- Highs: No monthly fee. Transaction fees on the low side. Multi-currency support. Advanced customisations through APIs.

- Lows: Customer support not great. No phone number. Slow payouts and refunds. Advanced features require programming.

- Best for: Businesses that want a modern, tailored checkout that’s affordable – or startups with specific payment processes.

What is Stripe?

Stripe is an online payment processor used by many online businesses globally, big and small.

It’s the payment platform of choice for huge marketplace websites like Amazon, Uber and Booking.com as well as start-ups with special payment systems, largely due to its developer-friendly code documentations, anti-fraud protection and diversity of payment methods for any type of business. You basically get building blocks in the form of APIs (Application Programming Interface) that developers can apply in apps or on websites through relatively simple instructions.

Small businesses, on the other hand, are much more likely to use Stripe as a simple, integrated checkout in their online store or through invoicing software, without getting a developer to link it all up. The Stripe checkout may be easily activated in your online store, or you may need to copy and paste a code sequence into, say, a WordPress site.

Basically, there’s Stripe for the small business that just wants to get paid online, and Stripe for the internet company that wants to build a custom payment system. We look mainly at whether Stripe is a good choice for a small business considering affordable solutions for online payments.

Stripe pricing

There’s a distinction between ‘Integrated’ and ‘Customized’ Stripe. The latter is for “businesses with large payments volume or unique business models” while Integrated gives access to a complete payments platform that works for most smaller ecommerce merchants.

The integrated Stripe does not have monthly fees, contractual commitment or setup fees. There are only pay-as-you-go charges related to transactions, as seen in the table below.

| Integrated Stripe | Costs |

|---|---|

| Monthly fee | None |

| Transaction with European card | 1.4% + 20p |

| Transaction with non-European card | 2.9% + 20p |

| Currency conversion | +2% |

| Adaptive acceptance | +0.08% |

| Bacs Direct Debit | 1% (min. 20p, max. £2) |

| Chargebacks | £15 each |

| Recurring payments (Billing) | 0.5% per recurring payment |

| Chargeback protection (Radar) | 0.4% per transaction |

| Extra fraud protection (Radar) | 0p-2p per screened transaction |

| Integrated Stripe |

Costs |

|---|---|

| Monthly fee | None |

| Transaction with European card | 1.4% + 20p |

| Transaction with non-European card | 2.9% + 20p |

| Currency conversion | +2% |

| Adaptive acceptance | +0.08% |

| Bacs Direct Debit | 1% (min. 20p, max. £2) |

| Chargebacks | £15 each |

| Recurring payments (Billing) | 0.5% per recurring payment |

| Chargeback protection (Radar) | 0.4% per transaction |

| Extra fraud protection (Radar) | 0p-2p per screened transaction |

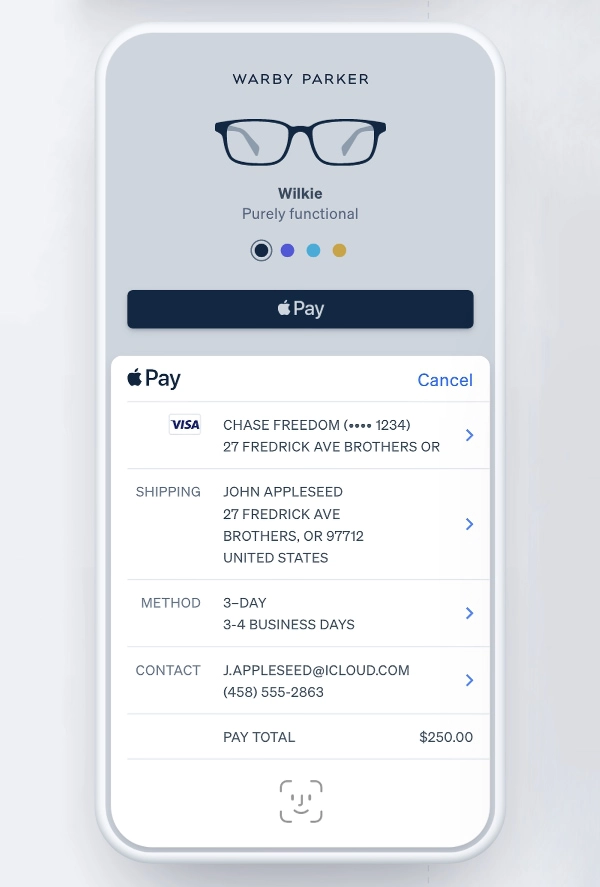

Transaction rates refer to all Visa, Mastercard, Maestro, American Express, Apple Pay and Google Pay payments. In the UK, transactions with a European debit or credit card cost 1.4% + 20p each, while non-European card transactions cost 2.9% + 20p each. This includes any online payment done manually by the customer, e.g. through an online shop or one-off invoice.

If a customer pays with card in a different currency from your your checkout’s, a 2% currency conversion fee is applied on top of the base transaction fee.

An optional ‘adaptive acceptance’ fee of 0.08% can be added to the transaction rate. This is an additional feature where Stripe uses machine learning models to improve authorisation rates in real time. This can potentially increase your customer conversion rate at the checkout.

You can also accept Bacs Direct Debit payments for 1% per transaction. This fee can maximum be £2 and minimum 20p.

If you need to set up customer billing (invoicing) where money is charged automatically, Stripe offers this for 0.5% per recurring payment.

Accept Apple Pay with Stripe.

Greater card security can be achieved with an optional Chargeback Protection fee of 0.4% per transaction. This covers both the disputed amount and all dispute fees, plus Stripe will handle the dispute with no evidence submission required from your end. Otherwise, you pay a £15 admin fee per chargeback.

An additional 0p-2p per screened transaction (for users with the above standard pricing) pays for ‘Radar’ which brings an additional layer of fraud prevention for those who want more advanced security tools. Moreover, you may need to set up PCI compliance for your business, which comes with extra costs.

Payment features

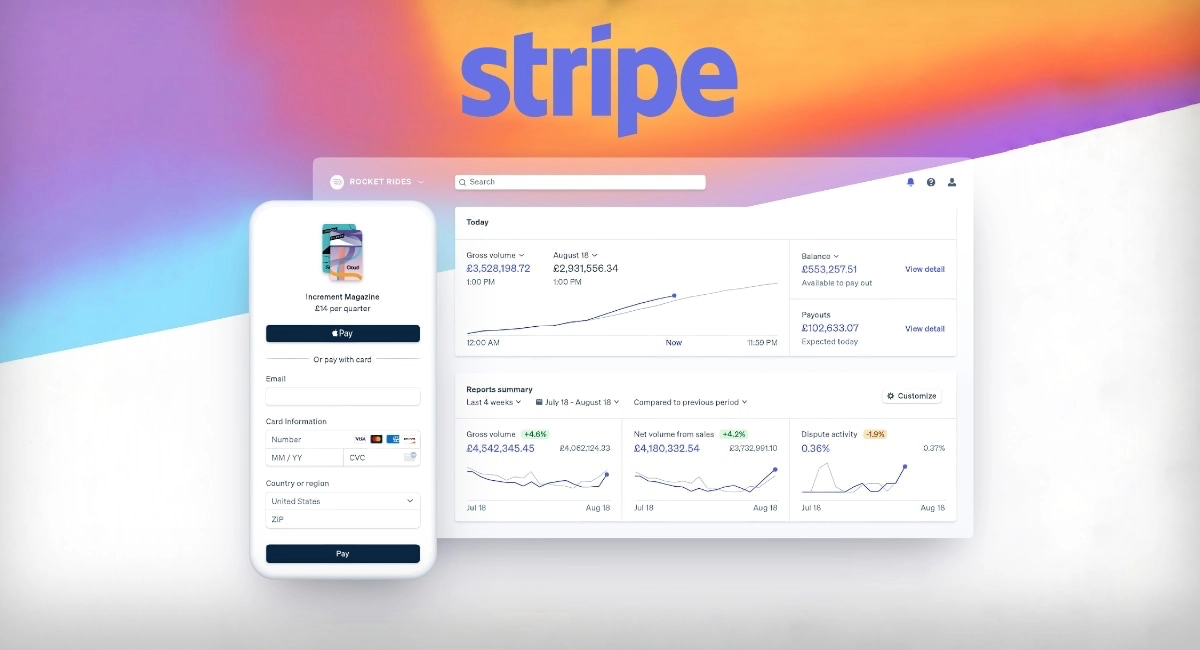

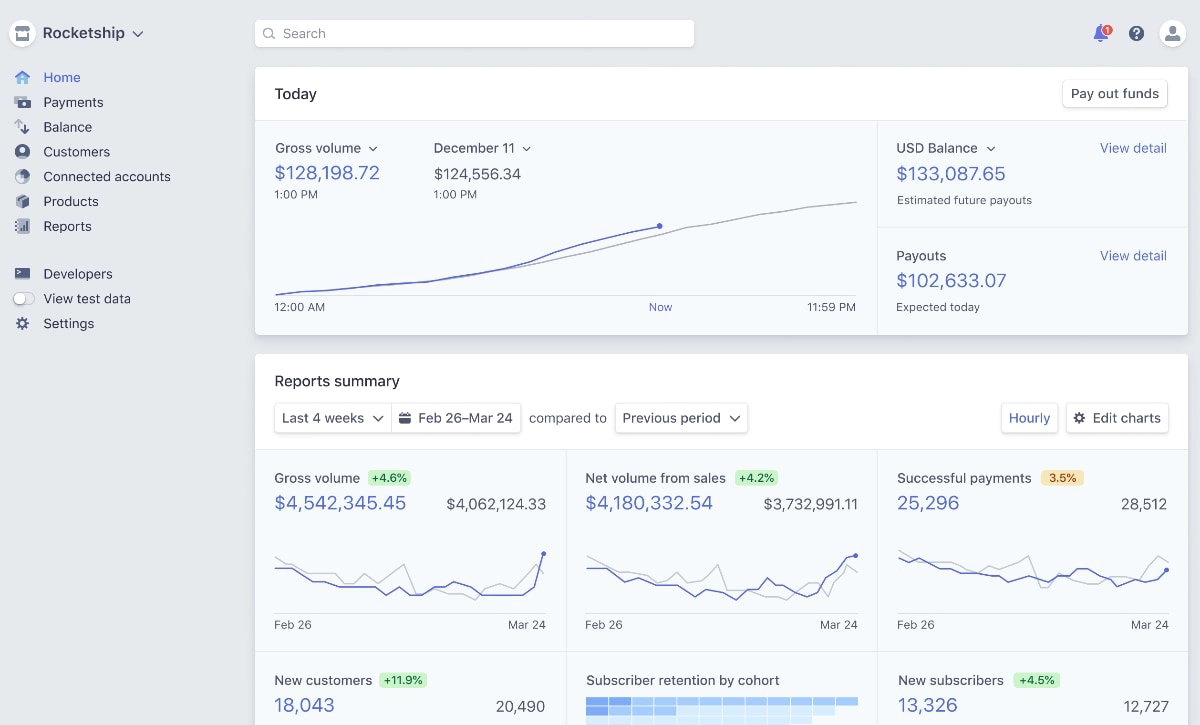

Those without development resources may only use one category of Stripe’s services called Stripe Payments. This is the online gateway and payment system implemented on ecommerce websites like Wix. The system gives access to your sales in a Stripe Dashboard (via web or mobile app) through which payments, refunds and disputes can be managed.

Image: Stripe

Stripe Dashboard is accessible in a web browser or through a mobile app.

Apart from ecommerce integrations, you can connect the Stripe account with accounting and invoicing software. More than 135+ currencies can be accepted, as long as your bank account and ecommerce solution permit it. There is even a virtual terminal for the odd over-the-phone transaction.

Payouts can be a pain point, though. It typically takes about seven working days for an online transaction to clear in your linked bank account. You can schedule payouts in advance, or receive them more randomly in batches. Refunds can take about two weeks to process, which is quite a wait you’ll need to communicate to customers.

Stripe also offers the following services:

Billing: Invoicing with Stripe payments built in. Recurring invoices charge the customer’s account automatically, while one-off invoices let the customer pay online manually.

Radar: Advanced fraud prevention system based on machine learning. Chargeback protection where you don’t have to deal with disputes.

Sigma: Complex analytics based on your payments data. For those with complex analytics needs. SQL coding may be required.

Connect: Comprehensive payment features for a specialised setup such as online marketplaces. Possible to pay sellers based in 30+ countries. For those with development resources.

Atlas: Help with setting up a business and providing the legal documents for this (US$500 one-off cost). Intended for new companies.

Premium support: Fast, prioritised support responses and a dedicated account manager (starts at £1,400). Intended for complex, fast-growing businesses.

A few other features are only available in the US, including Stripe Terminal for in-person card payments.

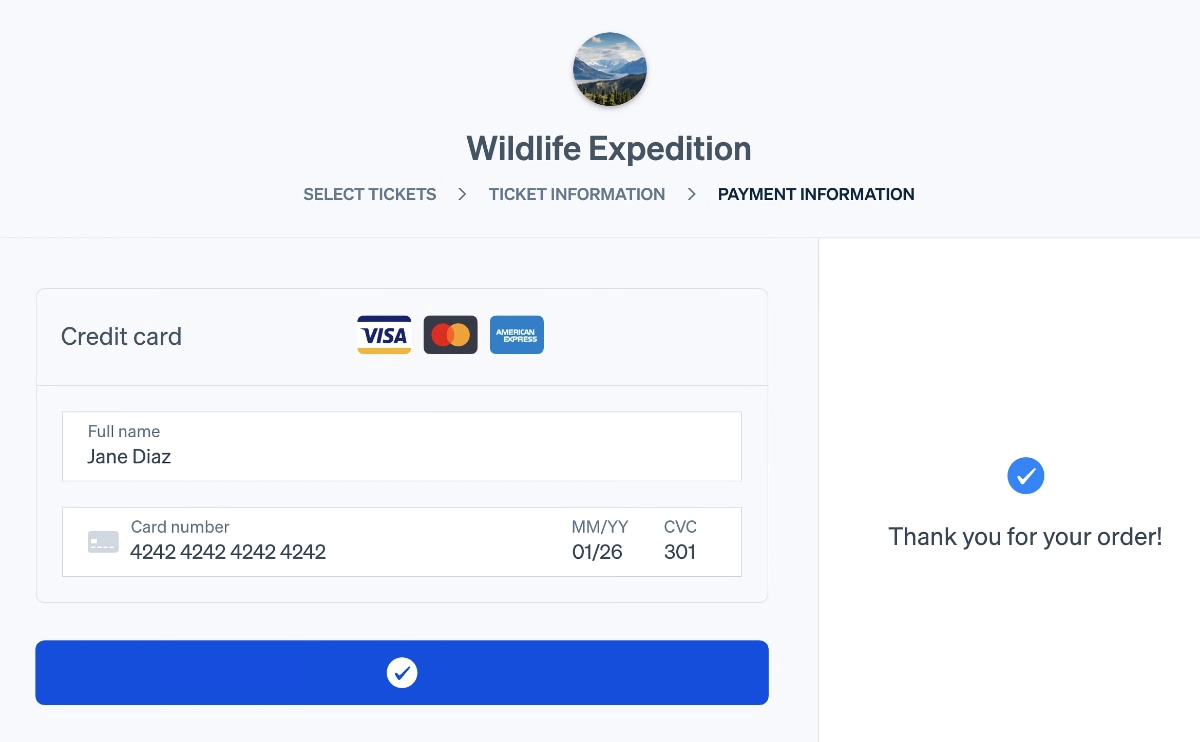

Example of a Stripe online store checkout.

What’s required to set up Stripe?

If you’re setting up Stripe through an ecommerce platform, then you probably just need to create a Stripe account to link with the online store. This is the case for:

Usually, you just have to click a link in your online store account to be redirected to a Stripe form to create an account with them (or connect an existing Stripe account with the ecommerce provider). You may be required to “claim the account” within a limited frame of time to complete the setup. Make sure you follow all the instructions from Stripe to avoid issues with transactions.

The first transactions can take up to two weeks to receive through Stripe, whereafter payouts will take around seven working days to reach your bank account.

When it comes to Shopify, a separate Stripe account is not needed. Instead, the Shopify Payments system is actually powered by Stripe. There is no option to connect your own Stripe account directly with Shopify in the UK, but other countries that do not have the Shopify Payments option can.

Companies using Stripe to tailor their own solution will be dependent on the extensive programming documents online. Various APIs and infrastructures are explained in these guides, which the developer may need to get their heads around first before they can implement Stripe on your platform. Although Stripe is geared towards simplifying programming for developers, Stripe has, after all, its own infrastructures and limitations to payment processing.

Stripe reviews and customer service

There is no phone number for support – only email and chat support. Stripe aims to reply to all emails within 24 hours, seven days a week. The messaging chat typically has a wait time of three minutes. Alternatively, you can request a callback to speak with a Stripe representative within minutes.

Stripe has a comprehensive help section with guides mainly for developers. Non-coders may be better off contacting or looking for Stripe information on their ecommerce platform, as this would be geared towards those who simply use the integrated Stripe checkout.

Non-coders may be better off contacting or looking for Stripe information on their ecommerce platform, as this would be geared towards those who simply use the integrated Stripe checkout.

Many Stripe reviews from customers complain of:

- Unhelpful and slow customer support

- Sudden account closures where Stripe is withholding funds

- Requests for submission of documents to verify the account or transactions

- Slow payouts and problems matching payouts with specific customer transactions

It seems Stripe is good at dealing with general queries, but once you get a real problem, you can go round and round in circles with support until it sort of gets resolved (or not).

Our verdict

As a modern online gateway in an online shop, Stripe works well – if you don’t need fast payouts (a week’s processing is normal!). You also have to be comfortable telling customers that refunds can take two weeks to process.

The transaction rate on European cards is low compared to many other payment gateways such as PayPal Checkout, but non-European card transactions are not cheap, especially when currency conversion is added on top.

Although Stripe is designed with developers in mind, the lay person can enjoy an already-integrated Stripe checkout in select ecommerce builders, invoicing with built-in payments, sales reports and fraud prevention tools without knowledge of code.

Just hope that you won’t run into issues with our account – or else you may be stuck in a loop with customer support.