- Highs: Customers can enter any amount. Multi-use link for unlimited transactions. Fast payouts in e-account.

- Lows: Customers cannot pay without a PayPal account. Fees high for low transaction amounts and foreign cards. Can be fiddly to send links from a phone.

- Choose if: You prefer having one link for all customers who are okay with using PayPal for transactions.

PayPal.Me fees and payouts

There is no monthly fee for using PayPal.Me, nor does it cost anything to create a PayPal account where you receive transactions.

Each transaction paid in GBP with a domestic debit or credit card costs 2.9% + 30p. If the customer pays with a card issued abroad, a 1.5% fee is added. If currency conversion is involved, a further 2.5% free above the currency exchange rate is added as well. Consequently, PayPal may charge you 4.4% or 6.9% plus 30p to process a foreign card.

| Charges | |

|---|---|

| PayPal.Me transactions | 2.9% + 30p |

| Cross-border fee | 1.5% |

| Currency conversion fee | 2.5% |

| Monthly fee | None |

| Contractual lock-in | None |

| Payouts | To online account: Free Standard withdrawal to bank account: Free Instant withdrawal to bank account: 1% fee |

| Refunds | Same as transaction fee |

| Chargebacks | £14 each |

| Charges | |

|---|---|

| PayPal.Me transactions | 2.9% + 30p |

| Cross-border fee | 1.5% |

| Currency conversion fee | 2.5% |

| Monthly fee | None |

| Contractual lock-in | None |

| Payouts | To online account: Free Standard withdrawal to bank account: Free Instant withdrawal to bank account: 1% fee |

| Refunds | Same as transaction fee |

| Chargebacks | £14 each |

The transaction fee can make small transaction sizes very expensive due to the fixed fee of 30p. A £1 payment from a bank card would cost 33p – i.e. 33% – from a domestic card. If you picked a provider that only charges a fixed rate like 2.9% – without a flat fee added – the cost would only be 3p.

Transactions go straight into your online PayPal account for free. If you want to move this money to your bank account, you need to manually withdraw an amount from the e-account to your connected bank account. This is free for a standard transfer that takes one working day to clear in your bank account, while an instant deposit to your bank account can be done for 1% of the transfer total.

Full or partial refunds can be processed back to the customer, but PayPal charges a fee equivalent to the transaction fee paid during the original payment.

Chargebacks cost £14 each unless the transaction is covered by Seller and Buyer Protection, in which case there is no chargeback fee.

Best PayPal.Me alternative?

Compare the 7 best pay by link providers

Getting started

Before you can send any links with PayPal on behalf of your business, you need a PayPal Business account. The sign-up form is accessed through a “Sign Up” link on PayPal’s website. You just need to fill in a brief series of answers about your business and personal information, and you will be asked to link a bank account or debit card with the online PayPal account.

No phone call is required unless you apply for specific payment services like a Virtual Terminal or a different fee structure for credit card payments.

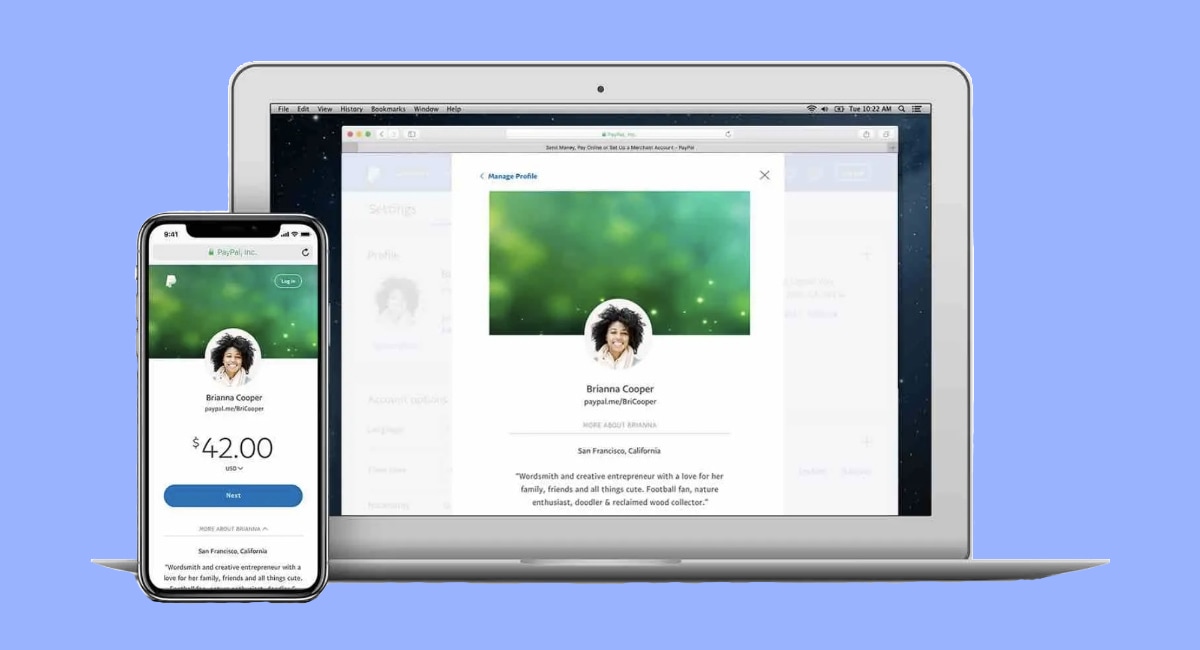

When you have a PayPal Business account, you can create a PayPal.Me URL to use for all your pay-by-link requests. This is where PayPal stands out from other payment link providers, as you get to choose a web address where all your clients go to rather than generating unique one-time links for individual bills.

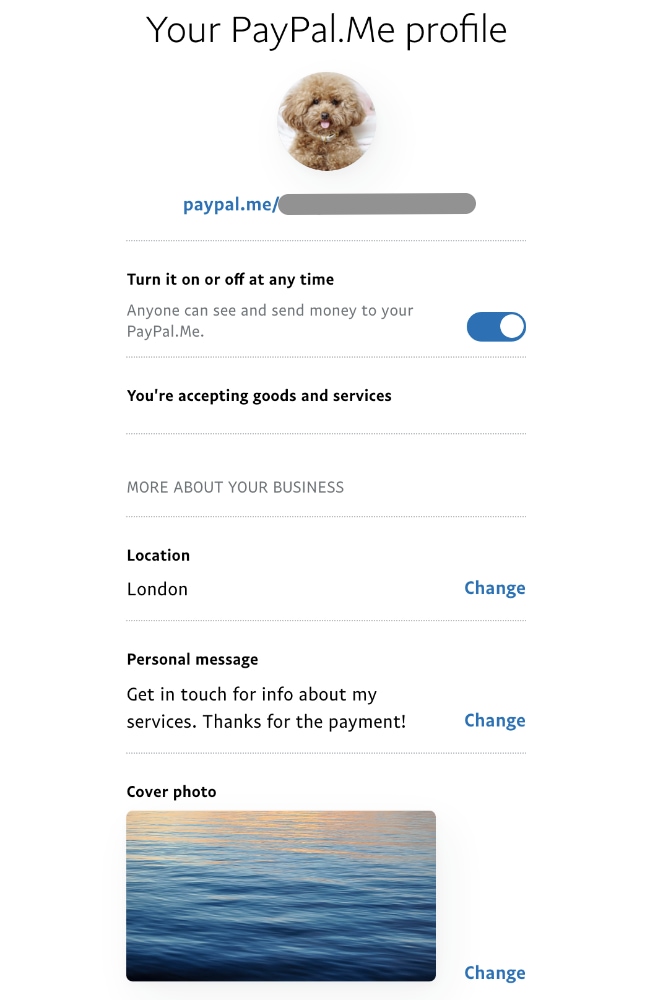

Image: Mobile Transaction

PayPal Me profile editor.

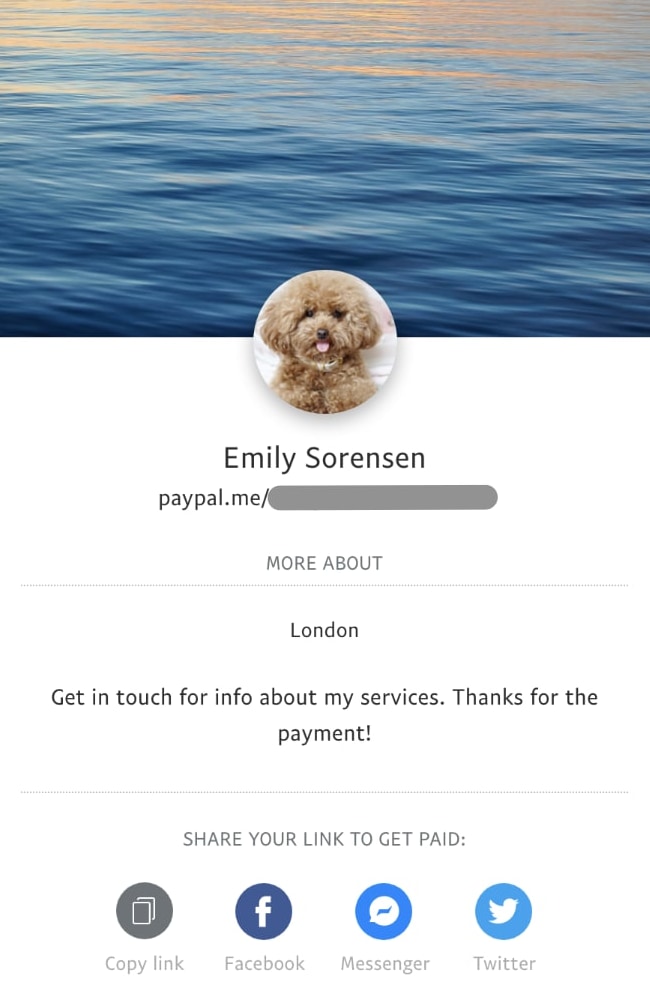

Image: Mobile Transaction

Page from where you can share your link.

The URL is in a “paypal.me/yourbusiness” format where you can decide on a name for the “yourbusiness” part (that isn’t taken by someone else). Once this is created, you will be stuck with it, so if the link is for your business only, it is a good idea to use your long-term business name or a suitable description for what you do.

Apart from choosing the link, you can pick a profile picture, header background, and add a note about your business and location. These will be visible for anyone going to your payment page. At any point, you can decide to “switch off” the link to stop people from making payments to you.

How it works

Once you have the link, you can send it any way you like, put it on social media profiles or add it to a website. This can be done by copying and pasting it into the relevant page, email or message.

If sending the link from your phone, it’s a good idea to keep a copy of the URL in your notes app for easy reference, as you cannot view the link in your PayPal Business app.

On your PayPal.Me page viewed in your PayPal account in an internet browser, there are four buttons for making it easier to share: Copy Link, Facebook, Messenger and Twitter. The latter three will open up a window where you edit the post or message for the relevant social channel before sending or posting it.

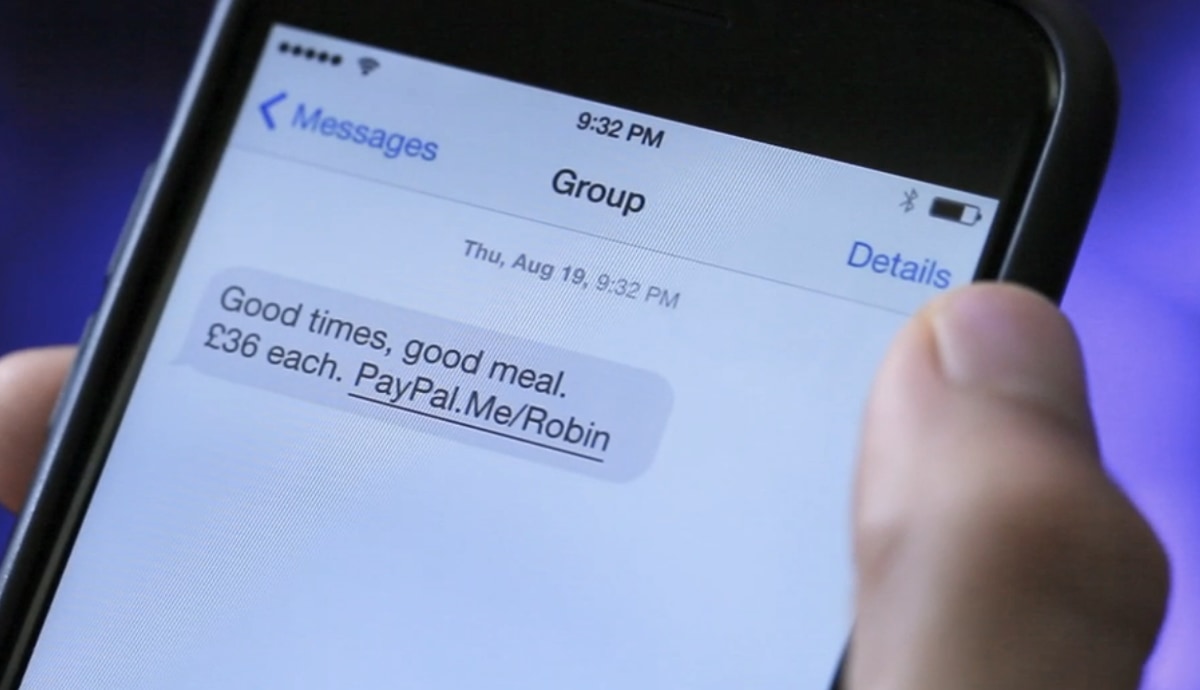

Credit: PayPal

Others can receive the link by text, but you have to manually paste the link into an SMS.

PayPal Business app users do not have the option to easily send a text message with the PayPal.Me link. Instead, you have to copy and paste (or manually type) the URL into a text message to send to your recipient. If you’re paying for text messages, this will be a cost to add to your business expenses.

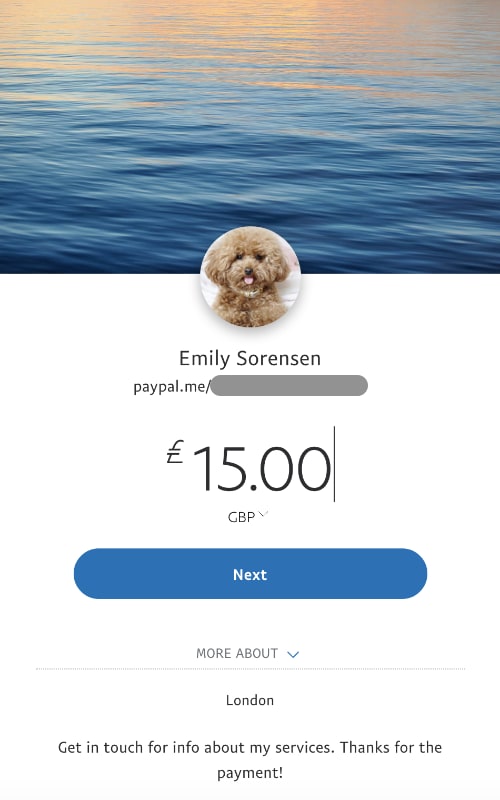

Credit: PayPal

The PayPal.Me link goes to a payment page where the customer can proceed with paying.

When the receiver clicks the link in the message or on the web page where the link is written, they are led to a browser page where they can enter the transaction amount before proceeding with payment.

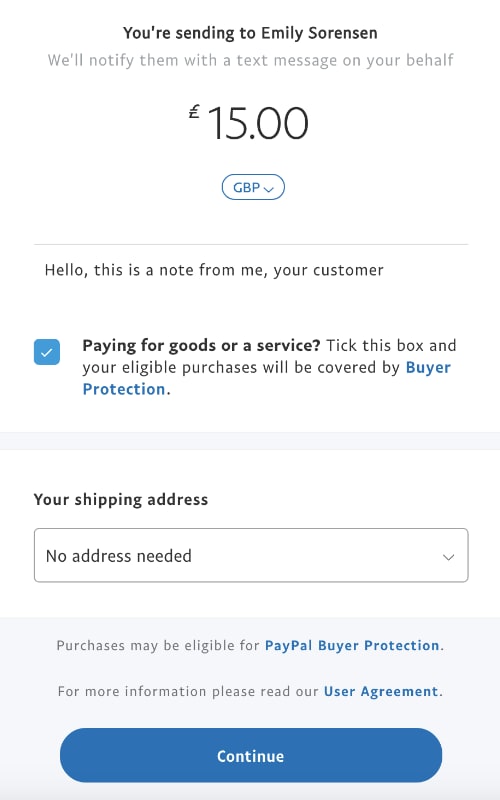

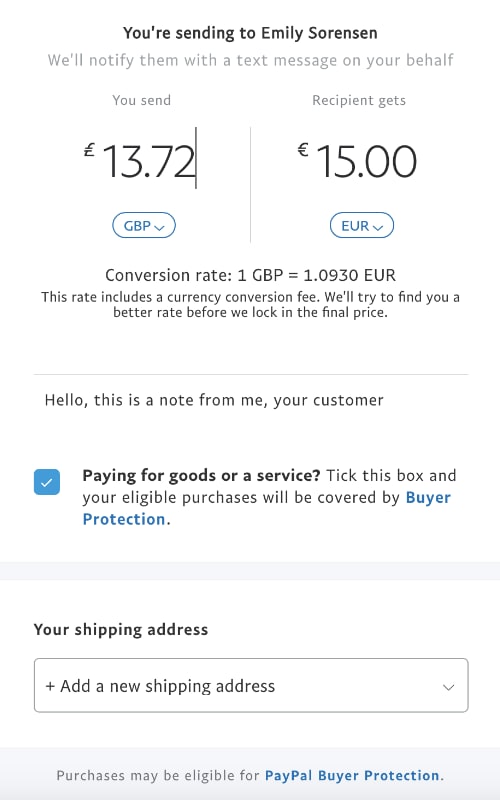

The checkout page gives the option to add Buyer Protection for goods or services paid for, shipping address and change the currency if required. You can edit the payment amount any time before confirming the payment.

Credit: Mobile Transaction

PayPal Me link page.

Credit: Mobile Transaction

Checkout page.

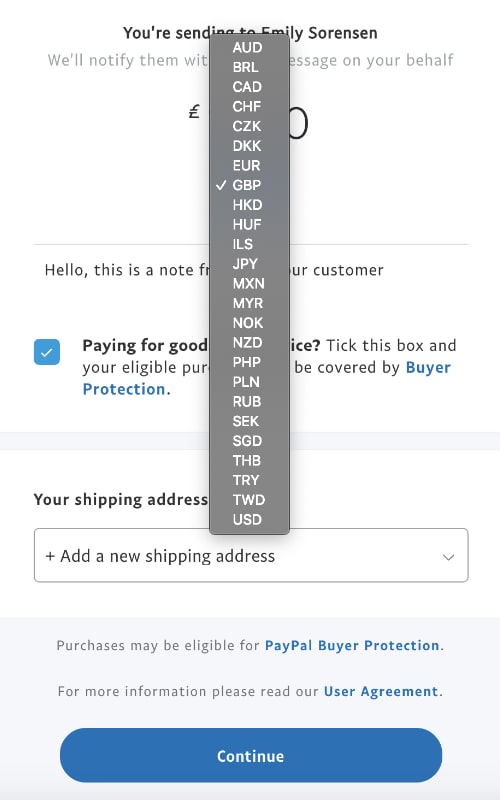

It is even possible to choose a currency from a dropdown and immediately see the conversion rate and calculation before confirming the payment amount. This is a nice feature for cross-border payments that allows clients more choice in how they pay.

Credit: Mobile Transaction

Choice of currency on checkout page.

Credit: Mobile Transaction

Adjust the amount on the checkout page.

The customer has to use their PayPal username/email address and password to complete any PayPal.Me transaction. It is not possible to just enter card details, so the recipient has to have a PayPal account to send you a payment. It also means you cannot use these links for customers who only want to pay with typed card details online.

When we tested the payment process, we found the recipient of the link was not able to change the payment method through PayPal at the checkout. This is the case if the recipient has chosen a default card or bank account to always use for PayPal transactions online.

It is possible to send a URL that leads to a PayPal.Me page with a pre-defined amount to pay. You do that by adding the amount after the “paypal.me/yourbusiness/” URL, for instance “paypal.me/yourbusiness/15” for a bill of £15. The recipient will still be able to edit the amount from their end, so it is possible for them to end up paying something else.

As with the unspecified-amount link, you can use the specific-amount link for an unlimited number of payments from different people.

What is PayPal.Me best for?

PayPal Me has one of the highest transaction fees in the UK, but it could still be the best option if you need of a temporary pay-by-link solution that integrates with the rest of your PayPal sales. If you’re already using PayPal for ecommerce or other sales channels, it can save time to use PayPal Me instead of opting for an external payment link provider where transactions are recorded in a different payment system.

Secondly, charities and crowdfunding projects can benefit from the option to input any amount on the payment page, as opposed to most other payment links that require the merchant to specify a fixed amount to pay. Including your PayPal.Me link on your crowdfunding page or website is all you need to enable others to send you a voluntary amount.

Charities and crowdfunding projects can benefit from the option to input any amount on the payment page, as opposed to most other payment links that require the merchant to specify a fixed amount to pay.

There are, however, restrictions on the types of products eligible for Buyer and Seller Protection available for PayPal Me purchases. If you, for example, sell “intangible” services or digital goods, neither you nor the customer will be covered with these PayPal protections. There is also has a list of restricted business types PayPal does not allow among their merchants at all.

Reporting

All sales and money transfers through PayPal can be viewed in the Reports section of the online PayPal Business account. That includes transactions from e.g. ecommerce, email invoices, PayPal Virtual Terminal and the PayPal card reader. Sales reports can be customised and PDF or Excel files generated.

Though you can’t send PayPal Me links from the PayPal Business app, there are Sales Insights and Activity sections in the app that cover all transactions, so you can keep an eye on received payments that way. You also receive an email for each PayPal.Me transaction received.

Customer support

A good thing about PayPal is that customer support is offered round-the-clock by phone, chat or email. There is also a Help Centre with guides, and a Community Forum on their website, where PayPal users can post questions that other users can answer. The email support typically takes up to 24 hours for a response, but the messaging chat is faster.

Looking at customer reviews, there have been quite a few complaints about withheld funds, PayPal tending to be more on the buyer’s than seller’s side in disputes, and high transaction fees. Generally, though, the PayPal support team is keen to help, so most people will have a decent response of the service when trying to solve issues.

UK’s best invoicing apps:

6 invoice apps for small businesses

Our verdict

PayPal Me is ideal as a short-term solution for remote payments from customers who are okay about using PayPal. It may also be the fastest way to add a payment option on a website or crowdfunding page without having to find to a new payment system.

We do not recommend using it as the only remote payment method, though. Many of your customers may not have used PayPal for a while (if ever, in which case they have to sign up) and may be put off by the sudden requirement to use (or find) their PayPal credentials.

Nowadays, British consumers are quite used to entering card details on a checkout page online – they may even prefer the freedom of choosing any credit or debit card. At a PayPal.Me checkout, the payer is locked into using the card or bank account associated with their PayPal account.

Fee-wise, this is not the cheapest solution. If costs are your main concern, you can get a lower fee with no added charges for foreign cards through iZettle. But if you prefer using PayPal for everything – and like the flexibility of using one link for all purposes – it can make sense to pay a higher transaction rate for PayPal Me.