Contents

In summary

What is it?

Our opinion

In detail:

Pricing

Card machine

Account, card and payouts

Remote payments

Reporting

Financing and growth tools

Support and reviews

MobileTransaction has personally tested Teya’s products for an authentic experience. Photos and opinions are the editor’s own.

What is Teya?

Teya is a new merchant service provider with a presence in several European countries including the UK. It used to operate as SaltPay until 2023 when it relaunched as a one-stop business solutions provider with a simplified payment solution at its core.

The main products of Teya UK are:

- Card machine with a payment processing contract

- Payment links

- Business account with debit card

- Merchant portal and app for monitoring payments

- Cash advances

- Tap-on-phone app for Android

More tools and integrations are continually added to make the platform more comprehensive. For example, a customer engagement tool (Teya Boost) helping merchants to generate more customer reviews online is a nice extra that promotes the business’ local presence online.

Emily Sorensen (ES), MobileTransaction

The terminal has a holder and yellow cover.

ES, MobileTransaction

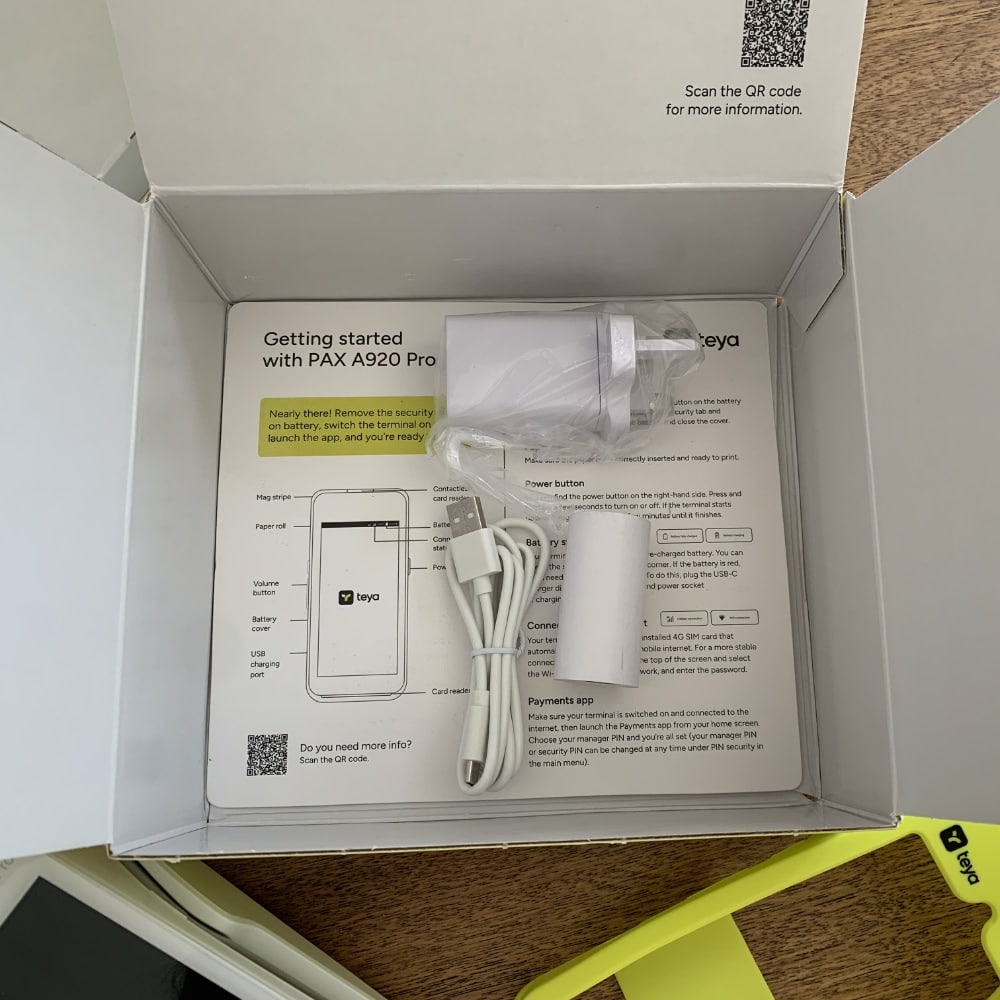

An adaptor, cable and receipt roll are included.

The main product of Teya is still its payment terminal, which we received and tried ourselves for this review (unboxing photos above). It accepts the most popular debit and credit cards and is very easy to set up and use straight away.

Accepted cards

Teya mainly targets small, local businesses such as corner shops, hairdressers, cafés and independent retail shops. Most small-to-medium business types are accepted, but not charities or a number of high-risk businesses.

Our opinion: very promising card machine contender

The UK payments market doesn’t lack card machines, but still there is room for someone like Teya. We found their team genuinely invested in transforming old systems into a new, simple-to-use payment system dedicated for business owners with a local presence.

I found the payment terminal very easy to use from the start – definitely sufficient for straightforward payments with a single transaction amount. Those who need POS features and cash management would need an EPOS integration or Loyverse installed on the terminal.

“I like Teya’s approach of keeping fees and contracts really minimal for new and growing companies. I wouldn’t fear a bad service or what would happen with a change of heart if I went with Teya.”

– Emily Sorensen, Senior Editor, MobileTransaction

You can tell from the limited choice of add-ons to boost an online presence and finances that this is geared mainly towards small retailers, hospitality and services with a physical presence to nurture. Teya is not a service for online-first companies, nor can charities apply.

The costs are very reasonable, with some of the best contract options on the market which would include Dojo and Worldpay. I would’ve liked to see more customer support hours, though, as well as more features in the Business Portal, but those things are coming up in 2024.

| Criteria | Verdict |

|---|---|

| Product Payments: Good / Excellent Hardware: Good / Excellent Software: Good |

Good / Excellent |

| Cost and fees | Good |

| Value-added services | Passable / Good |

| Contract | Good / Excellent |

| Sign-up and transparency | Good |

| Customer service | Passable / Good |

| FINAL RATING | [4/5] |

Pricing: made simple for individual merchants

Teya likes to personalise fees to suit your circumstances, but also has this choice of plans for the card machine:

- Monthly Plan: £20/month, 1.68% for Visa/Mastercard, 1.9% for Amex/Diners

- Annual Plan: £15/month, 1.38% for Visa/Mastercard, 1.9% for Amex/Diners

- Pay Once: £99-£225 upfront, 1.68% for Visa/Mastercard, 1.9% for Amex/Diners

VAT is added to monthly and upfront charges. There’s a 12-month contract on the Annual Plan, while Monthly Plan and Pay Once don’t require any commitment. Pay Once doesn’t have a monthly fee.

More established or higher-volume businesses can opt for a commitment-free Custom Pricing plan with variable fees (interchange++ pricing) that would be cheaper for their sales volume.

| Teya fees | |

|---|---|

| Monthly fee | Monthly Plan: £20 + VAT Annual Plan: £15 + VAT Pay Once: Free |

| Upfront cost | Monthly Plan, Annual Plan: Free Pay Once: £99-£225 + VAT |

| Contract | None on Monthly, Pay Once; 12 months on Annual |

| Chip, contactless, Pay by Link transactions | Visa, Mastercard: 1.38% (Annual) or 1.68% (Monthly/Pay Once) American Express/Diners Club: 1.9% (Monthly/Annual/Pay Once) Custom fees on Custom plan |

| Refunds | Free before payout; fee retained after payout |

| Chargebacks | Free |

| Terminal replacement | Free |

Unlike many card machine providers, the Visa and Mastercard transaction fees above apply to all transactions with those card brands, whether it’s a domestic, international, consumer, commercial or premium card, and even payment link transactions. The same goes for the Amex and Diners Club fee quoted.

Teya mentioned a free trial to us, so some merchants benefit from this on the pay-monthly plans. This would be part of their personalised approach to new merchants.

The Pay Once plan is ideal for new businesses that don’t want a monthly fee, especially if there’s a deal on the upfront cost. The normal, full upfront cost is £225 + VAT. Compared with the monthly plan, this works out cheaper if you plan on staying for at least a year. The current deal of £99 + VAT upfront makes it worthwhile for merchants staying with Teya for 6 months minimum.

The upfront cost does not mean you are buying the terminal, though – it comes with a 3-year lease, meaning it should be returned if you decide to leave Teya early. It does not mean you are tied into 3 years, so it is still a commitment-free plan.

In general, Teya wants to make it pain-free to leave Teya early if on the Annual Plan, so there’s no specific notice period. Plus, the only cost of leaving before the end of the 12 months are the remaining monthly fees that were due for the contract term.

“Other providers typically require 30 or 90 days’ cancellation notice, so Teya’s immediate cancellation is a breath of fresh air.”

– Emily Sorensen, Senior Editor, MobileTransaction

There’s no upfront cost whatsoever for the Monthly or Annual plans, and Teya is proud to say it doesn’t charge for PCI-DSS compliance or chargebacks. In fact, there’s no PCI paperworks to deal with, since Teya will handle all that.

Refunds are free to process before the original transaction has settled in your account. If settled, Teya only retains the interchange and card scheme fees originally paid, but returns their own margin of the transaction fee to the merchant.

Card machine: effortless start, does the job well

Teya’s central product is its card machine, a mobile and portable PAX A920Pro terminal. This is currently the only payment terminal offered by Teya, but the company plans to add more options down the line.

We were sent the card terminal to test it. Now, many card machines on the market today are easy to set up, but the Teya card machine has possibly been the easiest and fastest to use for the first time after unboxing it.

The battery came fully charged, and very few steps were required to open the Payments app on the terminal and take the first card transaction. The package came with a simple step-by-step sheet and QR code for more information.

It’s normal for high-end card machines like PAX A920 to connect with WiFi first, but Teya’s came with a 4G SIM card preinstalled and there was no requirement to connect with WiFi (though it’s recommended in case the mobile network drops out).

The box also comes with these accessories:

- White countertop holder

- Lime/yellow, rubbery, protective cover with the Teya logo

- Charging cable and adaptor

- 2 receipt rolls (1 inside the terminal and 1 spare)

Photo: ES, MobileTransaction

The Teya card machine looks best on a countertop when placed in its accompanying desk holder.

The card machine is a standard, handheld size with a large colour touchscreen where you navigate all functions. There’s a volume control and scan button on the left side and power button on the right. Like most card machines, the chip card slot is below the screen and contactless field and swipe card slot above the screen.

The camera openings on the top and bottom sides can be used for scanning barcodes, QR codes or simply taking a picture, but none of those things are possible through the Teya Payments app which is quite basic.

Photo: ES, MobileTransaction

Contactless taps are done above the screen.

Photo: ES, MobileTransaction

A virtual PIN pad shows when required.

So how does the payment process work? The terminal comes pre-equipped with a ‘Payments’ app that you tap from the main menu. A code is required to log in, but that’s quick to create.

The main screen in the Payments app is a numbered keypad where you enter a total transaction amount. At present, there’s no way to itemise sales by adding different amounts or products to the same transaction.

Then you just proceed to the payment, ask the customer to tap or insert their card and enter their PIN on the screen (if requested). A receipt can either be printed from the terminal’s built-in receipt printer or sent via email or text.

Photo: ES, MobileTransaction

Paper receipts come out of the rear, and the roll is easily changed by pulling out a flap underneath.

Which extra features does it have? The Payments app allows users to add these optional functions to transactions:

- Tipping options

- Acceptance for American Express and Diners Club cards

- Payment links as a payment option

- Dynamic Currency Conversion support

- Assignment of a transaction reference number (useful for invoice payments)

- Automatic receipt printing

- Preauthorisations (only available to hotels and car/equipment rental services)

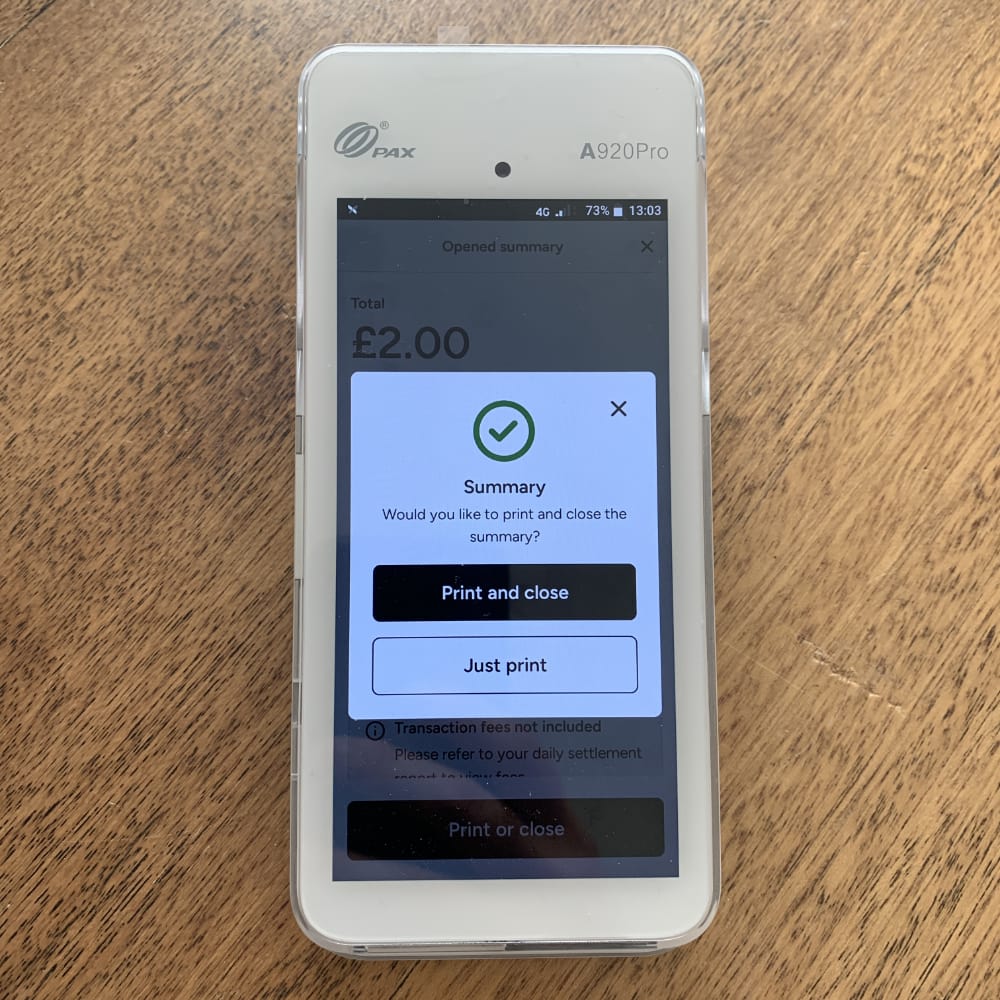

Transactions and a daily summary of sales can be viewed and printed from a side menu, and refunds are also done from there. At the end of a trading day, you can finalise the day and print a sales summary showing overall card totals per card scheme accepted.

Photo: ES, MobileTransaction

The sales summary is just about card sales.

Photo: ES, MobileTransaction

The underside has rubber grips and a camera.

We could also change the interface language to a number of European languages, if English isn’t understood that well. Apart from a few other minor settings, these features are basically all you get if using the terminal unintegrated through the Payments app.

What about point of sale (POS) integrations? The card terminal isn’t limited to accepting straightforward payment totals, though. A few POS apps can be downloaded directly on the card machine, the main one being Loyverse which we’ve tested and reviewed.

Loyverse is actually owned by Teya and better suited for retailers and hospitality with its inventory library, customer loyalty and cash management functions. It’s also completely free to use, though add-on features are available for a fee.

More advanced EPOS systems can be integrated with the card machine instead, such as Epos Now, uniCenta and Shopwave. This would mean having a whole setup of POS equipment and connecting it with Teya’s card machine so card payments are automatically communicated between the two.

No card machine? That’s what Teya Tap is for

Like many card machine companies in the UK, Teya also has a free tap-on-phone app for Android users (not yet iPhone).

If you download this on your Android phone with NFC enabled, you can enter a transaction amount in the app and ask customers to tap their Visa, Mastercard or mobile wallet on your phone to pay via contactless. These transactions have the same rate you got for the card machine.

Business account, card and settlements

Teya offers a complimentary business account that small businesses can use to keep track of funds and expenses. This is not a bank account – it’s an electronic money (e-money) account, so funds are not protected in the same way as a bank account.

The account is managed in the Teya Business app, and merchants receive a free Visa debit card in the post within 5 working days. The card gives you 0.5% cash-back on all transactions, so that’s a compelling reason to use it for business expenses.

A virtual card can be used for Google Pay, but not yet Apple Pay (we’ve been told it will be added there soon, though). Each business can have multiple cards to split between staff members – up to 15 virtual cards, in fact.

The account is able to handle unlimited Direct Debits and UK bank transfers, but doesn’t do international transfers. You can withdraw cash from ATMs 30 times a month for free, after which it costs £0.50 per withdrawal. No other costs apply to the account.

Funds from card machine transactions either settle in the Teya Business Account or a bank account associated with your business. It makes no difference to the settlement time which one you choose.

Teya oprates a 5am-5am payout schedule. This means all transactions accepted on the card machine between 5am on one day and 5am the following morning arrive in your chosen account the same morning (or next working day if on a weekend) between 9am-11am, minus transaction fees. Teya plans to introduce same-day payouts later this year.

For any payout to happen, though, there has to be at least €15 (i.e. the equivalent in GBP) to transfer. This won’t be a problem for most businesses, though.

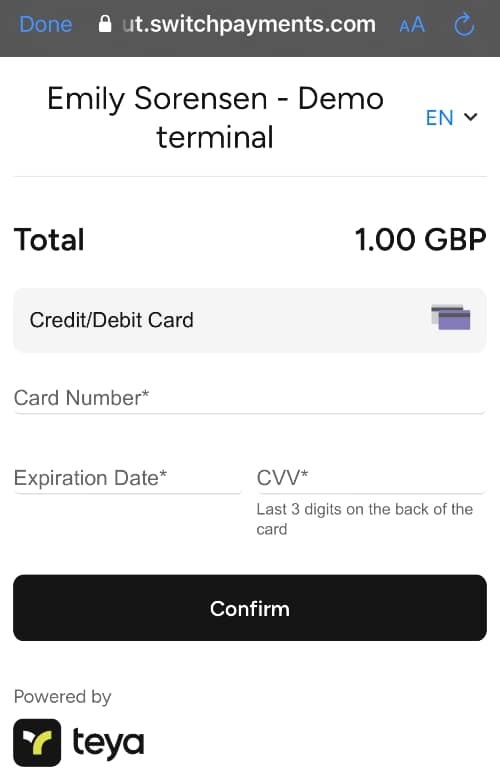

Image: ES, MobileTransaction

Teya payment links lead to a page like this.

The merchant can then send a link via SMS or email for the customer to click to complete the transaction on a web page in their phone or computer browser.

Each payment link expires after either 30 minutes or 24 hours – that’s something the merchant sets on the terminal. It’s not possible to send links without an expiry time, nor can you cancel them after sending.

The best thing about Teya’s payment links is that the transaction fee is the same as for in-person chip or tap card payments. Normally, online payments are more expensive.

Teya doesn’t have an option for keyed card transactions (sometimes referred to as a virtual terminal) for over-the-phone payments. No ecommerce integrations are available either.

Reporting: basics are there, but still limited

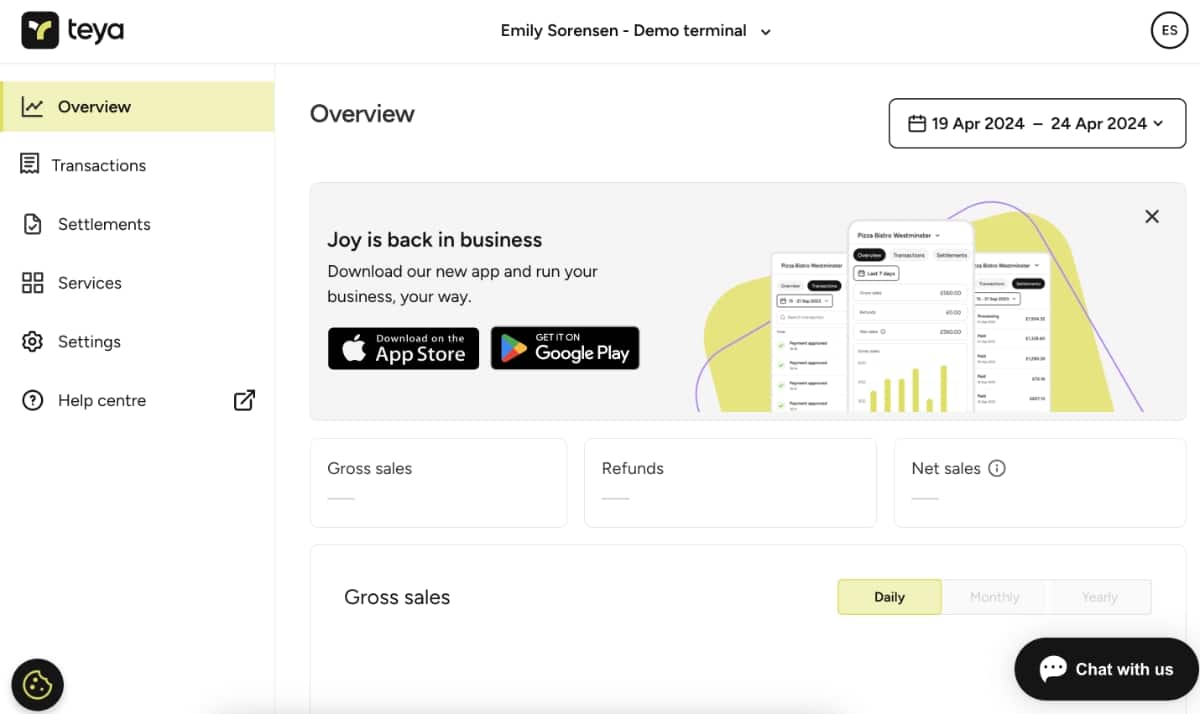

With sales synced in the cloud, merchants can view transactions in real time from the Teya Business app on a phone or web portal in an internet browser.

Having tested both the app and browser portal, I can confirm it’s just transaction details and settlement details you can search, browse and filter. Transactions – not settlements – can be exported to a CSV file for feeding into an accounting system of your own.

Image: ES, MobileTransaction

The Teya Business Portal in a desktop browser is quite straightforward to navigate.

Teya doesn’t yet offer accounting integrations directly, but it would be possible to connect with bookkeeping software through a connected POS system. Eventually, the Teya Business Account will integrate with accounting programs in the UK, we’ve been told.

The card machine does print a basic sales summary (X report) and end-of-day report (Z report) specifying card sales grouped into card schemes (Visa, Amex, etc.). But given how simple the terminal app is, it doesn’t include things like cash movements and other payment methods.

Growth tools: cash advance and online presence boost

Teya is keen to not only help businesses get paid, but also support growth for local, physical businesses. Two products do that:

- Teya Cash Advance: Flexible financing repaid through a fixed percentage of card takings until repaid. Just one fixed fee is required.

- Teya Boost: Tool that syncs business information like opening hours with 58 online platforms and helps manage customer reviews.

Provided by Liberis, eligible businesses who’ve accepted payments for at least the previous 4 months can apply for the cash advance (needs to be backed up with merchant statements). It’s a popular alternative to business loans for small and medium companies, as no interest is applied and repayments are done in your own time through an extra transaction fee. Even new Teya sign-ups can apply for this and could get funding within 24 hours of registering.

Teya Boost is a particular gem, in my opinion, because it’s free and makes it really fast to share core business details across all the platforms where potential customers might find you online (e.g. Google Maps, Facebook, Siri, Nextdoor). The Boost portal also tracks customer reviews across platforms like Trustpilot, allowing the business owner to reply promptly to them which is meant to boost search engine rankings.

Customer support and reviews

Teya likes giving a personal service and will usually offer to meet in person to introduce the product and get you started.

I was pleased to see that Teya doesn’t stick to one mode of communication for support. All users can choose to contact support via telephone, WhatsApp, email or live chat on weekdays between 9am and 5pm. The help guides online don’t answer all questions, though, so it will be important to have these contact options.

There’s no out-of-hours support if the terminal breaks down at weekends or nights, but 24/7 support will be introduced in the next few months, according to our contact in the company.

Technical issues can in many cases be dealt with remotely, but if a new card machine is needed, Teya can send one out for the next working day if reported before 3pm on a weekday. This is a free service.

“Our own experience of Teya’s team has been really positive. The team seems genuinely honest, invested in making a good product, revamping poorly-performing systems and making things easy for the individual merchant.”

– Emily Sorensen, Senior Editor, MobileTransaction

Customer reviews so far are a mixed bag, but they are largely positive about the service and straightforwardness of the product. New sign-ups generally have a swift onboarding, with one day’s account verification and receiving a card machine within 24 hours.