Two of the most popular UK providers for phone payments are PayPal and Worldpay. As with any virtual terminal, you don’t need any equipment – only a laptop or tablet with an internet connection, since you’ll be using a web page to put payments through.

In the table, we compare entry rates from Worldpay and PayPal. The standard transaction rate with PayPal is 2.9% + 30p, but lower rates are available on other PayPal fee structures. If you opt for a custom package with Worldpay, you can qualify for better rates than PayPal’s.

|

|

|---|---|

| Monthly fee | |

| £20 | £9.95 + VAT |

| Transaction fees | |

|

|

| PCI compliance | |

| Extra cost | Extra cost |

| 24/7 online support | 24/7 phone support |

*IC = Card interchange rate which is between 0.2% and 2% depending on type of card. **Rates depend on sales volume, type of business and card type.

|

|

|---|---|

| Monthly fee | |

| £20 | £9.95 + VAT |

| Transaction fees | |

|

|

| PCI compliance | |

| Extra cost | Extra cost |

| 24/7 online support | 24/7 phone support |

*IC = Card interchange rate which is between 0.2% and 2% depending on type of card. **Rates depend on sales volume, type of business and card type.

The first question that comes to mind is: how come PayPal has gained such a high market share with a monthly charge that’s clearly not competitive? That and the standard rate of 2.9% + 30p, potentially with an added cross-border fee and currency conversion charge, can eat well into the margins of a small business.

The answer is in part the ease of signing up with PayPal’s virtual terminal, particularly for merchants who already have a PayPal Business account. Worldpay involves a bit more hassle, but they are trying to smarten up the onboarding process.

The first question that comes to mind is: how come PayPal has gained such a high market share with a monthly charge that’s clearly not competitive?

It should also be said that for new PayPal customers, signing up for the virtual terminal is not as easy as it once was.

Given the potential for fraud with phone payments, PayPal requires new customers to talk on the phone with an onboarding rep setting up the virtual terminal.

Fixed monthly fees unavoidable

Subscribing to the virtual terminal costs £20 a month with PayPal and £9.95 + VAT per month with Worldpay. Both platforms let you cancel the contract any month (Worldpay with 30 days’ notice), though charges paid for already are non-refundable.

| Costs | Worldpay | PayPal |

|---|---|---|

| Fixed monthly fee | £9.95 + VAT | £20 |

| Transaction rate | Depends on plan, business, card type & turnover | 2.9% (Standard), or 1.2% (Blended), or 1.2 + IC* (Interchange Plus) |

| Fixed per-transaction fee | 10p or 20p | 30p |

| Cross-border fee** | Undisclosed | 0.5%-2% depending on card’s country |

| Currency conversion fee*** | Undisclosed | 2.5% above exchange rate |

| PCI compliance | Undisclosed | Varies between providers (e.g. US$250/yr with Trustwave) |

| Per chargeback | £15 | £14 |

*IC rate is between 0.2%-2% depending on card type. **Applies to Standard and Blended pricing. ***Applies to all currency conversions.

| Worldpay | PayPal |

|---|---|

| Fixed monthly fee | |

| £9.95 + VAT | £20 |

| Transaction rate | |

| Depends on plan, business, card type & turnover | 2.9% (Standard), or 1.2% (Blended), or 1.2 + IC* (Interchange Plus) |

| Fixed per-transaction fee | |

| 10p or 20p | 30p |

| Cross-border fee** | |

| Undisclosed | 0.5%-2% depending on card’s country |

| Currency conversion fee*** | |

| Undisclosed | 2.5% above exchange rate |

| PCI compliance | |

| Undisclosed | Varies between providers (e.g. US$250/yr with Trustwave) |

| Per chargeback | |

| £15 | £14 |

*IC rate is between 0.2%-2% depending on card type. **Applies to Standard and Blended pricing. ***Applies to all currency conversions.

The information about Worldpay’s fees for the virtual terminal is not so transparent, but we do know there are two price structures: Simplicity with a fixed transaction rate for all card transactions, and Custom with varying rates depending on the card accepted.

The Worldpay website states light information about the service, PCI compliance package (without mention of cost) and the promising statement of “simple pricing plans”. However, you have to phone Worldpay up and give information about your business before receiving a full picture of fees.

It’s all very secretive, isn’t it – they refused to give us any details for publication when we last phoned them, but promised to tell merchants more over the phone. If you are interested in Worldpay, by all means ask for a callback and prepare to negotiate. This is a company that definitely has the ability to give you a good price as long as you know what you are looking for.

PayPal also requires a phone call to finish your application for the virtual terminal, but their fees are at least the same for everyone.

That being said, there are three different PayPal fee structures for the virtual terminal: Standard with a fixed 2.9% + 30p transaction fee, Blended with a 1.2% + 30p fee and Interchange Plus with a 1.2 + interchange rate (0.2%-2%) + 30p fee.

You get Standard pricing per default, but can ask for Blended or Interchange Plus pricing (subject to qualifying factors explained by PayPal). A 2.5% currency conversion fee applies to all currency exchanges, but the cross-border applies only to Standard and Blended pricing.

PayPal may sneak in some small extra fees, e.g. for “uncaptured authorisation transactions”. If you’re set on deciphering all the virtual terminal charges from the PayPal website, prepare to spend time trying to figure out which charge applies to what exactly in the lengthy service agreements.

PCI compliance is a required extra cost for both virtual terminals, but exact prices for that depends entirely on which providers you go with for this.

How do you adhere to PCI regulations? Safely accept phone payments

A refreshing entrance to the UK market is Square Virtual Terminal. In stark contract to PayPal and Worldpay, Square doesn’t charge merchants any fixed monthly fees for their virtual terminal – only a flat 2.5% rate for all key-in transactions no matter what card is used.

It will be interesting to see if Worldpay and PayPal will eventually simplify their fees in response to this kind of transparent package that will undoubtedly be attractive for small businesses.

PayPal’s interface is more modern

Is the design of the virtual terminal important to you? Then you should know there’s a difference in standards.

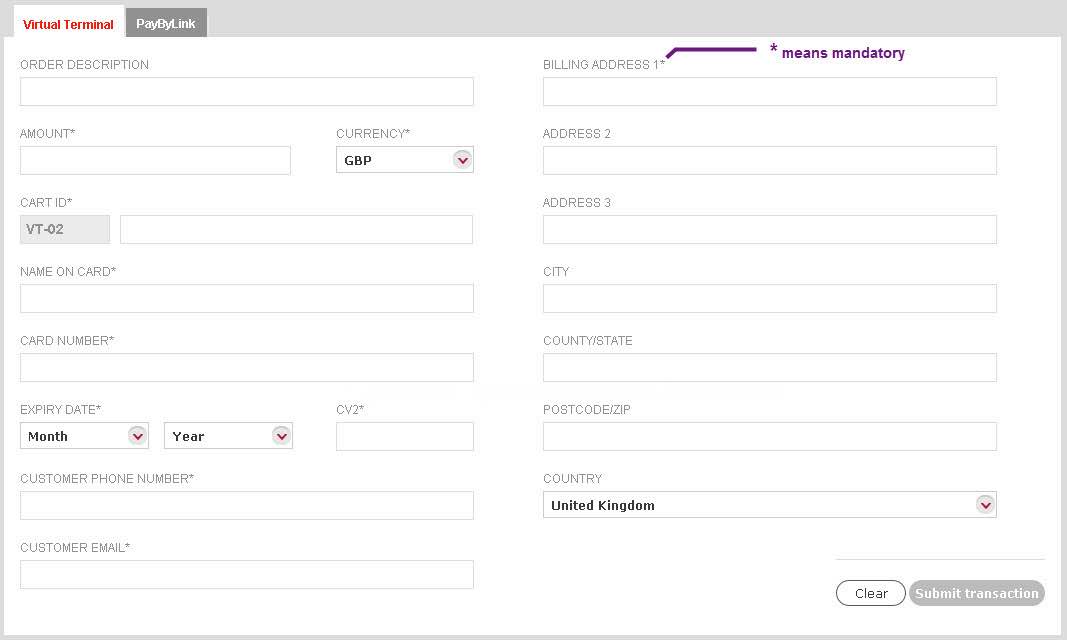

The Worldpay interface is totally acceptable and understandable. It just looks like it was made ten years ago, which is probably the case.

PayPal is more on the ball with online user experience and constantly tweaks their user experience to be as fast and painless as possible.

Worldpay’s interface can be a bit hard to read, but it is relatively intuitive. Image: Worldpay

Worldpay’s customer service only slightly better

Both PayPal and Worldpay offer 24/7 phone service and online support, but PayPal is often harder to get through to.

The customer service of Worldpay has a reputation for leaving a lot to be desired, but compared to PayPal, you are closer to real customer support teams based in the UK. This is, however, only a slight improvement on PayPal, as we have seen plenty of customer reviews stating Worldpay’s slow responses and the nuisance of being passed on from one department to another in an endless loop.

Although, if you get a frozen PayPal account and all phone payments have to be put on hold, you might actually wish you opted for the mixed bag of Worldpay responsiveness. It is no fun to have your hard-earned money put on hold due to the strict security protocols enforced by PayPal, which does happen occasionally.

If you need a card machine too, Worldpay is probably better

Our verdict

If you don’t already have a PayPal Business account and don’t want to centralise all your business funds in an online PayPal account (because that’s where your funds will go, as opposed to a bank account), we recommend getting an offer from Worldpay to get a clear picture of pricing.

Worldpay’s rates are generally better for businesses making over £2k monthly, but even a monthly turnover of less than that could be cheaper with Worldpay due to the significantly lower monthly cost.

On the other hands, PayPal could be better for online businesses with customers largely based in the UK. The high cost of foreign-issued card transactions can make PayPal much more expensive than other virtual terminals.