- Highs: Good pay-by-link features. Contract cancellable any month. 24/7 support.

- Lows: Can’t send or manage links from a phone. Monthly fee required. Not cheap for low sales volume.

- Choose if: You’re selling for over £2k monthly and need a solid solution for payment links by email, sent from a computer.

How it works

Worldpay Pay by Link is a solution that lets you create unique payment links for billing clients online. Links can be sent by email or messaging, and the recipient pays by entering card details on the secure web page accessed through the link.

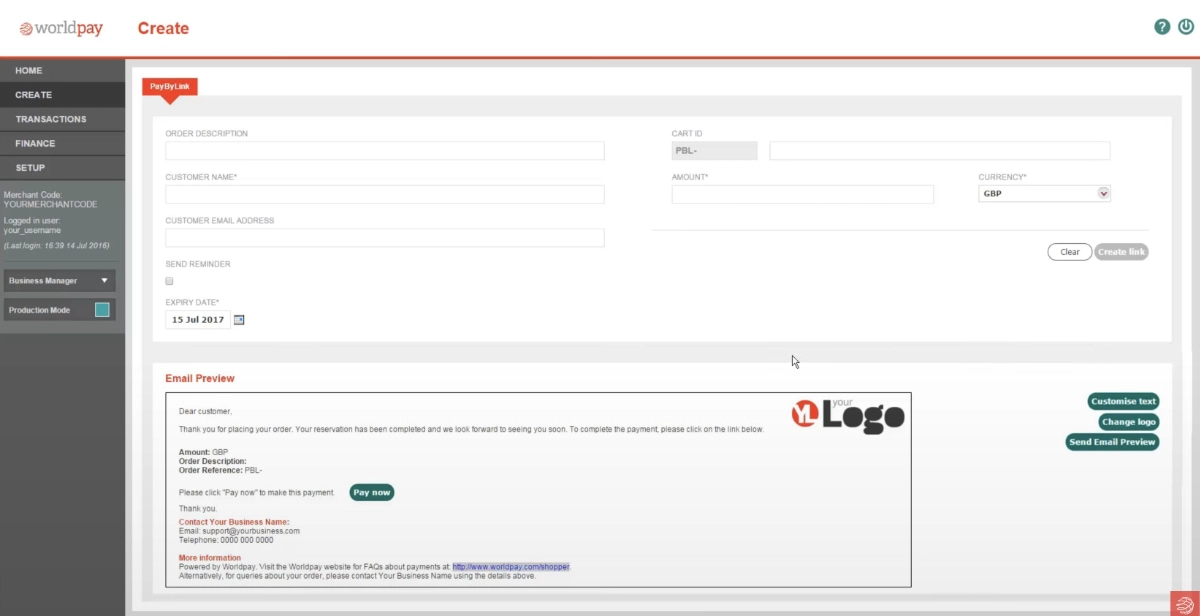

After opening a Worldpay merchant account and subscribing to Pay by Link, you get access to a browser-based dashboard called Business Manager where links are created, sent and managed.

Here, you can make new links by adding recipient details, transaction amount, description, currency (if billing in other currencies than GBP), payment due date and email reminders. Below these details is where you can customise the email content with a written text, company logo and links.

So basically, you can create email invoices from scratch directly in Business Manager. Although Pay by Link is ideal for that, you can also just generate payment links to copy and paste into any other message online for a client.

Credit: Worldpay

Worldpay payment links are created and sent from a web dashboard, not phone app.

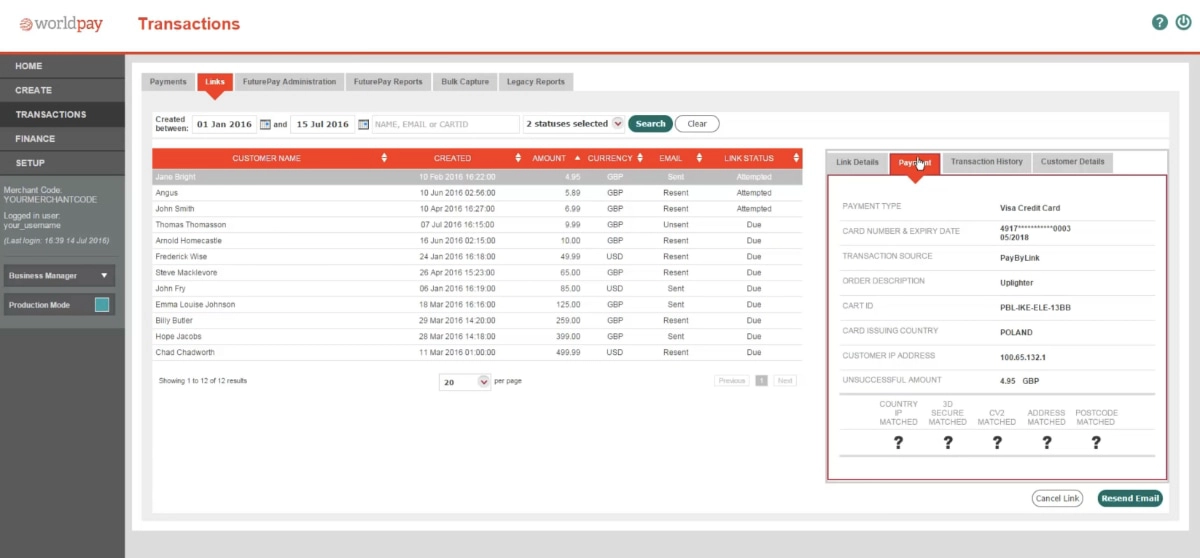

The links are unique for each recipient and transaction, so you cannot reuse them. This allows you to track the progress of them in Business Manager. For example, the Transactions section shows useful information like customer information, transaction details and payment statuses of the different, searchable links.

Pay by Link accepts the major debit and credit cards including Visa and Mastercard, as agreed with Worldpay. Transactions settle in your associated bank account within a few working days depending on the type of card that was used.

Looking for telephone payments? See our Worldpay Virtual Terminal review

| Worldpay Pay by Link | Charges |

|---|---|

| Monthly fee | £9.95 + VAT |

| Contract | 30-day, rolling |

| Transaction fees | 0.95%-2.75% + 10p/20p (custom rates) |

| Worldpay Pay by Link |

Charges |

|---|---|

| Monthly fee | £9.95 + VAT |

| Contract | 30-day, rolling |

| Transaction fees | 0.95%-2.75% + 10p/20p (custom rates) |

Transaction fees are not the same for everyone – you have to contact Worldpay for a quote, because they base rates on your type of business, sales volume and types of cards accepted.

Businesses selling for less than £2,000 monthly will not get the most competitive fees, particularly with the monthly cost factored in. But anything above this threshold is likely to be cheaper than, say, Square’s payment links that come with no monthly fees.

The lowest rates are for domestic consumer cards by Visa and Mastercard (e.g. 0.95%), whereas foreign, premium and corporate credit and debit cards have the highest fees (e.g. 2.75%). There’s also a fixed fee added to the percentage rate, such as 10p or 20p. American Express has separate costs and may require an additional agreement.

In contrast with virtual terminals where you pay for PCI-DSS compliance (payments security standard), you do not have to implement and pay for PCI-DSS compliance with Pay by Link. That’s because the customer enters their own card details, so you never have to handle those yourself.

You can expect fees for chargebacks and refunds, which are specified in the contract.

Best Worldpay alternative?

Compare the best pay by link providers

What is it best for?

Apart from email invoices, what can Worldpay payment links be used for? Businesses are using the solution for:

- Accepting deposits for a booking or order

- Billing clients within the UK and abroad through email invoices

- A secure alternative to taking payments over the phone

- Giving customers a way to pay online for a quote

- Having a system for chasing up overdue invoices

To use Worldpay Pay by Link in the first place, you have to be on a computer or tablet, because it can only be accessed through a web browser. There’s no Worldpay app for payment links, nor is Business Manager practical to use in a small phone browser (Worldpay recommends a screen size of min. 1024 x 768 pixels).

You cannot use a link more than once, so it is not for embedding on a website, nor is the system geared towards recurring payments.

Credit: Worldpay

Monitor payment links from the web dashboard.

Getting started

To get started, you need to fill in a contact form for a callback from Worldpay. On this call, you can ask them anything about the service and get a quote based on your situation.

Talking to a sales rep on the phone is not to everyone’s liking, but Worldpay does generally have a good reputation compared with other merchant service providers. Just make sure you ask for a copy of the contract and detailed list of all fees to peruse before signing up for the Pay by Link subscription.

Customer support and reviews

Merchants can contact Worldpay customer support on the phone 24/7, which is more than many pay-by-link providers can offer.

That being said, Worldpay reviews are a mixed bag. We’ve seen complaints about poor customer service on the phone, lack of email support, hidden fees, issues with chargebacks and outdated software.

Many of these reviews relate to the card machine service or online payment gateway, but the payment link software does look a bit outdated in Business Manager.

Our verdict

Overall, Worldpay Pay by Link has a good range of features for managing unique links for different client transactions. It is particularly well-suited for traditional email invoices with a logo, text and payment button within the email itself, as that is what you can create through the Worldpay account.

As long as you’re primarily working on a computer, any link can be shared online to get someone to pay. However, many merchants conduct their business on the go from their phones, and Worldpay should ideally offer an app for Pay by Link to keep up with the times.

In terms of costs, Worldpay suits those who make more than a few grand a month through payment links, as otherwise the monthly fee on top of transaction charges can be expensive. If you’re unsure of how much you’ll make, there are other payment link solutions without a monthly fee.