- Highs: All app features are free, just pay a transaction fee. No contract. Very user-friendly.

- Lows: Sales reports could be more advanced. Only weekday customer support.

- Choose if: You’re a small business wanting an easy, free POS solution for payments.

What is iZettle Go?

iZettle Go is a point-of-sale (POS) app for your phone or tablet, enabling your small business to take payments for just a simple transaction fee.

To get started, you sign up with iZettle online to get your business and bank account verified, then download the app on a mobile device (it does not work on a PC or Mac). Order iZettle Reader to take chip and PIN and contactless payments in conjunction with the app, or send invoices and payment links for a higher fee.

It works as a complete, cloud-based POS system for face-to-face businesses, including backend analytics and reports.

| iZettle Go | |

|---|---|

| Monthly fees | Free |

| Contract | No commitment |

| iZettle Reader price | £29 (normally £69) + VAT (offer here) |

| Card reader payments | 1.75% per transaction |

| Cash payments | Free |

| Invoices & payment links | 2.5% per transaction |

| Refunds | Free |

| Chargebacks | Up to £250 cover/mo free |

| iZettle Go | |

|---|---|

| Monthly fees | Free |

| Contract | No commitment |

| iZettle Reader price | £29 (normally £69) + VAT (offer here) |

| Card reader payments | 1.75% per transaction |

| Cash payments | Free |

| Invoices & payment links | 2.5% per transaction |

| Refunds | Free |

| Chargebacks | Up to £250 cover/mo free |

The main things you’re paying for are the transaction fees and hardware (where relevant). If you’re taking card payments at the point of sale, you will need iZettle Reader costing £29 (usually £69) + VAT. All chip and PIN and contactless payments through iZettle Reader have a 1.75% charge per transaction. Cash transactions are free to register in the app.

Payments through electronic invoices paid by card cost 2.5% per transaction. For the same fee, iZettle Go also offers the more flexible pay by link option, where a simple payment link can be sent by sms, email, or through WhatsApp or Messenger.

You have the option to subscribe to iZettle E-commerce for £29 + VAT monthly to build an integrated online store. Card transactions via your online store cost 2.5% each, while PayPal transactions only cost 2% to accept for iZettle merchants.

PCI compliance, which typically comes at an added cost, is free. All card payments automatically clear in your bank account within 1-2 working days for free.

Card refunds are transferred back to your bank account, including the iZettle transaction fee – so ultimately, refunds are free. iZettle covers up to £250 worth of chargebacks a month for free provided you follow basic security standards when you accept cards.

Checkout and payments

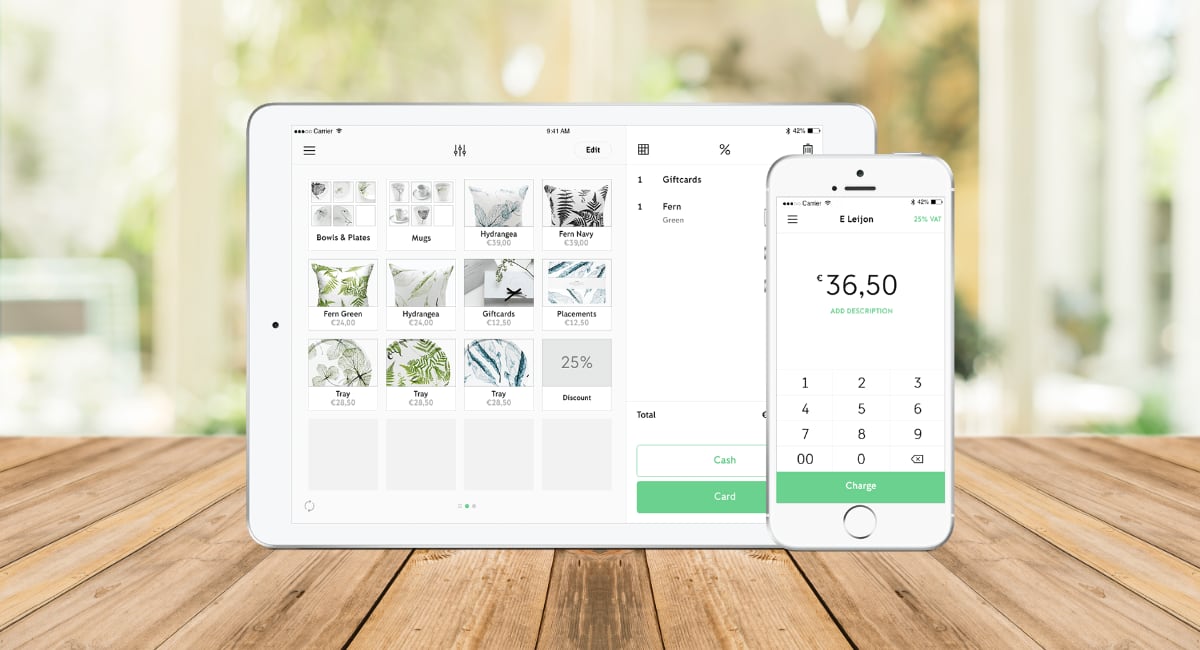

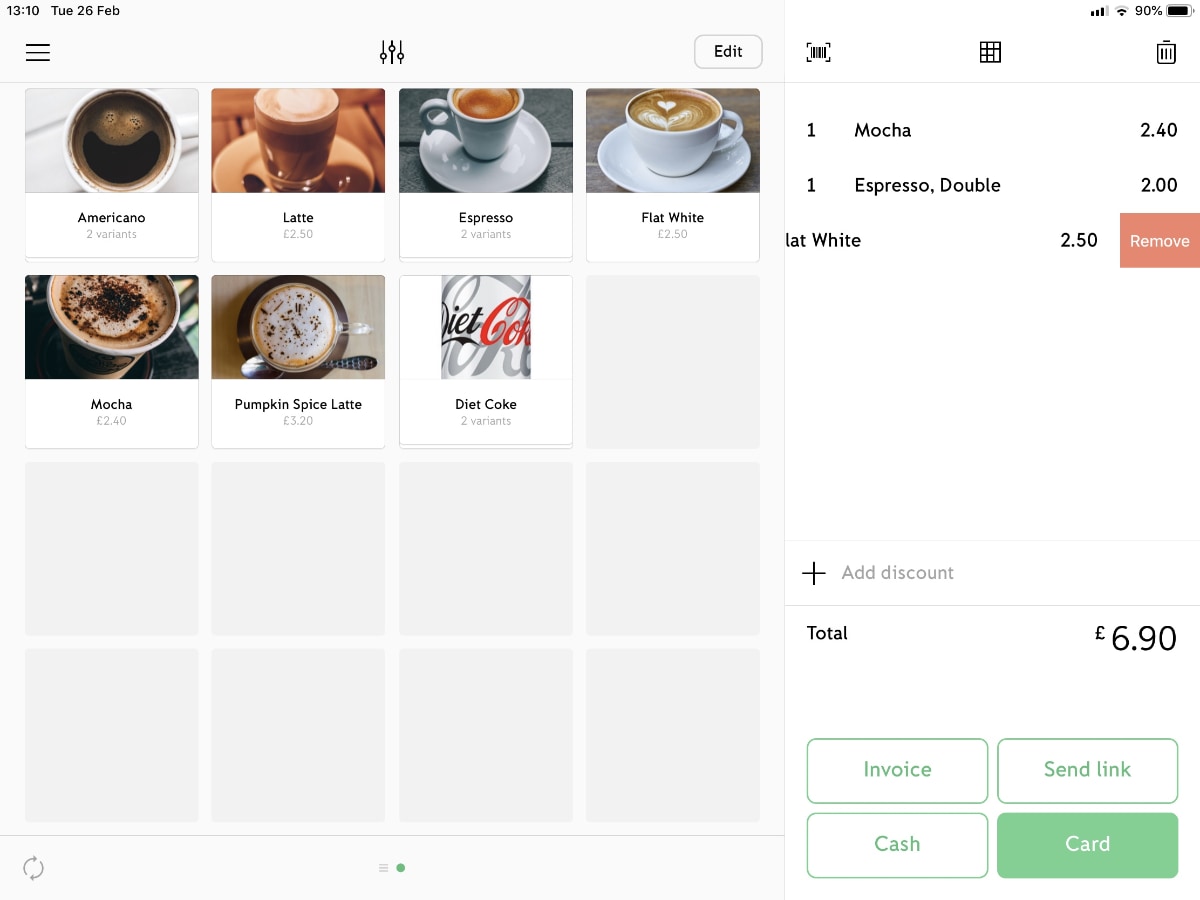

The checkout screen in the Go app is pretty straightforward. It’s recommended you first add products with images which will then show on your screen, ready to choose for the cart.

If your products have a barcode, you can use the app’s inbuilt barcode scanner. It is also possible to add a description of an item at checkout, for example, if none of the options in the product library matches what’s being bought or you haven’t added anything in the product library.

You can easily slide left to delete an item off the bill, add a discount and choose a payment method from the checkout screen, but there is no option to split the bill or use more than one payment method.

Photo: Mobile Transaction

Checkout screen on iPad, grid layout.

To take card reader payments, you need to pair iZettle Reader with the app via the Settings menu. Just remember to switch on Bluetooth on your mobile device, as the card reader connects through Bluetooth. Once you have done that, you only need to switch on the card reader and have it in the vicinity of the Go app to activate it for any card payments.

If you take a cash payment, you register the amount given in change, and it will tell you what to give back.

Email invoices can be sent to new or existing customers saved in the customer library. Just tap the invoice button from the checkout and either choose a customer on the list or create a new customer profile including company name, email address, postal address and optional details. You can then pick a payment due date and delivery date (if relevant) and send it via email.

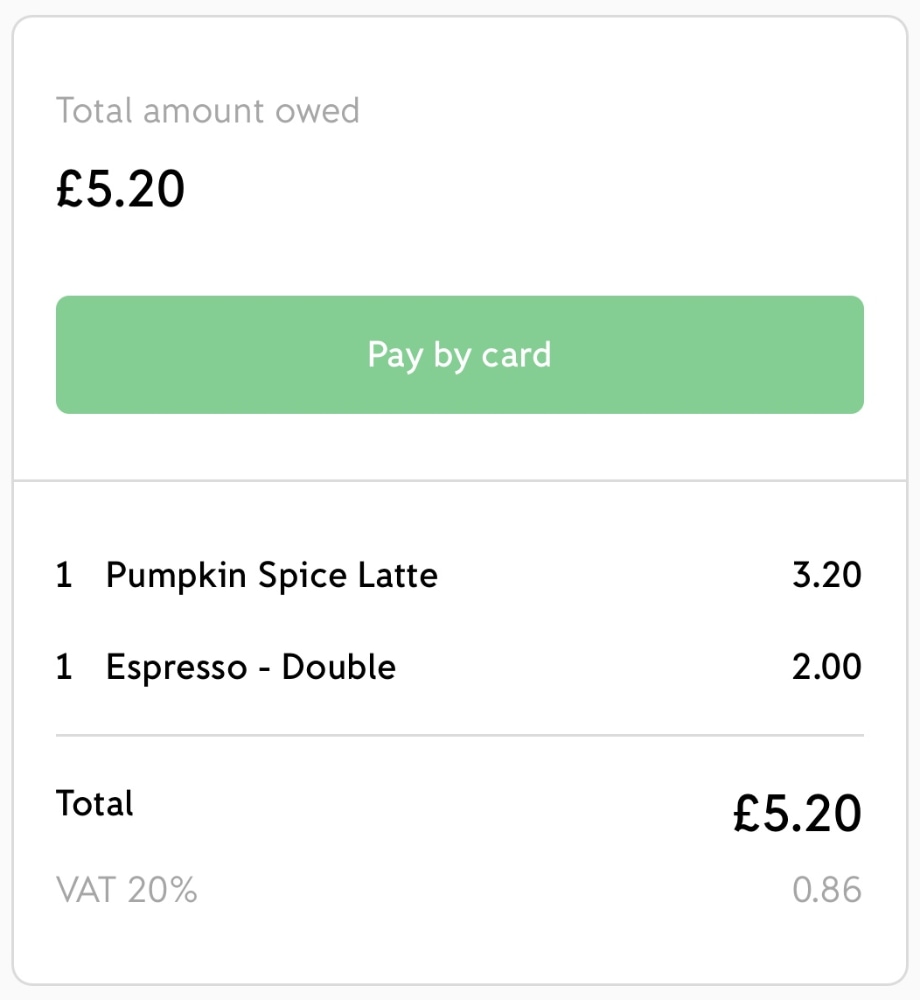

Payment links are different, mainly because there are no customer details attached to them. You simply enter the customer’s name (as payment reference) and mobile number if you want to send the link by text, or pick a social app such as Gmail or Messenger if the customer prefers getting the link in another kind of message. Payment links don’t expire, and the customer is not obliged to pay, as opposed to invoices with a due date.

Tipping is possible on the iZettle Reader – you can’t enter a tip in the app directly. Instead, the iZettle Reader screen asks the customer whether they want to add a tip, prompting them to type a tip amount on the card reader.

Photo: Mobile Transaction

A payment link for a drinks order, as seen from the customer’s end.

This will subsequently be added to the bill and registered in the system that way. For cash payments, you can add a tip manually on the checkout screen the same way as adding a custom item with a written description to the bill.

After each payment, the app gives the option to text or email a digital receipt to the customer. This, of course, requires a phone number or email address. The smart thing about iZettle is that once someone has requested an email receipt after a card payment, iZettle associates that email address with that particular debit or credit card. The next time he or she pays with any iZettle Reader, the till assistant only needs to ask if they want an email receipt, and they can send it without further details. Receipts can be customised in the back office account with terms and company information.

Inventory management

In terms of product management, iZettle Go is versatile enough for both food-and-drink businesses and retail shops.

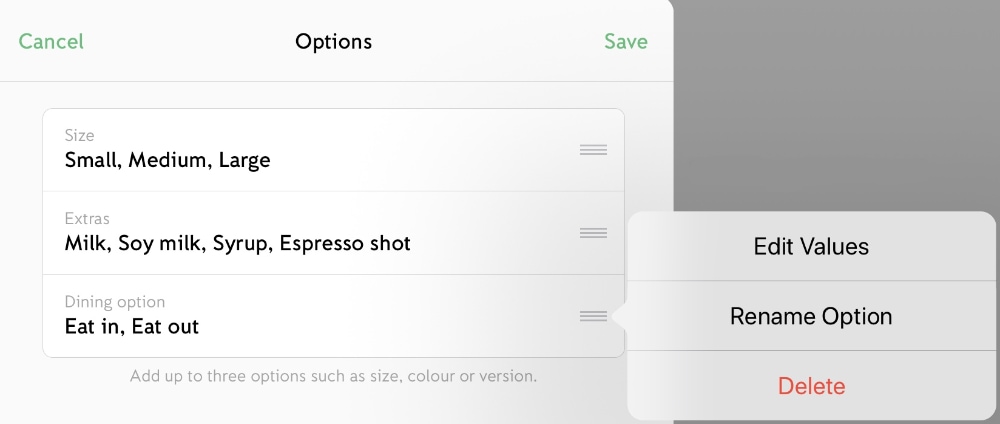

Each product in the library can have a title, colour or photo, inventory tracking, price per unit (custom-add any unit type), VAT (0%, 5% or 20%), selling price, barcode (can be scanned from the app), stock count, cost price, SKU number and variants. Default variants include colour, finish, material, size and style, but you’re free to add any custom variants too. Products can maximum have up to three variant options associated with them.

The iZettle E-commerce platform enables you to copy over all in-store products from the library to the online store, or you can select only some (or none) of them. This is a crucial benefit: the smooth integration between online and POS transactions, so all sales can be viewed together in the dashboard.

Switch on inventory tracking for individual products and you get stock alerts to replenish items low in stock.

Although transactions are individually stamped with the payment location, there is no option to distinguish multiple locations with Go. The hospitality-focused iZettle Pro, on the other hand, includes location management.

Photo: Mobile Transaction

Example of product options for a café menu.

Employee access and permissions

To distinguish between employee sales, you can create separate app logins for each staff member. All you need is a name and email address from each person, and you can send an email invite. The recipient can then create a password. The admin can sort sales by employee in the back office and thereby check remotely what’s going on in the shop.

With iZettle Go, there is only one admin account, but you can have unlimited staff accounts. The latter can only view reports and receipts related to their own sales, but they can see payment links created by anyone on the team. Everyone can refund from receipts displayed in the app. There are no permission settings to deal with – just simple user accounts without the ability to change admin details or edit products.

Timesheets are another thing you can’t do with Go, but this is available in iZettle Pro.

Customer loyalty tools

Customer profiles can be created after sending a digital receipt. These profiles are essentially a list of your customers with an email address, which you can export to a CSV file for mailing lists or similar. Due to privacy regulations, customers are not automatically added after sending the invite – they have to click a link in the email, saying they accept having their email address, name and purchase details stored by you, and that receiving emails from you is okay.

Photo: Mobile Transaction

Returning customer statistic on iZettle’s dashboard.

Whether or not a person has a profile, returning customers using the same credit or debit card will be marked as “returning customer” in the system – but only for analytical purposes so the dashboard can show the percentage of returning customers today or this month.

While there is no option for automatic, recurring promotions, you can give discounts on a product or transaction either set by percentage or British pounds. Name the discount at checkout, e.g. Student or Discontinued, to mark the reason for it. You can also add fixed promotions in advance, applied at checkout where applicable.

The system does not enable loyalty points, but you can mark voucher points with a £ or % discount, naming the markdown “1 free coffee voucher” or whatever suits the situation.

It is also possible to sell and accept gift cards, but only in the iPad or iPhone app (so not Android). You decide on the gift card’s expiry date (1, 2 or 3 years), which can later be changed in settings.

At checkout, just tap the gift card item, add the value, write a code (or scan the barcode of a physical gift card you have in stock – you can order some through iZettle) and then you can give this code to the customer in whichever form you prefer, e.g. handwritten in a greeting card or just on the receipt. Gift cards will show as a payment method when it is switched on.

Reports and sales analytics

Because the system is cloud-based, you always have access to sales and transactions through the iZettle dashboard in an internet browser in real time.

View daily reports in the iZettle Go app, which can be printed directly via AirPrint or emailed the account holder. The app reports are limited to an overview of sales arranged by date, with no option to filter results except for viewing totals by day or month.

They are basically like end-of-day/month totals used for cashing up or stored for accounting, with totals for card, cash and invoice payments and refunds via each method. Discounts and iZettle fees show here as well. Furthermore, it shows the top-selling products of the day along with quantities sold – handy for checking what stock to order back in for replenishment.

In the browser back office, we only noticed one extra search filter: seeing what individual staff members have sold (requires separate login accounts). Searching by product or location is not possible, but the percentage of returning customers based on the card used for payments is shown in the overview dashboard. For more detailed analytics, upgrade to the more advanced iZettle Pro.

That said, both the app and back office allows you to search any receipt, invoice and payment link. These contain detailed information about transactions, including purchase location and products sold. It is through these itemised receipts you can refund payments or individual items.

Gift cards can be tracked on a separate dashboard page in the Products section.

For more advanced accounting functions, iZettle can be integrated with Xero or QuickBooks.

Hardware for the point of sale

For a till point, getting the iZettle Reader with accompanying Dock is recommended. The iZettle Dock will keep the card reader charged all day, securely stationed and ready for card payments. We also recommend a tablet for a stationary point of sale, placed in a tablet holder on top of a cash drawer if needed.

Although the app is compatible with Android phones and tablets, some features are made available in the iOS app sooner than on Android. However, any of the Android, iPhone and iPad apps generally work fine and have good average user scores.

Quite a few receipt printers are compatible with iZettle Go, both stationary and mobile ones. You can connect a barcode scanner and cash drawer, automatically opened when connected to a receipt printer.

iZettle Go is not compatible with any other card machine than iZettle Reader. If you want another card terminal, you will have to switch to another EPOS system.

Photo: Mobile Transaction

iZettle point of sale with iZettle Reader on a charging Dock.

Customer service

iZettle Go includes free customer support – but only between 9am and 5pm, Monday to Friday. During those hours, you can phone the support line with any queries or issues or email either directly or through a contact form on the website.

They will respond via email as soon as they have an answer during the weekday working hours, maybe within an hour or a few days depending on the urgency and complexity of the matter. Alternatively, you can find answers to a lot of questions in the online help section.

iZettle Go vs. iZettle Pro

While iZettle Go is for many kinds of merchants, iZettle Pro is an EPOS app for iPad focused on food-and-drink businesses. It costs a monthly subscription of £39, but per iPad licence rather than one total fee.

iZettle Pro has many hospitality-focused features such as table layout, split orders, food modifiers and so on. It also has extended sales analytics – something we found to be a vast improvement on the free reports in Go.

Interestingly, it has a retail setting which changes the functions to focus on shop products rather than food- and menu-oriented. iZettle does not advertise this setting, leading us to wonder whether it is something they will quietly discontinue.

Photo: Mobile Transaction

Some newer businesses keep POS systems simple by just accepting cards.

Upgrade options for growing businesses

Many new or small businesses start out using iZettle Go as an easy way to accept cards and manage all basic POS operations. At some point, you may need advanced features, in which case it is time to consider more extensive EPOS systems.

You can still use iZettle Reader with several other POS systems such as Vend. In contrast, the Go system doesn’t work with other card machines than iZettle Reader.

For more advanced accounting and payroll features, Go can be integrated with Xero or QuickBooks, paid for separately.

Our verdict

It’s not due to any clever marketing campaign that iZettle is a top choice in the UK. The POS system is super-easy to work out, there’s no contract to commit to, the card reader is cheap and payment fees simple. Add to that how easy it is to create an iZettle account, and nothing is stopping you from running a small business.

Cash-strapped businesses can opt for iZettle E-commerce for a user-friendly way to sell online without any technical assistance, except for iZettle’s easy-to-understand guidance throughout the process.

The POS system covers essential features for retail shops, cafés, bars, market stalls, plumbers, hairdressers, beauty salons – you name it. There are hardly any superfluous functions to complicate the POS system; a plus for merchants who just need to cover the bases in a store.

At the same time, the app is evolving with continuous updates and targeted tools in response to user feedback. It is a system that lives to give you maximum benefits for the lowest cost possible.