- Pros: No monthly fee. Simple rate. Easy to use, but excellent features. Fast transfers. Commitment-free.

- Cons: Refunds take 1-3 weeks to clear. No preauthorisations.

- Use if: You want to get started quickly with phone payments without committing to a contract or monthly fees.

This review

In brief

What is it?

Our opinion

In detail

Fees

Signing up

Taking payments

Security

Limitations

Additional features

Who is it for?

Virtual terminals allow you to take payments over the phone in a browser on a PC computer, Mac or mobile device such as a tablet. No other equipment is needed.

Square offers a free virtual terminal, which was unheard of before this American company arrived in the UK. You don’t even have to use any of Square’s other services – the card reader, POS systems, online payments or invoices – to get access.

The only cost is a flat rate per payment taken through the virtual terminal. There is no contractual commitment.

Accepted cards

One of top reasons merchants choose Square is its fast transfer options. Normal payouts go to your chosen bank account the next day, even on weekends and Bank Holidays.

With Square Card, merchants receive transactions immediately (at no cost) to spend with the card straight away. For the extra fee of 1.5%, businesses can also receive payouts right away in their bank account.

Our opinion: one of the best virtual terminals

Having tested many virtual terminals, we think Square Virtual Terminal is very efficient for immediate, user-friendly payments without contractual commitment.

“I love the ‘clean’ design of Square’s Virtual Terminal and have never had any problems processing payments through it.”

– Emily Sorensen, Senior Editor, Mobile Transaction

While Square is great for their wide range of payment methods, it doesn’t include options to upgrade to a more advanced virtual terminal. However, the breadth of its features is sufficient for many small businesses.

| Square Virtual Terminal criteria |

Rating | Conclusion |

|---|---|---|

| Product | 4.5 | Good/Excellent |

| Costs and fees | 4.2 | Good |

| Transparency and sign-up | 5 | Excellent |

| Value-added services | 4.5 | Good/Excellent |

| Service and reviews | 3.9 | Good |

| Contract | 5 | Excellent |

| OVERALL SCORE | 4.5 | Good/Excellent |

Square is arguably cheaper for a small business than the virtual terminals offered by PayPal and Worldpay.

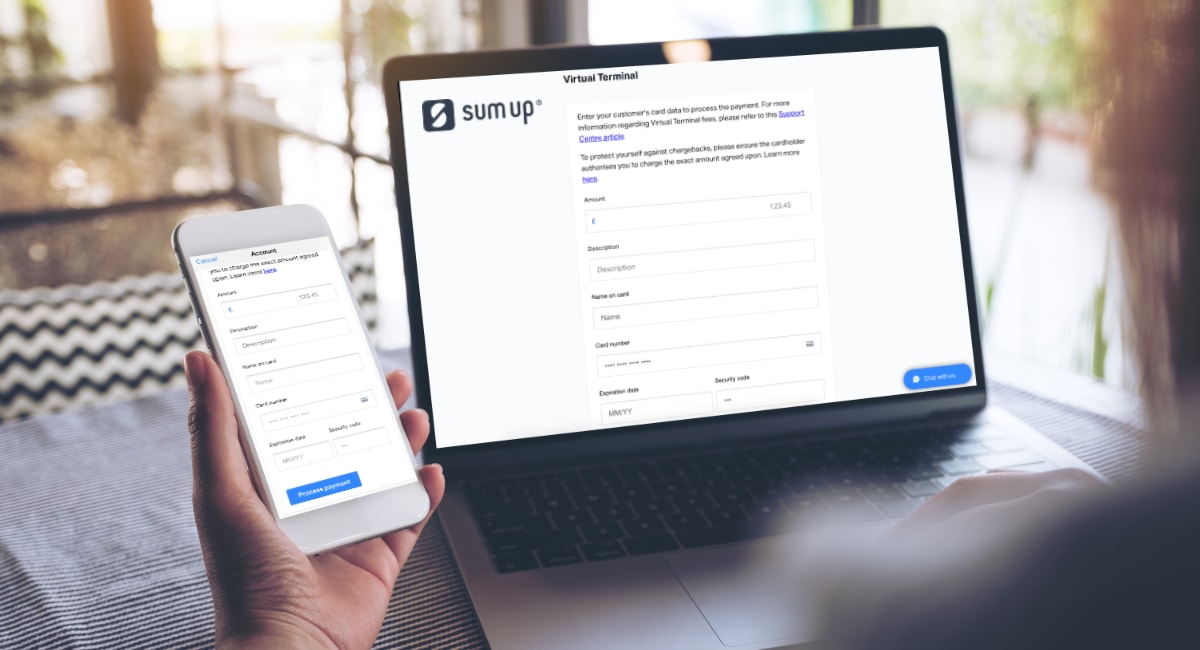

SumUp offers a simple rate similar to Square’s, but the transaction cost is higher and not everyone is eligible for it.

Bottom line: Square Virtual Terminal is the easiest and most economical way for a small UK business to start taking phone payments.

Keyed transactions with Square

- Virtual Terminal in web browser

- Key-in card entry in app

- Invoices via app or browser

= 2.5% per transaction

No other costs

Square doesn’t charge for anything else, and that includes chargeback processing, including the handling of disputes.

Because there’s a slightly higher risk of fraud for keyed card payments, you should take extra precautions in some payment scenarios – more on that below.

Compared to other virtual terminals in the UK, Square’s fee is pretty competitive:

The competitors’ costs are greater than Square’s, except for if you have a large sales volume, in which case Worldpay and PayPal can get cheaper.

SumUp’s high rate is fixed regardless of transaction volume and card type, and you’ll also need to apply and meet certain requirements before SumUp can activate the virtual terminal.

Setting up

All it takes to set up Square’s virtual terminal is to sign up and get your bank account verified.

Once you’ve added business details and clicked to register, you’ll have instant access to Square Dashboard features from any web browser. You don’t need to download an app for face-to-face transactions.

Even though it takes about four days to get your bank account verified by Square, you can still process payments straight away. The money will just be held in your Square account until your bank account is connected with the payment system, after which settlement takes a day following each transaction.

What are the alternatives? Best 5 virtual terminals in the UK

Using Square Virtual Terminal

Processing the phone payments really couldn’t be easier.

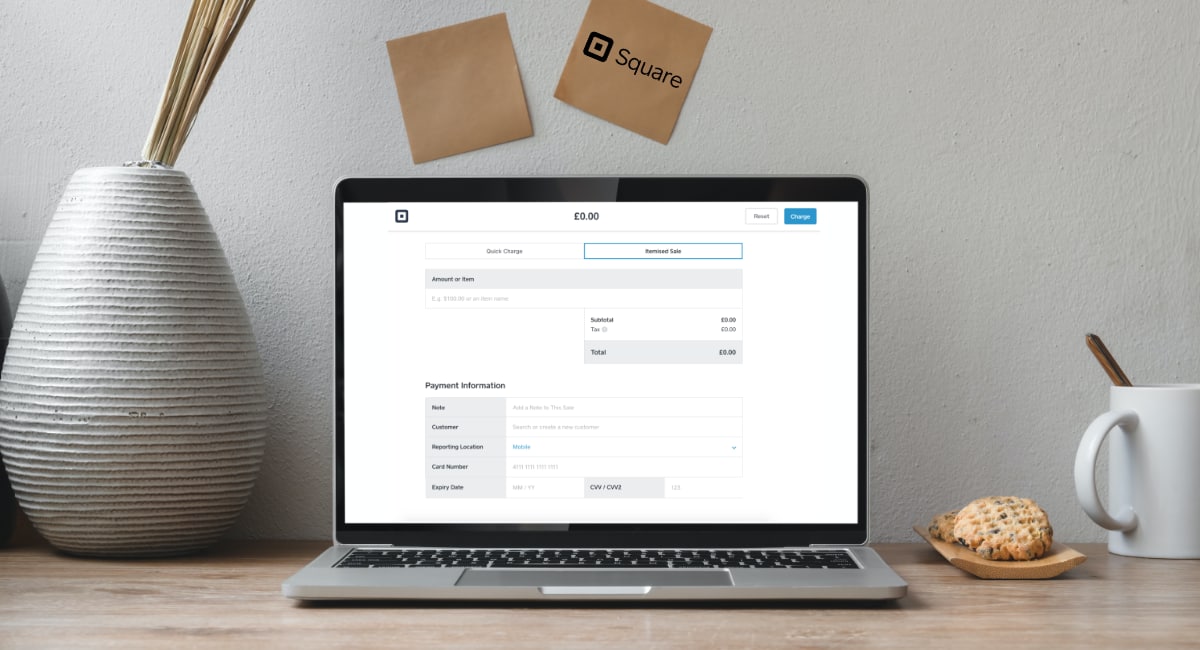

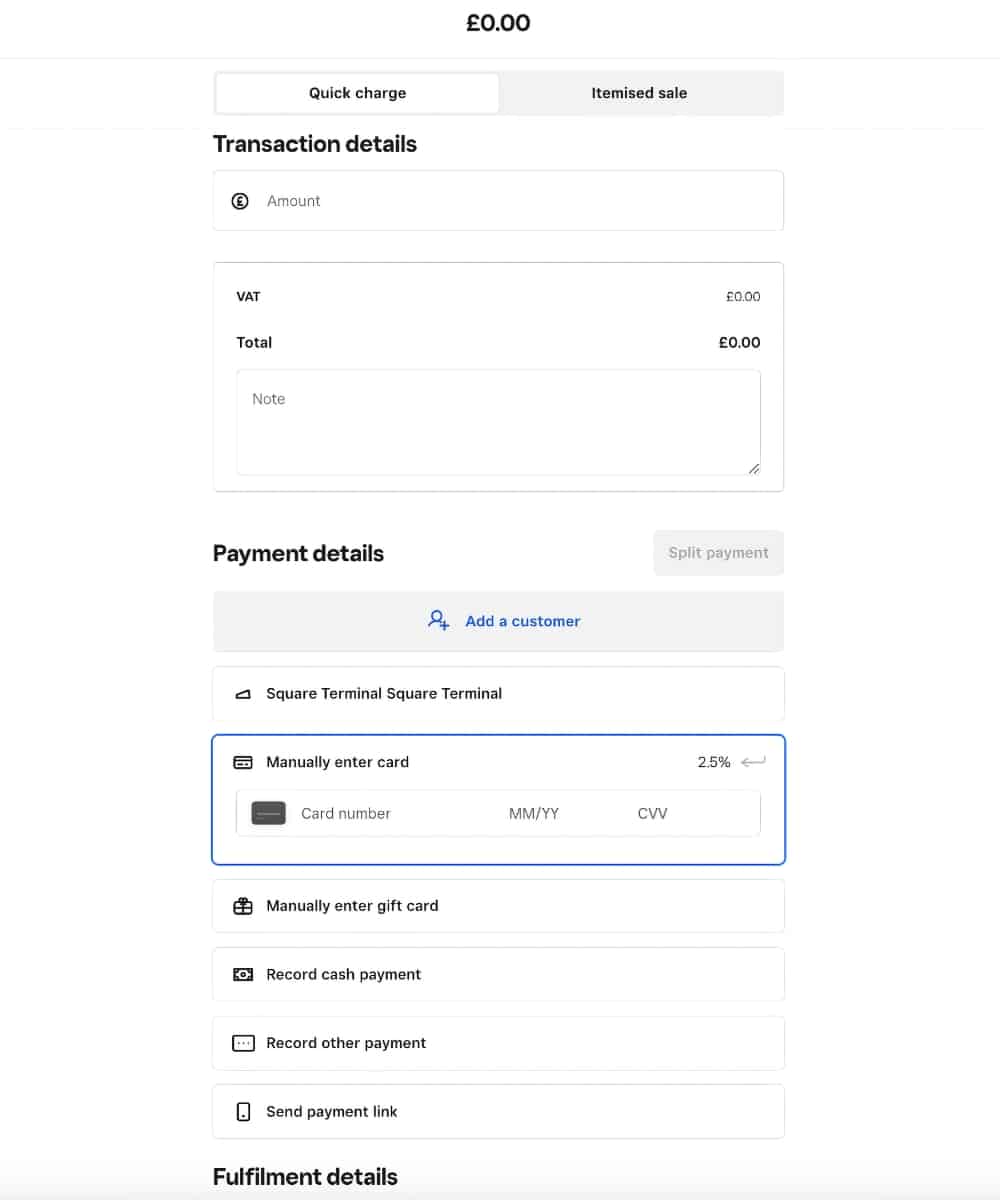

We prefer using the virtual terminal in a browser through Square Dashboard, accessible on any device. The Square Point of Sale app also has Manual Card Entry at checkout where most of the same features are available.

In the back-office account, a simple ‘Quick Charge’ page is shown when the Virtual Terminal is opened. This is where you can just enter basic transaction details before clicking ‘Charge’.

This is what you can enter on the Quick Charge page:

Image: Mobile Transaction

The Quick Charge page allows you to enter a good range of basic information.

You can record alternative payment methods such as cash or gift vouchers, if preferred. This means that if someone gives you cash or another payment method that couldn’t be processed when the customer was present, you can enter that transaction from your web browser.

A cool new feature is the ability to connect Square Terminal so that an order created in Virtual Terminal can be sent to the card machine for chip and PIN or contactless processing instead of a keyed payment.

Splitting the payment into several payment methods is also handy for large purchases or using up a gift card and paying the rest by card.

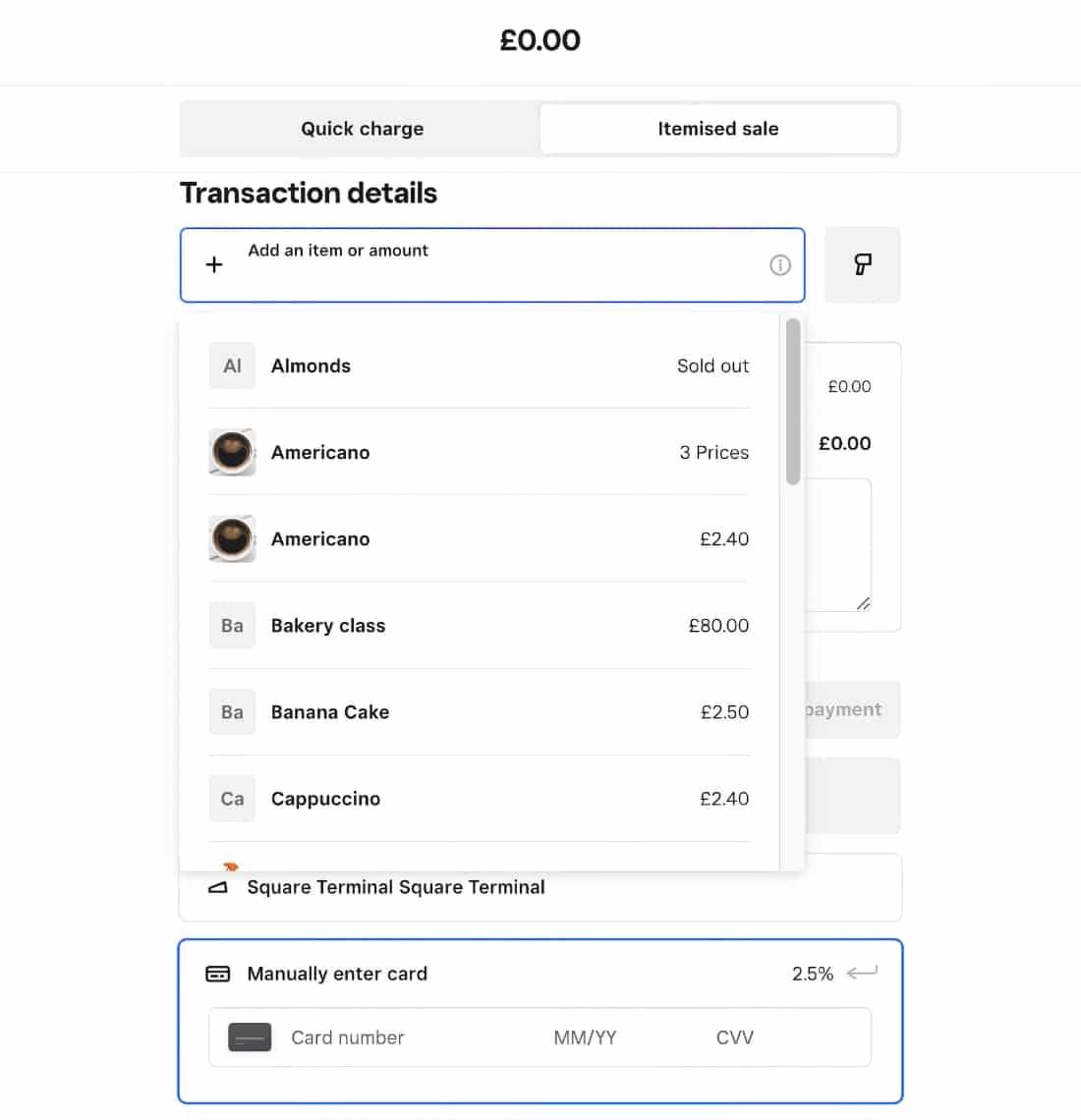

You can can also click the ‘Itemised Sale’ tab at the top to switch to creating a bill with product details.

This page allows you to create an itemised bill, where you – in addition to the above details and in place of the transaction total – can add individual products from your Square product library or enter items manually. Individual notes can be added to each item as well.

Image: Mobile Transaction

Add products, VAT, discounts and custom product details to the bill in the Itemised Sale tab.

After the sale is put through, you have the option to send a digital receipt via text or email (you’ll need a mobile number or email address from the customer if they ask for this) or print a receipt from a connected printer.

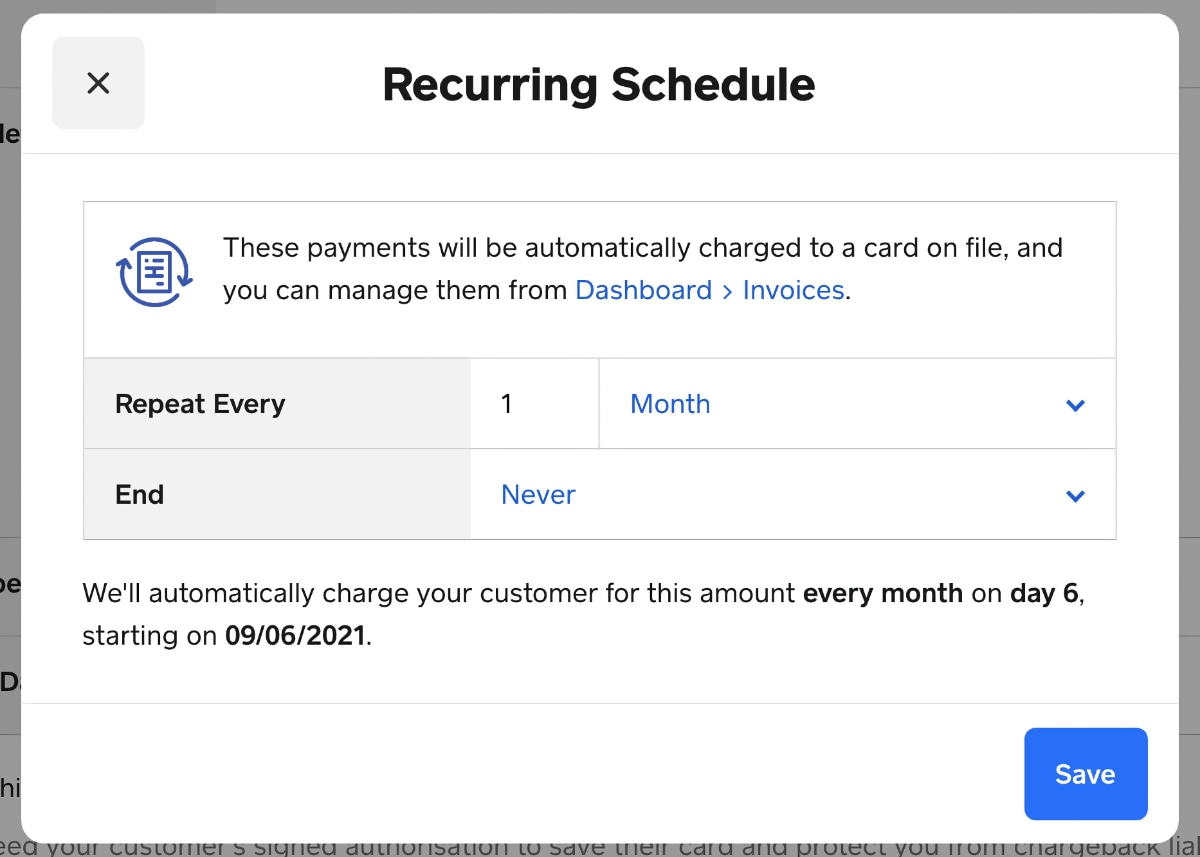

You can add the card details to a customer profile for recurring or future payments if the customer signs a form to grant permission for this. Once saved, the virtual terminal gives the option to select that customer and process the payment using the saved card details.

But note: saved cards can at any time be removed by the customer through a link they receive in an email.

Image: Mobile Transaction

The frequency and end of a recurring payment can be specified.

If you expect to offer refunds, you’ll need to warn customers that this can take 4-14 working days to receive the refund. This is not unusual for online payments, but it could cause some grief for those who did not expect such a delay.

Security

To avoid payment issues, Square recommends taking certain precautions during customer-not-present card transactions. Although it’s not required to complete a PCI Self-Assessment Questionnaire for card-not-present merchants like some virtual terminal providers demand, you are responsible for doing your bit to minimise the risk of issues.

Chip and contactless payments are inherently safer than remote payments due to the card being processed electronically through a terminal and the customer being physically present to verify the card ownership. But you can also ask for extra details over the phone or mail order form to ensure the customer is the owner of the card.

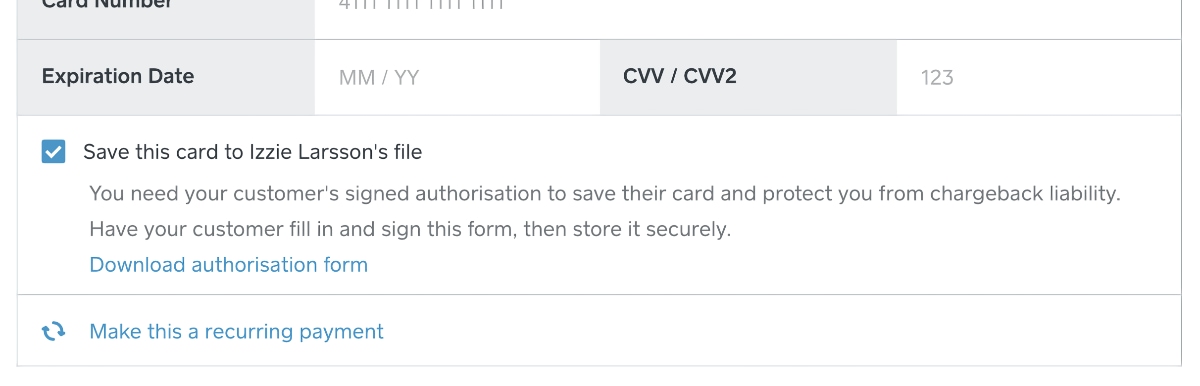

If you need to keep a customer’s card details on file – for instance, for recurring payments – Square requires that you get the customer to sign a Credit Card Authorisation Form to protect yourself from chargeback liability.

Image: Mobile Transaction

To save card details, you will be asked to get written permission from the customer.

This form is downloadable through the Payment section of the virtual terminal page, after you have ticked to save the card details to a customer profile. You need to print and complete the form and get the customer to sign this paper document, which you then keep on file for as long as you store their card details.

Square also suggests asking the customer for the cardholder’s full address and name as written on the card. Linking sales to a customer profile enables you to save the address during or after the transaction to protect yourself against a chargeback claim.

Want the customer to enter card details? See Square Online Checkout

Limitations mostly relevant to tourism and hotel industry

Though the virtual terminal works smoothly, but it has a few limitations.

Firstly, it doesn’t accept foreign currencies or preauthorisations, which hotels and Bed and Breakfast places might need.

Secondly. the virtual terminal also has an extra field where you can add information to. This is called the ‘Note’ field, but anything entered here will be shown in your Square Dashboard, sales reports and the payment confirmation received by the customer.

Suffice to say, you cannot add personal or otherwise sensitive information here.

‘Square Contracts’ also lets you create contracts easily through templates like ‘Service agreement’, ‘Sale of goods’, ‘Confirmation of delivery’ and ‘Completion of services’.

If you’re planning to use Square POS systems, invoices, the online store or payment links, you’ll benefit from the integration between all payments in your Square account. These can be analysed together or separately, and exported to Xero, Excel or other accounting software.

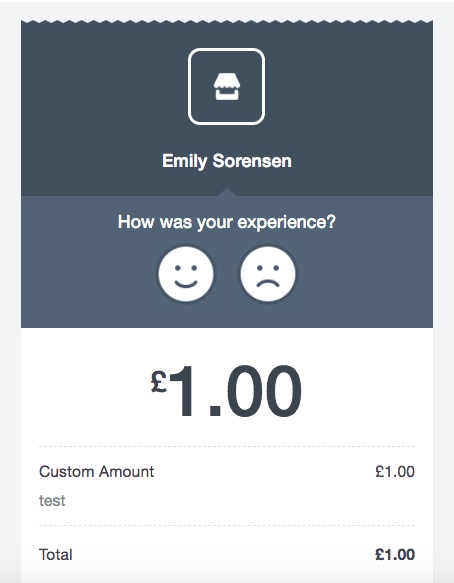

Receipts can be customised to include business logo, address, contact details, refund policy, social media links, personalised messages and more. Customers can even give feedback through the receipt, and you can monitor the responses.

Customers can rate the merchant on the e-receipt.

Who is it best for?

Square is an easy solution for most small-business types, whether you sell in person, online or remotely. The card reader and customer-not-present payment options make it excellent as an integrated hub for all your transactions.

Still, businesses travelling a lot should be aware that Square can only be used in their country of registration. Similarly, UK users can only charge in GBP, not other currencies.