- Pros: Same terminal for card payments and checkout features. Upgraded model. Offline mode. Product looks good.

- Cons: Poor service. Expensive for a small business. Proprietary hardware. Doesn’t integrate with other software than Clover’s own.

- Choose if: You have a stable turnover and need a smart POS terminal with pick-and-choose features.

Looking for the Irish review of Clover Flex and Mini?

Overview

In brief

What is it?

Our opinion

In detail

Card machine

Pricing

Software

Customer support

Who is it for?

What is Clover Flex?

Clover is a cloud-based point-of-sale (POS) platform that makes Android-based POS terminals and software. Their payment terminals are sold through third-party merchant service providers, but the owner and creator of Clover is the American acquirer Fiserv (previously First Data).

Clover Flex is the only one of the terminals that’s portable and mobile, whether that’s for table-side ordering or on the go. It has a touchscreen with different optional POS features to set up. In the past few years, a new version of Flex was launched so it looks even better than before.

But despite its sleek looks and user-friendliness, the card terminal comes with conditions, limitations and costs to be wary of.

Our opinion: decent, but fees and service not the best

Clover Flex generally works fine as a card machine and looks good. It would be ideal as part of a whole POS system with other Clover terminals, or independently if you want to make a good impression among customers on the go.

It’s not without problems, though. The options for tailoring apps on the terminal is the main advantage, as not all touchscreen card terminals have a customisable selection of features. But extra features add to your monthly bill, and many customers report glitchy software and poor customer support.

| Clover Flex criteria | Rating | Conclusion |

|---|---|---|

| Product | 4 | Good |

| Costs and fees | 3.1 | Passable |

| Transparency and sign-up | 3 | Passable |

| Value-added services | 3.8 | Good |

| Service and reviews | 2.2 | Bad |

| Contract | 3.5 | Passable/Good |

| OVERALL SCORE | 3.6 | Passable/Good |

There are also plenty of other fees depending on the provider. Better transaction fees can be negotiated for businesses with a large card turnover, but this won’t benefit a small business with a smaller sales volume.

Clover used to require up to 4 years’ contract lock-in, but this has reduced to 18 months thanks to new rules in the UK.

“We are mainly concerned about a lack or very poor customer service. Everything works fine until you get an issue requiring Fiserv’s attention. Many merchants have lost money or time from not getting a serious response to the problem.”

– Emily Sorensen, Senior Editor, MobileTransaction

We recommend checking other affordable card machines on the market before settling on a contract solution like Clover.

Best for: Stable businesses that want a unique smart POS terminal with custom features.

Clover Flex: card machine features

Clover Flex is one of several Clover POS terminals (the others are Mini and Station), but it’s the only mobile Clover terminal available in the UK.

It accepts chip and PIN, magnetic stripe and contactless cards or mobile wallets. This includes Visa, Mastercard, Discover, American Express and the mobile wallets Apple Pay, Google Pay and Samsung Pay.

Similar to myPOS’s smart terminals, Clover Flex’s touchscreen display gives you access to a range of POS features like inventory management, gift cards, sales reports and customer management.

“We like Clover Flex’s new design – the screen is larger than its predecessor, so it’s easier to manage as a portable checkout. The terminal has more competition in the UK now, though, with similar smart POS terminals around, like PAX A920.”

– Emily Sorensen, Senior Editor, MobileTransaction

It also has a built-in barcode scanner and receipt printer. You can buy receipt paper through Clover, but it’s cheaper to get compatible till rolls through other suppliers. Flex’s battery life is up to 8 hours from a full charge.

The Flex terminal works with WiFi but can be used with 4G on the Register subscription. It accepts cards offline for a limited period of time, but as with all offline card payments, these are only fully processed when back online.

Clover Flex accepts contactless, swipe and chip card payments.

The touchscreen interface adapts to the features being used. If the customer, for example, needs to enter a PIN code, the screen will show a virtual PIN pad. Clover produces a tactile cover for customers who need it for the PIN pad, but not all merchant service providers offer this.

Some Clover Flex users have remarked on how clunky the terminal feels in their hands. Flex looks fancy in photos, but you may need both hands to hold and use it without dropping it.

Price? Not that simple

The Flex terminal is typically rented for a monthly fee, but there are other costs involved – upfront, ongoing and at the end of a contract. The hardware may need to be returned since Clover hardware is proprietary.

Costs and contract are in part determined by the reseller and in part by the type, size and sales volume of your business. This means you don’t get the full picture of costs until asking a sales rep from your chosen merchant service provider.

These acquiring banks and/or authorised resellers offer Clover products in the UK:

- AIB Merchant Services

- Fiserv/First Data

- Lloyds Bank Cardnet

- Tyl by NatWest

The terminal is sold with a merchant account that used to require up to 4 years’ commitment, but it can now only be up to 18 months due to recent UK legislation changes.

Transaction charges are determined by your card turnover and type of business. Add to that ongoing software costs and the upfront or ongoing hardware costs.

The following are typical hardware and software costs applicable to renting a Flex terminal.

| Hardware and software pricing* | |

|---|---|

| Clover Flex terminal rental | £15+/mo |

| Setup fee | £0-£175+ |

| Payment Plus or Register software | Varies (monthly subscription) |

| Extra features from App Market | £0-£26/mo per app |

*Pricing is based on reported data from a mix sources.

The Flex terminal requires subscribing to a Clover software plan with pre-selected POS features (Payment Plus or Register), after which you can add extra software features on the terminal through the Clover App Market. Most of these extra apps incur monthly fees (even if it says they are “free” – this often refers to a free trial), so software costs can easily rack up with more features.

A merchant account comes with its own contract and charges along these lines:

| Merchant account costs* | |

|---|---|

| Monthly fee | £10+/mo |

| Account on file fee | £5/mo |

| Monthly minimum turnover fee | £15/mo |

| Transaction fees | 0.2%-3.5% + 20p-40p |

| Chargeback fee | £25 + £250 review fee |

| Paper statement fee | £5.95/mo |

| PCI compliance service fee | £15/mo |

| PCI non-compliance fee | £25/mo |

| Early termination fee | Equivalent to monthly fee of remaining months of your contract |

*Pricing is based on reported data from a mix sources.

Payout times depend on the merchant service provider and the card being accepted. If the customer disputes the transaction, a chargeback fee is applied, the amount of which also depends on your acquirer.

There may be other costs for using Clover depending on your provider.

For instance, it’s common to pay a replacement fee if you damage the hardware. Leaving before the end of a contract will most certainly cost an early termination fee that may be equivalent to the amount you would’ve paid for the remaining months. This is on top of the collection fee if the provider wants the Clover Flex terminal back.

Cheaper alternative: Square Terminal – pay-as-you-go smart POS terminal

POS features

Regardless of which merchant service provider you choose, UK users will be presented with a choice of two software subscriptions: Payment Plus and Register.

Since Payment Plus is the cheapest POS plan, there are limitations with it. In either plan, features are general so they apply to most retailers and food businesses that don’t require very specialised features.

| Feature | Payment Plus | Register |

|---|---|---|

| All payment methods | ||

| Staff shifts & accounts | ||

| Open tabs | ||

| Discount-based rewards | ||

| 4G connectivity | ||

| Inventory management | ||

| Order management | ||

| Item discounts, rewards & taxes | ||

| Full Clover App Market access | ||

| Items-orders integration | ||

| Remote order printing |

| Feature | Payment Plus |

Register |

|---|---|---|

| All payment methods | ||

| Staff shifts & accounts | ||

| Open tabs | ||

| Discount-based rewards | ||

| 4G connectivity | ||

| Inventory management | ||

| Order management | ||

| Item discounts, rewards & taxes | ||

| Full Clover App Market access | ||

| Items-orders integration | ||

| Remote order printing |

These features come pre-installed on the terminal so you can use the terminal straight away. 4G connectivity is only available on the Register plan, so if you’re on the Payment Plus plan, you can only use the Flex terminal with WiFi.

In addition, you can add extra features from the Clover App Market, but not all these apps are available on the Payment Plus plan. You actually have to pay extra (i.e. upgrade to the Register plan) for the privilege of accessing all apps with specialised features incurring additional costs. For industry-specific functions, it may therefore be necessary to subscribe to Register to subscribe to relevant apps.

Some of these apps are free, but many aren’t. Some only work on the payment terminal, while others are for the Clover browser dashboard, or both. Clover’s reporting app is essential for many merchants, but it’s only free for the first 30 days before a monthly, paid subscription starts.

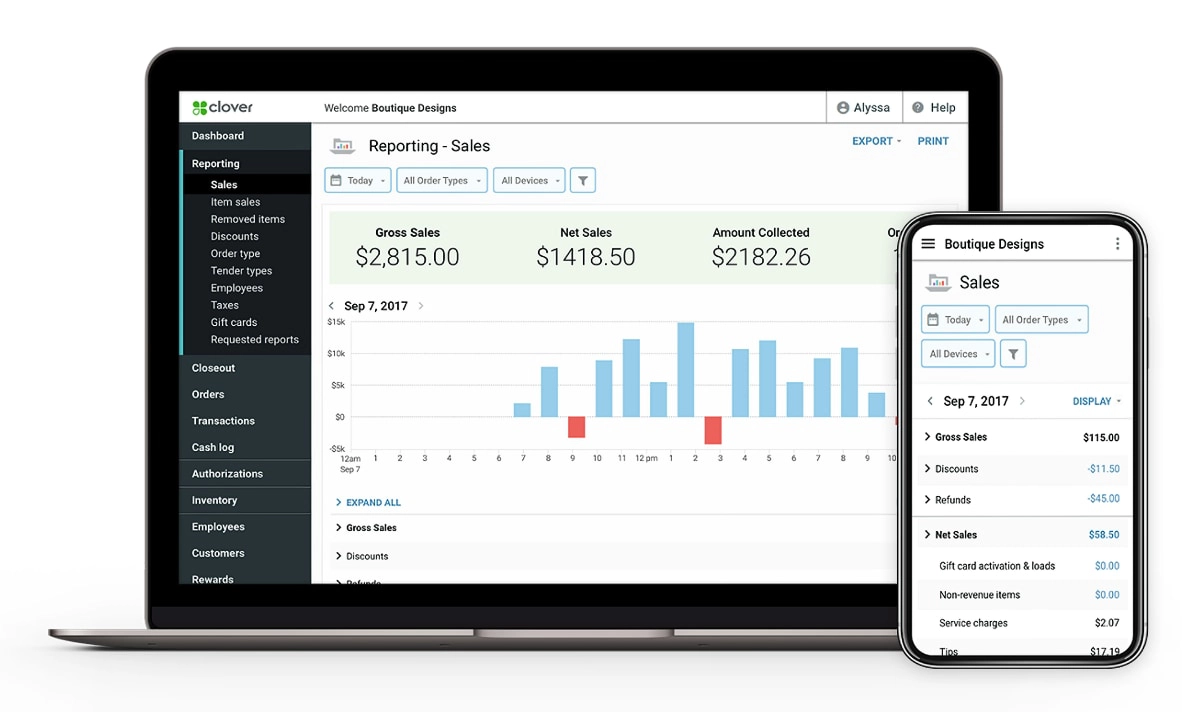

Image: Clover

View in-depth sales reports in the Clover dashboard – if you subscribe to Clover Reporting.

Customer support and Clover reviews

Regardless of where you got the Clover Flex, Fiserv provides customer support directly. You can call the Fiserv support line between 8am and midnight every day of the week, or search the help section for answers. Some merchant service providers advertise additional customer service, but this is not the norm.

Clover reviews from users are quite varied. We’ve seen many complaints about customer support being unresponsive, and unexpected or high fees.

In the US, First Data/Fiserv has a poor reputation while the UK support has more limited reviews to judge from. Trustpilot tends to show many positive customer reviews speaking of excellent customer service, but I don’t think many of those are legitimate.

In any case, we strongly recommend close-reading the contracts you sign, paying particular attention to hidden fees and commitments that the sales rep may not mention unless asked directly about it. Otherwise, you could be tricked into a contract with fees too high for what it’s worth.

Who is Clover Flex best for?

Flex is suitable for payments in most environments, whether out-and-about at markets, conferences or outdoor spaces, or inside for e.g. table-side orders or busting queues while the main till is handling slower transactions.

Since the screen is made of durable, antibacterial glass, it suits food and drink environments perfectly. That is also where I tend to see Clover Flex when out and about in London.

Clover’s terminals all work together smoothly.

Clover Flex is a natural extension to a stationary Clover POS system as it works with it.

Small businesses not already signed up for a Fiserv contract should think twice before applying, though. Why? Because software, hardware and merchant account fees can easily end up costing more than you can afford.

Bigger companies can get better card rates, while the (expensive) customisation options can be just what they need for a till system tailored around the business.