There’s no shortage of invoice apps in the UK, but they vary hugely in costs and features – so which are trusted by small businesses? Only a few.

Many companies offer an invoicing app as an added extra to a main product. They can be grouped into:

- Invoicing in accounting software

- Invoicing from payment company

- Invoicing from digital bank

Some allow you to receive payments directly through the invoice through a link, others are not integrated with a payment system. For instance, certain apps just have free invoice templates where you can include your bank details for a manual bank transfer.

We’ve tested different invoicing apps and shortlisted what we think are the best options.

Best invoice apps for a small business in the UK:

| Invoice app | Features | Pricing |

|---|---|---|

| Payment services, free app and business tools, easy sign-up | Free or £20*/mo 2.5% /card transaction 6% + 30p for Clearpay |

|

| Extremely easy online account app with sole trader features | Free 1%-2.8% + 20p /card transaction 1% + 20p (max. £1) for bank transfers |

|

| Accessible app, more features in browser, next-day payout account | £0-£7*/mo 2.5% (Free plan) / 1.25% (Pro plan) |

|

| Full range of accounting features, good invoice tracking | £10-£115*/mo 1%-2% + 20p (max. £4) /bank transfer 1.45%-2.9% + 30p for PayPal |

|

|

Advanced free invoice app, linked to accounting if needed | Free + add-ons 2.3%-3.45% /card transaction |

| Good business account app, basic invoicing features | £9-£25/mo 1.5%-3.25% + 20p /card transaction Free bank transfers |

|

| Software dedicated to invoicing, all-round invoice tools | £4.17-£29.99*/mo 1.9%-3.9% + 20p /card transaction 2.9% + 30p for PayPal |

|

| Extensive accounting system, invoicing features tiered according to plans | £16-£59*/mo 1.5%-3.25% + 20p /card transaction From 1% + 20p for bank transfers |

|

| Online business tools, quick payments via email, recognisable brand | Free From 2.9% + 30p /card transaction |

*Excluding VAT.

What to look for in invoicing apps

Like most life admin today, invoicing is usually done online, via email.

Many sole traders and small businesses also like to send invoices from a mobile app, which is what we’re looking at in this article. So what should you consider when choosing an invoice app for billing clients?

First of all, all invoicing solutions should as a minimum comply with GOV.UK’s invoice requirements by including certain information like a unique invoice number, customer address, payment due date and a list of products charged for.

You should also consider the features that help you get paid promptly and make your business look more professional:

- Card payment acceptance: Bank transfers may be cheaper, but card payments via a digital invoice reduce payment time – important for cash flow.

- Payment reminders: One of the most effective ways to prevent non-payment is to send payment reminders, which many invoicing apps automate.

- Invoice customisations: Adding a company logo, colour scheme, fonts and design allows you to match your brand with the invoice, but not all apps can do it.

- Terms and conditions: Some businesses have custom terms and conditions for their services, so it’s worth checking if you can attach files or edit a T&C template.

Other questions to consider is whether the invoice software should integrate with accounting or a specific payment system.

Square – best features in a dedicated app

We think Square Invoices is the best free invoice app in the UK. It’s easy to use, and you can accept card payments directly through the invoice for 2.5% per card transaction or 6% + 30p per Clearpay transaction (buy now, pay later).

“I’ve always had a positive experience when testing Square Invoices. The app is regularly updated, easy to use and with an impressive amount of features. It’s the best free invoice app, in my opinion.”

– Emily Sorensen, Senior Editor, Mobile Transaction

It’s free to use the basic app features, including unlimited invoices – you only pay when the client pays online through the link in the email invoice. The paid Plus subscription has more advanced features, like custom layouts and organising project files into folders.

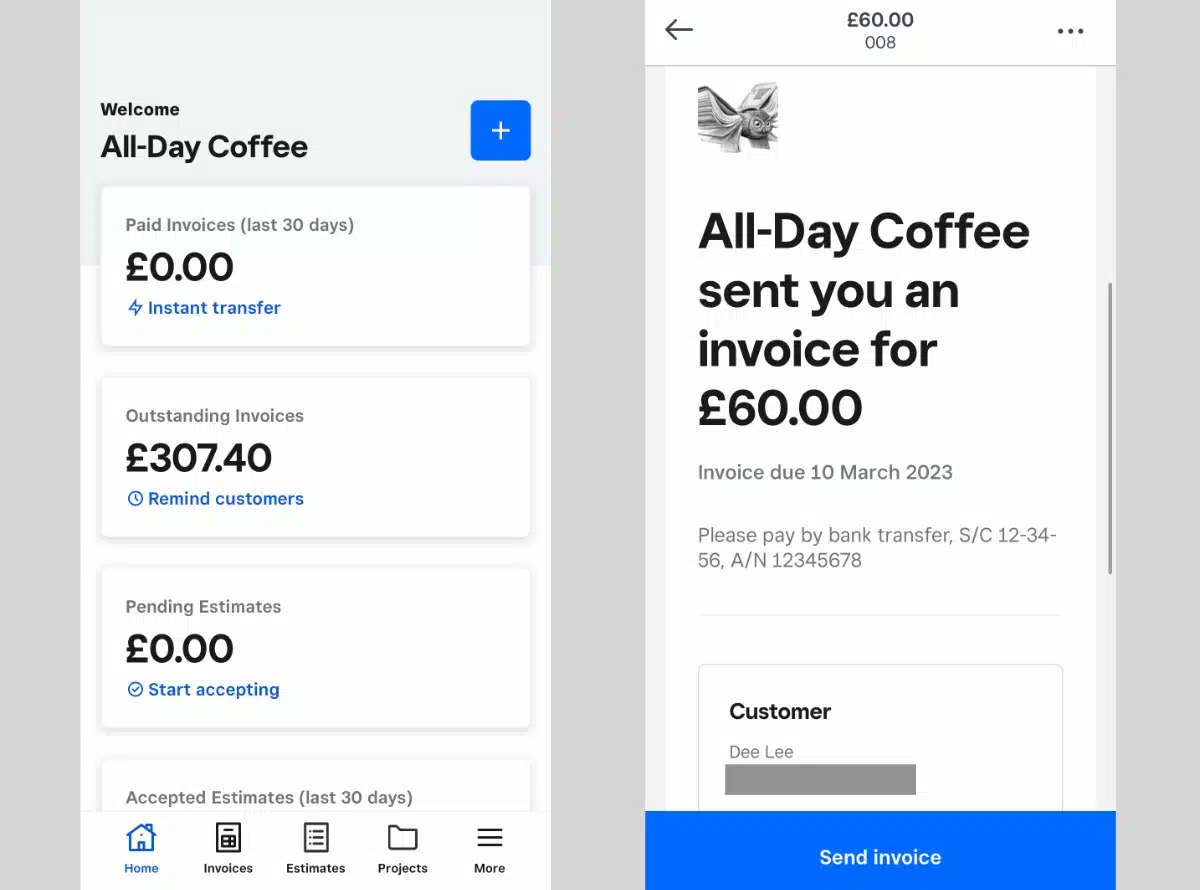

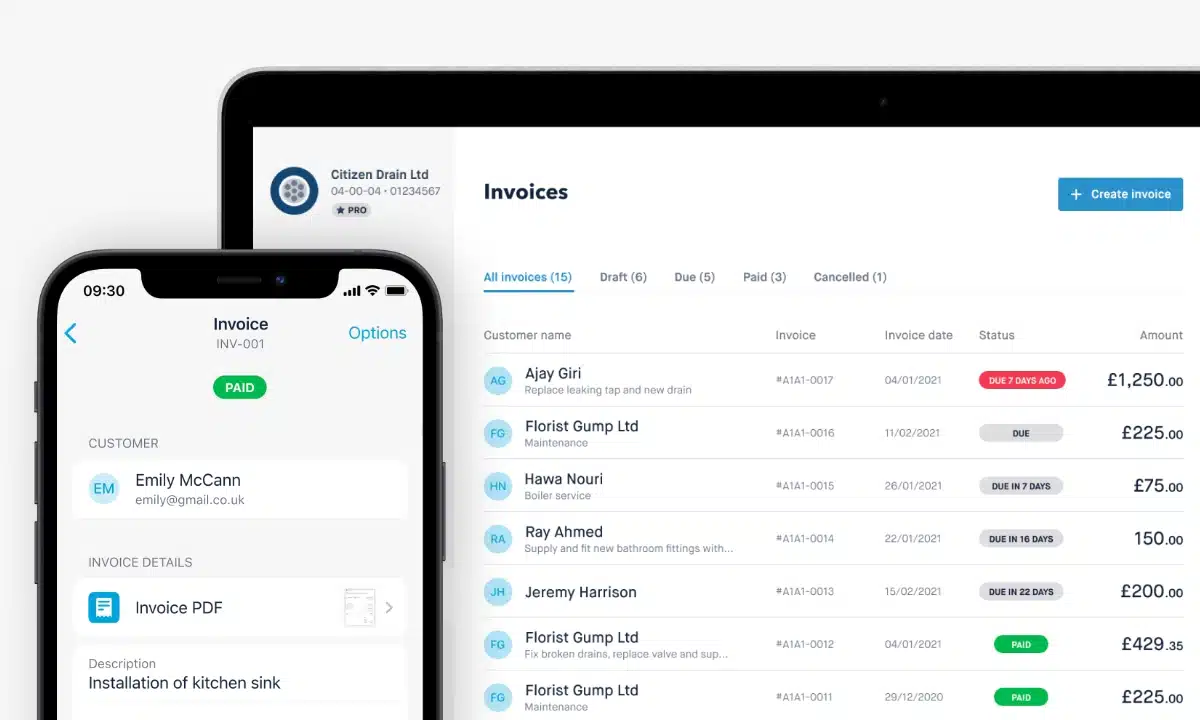

Image: Mobile Transaction

Square Invoices has more features than other free invoicing apps.

Payments are deposited in your bank account the next working day, or sooner if you opt for Instant Transfers (for an extra 1.5% fee). When signing up through the simple online form, Square performs identification checks to verify your business and bank account.

It can take up to 4 working days to get the bank account linked, but it’s possible to accept invoice payments sooner where the money pends in the Square account.

The paid plan allows you to send estimates converting into invoices when the client accepts the quote. You can also set up recurring invoices, invoice tracking and deposit requests.

If the client does not pay directly through the invoice link, you can mark invoices as paid with cash, gift cards, Bacs or another method.

Pricing

Monthly cost: £0 (Free plan), or £20 + VAT (Plus plan)

Card processing: 2.5% transaction fee

Instant Transfers: Additional 1.5% of transaction amount

Existing users of Square Reader can already send invoices through the Square Point of Sale app for the same fee. If you have the Square Reader, you can even accept invoice payments directly through the invoice app, if the card is physically processed in the card reader, for the lower fee of 1.75%.

Integrated payments: Square (Visa, Mastercard, Maestro, American Express), Clearpay

Best for: Most accessible solution to receiving invoice payments in your bank account.

Revolut – just enough advantages to make it great

Revolut offers a feature-rich business current account (not bank account) for merchants that charge across borders. Two accounts are available:

- Revolut Pro for sole traders (free): A personal account with added business tools useful for individual freelancers – very easy sign-up

- Revolut Business for companies (from £0/month): A business account with a full range of business features, e.g. expense management – sign up here

Email invoices can be generated in any of these accounts and managed in the Revolut app.

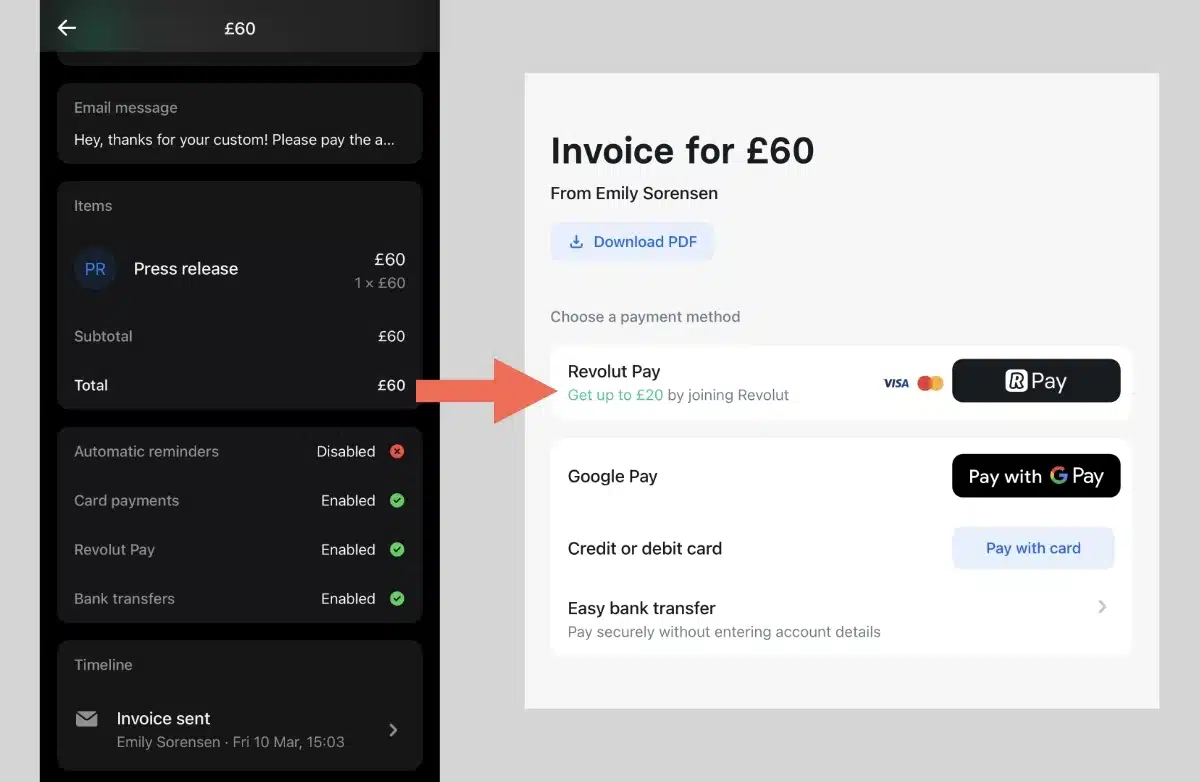

Image: Mobile Transaction

Revolut lets you send invoices to pay via card, bank transfer, mobile wallet or Revolut Pay.

The invoicing feature is accessed via a Merchant dashboard on your iPhone or Android phone. You can choose between sending a payment link or email invoice (among other payment options).

When you choose ‘invoice’, a user-friendly screen lets you create one. You can add a customer (new or saved), message for the email, currency (28+ to pick from), item(s) and costs, and an invoice note. Invoices can recur on a schedule or be sent as a one-off, with or without automatic reminders to pay.

We really like the fact you have full control over the payment methods presented to clients. This includes card payments (Visa, Mastercard, Apple/Google Pay), Revolut Pay (from other Revolut accounts), and streamlined bank transfers where the payer doesn’t need to manually enter account details.

Pricing

Monthly cost: Free Pro account, £0-£100 for Business account

UK consumer cards, bank transfers, Revolut Pay: 1% + 20p per transaction

All business and non-UK cards: 2.8% + 20p per transaction

The easy bank transfer option lets the payer pick their bank from a list and verify the payment via their banking app, which is simpler than manually entering account details.

“I found it fast and easy to create Revolut invoices and accepting payments through them. It’s big plus for me that the invoices include both card payment and streamlined bank transfer options to maximise the chance of a fast payment.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Transaction fees are low for domestic consumer cards and bank transfers, while all other cards cost more.

The fact you can opt for a free account plan makes Revolut great value, particularly if you need a multi-currency business account to save money on cross-border transfers.

Just beware that all of the payment features are only available with a Merchant Account requiring a separate application after getting the Pro or Business Account. Once approved, you receive payouts within 24 hours in the Revolut account.

Integrated payments: Visa, Mastercard, Apple Pay, Google Pay, Revolut Pay, bank transfer

Best for: Revolut account users whose clients like a choice between card and bank payments.

SumUp – better than average for a free solution

SumUp is best known for their cheap card readers and payment features for small businesses. But the platform has added a wealth of new features to help merchants receive payments remotely, including digital invoicing.

SumUp Invoices can be created, sent and managed from SumUp App.

SumUp has no contract terms, and there’s no monthly fee for standard-template invoicing, just a pay-as-you-go rate of 2.5% per card transaction.

Upgrading to the Pro plan gives you invoice customisations, bank transfers to any bank account, and 14 invoice languages. Crucially, the transaction rate drops to 1.25% for all cards on Pro.

It’s easy to get started: just sign up on the website, connect your bank account and start invoicing clients from the SumUp App or browser dashboard.

SumUp App is actually a payment and simple point of sale (POS) app. It has a product library, transactions overview and checkout interface for accepting cards, cash, QR code payments, keyed transactions and payment links.

In another section of the app, you can create, manage and monitor invoices and quotations with your own terms and conditions attached.

Pricing

Monthly fee: £0 (Free plan) or £7 + VAT/month (Pro plan)

Transaction fee: 2.5% (Free plan), 1.25% (Pro plan)

There is no limit on how many email invoices you can send, and items from your library of products and customers can be added. If you log into your SumUp account on a computer, you can create credit notes and delivery notes as well, neither of which are available in the app.

“Apart from the very user-friendly invoice management in SumUp App, I was struck by how professional the extra invoicing features in the browser dashboard are.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Payouts take 1-3 working days to reach your bank account. With the free SumUp Business Account and Card (online account and prepaid debit card), you can receive transactions the next day, including on weekends.

Integrated payments: SumUp (Visa, Mastercard, Maestro, American Express, Diners Club, Discover, JCB)

Best for: Selection of free payment methods, not just invoices, from the same app.

QuickBooks – best with accounting software

Mostly known for accounting software, Intuit QuickBooks’s invoicing is an integral part of their offering too. All the tiered QuickBooks packages include a variety of business tools, so this is a good choice for managing your books and invoices in one place.

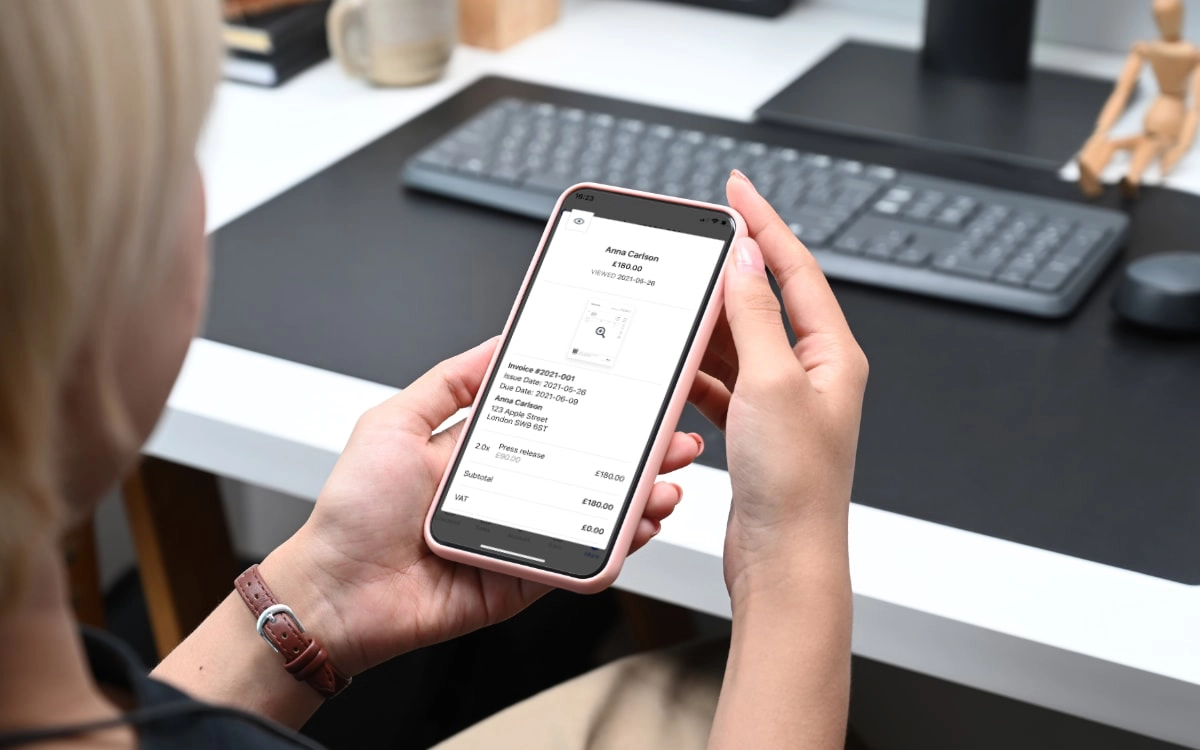

The QuickBooks invoice app gives an intuitive overview of paid and outstanding payments.

If you’re already using QuickBooks for bookkeeping, you might as well use its invoicing, included to some extent on all plans. The less dispersed your documents, invoices and receipts are, the more streamlined your admin can be.

A plus is that QuickBooks is HMRC-recognised and adheres to the government-incentive Making Tax Digital.

The app is compatible with iPhone, iPad and Android devices.

The number of invoicing features depends on your plan. The cheapest subscription, Self-Employed (£10 + VAT/month), is for sole traders who are not VAT-registered. It includes unlimited invoices by email and the ability to track which ones have been read.

The next tier, Simple Start (£16 + VAT/month) is for sole traders and companies, whether VAT-registered or not. This plan has more customisation tools, payment tracking, recurring invoices and the ability to accept invoice payments online.

Pricing

Monthly fee: £10 + VAT/mo for Self-Employed, £16 + VAT/mo for Simple Start

GoCardless bank transfer: From 1% + 20p for (domestic) and 2% + 20p (international)

PayPal payments: From 1.45% + 30p for Visa and Mastercard, 3.5% for Amex, 2.9% + 30p for PayPal Wallet

Higher plans generally do not include more invoicing functions, only more accounting tools. The Advanced plan (£115/month) lets you send batch invoices, though.

You can either accept payments outside the QuickBooks system and mark when invoices are paid, or accept payments through a link on the electronic invoice (except on the Self-Employed plan).

The latter can be done as a GoCardless Direct Debit integration which has no setup fee or monthly costs, just a transaction fee from 1% + 20p. PayPal can be integrated too – but again, only on Simple Start and higher plans.

Integrated payments: PayPal (Visa, Mastercard, American Express), GoCardless Direct Debit

Best for: SMEs wanting a complete, HMRC-compliant invoicing and accounting system.

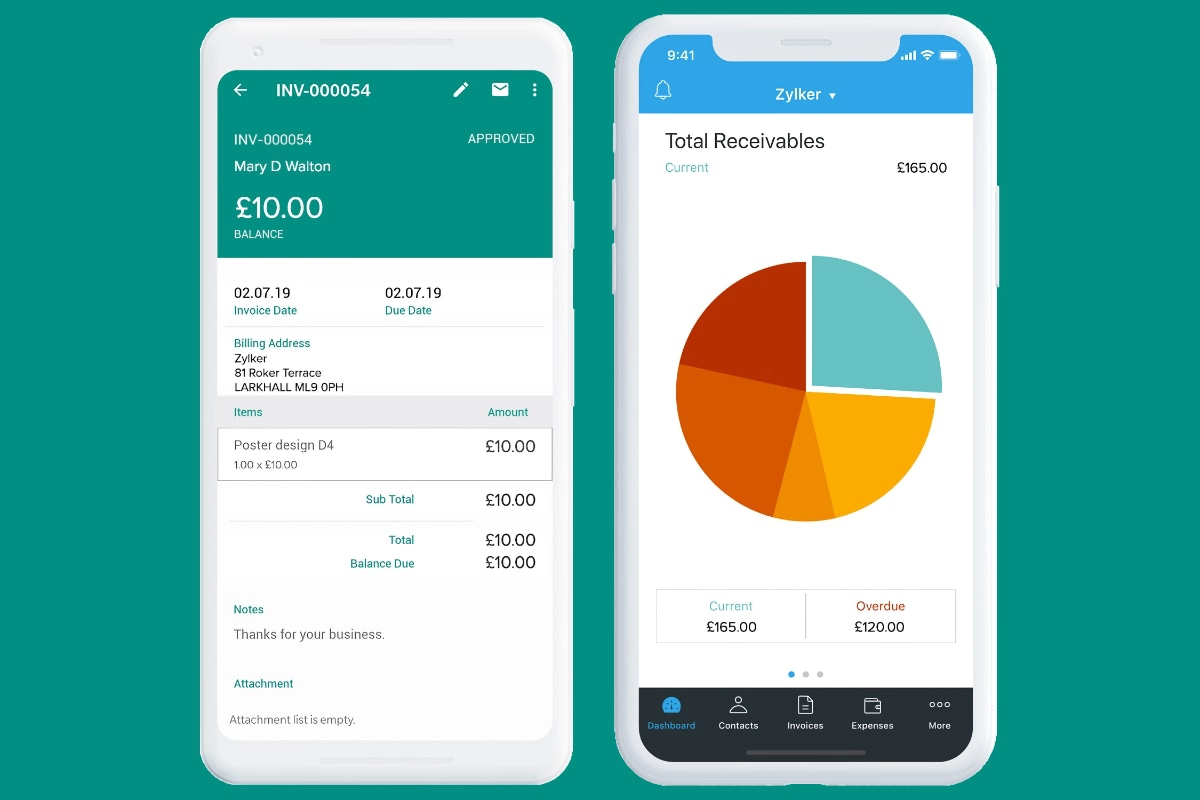

Zoho – “forever free” invoice app with many features

Zoho is another all-round accounting system. Their invoice app is free with no contract or tiered plans – but it does have optional add-ons. Still, you get detailed invoicing features without a paid subscription.

If you only want to create a PDF invoice to download or send from your phone, you can also do that free without creating a login or signing up for anything in the Zoho Invoice Generator app (separate from the main Zoho Invoice app).

Zoho Invoice is compatible with macOS, iOS, Android and Windows phones and tablets.

The invoicing apps are supported on macOS, iOS, Android and Windows mobile devices. To be clear: the Invoice Generator app is a separate app you can download and use for free. What we describe below requires the free Zoho Invoice app, which has more features.

Features include recurring invoices, estimates, retainers, expense tracking, time tracking, multi-currency features, digital signatures, automated workflows, integrations with external apps, and much more.

The Zoho Invoice app lets you create up to 1000 per year, adapted to comply with your local tax laws, language and currency.

Pricing

Monthly cost: None, but add-ons may apply

Transaction fees: 2.3% (incl. service tax) for domestic cards, 3.45% (incl. service tax) for other cards

The standard transaction fee is 2% for domestic cards or 3% for international cards, plus a “service tax” of 15%, through the invoices. This is more expensive than other solutions, especially since payouts take 2 working days.

You can integrate the invoices with other payment systems, though.

Integrated payments: Braintree, CSG Forte, GoCardless, PayPal, Square, Stripe, Verifone

Best for: Cheap way to start small, with options to expand features later on.

Monzo – free account-to-account payments

The online bank Monzo offers a decent business account that can be used for free.

If you need invoicing, you can subscribe to Pro for £9 monthly or Team for £25 monthly without contractual obligations. This adds features like accounting integration, multi-user access, tax pots and digital invoicing.

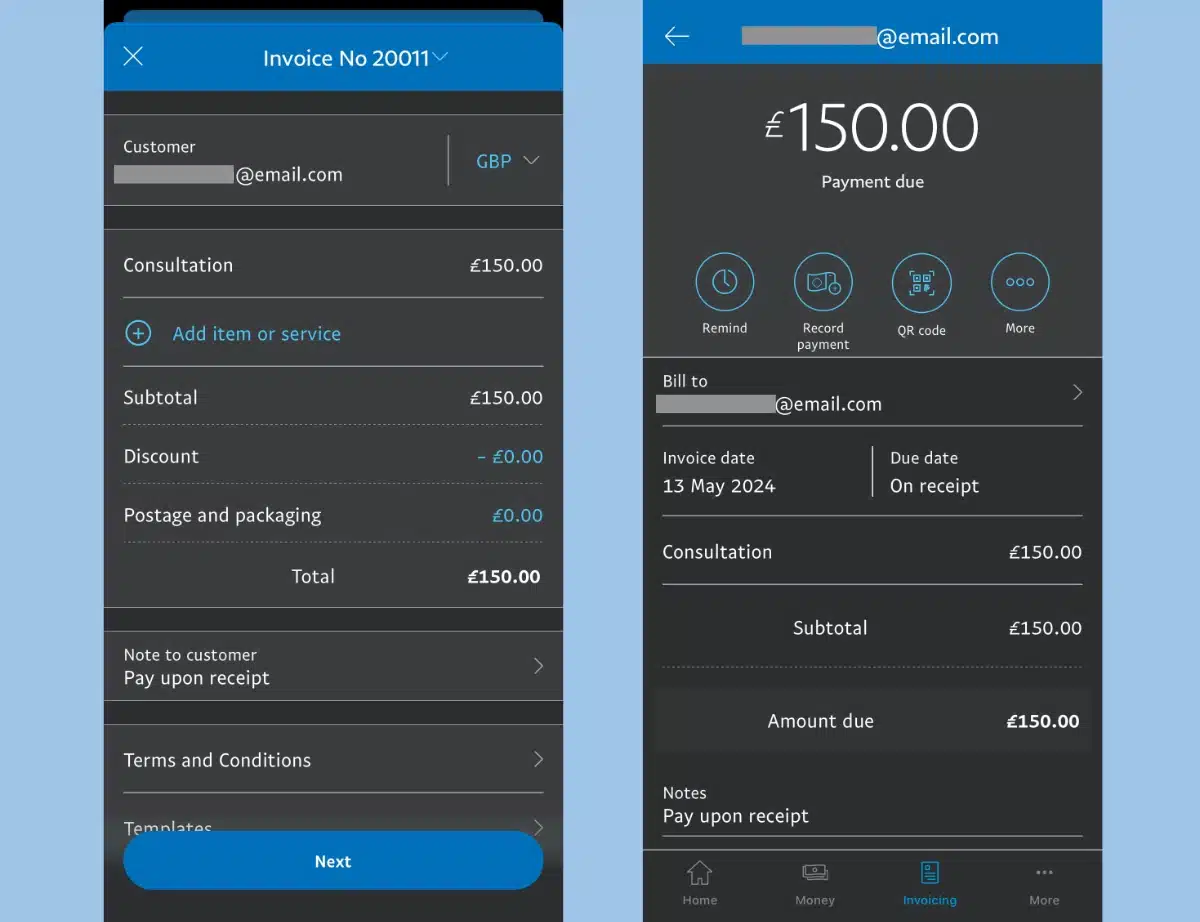

Image: Monzo

Monzo Bank offers an in-app invoicing solution with a streamlined bank payment option.

Once subscribed, you can generate invoices in the Monzo Business app on your smartphone. Customisation options include products or services paid for, your own logo and a note on each invoice.

Invoices are generated in a PDF format and sent via email, text or messaging app on your phone.

To accept card payments, you have to register with Stripe and connect that with Monzo. This is easily done via the Monzo app. It means transactions are processed via Stripe, so you are charged Stripe’s processing fees.

The biggest advantage of Monzo invoicing is its new integration with “easy bank transfers”, enabling customers to pay via bank transfer in a few taps on their phone. It involves selecting their bank from a drop-down menu and verifying the transaction in their banking app. These payments are free for the rest of 2025.

Pricing

Monthly fee: £9/mo for Business Pro, £25/mo for Business Team

Card transaction fee: 1.5% + 20p (UK consumer cards), 1.9% + 20p (UK premium cards), 2.5% + 20p (EEA cards), 3.25% + 20p (all other cards)

‘Easy’ bank transfers: Free until year 2026

Card payments via Stripe cost between 1.5% + 20p and 3.25% + 20p, depending on the type of debit and credit card. Funds arrive in your Monzo bank account within a few working days, or faster via bank transfer.

Integrated payments: Stripe (Visa, Mastercard, Amex, Google Pay, Apple Pay), bank transfer

Best for: Monzo Business account holders who want the cheapest, easy way to accept bank transfers.

Invoice2go – established invoicing brand

Invoice2go is a well-known invoice app in the UK, which is understandable given its sleek looks and branding, but it does not offer a free app (barring the 30-day trial). It comes with invoice templates, invoice tracking, multi-currency support, customisation, recurrent billing and estimate-to-invoice conversion.

The invoice templates in Invoice2go have several customisation options.

Invoice2go has three plans that can be paid upfront monthly or annually (the latter works out cheapest per month). The cheapest subscription, Starter, includes 30 invoices for the whole year on an annual plan (£4.17/month) or 2 invoices per month on the monthly plan (£4.99/month).

The annual Professional plan costs £6.67/month and includes 100 invoices annually. The same plan paid monthly (£7.99/month) allows for 5 invoices per month.

Premium (£29.99/month on a monthly plan, £25/month on annual) allows unlimited invoices to be sent.

All the subscriptions allow you to have unlimited clients, team members and projects, and send unlimited estimates. The system integrates with Stripe for card transactions that take around 3-5 working days to reach your bank account (or up to 7 working days in some cases – quite slow!).

The higher your plan, the lower is your transaction fee through Stripe.

Pricing

Monthly fee: £4.17-£25/month for annual plans, £4.99-£29.99/month for monthly plans

Card payments: 1.9%-2.4% + 20p for domestic cards and Amex, 3.4%-3.9% + 20p for foreign cards

PayPal transactions: 2.9% + 30p

PayPal is also integrated for a fixed fee of 2.9% + 30p per transaction regardless of the plan, though PayPal tends to add more fees to that.

On the plus side, Invoice2go specialises in invoicing features rather than the general accounting tools that QuickBooks and Xero, for example, offer together with invoicing.

However, many users have reported the app is cumbersome to use, the disappearing of features or data saved in the app, and generally the high price for an increasingly problematic user experience.

Integrated payments: PayPal (Visa, Mastercard, American Express)

Best for: Those who don’t mind paying more for a reputable, dedicated invoice app.

Xero – trusted by bigger businesses

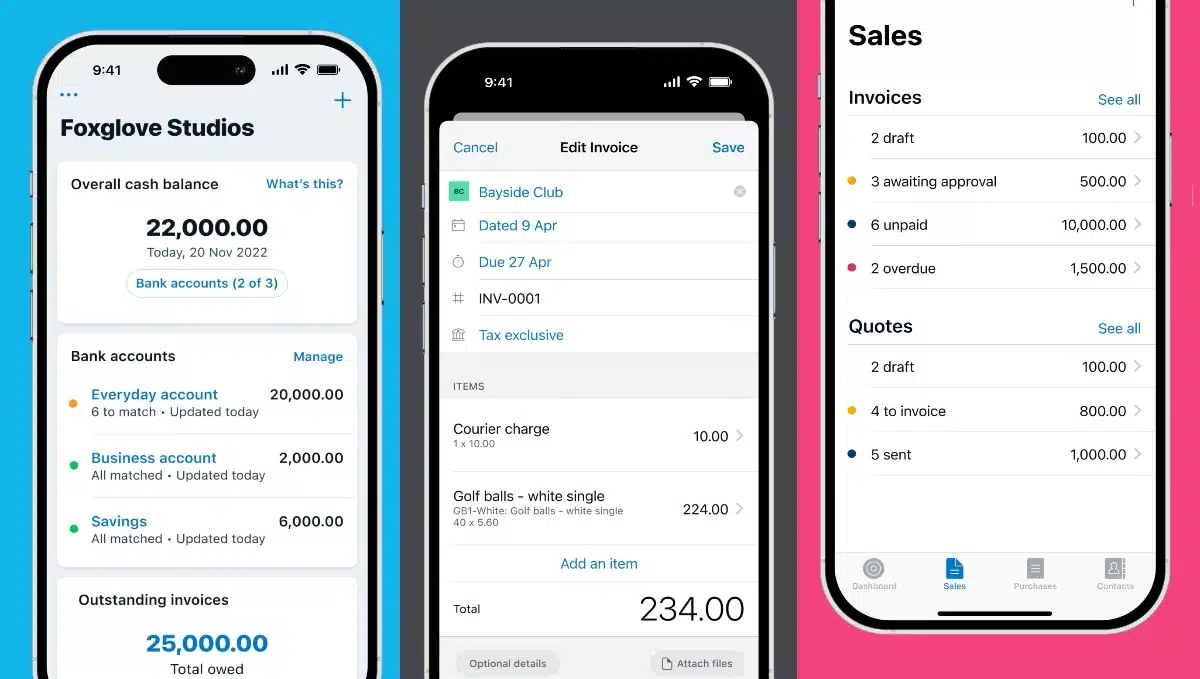

Better known for its advanced bookkeeping software, Xero’s invoicing app (actually the main Xero Accounting app) is approachable for small businesses too.

The app works on iPhone and Android devices, but it’s quite expensive because the plans include accounting functions too. You can’t just pay for invoicing for a lower fee.

The main Xero Accounting app doubles as an invoicing app.

The cheapest plan, Ignite (£16 + VAT/month), lets you send quotes and up to 20 invoices per month from the app and enter 10 bills monthly. The higher plans Grow (£33 + VAT/month), Comprehensive (£47 + VAT/month) and Ultimate (£59 + VAT/month) provide unlimited invoices, quotes and bills.

Regardless of the plan, you get accounting reports, VAT returns to the HMRC and Hubdoc capture of receipts. Grow lets you reconcile transactions in bulk, while Comprehensive also lets you work in multiple currencies.

You can add a button to invoices for accepting cards via Stripe and direct bank payments via GoCardless. Rather than paying transaction fees to Xero, each accepted card payment or Direct Debit transfer incurs a cost via Stripe or GoCardless.

Pricing

Monthly fee: £16-£59 + VAT

Stripe payments: 1.5% + 20p for consumer UK cards, 1.9% + 20p for premium UK cards, 2.5% + 20p for EEA cards, 3.25% + 20p for international cards; 2% currency conversion

GoCardless transfers: Fees via GoCardless

It’s possible to add a payment button on invoices that’s handled by another card processor – Xero is flexible like that.

We know from experience that Xero reportedly has a steep learning curve that some only find worth the time if they use it for a larger company. But the interface has improved over the years, and it is generally a solid system for keeping the books in order.

Integrated payments: Stripe (Visa, Mastercard, Apple Pay, Google Pay), GoCardless bank transfers

Best for: Xero users who’d like their invoices integrated with bookkeeping.

PayPal – simplest for PayPal users

PayPal invoices have been the easiest way for sole traders and small businesses to send invoices online for a couple of decades, so it would be amiss not to mention it. Anyone with a PayPal Business account can download the PayPal Business app to create and send invoices via email.

Image: Mobile Transaction

It’s very straightforward to create an email invoice in the PayPal Business app.

Customisation options are not the most extensive, but they cover both the legal requirements for invoices and additional extras like allowing partial payments, tips, postage cost, doscounts and custom terms and conditions.

Like most invoice apps, you can itemise the invoice, attach a reference, note to the customer and VAT details. For repeat billing, you can save customers and invoiced items so you don’t have to spell out the same service for the next invoice.

Clients receive the invoice via email, with buttons to pay straight away via their PayPal account, debit or credit card, or PayPal Pay Later (credit option). Since many people are familiar with the PayPal brand, they are likely to trust these methods and pay faster.

Transactions clear right away in your online PayPal Business account, not a bank account, minus transaction fees.

Pricing

Monthly cost: None

Transaction fee: 2.9% + 30p for domestic Visa and Mastercard

If you need the money in your bank account, you must transfer it from the app to the business bank account associated with the PayPal account.

“I’ve used PayPal invoices many times because some clients prefer it (mostly for convenience), but I do hate the fees. I much prefer another invoice solution that doesn’t eat into my margins just to get paid.”

– Emily Sorensen, Senior Editor, Mobile Transaction

What about fees? Well, that’s the hardest part to swallow. PayPal isn’t cheap even for domestic consumer cards.

The standard rate is 2.9% + 30p per card transaction, plus 1.29% for EEA cards or 1.99% for other international cards, if a non-UK card was used. There is also a currency conversion fee of 3% if at any point you receive a foreign-currency amount into your GBP account.

Integrated payments: PayPal (Visa, Mastercard, American Express)

Best for: Existing PayPal merchants who want to bill clients in the most convenient way possible, despite higher transaction fees.

Other invoice apps

Lots of invoicing apps are available to the UK, but many have flaws.

For example, some invoice apps are created for the North American market, are buggy, have limited features or use Stripe for payment processing – known for their slow settlement (about a week) to UK bank accounts.

Alternatively, you can sign up for an online business current account with invoicing. Starling Bank’s Business Toolkit includes invoicing software only accessed in a web browser.

We also tested Tide Invoicing – from another digital bank – which was overall easy to use, but required a subscription for features we considered essential.