SumUp Business Account is an e-money account, not bank account, managed through an app or online dashboard.

It allows you to transfer money to any UK bank account, receive next-day payouts from SumUp and use a debit card for business expenses.

The app is the same application as that used for the SumUp Air reader, invoicing and remote payments. This way, you have access to all the SumUp tools from your iPhone, iPad or Android device anywhere with an online connection.

This is SumUp’s alternative to those in need of a basic, free and convenient business account with next-day card reader payouts. It can act in place of a bank account with complicated costs, but is limited to UK bank transfers in British pounds only.

Eligibility and getting started

To qualify for an account, you’ll need to be a company or sole trader registered in the UK. Private individuals and non-UK businesses cannot create an account.

Certain high-risk business types are restricted, such as multi-level marketers, adult entertainment and pawnshops, but most applicants are accepted the same day.

To get started, you only need to complete an online sign-up form on the website. In most cases, it takes minutes to complete the form, but certain businesses may need to submit documentation for further verification.

A bank account in the name of your business must be added in order to receive payouts when using SumUp’s payment tools.

If you already have a SumUp account, you can access the business account already in the app and SumUp Dashboard (in a browser). Only one Business Account can be created per registered business entity.

Pricing

Fees couldn’t be any simpler. SumUp Business Account has no monthly or annual cost, no contract lock-in or transaction charges.

You get the SumUp Card free of charge, with 3 monthly ATM withdrawals in the UK included free. Above this limit, SumUp will charge 2% of the amount withdrawn. Taking out cash abroad always incurs a 2% fee.

| SumUp Business Account | Fees |

|---|---|

| Monthly fee | None |

| Prepaid Mastercard | Free |

| UK bank transfers, Direct Debits | Free |

| UK cash withdrawals | 3 per month free, then 2% fee |

| Foreign cash withdrawals | Always 2% |

| SumUp Business Account |

Fees |

|---|---|

| Monthly fee | None |

| Prepaid Mastercard | Free |

| UK bank transfers, Direct Debits | Free |

| UK cash withdrawals | 3 per month free, then 2% fee |

| Foreign cash withdrawals | Always 2% |

There are no charges for transferring money to a UK bank account or Direct Debits, nor does it cost anything to receive bank transfers or SumUp payouts in the account.

The card can be used in any online and physical shop (accepting Mastercard) globally without charges.

There’s no minimum account balance required (i.e. £0 is fine), but there is no overdraft option either. No interest is added to the balance over time.

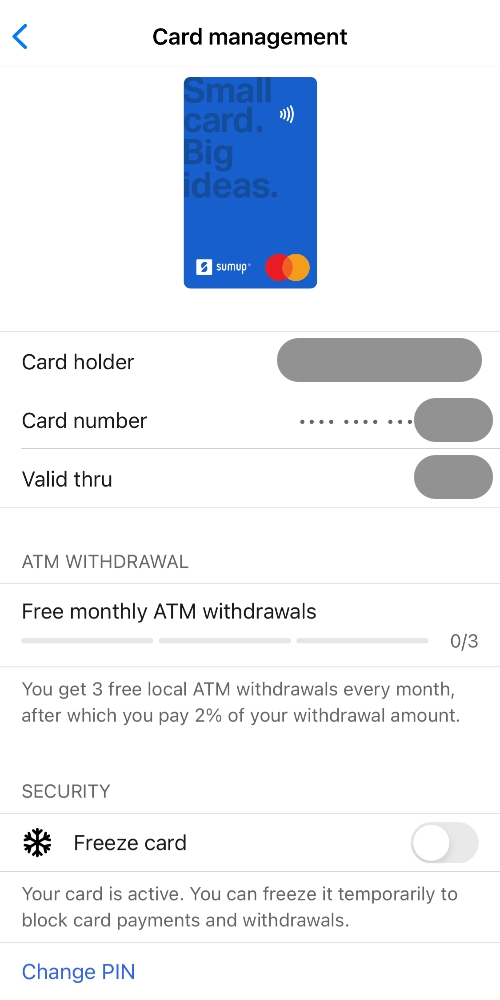

Photo: Mobile Transaction

The reviewer’s SumUp Business Card.

Account and card

SumUp is not a bank; it is an e-money institution and mobile payment solutions provider. The Business Account is therefore an e-money account rather than a bank account, but it has an account number, sort code and BIC.

It does not have an IBAN for international transfers.

The account can be used for:

It is regulated by the Financial Conduct Authority (FCA) in the UK. Your money is safeguarded in separate accounts unattached to SumUp’s own accounts, so if anything happens to SumUp, your funds are safe.

If you accept cards through SumUp, you can choose to receive payouts in the Business Account the following day, including weekends.

Image: Mobile Transaction

Card controls in the app.

It takes a bit longer when you settle in a bank account directly, i.e. 2-3 working days depending on your bank and type of card accepted.

Each account comes with one free, contactless and chip SumUp Card, i.e. Business Prepaid Mastercard for your business finances. You can only have one card per account, not extras for staff.

Because the card is Prepaid, not Debit Mastercard, there may be stores that don’t accept it. In the vast majority of cases, you can use the card in online and physical stores anywhere in the world accepting Mastercard.

Online purchases with SumUp Card are verified with 3D Secure technology, which means you’ll get a phone notification asking you to verify each transaction.

The card controls in SumUp App are useful, but not extensive: you can only freeze/unfreeze card payments and change the PIN. The card can be added to your Apple Pay or Google Pay wallet.

App features

Your account is managed in the very user-friendly SumUp App where you’ll find a range of complimentary features.

The following are pretty much all the Business Account features:

Transactions and payout history: View a list of transactions or tap on them individually for more details.

Card controls: Block your card or change your PIN in the app.

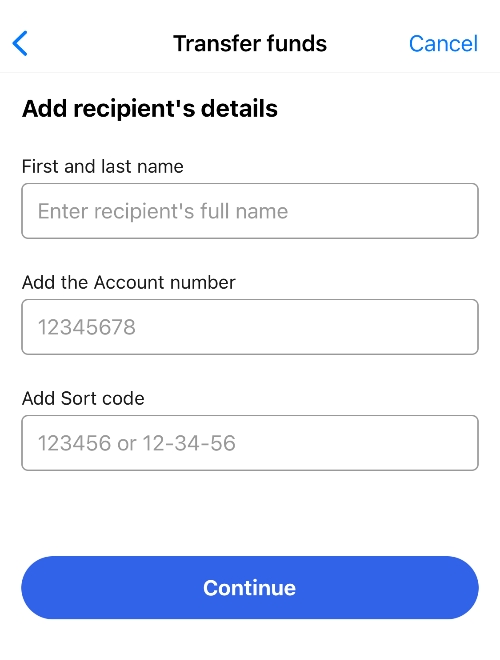

Bank transfers: Transfer funds to your own bank account or another person or business. You’ll need a bank account number and sort code for the latter. Alternatively, you can share your account details via a message or AirDrop (for Apple devices).

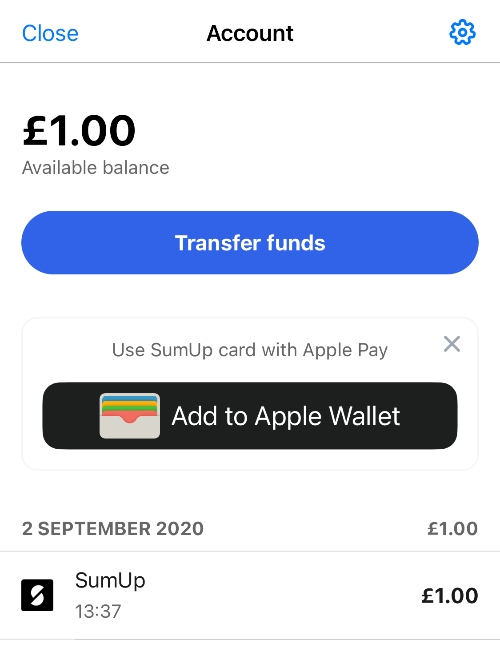

Image: Mobile Transaction

Main Business Account screen.

Image: Mobile Transaction

Bank transfer screen.

Payout settings: Choose settings related to payouts, such as whether to settle directly in your bank account or e-money account, frequency of payout report emails and the transfer description shown on your customers’ bank statements.

Security settings: Toggle on Strong Customer Authentication and face/biometric ID instead of using a PIN to log into the app. Push notifications alert you to transactions so you can keep a close eye on them.

Apart from the Business Account section, SumUp App also has these additional features – without monthly fees – that are super-handy for taking payments:

Payment links: Create payment links to send via text, app or email, or show a QR code of the link (for in-person payments). The payer clicks on the link to finalise the payment on their phone with their card details.

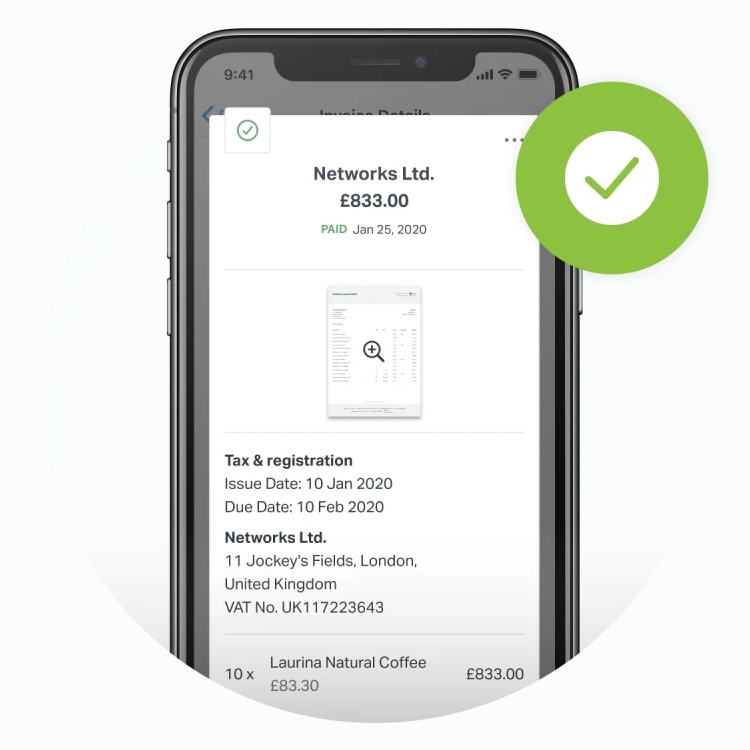

Invoicing: Send email invoices with a payment due date, customer and product details. Monitor payments and send reminder emails to the payer.

Image: SumUp

SumUp Invoice on phone.

Image: SumUp

Steps to build an online store from the app.

Online store: Create a basic online store from the app, where you can sell items added to your product library. Referred to as “the online store that doesn’t need instructions”, SumUp Online Store is the fastest way we know of to set up shop online.

Gift cards: Sell gift cards from a web page, which the customer receives over email.

Virtual terminal: Accept telephone or mail order payments via keyed entry on this screen (not available for all merchants).

POS checkout: Connect the app with the SumUp Air reader and add items to a bill, before accepting a chip and PIN or contactless payment with the card reader.

Customer service and reviews

Businesses can chat with SumUp on weekdays between 8am and 7pm or weekends between 8am and 5pm. If you send SumUp a message, you typically get a response back within one working day.

SumUp as a company is popular in the UK, but that doesn’t stop it from getting negative reviews from some users. The main criticisms are slow support responses, difficulties of getting to talk to a real person, slow shipping and technical issues with card readers.

Several people have recently complained that SumUp has switched payouts to go to the Business Account rather than the merchant’s bank account – without the knowledge of the user. This implies that SumUp prefers you to use the Business Account rather than bank account, but you are of course free to use either.

Our verdict

SumUp Business Account is quite basic on its own, but comes in a unique package with many other payment tools.

The online account offers fast payouts for SumUp merchants preferring to see their funds the next day rather than days later. But even if you’re not bothered about payout times, there’s a lot of value in the versatility of the app.

Whereas similar solutions charge extra for invoicing (for example, Starling Bank), SumUp provides decent free invoice features (you only pay a transaction fee). In addition, you get an online store, payment links, QR codes and a portable till system free in the same app as where you manage the business account.

The GBP-only account is, however, limited when it comes to international functions. You cannot send or receive foreign wire transfers, only use the Mastercard globally.

It isn’t an account for multiple users, and card controls are few. But on the whole, SumUp Business Account is suitable for freelancers and small businesses that just need a simple business account to simplify finances.