|

|

|---|---|

| Company | Wise (previously TransferWise) |

| Account name | Wise Business |

| Type | Online/e-money account |

| Subscription | None |

| Card | Business Debit Mastercard |

| Transfers | Faster Payments, BACS, CHAPS, SWIFT, SEPA, ACH |

| IBANs | Available in UK, Belgium and Romania accounts |

| Local accounts | 8 countries available |

| Storable currencies | Up to 53 currencies |

Pros: No monthly fee. Multi-currency. Fast and inexpensive international transfers. Local accounts in different countries.

Cons: Not a bank account. Not many app features. No cash deposits.

Wise (formerly TransferWise) was founded in London in 2011. It offers Wise Business, an online account for all types of businesses including self-employed people.

The account is particularly interesting for those with clients outside the UK, as the rates for international transfers are low.

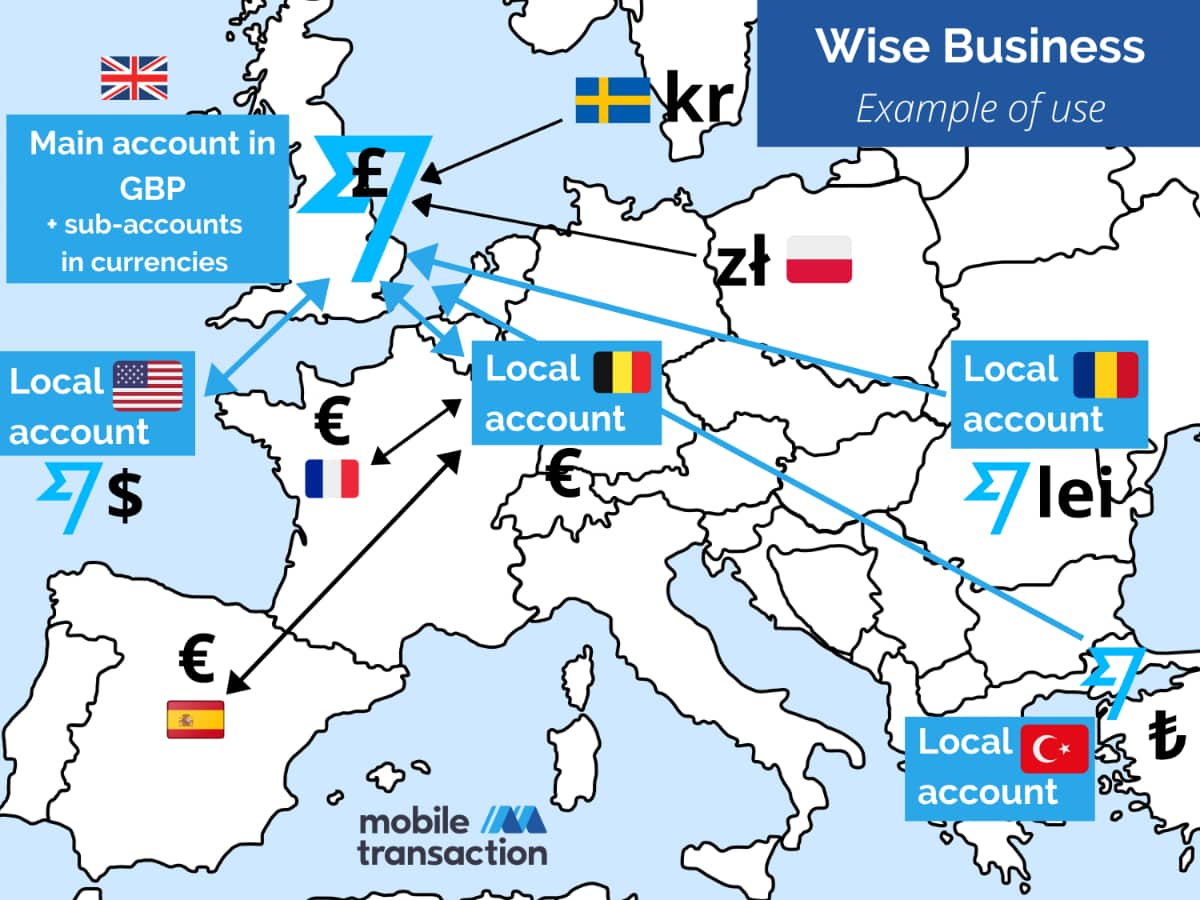

Although Wise is not a bank, British users get a British account number, sort code and IBAN – similar to a bank account. Businesses can also add local accounts in up to seven other countries, allowing you to bank like a local in those countries.

Accounts are managed entirely online through a web browser or the Wise app. The key things you can do with Wise Business are:

Image: Mobile Transaction

In this example, the main account, based in the UK, receives various currencies. Additional local accounts save money on wire transfers.

Is Wise safe? In short: yes, pretty safe

Wise is authorised as an Electronic Money Institution (EMI) and regulated by the Financial Conduct Authority in the UK and similar regulators globally. Your money is stored in different banks around the world depending on the location of the account. For example, the money in your UK account is stored at Barclays, while a USD account may use JP Morgan Chase.

Since Wise is not a bank, your money isn’t protected by the Financial Services Compensation Scheme (FSCS). This means that if Barclays for whatever reason goes bust, you won’t get your GBP money back. If Wise becomes insolvent, on the other hand, you will get all your account balances back due to stringent safeguarding.

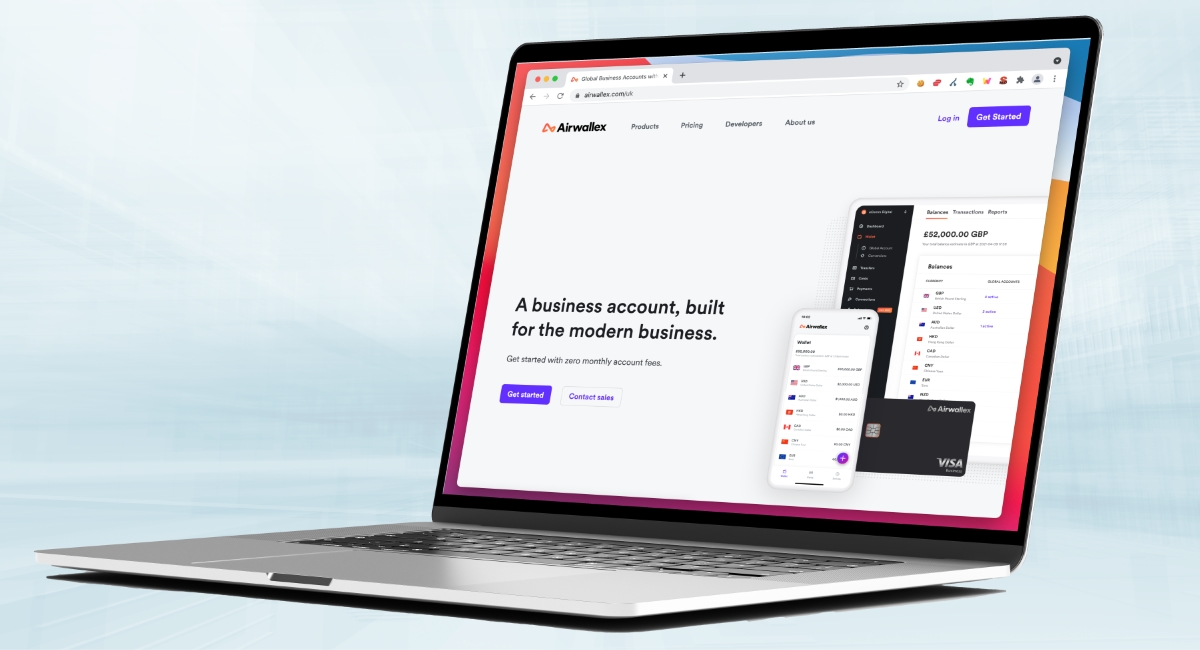

Wise Business alternative: Airwallex – good account if you’re accepted

Some types of businesses are prohibited such as the tobacco, cryptocurrency and adult entertainment industries.

If you have more than one business, you can sign up for a Wise Business account for each business. It’s not possible to attach more than one company to the same account.

Apart from Wise Business, you can also open a Wise personal account, intended for private individuals. Both accounts are managed from the same Wise app.

What are the alternatives?

Best business accounts for small businesses

Pricing: no subscription, but other costs apply

In contrast with most other business accounts, the Wise Business account does not offer premium plans. It is free to open the account where you can make payments to others, and there is no monthly or annual service fee.

However, a one-off payment of £16 is required to:

- Get your account details and receive transfers.

- Set up Direct Debits.

- Receive payments from third parties.

- Withdraw money from platforms like Stripe and Shopify.

The general pricing is relatively simple:

| Wise Business fees | |

|---|---|

| Monthly fee | None |

| Accounting opening | Free |

| Getting account details | £16 (one-time fee) |

| Incoming transfers | No Wise fees Exception: $7.50 per USD (SWIFT) transfer |

| Outgoing transfers | Fixed fee: From £0.20 (depends on currency) Transfer rate: On average 0.35% (variable, depends on currency) No transfer rate for same currency |

| Business Debit Mastercard | First one free, additional ones £3 each |

| Card payments | No charge if paying in same currency, 0.33%-3.56% with currency conversion |

| Cash withdrawals | First 2/mo. free, 50p per extra withdrawal Up to £200/mo. free, 1.75% fee above |

| Wise Business fees |

|

|---|---|

| Monthly fee | None |

| Accounting opening | Free |

| Getting account details | £16 (one-time fee) |

| Incoming transfers | No Wise fees Exception: $7.50 per USD (SWIFT) transfer |

| Outgoing transfers | Fixed fee: From £0.20 (depends on currency) Transfer rate: On average 0.35% (variable, depends on currency) No transfer rate for same currency |

| Business Debit Mastercard | First one free, additional ones £3 each |

| Card payments | No charge if paying in same currency, 0.33%-3.56% with currency conversion |

| Cash withdrawals | First 2/mo. free, 50p per extra withdrawal Up to £200/mo. free, 1.75% fee above |

As you see in the table, Wise incurs transfer fees when sending from one currency to another. There is no transfer % rate if you pay another account in the same currency as your account, but you do still pay a low fixed fee for any payments sent from Wise to a bank account – even your own bank account.

A main strength of Wise is the ability to create balances in many different currencies. This allows you to save money that would’ve otherwise been spent on currency conversion and cross-border transfer charges.

If you send more than £100,000 a month, you can get discounted transfer rates. Where the average transfer rate is o.35% for those who send less than £100k monthly, volume discounts for sending, say, £1m a month get the rate down to 0.22% on average. Higher volumes mean lower rates.

There is also a fee for holding more than €70,000 euros in the EUR account balance: 0.40% annually of the euros held above the €70,000 free allowance. Wise introduced this because eurozone interest rates are currently negative, so Wise would lose money if they didn’t charge customers for it. Suffice to say, this fee does not apply to any of your other balances including USD and GBP.

The first Wise Business Debit Mastercard is included for free. Additional cards can be ordered for £3 each.

Outgoing transfers

A Wise Business account is intended for transfers and payments pertaining to your business only. International transfers are therefore used mainly to pay workers and suppliers, or buy goods and services.

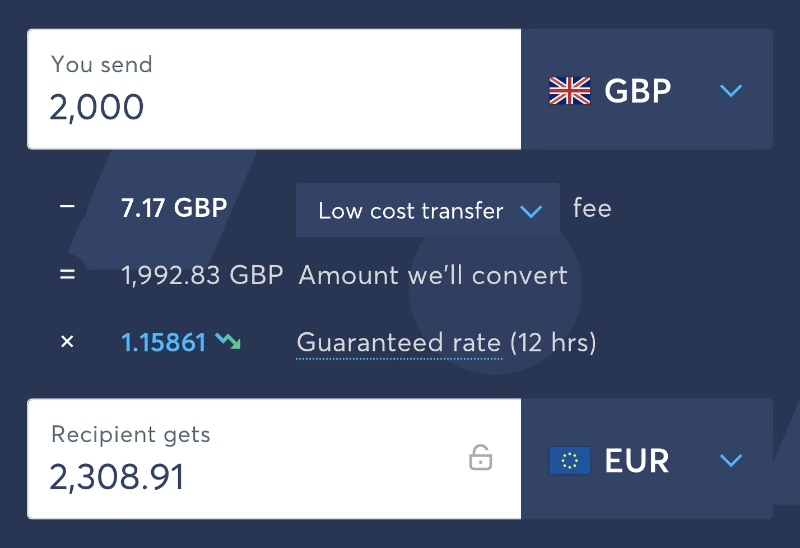

When sending a payment from one currency to another, Wise charges a fixed fee plus a small percentage rate above the mid-market (real) exchange rate, which is the fairest exchange rate you can get. The exact fees depend on the chosen currencies and exchange rates at the time of sending.

You know exactly how much you’re going to pay before you send a payment, thanks to Wise’s fee calculator. Although that’s great, the calculator does not always break down the total charge to show what the fixed fee and percentage fee are individually.

There are a few options for making an international transfer with Wise:

- From a bank card (most expensive, but fast)

- From a bank account or Wise balance (low cost)

- Via SWIFT (advanced, e.g. euros sent from Japan)

The availability of these options varies depending on the currencies chosen.

By choosing the “low cost” option and sending from your Wise balance, you keep costs as low as possible while ensuring a fast service.

Transfer limits

The exact sending limits depend on the currencies being sent. It is safe to say that the limits are generally very high, for example: 1.2 million euros, 1 million dollars and 1 million yen.

Price, speed and transfer method depend on the chosen currency

Wise must comply with the rules of each country. In particular, it’s impossible to send dollars without going through the SWIFT system. The transfer method can also vary depending on the geographic area. For example, with a local euro account, you can use Direct Debit to pay your suppliers in the eurozone.

You can send GBP transfers to GBP accounts outside the UK through the SWIFT network, which adds £3.95 to the regular Wise fee.

If you plan to send currencies other than British pounds, be sure to read the rules for sending each currency in Wise’s help guides.

Say, for example, you need to send £1,000 to settle an invoice from an American customer. If you go through a bank and its SWIFT fees, you might pay around £15-£30. If you go through Wise, the cost is only £4-£5.

Euro transfers are speedy across the eurozone, as your local euro account in Belgium uses the SEPA network to send these payments. Sending payments from the euro account to outside the eurozone is slower, as it would require the SWIFT network.

Wise’s great strength lies in bypassing the international SWIFT system through the local accounts you can create in other countries, even when you’re based in the UK. These can be used for both sending payments and receiving money from local clients.

So how can you save on incoming transfers from your customers’ banks? Can the fees be completely eliminated in both directions?

How Wise’s local accounts save you money

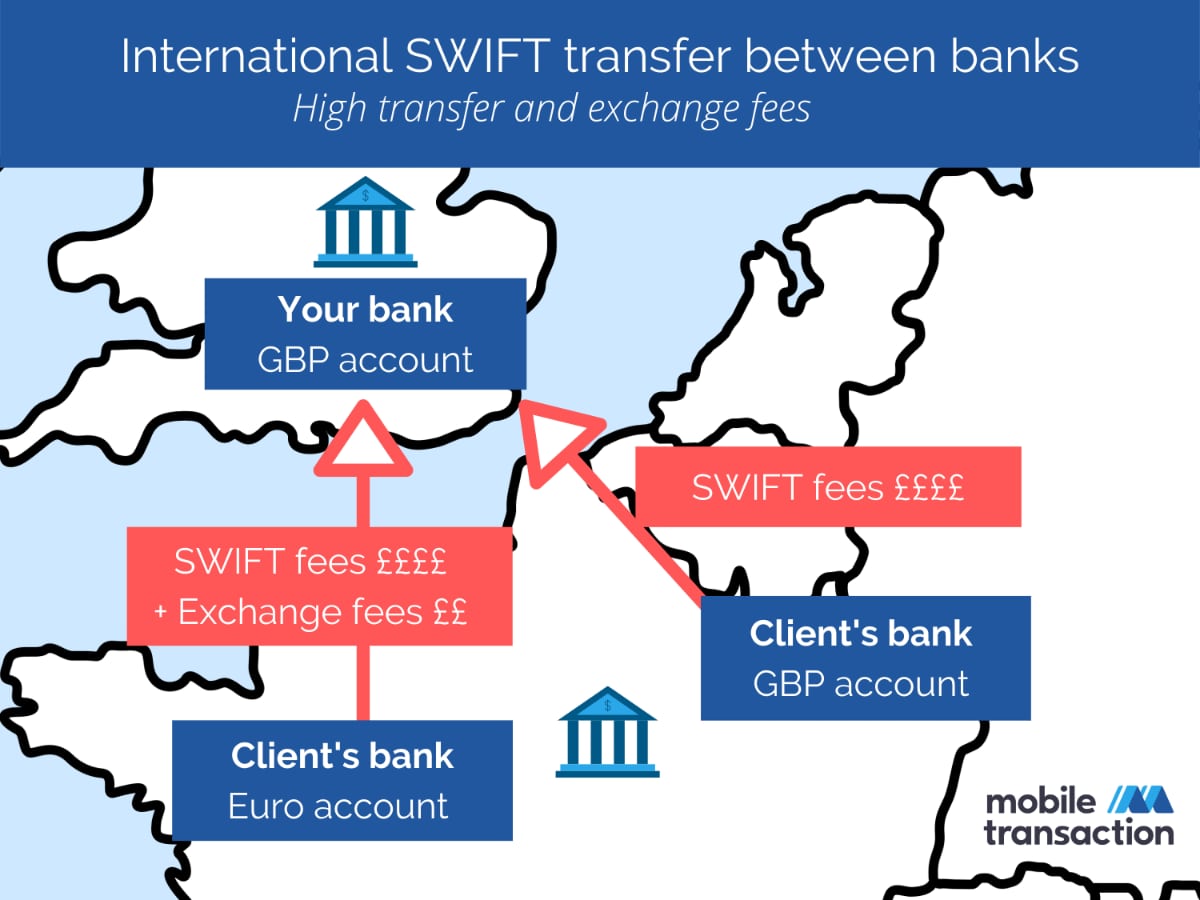

If you have clients abroad, neither of you with a Wise account, you’ll already know about the slow and expensive SWIFT network.

Consider this example of an inbound transfer. When you receive a cross-border transfer in your regular bank account, there is typically both a SWIFT transfer fee (e.g. £9-£25) and recipient fee (e.g. £6-£12). Intermediary banks may also – unpredictably – apply a charge.

Here is a diagram of a SWIFT transfer from a French bank to your British bank:

Image: Mobile Transaction

Transfers that go through the SWIFT system cost more.

If your client in France has a GBP account, you won’t have to pay any exchange fees, but you and the recipient still have to pay SWIFT fees.

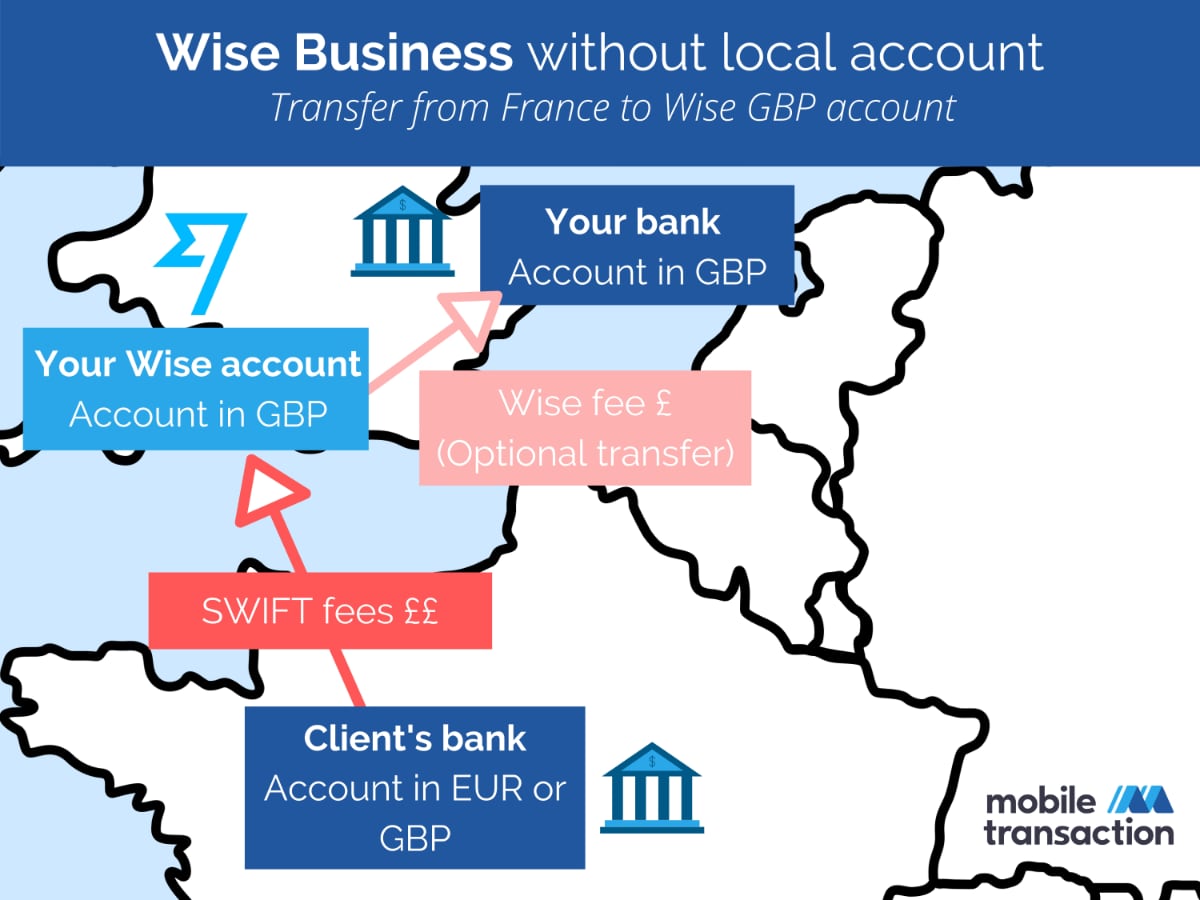

If a foreign bank sends money to your Wise account, the sending bank will also charge a SWIFT fee, but Wise will not charge a recipient fee. However, receiving transfers to your Wise account is not always more beneficial, as intermediaries can slip between Wise and the issuing bank with interbank charges.

Image: Mobile Transaction

Wise does not apply SWIFT recipient fees, but the sending bank does apply fees.

To avoid the banks, some people use PayPal. Wise is generally much cheaper than PayPal who applies recipient fees of over 6% (incl. 2.5% above the currency exchange rate) depending on your customer’s payment method and location. In fact, Wise does not apply any recipient fees – only the sending bank applies fees.

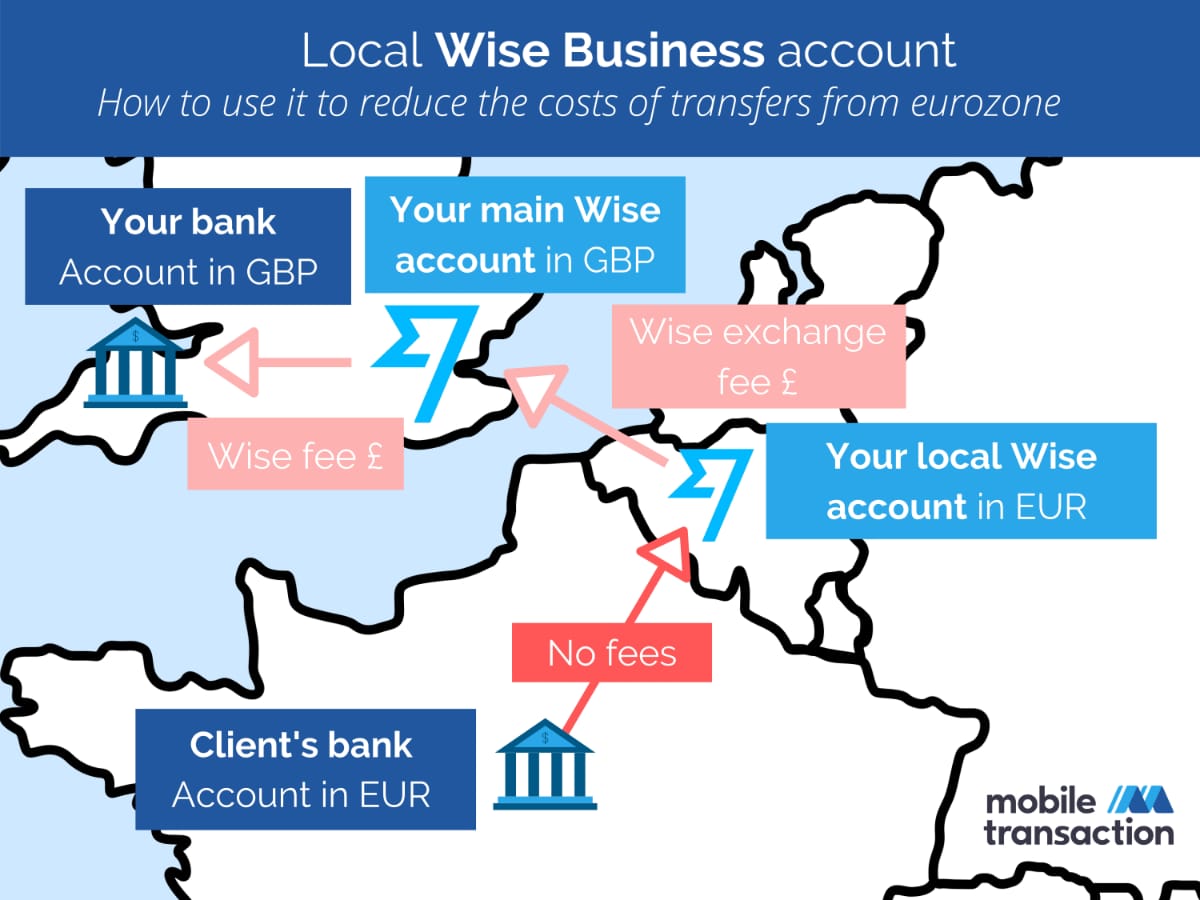

To make savings on transfers, the most effective way is to use local accounts in Wise Business. With a Wise account located in the same country as your customer, you eliminate the risk of international SWIFT fees.

For example, transfers between your client’s French bank and your Belgian (also euro) Wise account are free. On the other hand, you will have to pay a low Wise transfer fee (variable, on average 0.35%) to send the money to your main account in pounds sterling.

Image: Mobile Transaction

You are charged no transfer fee if your French customer pays your Wise euro account.

It also works the other way around. To pay a supplier, make a local transfer to their bank if you already have the local currency balance in Wise. Otherwise, send GBP from your main account to the applicable currency balance (which only incurs a low Wise fee), then pay the supplier from that.

The following eight local accounts are available to add in your Wise Business account for free:

| Country | Currency | Account details |

|---|---|---|

| UK | GBP | Account number, sort code, IBAN |

| Belgium | EUR | SWIFT/BIC, IBAN |

| United States | USD | Account number, Routing (ABA) |

| Romania | RON | SWIFT/BIC, IBAN |

| Hungary | HUF | Account number |

| Australia | AUD | Account number, BSB Code |

| New Zealand | NZD | Account number |

| Singapore | SGD | Account number |

| Country | Currency | Account details |

|---|---|---|

| UK | GBP | Account number, sort code, IBAN |

| Belgium | EUR | SWIFT/BIC, IBAN |

| United States | USD | Account number, Routing (ABA) |

| Romania | RON | SWIFT/BIC, IBAN |

| Hungary | HUF | Account number |

| Australia | AUD | Account number, BSB Code |

| New Zealand | NZD | Account number |

| Singapore | SGD | Account number |

You can open a local account in your client’s country with a few clicks from the website or the app. It varies between the countries which account details you get. For example, only the UK, Belgian and Romanian accounts come with an IBAN (see table above).

Apart from the local accounts, Wise Business also lets you create balances in 53 currencies. This is better than Revolut Business and its (already impressive) 28 currencies.

Balances are like sub-accounts in different currencies, with no account details for others to send payments to directly. You can send payments, pay bills and spend by card from the 53 different currency balances, provided you have added the currencies and have enough money stored in the balances you use.

The balances also allow you to convert from, say, pounds sterling to Danish kroner, then pay a Danish bill without currency conversion. At any time, you can convert different balances to another in your Wise account, paying only Wise’s transfer rate (e.g. 0.35%) that is considerably lower than the markups charged by competing business accounts.

Finally, you can send money to over 80 countries around the world from your balances and local accounts. All these possibilities make Wise Business a decent choice for borderless companies and freelancers.

Wise Business debit card

A free Wise Business Debit Mastercard is included to use online and in stores. It has no overdraft, but beats many other online accounts that only offer prepaid cards that tend to have more issues.

The card can be added to the mobile wallets Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

The Debit Mastercard is connected to your currency accounts, allowing you to avoid currency conversion fees when using the card in foreign shops. As long as you have a Wise balance in the currency of your transaction, the Wise card uses the same currency for the payment, making the transaction totally free.

Image: Wise

If there isn’t a matching currency balance, Wise automatically converts it from whichever available balance has the lowest conversion fee. This makes the debit card really handy for travelling or using anywhere online, as you won’t have to calculate which way is the cheapest to pay.

You are also protected against fraudulent transactions. Anywhere in the world, you can get assistance for theft or even finding a local ATM.

Spending limits and card controls can be accessed in the Wise app. By default, the debit card comes with per-payment, daily and monthly transaction limits, but these can be adjusted. For example, you can select the payment method “contactless”, which is normally limited to £500 per day and increase it to £1,000.

| Transaction type | Default (max.) limit |

|---|---|

| Chip and PIN/mobile wallet | £2,500 (£10k) /payment £3,000 (£10k) /day £10k (£30k) /month |

| Contactless | £500 (£500) /payment £500 (£1,000) /day £4,000 (£4,000) /month |

| Swipe | £300 (£1,200) /payment £400 (£1,200) /day £1,200 (£6,000) /month |

| Online | £1,000 (£10k) /payment £1,000 (£10k) /day £2,000 (£30k) /month |

| Cash withdrawal | £1,000 (£1,000) /payment £1,500 (£1,500) /day £3,000 (£4,000) /month |

| Transaction type |

Default (max.) limit |

|---|---|

| Chip and PIN /mobile wallet | £2,500 (£10k) /payment £3,000 (£10k) /day £10k (£30k) /month |

| Contactless | £500 (£500) /payment £500 (£1,000) /day £4,000 (£4,000) /month |

| Swipe | £300 (£1,200) /payment £400 (£1,200) /day £1,200 (£6,000) /month |

| Online | £1,000 (£10k) /payment £1,000 (£10k) /day £2,000 (£30k) /month |

| Cash withdrawal | £1,000 (£1,000) /payment £1,500 (£1,500) /day £3,000 (£4,000) /month |

That said, it is not very attractive to use Wise’s high withdrawal limits, as you only get two free cash withdrawals a month totalling £200. After that, you pay 50p per withdrawal, with 1.75% added to any amount exceeding the £200 monthly free limit.

Suffice to say, Wise Business Mastercard is not really meant for cash – especially as there is no option to deposit cash (or cheques) into the Wise account.

The card controls are pretty decent, though. You can block different payment methods such as contactless and online payments, while allowing others such as chip and PIN. If necessary, you can temporarily freeze the card or even view the PIN, if you have forgotten it.

It’s a good start, but a few essential functions are missing: being able to upload expense receipts and generate invoices.

That said, you can use the business account to link with certain online platforms like Amazon, Stripe and Shopify for receiving payments. This way, you may be able to avoid having to set up a business bank account elsewhere to sell online.

Additional benefits apply to Wise Personal account holders. It has savings pots called ‘Jars’. These are sub-accounts where you can store money that is not directly accessible when you make a card payment – unlike currency balances. You can create as many jars as you want, in the currencies of your choice.

Working as a sole trader?

Best business accounts for freelancers

Customer service and reviews

Customer support can be contacted by email from the site or Wise app. An online help section is also accessible through the app and website. This only answers frequently asked questions, though – not all the questions we looked for were covered.

We tested customer service for issues caused by changing phones, and found it to be fairly quick and efficient, with good follow-up. We were, however, surprised to see our file handled by different staff members over the course of the responses, but the experience was generally positive.

Wise (or TransferWise) reviews are generally really positive. The vast majority of users are happy with the low-cost transfers, though customer support is not always helpful. Some users also remark that outgoing transfer times take a little longer than advertised on the site.

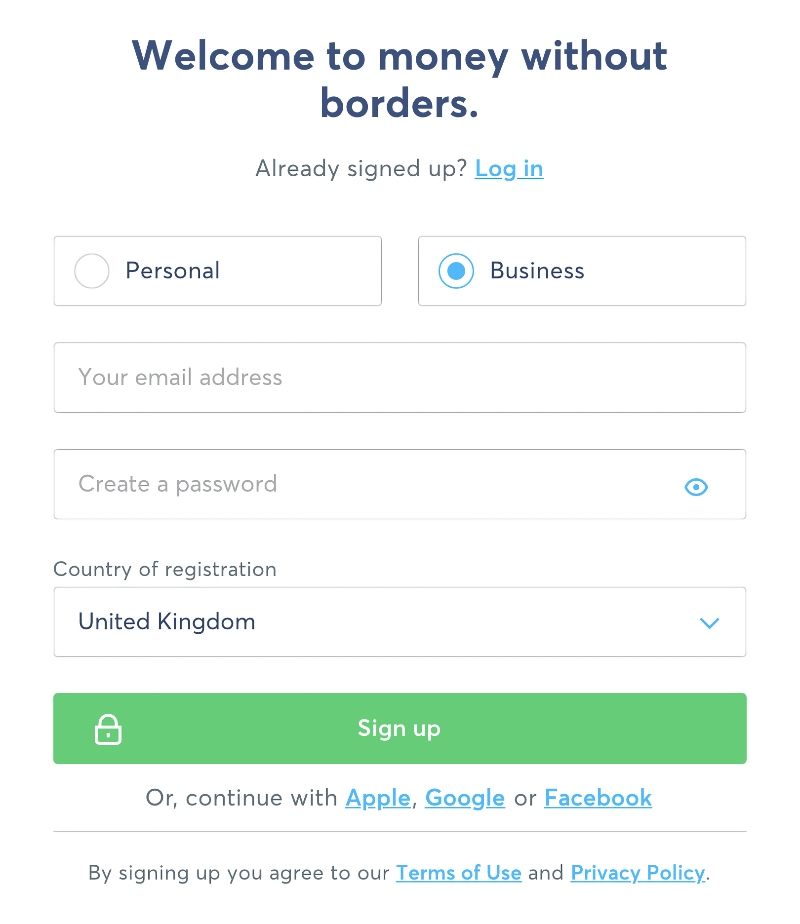

Opening an account

Creating a Wise Business account is very easy. You just click any registration button on the website, select the Business account option, enter your email address, new password and country of residence, and click to register.

Following this, you answer questions about your identity and company, for example your name, address, website, company registration number and type of business.

Image: Mobile Transaction

Wise has a simple registration process.

You also need to submit a photo of a valid ID such as your passport or driver’s licence, proof of address and in some cases business documents.

If you want to receive transfers and add foreign-currency accounts, a one-time fee of £16 is required to release these features. This can be paid with a debit or credit card. Alternatively, you can add funds to Wise by adding your bank account details (must be in the same name as the business or sole trader name registered for the Wise account).

It can take a couple of (up to 4-7) working days for Wise to verify these details, so the account is not necessarily ready to use immediately.

Once accepted, you can order the debit card, which takes 2–6 days to receive in the UK.

Our verdict: designed for cross-border businesses

Does Wise Business replace the need for a bank account? It really depends on what you need to do with it.

With clients, customers and suppliers in different countries – especially countries with a local Wise account option – you can easily save money on payments. The platform is made for low-cost international transfers, with the added flexibility of storing many currencies to avoid currency conversion fees.

Our own tests have shown a fast and reliable service, and we definitely saved money compared to using our bank accounts.

We wouldn’t go as far as to say that it replaces the need for a bank account, though. There are no overdraft and loan options, and features are limited to payments and transfers, without the usual extras like bookkeeping tools and invoicing seen elsewhere.

Cash and cheques deposits are not possible, which would be a deal-breaker for some. Wise Business seems to be totally geared towards online businesses as well as freelancers, given that only Shopify, Stripe and Amazon are mentioned as platforms that can send payments to your Wise Business account.

Overall, Wise Business is one of the cheapest bank transfer systems around. It’s fast, easy and cheap for borderless businesses, but we’d consider using it alongside another business account for other features than international payments.