How it works

Revolut is one of the most popular online current accounts in the UK, Europe and beyond. Its suite of business account features has in recent years expanded to include payment acceptance both online and in-person, and email invoices is part of this.

To issue Revolut invoices, you need to sign up for a Business Account (for all business features) and Merchant Account (for payment acceptance). Approval can take a few days if your submitted proof of business is sufficient. Once accepted, you have access to an invoicing section in the Revolut Business app.

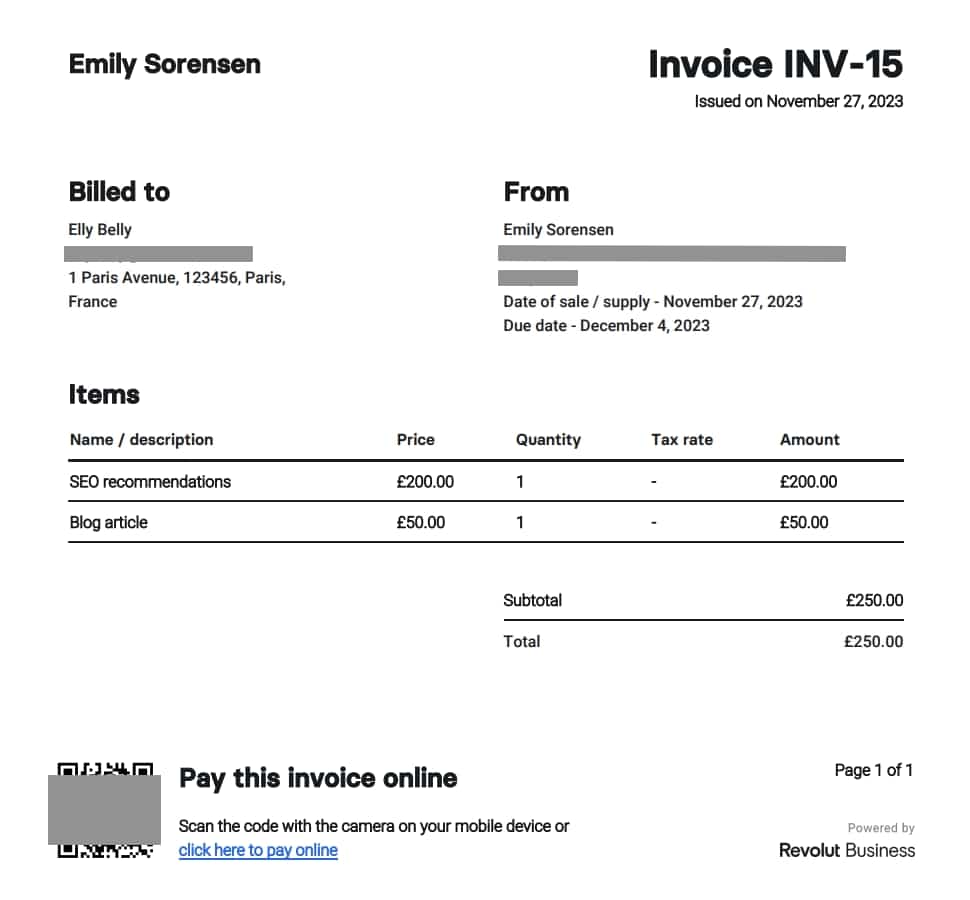

Image: Mobile Transaction

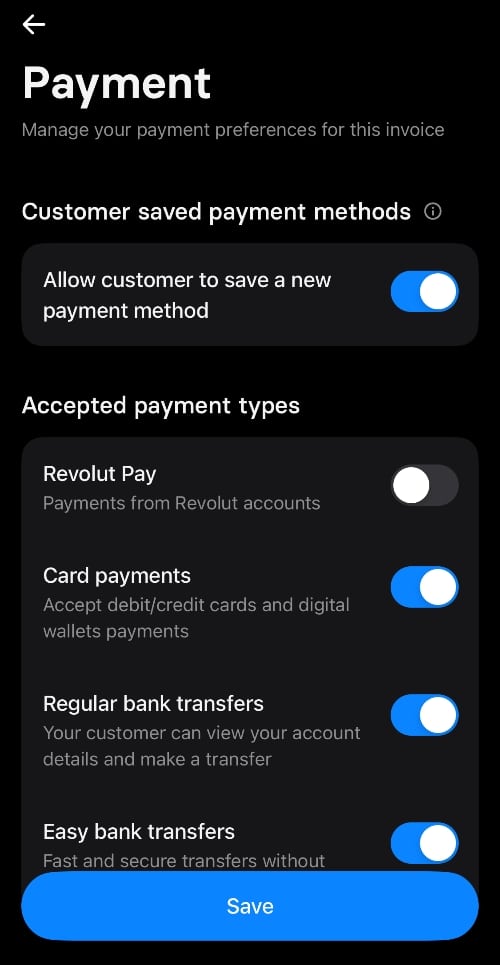

Example of a PDF invoice created through Revolut.

Invoices through Revolut are emailed to clients, with a custom selection of online payment methods they can use to settle it straight away. Along with some valuable extras like payment reminders and recurring invoices, the product is easy to use, but isn’t the most feature-rich invoice software on the market.

Pricing

A verified Revolut Business account is required to use the invoicing tools. There are two types of business accounts: one for companies and another for freelancers. Each of these has a choice of subscriptions:

- ‘Company’ account: Basic (free), Grow (from £19/month), Scale (from £79/month), Enterprise (custom price)

- ‘Freelancer’ account: Basic (free), Professional (from £5/month), Ultimate (from £19/month)

Suffice to say, sole traders can opt for the Freelancer account whereas limited companies and partnerships can apply for a Company account. There are monthly and annual subscription options, the latter being cheapest per month.

The higher your plan, the more business tools are included, such as lower currency exchange fees, expense approval and API access for custom integrations. For more information about the different account features on the plans, see our Revolut for Business review.

It does not matter which plan you choose where invoicing is concerned, since the invoice features are the same on all plans. Just be sure to apply for a free Merchant Account too, which also gives you card payment acceptance options.

| Tide invoicing fees | |

|---|---|

| Monthly fees | Business account: From £0/mo (depends on plan) No separate fee for invoicing features |

| Transaction fees | UK consumer cards: 1% + 20p Commercial and international cards: 2.8% + 20p Easy Bank Transfer and Revolut Pay: 1% + 20p |

| Refunds | Original transaction fee is retained by Revolut |

| Chargebacks | £15 per chargeback |

| Commitment | Cancellable any time |

There is no minimum contract, so you can try the invoicing tools on the Basic business account free of charge and just stop using it if it doesn’t suit you.

The only charges are the pay-as-you-go fees for transactions, refunds and chargebacks (see above table). In other words, you can send an unlimited amount of invoices and only be charged for the online payments received through Revolut.

Invoicing features

Now, let’s consider the invoicing features.

You can create, send and manage invoices directly from the iOS or Android app ‘Revolut Business’ or by logging into your Revolut account in a desktop browser. The features are more or less the same on a smartphone and desktop – the main difference is just how you type and navigate.

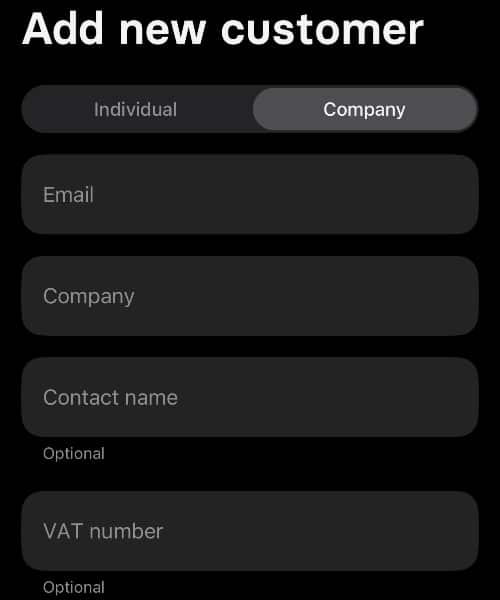

When you create an invoice, certain information is required such as recipient details, VAT (if applicable), product/service items and the payment due date. Conveniently, you can add customers to a library so it’s easy to tap to add the right recipient with their correct email address.

Image: Mobile Transaction

When a customer is added, you can easily select them for future invoices.

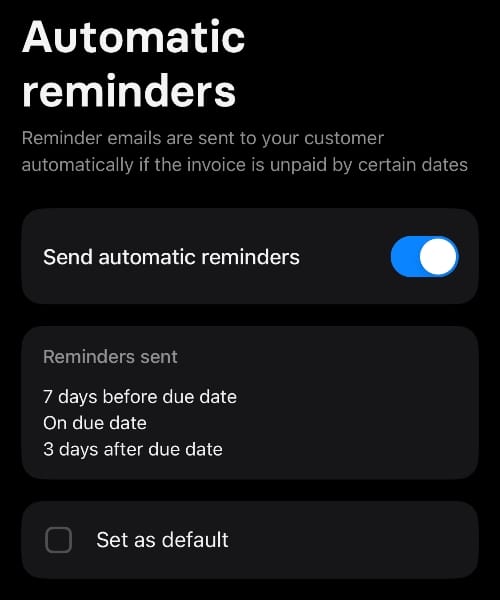

Image: Mobile Transaction

Activate automatic email reminders to maximise chances of getting paid.

The following features are similarly useful.

Auto-reminders: Automatic reminder emails can be sent to remind the recipient to pay the invoice. This is a very important feature for settling bills consistently – without it, businesses tend to struggle with delayed or missed payments.

If the automatic reminder setting is on (it can be switched on as default), a reminder is sent on the due date, 7 days before and 3 days after the due date. It’s currently not possible to alter those times.

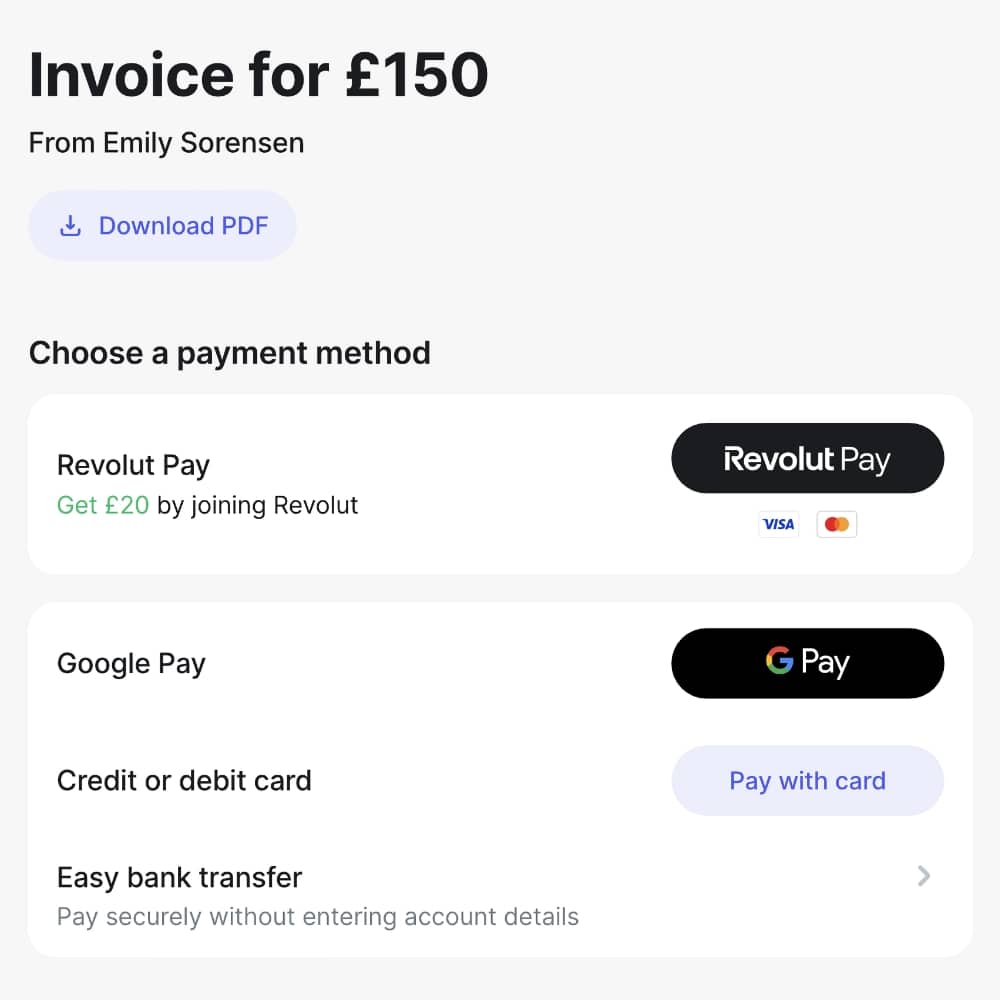

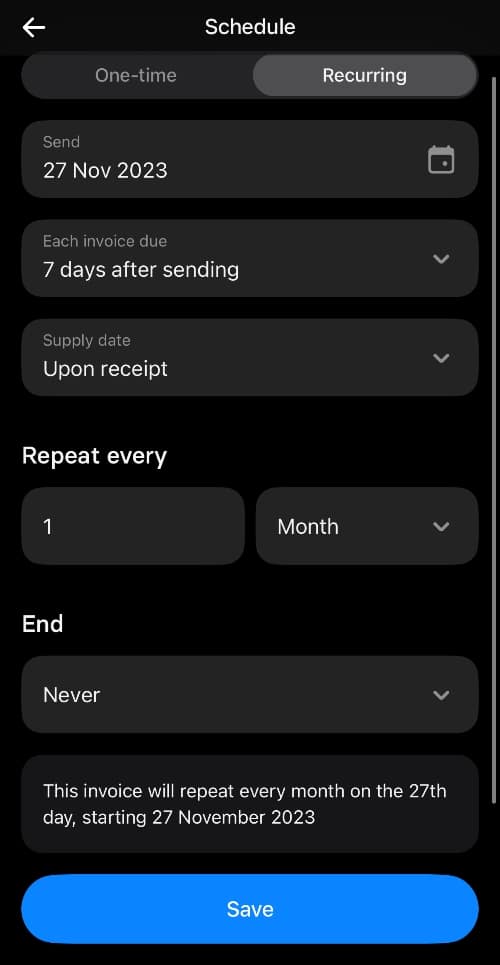

Image: Mobile Transaction

Revolut offers a good range of payment options.

Payment options: If your Merchant Account is fully verified, you’ll be able to accept any of the following through a link on the email invoice:

- Mastercard and Visa card: Manual entry of card details

- Apple Pay and Google Pay: Easy payment via the client’s mobile wallet

- Easy Bank Transfer: Streamlined transfer via the client’s banking app

- Revolut Pay: Transfer between Revolut accounts

Any combination of these can be selected for each invoice, allowing you the freedom to choose how customers pay (and thereby what your transaction charges will be).

Image: Mobile Transaction

It’s up to the merchant which payment options to include.

Image: Mobile Transaction

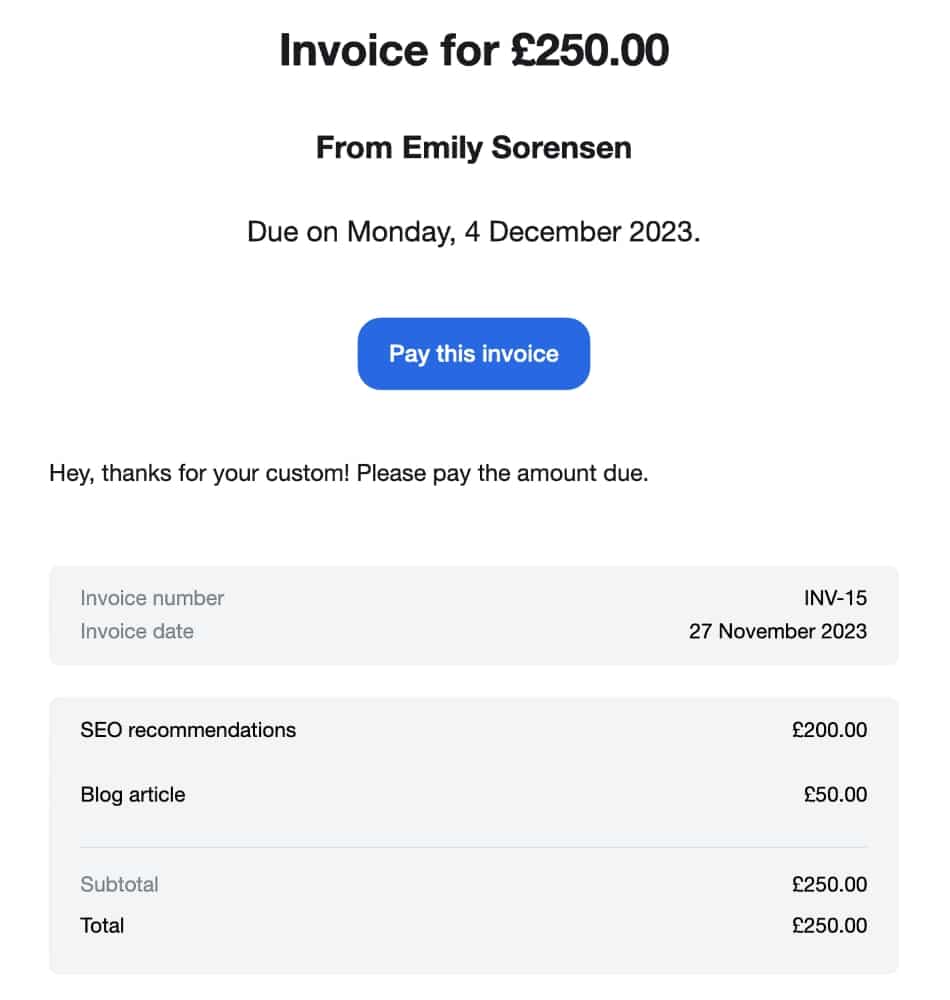

Recurring invoices are easily scheduled during invoice creation.

Recurring invoices: You can schedule invoices to go out weekly, every 5 days or every other month – or whatever time interval you need, as the system is very easy to configure. Even one-off invoices can be scheduled to go out on a specific date in the future, as it doesn’t have to be sent the second you create the invoice.

Invoice tracking: When customers pay via Revolut’s payment page, the invoice will be registered as paid in the merchant’s account – useful for tracking payments.

Multiple currencies: Those with international clients will appreciate that you can select a currency for each invoice, enabling you to receive online payments in that currency into your matching currency account (Revolut allows you to have multiple currency accounts). This way, you can keep them separate and only pay currency exchange fees if you transfer between the accounts.

Customisation options: There aren’t any customisation options for the design and layout of invoices, but you can set a prefix and number for the invoice title, contact details and custom message to go on the invoice.

Image: Mobile Transaction

The email invoice looks basic, but contains a link to a payment page online.

When you send each invoice, a simplified version shows in the content of the recipient’s email. A PDF file with a neutral-looking, complete invoice is available to the customer through the email.

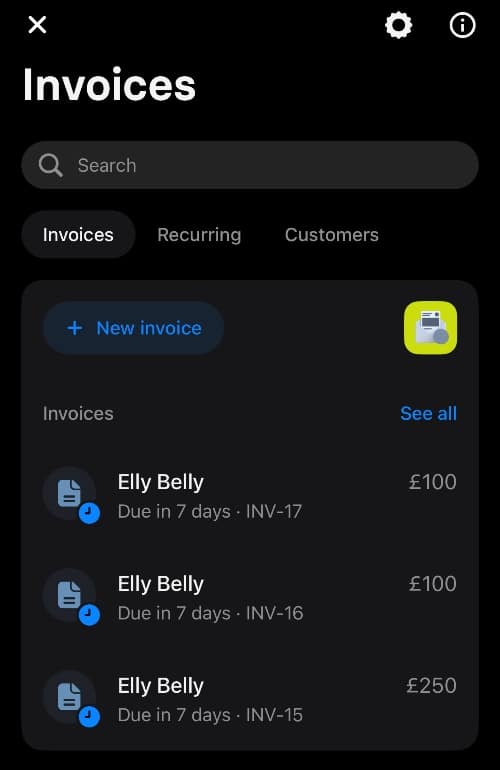

Editing existing invoices: An unusual feature for a free invoicing tool is the ability to edit invoice information after sending it (as long as the invoice is still unpaid), whereafter you can resend it. Since there is no proforma invoice or quotation option, Revolut might have added this as a workaround. It’s also possible to duplicate old invoices, in effect using it as a template.

Image: Mobile Transaction

Overview of sent or draft invoices, which can be edited if unpaid.

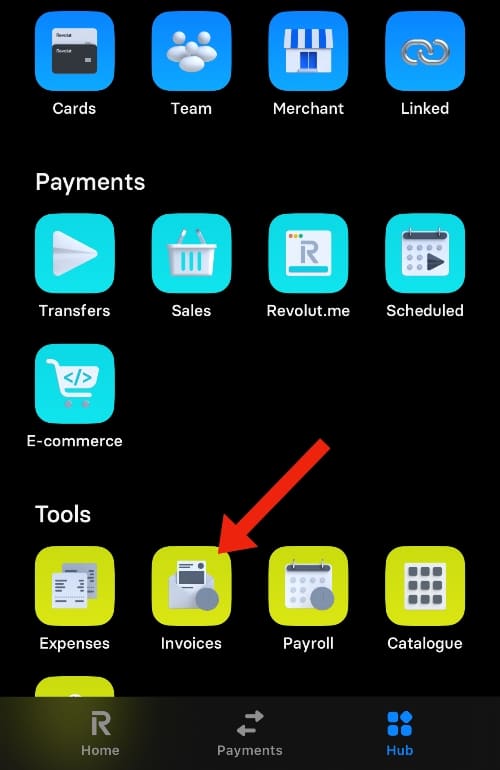

Image: Mobile Transaction

Some of the many Revolut Business tools available to account holders.

Integrations: Many integrations can be added to the Revolut account, such as accounting (e.g. Xero, FreeAgent) and ecommerce (e.g. Shopify, WooCommerce) software and tools for automation (e.g. Zapier). Unfortunately, you can’t expand Revolut’s existing invoicing features, but you can connect software like QuickBooks that offers invoicing software outside Revolut.

Compared with alternatives

Revolut is not the only option for small businesses looking for easy invoicing with a business account.

Tide Invoicing is an obvious choice if you want a full-fledged bank account with invoicing through the banking app. The features are a bit more limited, e.g. you can’t schedule recurring invoices, and processing a refund requires contacting support. It does have some options not offered by Revolut, however, such as adding your own business logo to invoices, categorising the type of bill and accepting Direct Debits.

If you prefer handling invoices on a computer, SumUp Invoices is a surprisingly feature-rich choice with a free business account. In its web portal, you can send quotations, credit notes and delivery notes apart from the one-off and recurring invoices that can be fully customised, even in different languages. The most advanced features do require a subscription, though.

Lastly, Square Invoices is our top choice for a free, dedicated invoicing app. Compared with Revolut, the invoicing features are far more developed, varied and even visually more appealing, but again, the most advanced settings require a monthly subscription. Square also comes with many flexible, free payment tools for selling remotely, online and in person.

Customer service and reviews

Revolut users can access a responsive customer support chat from within the Business app 24/7 every day, regardless of the subscription plan.

Although it only takes a few minutes to hear back from a chat agent, we didn’t in our experiences get issues resolved the same day. Unless you’re asking a question that can be looked up in the generously-populated online resources (in which case it’s best just to go there), you are likely to be passed on to different support people. Our issues about different parts of the service over the last few years have typically been fixed within a few hours to a few weeks.

We should also warn that very infrequent use of Revolut Business will probably result in having to resubmit information about your business over and over again, even if you’ve done it the last time you used the app. In our case, the online payment options were not immediately available (they were before) on our invoices while testing it, just because we hadn’t used the app for months. After contacting support, we were told to resubmit information which would take a few days to approve.

Other users have also complained about tedious verification processes and slow progress on resolving issues. Overall, however, Revolut is used by many UK businesses, and when used frequently, it should work smoothly.

Our verdict

Revolut invoices can definitely act as a standalone solution for Revolut Business account holders who want to bill on the go. It has enough essential features to comply with UK invoicing requirements and maximise chances to get paid on time.

Critically, it has varied and very easy payment options for clients to settle invoices immediately on a mobile-friendly payment page. The transaction fees for domestic consumer cards and easy bank transfers are also attractive, though international and commercial cards are expensive to accept.

| Revolut invoice criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.1 | Good |

| Costs and fees | 4.2 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 4.2 | Good |

| Service and reviews | 3.7 | Passable/Good |

| Contract | 4.8 | Good/Excellent |

| OVERALL SCORE | 4.1 | Good |

| Revolut invoice criteria |

Rating | Conclusion |

|---|---|---|

| Product | 4.1 | Good |

| Costs and fees | 4.2 | Good |

| Transparency and sign-up | 3.7 | Passable/Good |

| Value-added services | 4.2 | Good |

| Service and reviews | 3.7 | Passable/Good |

| Contract | 4.8 | Good/Excellent |

| OVERALL SCORE | 4.1 | Good |

Customer service could be more efficient, but if you’re only using a free account, the whole package is still excellent value considering you also have a multi-currency business account with other tools for your business included. As a solution for infrequent use, however, you may have to endure repeat account verifications, in which case other invoicing apps could be more reliable.