- Highs: Versatile features. Multi-currency support. Preauthorisation option. Can add other online payment features.

- Lows: Can only send links from browser. Outdated user interface. Contractual commitment. Monthly fee.

- Choose if: You want a full range of browser-based pay-by-link features with tailored pricing.

How it works

Takepayments (previously Payzone) is a merchant service provider offering tailored payment solutions including card machine rental, online payments and card processing contracts.

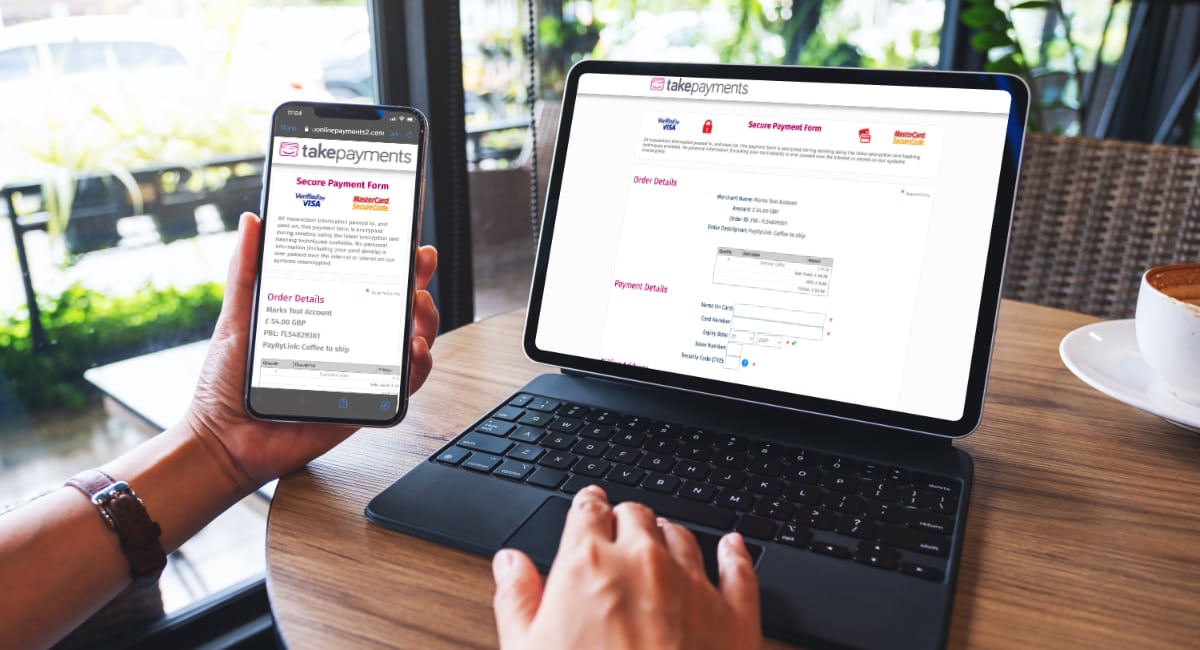

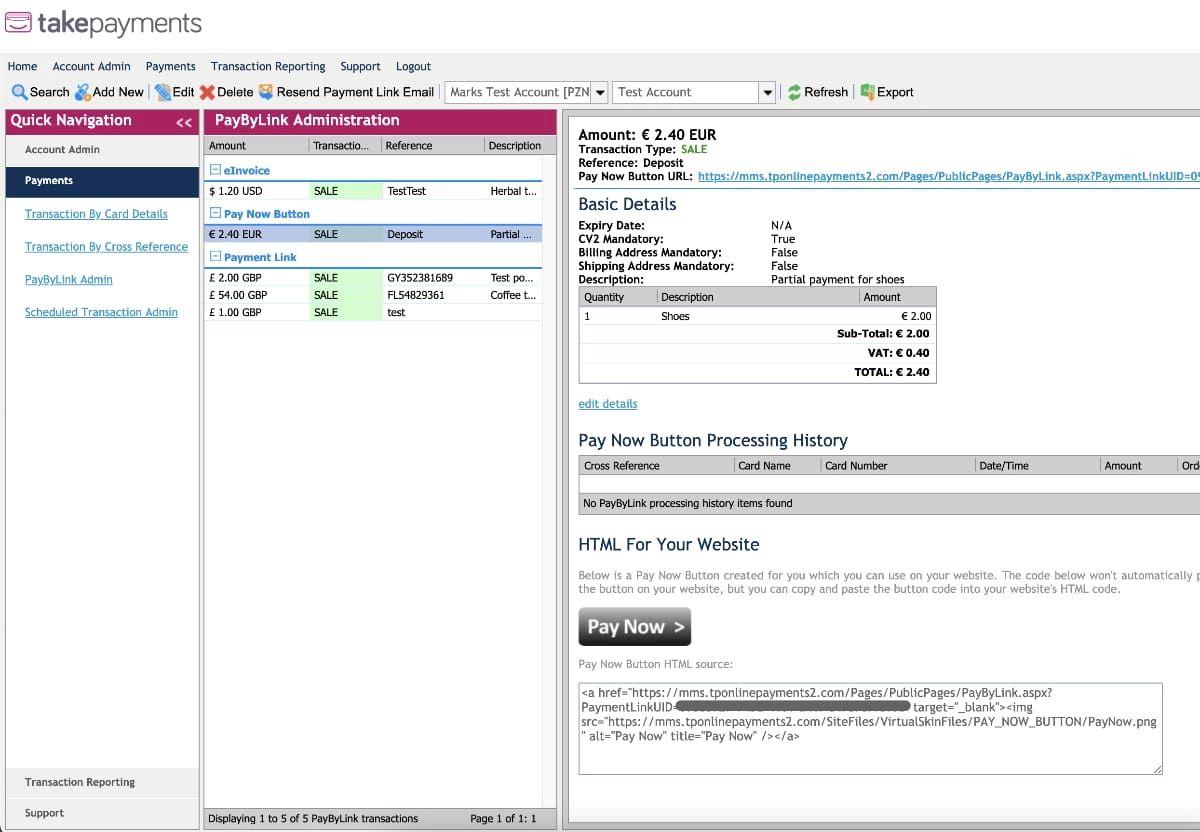

The Pay by Link service in particular allows you to accept transactions online via different kinds of payment links. These are created, sent and managed through a browser in the Takepayments Merchant Management System (MMS) that you get access to with a username and password.

You can log in through a smartphone or tablet browser, but the outdated MMS interface does not make it easy to navigate. For example, links and text have very small writing, making it harder to click on different sections and functions. It is much easier to use on a desktop computer, even though fonts are still tiny and the navigation not that intuitive.

Credit: Mobile Transaction

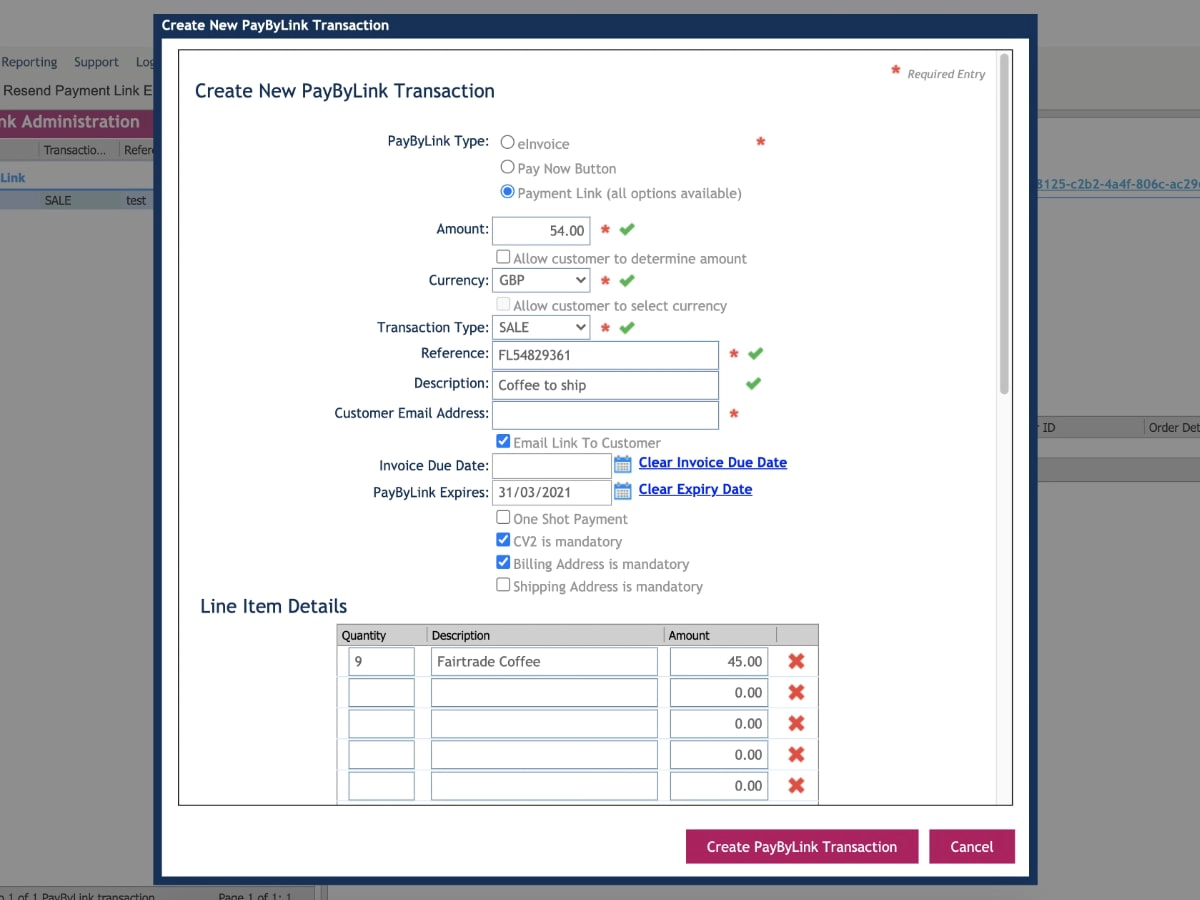

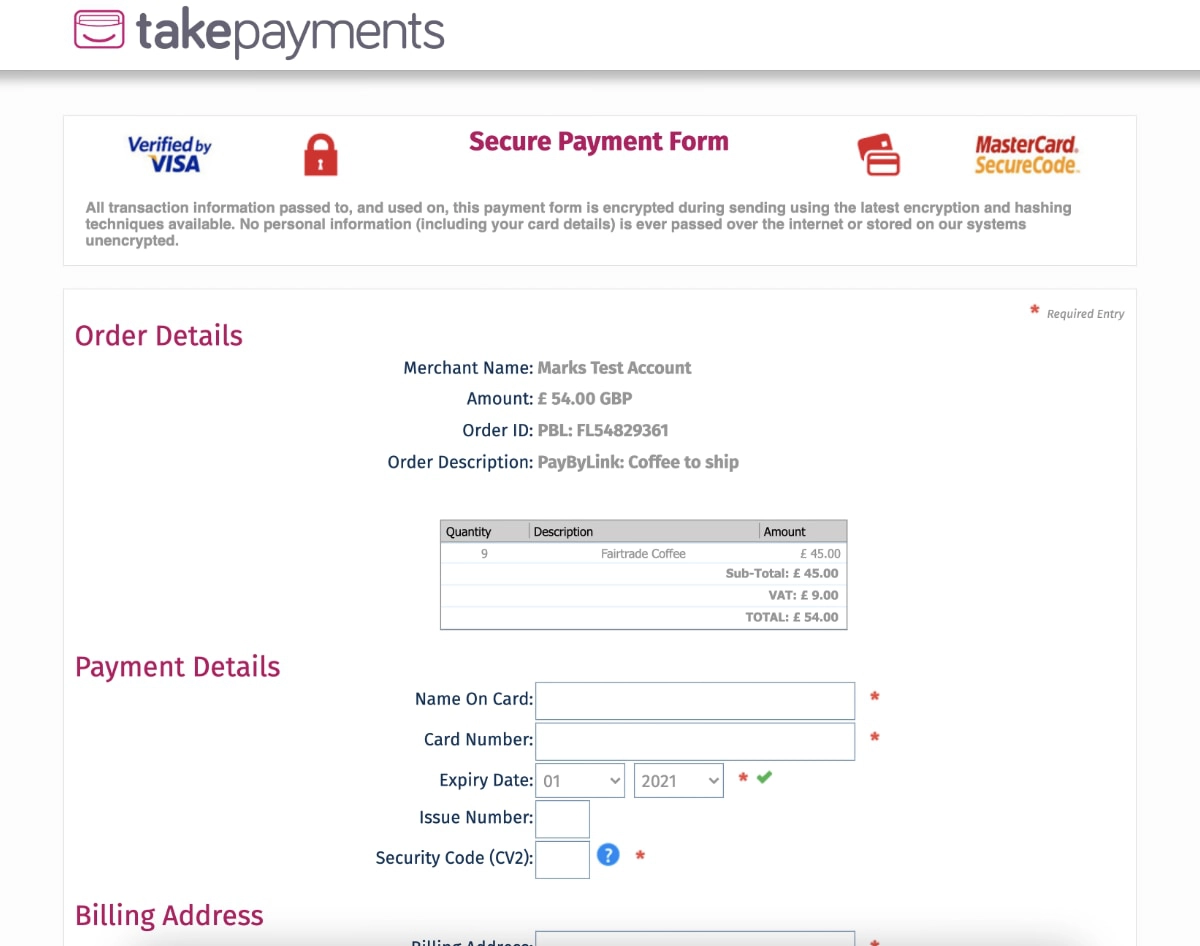

You create a payment link through the Merchant Management System in a browser.

You can generate these different types of payment links:

All of these Pay by Link (or “PayByLink” as they also spell it) options let you itemise the transaction, add tax and require the payer to submit various combinations of billing and security details on the payment page. You can also set the transaction currency to either GBP, EUR or USD. There’s quite a bit of control here, which is great!

Interestingly, you can control if the payer’s transaction goes through even if they make a mistake filling in their address, card security code or fail the 3D Secure check required as standard for online transactions.

Credit: Mobile Transaction

The MMS interface works smoothly, but is very “Windows”-style.

Takepayments Pay by Link also includes the option to preauthorise card details, which many hotels, travel agents and other booking services require to ensure a customer can pay for a high-value transaction.

Online transactions take two working days to reach your bank account. The payment page accepts Visa, Mastercard and Maestro, with options to add American Express and other card brands.

Completed transactions are shown in the MMS and can be exported in a spreadsheet, but there’s no option to integrate with accounting software. The MMS allows you to manage links, e.g. deactivating or resending, and handle general business settings.

What are other pay-by-link solutions in the UK?

Overview of 7 leading payment link providers

Takepayments fees and contract

With Takepayments, every merchant gets a personalised quote based on their type of business, sales volume and choice of plan. There is no setup fee for getting started.

Payment links require a monthly or annual subscription, which can be max. £19 + VAT per month if you choose the full ecommerce package. If you only need payment links without additional features, the package cost is lower. A subscription applies to all of Takepayments’ online payments features, even if you already have a card machine contract with the company.

| Takepayments Pay by Link | Charges |

|---|---|

| Monthly or annual plan | Max. £19/mo. (custom plans) |

| Contract | 12 months |

| Transaction fees | Custom no. of free transactions included/mo. Beyond free quota: Transaction fee + fixed fee (both custom) |

| PCI-DSS compliance fees | Barclaycard: £15/mo. (mandatory) Takepayments: £35/yr. (optional) |

| Chargebacks | £9 each |

| Refunds | 30p each |

| Takepayments Pay by Link |

Charges |

|---|---|

| Monthly or annual plan | Max. £19/mo. (custom plans) |

| Contract | 12 months |

| Transaction fees | Custom no. of free transactions included/mo. Beyond free quota: Transaction fee + fixed fee (both custom) |

| PCI-DSS compliance fees | Barclaycard: £15/mo. (mandatory) Takepayments: £35/yr. (optional) |

| Chargebacks | £9 each |

| Refunds | 30p each |

The monthly fee covers a certain amount of online transactions (decided at sign-up), i.e. you do not pay a transaction fee for those. This could, for example, be 350 free online payments a month. Beyond this quota, you pay a premium – typically 10p – on top of a base transaction rate, also determined when signing up.

There is a mix of transaction fees depending on the type of card being used and whether currency conversion occurs. Foreign, premium and corporate cards typically cost more to accept, whereas domestic Visa and Mastercard debit cards cost least.

All packages come with 12 months’ lock-in that has to be cancelled at least two months before the end of the contract – otherwise, it renews for another year. If you want to exit the plan before the 12 months, an early cancellation fee applies, which is typically the cost of the remaining contract.

If Barclaycard – the preferred credit card processor of Takepayments – processes your Pay by Link transactions, a 30p refund fee and £9 chargeback fee applies. Settlement into your bank account is free.

PCI-DSS compliance (card data security standard) incurs a monthly fee of £15 to Barclaycard. Takepayments can help you manage the paperwork associated with this for £35 per year.

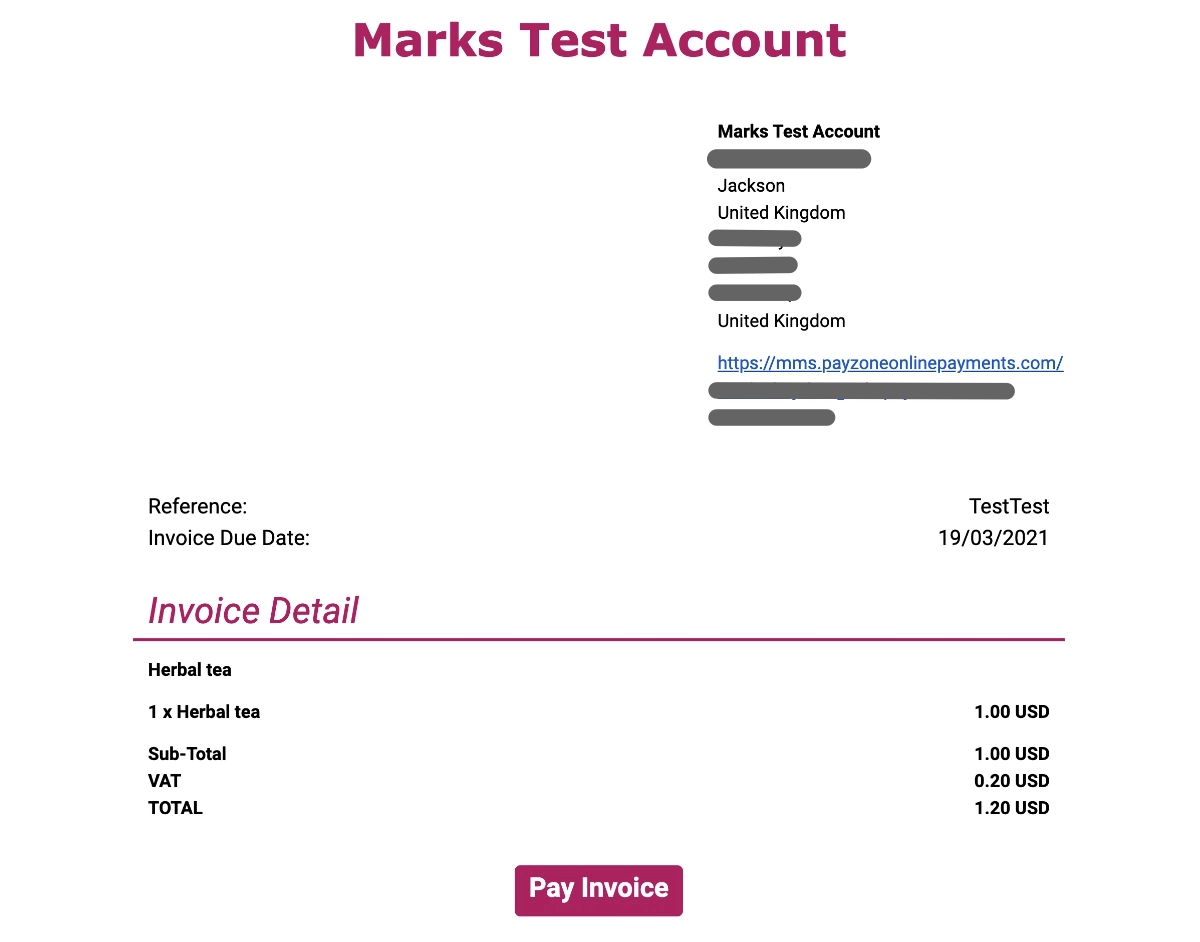

Credit: Mobile Transaction

Example of an eInvoice by Takepayments.

The Pay Now Button and Payment Link options allow you to require a shipping address, making them ideal for takeaway websites and other delivery services.

You can use it as a click and collect solution – if a payment page specifying the items for collection is enough for you. This is more of a manual solution, as the items on the payment page are not linked to an inventory library or delivery notifications system. Consequently, you have to find a way to monitor the online transactions so you can prepare collections in time for the pickup.

Credit: Mobile Transaction

All links open up a payment page in your mobile or desktop browser.

Since the web account is much more tedious to use on a small screen, we don’t recommend Takepayments Pay by Link for merchants who need to send links on the go. It is far better for those managing payments from a laptop, which is what the MMS interface is geared towards. That said, the payment page that your customer sees is fine for mobile screens.

Getting started

To get started with Pay by Link, you first need to complete an online form with contact details. A Takepayments representative will then get in touch the same day to discuss your requirements and costs, and schedule a visit for an in-person chat if appropriate.

Before you sign a contract, make sure you read the small print in detail so you know about the requirements for cancellation and possible hidden clauses. After agreeing to everything, it should be quick to get up and running with online payments.

Customer support

As a Takepayments merchant, you can phone customer support between 8am-7pm on weekdays, 9am-5pm on Saturdays and 9am-1pm on Sundays. Support is also open on Bank Holidays between 9am and 5pm.

In the beginning, it may take some time to familiarise yourself with the Pay by Link features, as it is not entirely intuitive to use. A detailed help guide is available, which helps you understand all of the sections of the MMS account. You can also ask Takepayments for help any time (within working hours) if needed.

What other online payment methods are available?

See different online payment systems in the UK

Our verdict

Takepayments Pay by Link very much appears like an old email invoicing product (hence the not-modern interface), but it actually has a decent range of features to accommodate for the changing needs of merchants today. Certain limitations do apply, though, such as lack of accounting integrations.

As long as you’re happy managing the links from a laptop rather than a phone, you’ll quickly get used to the interface and want to experiment with different payment requests. The monthly fee is fair for what you get, but you do need to be happy with an annual contract.

If you require a full ecommerce setup with a website or integrated click and collect solution, then Pay by Link on its own will not cut it. Instead, Takepayments offers “beeonline” packages ranging between £39-£139 + VAT per month. This includes a hosted website built for you, product management and online ordering features.