Monese is a UK-based company providing current accounts for individuals and businesses. We should be clear: Monese is not a bank. Instead, the company is an agent of PrePay Technologies, an electronic money institution, that provides e-money accounts as an alternative to traditional bank accounts.

The Monese Business account is exclusively for UK-registered businesses. For a monthly fee, companies can sign up and manage their funds through a mobile app and a prepaid Mastercard.

The account comes with useful banking and budgeting features relevant for SME businesses. For example, you can make and receive domestic and international payments, send invoices and categorise transactions for a neat overview of earnings and expenses.

But are the features better than other business accounts by challenger banks? Is the monthly fee worth the package?

Requirements for opening an account

Firstly, you have to be at least 18 years old and a resident of the European Economic Area (EEA) to apply for a Monese account. Applications for the Personal account are open to anyone regardless of citizenship or financial history.

When it comes to opening a Monese Business account, only companies registered with Companies House in the UK can do that, but you can live anywhere within the EEA. You must be an authorised individual (e.g. company director) to apply.

Sole traders cannot open a Monese Business account. Instead, they are encouraged to use the Monese Personal account, since UK tax laws do not require sole traders to use a separate account for business funds.

Some business types are not accepted by Monese, for example charities, cryptocurrency trading, financial services, adult industries, unlicensed pharmaceuticals and sales of illegal goods, precious stones and metals. It’s quite normal for e-account providers to restrict these industries in order to minimise dubious or fraudulent activities.

Pricing

A Monese Business account costs £9.95 a month. This includes a Business account and Plus Personal account. You will need to add money to the account as soon as it is opened so Monese can deduct the first subscription cost. Subsequently, the subscription will be deducted every month on the same date.

The account can be cancelled any time for free, but subscription charges already deducted will not be refunded. You cannot only have the business account – the personal account is a compulsory feature of your membership with Monese.

On top of the monthly cost, you pay for using the below account services.

| Monese account features | Charges |

|---|---|

| Account subscription | £9.95/month |

| Monese Business card | First one is free, additional £4.95 each |

| Faster Payments, BACS, CHAPS, Direct Debits (UK) | Free |

| Card usage in GBP | Free |

| Card usage & cash withdrawals in non-GBP currency | Mastercard wholesale exchange rate + 0.5% of transaction value |

| Cash withdrawals in GBP | First 6/month free, then £1 each |

| Cash deposits | 2.5% of cash total at PayPoint £1 at Post Office |

| Monthly ATM & cash deposit allowance | £900 free, 2% charge above this threshold |

| Outgoing international transfers | Wholesale exchange rate + min. 0.5% currency exchange fee (min. fee of £2) |

| Monthly foreign currency card spending allowance | £9,000 free, 2% charge above this threshold |

| Monese account features |

Charges |

|---|---|

| Account subscription | £9.95/month |

| Monese Business card | First one is free, additional £4.95 each |

| Faster Payments, BACS, CHAPS, Direct Debits (UK) | Free |

| Card usage in GBP | Free |

| Card usage & cash withdrawals in non-GBP currency | Mastercard wholesale exchange rate + 0.5% of transaction value |

| Cash withdrawals in GBP | First 6/month free, then £1 each |

| Cash deposits | 2.5% of cash total at PayPoint £1 at Post Office |

| Monthly ATM & cash deposit allowance | £900 free, 2% charge above this threshold |

| Outgoing international transfers | Wholesale exchange rate + min. 0.5% currency exchange fee (min. fee of £2) |

| Monthly foreign currency card spending allowance | £9,000 free, 2% charge above this threshold |

The above allowances and fees are shared between the Personal and Business accounts. If, for example, you deposit £900 cash into the Business account, you will start to pay 2% of cash amounts deposited into the Personal or Business account until the monthly allowance resets.

All payments and transfers to and from another account in GBP currency within the UK are free to process. If the recipient account is in another currency/country, a minimum fee of 0.5% on top the FX exchange rate (minimum of £2) is applied to the transfer.

Although Monese states that SEPA transfers are free, this refers to the Euro account only available as a personal account. When Monese adds a Business Euro account, you should be able to make EUR-EUR business-related transfers for free.

- No standing orders/recurring payments

- No euro account

- No ‘Instant Debit Card Top-ups’ to add funds to the account

However, the business account accepts Direct Debits (incoming and outgoing), Faster Payments (incoming and outgoing), BACS (incoming) and CHAPS (incoming) transactions as well as deposits via bank transfer. You can also send and receive international payments.

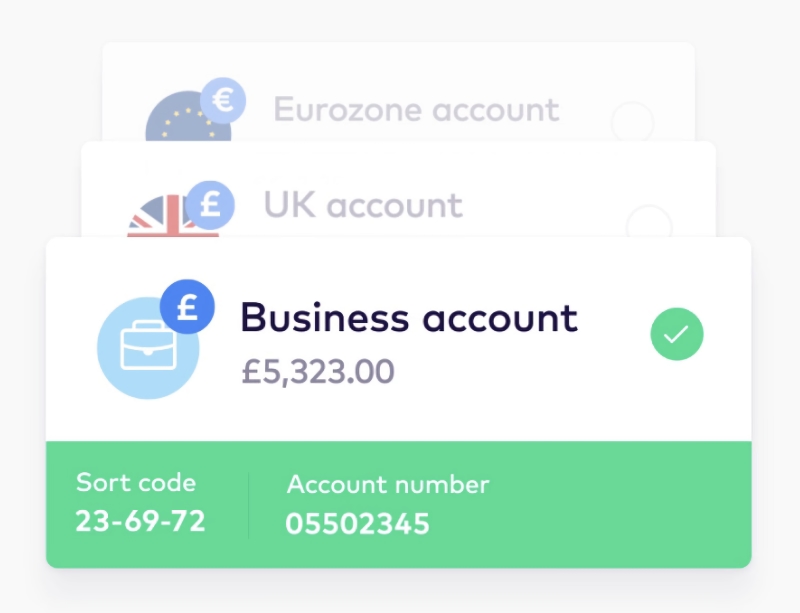

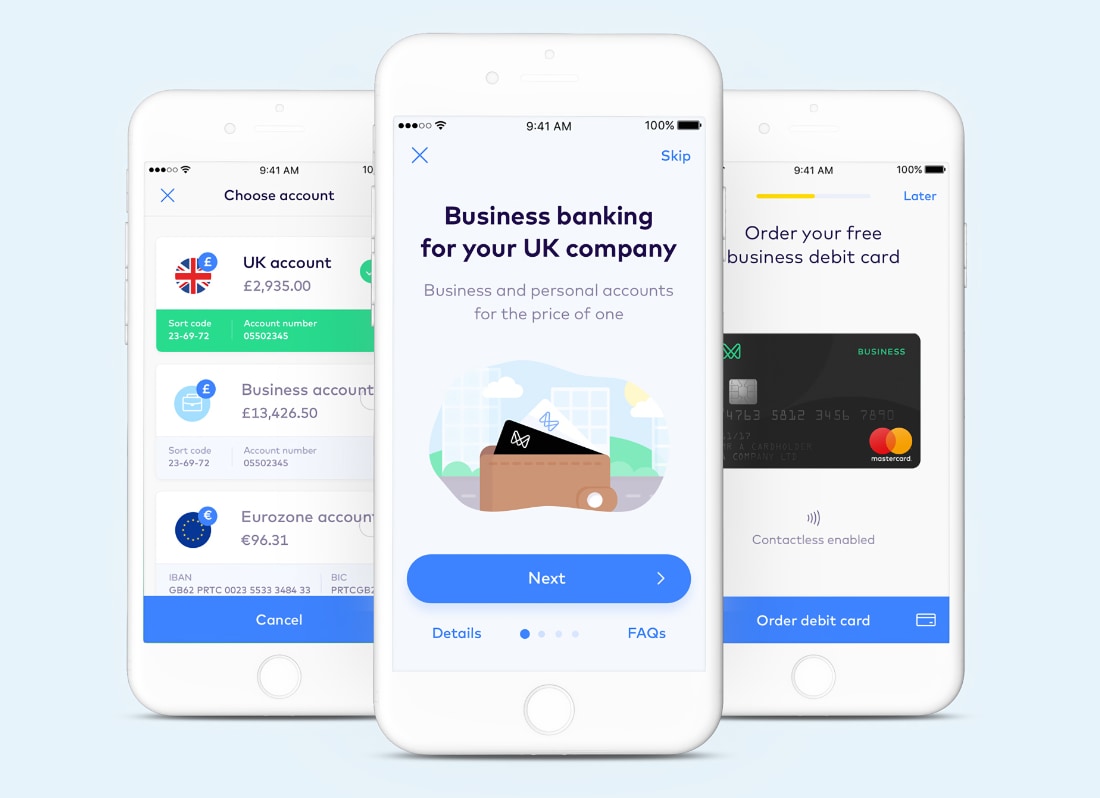

Image: Monese

Switch between personal and business accounts in app.

The account is provided by PrePay Technologies Limited that is authorised by the Financial Conduct Authority (FCA) under Electronic Money Regulations 2011 for the issuing of e-money. Monese is also an agent of PPS EU SA, an electronic money institution authorised by the National Bank of Belgium to issue e-money and provide payment services. In other words, Monese’s account and software are based off services by these two institutions.

What does that mean in terms of security? Although Monese does not have Deposit Guarantee Scheme (The Guarantee Fund or FSCS) protection, the company guarantees the protection of 100% of your funds through the compliance of safeguarding regulations applicable to money received in your account. Monese does not reinvest your funds, meaning that if Monese goes out of business, you will get 100% of your account balance back.

There are actually two different Monese Business plans: Business Basic and Business Plus accounts. These have exactly the same fees, as far as we can tell from terms and conditions.

Basically, when you apply for a business account, you will be given a Business Basic account with a maximum balance limit of £50,000 as standard. If your company requires a higher limit, you can apply for a limit of up to £100,000 after three months. Monese will review your application, and if they accept your limit increase, your account will become Business Plus with the higher balance limit.

| Business Basic plan | Business Plus plan |

|---|---|

| £9.95/mo | £9.95/mo |

| Maximum account balance | |

| £50,000 | £100,000 |

| Business Basic plan |

Business Plus plan |

|---|---|

| £9.95/mo | £9.95/mo |

| Maximum account balance | |

| £50,000 | £100,000 |

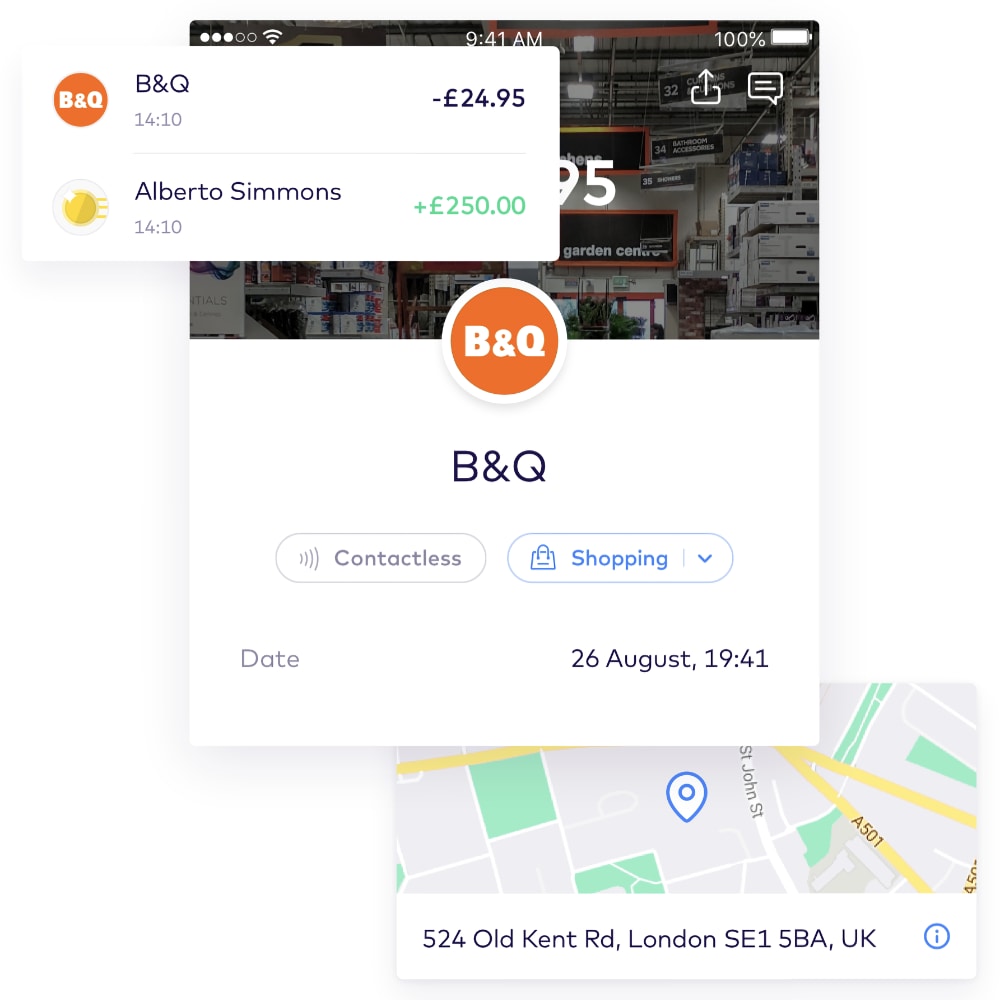

A business account comes with a contactless prepaid debit Mastercard, on top of the personal account’s Mastercard also received. Since it is a prepaid card, there may be some limitations on where it can be used compared to a normal Debit Mastercard, but most users will not have problems with it.

The Mastercard can be added to your Apple Pay or Google Pay wallets depending on whether you have an iPhone or Android phone.

International transfers

The prepaid Mastercard can be used anywhere in the world, whether online or in person, accepting Mastercard. This includes transactions in foreign currency, which will be subject to a 0.5% currency conversion fee. Non-GBP transaction amounts will be exchanged to GPB using a wholesale rate set by Mastercard.

It is also possible to receive and send international transfers at a low cost.

In order to receive an international payment, you need to use the IBAN and BIC/SWIFT details of a dedicated Monese account for all business account users. Monese will then forward the transfer to your account as long as you have provided your Monese ID.

This is a relatively painless way to receive money from abroad, as certain other e-accounts either do not have the option or suggest external methods for cross-border transfers.

It’s only possible to receive transfers in GBP and EUR currencies. The latter will be converted into GBP at the mid-market rate when the funds arrive.

When you send an international payment, the money will be converted at the wholesale exchange rate plus a currency exchange fee shown in the app before submitting the transfer. Currency exchange fees start at 0.5% of the transaction value (the minimum fee is £2).

You can send payments to around a dozen different currencies across the world incl. US, Canadian, Hong Kong and Australian dollars, euros, Brazilian reais and misc. European currencies.

Cash deposits and limits

You can deposit cash into your Monese account at any PayPoint or Post Office in the UK. Just hand your Monese debit card and cash amount to the cashier, and they will deposit it into your account for £1 at the Post Office or a 2.5% charge at PayPoints.

There is a limit for how much you can deposit or withdraw during a month without further charges: £900. Above this, an additional 2% of the cash total is charged. You can max. take out £500 daily, £2,000 weekly and £4,000 monthly from a cashpoint.

At the Post Office, a maximum of £500 can be paid in at a time, while PayPoints have a £249 maximum per deposit. PayPoint has additional limits on cash deposits: £2,500 weekly and £5,000 monthly. This could make Monese unsuitable for certain brick-and-mortar shops that routinely deal with large volumes of cash.

Cheques cannot be deposited into Monese accounts.

Business loans

Monese does not directly offer business loans, but has partnered with Iwoca to offer business loans of up to £15,000 for eligible companies.

You can usually apply for this through the app menu, but since May 2020, Monese have paused applications so Iwoca can focus on (hopefully soon) providing Coronavirus Business Interruption Loan Scheme (CBILS) loans to Monese businesses that have been affected by coronavirus.

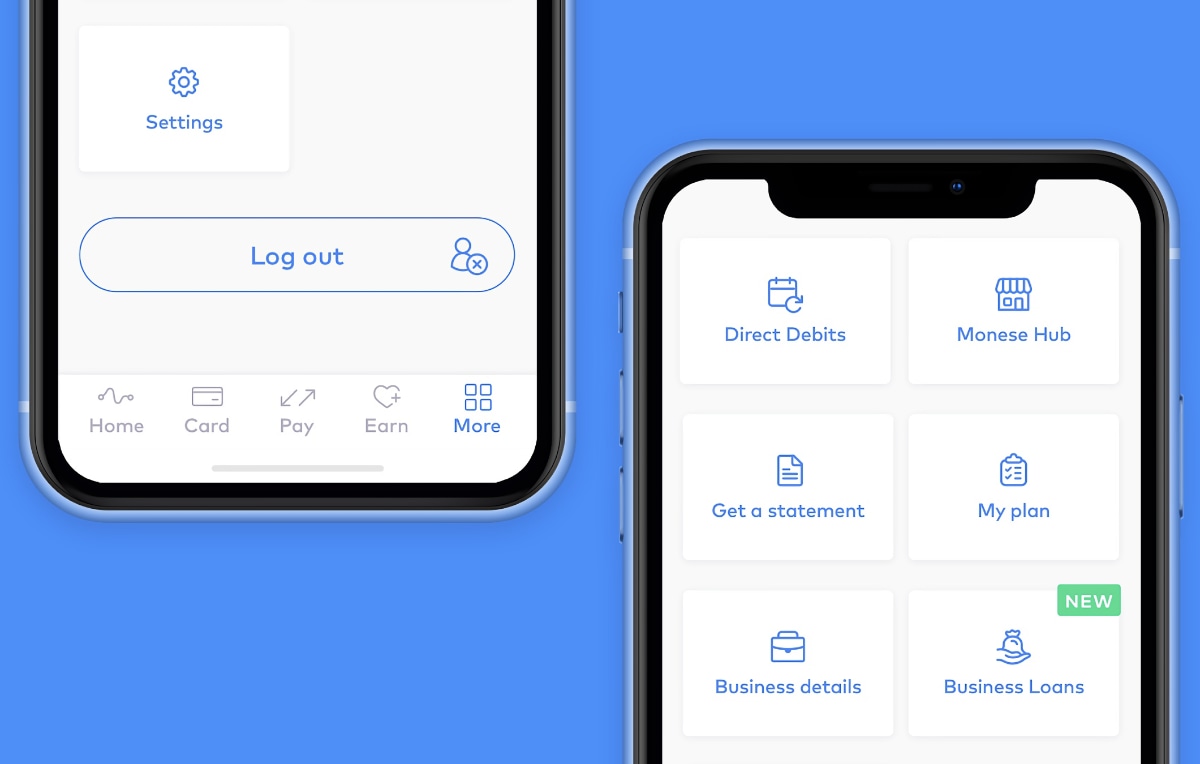

Image: Monese

Monese partner Iwoca normally offers business loans through the app.

When Iwoca is open for new applications, you need the following to apply:

- Monese Business account

- £10k+ annual turnover

- Business that’s been registered for over three months

If approved, you will receive the money in the current account within minutes.

Personal account holders are eligible for personal loans through the partner platform Monevo, but this does not apply to business accounts. There is no credit card or overdraft available for any users.

Monese app

The business account is managed entirely through the Monese app. In it, you can switch easily between your personal and business accounts to distinguish funds and features (Personal and Euro accounts have non-business features only).

Businesses benefit from the following features in the app:

Image: Monese

Transactions are neatly categorised.

You have to go to a cashpoint offering ‘PIN services’ in order to change your card PIN. Other banking apps usually allow this straight from the app, sometimes with advanced card controls as well. Overall, the business account in the Monese app is fairly simple with not too many features.

The personal account has some cool features, but these cannot be used for the purposes of your company. For example, you can collect Avios points on certain purchases and send payment requests to people in your phone contacts. There is also a Marketplace to connect with external partner tools, but this is at an early development stage.

The accounts can also be managed in a web browser, but fewer features are available there compared to the app.

Customer service and Monese reviews

Monese account holders can contact customer support by calling between 8am and 5pm on weekdays. Alternatively, you can email the team any time or send a chat message from the app, though you should only expect a response within office hours.

In contrast to other online accounts in the UK, Monese offers multi-lingual support when communicating with the support team. That is, you can speak, write or chat-message the team in any of 14 different languages.

There is no emergency contact number/email for urgent problems with the account at the weekend. Instead, it is encouraged you look up answers to queries in the online help section before trying to get help from a Monese representative.

Customer reviews are mostly positive about Monese, but there have been consistent, negative reviews about the company in recent months. Many users complain of very slow transfers or funds being held by Monese with no way to access it, and no explanation about why Monese has frozen the account. Some have said that after multiple calls or emails, they still haven’t got access to their money (often several thousands of pounds) or a reason for why the account was blocked.

It’s common to see users complaining about the lack of extremely slow responses from Monese support, which is concerning. One user was given the explanation that Monese has fewer staff working at the moment due to the coronavirus crisis.

Others have raised an issue with the support team about SEPA transfers being lost, but without getting a reply from customer support for many days. Clearly, Monese is burdened with the volume of customer issues, but that shouldn’t be an excuse not to communicate or try to resolve people’s issues promptly.

Image: Monese

The Monese app is user-friendly and lets you manage all your Monese accounts.

Signing up

In order to sign up, you need to download the iOS or Android app on your phone and follow the sign-up steps in the app, which should only take a few minutes. You should have a valid photo ID handy and expect to record yourself in a short video for identification purposes (this is normal for online banking sign-ups). A valid email address and mobile phone number are also required.

These steps are for creating a Personal account. Only when the Personal account is approved by Monese can you add a Business account. It is not possible to go straight to creating a Business account.

Adding a Business account is done via the app menu when logged into the Personal Monese account. Follow the sign-up steps, then wait for Monese’s approval which can take anywhere between a few hours to two working days, or more if additional checks are required. The Personal account is usually accepted faster, within a couple of hours.

Our verdict

Monese is one of many online accounts across Europe, but the only UK-based account (as far as we’re aware of) that allows you to live elsewhere in the EEA. This is a major upside to British start-ups resident in Europe, but who prefers a GBP account that can count as the main hub for business funds.

Freelancers and the self-employed are left out of the business solution, instead encouraged to use the Personal account. This could actually be a good alternative for freelancers, since you are able to get a Euro account and benefit from additional features not available for companies. The catch is that freelancers don’t get a dedicated business account to separate finances completely.

The international payment options make Monese better than some other online banks that don’t offer cross-border transfers at all.

Overall, the business account features are nothing out of the ordinary among other online accounts. The app isn’t very advanced for businesses, but it does the job and it’s a fantastic way to open an account quickly.

But the fact you don’t get a personal IBAN for incoming transfers means it is not the fullest-fledged account for regular cross-border transfers. The customer complaints we’ve seen about slow transfers confirm that it might not be the best solution for fast payments from clients abroad.

We are concerned about the volume of poor reviews about the customer service. Too many users have complained about very slow, or no, responses from the support team, often not resolving issues satisfactorily. And business loans are paused for the foreseeable future. We could blame all this on Covid-19 for the moment – but will it improve in the coming months?

Overall, the business account features are nothing out of the ordinary among other online accounts. The app isn’t very advanced for businesses, but it does the job and it’s a fantastic way to open an account quickly. Monese doesn’t appear to make grand promises to mislead new users, but it would be good to see more advanced features developed for businesses, not just private individuals.