- Highs: Free transactions included. Competitive custom fees. Good payment tools. Multi-currency support.

- Lows: Outdated interface. No integrations. Only works in browser, not app. Contract lock-in. Monthly fee.

- Choose if: You’re regularly taking phone payments for high transaction amounts.

How it works

Previously called Payzone, Takepayments offers a good mix of payment solutions with short contracts for small businesses in the UK.

Products include card machines, payment links, ecommerce and a virtual terminal for Mail Order and Telephone Order (MOTO) payments. Barclaycard Business processes transactions through your chosen sales channel.

Payouts reach your bank account within two working days. Visa, Mastercard and Maestro are accepted through the virtual terminal, but you can add American Express and other card brands to your contract.

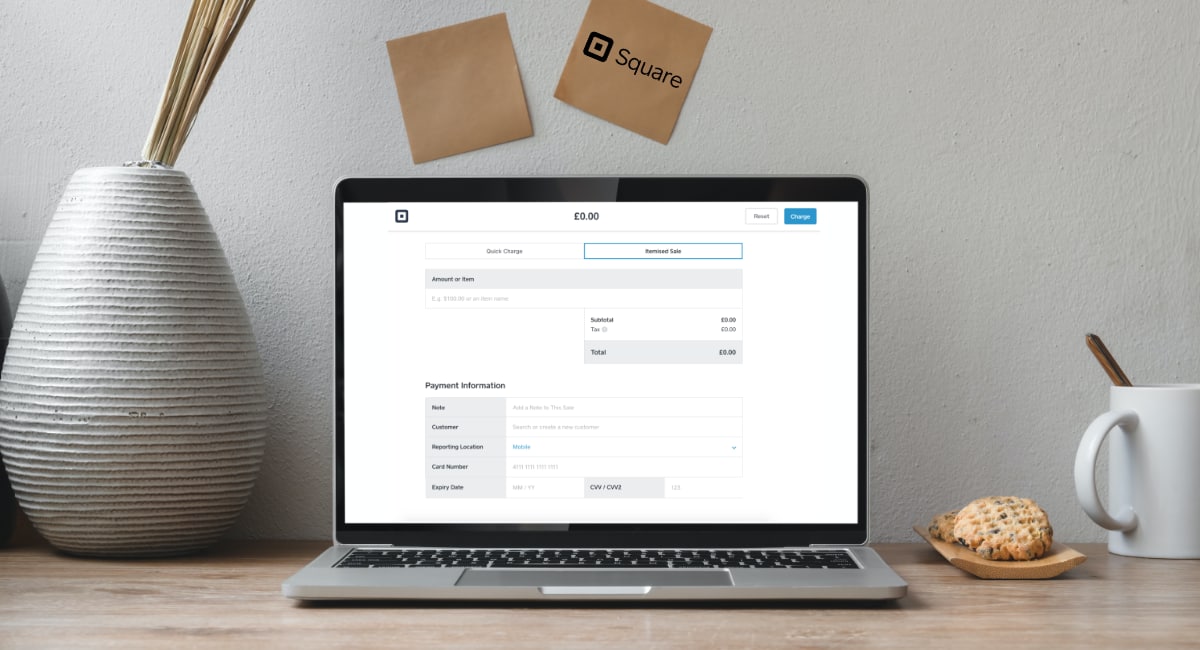

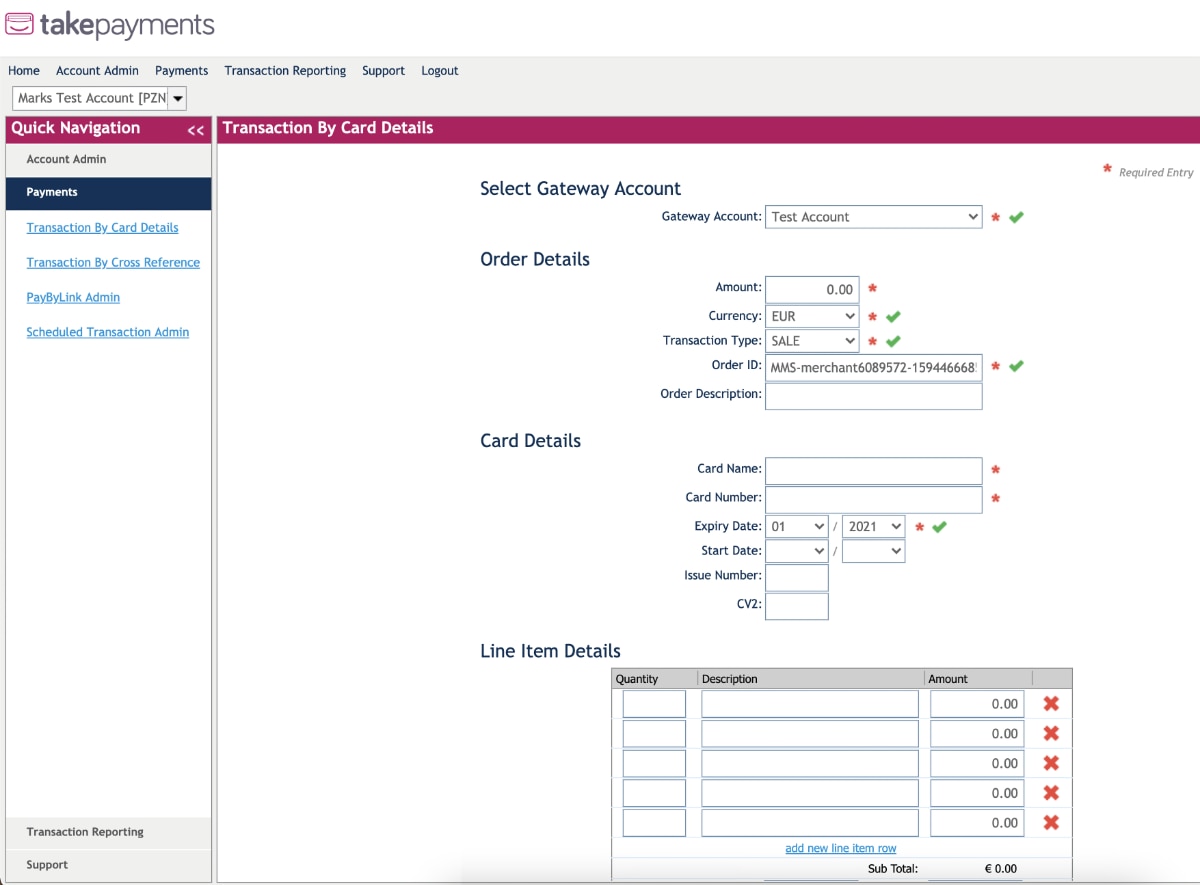

The virtual terminal is accessed in a web browser account called Merchant Management System (MMS). It is actually labelled “Transaction By Card Details” which isn’t very intuitive, but the page (below) is unmistakably for key-in transactions.

Credit: Mobile Transaction

The “Transaction By Card Details” page is like any other browser-based virtual terminal.

Its navigation buttons and design look like an early 2000s Windows interface, but the functions work fine. The font size is quite small, so those with poor eyesight might need to zoom in on the text. Although you can use the virtual terminal on a smartphone or tablet, the interface is clearly designed for a computer screen – it’s not easy to use or read the text on a small screen.

To accept a payment, you select a transaction amount, currency (GBP, USD, EUR), transaction type (sale, preauthorisation, refund) and order ID (generated automatically, but editable). The bill can be itemised further down the page with tax information. MMS isn’t linked with a product library, so items have to be added manually.

Not all virtual terminals accept different currencies, so that’s a nice extra. Preauthorisations are also useful for holding a payment amount before it actually takes place, for instance when booking a hotel room.

It’s up to you how many card details you submit, but required fields include name, the long card number and expiry date. You can also add a start date, issue number or CV2 code. Billing and shipping addresses can be submitted alongside a customer phone number and email address.

For extra flexibility around security, you get to decide if the payment system should override mistakes in the billing address or CV2 (card security code). We don’t recommend passing transactions if details aren’t 100% correct, but it can be a massive help if a payment on behalf of a trusted customer keeps having issues.

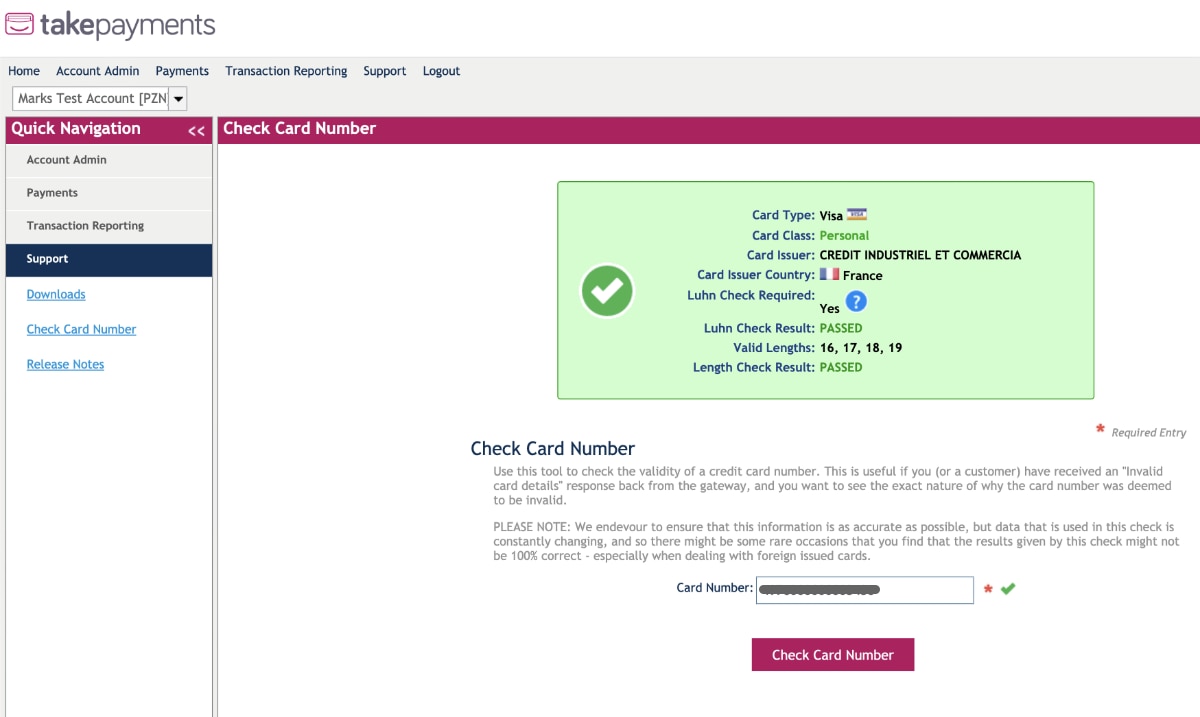

Credit: Mobile Transaction

Takepayments lets you check why a card number wasn’t accepted.

Another useful tool is the “Check Card Number” page (above). This allows you to check why a transaction has come back with an “invalid card details” response.

You can refund full or partial transaction amounts, and even void payments before they finish processing. Transaction history and a summary of payments can be accessed in the MMS and exported to a CSV file for accounting. The system doesn’t integrate with external bookkeeping software, though.

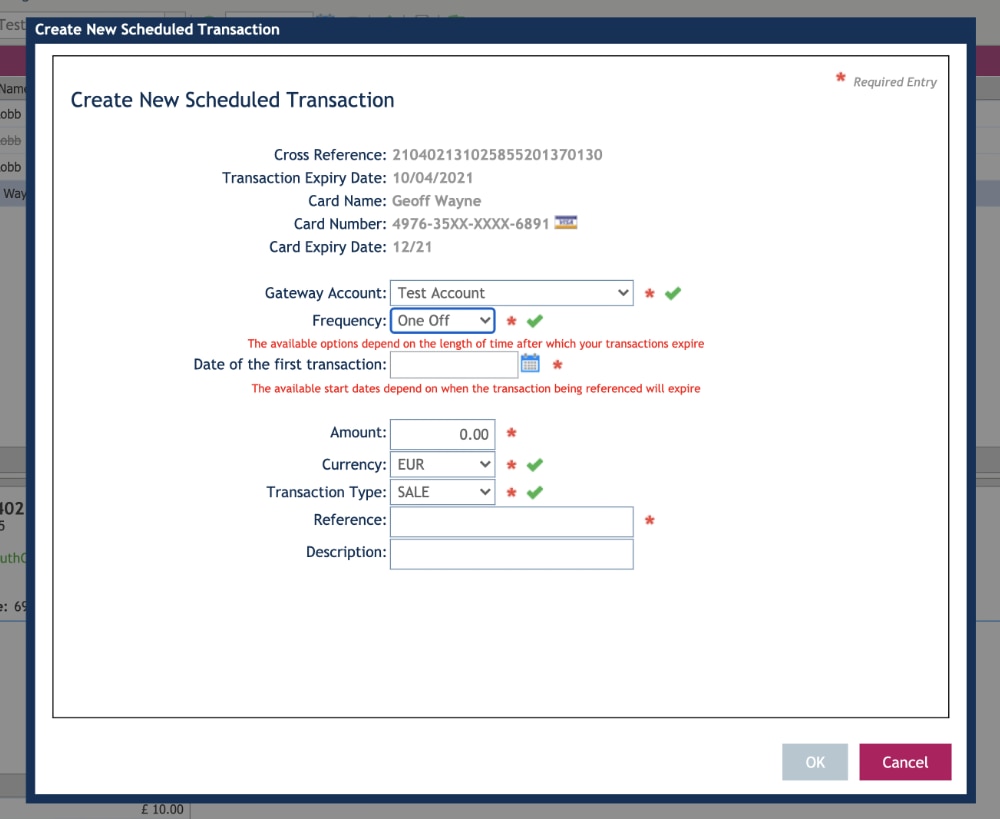

To save time creating a new payment for the same customer, you can reuse old transaction details with the click of a button. Alternatively, one-off or recurring payments can be scheduled, which is useful for subscriptions and ongoing services.

What are the best alternatives?

Compare leading virtual terminals in the UK

Takepayments fees

All merchants get a personalised quote based on their business, expected card turnover and transaction value. The best transaction rates are given to businesses with high average transaction sizes.

The virtual terminal plan comes with a 12-month contract where you pay a monthly or annual subscription. There’s no setup fee, but you are responsible for an early termination fee if cancelling the contract before the year is up. It’s required you give at least 60 days’ notice by the end of the term to avoid rolling into another year’s commitment.

| Takepayments Virtual Terminal | Charges |

|---|---|

| Setup fee | None |

| Monthly fee | Max. £19/mo. (custom plans) |

| Contract | 12 months |

| Transaction fees | Free quota of transactions included/mo. Beyond free quota: Transaction fee + fixed fee (both custom) |

| PCI-DSS compliance | Barclaycard: £15/mo. (mandatory) Takepayments: £35/yr. (optional) |

| Chargebacks | £9 each |

| Refunds | 30p each |

| Early termination fee | Equivalent to remaining contract cost |

| Takepayments Virtual Terminal |

Charges |

|---|---|

| Setup fee | None |

| Monthly fee | Max. £19/mo. (custom plans) |

| Contract | 12 months |

| Transaction fees | Free quota of transactions included/mo. Beyond free quota: Transaction fee + fixed fee (both custom) |

| PCI-DSS compliance | Barclaycard: £15/mo. (mandatory) Takepayments: £35/yr. (optional) |

| Chargebacks | £9 each |

| Refunds | 30p each |

| Early termination fee | Equivalent to remaining contract cost |

The monthly cost varies depending on the online payment methods needed. A full ecommerce package with other online tools costs a maximum of £19 + VAT monthly. If you just want the virtual terminal, the price is lower.

The subscription fee includes a custom number of “free” transactions per month without transaction charges, e.g. 350 phone payments. Beyond the free quota, you typically pay a fixed fee like 10p on top of a card rate per virtual terminal payment.

The card rates depend on the type of card being used. For example, premium and foreign cards incur higher fees than a consumer Visa card from the UK. Currency conversion charges may also apply if the currency of the cardholder account is different from your transaction’s currency.

Takepayments is likely to set you up with a Barclaycard merchant account, responsible for processing your virtual terminal transactions. If a customer disputes a payment, you pay a £9 chargeback fee to Barclaycard. Refunds cost 30p each to process. Settlement is free with Barclaycard.

PCI-DSS compliance paperwork is required for using the virtual terminal. Barclaycard charges a compulsory fee of £15 per month for PCI compliance, so that is something to factor into your ongoing cost. If you’d rather have someone else deal with PCI-DSS compliance (it does take effort to manage), Takepayments can help you for £35 per year.

What is it best for?

Many types of businesses would find Takepayments Virtual Terminal useful, particularly in the age of Covid-19 when remote payments are the only way for many to keep trading at a safe distance.

Since merchants with high average transaction sizes save the most money from the free monthly transactions and lower card rates, we can recommend it for:

Many other professional services can use the virtual terminal to take bookings and deposits over the phone. The scheduled payment features can be really useful for booked services or repeat payments. Retailers selling face-to-face, online or via payment links may also get a virtual terminal for added payment flexibility.

Credit: Mobile Transaction

You can schedule payments in advance.

Takepayments’ rates can be high for small transactions, so cafés and off-licences may not be the best matches. Those who mostly sell on the go may also struggle with the interface on a mobile device, since it’s designed for desktop.

Companies shipping internationally will benefit from the choice of payment currencies in euros and US dollars in addition to British pounds.

Getting started

To get the ball rolling with Takepayments, you need to fill in an online form with contact details on the website. You will then receive a callback with a sales rep who will listen to your requirements and give a quote based on your situation. Takepayments likes to schedule an in-person visit where appropriate.

The contract is provided before you sign up – make sure you read this in full so you’re aware of any potentially hidden fees or responsibilities. Normally, Takepayments is transparent about all their fees upfront, but you may need to ask for clarification on certain Barclaycard charges, for example.

After signing the contract, you may need to complete certain PCI-DSS documents, which may require help from Takepayments. Otherwise, you should soon be good to go with phone payments.

Customer service

Takepayments customer support is available to call every day of the week, but only during office hours: weekdays between 8am-7pm, Saturdays and Bank Holidays between 9am-5pm and Sundays between 9am-1pm.

Since it isn’t the most intuitive interface, it may take a bit of effort to get to know all your virtual terminal-related features. There’s a user guide to help you navigate the MMS account, should you need it. Otherwise, Takepayments support does a good job of supporting when you call them.

Looking for payment links? Compare best pay-by-link providers

Our verdict

The virtual terminal by Takepayments is a reliable, standard solution for taking payments from customers over the telephone.

As long as you’re on a computer, you can easily key in payments for simple amounts, itemised orders, recurring transactions and preauthorisations. It is not user-friendly on a phone, though, so we do not recommend it for transactions on the go.

You get all the standard features expected from a reputable virtual terminal, but certain limitations still apply such as the lack of integrations with accounting software or inventory. Even if you’re renting Takepayments’ card machines, the virtual terminal portal is not connected to your in-person payments.

That being said, Takepayments’ virtual terminal is a professional service with a fairly-priced subscription for regular phone payments and/or high transactions taken remotely. It’s unlikely you’ll need more features, and a year is not long to commit to for this kind of payment provider.