- Pros: Quick to get started. Next-day payouts. Competitive fees. 24/7 customer support. Reporting app.

- Cons: Outdated (for some people) card machines. Sales reps can be pushy.

- Choose if: You want a push-button card machine with decent card rates on a short contract.

Overview

In brief

How it works

Our opinion

In detail

Card machines

Contract

Pricing

Online payment tools

Service and reviews

What is Paymentsense?

Paymentsense is a payment processor and merchant service provider that rents out card machines to businesses in most sectors.

The company launched Dojo a few years ago, which is now getting the bulk of new card machine customers. However, some merchants prefer the traditional Ingenico machines that Paymentsense offers.

Merchants can also get:

- payment links for email invoices

- a payment gateway for online stores

- a virtual terminal for over-the-phone payments

Card transactions are either processed by Paymentsense directly or First Data Europe.

Either way, new merchants are offered monthly rolling contracts as standard. Costs are tailored around card turnover, average transaction size and type of business.

Signing up

To sign up, you need to fill in basic contact details online, then await a phone call by a sales rep.

The contact form requires you to include a phone number, postcode and email address, and there’s no option to include a message. You can only get a quote over the phone after submitting additional details about your business verbally.

If the application goes well, you can start receiving online payments within 24 hours already, or by card machine within three working days.

Our opinion: short contracts, standard machines

Paymentsense has grown more transparent and a lot more attractive in recent years, due to its short monthly contracts which are rare from a traditional merchant service provider. The costs of a card machine contract with Paymentsense are typical in the industry, though.

The online payment options are unremarkable compared with other online payment systems. The reporting app, however, is a welcome feature for on-the-go merchants in need of a real-time overview of transactions.

| Paymentsense criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.8 | Good |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 3.9 | Good |

| Value-added services | 3.6 | Passable/Good |

| Service and reviews | 4.1 | Good |

| Contract | 4 | Good |

| OVERALL SCORE | 3.8 | Good |

The card machines are standard push-button models of high quality, most of which integrate with popular POS systems. It’s also relatively quick to start taking payments with a card machine – only three days with a successful application.

“Paymentsense has improved in key areas – it now has monthly contracts, 24-hour (working day) payouts, better service and transparent fees. It’s still not cheap with its monthly costs and average rates, though.”

– Emily Sorensen, Senior Editor, Mobile Transaction

In the past, we’ve seen many negative reviews about the service, hidden charges and dishonest sales reps. This has changed substantially in the last couple of years, just as many of its merchants have migrated to a Dojo card machine that looks more modern with its large touchscreen.

We don’t think there’s anything wrong with Paymentsense’s old card machines, but some merchants might prefer the look of touchscreen terminals. In any case, Paymentsense is a solid choice for trusty Ingenico terminals, if you can afford all the monthly fees.

For alternatives, compare the leading card machines in the UK.

Card machines: traditional models, not touchscreen

Paymentsense has a standard selection of traditional card machines for most uses.

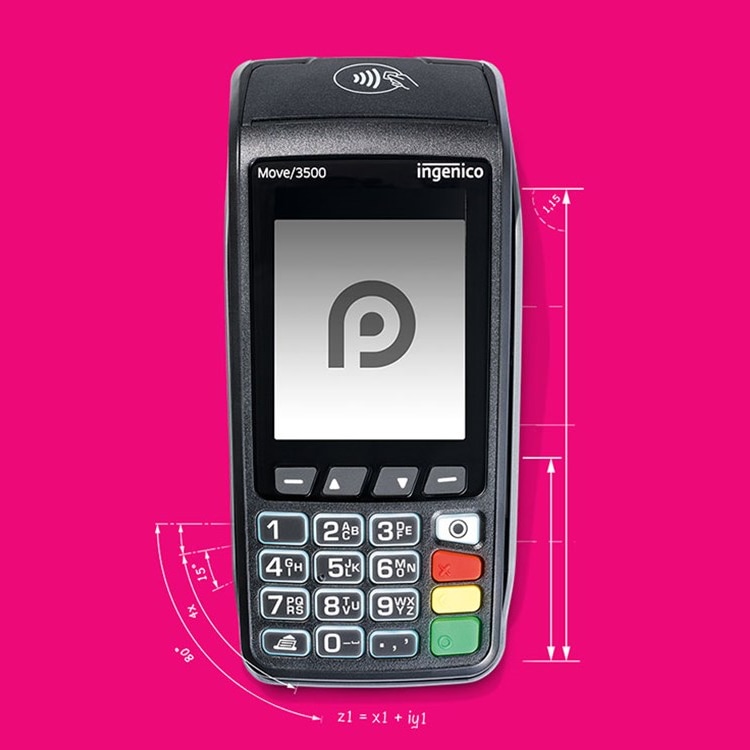

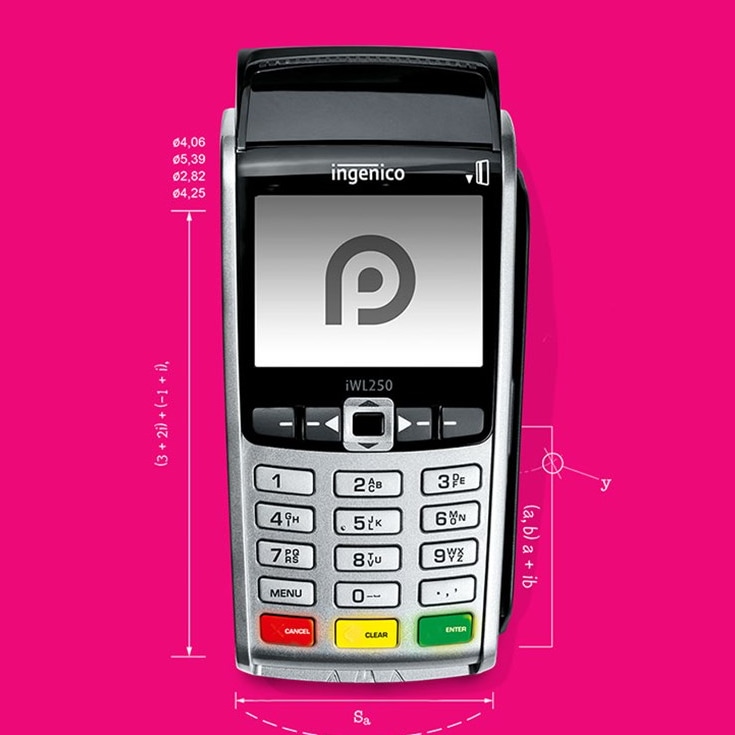

Their advertised models are three Ingenico card machines: one for a fixed countertop (Ingenico iCT250), a portable (Ingenico iWL250) and mobile (Ingenico Move 3500) model. The designs are all a bit old, but arguably more ergonomic with their push-buttons compared with touchscreen terminals like Dojo Go.

All the card machines accept chip and PIN, swipe and contactless transactions including Apple Pay and Google Pay.

Mobile card machine

The mobile terminal model, Ingenico Move/3500. Photo: Paymentsense

Portable card machine

The portable terminal, Ingenico iWL250. Photo: Paymentsense

Countertop card machine

The countertop terminal, Ingenico iCT250. Photo: Paymentsense

The mobile terminal works independently with its SIM card inserted. This makes it ideal for e.g. couriers, taxi drivers, market stalls, plumbers and other professionals meeting clients in different locations.

The portable terminal is intended for use within 100 metres on fixed premises, for example for table-side ordering or queue-busting. The countertop terminal needs the power cable to function, so it can only be used at a fixed till point.

Both the portable and fixed terminals integrate with a choice of 500+ point of sale (POS) systems so you don’t have to enter transaction totals manually on the card machine to accept payments. Instead, the POS software sends transaction amounts to the card machine, and the card machine communicates the status of payments back to the POS system.

Apart from these three models, Paymentsense offers a completely separate product called Dojo that has its own website. Dojo is a smart POS terminal of the PAX A920 model. It has built-in POS software to use via 4G or WiFi and a 10-hour battery life, so it’s ideal for mobile payments on the go or around your premises.

If you have particular hardware requirements or concerns about features, we recommend asking the sales rep about it.

Contractual commitment: then and now

Paymentsense now offers 30-day rolling contracts to all new customers. Until fairly recently, the company only had contracts of between 18 months and 5 years. This was a big commitment for many small businesses, so Paymentsense lowered this lock-in considerably.

If you’re in another card machine contract, Paymentsense can help you pay the cost of leaving that. The official promise is “We’ll save you up to 40% on your current bill and can even pay up to £3,000 of your exit fees.” Some users report that Paymentsense doesn’t always follow through on the promise, although efforts were made to make this process easier.

Another thing we’ve been made aware of is that card rates are capped throughout the contract period. This used to be an issue for those on long contracts whose turnover increased over the years, because lower fees are the norm for a high turnover. With the monthly contracts, you can just cancel the contract or change the fees in line with your growth.

You cannot leave the contract early without cancellation fees equivalent to the costs of the remaining months of the contract. This used to run into hundreds of pounds with many months left, but the notice period on a monthly plan is just a month, so that’s the maximum you’ll pay after cancellation.

You should always cancel the contract in the method agreed in the contract (usually in writing), as otherwise it auto-renews.

Fees

Paymentsense didn’t used to be transparent about fees, but has added a pricing calculator on their website with an overview of fees adjusted to your sales and industry. I haven’t seen this level of transparency from other merchant service providers without having to contact them, so this is unique.

The card transaction fees we’ve seen are fair. They depend on your:

- Annual card sales from the last 12 months

- Average transaction value

- Type of business

- Types of cards accepted.

UK-issued consumer debit and credit cards have the lowest rates, whereas corporate, premium and foreign cards have the highest fees.

The contract ensures you can accept Visa, Mastercard and American Express transactions into your bank account. Acceptance of Diners Club and Discover may be added at an additional cost.

Typical fees for merchants accepting less than £150k annually:

| Paymentsense pricing | |

|---|---|

| Contract length | 1 month |

| Setup fee | None |

| Monthly terminal rental cost | £20 + VAT/mo |

| Monthly minimum charge | £24.95 |

| Account On File fee (merchant account) | £3.99/mo |

| Transaction rates | UK-issued Visa or Mastercard debit and credit cards: 1.4% + 5p UK-issued Visa or Mastercard business cards: 1.99% + 5p |

| Chargebacks | £28 each |

| Refunds | 50p each |

| PCI-DSS compliance | Service fee: £4.95 + VAT/mo (required) Non-compliance fee: £35 + VAT/mo |

| Reporting fee | £12.95/mo |

| Online payments, monthly fee | £8.29-£19.95/mo depending on turnover and plan |

Fees can be tailored for businesses accepting more than £150,000 per year.

Standard settlement used to be 3-5 working days, but all new customers are now offered free payouts within 24 working hours.

The ‘monthly minimum service charge’ is the minimum amount Paymentsense requires in transaction fees on a monthly basis. If this is £24.95 and your month’s card processing fees are only £20, then Paymentsense will bill you £24.95. If your processing fees are £30 for the month, then £30 will be charged.

In essence, your monthly card processing fees amounts to at least £24.95 even when you’re accepting few – or no – card payments for the month.

Integration with POS software does not cost anything, according to the website. There is no setup fee for the card machine, but you do pay extra for the 24-hour replacement service, should this be part of your agreement.

As for PCI-DSS compliance (card security standard), a monthly service charge of £4.95 + VAT applies. If you don’t complete the necessary PCI-DSS paperwork in time, though, a hefty £35 + VAT non-compliance fee applies monthly until it’s submitted.

You should ask about other fees before signing up, because many users have reported unexpected charges. For example, some merchants mention a surprise annual fee, charges for performance reports and receipt rolls, and costs from third-party providers. Month-on-month, these costs can rack up significantly.

What about online payments?

If you transact for less than £50k annually, you pay £9.95/month on a monthly contract or £8.29/month on an annual contract.

A higher turnover of up to £250k per year costs £14.95/month with a monthly plan or £12.45/month on an annual plan.

Processing up to £1.2m annually costs £19.95/month on a monthly plan or £16.62/month with yearly commitment.

Other costs apply depending on your online solution, which are only disclosed when talking to Paymentsense.

Online payment tools

In addition to card machines, Paymentsense offers the following online payment solutions:

Online payment gateway: Customisable checkout for an online store. Can be integrated on your site (makes you responsible for PCI compliance) or hosted by Paymentsense on an external web page (PCI compliance is done for you). Compatible with over 40 shopping cart software solutions. Accepts different currencies for international payments, not just GBP.

Virtual terminal: Browser-based web page for entering card transactions on behalf of customers. Ideal for mail order and telephone order (MOTO) payments.

Pay by link: Payment links for email invoices, so customers can pay on a secure web page. Created and sent from a web browser.

All these solutions are included in the monthly fee for online payments (£8.29-£19.95/month). You can either sign up for a monthly or annual plan, which can be upgraded or downgraded later on.

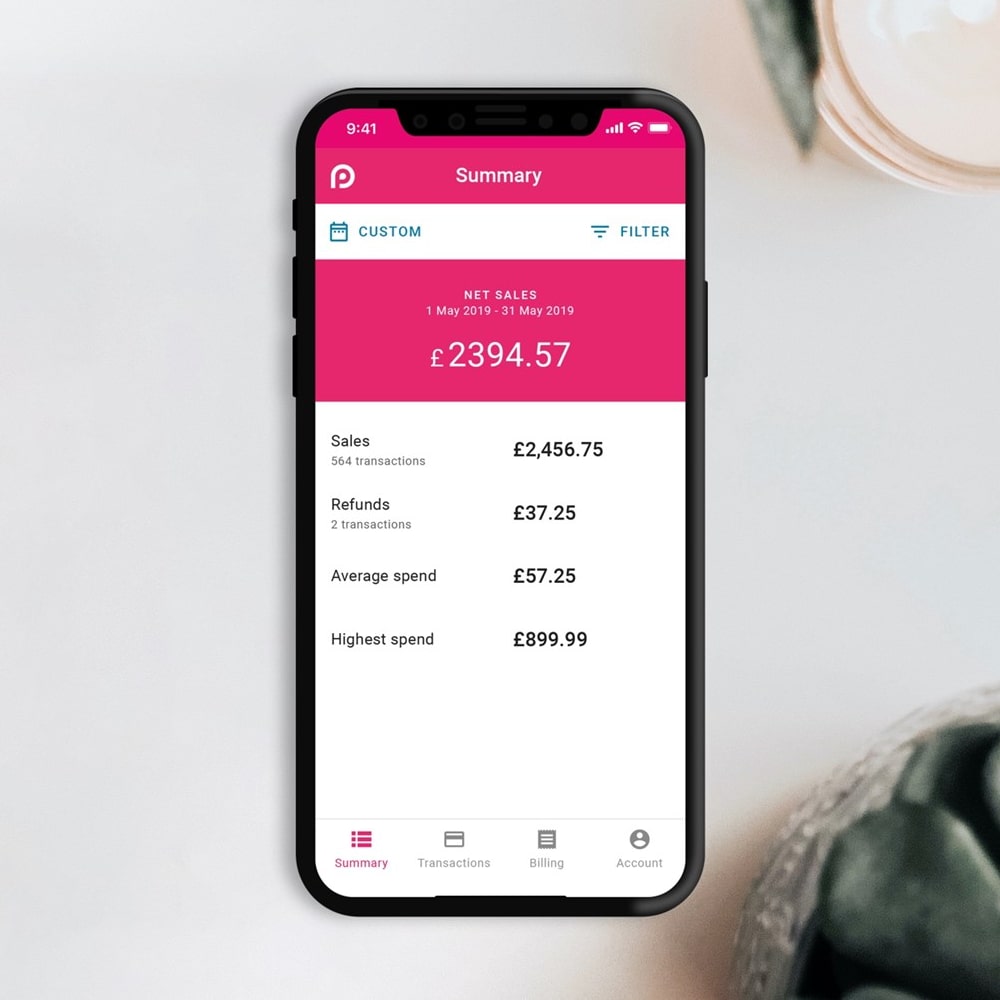

Photo: Paymentsense

Paymentsense app for reporting.

The online Paymentsense portal is where you can send payment links from and use the virtual terminal. It can be accessed in a web browser, whether you’re on a computer or using a mobile device. The portal also allows you to manage the Paymentsense account and oversee transactions, fees and more.

The Paymentsense Dashboard app is specifically for tracking sales, transactions, billing statuses and exporting data for your accountant. This is useful for real-time reporting on a phone, but you can’t send payment links or key in transactions from there.

Customer service and reviews

Paymentsense offers card terminal support 24/7 by a team based in London, UK. Onboarding is handled by sales reps that may be outsourced contractors, so they are different to the customer service team dealing with the fixed contract.

The number of complaints about Paymentsense used to be concerning, but have calmed down in the last few years. Issues that used to recur include:

We should add, though, that most of the fees mentioned by customers are typical of a standard terminal and card processing contract. And reviews for the last year have been much more positive, so we think there’s been a definite improvement.

Just make sure that Paymentsense is right for you by checking the small print before committing to any contract.