generally expect long wait times on the helpline according to users, and emailing sometimes doesn’t yield any response, so it may be best to resort to the contact form and await a callback. Customer reviews generally indicate frustration at slow responses from Barclaycard.