- Pros: Fairly simple package. Potentially tailored fees. Expandable POS features on Flex.

- Cons: Year’s lock-in. Hourly, not real-time, reporting portal. No EPOS integration. Limited customer service.

- Choose if: You already bank with NatWest and want to keep everything payments-related with one provider.

Overview

In brief

How it works

Our opinion

In detail

Card machines

Pricing

Online payments

Service and reviews

How it works

NatWest is one of few UK banks with a card machine offering (another one is Barclaycard), though it was only launched in 2020. The payment solution is called Tyl by NatWest and includes a selection of card payment machines to rent, a virtual terminal, payment links and online payment gateway.

Background

The Tyl platform was created by the software company Pollinate, using Android-based Clover hardware. In other words, NatWest did not create Tyl internally, but hired an outside team to build a solution for small business payments, and NatWest then acts as the reseller.

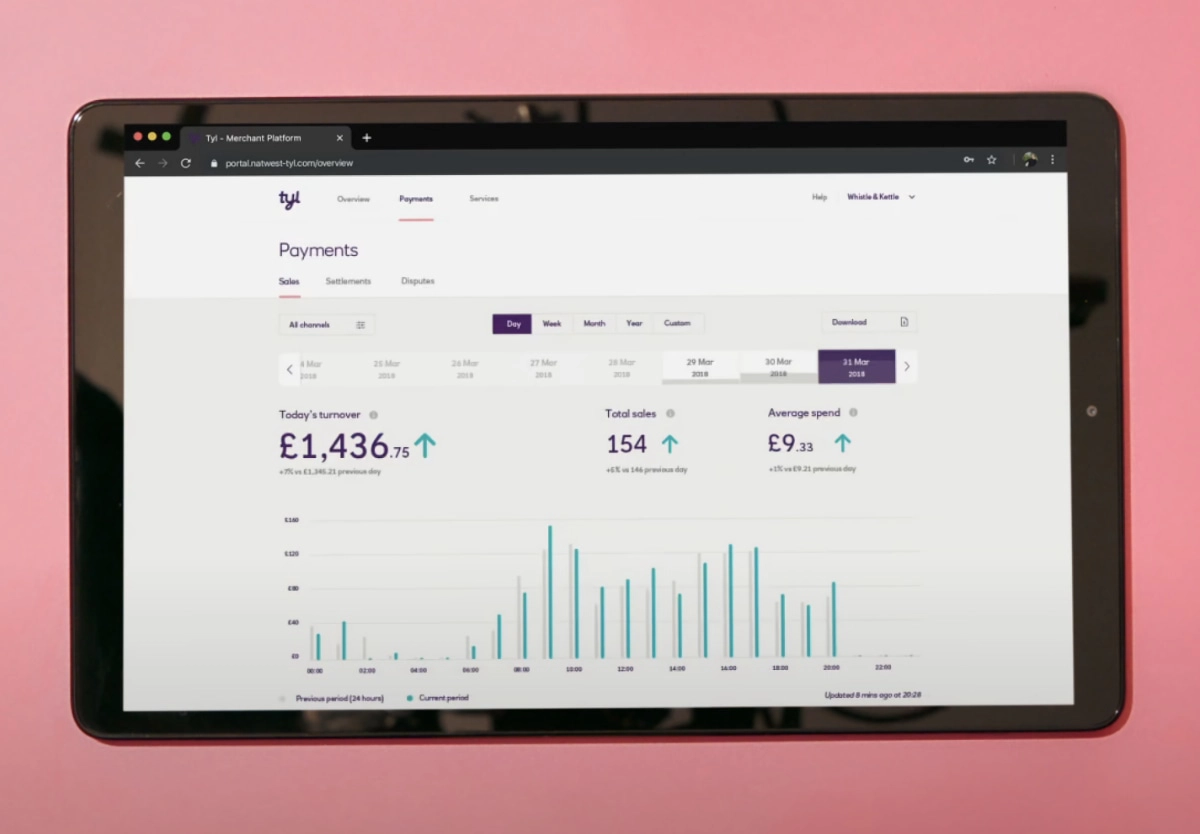

Merchants get free access to a browser dashboard (Tyl Portal) to track sales, chargebacks and more. This is updated once an hour, so it is not entirely real-time like most cloud-based payment solutions. There is no smartphone app for the Tyl portal, only a customer loyalty app for consumers spending at your store.

To sign up with Tyl, companies and sole traders should fill in an online contact form, receive a phone call, get a quote and sign a contract.

After the application is processed – which may take a few days – you should receive your chosen card machine within 48 hours.

Photo: Tyl/NatWest

Check sales and account details from a web browser in the NatWest Tyl portal.

NatWest promises a quick application and simple pricing, but the lack of a dedicated team handling Tyl merchants means onboarding may take longer than expected.

Tyl benefits from relatively fast payouts. You should receive card transactions the next working day in your business bank account, which could be from any British bank, not necessarily NatWest.

Best Tyl alternatives? Compare card payment machines in the UK

Our opinion: not as polished a service as alternatives

NatWest has clearly put effort into create a good-looking website with an attractive-looking card machine solution. Next-working day payouts sound great, as do the all-round functions of Clover Flex that basically acts like a portable POS system, or the other relatively affordable rented card machines.

| Tyl by NatWest criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.6 | Passable/Good |

| Costs and fees | 3.8 | Good |

| Transparency and sign-up | 3.8 | Good |

| Value-added services | 3.4 | Passable/Good |

| Service and reviews | 3.5 | Passable/Good |

| Contract | 3.8 | Good |

| OVERALL SCORE | 3.6 | Passable/Good |

With regards to cost, the monthly charges and card rates are unlikely to be cheaper than SumUp’s or Square’s for small businesses making less than £50k a year.

At the same time, the card machines are okay models, but the Clover terminal is not the fastest, nor cheapest on the market with its added fees for software and mobile connectivity.

“I’m personally baffled by the fact the backend dashboard only updates sales once an hour – the norm for modern card machines is real-time reporting.”

– Emily Sorensen, Senior Editor, MobileTransaction

As one of the few English banks with a card payment solution, it is admirable that NatWest has dipped its toes into this dynamic market. It looks like a sufficient solution for sole traders and businesses needing a standalone card terminal, but improvements are still needed to both its product and customer service.

Card machines

Tyl has three types of card machines to rent, but let’s start with the star of the show: Clover Flex.

Clover Flex is a portable, touchscreen card terminal with built-in point of sale (POS) software. The model is manufactured by Clover Network whose parent company, Fiserv (formerly First Data), handles the card processing.

Clover Flex specifications:

The card machine is designed for ease of use, much resembling your smartphone screen with separate apps for different functions. For example, there are different Clover apps for reporting, the register screen and editing the style of your receipt.

“We’ve heard from merchants that Clover’s terminals are a little slow and cumbersome to use. I wouldn’t personally choose them, because they software is expensive and the hardware is not as good as their clean looks.”

– Emily Sorensen, Senior Editor, MobileTransaction

You’ll get a standard selection of apps to enable you to add a simple product library, accept cards, do refunds, view transactions and reports, manage orders (unpaid and paid) and add employees with different user permissions.

Additional features can be added through the Clover App Marketplace, essentially expanding the use of the Flex Terminal to encompass a full range of POS and business features.

Tyl NatWest gives you an overlay for Flex so you can add a PIN pad (optional).

Clover Flex looks stylish, but may be a bit slow.

Then you have the more conventional portable card machine: Ingenico Move/3500. This is smaller and more lightweight than Clover Flex and comes with a WiFi or 3G connectivity setup. The wireless internet version is ideal for table service, fixed premises and locations with access to a secure WiFi connection. If you need to use it on the go or where WiFi is unreliable, a 3G version may be offered.

“My long-term use of Ingenico Move terminals is pretty eventless for a good reason – they just work very well so you don’t think about it. The push-buttons and ergonomic shape make them easy to hold, and payments go through smoothly.”

– Emily Sorensen, Senior Editor, MobileTransaction

Like Clover Flex, Move 3500 has a battery life of up to 8 hours (it comes with a charging base) and built-in receipt printer. The 3.2-inch display is backlit and the push-button PIN pad embossed for user-friendliness, which some retailers prefer for accessibility over the more popular touchscreen terminals.

The latest – and cheapest – addition to Tyl by NatWest is the pocket-sized PAX A50 terminal. It doesn’t print end-of-day reports like Ingenico or Clover, but it does accept card payments and refunds.

Unfortunately, the Ingenico and PAX machines don’t integrate with POS systems, meaning they only work independently and cannot sync with a till system for a better checkout flow or unified reporting.

All the card machines accept chip and PIN and contactless cards from Visa, Mastercard, American Express, and the mobile wallets Apple Pay, Google Pay and Samsung Pay.

Tyl by NatWest recently introduced Tap to Pay on iPhone or Android as well, which means you can accept contactless payments directly on your mobile device through an app. This has no rental fee, but still requires a Tyle account.

| NatWest Tyl pricing | |

|---|---|

| Clover Flex – rental | £16.99 + VAT/month Extra cost applies per day of SIM usage Extra cost applies to Clover apps |

| Ingenico Move 3500 – rental | From £19.99 + VAT/month |

| PAX A50 – rental | £9.99 + VAT/month |

| Online payments subscription | £14.95 + VAT/month |

| Contract lock-in | Card machines: 12+ months Online payments: 1 month |

| Transaction fees | Up to £50k turnover: 1.39% + 5p for UK & European personal cards 1.99% + 5p for other cards Above £50k turnover: Custom rates |

| Refund processing | Free |

| PCI-DSS compliance | Costs apply |

The card machines have a lock-in of one year, whereas online payments have a monthly, rolling subscription.

The card terminals come with a monthly rental cost ranging between £9.99-£19.99 excluding VAT. If you choose Clover Flex with a SIM card (for 4G connectivity), an extra charge applies every day you are using it, so we recommend only activating it when needed. It’s unclear whether the portable Ingenico terminal has an extra cost for the 4G version, apart from a higher rental price.

Transaction fees depend on turnover. Merchants processing up to £50,000 annually (about £5.2k monthly) get two fixed rates with a fixed authorisation fee: 1.39% + 5p for consumer Visa and Mastercard cards issued in the UK or Europe, and 1.99% + 5p for all other Mastercard and Visa card transactions. American Express cards have their own fees quoted during onboarding.

For businesses with a card turnover in excess of £50,000 per year, transaction fees are tailored around your type of business and card turnover and depend on the type of cards accepted. Domestic Visa and Mastercard are typically cheapest whereas Amex payments have a higher fee per transaction.

“Most businesses selling for less than £50k annually would pay less with SumUp or Square’s fixed card rates and lack of monthly fee. So it’s only really beneficial for £50k+ businesses to look into a contract with Tyl by NatWest.”

– Emily Sorensen, Senior Editor, MobileTransaction

Other charges will most likely apply for chargebacks, early termination of a contract (if applicable) and more, but refunds are free to process.

With Clover, there may be additional charges for several of its apps. In fact, Clover typically has a monthly fee even for its basic functions, which you should also ask Tyl about.

PCI-DSS compliance (international card payments standard) will have to be set up at the beginning of the online payments package, so costs will most likely apply to that. It is unclear whether the card machines incur extra fees for PCI compliance.

Online payments

Like most merchant service providers, Tyl offers these basic online payment options:

Virtual terminal: Clover Flex has a Phone Sale app where merchants can complete manually entered card payments. This is used for over-the-phone and mail order payments. If you don’t have the Flex, a more advanced virtual terminal can be accessed through a browser.

Payment links: Through the virtual terminal in a browser, you can create payment links to send via email, text or QR code. These lead to a web page where the customer can pay online.

Online payment gateway: The Tyl payment system can be implemented as an online checkout on compatible ecommerce platforms like WooCommerce. This can be customised to suit your branding.

All these online payment methods come with a monthly rolling contract where PCI-DSS compliance needs to be implemented.

Photo: Tyl/NatWest

Example of a Tyl payment page where a payment link leads to.

Customer service, reviews and our experience

Tyl by NatWest offers customer support Monday to Saturday between 8am and midnight and Sundays between 9am and 5pm. Any account changes have to be dealt with on working days between 9am-5pm.

There used to be a web chat, but this seems to have been disabled – we checked on several weekdays during working hours, and it said all agents were offline.

Tyl by NatWest has received numerous customer reviews since its beginning, but it looks like the many positive ones are fake. The genuine-looking reviews talk of a hard time getting any useful customer support, sign-up issues, frozen accounts with no reason given, fees not being better than other providers, and products not working properly.

“It sounds as if Tyl only has a few staff members to support their merchants, and with technical and account issues, this can be a major problem.”

– Emily Sorensen, Senior Editor, MobileTransaction

We tried to get a quote through Tyl’s contact form using genuine details, which apparently should yield a response within an hour. We submitted a phone number with a voicemail to encourage contact by email, but never heard from Tyl afterwards via email. It seems a phone call really is required before getting any information, which could be a turn-off for merchants who want to avoid giving personal information.