- Highs: Fast checkout experience. Convenient for Amazon users. No monthly fees or contract. Works with many ecommerce platforms.

- Lows: Slow account verification and settlements. Withheld funds. Insufficient support at times.

- Choose if: You want to give customers an easy way to pay online as an alternative to PayPal.

How it works

Amazon Pay is an online payment gateway that allows customers to finalise transactions using just their Amazon credentials. Businesses can implement it on their online checkout page, directly on product pages and use it for one-off or recurring payments.

To complete a payment, the customer simply clicks the Amazon Pay button and enters their email address and Amazon password. If already logged into Amazon in the browser, they only need to confirm the transaction. The debit or credit card saved in their Amazon account is then charged immediately.

Anyone who buys on Amazon is already able to make transactions through Amazon Pay. Card details and billing address are not shared with the merchant when a payment is made, but the customer’s email address, name and shipping information are.

Payers can use the following cards through their Amazon account: credit and debit cards by Visa, Visa Electron, Mastercard, Maestro, American Express. You cannot add PayPal to an Amazon account, as they are two different payment systems.

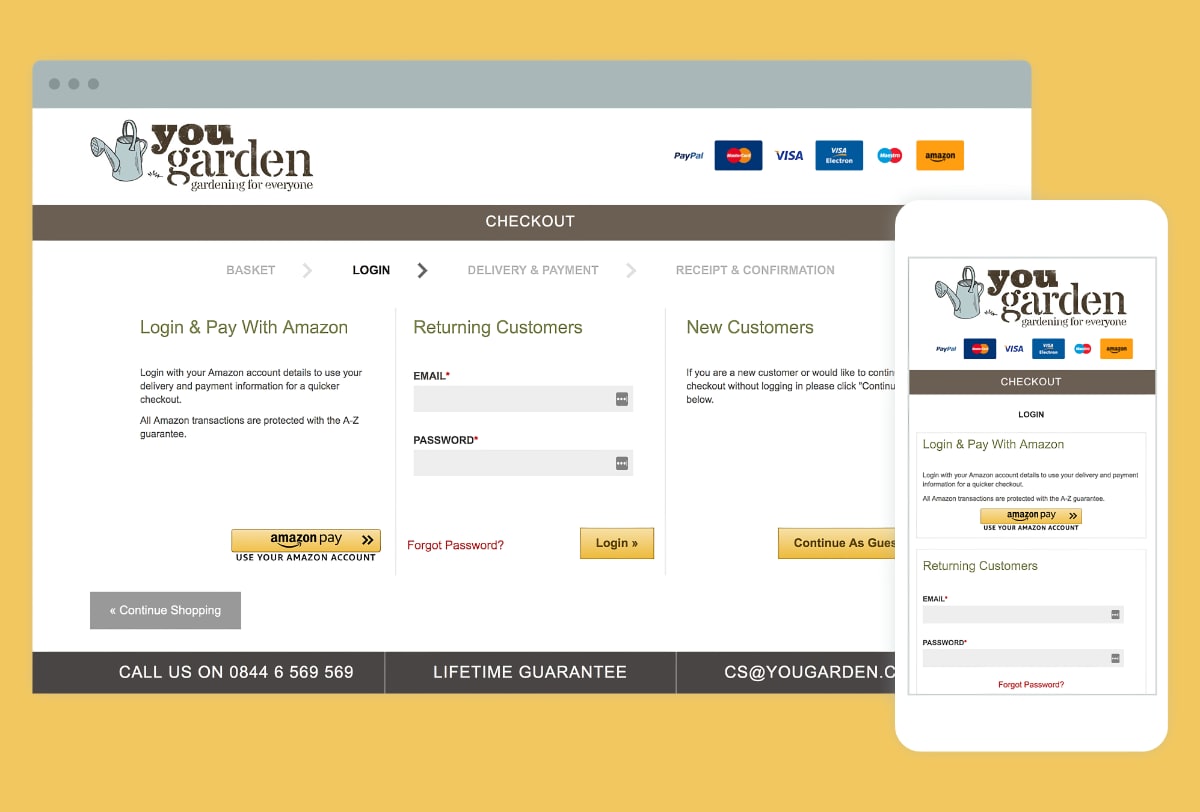

Amazon Pay is optimised for both web and mobile checkouts.

Amazon Pay can be added on many ecommerce platforms via different methods. For example, you can activate Amazon Pay in Shopify, Magento, BigCommerce and WooCommerce following clearly defined steps in your Amazon and online store accounts.

Alexa users can pay by voice if your business has set up Amazon Pay for Alexa Skills. However, only 2% of Alexa owners use it for online purchases, so this is unlikely to make a difference for a small business.

Amazon Pay fees

To accept Amazon Pay, merchants have to pay a fee per transaction. There are otherwise no monthly fees or contractual commitment.

It costs a fixed rate of 2.7% plus 30p for domestic UK transactions if your online turnover is less than £50,000 per month. A higher average monthly turnover – based on the most recent three months – can get you lower fees if you contact Amazon.

| Amazon Pay fees | |

|---|---|

| Online transaction fee | Less than £50,000 turnover/mo: 2.7% + 30p Over £50,000 turnover/mo: Custom fees Cross-border fees apply |

| Currency conversion fee | 2.5% above wholesale exchange rate applied by Amazon’s bank service provider |

| Chargebacks | £14 + VAT per disputed chargeback claim |

| Monthly fee | None |

| Contractual lock-in | None |

| Amazon Pay fees |

|

|---|---|

| Online transaction fee | Less than £50,000 turnover/mo: 2.7% + 30p Over £50,000 turnover/mo: Custom fees Cross-border fees apply |

| Currency conversion fee | 2.5% above wholesale exchange rate applied by Amazon’s bank service provider |

| Chargebacks | £14 + VAT per disputed chargeback claim |

| Monthly fee | None |

| Contractual lock-in | None |

Payments with a debit or credit card issued outside of the UK incur a cross-border charge of 0.4%-1.5% depending on the country of issue (see below table). If a currency exchange took place, you also pay a currency conversion fee of 2.5% above the wholesale exchange rate applied by Amazon’s banking provider.

These fees are similar to – but slightly cheaper than – PayPal charging 2.9% + 30p for online transactions plus a 0.5% or 2% cross-border fee and 2.5% currency conversion rate.

| Country of card issue | Cross-border fee |

|---|---|

| Aland Islands, Denmark, Finland, Iceland, Norway, Sweden | 0.4% |

| Austria, Belgium, Canada, Channel Islands, Cyprus, Estonia, France (incl. French Guiana, Guadeloupe, Martinique, Reunion and Mayotte), Germany, Gibraltar, Greece, Ireland, Isle of Man, Italy, Luxembourg, Malta, Monaco, Netherlands, Portugal, Montenegro, San Marino, Slovakia, Slovenia, Spain, United States, Vatican City State | 0.5% |

| Andorra, Albania, Bosnia & Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Poland, Romania, Russian Federation, Serbia, Switzerland, Turkey, Ukraine | 1% |

| Rest of the world | 1.5% |

| Country of card issue |

Cross- border fee |

|---|---|

| Aland Islands, Denmark, Finland, Iceland, Norway, Sweden | 0.4% |

| Austria, Belgium, Canada, Channel Islands, Cyprus, Estonia, France (incl. French Guiana, Guadeloupe, Martinique, Reunion and Mayotte), Germany, Gibraltar, Greece, Ireland, Isle of Man, Italy, Luxembourg, Malta, Monaco, Netherlands, Portugal, Montenegro, San Marino, Slovakia, Slovenia, Spain, United States, Vatican City State | 0.5% |

| Andorra, Albania, Bosnia & Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Poland, Romania, Russian Federation, Serbia, Switzerland, Turkey, Ukraine | 1% |

| Rest of the world | 1.5% |

If one of your customers disputes a transaction (e.g. if they didn’t receive the purchased item), Amazon will be notified of this by the cardholder’s bank. Amazon will then contact you for the option to:

When a refund takes place, you are also refunded the processing fee (2.7%) and applicable cross-border charge, but the authorisation fee (30p) and chargeback dispute fee are not refunded.

Settling transactions in your bank account takes 5 working days, which is on the slow side among payment gateways. When the Amazon Pay account has just been set up, you won’t get any payouts for the first 14 days. This could be an obstacle for sellers dependent on a fast cash flow.

Getting started

If you’re already selling on Amazon, you can proceed directly to integrating the online gateway on your ecommerce website. Otherwise, you first need to create an Amazon Payments Merchant account.

The online registration requires various information about your business and identity, e.g. company registration details and your nationality. Following this, you need to upload specific documents to complete through Seller Central. It usually

A bank account should also be added for receiving money from sales. This must be in the same name as the Amazon Payments account holder, and the currency has to be GBP for UK Amazon accounts.

After submitting all the required documents and details, it normally takes 5-10 working days for Amazon to verify your account. You cannot add Amazon Pay to your online shop until this verification is complete.

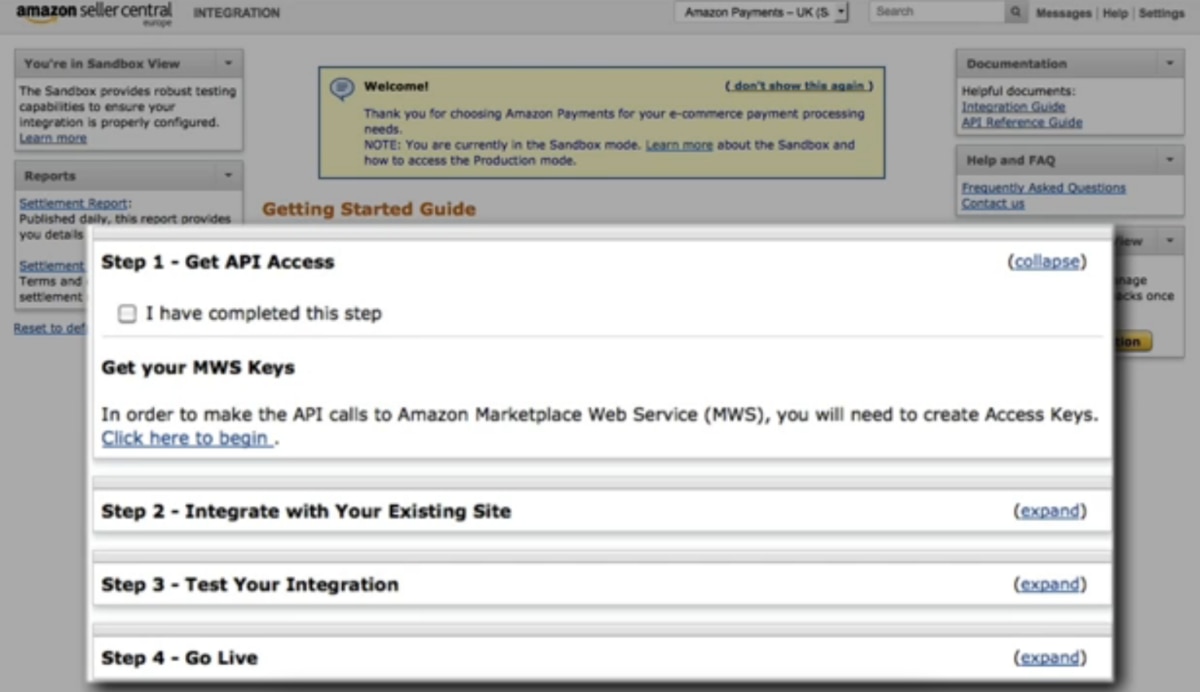

Image: Amazon

Steps for integrating Amazon Pay with an online store and testing payments in Seller Central.

The way you integrate Amazon Pay on a website depends on your ecommerce platform of choice, but it usually requires entering information in Seller Central and linking it with the ecommerce software. Someone with little coding experience should be able to do it from the step-by-step instructions.

If at any point you need help setting up Amazon Pay, there is always contact Merchant Support for assistance while logged into the Seller account. Overall, it is not as fast to sign up with Amazon Pay as with PayPal, but it is still easier than applying for a traditional payment gateway.

Service, reviews and fraud prevention

Whereas regular Amazon users find it impossible to contact Amazon for help, sellers have 24/7 access to customer support via email, phone and live chat. An extensive online support section also provides clear answers to most questions asked by merchants.

However, we’ve seen complaints from users about how Amazon handles what the company perceives as fraudulent account activities. If Amazon detects a potentially fraudulent transaction, the payment may be withheld for 90 days or longer, with little or no help to resolve it from Amazon’s end.

Some merchants have had their accounts frozen unexpectedly with no clear reason given as to why. This is usually due to selling a prohibited product or service such as adult entertainment, financial services, weapons, alcohol and membership clubs, but some have claimed that Amazon’s algorithm for detecting this was off the mark.

Such security measures are not unusual for an online payment service such as Amazon Pay that – PayPal has tons of complaints about similar issues. That’s because Amazon Pay transacts in e-money, an online currency equivalent to regular money, through its own merchant account shared across users. You do not get your own traditional merchant account like, say, Worldpay provides.

This means there are different security measures in place that are less predictable, with stricter account limitations dependent on the nature of your business. In fact, Amazon Pay states in its user agreement: “E-money does not qualify as a deposit so you are not protected by any deposit guarantee schemes” – so you need to make peace with that before signing up.

Pros, cons and verdict

Is Amazon Pay worth using for your online checkout? The advantages are pretty compelling:

Taps into a huge user group: 300 million Amazon users worldwide (estimate from 2017 – the current number is higher) can use this payment method. That said, the direct competitor PayPal had 361 million active users in the third quarter of 2020, and consumers are a lot more used to PayPal transactions.

Increases sales conversion: With no need to enter shipping information, card and personal details, customers are less likely to abandon their shopping cart in your online store. Additionally, the Amazon checkout does not redirect payers to an external web page (causing fewer completed transactions) like the free PayPal checkout solutions.

Free setup, no monthly fee, no lock-in: The pay-as-you-go transaction fees are a draw for many small shops testing the territory in online payments. What’s more, implementing Amazon Pay on your site does not mean you can’t also add PayPal or another payment gateway. It’s a win-win situation: you attract customers who swear by Amazon Pay, and there’s no loss from non-usage.

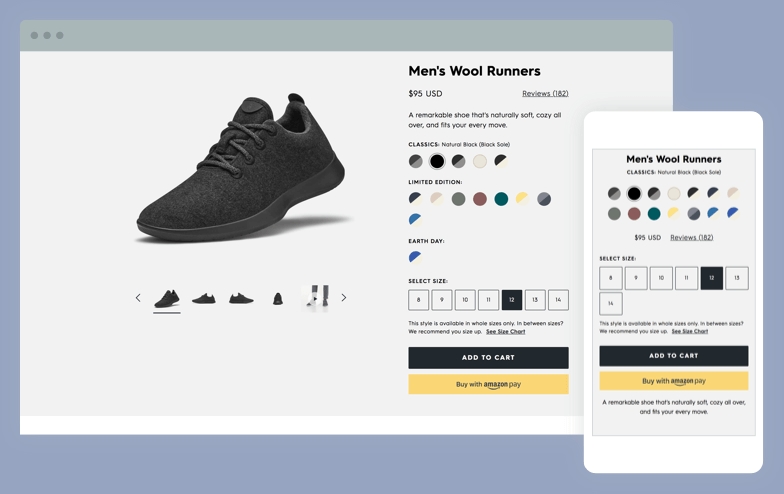

Image: Amazon

Businesses can embed Amazon Pay buttons on product pages to increase conversion further.

As with anything, there are also disadvantages:

Slow to get started: You have to wait a while for your first payment to reach your bank account: up to two weeks to get the account verified + two weeks’s observation period for payouts + one week for the first payout. Even after the initial settlement, payouts will continue to take a week to reach your bank account.

Amazon’s stronghold of online retail is another reason why small shops are hesitant to send money (transaction fees) to Amazon while reminding customers at checkout of the ubiquitous Amazon website that probably has a cheaper version of what you’re selling.

Do you want to manage another online gateway? You’re more likely to sell if customers can choose their preferred payment method. This means a higher sales conversion – and another payment system to manage. If you use, say, Fiserv as your main online gateway, you manage transactions, reports and chargebacks within the relevant accounts separately. The more payment systems, the more there is to deal with.

Do you trust Amazon? This is more speculative, but many merchants have worried about Amazon’s propensity for using their data for its own gains. Amazon’s stronghold of online retail is another reason why small shops are hesitant to send money (transaction fees) to Amazon while reminding customers at checkout of the ubiquitous Amazon website that probably has a cheaper version of what you’re selling.

At the end of the day, Amazon Pay is a worthy solution for online payments. Fees are slightly lower than PayPal’s in the UK, but consumers may still prefer the latter. If you choose an online payment solution accommodating for Amazon Pay, you could try it to see if it makes a difference to sales.