The past few years have seen an increase in credit options for consumers, in particular the Buy Now Pay Later (BNPL) schemes. It is no longer just for large stores or ecommerce businesses – more and more small businesses are offering this payment method too.

Before we delve into how it works, let’s first explain what it is:

Buy Now Pay Later (BNPL) is a credit option offered at the point of sale or online checkout, allowing consumers to buy a product straight away and pay for it later through instalments.

Many of the popular BNPL schemes do not require an upfront payment, but some charges a first instalment at the point of purchase. Using a BNPL option allows customers to buy your products straight and pay them off in, say, monthly instalments without interest added.

Most BNPL providers perform a soft credit check at the point of purchase, which should not impact people’s credit rating negatively, but they may be rejected if the credit score is bad.

This form of payment is used by customers as a means to avoid credit card interest or be more flexible with their budget. Many people also use BNPL when they cannot currently afford the purchase or have no other credit options available.

How does it work for the merchant?

The merchant receives the full payment (minus transaction fees) upfront from the BNPL provider who then takes care of charging the customer through the agreed repayment schedule.

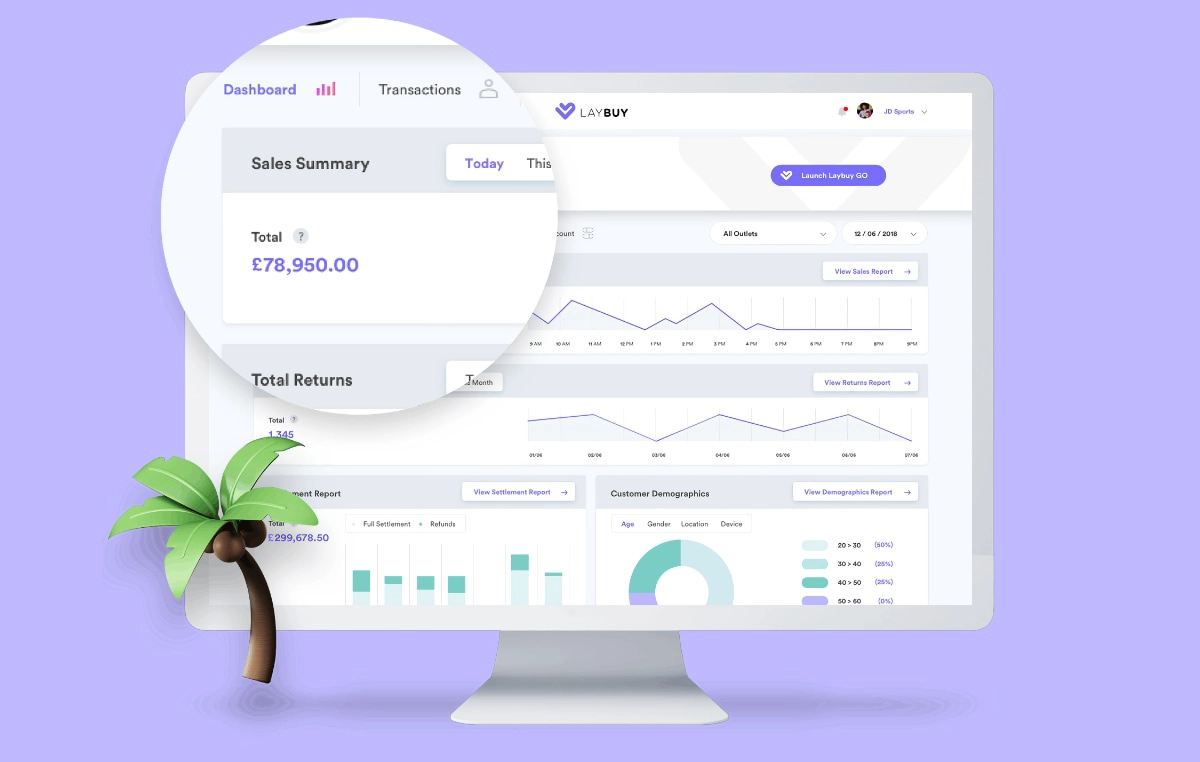

In other words, the business owner does not deal with the repayments. Instead, the customer enters into a direct agreement with the BNPL provider that continues until the repayments are complete. Instead, merchants get access to a web portal or app where they can check the status of BNPL sales any time.

Laybuy’s online merchant portal helps you keep track of sales, payouts and customer analytics.

If a late payment is made, the customer may be charged high interest or penalty fees and not be allowed to use the service again, if attempting a future purchase. This – or a bad credit rating – may result in some rejected sales in your store. Generally speaking, though, you should see an increase in sales as a direct result of offering a credit option.

Because BNPL is essentially a form of credit handled by a specialist lender, the merchant’s transaction fee is usually higher than when the customer pays the full amount upfront. That is why it’s worth comparing fees to ensure you do not pay too much compared to your gains.

Types of BNPL solutions

There are BNPL schemes for online stores and point of sale (POS) systems. Let’s have a look at the different setups.

Online: Buy Now Pay Later options can be added to the payment methods of your online store checkout. Online customers can then pick it as a payment method, choose a repayment plan and complete the transaction on their mobile device or computer.

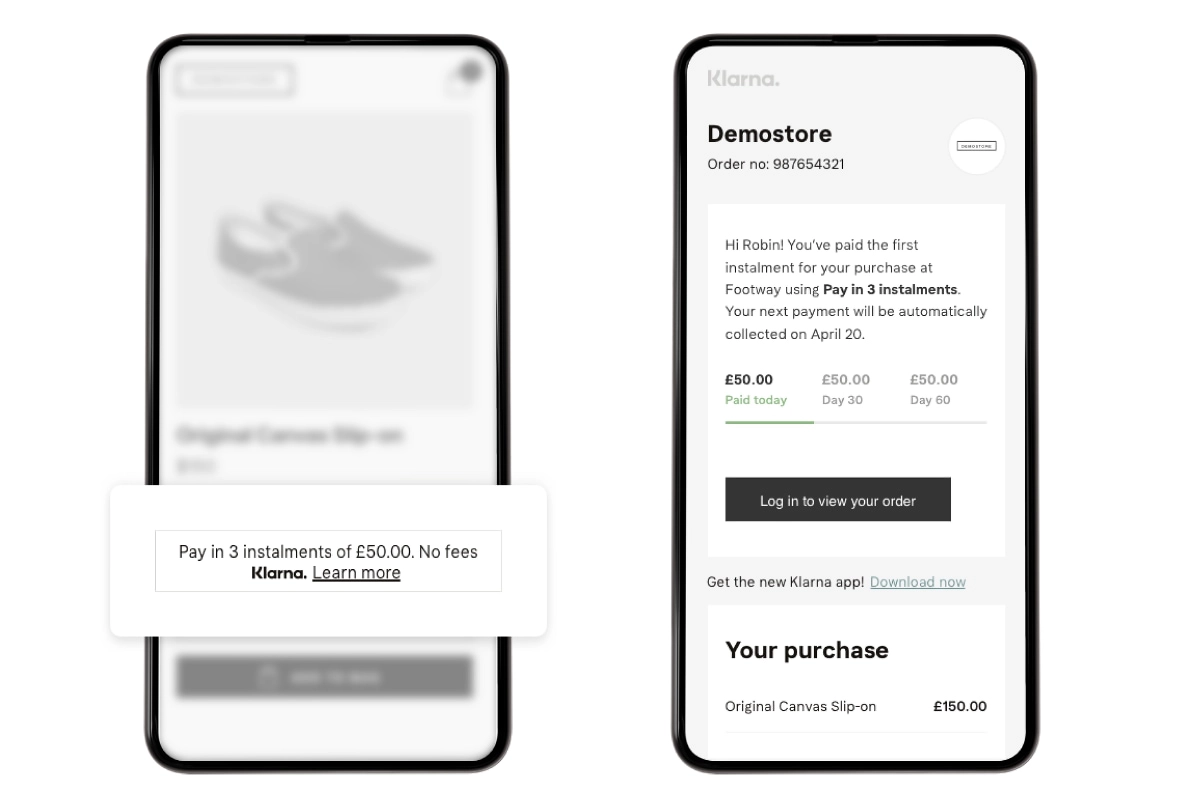

Image: Klarna

Example of Klarna’s payment process for paying in three instalments.

In store: Also called point of sale credit or point of sale financing, brick and mortar shops can use a POS system with a BNPL option added to payment methods. The merchant can then offer this at the in-store checkout, typically through a QR code or payment link.

In both cases, your customer will be encouraged to sign up for an account with the BNPL provider to track repayments and generally be encouraged to use the service again with other retailers. Most BNPL providers have a dedicated app for consumers, but not necessarily for merchants.

How to set up BNPL

Though financing reeks of complexity, it is usually straightforward for merchants to set up a BNPL option.

You will need an:

- Account with your chosen BNPL provider

- Ecommerce platform or POS system that works with it

How you set it up depends entirely on your chosen combination of the two.

In-store setups

If you’re offering it at the point of sale, you can simply choose a POS system that already integrates with a BNPL provider.

In the UK, Vend is currently the only POS system advertising a partnership with a BNPL option (Klarna). Through Vend, you can just register with Klarna and add it to your payment methods.

Verifone card machines are also compatible with Klarna, but may require more effort to set up as not all Verifone merchant services providers offer it openly.

Alternatively, you can send a payment link – or show a QR code for scanning – to your customer in store from a Klarna merchant app, but then it is not integrated with your main POS software.

Image: Vend

In-store customers may need to scan a QR code to complete a BNPL transaction on their phone.

Most higher-end POS systems may agree to integrate with a BNPL provider if you contact them. Likewise, your chosen BNPL provider can help you set up a connection, which may involve technical coding with APIs.

Online setups

It is much more common to find ecommerce platforms that openly integrate with BNPL schemes, for example:

| Ecommerce software | BNPL integrations |

|---|---|

| Shopify | Clearpay, Klarna, Laybuy, Splitit |

| PrestaShop | Clearpay, Klarna |

| Wix | Clearpay, Laybuy |

| BigCommerce | Klarna, Laybuy |

| Ecwid | Clearpay, Klarna |

| WooCommerce | Klarna |

| Ecommerce software |

BNPL integrations |

|---|---|

| Shopify | Clearpay, Klarna, Laybuy, Splitit |

| PrestaShop | Clearpay, Klarna |

| Wix | Clearpay, Laybuy |

| BigCommerce | Klarna, Laybuy |

| Ecwid | Clearpay, Klarna |

| WooCommerce | Klarna |

If you choose one of the above platforms, you will just need to create a merchant account with the chosen the BNPL provider and activate the integration in the website builder using your merchant ID or other details.

An alternative BNPL option is PayPal Credit. If you have PayPal Checkout installed in your online store, PayPal Credit automatically appears to eligible customers as an option when they pay. This can come in handy if you’re using a website builder that does not connect with a BNPL provider directly, but does connect with PayPal – such as Squarespace and Square Online.

What are the best BNPL for businesses?

The biggest BNPL companies in the UK are Klarna, Clearpay and Laybuy. Since many people – especially younger adults – have already used at least one of these options, they are more likely to opt for them in your store as well.

All of these providers perform a soft credit check at the point of purchase and charge no interest from the customer. The exception is Klarna’s Financing option where the customer pays at least six monthly instalments – this adds a consumer interest rate of up to 18.99% APR.

As well as knowing the type of payment plans offered, merchants should consider costs and practicalities. Unfortunately, none of the platforms are transparent about fees, contract terms or settlement until you sign up.

Compare Klarna, Laybuy and Clearpay:

Klarna Klarna |

Clearpay Clearpay |

Laybuy Laybuy |

|---|---|---|

| Payment plans: 3 mthly. instalments Pay within 30 days 6-36 mthly. instalments No transaction limit |

Payment plans: 4 instalments at 2-week intervals £800 transaction limit |

Payment plans: 6 weekly instalments £600 transaction limit |

| Merchant sign-up: Register online, then connect to online store/POS |

Merchant sign-up: Register online, then connect to online store/POS |

Merchant sign-up: Register online, then connect to online store/POS |

| 12-month contract | No contract info | No commitment |

| Merchant fees: 1.9%-5.4% + 20p per transaction Monthly fee may apply |

Merchant fees: Flexible transaction fees |

Merchant fees: Transaction fees apply No setup or monthly fees |

| Payouts: Within days (varies) |

Payouts: Within days (varies) |

Payouts: Next day (may vary) |

Klarna Klarna |

Clearpay Clearpay |

Laybuy Laybuy |

|---|---|---|

| Payment plans: 3 mthly. instalments Pay within 30 days 6-36 mthly. instalments No transaction limit |

Payment plans: 4 instalments at 2-week intervals £800 transaction limit |

Payment plans: 6 weekly instalments £600 transaction limit |

| Merchant sign-up: Register online, then connect to online store/POS |

Merchant sign-up: Register online, then connect to online store/POS |

Merchant sign-up: Register online, then connect to online store/POS |

| 12-month contract | No contract info | No commitment |

| Merchant fees: 1.9%-5.4% + 20p per transaction Monthly fee may apply |

Merchant fees: Flexible transaction fees |

Merchant fees: Transaction fees apply No setup or monthly fees |

| Payouts: Within days (varies) |

Payouts: Within days (varies) |

Payouts: Next day (may vary) |

There are also differences in which types of businesses they accept, and the terms you agree to at sign-up. As with all payment companies, merchant applications are subject to approval.

Some other options in the UK include Zip, Openpay, Affirm and Splitit. It might be worth contacting a few of the providers for terms and fees to get the best deal for your business.