Whether you’re a new business about to choose what payment types to accept, or existing shop tempted to give up cash, it’s important to consider the reasons for and against operating as card-only.

There are good reasons for ditching the cash, but it can also create problems. Firstly: do you have to accept cash?

Do businesses have to accept cash in the UK?

Let us first make clear whether we are even allowed to ditch cash as a payment method.

Is not accepting cash illegal? No, in the UK, it is not illegal to refuse cash as payment. In fact, we see more and more small businesses opting for card-only as the majority of consumers are using debit cards regularly.

Although coins and banknotes are officially classed as a “legal tender”, this only applies to settling a debt, not paying for goods in a transactional situation. In other words, it’s a requirement to allow cash payments to pay for a debt, but shops are free to refuse cash as a tender when a customer wants to purchase a product.

That being said, 51% of British people think it should be required that UK businesses accept cash, according to a recent Access to Cash Review. Yet it wasn’t recommended by the report that it becomes law, except for the cases of essential services like utility bills and Government services.

The other extreme: Do you save money by going cash-only?

Reasons for card-only

Why, then, would it be a good idea to opt for cards only?

Cash is no longer preferred, so it’s not the end of the world to refuse it: Debit card usage overtook cash payments in 2018, as consumers are finding contactless and chip and PIN payments more convenient than fiddling with coins and banknotes. There’s a number of reasons why people have warmed to cards, but the bottom line is this: your sales may not take a dent by only accepting cards.

Banks are making it harder to use cash: In recent years, banks are pushing the trend for card payments by shutting down cash machines and bank branches accepting cash deposits from businesses. This has made it more of a hassle to reach a bank where you can deposit cash takings regularly and get change, plus the charges for deposits have risen. Not dealing with this can be a relief and save you money.

It takes time to manage the till float and cash up: How long do you spend on your cash float? How long does it take to count the money and balance the tills at the end of each day? If you only accept cards, you don’t have to deal with that, which will save you time and money on staff wages.

Counterfeit money is no longer a risk: Some areas of the country are more susceptible to fake notes and counterfeit pound coins, so this is less relevant for some businesses. But there is always fake cash in circulation, which requires skill in detecting at the till point. If you only accept cards, you don’t have that problem.

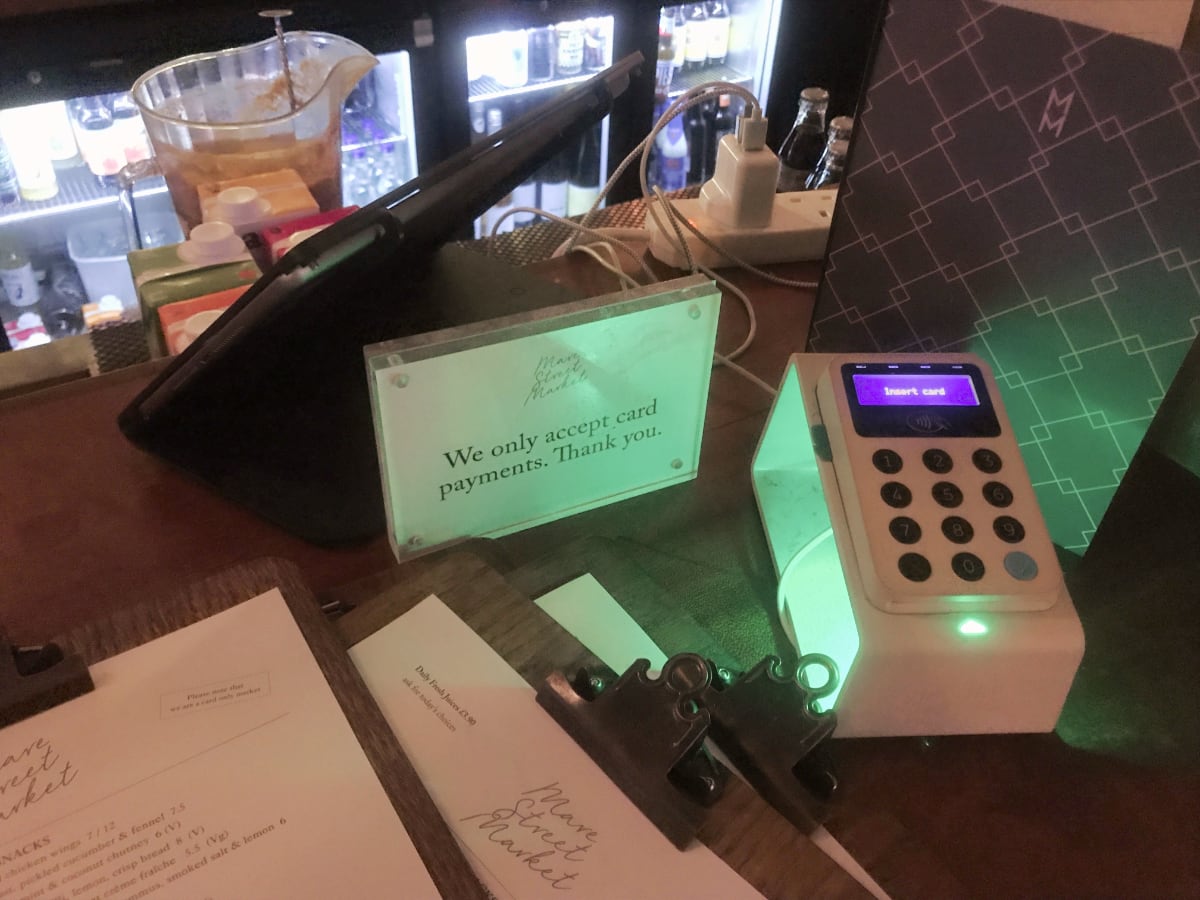

Photo: Emily Sorensen, Mobile Transaction

More bars and food-and-drink venues accept cards-only in order to reduce queue times.

Queues are slower if you accept cash: A big reason why many bars, quick-service places and restaurants are moving over to cards-only is strategic: you can sell more if your queues are faster. With contactless payments, it takes mere seconds to tap and go, meaning you can serve more people in the same space of time as merchants who deal with cash.

A cash drawer of money makes you susceptible to theft: Would your staff ever steal? That’s hard to answer, but the possibility is there if you leave them unattended at any time. You are also at risk of robbery if you store cash on the premises. If all your payments were by card and you have a sign stating this, the risk of robbery is significantly lower. This is especially the case if you sell high-value products like jewellery and computers.

Your insurance might cost less if there is no cash on site: A hidden benefit of refusing cash is the possibility of a cheaper insurance plan for your business inventory. With large amounts of cash on your premises, the stakes of theft are higher, and that reflects on your insurance costs.

Reasons to accept cash

Although you may be tempted to avoid coins and banknotes, there are compelling reasons to accept cash:

2-3 million British people still rely on cash for everyday transactions: Card-only businesses just cater to those with a debit or credit card. The minor proportion of consumers who don’t have a payment card will be totally excluded from shops that don’t accept cash. You’ve got to ask: does your business serve this part of the population? This may include teenagers yet to get a card, people with debt issues and blocked accounts, among many other groups.

Even people with cards can prefer cash: There is still convenience in coins and notes if it helps you budget and visualise how much you spend – or you just want to get rid of change. Customers are sensitive to a “no” at the till point, even if they can pay by other means. Consider if refusing cash is worth putting off some of those people.

Handling change can be fiddly and prone to mistakes, but perhaps it’s still worth it in your business.

Your card machine connectivity is unreliable: Let’s face it – you can’t make money if there’s no way to accept it. If you only took card payments, but the phone line, 3G or WiFi, which many terminals require for card processing, stops working, cash can save the day. Even though debit cards are king, they fail if the technology fails.

Cash is instant access to money: If sales are a balancing act in your small, unpredictable venture, every penny received now can really help you survive day by day. Card transactions can take days (varies between payment companies) to reach your bank account. You can’t spend that money until then.

Cash doesn’t cost transaction fees like cards do: It varies what card payment companies charge, but you can rely on the fact that cash in hand is free at the point of sale (unless you give too much change back to the customer, so you get an “under” discrepancy). That said, you pay a bank deposit fee when you put the cash into the business bank account.

Questions to ask yourself

Now you know the pros and cons, how do you decide whether cash-free is clever? The answer is different for everyone, but these questions can help you decide:

Different situations call for different benefits and downsides. For instance, it’s less important for a large business to pick sides because they have the capital to invest in all payment methods.

Other traders like busy coffee shops and food stalls may decide to ignore cash because it’s much more efficient to tap a contactless card than exchange cash, especially under pressure. Cities and student towns with a young adult population may find that no one even wants to pay by cash, so removing that option can save time and money.

In any case, payments habits have got us to the point where we can even thrive going cashless. It’s definitely not a lighthearted choice, though, so best to consider how the pros and cons apply to you in particular.