QR codes have many uses, but how are they utilised for payments? Are they still relevant?

Let’s begin with the origin of QR (Quick Response) codes. The name is the trademark of a type of matrix barcode created in 1994 for the Japanese automotive industry. It has since been used in many contexts, for instance marketing and information sharing, but it is also a popular way for people to make mobile payments, especially since the Covid-19 pandemic started.

Although similar to the linear barcodes we see on products in shops, the QR code has four important advantages:

QR code meaning

A QR code is the abbreviation of Quick Response code, a trademark name of the most popular type of 2D barcode readable by smartphones.

When a QR code is scanned, the horizontal and vertical patterns of the matrix are decoded by the software on your smartphone and converted into a string of characters. Depending on the command of those characters, your phone may open a browser link, confirm payment information, verify geolocation, among other operations.

Characteristics of QR codes

There are many variations of one-dimensional and two-dimensional barcodes, a lot of which look very similar. The QR code is just one of the two-dimensional designs that happens to be the most frequently used code to scan with smartphones.

QR code that links to Wikipedia.

The QR code stands out with its three small squares placed in the lower and upper left corners and upper right corner. The overall code has a square shape composed of a matrix of small squares. The number of small squares per side can vary, e.g. 33 x 33 or 177 x 177.

The fewer the squares, the less information the code contains and vice versa for more squares. Because information is contained in two directions, it can hold a lot more data than a one-dimensional barcode. A QR code composed of 177 x 177 squares can, for example, contain 4,296 characters or 23,648 bits.

Since QR codes contain more data, they allow for encryption that is useful for payment processing.

How do QR code payments work?

Contrary to linear barcodes that can only be read by a laser barcode scanner from paper, QR codes can be scanned from both paper and screens. That is why you see QR codes in some online stores and apps.

To process a QR code, you need one of the following:

- Smartphone or tablet with built-in camera

- Barcode reader that can scan QR codes

Both iPhones and Android smartphones can scan QR codes directly from the main camera app, as long as it is using the latest iOS or Android software. You simply open the camera and point it towards the QR code, which will immediately recognise it and open a push notification requiring you tap it to finish the relevant operation.

Only a few years ago, it was necessary to use a dedicated QR code scanning app (there are many to choose from) on your mobile device, some of which are company loyalty apps where your payment card details can be saved.

Certain banking and payment apps can also process a QR code for payment processing or bank transfers.

QR payments can be processed in any of the following ways:

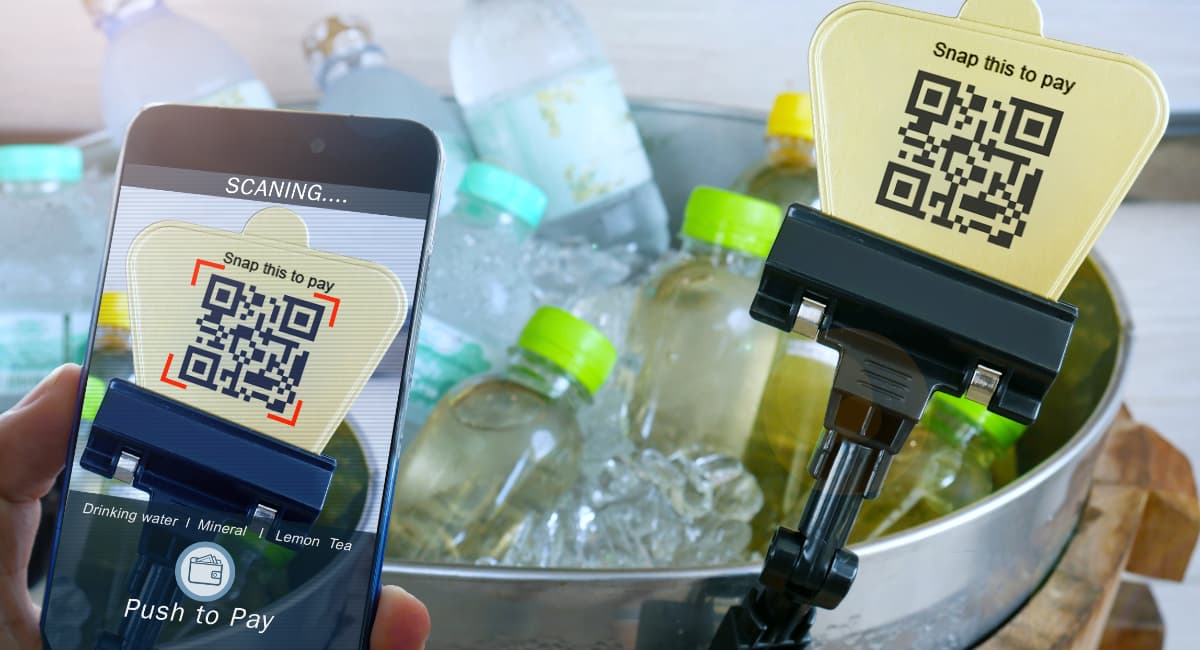

1) Smartphone scanning the business’ QR code.

Open the relevant QR code payment app.

Image: Mobile Transaction

iPhone cameras quickly recognise and read a QR code.

Then scan the code displayed at the shop’s checkout, on individual products, the website or paper bill and confirm the price, if required, before tapping to finalise the payment. In most cases, you will need to manually type your card details to pay. Offers and loyalty points may be applied through the app if it is a store-specific application.

2) Business scanning a QR code on customer’s phone screen.

When the total transaction amount is confirmed in the retailer’s POS system at checkout, you open the relevant company or payment app allowing QR code transactions. The app displays a unique QR code identifying your card details. The shop scans this code with a QR code scanner, finalising the transaction.

3) App-to-app payments.

Both you and the recipient open the relevant apps, then you scan the recipient’s unique QR code displayed in their app through your own app. You confirm the amount to pay and tap to process the payment.

Many big companies include a QR code for bill payments on their invoices.

Not many years ago, QR code payments weren’t that fast because of slower internet speeds, but network connections have become so fast that payments are now processed instantly. Many smartphone users are, however, still deterred by having to open an app and accurately place the camera to capture the QR code within the designated square border shown on their phones.

Other ways to get paid via phone: Types of mobile payments explained

How can merchants accept QR code payments?

There are different ways to accept QR code payments as a business, but options are limited in some countries. In any case, you need to choose a payment company that offers QR codes as a payment method (or can add it from a third party).

For example, Square now allows businesses to create a food-and-drink menu with a QR code to display at your premises in the UK, US and Australia. This is great for table-side ordering or letting customers order for takeaway at a distance from the till. This – and other QR code options – are automatically available for Square users for free.

In several European countries, SumUp can now display QR codes in its point of sale (POS) app that customers can scan off the screen, or you can print QR codes for individual products to display on store premises for contact-free payments. Zettle can also display QR codes in its POS app, but customers have to use their PayPal app to scan and pay this way.

In the UK, mobile wallets with the capacity to pay by QR code are not really used yet, since the major ones – Apple Pay and Google Pay – are widely processed through NFC technology accepted by all modern card terminals. The exception is Pingit. This Barclays app can create QR codes for fixed or open amounts that merchants can display in store or online. Customers using Pingit can then pay by scanning the code through their app.

Photo: iDEAL

In the Netherlands, you can add QR codes to receipts so customers can pay without queuing.

In the Netherlands, iDEAL allows merchants to generate QR codes on customer receipts, to print and display in store, include on invoices or offer as an online payment method. Customers are free to scan it through their phone camera, generic QR scanning app, Dutch banking app or iDEAL app. They then confirm the transaction with their mobile banking code, facial recognition or fingerprint.

Belgium’s most popular payment card, Bancontact, has a mobile wallet that can accept QR payments both online and in-store. If you’re based in Belgium, Bancontact would therefore be your go-to provider for payments by QR code.

In Brazil, the payment companies Cielo, PagSeguro and Mercado Pago offer QR payments, for example by displaying the code on a smart POS terminal screen or in print for the customer to scan.

Barcode scanners for QR codes are often used for customer loyalty apps and verifying tickets.

Online stores can accept QR payments as long as the payment gateway or ecommerce solution supports it. For example, Stripe supports Alipay, Bancontact and WeChat QR codes on the checkout page. The global acquirer for online and POS payments, Adyen, can accept WeChat and Alipay QR codes both online and in-store.

Companies with the funding to create their own app can implement QR codes in the app, connected with customer loyalty points and customer data.

What about pay buttons? See our definition of payment links

Can QR code payments compete today?

Previously in Europe and the United States, QR codes were mostly known as useful (actual quick-response) access points to information, websites and personal verification. They have been scattered across advertising posters, product labels, event tickets, even random street corners.

In the UK and US, the dominant payment methods in physical stores are usually payment cards via chip or contactless, with cash coming in as a close second. But since early 2020 when national lockdowns started, QR codes have become a viable way to accept socially distanced payments at takeaway pickup points.

QR codes did not initially have the same rapid adoption rate as contactless cards in the UK. A lot of investment has gone into NFC (contactless) cards and mobile wallets, and British consumers and banks alike are still happy with the convenience of tap-and-go payments.

However, a world that now depends on socially distanced payments has boosted usage of QR codes. It is now a convenient and safe payment method that consumers are increasingly getting used to – especially at restaurants, cafés, bars and other hospitality venues.

Brits are also used to seeing QR codes on credit card statements from the big banks, offered as one of several ways to pay a bill, and in connection with utility bills, loyalty apps and bank transfers.

Photo: Alipay

In China, it’s common to pay with QR codes, mostly through Alipay or WeChat.

In China, people have used QR codes for payments for a long time. According to App Annie, the Chinese payment app Alipay was the world’s most used app in 2018 outside of social networking apps. If you factor in social apps, the Chinese multi-purpose WeChat app – which does social media, messaging and QR code payments – was in the fourth place, only topped by Facebook, WhatsApp and Messenger. 15 million small-business merchants accept Alipay’s QR code payments in China.

QR codes have, for a while, been a popular way to transact in quite a few other countries too. In India, 9 million merchants use the digital wallet Paytm, which processes QR payments. In African countries, restaurants print QR codes on receipts so customers can pay on their own.

In these and other countries, QR codes continue to be an excellent way for merchants to accept payments without a card machine or other expensive setup, and the customer doesn’t even have to own a payment card.

Compare that to countries where nearly everyone uses payment cards and bank accounts, and the appeal of QR code payments is not that pressing. That said, Covid-19 has boosted usage in the past year beyond predictions.

In the future, places with many tourists from countries used to QR codes could see additional gains from accepting digital wallets like Alipay and Paytm.