Contents

In brief

What is it?

Our opinion

In detail

E-account

Pricing

Card reader

Alternatives

myPOS Go vs SumUp

MobileTransaction tested myPOS Go 2 first-hand for an honest review of the card reader. Photographs and opinions are our own.

We often refer to the card reader as myPOS Go 2 because there used to be an inferior predecessor that looked a bit like an old calculator. The new version is much prettier and has WiFi connectivity as well as 4G reception with its built-in SIM card.

“The second, latest edition of myPOS Go has better software and feels more pleasant to hold.”

– Emily Sorensen, Senior Editor, MobileTransaction

Thanks to the many types of payment methods accepted at a competitive price, the myPOS Go 2 card machine is a viable competitor to the similarly independently-working Solo terminal by SumUp.

Full myPOS review: Portable card machines with business e-account

Our opinion

We think myPOS Go is a great-value card machine that does what it says on the box for a low upfront cost. It doesn’t need extra equipment or a contract and even comes with extra features – like payment links and cross-border transfers – in an online business account.

The complimentary Visa Business card gives immediate access funds, but you’ll have to transfer them to a bank account for a fee if and when this is needed.

“We know many craftsmen and taxi drivers love myPOS’s instant access to funds, which comes in handy for buying materials urgently or refuelling right after dropping off a customer.”

– Emily Sorensen, Senior Editor, MobileTransaction

The card reader is pretty standard and could be sturdier, but the fact it works with 4G, WiFi and across borders makes it extremely convenient for travelling merchants.

| myPOS Go criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 4.1 | Good |

| Transparency and sign-up | 2.8 | Passable |

| Value-added services | 4.4 | Good/Excellent |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 3.9 | Good |

| OVERALL SCORE | 3.9 | Good |

| myPOS Go criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.2 | Good |

| Costs and fees | 4.1 | Good |

| Transparency and sign-up | 2.8 | Passable |

| Value-added services | 4.4 | Good/Excellent |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 3.9 | Good |

| OVERALL SCORE | 3.9 | Good |

Above all, myPOS Go is for merchants on a very small budget, but absolutely want a small, independent card reader that works everywhere. This will usually be sole traders or entrepreneurs who have not got a business bank account or company card.

Those working in several European countries may also be interested in myPOS, though not necessarily this entry-level model.

myPOS Go inseparable from e-account

myPOS Go is ordered directly from the myPOS website. Along with the card reader and charger, you get a business myPOS debit card delivered, which you can use everywhere accepting Visa. This is how myPOS stands out compared with the likes of Square and Zettle.

The payment card is linked to an online “e-account” where all transactions through the card reader are settled instantly. Some entrepreneurs who do not yet have a business bank account may find this attractive, particularly since it’s free to set up and run.

The e-account, however, has some disadvantages. For example, although you receive an IBAN for international transfers, you have to pay a fee to transfer any funds to your UK bank account. There are also some monthly inactivity fees kicking in if you don’t accept card payments for over 10 months.

myPOS Go costs: cheap for a card reader with SIM

The purchase price of myPOS Go is attractive, but you also have to add the cost or delivery. At £39 + VAT for the card reader, it is much cheaper than SumUp Solo (£79 + VAT) that also comes with a SIM card and business account.

On top of the card reader price, myPOS adds a delivery charge of £5 + VAT, which works out as £6 total.

The unlimited SIM data plan, valid across Europe, is included.

The unlimited SIM data plan, valid across Europe, is included in the service offering, which has no subscription. Instead, you pay a commission of 1.1% + 7p on UK and EEA-issued Mastercard and Visa transactions, 2.45% + 7p for American Express and 2.85% + 7p for all other card transactions.

Among the negative points noted in our review of myPOS: payout fees from the myPOS account to a British bank account are £1.50 per transfer. You also pay fees if you withdraw cash from the myPOS business card, or make another kind of transfer with the e-account.

Unlike Square, SumUp and Zettle, myPOS will charge you two fees if you don’t accept card payments for 10 months in a row:

- £15 inactivity fee/month

- £30 no acquiring fee/month

That means £45 per month until the day you use the card reader again or close the myPOS account. We find these charges rather aggressive, but if it’s a product you will use regularly, this won’t be a problem.

Photo: Emmanuel Charpentier (EC), MobileTransaction

The box comes with the card reader and a myPOS Visa card.

Tech specs and features

The card reader accepts most debit and credit cards including chip, magnetic stripe and contactless via card or mobile wallet.

It automatically connects to the local 4G network, but has to be activated upon receipt through an activation code on the myPOS website, otherwise it will not work. Slower connections such as GPRS would normally work as well.

| myPOS Go specifications | |

|---|---|

| Dimensions | 136.6 x 67.6 x 21 mm |

| Weight | 181.6 g (with battery) |

| Connectivity | GPRS, 3G, 4G, WiFi |

| Data | Unlimited with the myPOS SIM card (pre-installed) |

| Screen | Colour screen, 240 x 320 resolution |

| Accessories included | USB-C cable and AC adaptor |

| Battery | Rechargeable 3.7 V, 1500 mAh |

| Payment technology | EMV (chip), NFC (contactless), magnetic stripe |

| Receipts | Via email or text (paper receipts only with printer attachment) |

| myPOS Go specifications | |

|---|---|

| Dimensions | 136.6 x 67.6 x 21 mm |

| Weight | 181.6 g (with battery) |

| Connectivity | GPRS, 3G, 4G, WiFi |

| Data | Unlimited with the myPOS SIM card (pre-installed) |

| Screen | Colour screen, 240 x 320 resolution |

| Accessories included | USB-C cable and AC adaptor |

| Battery | Rechargeable 3.7 V, 1500 mAh |

| Payment technology | EMV (chip), NFC (contactless), magnetic stripe |

| Receipts | Via email or text (paper receipts only with printer attachment) |

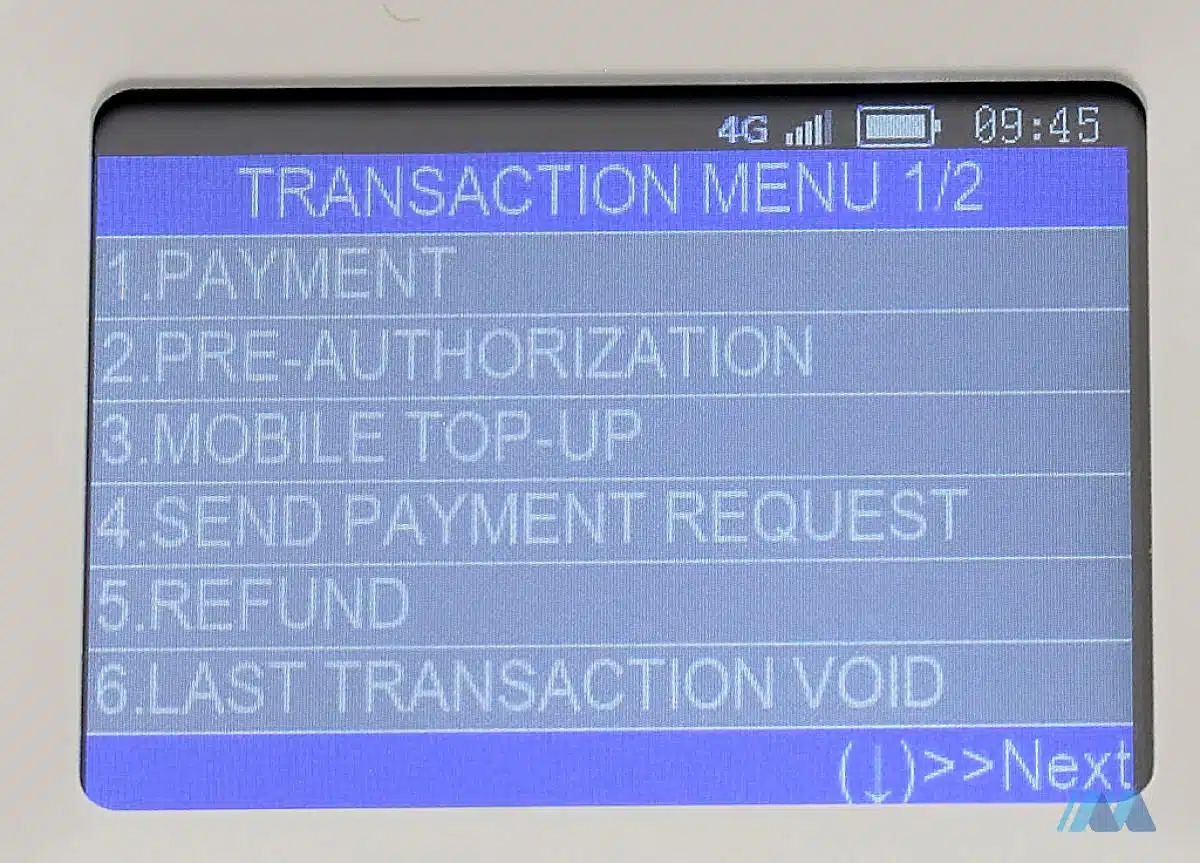

Using it is very simple: once the terminal is switched on, simply press any numeric key to activate transaction mode. Then enter the amount followed by insertion of the chip card or a contactless tap.

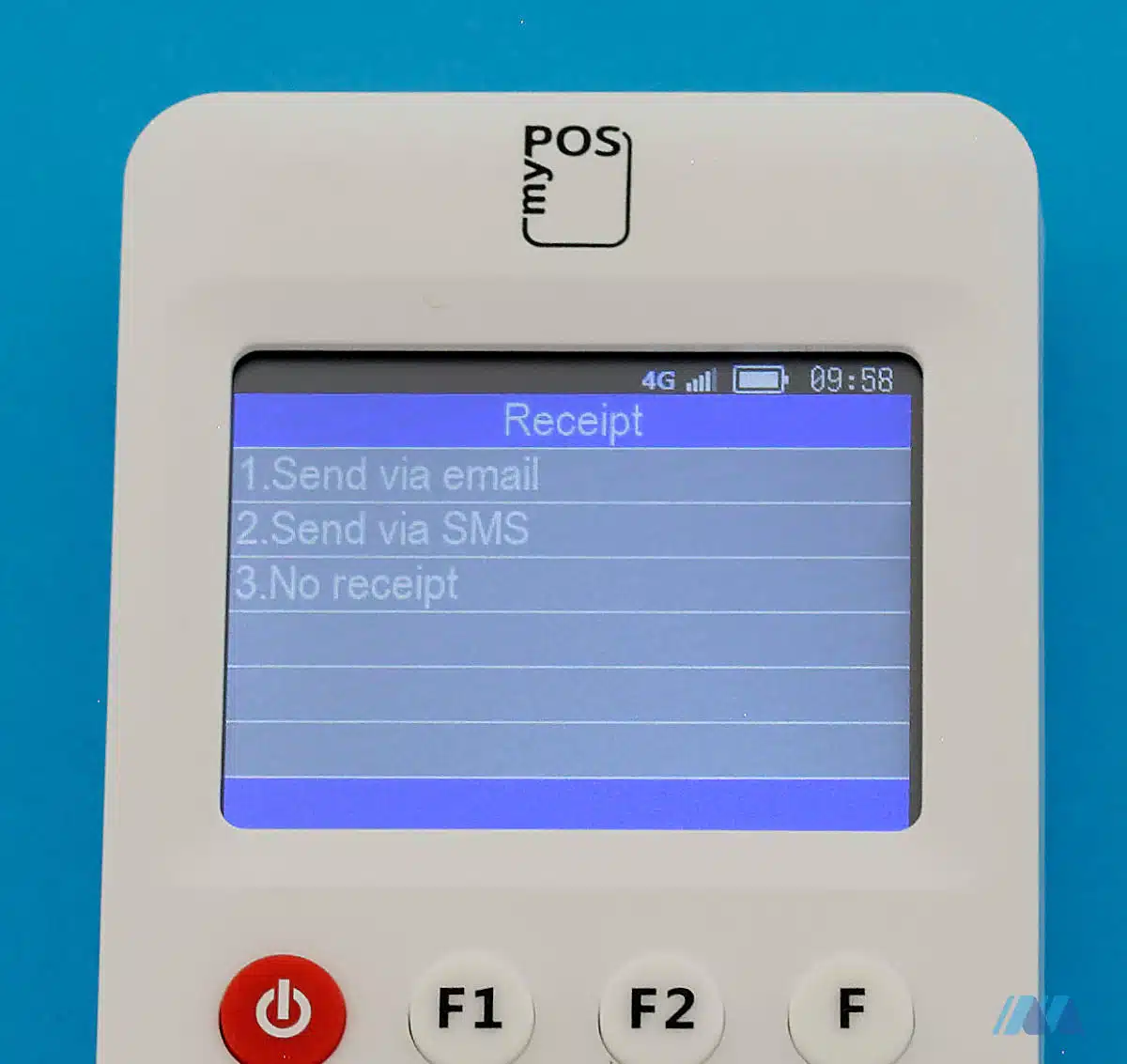

The receipt is sent to the customer via text or emai. Since the card reader does not have a touchscreen, you will need to enter an email address through the numbered keypad, as in the days of texting with the first mobile phones.

You may opt for the Printer Dock to print written receipts, but this bumps up the price considerably to £179 + VAT for the bundle.

Photo: EC, MobileTransaction

Fast transaction in our test.

Photo: EC, MobileTransaction

Receipt menu with options.

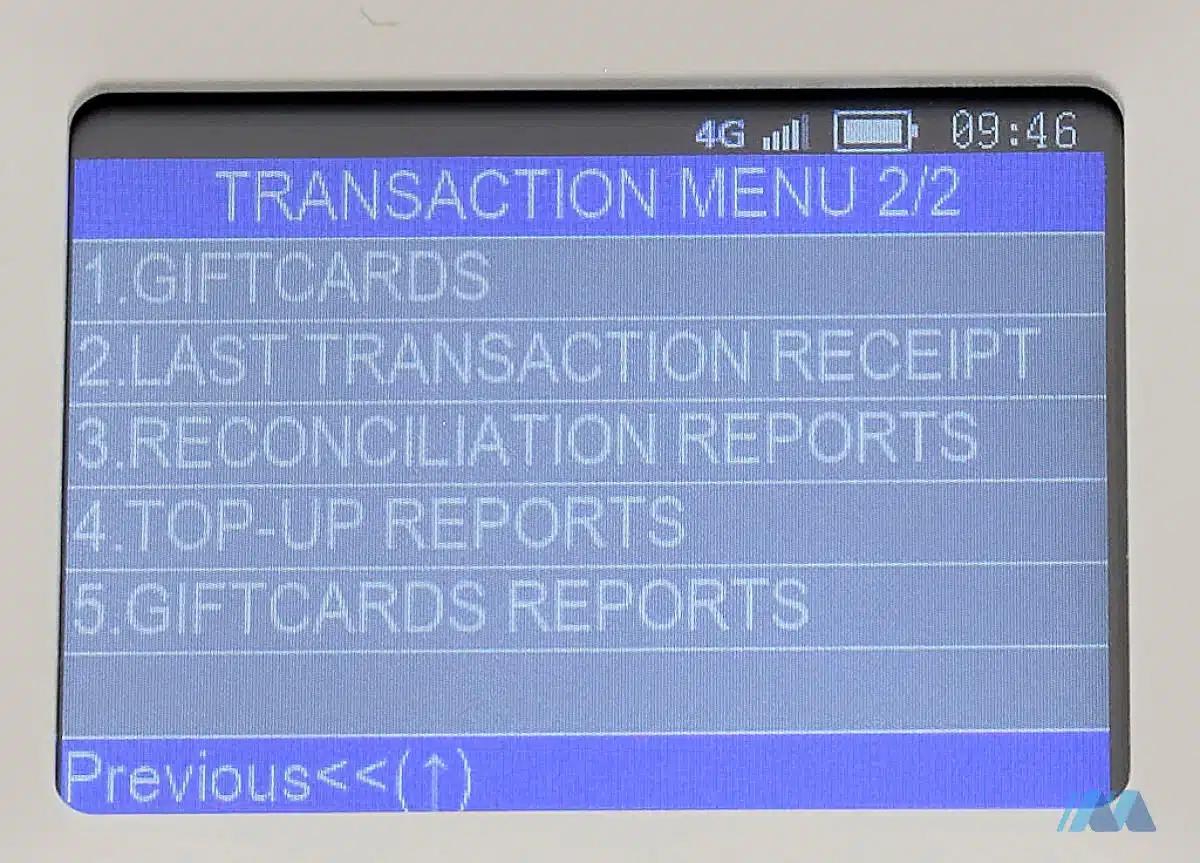

If your customer does not have a card or digital wallet on them, you can use the deferred payment option, which sends a payment link by email or text message. There are also preauthorisation and gift card functions, both of which are rare to see in a low-cost card reader.

Photo: EC, MobileTransaction

Transaction menu with options.

Photo: EC, MobileTransaction

Transaction menu part 2.

And looks? myPOS Go 2 is certainly an upgrade from the dark, dull-looking original myPOS Go, which you could mistake for an old calculator. While some will miss a touchscreen, the buttons are familiar and easy to use on the new version, unless you need to type several words which would be tedious.

“myPOS is not quite the size of a mobile phone, as it’s significantly thicker. With its angular shape, black plastic casing and small non-touch screen, it doesn’t really look like much. But the well-contrasted rubber keys and its very simple mode of operation make it a pleasant device to use.”

– Emmanuel Charpentier, Editor of MobileTransaction France

The myPOS Go Combo package includes a unique receipt printer, which doubles as a charging station to extend the life of the card reader battery if out and about.

Photo: EC, MobileTransaction

myPOS Go Combo is expensive, but prints receipts and boosts the card reader battery.

Alternatives to myPOS Go

Not many merchant service providers in the UK offer a card reader like myPOS Go, because cheap card readers usually require an app connection, and the standalone card machines tend to cost over £80-£200. myPOS Go is both cheap and works independently – an anomaly of sorts.

The closest alternatives in terms of cost and utility are offered by Square, Zettle and SumUp. They can all transfer funds directly into your bank account free of charge, and SumUp also offers its own free business account with next-day transfers.

Square Reader is the cheapest card reader, but requires an app and has no PIN pad (this is displayed in the app). The standalone Square Terminal is pricier at £149 + VAT, but is also more attractive and has a large touchscreen with many functions (but only works with WiFi).

The pocketable, independent Zettle Terminal is also expensive (from £149), but is smaller, looks and feels like a smartphone and works with 4G.

SumUp Solo is the most comparable device with its relatively low cost, SIM card and online business account transfers.

myPOS does offer another standalone, compact terminal called myPOS Pro. Instead of a physical keypad, it has a touchscreen and app features built in, as well as a built-in receipt printer. This is considerably more expensive at £229 + VAT.

Alternatively, the myPOS Glass app allows you to accept contactless cards via your iPhone or Android smartphone. This way, you don’t have to purchase a card machine, but it does rely on customers having to use contactless tap and not chip and PIN.

Photo: EC, MobileTransaction

The myPOS Go Combo package contains the Go 2 card reader and receipt printer dock.

myPOS Go or SumUp?

How do SumUp’s standalone card reader, SumUp Solo, compare with myPOS Go? Let’s start with the highlights of myPOS Go:

- myPOS Go is cheaper and works with low network connections.

- Multiple user accounts: each user can have a login code, which is practical in theory, but not really relevant since this card reader is intended for individual merchants.

- Works all over Europe, contrary to SumUp which by default only works in the country of registration (although you can arrange foreign acceptance by contacting SumUp). This is interesting for some cross-border sellers or taxis.

- The myPOS Visa card gives access to funds immediately after transactions.

However, the price difference is partly justified because SumUp Solo has several advantages:

- SumUp Solo has a touchscreen, which could work better for entering an email address for a customer receipt.

- SumUp’s 1.69% transaction fee is the same for everyone and all cards.

- SumUp automatically settles transactions in your bank account, and for free (myPOS charges £1.50 per payout, and this is manual). It should also be noted that some customers report account holds with myPOS.

- SumUp does not require a video call during registration, unlike myPOS. It is generally very easy to sign up with SumUp, while myPOS requires multiple steps and paperwork.

At the end of the day, the question is what you value the most. The instant access to funds through the payment card and cross-border functionality are two top reasons for merchants to opt for myPOS.