Contents

In brief

What is it?

Our opinion

In detail

Card machines

Getting started

Fees

Account and card

Online payments

Who is it for?

Customer service

Mobile Transaction has tested myPOS, communicated with the company and researched user experiences for an accurate review. Photos and opinions are our own.

| myPOS Go | myPOS Ultra | |

|---|---|---|

|

|

|

| Advantages | Cheapest model, standalone | Many functions, prints receipts |

| Price | £29 + VAT | £229 + VAT |

| Delivery fee | £5 + VAT | |

| Transaction fee | 1.1%-2.85% + 7p | |

| Connection | WiFi, 4G | WiFi, 4G, Bluetooth (SIM included) |

| Size | 136.6 x 67.6 x 21 mm | 212 x 79.6 x 64.5 mm |

| Weight | 181.6 g with battery | 485 g with battery |

| Prints receipts? | Only with Combo printer | Yes |

| Accepted cards | ||

| Contactless options | ||

What is myPOS and why choose it?

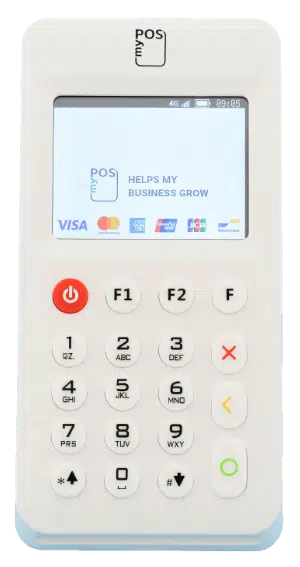

The compact, standalone card machines by myPOS accept a wide range of credit and debit cards anywhere with a network connection.

There’s no contractual commitment and no monthly or annual fees. You just pay a one-off price for the terminal, transaction fees and other costs for applicable account activities.

A major selling point is the “instant access to funds” after transactions, which you have through the complimentary myPOS Business Card (Mastercard-branded) linked to an online myPOS account where payouts go.

Photo: Emmanuel Charpentier (EC), Mobile Transaction

myPOS devices come in a sturdy, nice-looking box.

There is no automatic settlement to your bank account, but you can use the myPOS Business Card in any store – online or physical – carrying the Mastercard sign.

The business account has additional features similar to a bank account, as well as online payment tools, so you can use it as your main hub for business transactions.

Our opinion

We think myPOS is great for instant access to funds, a commitment-free business account and mobile card processing on the go. The system allows you to transfer money internationally, give out Business expense cards to multiple staff members and process payments through a multichannel, multi-currency solution.

The card machines are easy enough to use for transactions, with the added benefit of working outside the UK. If you’re trading across the EEA and domestically, it could therefore be your go-to card solution.

“myPOS Go 2 is a good, small size for mobile payments with user-friendly push-buttons you so rarely see today – definitely an upgrade from the old, unattractive version. But Ultra meets more needs for a cab driver, independent shop or market stall with products to track.”

– Emily Sorensen, Senior Editor, Mobile Transaction

That being said, we’ve seen mixed reviews about the service, and the hidden costs of payouts, transfers and miscellaneous things like cash withdrawals can make it more expensive than small-business alternatives like SumUp that also includes a business account.

The fact you have to close the account to avoid hefty inactivity fees is another minus, as it makes myPOS not totally commitment-free. It is, however, a potentially valuable service with many tools to draw from.

Bottom line: Ideal for those who need a mobile card machine connected to an online business account with instant access to funds.

| Criteria | Verdict |

|---|---|

| Product | Good |

| Cost and fees | Good |

| Value-added services | Good / Excellent |

| Contract | Good |

| Sign-up and transparency | Passable |

| Customer service | Passable / Good |

| FINAL RATING | [3.9/5] |

Mobile terminals that work across Europe

myPOS UK currently sells these models:

- myPOS Go 2

- myPOS Go Combo

- myPOS Ultra

They all connect with 4G thanks to their free SIM card with unlimited data, valid across the UK and EU. This makes them great if you travel a lot and frequently need to take payments in other countries, like France or Ireland. If mobile connectivity is not an option, all of them connect with WiFi.

If you’re looking to accept just simple payments, i.e. manually entering the card total to process, they would all suit. Features include tipping, multiple staff accounts and customised receipts.

myPOS Ultra

For more POS features, we recommend the Ultra terminal that has POS register software built in.

Here, you can add products to a library, track stock, set discounts and more directly on the touchscreen. It’s not as advanced as tablet EPOS, but does the trick for, say, table-service staff and corner shops.

myPOS Ultra has a large touchscreen with all of myPOS’s apps, built-in camera for e.g scanning vouchers, and third party apps for different industries.

It also has a built-in receipt printer and an exceptional battery life – 15 days on standby or over 1500 transactions with receipt prints. That’s several days’ active use for most merchants.

myPOS Ultra is a slick new addition to myPOS’s card machines.

myPOS Go, with or without a receipt printer

The myPOS Go card reader, on the other hand, can perform basic functions like accepting chip, contactless and swipe cards.

“I noticed the myPOS Go 2 screen lacks contrast, and using the navigations isn’t intuitive at first, but you quickly get used to it.”

– Emmanuel Charpentier, Senior Editor, Mobile Transaction France

The previous version resembled a narrow calculator with its push-button PIN pad and small (but colour) display. The new version (Go 2) launched in 2023 is significantly upgraded in appearance, but the display still lacks contrast so it’s not perfect. The keyboard is easier to work with, though.

Photo: EC, Mobile Transaction

myPOS Go 2 is the cheapest of all myPOS models, and an upgrade from the first version.

While simple, myPOS Go is the cheapest independently-working card reader in the UK that doesn’t require a Bluetooth connection with a smartphone to function.

But myPOS Go 2 only sends receipts via text or email. This enables it to be smaller and lighter-weight than Ultra.

The Go 2 reader has an optional charging dock with a printer, sold with the card reader as the myPOS Go Combo package. We think the printing dock is a bit chunky, and it doesn’t mount to a countertop, but it looks nice with the card reader.

Photo: EC, Mobile Transaction

myPOS Go Combo has a receipt printer-and-charging dock, but we found it doesn’t screw onto a countertop.

Additional features

The pricier Ultra terminal can sell mobile top-ups, request payments remotely and issue gift cards. There is also a myPOS app for your phone where you can monitor sales remotely, manage your myPOS accounts, send payment links and more.

For more complex features, you can integrate Ultra with POS systems through APIs and SDKs (the website provides technical information on setting it up).

The company also sells big touchscreen POS machines (‘Hubs’) and unattended POS registers for those with a larger budget.

Tap-on-phone app: myPOS Glass

An interesting alternative to the POS terminals is the myPOS Glass app available on iPhone and certain Android smartphones. It allows you to accept NFC cards or mobile wallets through a contactless tap on your phone (tap-to-pay), as well as QR code payments in person.

The Glass app has two plans: the free Starter plan with higher transaction fees (from 1.6% + £0.07) and Pro for £4.90 monthly for lower transaction fees (from 1.1% + £0.07). The app also allows you to order Platinum Silver, Gold and Metal cards with higher spending limits, loyalty perks and cashback on card purchases.

Getting started takes some work

Getting started with myPOS is done in three steps (if all goes well). Step one is going to the website, clicking “sign up” and completing required details including company and director information, ownership structure, projected turnover and more. You then receive a 4-digit code as a text message to your phone, to enter on the sign-up form.

After submitting all this, you get an email about the next step: identity verification. A 5-minute video call with a myPOS team member is required, along with proof of ID and documents to verify your identity. This, myPOS says, is a requirement from the EU Fourth Money Laundering Directive, which – maybe because the devices by default work across Europe – they need to comply with.

By contrast, SumUp and other card reader providers don’t typically have this requirement – perhaps because their terminals by default only work within the country of registration.

After the video identification, you will receive confirmation within 8 business hours of whether you can proceed with the application. Then you are required to provide legal documents to verify your company’s identity. The type of documents will depend on your company.

Only after these submissions have been accepted do we recommend purchasing a card machine, since some businesses will be rejected if they do not fit in with the accepted business models. It’s straightforward to buy a myPOS terminal on the website or by visiting their London store.

It is normally cheapest to buy a terminal on myPOS’s own website. You can find them online too, for instance on Android EPOS.

Fees fairly transparent, but there are catches

In some regards, myPOS has simple fees. They have no monthly costs and seemingly “no hidden fees”, but if you buy into the service expecting to receive transactions into your bank account, you’ve got another think coming.

Transaction fees

The transaction fee is 1.1% + 7p for consumer Visa, Mastercard, V Pay and Maestro cards issued in the UK or EEA, which is quite a good deal without a contract.

All American Express cards are 2.45% + 7p per transaction, and all other cards that are commercial, issued outside the EEA or of other card brands cost 2.85% + 7p per chip, tap and swipe transaction.

| Type of card | Transaction fee |

|---|---|

| UK & EEA-issued consumer Visa, V Pay, Mastercard, Maestro cards | 1.1% + 7p |

| American Express | 2.45% + 7p |

| All other cards | 2.85% + 7p |

| Online payments | Domestic consumer cards: 1.3% + 15p American Express: 2.5% + 15p All other cards: 2.9% + 15p |

| MOTO/Virtual Terminal payments | Online payment fee + 0.5% |

Payments online or via the virtual terminal (keyed) incur higher fees, as shown in the table above.

Other fees

In contrast to other mobile card machines in the UK, you have to pay a transfer fee to send money from the myPOS E-money Account to a bank account. Settlement is not automatic, but it is instant (or up to 2 hours in the slower cases) when you submit the transfer to a UK bank account.

| myPOS cost | |

|---|---|

| Card terminal | £29–£229* |

| Delivery charge | £5* |

| Fixed monthly fees | None |

| Payment with myPOS card | Free |

| ≤€300** withdrawal from myPOS card | £2 |

| >€300** withdrawal from myPOS card | £4 |

| Transfer to UK bank account | £1.50 |

| SWIFT transfers | From £3 |

| Refunds | Free |

| Chargeback fee | £15 |

| Fees after 10 months’ inactivity | £15/mo (inactivity fee) + £30/mo (no acquiring fee) |

*Excluding VAT. **Or its exchange value in GBP or other currency on the date of transaction.

| myPOS cost | |

|---|---|

| Card terminal | £29–£229* |

| Delivery charge | £5* |

| Fixed monthly fees | None |

| Payment with myPOS card | Free |

| ≤€300** withdrawal from myPOS card | £2 |

| >€300** withdrawal from myPOS card | £4 |

| Transfer to UK bank account | £1.50 |

| SWIFT transfers | From £3 |

| Refunds | Free |

| Chargeback fee | £15 |

| Inactivity fee after 10 months’ inactivity | £15/mo (inactivity fee) + £30/mo (no acquiring fee) |

*Excluding VAT. **Or its exchange value in GBP or other currency on the date of transaction.

If your account has been inactive for ten months, a monthly charge of £15 + £30 is taken until your next myPOS transaction or you close the account.

“Users are charged £45 monthly after 10 months’ inactivity, so you can’t just open a myPOS account and leave it unused indefinitely without surprise fees.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Apart from the above-mentioned fees, there are several other fees specific to international money transfers, myPOS Business Card use and more. And let’s not forget the £6 (£5 + VAT) shipping charge on all myPOS card machines.

myPOS merchant account with Business Mastercard

Would your business benefit from a dedicated merchant account separate from a local business bank account? Or do you just want a temporary business account before you set up a permanent one in a bank? If so, myPOS could work for you.

Merchants operating internationally will like that myPOS works through a “merchant account” – or myPOS E-money Account – with its own IBAN. (Note: The myPOS merchant account is different from a traditional merchant account purely for card processing purposes)

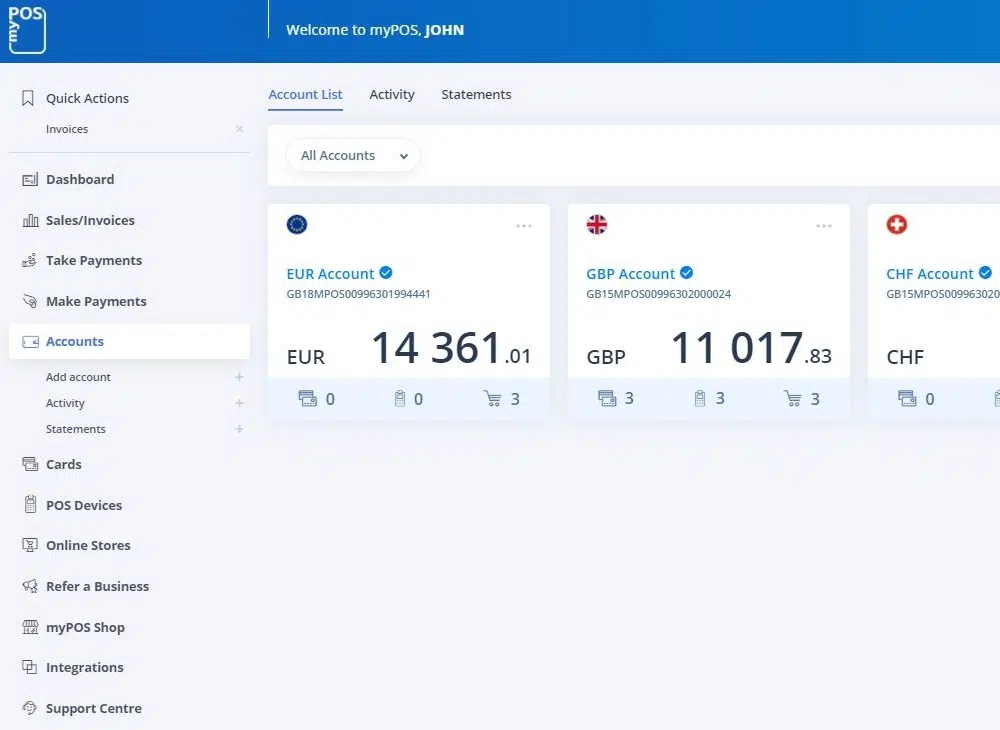

In fact, you can create multiple currency accounts in the online dashboard, sort of like different virtual wallets for designated currencies. This allows you to transfer foreign currencies across the border without paying currency conversion fees (if the recipient has the same currency as the one you send).

Multi-currency accounts are managed in the myPOS Dashboard.

The e-money account is where your money clears immediately after accepting a card payment on a terminal and where the money stays and can be spent in stores with the complimentary myPOS Business (Mastercard Prepaid) card.

Every merchant gets one free myPOS Business card to use in any store accepting Mastercard (additional cards cost £5 each) or for cash withdrawals.

Photo: EC, Mobile Transaction

A card is included with all the card machines, here pictured with Go 2 and the old myPOS Pro we tested.

This is great if you’re happy using the e-money account as your main business account and the myPOS Business Card for spending. But transferring money to a UK bank account costs £1.50, and this is done manually. There is, however, an option to schedule automatic or mass transfers.

PayPal similarly offers instant settlement in an online account and a Mastercard on request, but it doesn’t give you an IBAN.

Online payments

myPOS has in recent years added a plethora of online payment methods that don’t have monthly fees, just pay-as-you-go transaction fees. This makes myPOS a direct competitor to Square and SumUp that also offer multichannel payment tools at no monthly cost, in additional to in-person card machines.

You can send payment links and electronic (email) invoices from the online account in the myPOS app or browser dashboard. There is also a website builder with a choice of online store templates, making it easy to start an online business.

If eligible, you can have the virtual terminal activated in the account for Mail Order and Telephone Order (MOTO) payments. This is also accessible on any device – whether desktop, tablet or smartphone – and employee permissions can be set so only some team members can access the virtual terminal.

As with card machine payments, online and remote transactions are immediately settled in your myPOS account.

Who is it best for?

Rocky startups and low-volume merchants prioritising instant access to money – whether through card or cash – might prefer myPOS.

Its business model is centred around the e-money account making things easy for multichannel businesses. If you’re happy either using this as your main business account for money processing, or paying settlement fees, myPOS could be an effective, contract-free solution for you.

Photo: EC, Mobile Transaction

myPOS Go 2 is small, independent and with a SIM card – ideal for on-the-go payments.

The cross-border SIM card makes it great for merchants who travel in the EEA and still need a functional way to accept money in person.

The terminals meet the needs of those who just need to get paid in person, simply and anywhere. This makes it suitable for street vendors, small food-and-drink outlets, and cab drivers. If you need more features, the terminals can utilise third-party apps, provided they are developed for myPOS and made for Android.

The fact that the company operates internationally means they have more compliance rules to follow.

In line with that, we have seen more user reviews mentioning myPOS’s requests for additional documentation to verify certain payments than we have for other providers, so it appears you can expect them to take more anti-fraud precautions than other payment companies.

During the sign-up process, myPOS is asking for more proof and documentation than other UK-based payment providers.

According to myPOS, they are following the same UK and European laws as any other payment provider, but at least during the sign-up process, they are asking for more proof and documentation than other UK-based payment providers.

An example of more paperwork is account holds. Some users have entered into ongoing communication loops with myPOS who requested documentation and proof to verify payments, and sometimes it appears the merchant ends up not getting the money (though it’s hard to tell if the user really did provide the correct details).

There have also been reports of merchants whose accounts were shut down due to myPOS not accepting their business type, even though it was accepted during the application.

Londoners can visit their store near London Bridge to see the card machines in person and talk to a member of the team about any queries.