Square and Stripe are two giant payment platforms with similar kinds of products, but they’re geared towards different businesses.

Square was initially focused on face-to-face merchants with its app-dependent Square Reader, but have since expanded services to many sales channels. Stripe is a developer-centric online payments platform that lets you customise payment solutions, but also caters to the small business without technical know-how.

Let us go through the main differences between the payment services.

|

|

|

|---|---|---|

| Aimed at | Small businesses | Any size businesses |

| Lock-in | None | None |

| Fees | Pay-as-you-go, no monthly charges | Pay-as-you-go, no monthly charges |

| In-person payments | Choice of 2 card machines, POS software | No card machines in the UK, no POS software |

| Remote payments | Online store, virtual terminal, payment links, key-in via app, invoicing, custom solutions (APIs provided) | Online checkout, billing, invoicing, virtual terminal, custom solutions (APIs provided) |

| Payouts | 1-2 working days | 1-2 weeks |

| Card acceptance | Visa, Mastercard, Maestro, V Pay, Amex, Apple Pay, Google Pay, Samsung Pay | Visa, Mastercard, Maestro, Amex, Apple Pay, Google Pay |

| Reporting | Included | Included |

| Customer support | 9am-5pm, Mon-Fri | 24/7 |

|

|

|---|---|

| Aimed at | |

| Small businesses | Any size businesses |

| Lock-in | |

| None | None |

| Fees | |

| Pay-as-you-go, no monthly charges | Pay-as-you-go, no monthly charges |

| In-person payments | |

| Choice of 2 card machines, POS software | No card machines in the UK, no POS software |

| Remote payments | |

| Online store, virtual terminal, payment links, key-in via app, invoicing, custom solutions (APIs provided) | Online checkout, billing, invoicing, virtual terminal, custom solutions (APIs provided) |

| Payouts | |

| 1-2 working days | 1-2 weeks |

| Card acceptance | |

| Visa, Mastercard, Maestro, V Pay, Amex, Apple Pay, Google Pay, Samsung Pay | Visa, Mastercard, Maestro, Amex, Apple Pay, Google Pay |

| Reporting | |

| Included | Included |

| Customer support | |

| 9am-5pm, Mon-Fri | 24/7 |

No contract lock-in, but what about cost differences?

Stripe and Square were both launched in 2010, and that comes across in their pricing structure: no archaic contracts, no setup fees, no monthly fees (barring some features) and no contractual commitment. This is the modern way that many startups, small businesses and professionals feel most comfortable with.

The main costs are instead pay-as-pay transaction charges.

| Square fees | Stripe fees | |

|---|---|---|

| Lock-in | None | None |

| Monthly fees | None (few exceptions) | None (few exceptions) |

| In-person transactions | 1.75% | n/a |

| Ecommerce payments | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

European cards: 1.4% + 20p Non-European cards: 2.9% + 20p |

| Recurring billing | n/a | 0.5% |

| Currency conversion | Free | 2% |

| Payouts | Standard is free, 1% for Instant Transfers | Free |

| Chargebacks | Free | £15 each |

| PCI compliance* | Free | Costs may apply |

| Charges | Square | Stripe |

|---|---|---|

| Lock-in | None | None |

| Monthly fees | None (few exceptions) | None (few exceptions) |

| In-person transactions | 1.75% | n/a |

| Ecommerce payments | European cards: 1.4% + 25p Non-European cards: 2.5% + 25p |

European cards: 1.4% + 20p Non-European cards: 2.9% + 20p |

| Recurring billing | n/a | 0.5% |

| Currency conversion | Free | 2% |

| Payouts | Standard is free, 1% for Instant Transfers | Free |

| Chargebacks | Free | £15 each |

| PCI compliance* | Free | Costs may apply |

With both Stripe and Square, you can save money if the majority of payments are made with European cards. Stripe charges 1.4% + 20p for European cards and 2.9% + 20p for transactions made with a non-European card. Square offers similar fees: 1.4% + 25p for European cards and 2.5% + 25p for non-European cards.

The fixed 20p or 25p fee could get expensive if most transaction amounts are low (20p of £5 is the equivalent of a 4% fee!). In addition, Stripe charges a 2% currency conversion fee on transactions paid in a different currency from the customer’s card.

With billing, Stripe merchants pay the same transaction fees for one-off invoices as through ecommerce (1.4% + 20 for European/2.9% + 20p for non-European cards), but automatically charging customers on a recurring basis costs only 0.5% per payment.

Payouts are free on both platforms, but Square gives the option to settle transactions instantly in your bank account for an extra 1% added to transactions.

PCI compliance (card security paperwork) is managed free of charge by Square, while Stripe encourages their users to address this but with some support provided. This could cost extra depending on the level of protocols required for your business. Chargebacks cost £15 each with Stripe, but are free with Square.

Learn more: Stripe payments – would it suit your business?

Complete webshop vs. integrated checkout on your site

Though both platforms provide solutions for ecommerce, there’s a clear distinction in how this is done.

Square offers a complete (‘all-in-one’) ecommerce platform with website builder, payment system and hosting included as well as optional integrations with e.g. online ordering systems. Unless you only need a basic online store, the platform costs a monthly subscription fee to cover hosting and advanced ecommerce features. It is very user-friendly – built for non-technical merchants keen to create and manage an online store without hiring someone to do it for them.

Image: Square

Square Online is for a complete website.

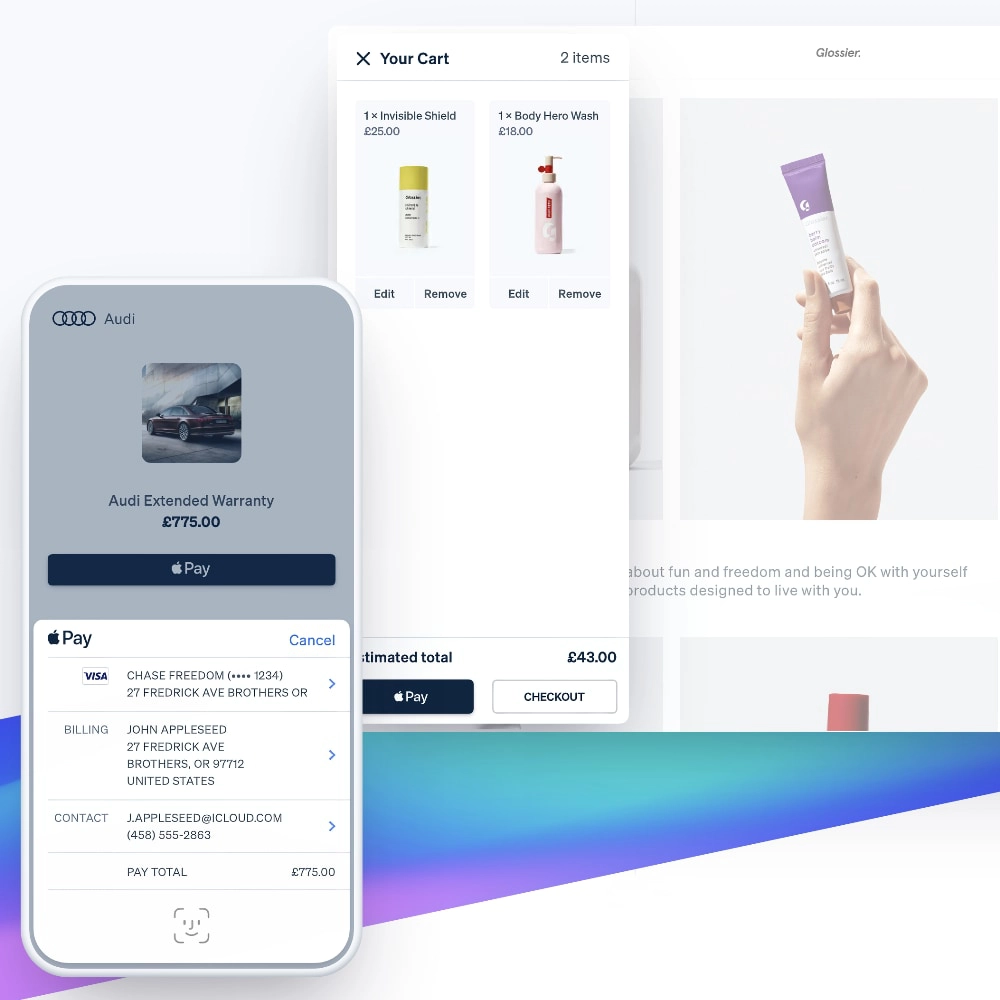

Image: Stripe

Stripe is commonly used as an online gateway.

Stripe does not provide a website builder or hosting, but it does serve as an online gateway (i.e. checkout page) to integrate on an existing website. Certain all-in-one platforms like Wix and Squarespace allow you to easily activate Stripe as your online checkout without knowledge of coding. However, using a Stripe checkout for a WordPress site requires adding a piece of code (Application Programming Interfaces/APIs) correctly into the system.

What’s great about this approach is the freedom to customise the style and features of the checkout – but it does require being comfortable with codes.

Square also offers APIs so you can use its payments system on a website that’s not hosted through Square. This allows customisations of style and function too. It is also possible to create payment links that go to a simple Square Online Checkout page.

Only Square offers in-person payments in the UK

If you’re looking for a card reader and POS system in the UK, there’s none provided by Stripe. Square, on the other hand, offers two card terminals:

- Square Reader for £19 + VAT – small card reader that connects with Square Point of Sale app on a smartphone or tablet.

- Square Terminal for £149 + VAT – portable WiFi terminal with POS app integrated on its large touchscreen.

The card machines are purchased upfront and do not have any contractual lock-in or monthly fees. Square Reader is best for mobile payments, as it is tiny, but it does need to be connected to an iPhone, iPad or Android device to accept card payments. Square Terminal only works through a secured WiFi connection, so works best on fixed premises where, for example, table service is required.

Photo: Square

Square Reader with Square POS system.

Photo: Square

Square Terminal.

The card terminals can be connected with a receipt printer, cash drawer, barcode scanner and other accessories to suit any retail or food-and-drink environment. There’s also a Square POS system for restaurants and another for retail apart from the general, free POS system. Compared to other low-cost POS systems, Square is generally superior with its many free features that suffice for many small face-to-face businesses.

Stripe does offer two ‘Stripe Terminal’ models with similar capabilities as Square’s, but these are only available for US merchants. It remains to be seen whether these will one day come to the UK.

Other remote payments

Online payments are not just about online stores, as both platforms would agree on. The following payment functions are also offered:

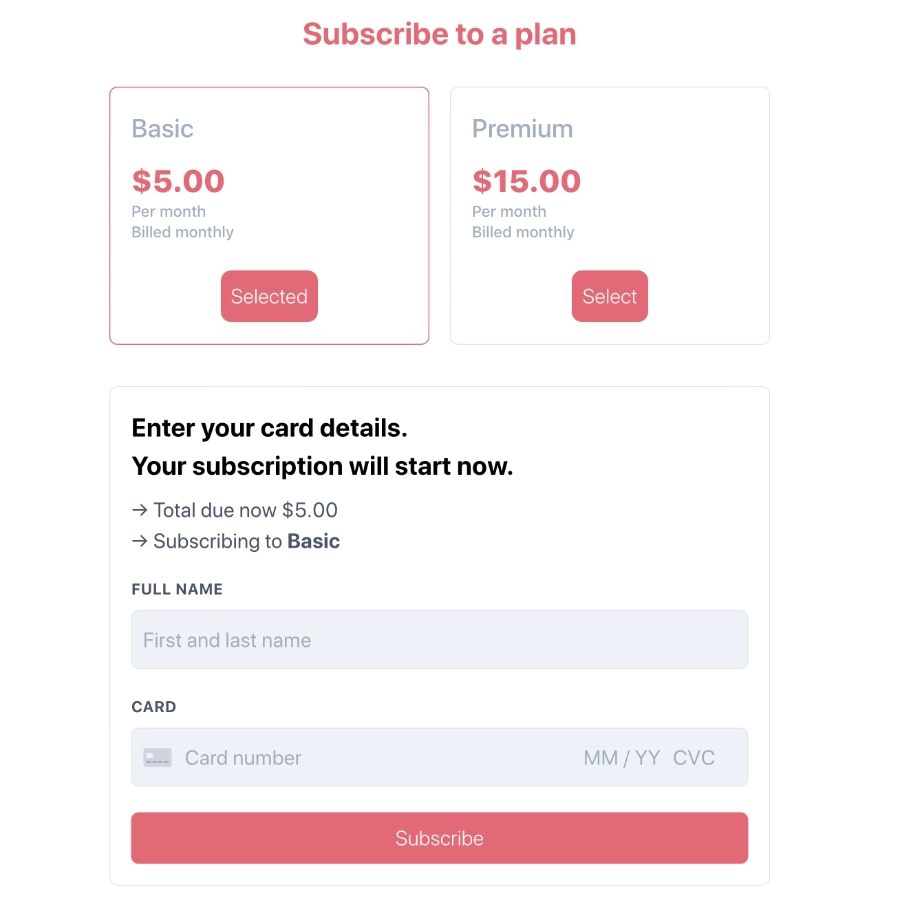

Invoicing: Stripe calls it ‘Billing’ and Square calls it ‘Invoices’. Both allow you to send one-off or recurring email invoices that customers can pay through. These can be managed through the web dashboard, but only Square has a dedicated (and free) invoice app. Then again, only Stripe can charge your customers automatically on a recurring basis as a subscription.

Virtual terminal: The feature-rich Square Virtual Terminal can be used as a standalone product for no monthly fees, just the transaction rate. It allows you to take MOTO (Mail Order and Telephone Order) payments. Stripe can also activate a simple virtual terminal in the dashboard, but only wants you to use it as a backup solution. This is because Stripe is not geared towards remote payments keyed in by the merchant, while Square is.

Payment links: Only Square has an easy-to-use pay-by-link solution (called Square Online Checkout). It allows you to define a product or service with a fixed price and generate a payment link for it. You can embed this as a button on a website, send it as a QR code or URL for a remote payment, or even create a donation link that allows customers to enter an amount to pay.

Image: Square

Square can generate payment links.

Image: Stripe

Create subscriptions with Stripe.

Advanced payment systems: Stripe and Square both allow you to build their payment system into any website or app of yours. But Stripe is the most advanced with its extensive API documents that are easy for developers to learn. This is the key strength of Stripe: the many options to build complicated payment systems for marketplace platforms, subscription services, loyalty apps and much more.

Transactions, payouts and reports

Even with regards to the payment systems, there are big differences. Let’s start with the similarities between Square and Stripe:

- Transactions are automatically processed to your bank account.

- Visa, Mastercard, Maestro, American Express, Apple Pay and Google Pay are accepted.

Square also accepts V Pay and Samsung Pay through its card readers. However, Stripe has the option to accept Bacs Direct Debit online as well.

The biggest difference is payout times. Square settles transactions in your bank account 1-2 days after each transaction, while Stripe takes up to two weeks to settle payments in your bank account. The first Stripe settlement takes about two weeks, and then it takes around a week or more. Square also offers Instant Transfers for an additional 1% added to the transaction fee, where you receive the payout within a couple of hours in your bank account.

Detailed transactions reports are free on both platforms. Businesses with SQL coders on hand can pay a monthly fee for Stripe Sigma, which gives access to in-depth user data from the payments processed in your business. The free Square analytics include details of products or services sold, as long as you make use of the inventory library in the Square account that is linked to all sales channels.

Taking payments over the phone? We’ve tried Square Virtual Terminal

Customer support

Whereas Square support can only respond to customer queries on weekdays between 9am and 5pm, Stripe support boasts round-the-clock availability every day of the year.

However, it doesn’t take much digging to find more complaints about Stripe than Square. For example, there’s no phone number for Stripe so you’re reliant on email, messaging chat or requesting a callback. Square has a phone number and email address for support queries.

Both companies have complaints about slow responses and frozen accounts with funds inaccessible to their owners. Account holds happen on many payment platforms, but it appears that Stripe users experience them more in the UK compared with Square.

Stripe has a good rep when it comes to solving general queries, but anything more serious appears to be more difficult for the support team to resolve. Square also gets some complaints about their support team, but many more reviews indicate happy users appreciative of the overall service and ease of use.

Our verdict

Choosing Stripe or Square depends a lot on your resources, business model and tools required.

Square is built for the lay merchant who wants a very user-friendly, complete system that can be managed easily without special knowledge. In particular, Square works great as a low-cost POS solution for merchants that also want remote payment options thrown in the mix for free.

In contrast, Stripe is intended for the tech-savvy, online-only business that needs a – perhaps unique – payment system adapted to their business model. It takes coding knowledge to tailor a Stripe solution, unless Stripe is already integrated on your ecommerce platform of choice.