Need to take payments over the phone, but not sure which virtual terminal to choose?

Many payment providers in the UK offer virtual terminals, but only few are truly good value for a small business.

Compared with card machine payments, manually typing card details is more expensive because there’s a greater risk of fraud when the card is not physically read.

What is a virtual terminal?

Payment links – where cardholders complete the transaction themselves online – have replaced virtual terminals to some degree. Still, taking payments over the phone is the best option in certain situations.

There is, however, a lot of variation in costs between different online payment terminals.

Some providers require a monthly fee and formal PCI-DSS documentation. Others only require the transaction fee, completely bypassing a traditional contract and subscription charges.

So which is the right one to choose? After in-depth testing and examining user feedback, we discovered that every virtual credit card terminal comes with key benefits, which we’ll dig into below.

Virtual credit card terminals in the UK:

| Provider | Costs | Rating | Website |

|---|---|---|---|

| Square | £0/mo Transaction fee: 2.5% |

Best for range of free features |

|

| Takepayments | Monthly/annual fee Transaction fee: Custom |

Tailored fees, 12-month contracts |

|

| Worldpay | £9.95 + VAT/mo Transaction fee: Custom |

For high-volume payments |

|

| SumUp | £0/mo Transaction fee: 2.95% + 25p |

Access in both app and browser |

|

| PayPal | £20/mo Transaction fee: 2.9% + 30p (standard) |

Connected with PayPal tools |

| Provider | Costs | Rating | Website |

|---|---|---|---|

| Square | £0/mo Transaction fee: 2.5% |

Best for range of free features |

|

| Take- payments |

Monthly/ annual fee Transaction fee: Custom |

Tailored fees, 12-month contracts |

|

| Worldpay | £9.95 + VAT/mo Transaction fee: Custom |

For high-volume payments |

|

| SumUp | £0/mo Transaction fee: 2.95% + 25p |

Access in both app and browser |

|

| PayPal | £20/mo Transaction fee: 2.9% + 30p (standard) |

Connected to PayPal tools |

How we rate virtual terminals

We have tested most of the virtual terminals for an honest comparison. The most important criteria for a high rating is how easy and efficient it is to take a payment with the virtual terminal.

We also look at the features on the virtual terminal page, like options to add information about the cardholder (to minimise the risk of chargebacks), preauthorisation, bill itemisation and adding items from a product or customer library. Do you have to use it on a computer or is it accessible on a smartphone too?

Apart from the product itself, we base our ratings on the following, in order of priority:

Have you considered pay-by-links?

Alternatives to a virtual card payment

Pros:

Cons:

If you’re looking for no commitment, quick registration and no monthly fees, our top recommendation – based on our own tests and experience – is Square. The only thing you pay is a fixed transaction fee per Virtual Terminal payment, and then you get a clearly polished product made for ease of use.

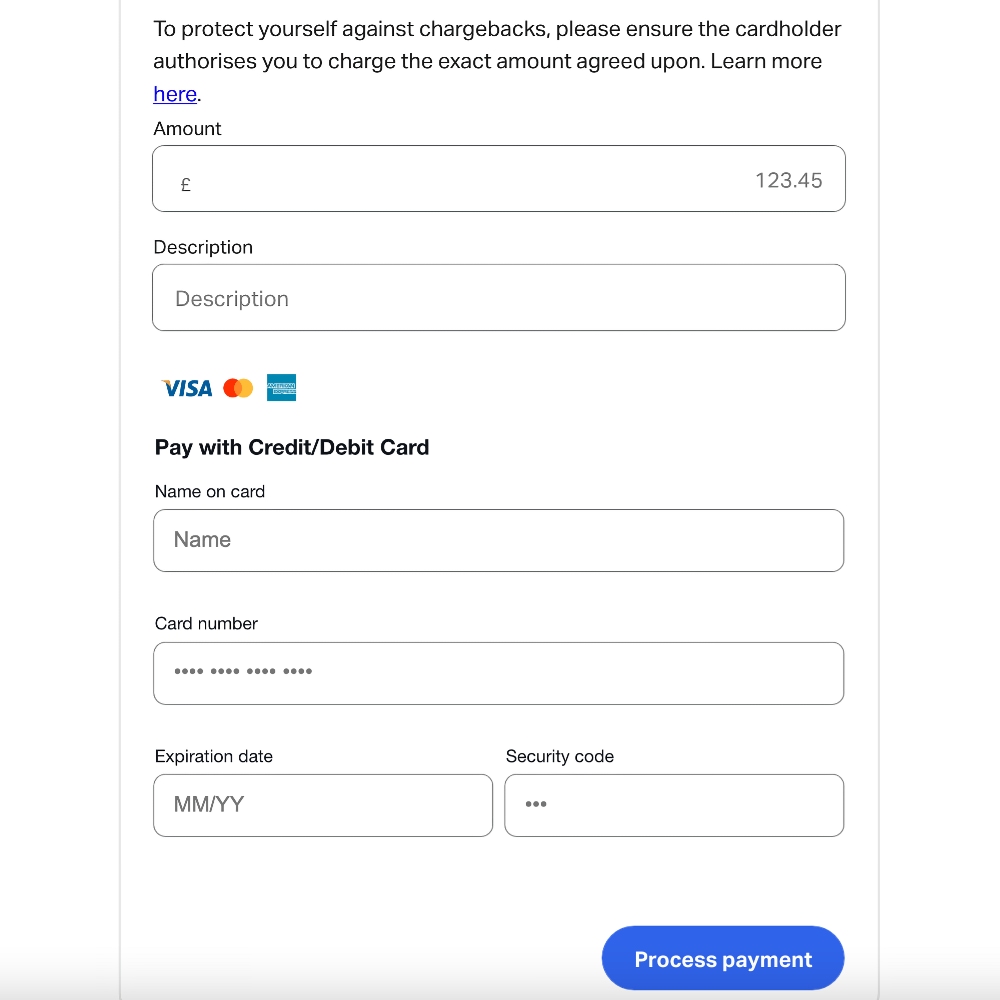

Image: Mobile Transaction

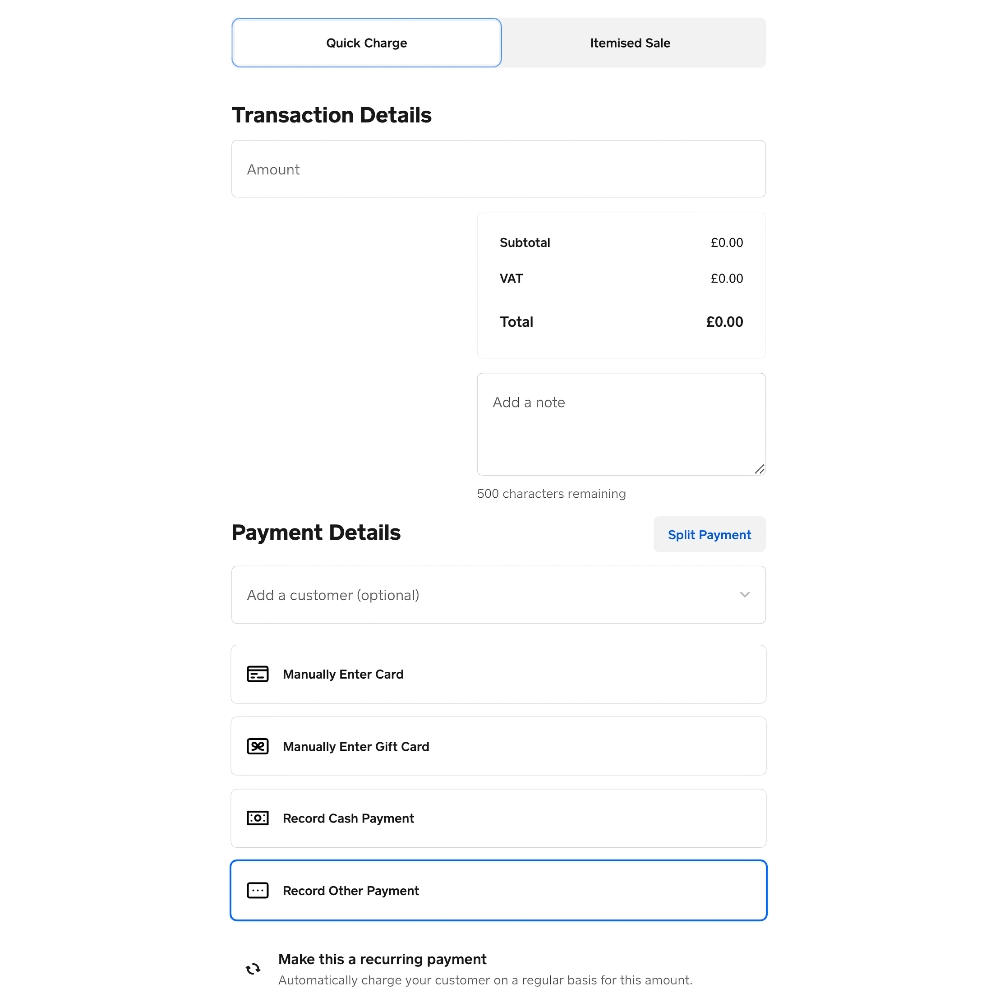

Square Virtual Terminal has a Quick Charge and Itemised transaction option.

You can go many months without using the terminal, without being charged anything, and it will still be available as a complimentary feature in your Square account.

Square Virtual Terminal accepts Visa, V Pay, Mastercard, Maestro and American Express.

The virtual payment terminal page is straightforward – enter the card details, amount to be paid and a short note that will be shown in your sales reports (i.e. not for personal details), or itemise the bill with products from your library (or new custom items), taxes, discounts and variants.

Pricing

Monthly cost: Free

Transaction fee: 2.5% (all cards)

PCI compliance: No cost

If you’ve saved a customer’s card details in the system, you can pick that for the payment, or start a recurring payment if charging for a subscription or ongoing service.

It’s also possible to record the payment in cash, gift card or other tenders, send a transaction to Square Terminal for a cheaper in-person payment, and split the transaction into different payment methods.

Alternatively, Square merchants can accept keyed card payments on the go in the free Square Point of Sale app on iOS and Android devices. Similar details can be added to these transactions, but you cannot create recurring payments in the app.

We tried Square’s browser-based virtual terminal on iPhone and found this is absolutely possible, but the responsiveness of the page is not perfect on a small screen.

“Square Virtual Terminal is my favourite, because it has many features weaved into its deceptively simple layout. You can use it with Square Terminal, subscriptions, various payment methods – almost any situation, really.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Square really has lowered the threshold for getting started with payments, whether it’s for the point of sale, invoicing, ecommerce or in this case a virtual terminal. With a Square account, you can take payments in any of these ways for a fixed percentage rate.

There’s no requirement to submit PCI-DSS documentation, but Square does expect you to follow general security recommendations in line with the regulations.

Best for: Small, new or seasonal businesses needing an easy, not-committing option for remote payments.

Pros:

Cons:

Takepayments is a popular merchant service provider best known for its card machines. Their virtual terminal solution requires a 12-month contract, but then fees are tailored to your business.

You can choose between an ongoing monthly or annual fee which may include a certain number of qualifying transactions, beyond which you pay an agreed rate per transaction.

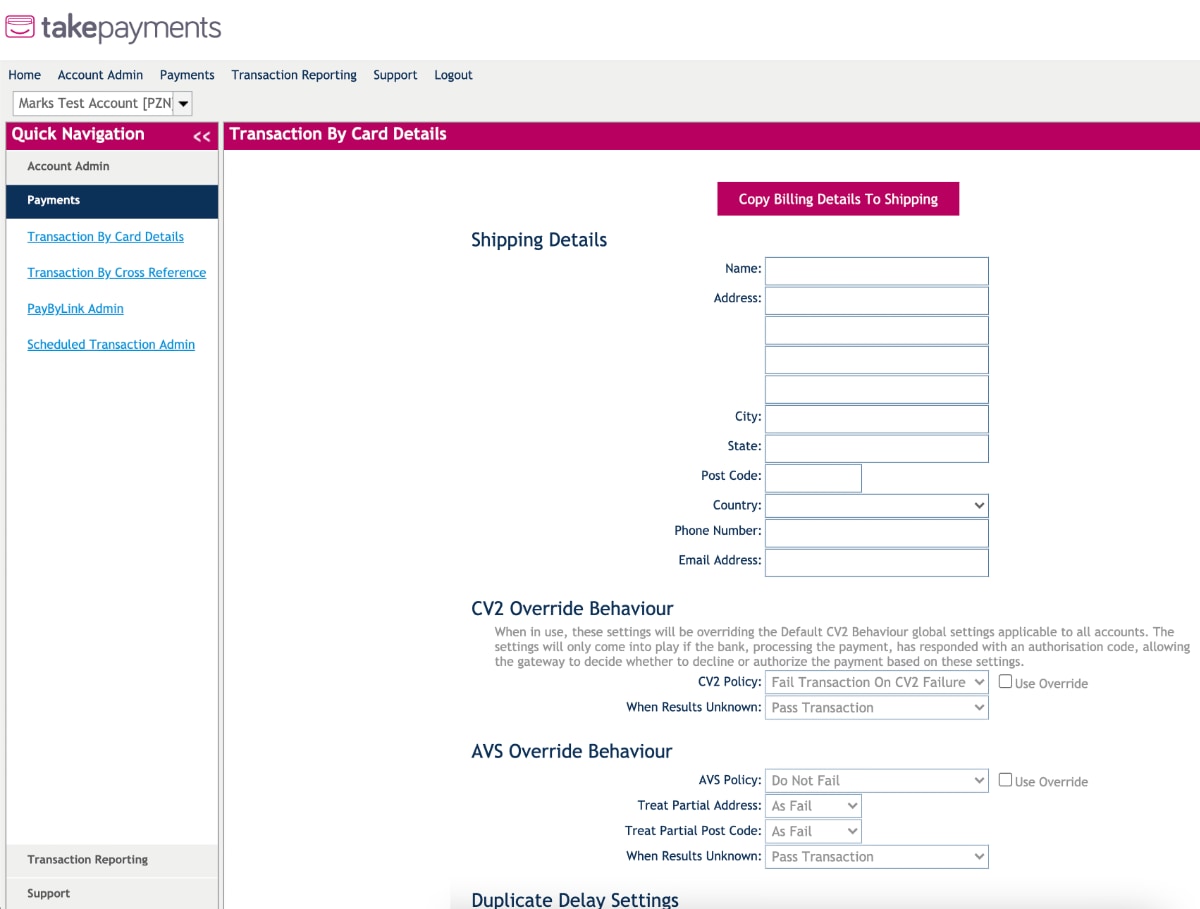

Image: Mobile Transaction

Takepayments Virtual Terminal has a full range of features accessed from a browser.

There is no setup fee with Takepayments, but you do need need to speak with a sales rep on the phone to sign up and hear about pricing. A merchant account from Barclaycard or Elavon (with a separate contract) will be created after agreeing to the quote and contract terms.

A termination fee applies if you do not give at least 60 days’ exit notice. There are also fees for chargebacks (£9), refunds (30p) and PCI-DSS compliance (£15 per month through Barclaycard).

With Takepayments, transaction fees vary between card types, but rates are typically lower than 1% for domestic Visa and Mastercard payments and higher for corporate, premium or foreign cards. Exact fees are only disclosed when you start an application process with the company.

Pricing

Ongoing fee: Custom monthly or annual fee

Transaction fees: Determined at sign-up

PCI compliance: £15/month

The virtual terminal looks a bit outdated, like an old Windows admin panel, but it worked surprisingly well when we got into using it. It is accessed in a web browser, where payment links are also available.

“Although Takepayments suggests you can log in and use the virtual terminal on any device, it’s far too fiddly to use on a small screen. I had to zoom in on the screen just to read the tiny text. I therefore only recommend using it on a computer or possibly a tablet.”

– Emily Sorensen, Senior Editor, Mobile Transaction

You can itemise transactions for a detailed receipt, and fill in lots of additional information like shipping and customer details. With its options to add CV2 and Address Verification Service (AVS) details, you can cover yourself well to prevent chargebacks. It’s possible to accept different currencies as well.

Takepayments accepts Visa, Mastercard, Maestro and American Express (with an added contract), and transactions settle in your bank account the following working day. Customer support is available every day of the week during working hours.

Best for: Good range of features, next-day payouts and fees tailored for your business.

Pros:

Cons:

As the biggest payment processor in the UK, Worldpay offers everything from card machines to online payments, including virtual terminals. Transaction rates are shaped around your card turnover, business area and card types accepted.

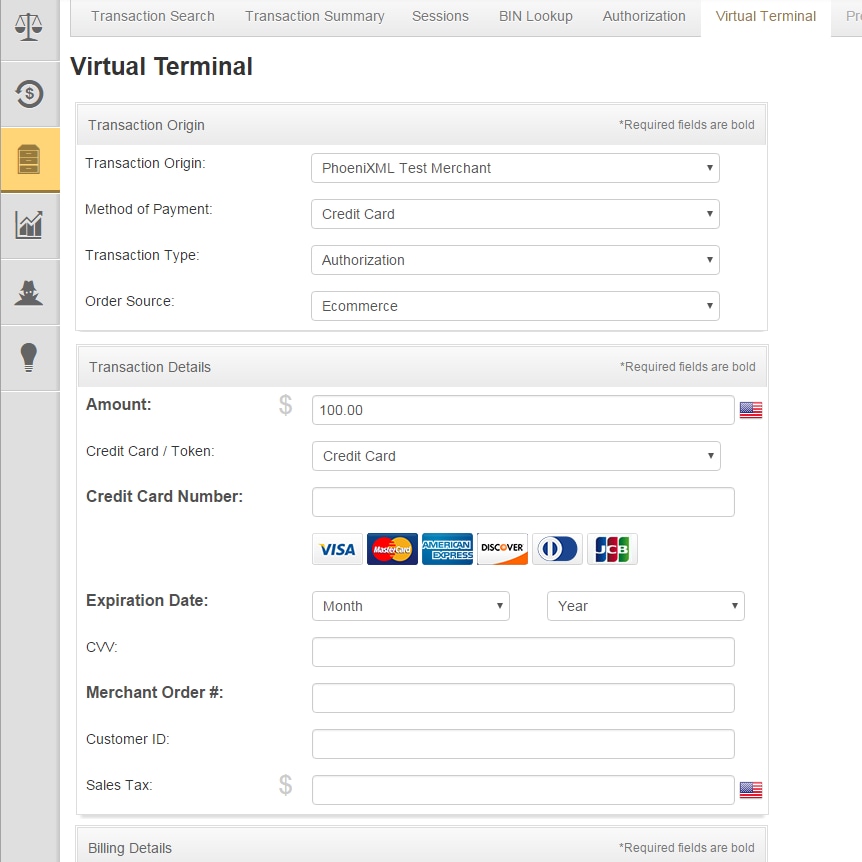

You get a decent, professional virtual terminal that we only really recommend for desktop use, since the layout is not so modern and responsive on a smartphone.

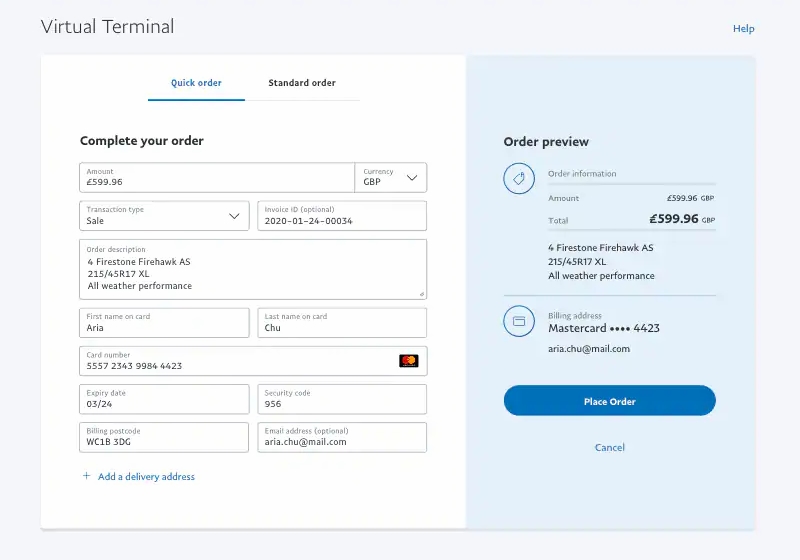

Image: Worldpay

Worldpay Virtual Terminal allows you to add standard information, billing address and more.

Precise card rates are given by Worldpay when you contact them, but one thing is sure: the Virtual Terminal, on its own, has a fixed monthly fee of £9.95 + VAT. You pay for transactions on top of the monthly cost, and the plan can be cancelled any time with 30 days’ notice.

Worldpay has a broad range of features for virtual card payments, including recurring payments and pay-by-link for payments via an email link. If you want a payment gateway and pay-by-links together with the virtual terminal, it costs £19.95 + VAT per month.

Transaction fees can be negotiated to comprise of a fixed amount like 10p or 20p + a percentage based on the card type. Debit cards are cheaper (from 0.5%) than credit cards (from 1.4%), and foreign, corporate and premium cards like American Express cost even more (from 1.9%). With no transaction history, you may just get a fixed general rate like 1.75%.

Pricing

Monthly cost: £9.95 + VAT

Transaction fee: Depends on plan, card type & turnover, higher for premium & foreign cards

PCI compliance: Additional costs apply

Visa, Visa Electron, Mastercard, Maestro, American Express and Diners Club are accepted through the Worldpay virtual terminal, but it is possible they allow other card brands with an extra agreement. Some features – such as advanced reporting – may incur extra fees.

“Given the monthly cost, we don’t think Worldpay Virtual Terminal is suitable for businesses who only use it occasionally. It’s better for merchants with an existing card machine contract, as it lets you deal with the same provider for all sales channels.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Customer service is available over phone and email 24/7, but Worldpay has for a while struggled to provide a good service for everyone.

Best for: Businesses with a relatively stable monthly turnover of over £2k monthly, accepting mainly UK-issued debit cards.

Pros:

Cons:

SumUp is mostly known for its low-cost card readers. They don’t advertise its Virtual Terminal, but if you have a SumUp account, you can message customer support to get it activated. SumUp will ask you to complete an application and submit documentation and proof of your online presence, which they check. If all goes well, the virtual terminal will be activated both in the online dashboard and mobile app.

Image: Mobile Transaction

SumUp Virtual Terminal has a simple layout, in line with all of SumUp’s no-fuss products.

The virtual terminal costs nothing in monthly fees, but transactions cost 2.95% + 25p regardless of card type or sales volume. Although higher than some other virtual terminals’ rates, the lack of a monthly fee could still mean it is the most economical solution for occasional phone payments.

SumUp merchants taking card payments through the Air or Solo card reader can benefit from keeping both face-to-face and phone payment transactions viewable in the same account, or exported to Excel for accounting purposes.

The virtual terminal accepts Visa, Mastercard, Maestro, American Express, Diners Club, Discover and JCB, which is the largest selection of accepted cards (on this shortlist) included automatically.

Pricing

Monthly cost: Free

Transaction fee: 2.95% + 25p (any card)

PCI compliance: Free

There is no contract to commit to with SumUp. Once activated, you can accept payments through the virtual terminal when required, but a period of non-usage may deactivate it eventually, requiring you to contact SumUp again.

The only additional information you can enter on the virtual terminal page is a short description. No customer address or other information than essential card details can be added, so it is by far the most basic option on this shortlist. It does mean that it’s quick and easy to use, as we have found when testing it.

“I think the main strength of SumUp Virtual Terminal is its accessibility in the app. No other provider has prioritised this.”

– Emily Sorensen, Senior Editor, Mobile Transaction

The main strength of SumUp Virtual Terminal is the fact you can use it in both SumUp App and a web browser. Most virtual terminals are only accessible in internet browsers or on a card machine, but SumUp’s access in their mobile app makes it ideal for on-the-go merchants with no computer access.

Best for: SumUp users requiring a simple solution for occasional over-the-phone payments.

Pros:

Cons:

PayPal is a popular choice for small business, partly because it is so well-known. The virtual terminal itself is effective and highly secure, but PayPal makes it your responsibility to set up PCI-DSS compliance, which we have found can be costly if you require assistance.

PayPal Virtual Terminal accepts Visa, Mastercard and Maestro, and transactions settle in your PayPal account within minutes. This is great for instant access to payments in an online account, but you have to “withdraw” the money manually to your bank account if that’s what you need.

Image: PayPal

PayPal’s virtual terminal is simple to use, but costs are a little complicated.

To cut to the chase, the costs of their virtual terminal are some of the highest for small businesses. Firstly, there’s a £20 (no VAT applicable) monthly fee for having the virtual terminal in the first place.

The Standard fee for virtual terminal payments is 2.9% + 30p per transaction. Alternatively, you can apply to be on a Blended pricing plan where transactions cost 1.2% + 30p or Interchange Plus plan where transactions cost the interchange rate + 1.2% + 30p.

Interchange fees range between 0.2%-2% according to the type of card accepted. For example, a UK-issued, personal Visa Debit card will have the lowest fee, while non-UK, premium or corporate cards have the highest interchange rates.

There is no cross-border charge applied for the Interchange Plus pricing structure, but it (1.29% or 1.99%) is applied to the Standard and Blended rates.

A currency conversion fee of 3% on top of the base exchange rate is applied on all plans if the payer’s account is in a non-GBP currency.

Additional fees apply in certain cases, e.g. for “card account verification” or “uncaptured” payments.

Pricing

Monthly fee: £20

Transaction fees:

Standard: 2.9% + 30p

Blended: 1.2% + 30p

Interchange Plus: Interchange % + 1.2% + 30p

Fees for foreign cards:

Cross-border: 1.29% (EEA) or 1.99% (other country) (Standard & Blended)

Currency conversion: 3% (any plan)

PCI compliance: Costs apply

Tired of reading about PayPal fees? Maybe this virtual terminal isn’t for you. However, the platform does offer a broad range of online payment features such as recurring payments and a PayPal checkout on your website. If you’d like to have all this in one place, you may prefer PayPal.

“I don’t have anything negative to say about the PayPal Virtual Terminal itself, but I rarely recommend it to anyone simply because of its high costs and problematic service. Users are often left to their own devices if they run into an issue or have funds frozen.”

– Emily Sorensen, Senior Editor, Mobile Transaction

To sign up, you submit an online form followed by a phone call with PayPal to discuss your requirements. It’s very easy to apply for just a PayPal Business account, but an extra feature like this, or if you require a different pricing plan, does need PayPal’s approval.

Best for: Online businesses using PayPal services regularly and with primarily UK-based customers (for lower fees).

Other virtual terminals

There are several alternatives that didn’t make our top virtual terminal list for a variety of reasons. This doesn’t mean they’re no good – perhaps they suit your business perfectly well.

So here’s a brief list of others to look at:

- Elavon: Standard virtual terminal from a traditional merchant service provider. Custom fees that suit bigger sales volumes.

- myPOS: Virtual terminal on any device, no monthly fee, 1.8%-3.4% + 15p transaction fees. Generally, myPOS is harder to sign up for and fees add up.

- Tyl by NatWest: In-browser, £14.95 monthly fee, custom fees. The monthly fee just for the virtual terminal is prohibitive.

- Barclaycard Business: The bank hints at offering this, but doesn’t actively promote it, which is a sign they don’t prioritise the product.

- Dojo: Available for existing customers through a browser account. Not advertised for regular use.

Looking for other virtual payment solutions?

Overview of online payments for small businesses

Summary

Which is the best virtual payment terminal, then?

For occasional payments

Go for an option without fixed monthly costs, if you won’t use it all the time – that would be Square or SumUp.

Square has the best overall features and value-added, free tools for a lower transaction rate than SumUp, so comes away as the clear winner.

But there could be a few reasons for choosing SumUp instead:

- convenience if you’re already using their card readers

- the straightforward virtual terminal in an app

- its integration with other SumUp products

Of the ones with monthly or annual fees

Takepayments and Worldpay are better for custom fees and a larger range of virtual terminal features. The problem for them both is their lack of mobile responsiveness, so you do need to get on a laptop to use them.

Takepayments is better for customer service compared with Worldpay’s poor track record in recent years. But Takepayments does require a year’s lock-in which is not ideal for some businesses, whereas Worldpay lets you cancel any month.

PayPal takes the bottom place…

…because of its high monthly fee, requirement to sort out PCI-DSS compliance separately (with fees) and high international rates. It’s expensive for what it is, but you do receive payments quickly in an online account and can manage all PayPal transactions in one place.

Strengths of each virtual card terminal:

| Virtual terminal | Best for | Website |

|---|---|---|

|

Quickest startup, no commitment, simple card rate – least hassle for a small business. | |

|

Full range of traditional features, next-day payouts and tailored fees. | |

|

Breadth of virtual terminal features for an affordable, 30-day rolling contract. | |

|

Convenience for SumUp users accepting occasional telephone payments. | |

|

Existing, medium-volume PayPal merchants using the online account as a central hub. |

| Virtual terminal |

Best for |

|---|---|

|

Quickest startup, no commitment, simple card rate – least hassle for a small business. |

|

Full range of traditional features, next-day payouts and tailored fees. |

|

Breadth of virtual terminal features for an affordable, 30-day rolling contract. |

|

Convenience for SumUp users accepting occasional telephone payments. |

|

Existing, medium-volume PayPal merchants using the online account as a central hub. |