Phone payments can be expensive for a small business if you choose the wrong virtual terminal provider. Two of the most popular solutions are from PayPal and Square – but which is best?

The fees and advantages of them are actually very different. As a long-standing online payments platform, PayPal often becomes the first hunch for people to check out, but Square – who arrived in the UK later – offers better value in many ways.

Let’s compare the virtual terminals with a focus on fees, features and service.

|

|

|---|---|

| PayPal Virtual Terminal review | Square Virtual Terminal review |

| £20/month | No monthly fee |

| 1.2%-2.9% + 30p per transaction + 0.5%-2% cross-border fee + 3% currency conversion fee |

2.5% per transaction No cross-border, currency or authorisation fees |

| PCI compliance extra cost | No cost for PCI compliance |

| 24/7 customer support | 9am-5pm weekday support |

|

|

|---|---|

| PayPal Virtual Terminal review | Square Virtual Terminal review |

| £20/month | No monthly fee |

| 1.2%-2.9% + 30p per transaction + 0.5%-2% cross-border fee + 3% currency conversion fee |

2.5% per transaction No cross-border, currency or authorisation fees |

| PCI compliance extra cost | No cost for PCI compliance |

| 24/7 customer support | 9am-5pm weekday support |

Pricing: many vs few fees

Square Virtual Terminal only has one fee: a pay-as-you-go fixed rate of 2.5% per transaction. There is no fee for setting up, chargebacks or refunds, nor is there a monthly cost or commitment.

The Square transaction fee applies to any Visa, Mastercard and American Express card accepted, whether it is issued abroad, premium or corporate. No extra fees are added on top.

Learn more: Square Virtual Terminal – full review

With PayPal, you must pay a monthly fee of £20 just to use the virtual terminal. This subscription can be cancelled any time without an exit fee.

The upside is that PayPal offers three pricing structures for Visa and Mastercard transactions:

- Standard: 2.9% + 30p + cross-border fee + currency conversion fee

- Blended: 1.2% + 30p + cross-border fee + currency conversion fee

- Interchange Plus: Interchange rate (0.2%-2%) + 1.2% + 30p + cross-border fee

The Standard fee applies automatically to Visa, Mastercard and Amex, but if you qualify, you can opt into a Blended or Interchange Plus pricing structure (applies to Visa and Mastercard only). If you process a lot of transactions with cards from another currency, the Interchange Plus fees may be cheapest since it does not add the 3% currency conversion fee.

| Virtual terminal costs | PayPal | Square |

|---|---|---|

| Monthly fee | £20 | None |

| Setup fee | None | None |

| Transaction fee | Standard: 2.9% + 30p Blended: 1.2% + 30p Interchange Plus: IC*+ 1.2% + 30p |

2.5% |

| Cross-border fee | 0.5% or 2%** | None |

| Currency conversion | 3% above exchange rate*** | Free |

| Refunds | Original transaction fee | Free |

| Chargebacks | £14 per chargeback + £12 Dispute Fee may apply | Free |

| PCI compliance | Extra cost (varies) | No cost |

*IC = Interchange rate, ranging between 0.2%-2%. **Fee depends on region of cardholder. ***Not applied to Interchange Plus pricing.

| Virtual terminal costs |

PayPal | Square |

|---|---|---|

| Monthly fee | £20 | None |

| Setup fee | None | None |

| Transaction fee | Standard: 2.9% + 30p Blended: 1.2% + 30p Interchange Plus: IC*+ 1.2% + 30p |

2.5% |

| Cross-border fee | 0.5% or 2%** | None |

| Currency conversion | 3% above exchange rate*** | Free |

| Refunds | Original transaction fee | Free |

| Chargebacks | £14 per chargeback + £12 Dispute Fee may apply | Free |

| PCI compliance | Extra cost (varies) | No cost |

*IC = Interchange rate, ranging between 0.2%-2%. **Fee depends on region of cardholder. ***Not applied to Interchange Plus pricing.

PayPal’s cross-border fee applies to all foreign cards, but the currency conversion charge only applies when the cardholder’s currency is different from the one you accept in the virtual terminal. PayPal also has a few hidden fees that don’t apply to all transactions, for example the “Uncaptured Authorisation” fee of 20p which only applies when a transaction is successful but uncaptured (not completed).

If a refund is processed, PayPal charges the transaction fee originally paid. Chargebacks incur a standard, non-refundable £14 charge, whereas certain eligible transactions disputed by a customer can also have a £12 Dispute Charge added on top.

Completing PCI-DSS paperwork is not required with Square, so that’s free. PayPal, on the other hand, requires all virtual terminal merchants to set up PCI-DSS compliance with an external provider – this can have various costs depending on how you do it.

Learn more: PayPal Virtual Terminal – full review

Virtual terminal features: different advantages

Both virtual terminals have essential functions, but the extra features divert quite a bit.

With PayPal Virtual Terminal, you can create keyed-in sales or preauthorisations where you check the legitimacy of a card.

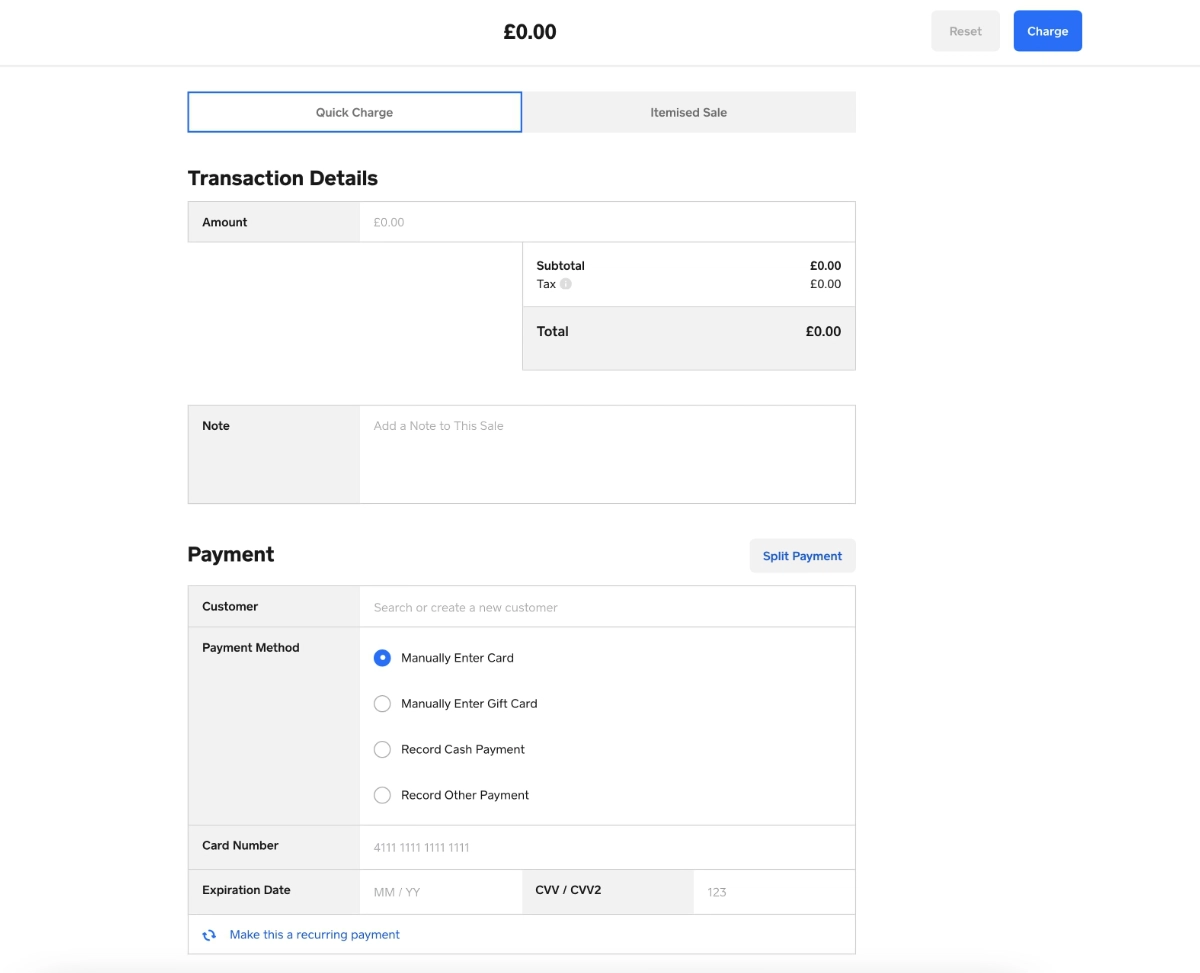

Square does not have a preauthorisation option, but is able to split a payment into several payment methods including debit or credit card, cash, gift card or other means of payment. You can even connect Square Terminal with the virtual terminal, allowing you to create a sale on a computer and send it (remotely, if you like) to the card machine for a contactless or chip payment.

You can also add VAT, tips and discounts to Square’s virtual terminal sale. PayPal doesn’t have a tipping or discount option, but lets you add tax and a shipping charge.

PayPal accepts many different currencies, whereas Square only accepts GBP if the account is based in the UK. Accepting foreign currencies is really handy for some international merchants, especially as PayPal can store these in separate balances in the online business account.

Image: PayPal

What the PayPal Virtual Terminal should look like.

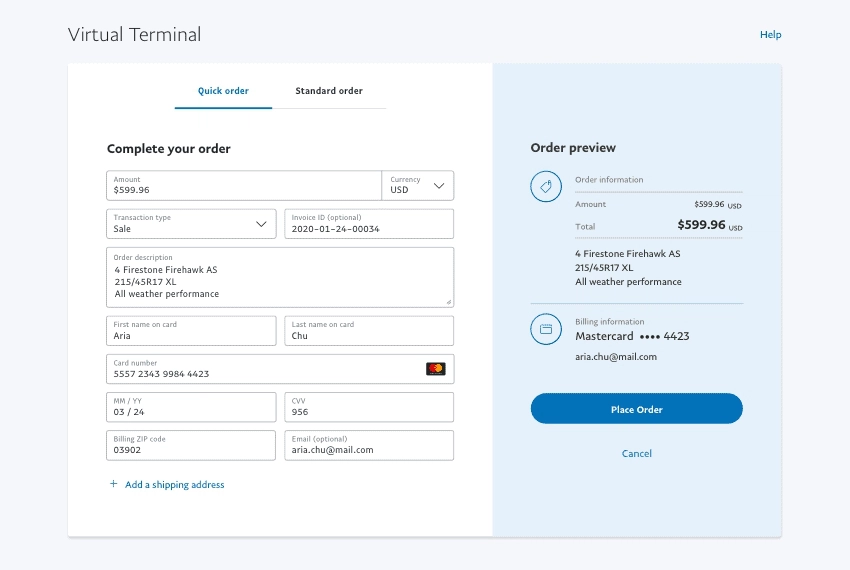

Apart from the card details essential to authorise a transaction, there are subtle differences in the kinds of information you can attach to transactions.

With Square, you can attach one custom comment to each sale, which could be the order ID or service description. This note will be shown in sales reports, so an address or other personal information might be too sensitive to add there. Instead, you can add a customer from the customer library (where postal address and contact details are included) to the sale.

Image: Mobile Transaction

The “Quick Charge” tab of the Square Virtual Terminal.

With PayPal, you can enter postal address and contact details directly to the transaction in dedicated fields. This could be more convenient for sellers routinely shipping items to different new customers, especially as you can add a postage cost to the order as well. Square requires you to use the customer library to add contact and shipping details, which would be more efficient for repeat customers when you just have to pick the buyer from your existing list of customers.

What if you’re selling a list of items? Then Square has the advantage of itemised sales. This is where you can add multiple items from a product library or various custom items to an itemised bill. With PayPal, you can only manually write one description of what you’re selling, noted as one comment with a maximum character limit.

Lastly, Square lets you turn the sale into a recurring payment. This is only possible if the customer has authorised this, as you’ll need to save the card details to the customer profile in the Square system (‘card on file’). PayPal has a recurring payment feature too, but this is separate from the virtual terminal.

Payouts in bank account vs online account

PayPal comes with an online business account which is where transactions from the virtual terminal are settled immediately. You cannot receive payouts directly into a bank account, but money in the online account can be “withdrawn” any time into your connected bank account, often within just a few hours.

Square initiates all transactions directly into your bank account, reaching your account within 1-2 working days. Eligible users can activate the Instant Transfers option (for 1% per transaction) that settles transactions in your bank account within a couple of hours. Square doesn’t yet have an online account in the UK.

Sign-up process: 1 step vs 2 steps

Signing up is very fast though Square. After entering basic contact details, business information and bank account details, you can use the virtual terminal straight away from the Square Dashboard in any web browser. It may take a few days for your bank account to be linked to your account for payouts, though.

The PayPal Business account sign-up (essential first step if you haven’t already got this) is equally simple. Only after you’ve created a PayPal Business account can you apply for the virtual terminal. PayPal will then have to approve this request within a few days before you have access to it.

Customer support and reviews

Unsurprisingly, the lack of a monthly fee with Square means that customer support is limited to 9am and 5pm on weekdays only. Emailing and phoning are possible, but the website is set up so you’re encouraged to find your own answers in the comprehensive online help or peer support pages.

PayPal supposedly has 24/7 email, chat and phone support, but has been criticised for slow and inconsistent responses. There is also an online help and community support section if you want to find answers quicker, but certain topics are not covered as thoroughly as they are in Square’s help guides.

PayPal has a damning amount of negative experiences from users. A main complaint about PayPal is sudden account holds or delayed payments, which may happen if you suddenly accept a large transaction or suspicious payment that may breach your seller agreement. PayPal also tends to be on the buyer’s side in customer disputes, rather than the merchant’s side.

Square tends to get complaints about a lack of support and account verification issues, but many others are happy with the ease of use and low cost.

What are the alternatives?

Top virtual terminals for a small business

Verdict: more positives with Square

PayPal is popular for general online payment methods, but it’s also expensive for the average small business. That doesn’t necessarily mean the virtual terminal is a no-go.

PayPal Virtual Terminal’s unique advantages:

Square Virtual Terminal’s unique advantages:

Although the list of pros is longer for Square, the pros of PayPal could be worth the £20 monthly cost and higher fees, for example if you have to accept international currencies and need to authorise cards in advance of a sale.

If neither of those things are important, however, Square offers a lot of value unmatched by other virtual terminals in the UK.