How do you accept contactless payments tapped on your phone without a card reader? What are the UK options for merchants?

We’re not talking about your phone’s mobile wallet as a payment method, tapped on a dedicated card terminal – we mean the other way around.

Using a smartphone as a contactless terminal is a topic called Tap on Phone, Tap to Phone, Tap to Pay or “SoftPOS” in tech speak.

SoftPOS (Software Point of Sale) is an app that transforms your phone into a payment terminal. If your smartphone has the near-field communication (NFC) technology built in, it can accept contactless cards and mobile wallets as long as you have an app to facilitate it.

As a rule, all phones with Google Pay (Android) or Apple Wallet (iPhone) are NFC-enabled. So what are the Tap to Pay apps available?

Tap to Pay solutions in the UK

Tap-on-phone apps have been trialled for years, but have finally been launched by many providers in the last few years.

All the tap-to-phone apps in the UK with a significant user base:

| Tap to Pay solution |

Device | Pricing | Best for |

|---|---|---|---|

| Square (offer) |

Android, iPhone | 1.75% /transaction No monthly fee |

Instant bank account payouts |

| Revolut (offer) |

iPhone | 0.8%-2.6% + 10p or 1.7% /transaction Requires business account |

Low rate for domestic consumer cards |

| Tide (offer) |

iPhone | 1.65% /transaction Requires business account |

Decent customer support options |

| SumUp | Android, iPhone | 1.69% /transaction 0.99%-1.99% /transaction for £19/mo |

User-friendliness in the payment app |

| Zettle by PayPal | Android, iPhone | 1.75% /transaction No monthly fee |

Merchants who prefer Zettle’s easy interface |

| Monzo Business | Android, iPhone | 1.4%-2.9% + 20p / transaction Requires business account |

Reputable bank account with good app |

| Dojo | iPhone | Custom or fixed transaction fees For card machine customers only |

Dojo users who’d like Tap to Pay as a backup |

| Tyl by NatWest | Android, iPhone | 1.39%-1.99% + 5p /transaction For card machine customers only |

Businesses who prefer a traditional bank |

| myPOS Glass | Android, iPhone | 1.6% + £0.07 /transaction 1.1% + £0.07 with £4.90 monthly fee |

Sellers accepting payments across Europe |

| Worldline Tap on Mobile | Android | Custom fees | One of Europe’s leading card processors |

| Viva Wallet | Android, iPhone | 1.69%-2.4% /transaction Requires viva.com e-money account |

Offline transactions and app access to funds |

| Stripe | Android, iPhone (SDK* only) |

Variable rates | Small businesses requiring a custom setup |

| Adyen | iPhone (SDK* only) |

Variable rates | Big companies who can negotiate good rates |

*Software development kit (SDK) for integrating tap-on-phone in your own payment app.

‘Tap to Pay’, the popular name now, is not usually displayed prominently on provider websites. That’s because the feature is regarded as a complimentary payment method when a card machine isn’t working or with specific business accounts.

Brief summary of solutions

Square, SumUp and Zettle were some of the first to introduce it in the UK – a natural addition to their cheap card readers.

Dojo, Worldline and Tyl by NatWest offer card machines primarily, but they also added Tap to Pay to keep up with competition.

Stripe and Adyen require merchants to build their own solution, whereas myPOS Glass has a plan with a monthly fee for a lower processing rate.

Tide’s, Revolut’s and Monzo’s Tap to Pay are available to all their business holders, but that means funds always have to go into those accounts.

Viva Wallet promotes it too, but is a less familiar app in the UK.

Let’s dig into the individual solutions.

Image: Viva Wallet

Viva Wallet Tap On Phone payment.

Square Tap to Pay – best value, free to sign up

Best known for its square-shaped card reader, Square Tap to Pay was launched in the last few years as a supplement to the company’s already-broad range of free payment methods.

Tap-on-phone works in the Square Point of Sale app on most Android phones and iPhones. Registered companies, charities and sole traders alike can sign up online for an account in a few minutes.

Each transaction costs 1.75% for any type of card or contactless mobile wallet.

It takes about 1-2 working days for funds to settle free, or you can receive funds in minutes in your bank account with the Instant Transfers setting for an extra fee of 1%.

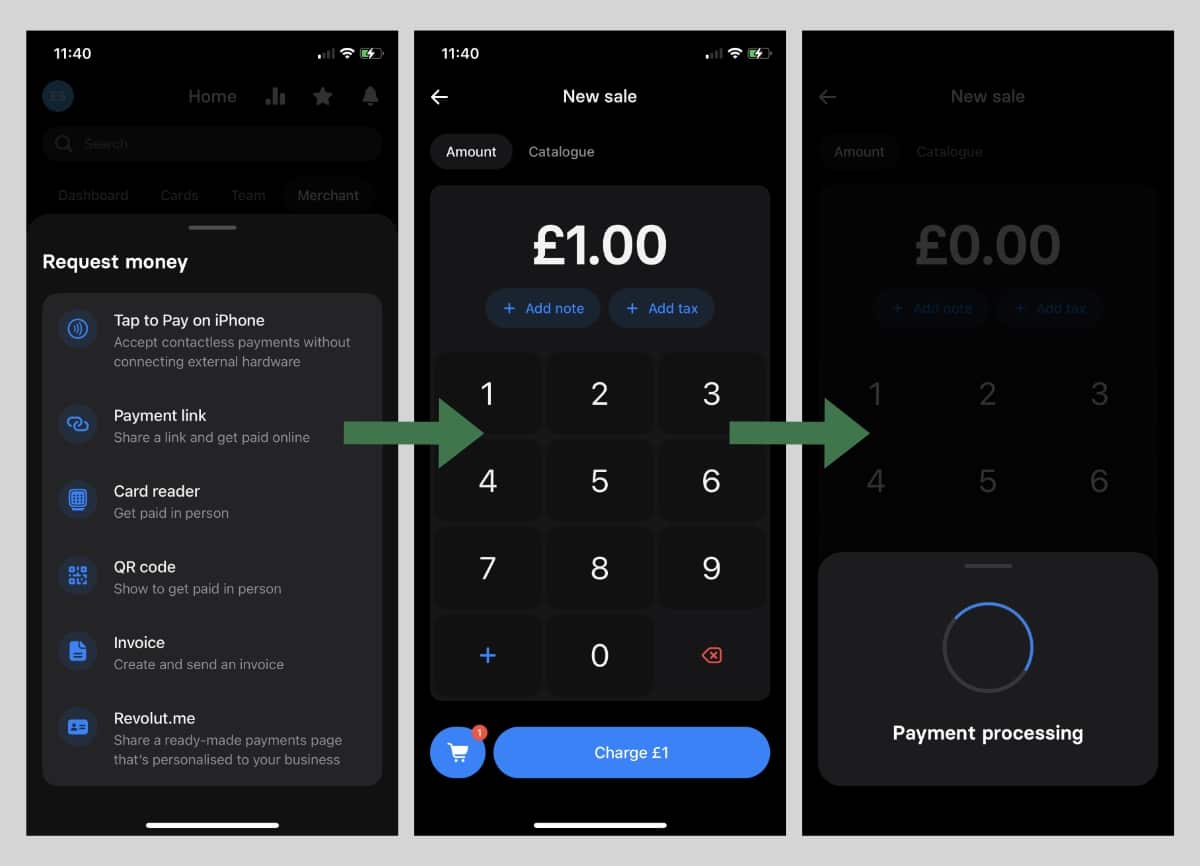

Revolut Tap to Pay – 24-hour payouts

Revolut ‘s Tap to Pay works exclusively on iPhone.

To use it, you first need to sign up for Revolut Business for companies or Pro for freelancers. There’s then a separate registration for a Merchant Account allowing you to accept card payments, which can take a couple of days to process.

Companies typically need to verify their business periodically by submitting documents (we’ve done it many times), but it’s less stringent for freelancers.

If all goes well, you’ll be able to accept tap-on-phone transactions with your Revolut app on iPhone. It’s not entirely intuitive to find the feature, but it’s easy to get the hang of.

Funds go to your Revolut Business account within 24 hours on average. There’s no monthly fee for payment acceptance, just the account if you opted for a paid subscription.

Companies pay 0.8% + £0.10 for UK consumer Mastercard and Visa cards, 1.7% + £0.10 for UK consumer Amex, or 2.6% + £0.10 for any other cards. Freelancers with the free Pro account just pay a fixed 1.7% for any card.

Image: Mobile Transaction

Revolut Business app flow for accepting Tap to Pay on iPhone.

Tide Tap to Pay – good customer support options

If you prefer Tide’s business account, it has Tap to Pay on iPhone alongside its card reader service.

The feature shows in the Tide app if your type of business is approved for it. Some businesses might need to contact Tide to get it activated.

In the last couple of years, Tide has added more payment tools to its account, so we genuinely think it’s a viable option for casual sellers on the go.

The fee is a fixed 1.65% per contactless transaction on the phone.

SumUp Tap to Pay – backup for card reader users

SumUp offers Tap to Pay on both iPhone and Android.

As with Square, the feature is considered supplementary to SumUp’s well-known card readers. Still, you can sign up for a SumUp account in a few minutes and (theoretically, at least) start accepting contactless payments through SumUp App straight away.

Every tap transaction costs 1.69% regardless of the card type or mobile wallet, and there’s no monthly fee or commitment.

Payouts are either processed to your bank account in 2-3 working days or the next day in a complimentary SumUp Business Account.

Zettle Tap to Pay – works well for card reader users

Last of the small-business card reader companies is Zettle by PayPal. Its Tap to Pay is mainly for businesses who have a Zettle Reader or Terminal, so companies can’t just sign up to use it exclusively.

The tap-to-phone option takes a few minutes to set up in the Zettle Go app on iPhone or an Android device. Of course, you’ll first need a Zettle account that you can sign up for online in a few minutes as well.

All contactless transactions on your phone or Zettle card reader alike cost 1.75% regardless of the card brand. No monthly fee or lock-in applies, and payouts take 1-2 working days to reach your bank account.

Monzo Tap to Pay – popular business account

Monzo Business account holders on any subscription can activate Tap to Pay on any compatible iPhone or Android phone. This was only recently introduced for occasional sellers to use at market stalls, events, pop-up stalls and anywhere in between.

Although the feature is part of the Monzo app, the payment system and fees are actually Stripe’s. It costs 1.4% + 20p for UK consumer cards and 2.9% + 20p for international cards.

The fixed 20p on all transactions makes it costly for small transaction values, plus the non-European card rate is high.

And payouts? Not the fastest either: 3 working days for funds to reach your Monzo account, and the first transaction takes 7-14 working days to settle.

Dojo Tap to Pay – for card machine subscribers

Dojo is a popular card machine provider in the UK, catering to most kinds of small businesses with a high footfall.

Its Tap to Pay on iPhone feature is, however, not the main reason you should sign up for it. It’s only available for merchants using Dojo’s PAX card terminal on an initial contract of 12 months if your annual turnover is below £100k.

Those who subscribe to Dojo and actively use their terminal can download the complimentary Dojo for Business app on iPhone (not Android) and accept contactless payments on their phone. This is a useful backup if the card machine breaks down or when you don’t have access to it.

Dojo lets you pick a flat fee or custom rates for transactions, depending on your preference and business turnover.

Tyl by NatWest Tap to Pay – for those who like the bank

As with Dojo, NatWest’s Tap to Pay is intended for existing customers, i.e. those signed up with a card machine from Tyl by NatWest.

This may involve a 12-month contract and monthly fees, and then you may pay 1.39% for domestic and European consumer cards and 1.99% for all other cards.

The Tap to Pay app doesn’t have any extra fees, just the transaction rate. If your annual card takings exceed £50k, you can get custom rates.

myPOS Glass – works across Europe

An Android or iPhone app for tap-on-phone is myPOS Glass by payments platform myPOS. Its biggest advantage is probably the fact it works abroad in other European countries.

To get started, you have to create a business account through the website through several steps requiring documentation. When accepted, you can download the app and accept tap payments.

myPOS Glass’ item library makes it easy to add products or services to each bill before the payer taps on the back of your phone.

Payouts go to your online myPOS account, and a complimentary debit card is provided so you can spend it straight away.

Transactions cost 1.6% + £0.07 for domestic Visa and Mastercard payments on the free plan, or 1.1% + £0.07 on the £4.90-per-month plan. Other fees apply including higher charges for foreign cards.

Worldline Tap on Mobile – not a top option

A lesser-known merchant service provider in the UK but well-known across Europe, Worldline, offers tap-to-phone on Android devices. iPhone compatibility will apparently be added “soon” in the UK, but Worldline has said that for a couple of years now.

Worldline has two options: a standalone Tap on Mobile app for smaller merchants, or an integration so you can build the function into your own point of sale software (mainly for large businesses). Costs are tailored to your size of business.

Viva Wallet – fast payouts in Viva account

A European company accepting tap-on-phone is Viva Wallet. This payments and e-money institution offers a Viva Terminal App on both iPhone and Android devices.

To get started, you sign up for a free Viva Wallet Business Account, which only takes a few minutes. You can then download the app from Google Play or App Store on your mobile device.

In the app, you enter the payment amount and let the customer tap their card or mobile wallet on the back of your phone to finalise it. An email or text receipt can be sent afterwards, or you can print a paper receipt from a Bluetooth printer.

Transactions settle in your online Viva Wallet Business account within an hour.

Viva Wallet charges 1.69% (min. £0.10) per tap-on-phone transaction with a domestic consumer card from Visa, Mastercard, Discover or Diners Club (including through Apple, Google and Samsung Pay). Other cards can cost around 2.4%.

Additional fees apply to specific account activities like ATM withdrawals and chargebacks.

Stripe and Adyen – both custom solutions

We list Stripe and Adyen last because they’re the most complicated to set up for an individual merchant.

Both Adyen and Stripe Tap to Pay are offered as an integration for retailers or other companies to code into their apps or point of sale (POS) software. A developer needs to implement the SDK/APIs (codes), but then the payment experience can be customised.

Stripe’s offering is part of Stripe Terminal, the platform’s suite of in-person payment options. It has no monthly fee, just a charge of 1.4% + 20p per UK- or EEA-issued card or 2.9% + 20p for other card transactions via contactless. Custom rates are available for those with a high turnover.

Adyen’s costs are customised for everyone, and the platform is geared towards large businesses with a high turnover.

Others in development

Alternative tap-to-phone apps are on the market, notably for charities looking at simple ways to receive donations. Other options are typically:

- Not for UK users

- Rarely updated (essential for app performance and security)

- Have very small user bases

- Only offers the backend technology, i.e. lacks a merchant-facing app

Many of these are listed by Visa. For example, MagicCube’s i-Accept technology is ready to implement in existing banking or payment apps, but cannot be downloaded as a standalone tap-on-phone app for merchants.

As a rule of thumb, you should go for an app that is regularly updated and has a proven track record of successful transactions.

The Viva Terminal App has over 1 million downloads (albeit across Europe) which is good, but the average user rating is only just under 3 stars (not great). In comparison, Pomelo Pay was last updated a year ago and only has a thousand or so downloads, meaning it’s not taken off.

Then there are all the many options not yet launched on the British market saying that a tap-on-phone feature is “coming soon”.

It’s hard to tell what is meant by “soon” when someone like the big acquirer Worldpay has been trialling this feature since 2017. We have yet to see this app launched for more than a small group of merchants.

Alternative ways to accept cards with your phone only

Sometimes, it is better to use another payment method in person – and you have options here too:

Otherwise, getting a cheap card reader that connects with your phone is a sure-fire way to accept contactless card payments with a phone.

The benefit of this is familiarity for customers. Most people trust a card reader, but may not – yet – trust the novelty of a smartphone as a payment terminal.