- Highs: Simple interface. Fraud protection. Integrated with other PayPal services. Multi-currency support.

- Lows: Account holds. Complicated bureaucracy. Can get expensive. Fee structure not that clear.

- Best for: Existing PayPal Business users preferring the online PayPal account as the main business account.

Accepted cards

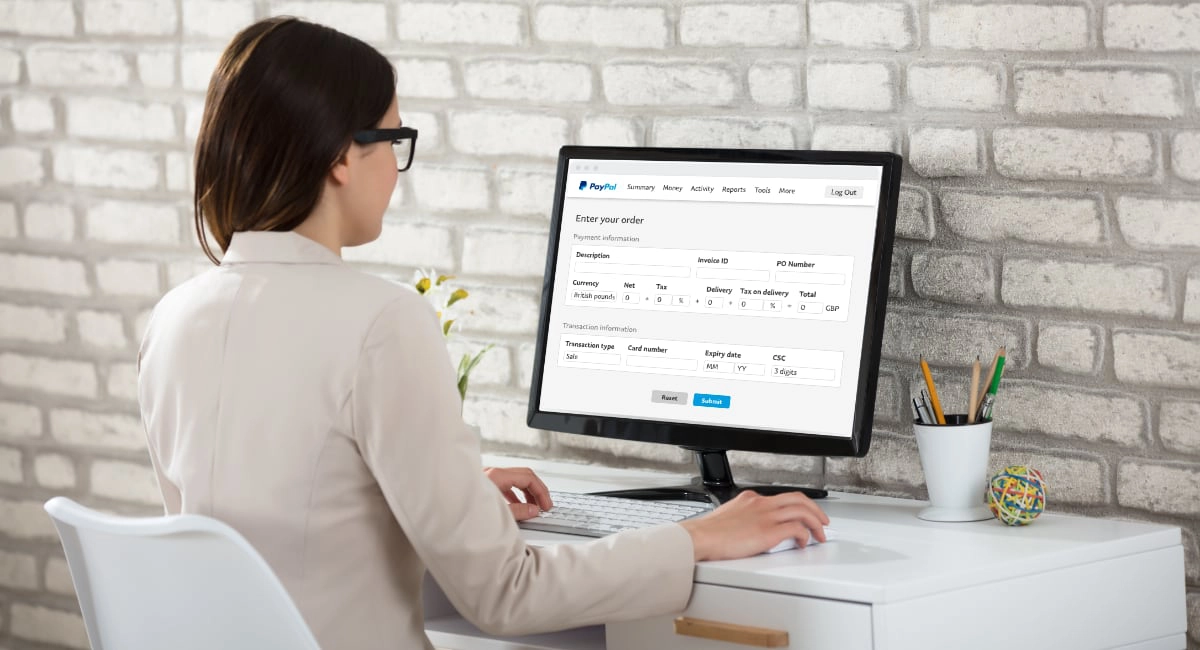

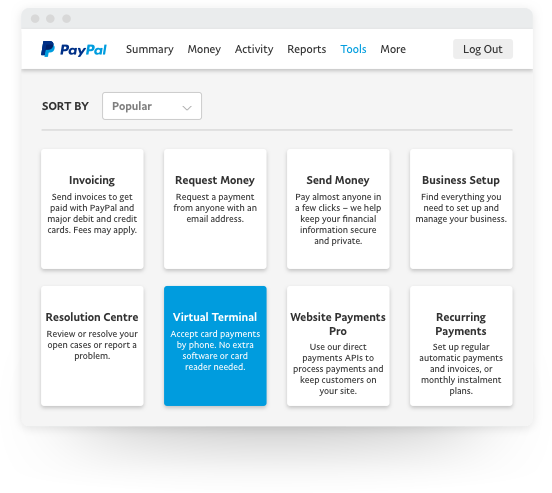

No doubt PayPal Virtual Terminal is easy enough to use. As with all virtual terminals, no equipment is needed except for a computer, tablet or mobile browser.

That said, you can no longer just sign up online to use this service. After completing a website form, a PayPal representative will call you to set up the virtual terminal, which – after approval – will be accessible in your PayPal account at all times.

The fee structure is not so simple. Charges continue to be on the high side, but PayPal is still a low-entry route into phone payments and thus still preferred by many new businesses.

The standard accepted cards included Visa, Mastercard and Maestro. It may be possible to accept American Express, but this would require special approval by PayPal.

Very different services: PayPal compared with Worldpay Virtual Terminal

Different fee options, high cost for foreign cards

Over-the-phone payments generally incur a higher rate per transaction than card machine payments. Even considering this – and despite being incredibly popular – PayPal Virtual Terminal fees are still higher than those of many competitors.

Regardless of how actively you accept phone payments, it costs a monthly fee of £20 to have the Virtual Terminal activated your PayPal account, and then you pay a per-transaction charge. Then you have to add PCI compliance (a PayPal requirement) which could, for example, cost US$250 annually depending on where you get it from.

Businesses with a high volume of sales might be able to swallow the ongoing cost, but small businesses with few phone payments will be hurt the most by the fixed costs.

The transaction fees depend on your pricing structure. As default, you will pay the standard 2.9% + 30p rate for domestic Visa, Mastercard and Maestro card payments through the Virtual Terminal.

| Virtual Terminal fees | Transaction fee (Visa, Mastercard, Maestro) |

|---|---|

| Standard rate | 2.9% + 30p |

| Blended Pricing Fee Structure | 1.2% + 30p |

| Interchange Plus Fee Structure | Interchange fee* + 1.2% + 30p |

| Currency conversion fee** | 3% above base exchange rate |

| Cross-border fee*** | 0.5% or 2% |

*Interchange rate ranges between 0.2%-2% depending on the card type. **Applies to Standard and Blended plans. ***Applies to all currency conversions for payments received.

| Virtual Terminal fees |

Transaction fee (Visa, Mastercard, Maestro) |

|---|---|

| Standard rate | 2.9% + 30p |

| Blended Pricing Fee Structure | 1.2% + 30p |

| Interchange Plus Fee Structure | Interchange fee* + 1.2% + 30p |

| Currency conversion fee** | 3% above base exchange rate |

| Cross-border fee*** | 0.5% or 2% |

* Interchange rate ranges between 0.2%-2% depending on the card type. **Applies to Standard and Blended plans. ***Applies to all currency conversions for payments received.

Subject to application and PayPal’s approval, you can choose a Blended Pricing Fee Structure with a rate of 1.2% + 30p for domestic card payments, or Interchange Plus Fee Structure costing a 0.2%-2% interchange fee + 1.2% + 30p for domestic card payments.

An additional charge of 3% above the base exchange rate applies to all currency conversions for received payments. In addition, a cross-border fee applies to cards issued outside the UK, but only on the standard and blended pricing structures. The interchange pricing does not incur the cross-border fee – instead, the interchange fee applies.

The cross-border fee depends on what country the card was issued in, as seen in the below table.

| Payer’s country | Cross-border fee |

|---|---|

| Canada & US | 2% |

| Europe I (Austria, Belgium, Channel Islands, Cyprus, Estonia, France, Germany, Gibraltar, Greece, Ireland, Isle of Man, Italy, Luxembourg, Malta, Monaco, Montenegro, Netherlands, Portugal, San Marino, Slovakia, Slovenia, Spain, United Kingdom, Vatican City State) | 0.5% |

| Europe II (Albania, Andorra, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Georgia, Hungary, Kosovo, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Poland, Romania, Russian Federation, Serbia, Switzerland, Ukraine) | 2% |

| Northern Europe (Aland Islands, Denmark, Faroe Islands, Finland, Greenland, Iceland, Norway, Sweden) | 0.5% |

| Rest of the world | 2% |

| Payer’s country |

Cross-border fee |

|---|---|

| Canada & US | 2% |

| Europe I (Austria, Belgium, Channel Islands, Cyprus, Estonia, France, Germany, Gibraltar, Greece, Ireland, Isle of Man, Italy, Luxembourg, Malta, Monaco, Montenegro, Netherlands, Portugal, San Marino, Slovakia, Slovenia, Spain, United Kingdom, Vatican City State) | 0.5% |

| Europe II (Albania, Andorra, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Georgia, Hungary, Kosovo, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Poland, Romania, Russian Federation, Serbia, Switzerland, Ukraine) | 2% |

| Northern Europe (Aland Islands, Denmark, Faroe Islands, Finland, Greenland, Iceland, Norway, Sweden) | 0.5% |

| Rest of the world | 2% |

To take an example: if you run a bed and breakfast and charge a future guest from Switzerland a deposit, the Blended fee is 1.2% + 30p + 2% cross-border fee for Switzerland, i.e. the total charge is 3.2% + 30p. This assumes the payment is done in GBP.

What about the Interchange fees? The total charge depends on the type of card being used and the card’s country of issue. A typical consumer debit or credit card from the UK or the European Economic Area (EEA) will have an interchange fee of 0.2%-0.3%. In contrast, a business credit card or corporate purchasing card will carry interchange fees of around 1.3%-2.0%.

To take the same example, if the Swiss bed and breakfast guest paid with a business credit card, the total fee might be 1.5% (interchange rate for Swiss business credit card) + 1.2% + 30p, i.e. 2.7% + 30p in total. No cross-border fee is applied to Interchange Pricing.

Tired of fees? Square only has one, fixed-rate virtual terminal fee

If your corporate and business credit card customers are marginal, the Interchange Plus Fee Structure might work out cheaper than the Blended rate. Keep in mind, though, that the Interchange model is less predictable, and funds will take longer to reach your account.

If the vast majority of your customers are based in the UK, the Blended pricing can easily work out cheapest. In fact, 1.2% + 30p is very cheap compared to other virtual terminal providers. But then, you have to pay the monthly £20 subscription to access the virtual terminal in the first place.

Regardless of the plan, chargebacks cost £14 each plus a possible £12 Dispute Fee for eligible transactions.

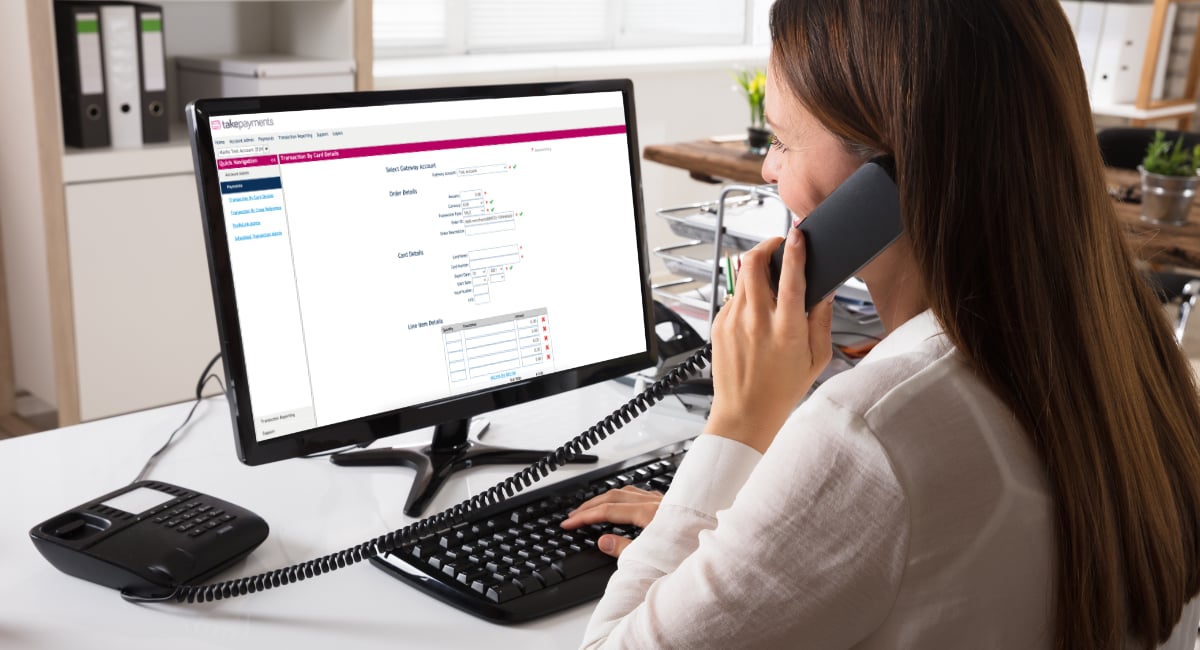

Setting up

Although sign-up looks simple on the surface, getting your account verified can be long-winded. Firstly, you need a PayPal Business account. Then you fill in a sign-up form on the website specifically to activate the virtual terminal. Once submitted, PayPal will give you a call-back to finalise your application.

PayPal initially approves accounts based on the sign-up information, but then may place yours on hold until the full verification process has completed. This usually involves sending proof of company registration and address, linking to your business bank account by way of a funds transfer, proof of identity, address of the person the business is registered to… and the list goes on!

So while some account sign-ups are straightforward, it’s not guaranteed.

Taking payments

Taking payments is straightforward and can be completed in just a few, short steps. The two things you need are:

A computer, laptop, tablet or smartphone

An internet connection

The virtual terminal is a web page you log in to, meaning there is no need to download software on your computer or mobile device. How does PayPal Virtual Terminal work, then?

- Log in to your virtual terminal in any internet browser.

- Enter the order details following the on-screen prompts.

- Enter card details, billing information and delivery information on the form, again following the on-screen prompts.

- Review and submit the order.

PayPal then processes and confirms the order right away and your business should (if there is no account hold – see customer service section below) receive the funds in your PayPal account immediately.

Payouts can only be initiated manually by you. It usually takes a few hours to process payouts to your bank account from the online PayPal account.

Once the transaction has been completed, you get the option of creating a postage label for dispatching the goods, saving you considerable time and minimising human errors in labelling.

Security – you’re responsible

PCI DSS stands for Payment Card Industry Data Security Standard and is a global security standard for businesses and organisations that handle card payments. While Paypal is PCI DSS-compliant and well-known for their strict security, when it comes to taking telephone payments, you as a merchant are responsible for setting up and maintaining compliance because you handle card details directly.

For most, this means an Annual PCI Self-Assessment Questionnaire and a Quarterly Network Scan. PayPal recommends that you work with a partner to achieve this. With Trustwave, PCI compliance can cost around US$250 annually depending on features.

Being PCI DSS-compliant reduces the risk of your liabilities such as the cost of fraud on a compromised card account. It also shows your customers that you take data security seriously. Therefore, it’s important your business becomes compliant to protect both yourself and your customers.

With PayPal Virtual Terminal, you are responsible for PCI compliance.

PayPal customer service, reviews and complaints

Apart from the monthly costs and high card fees for certain transactions, a major disadvantage of Paypal is the customer service – or lack thereof. There has been a lot of criticism about PayPal with regards to customer service, so it’s not surprising that there are plenty of complaints and negative reviews.

In fact, on TrustPilot, Paypal UK has an average rating of just 1.3 out of 10. One of the most common complaints refers to the lack of protection for both customers and merchants, citing a real lack of consistency in how they approach disputes, what processes and protocols they have in place and how they respond. This is particularly the case if you’re a merchant selling intangible services, as providing proof of delivery is virtually impossible.

Another regular criticism is the contact process. After a cumbersome account verification and lengthy holding time, staff who lack the knowledge to answer anything more than basic questions are your main point of contact. Alternatively, you can email PayPal, but many report slow or no responses to emails.

Avoid account holds: Is your business a “restricted business” type?

By far, one of the biggest concerns by merchants is a frustrating delay known as ‘account hold’. Account holds are where money paid by a customer is suspended midway between customer and merchant – conveniently, in Paypal’s own account – in the name of security for reasons such as:

- The transaction is significantly larger than normal

- There are significantly more transactions than normal

- Any other reason that flags up a potential security issue

The main problem with account holds or disputes is that they can take time to resolve, even if there is no fraudulent activity. Some report delays of several months or more before payments have been released. While this may not be much of a problem for large organisations, some small business have got into serious financial difficulties, or in rare cases collapsed completely, as a result of account holds and disputes.

Verdict

PayPal is the Marmite of the payment industry – some businesses love it, others hate it. We can only really recommend PayPal Virtual Terminal if you prefer having all sales connected to your PayPal Business account, and if you are selling enough on a monthly basis to justify the ongoing fees.

If you just accept payments from customers within the UK, the blended pricing structure is good value with a consistently high sales volume. Otherwise, charges can rack up quickly, particularly with PCI compliance costs added on top.

Why choose PayPal for phone payments?

Reasons not to choose PayPal Virtual Terminal:

Whether you love or hate it, PayPal will likely remain one of the dominant contenders for some time – if not for its advantages, then for its brand recognition among both merchants and personal users.

What are the alternatives? Compare the best UK virtual terminals