In this day and age, it’s forgivable to mistake a payment link for an invoice – or vice versa – but they’re not the same thing.

The terms describe different concepts. An invoice is a legally enforceable bill of itemised services or products provided to a customer. It usually contains a payment due date – if it doesn’t, British law states that the customer still has to pay within 30 days of issue.

Payment links are non-binding requests for payment via a hyperlink or payment button that leads to an online checkout page where the recipient can pay. You can use payment links in various contexts, e.g. for remote payments or an open-ended option for when the customer decides to go ahead with an order.

Granted, you can have a payment link on an electronic invoice, but then it is considered a part of that invoice with its legal implications.

Let us look closer at the differences between invoices and payment links.

Differences

There are several noteworthy differences between payment links and invoices.

An invoice is a whole document containing information about goods or services provided, itemised costs, business and customer details, payment instructions and a payment due date. It also has an invoice reference number to use for accounting and tax purposes.

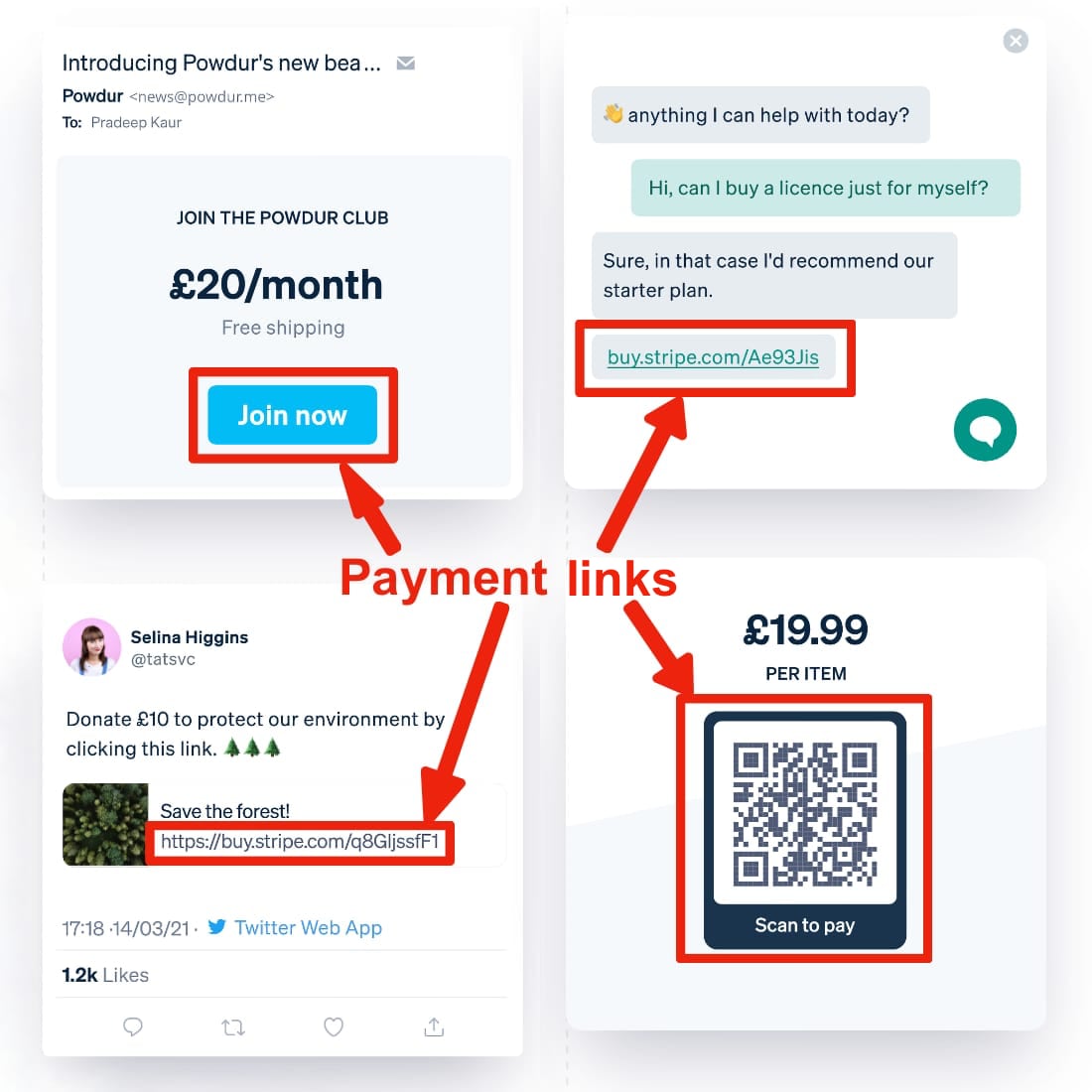

Also called pay by link, payment button or pay button, a payment link is literally just a link that goes to a payment page. It is used for accepting card payments online and can be sent via email, text or chat message, added on social media or embedded on a web page. It does not contain information about a specific customer like an invoice must.

Payment links are quite versatile because they can:

- Be a hyperlink (text) or button (graphic)

- Have an expiry date or not

- Have a unique URL per transaction or reusable URL

- Be used for one-off payments or reused by different people

- Be for fixed amounts or open-ended, amendable amounts

- Contain information about purchased items

- Be a QR code to scan with a smartphone

Examples of different kinds of payment links generated in Stripe.

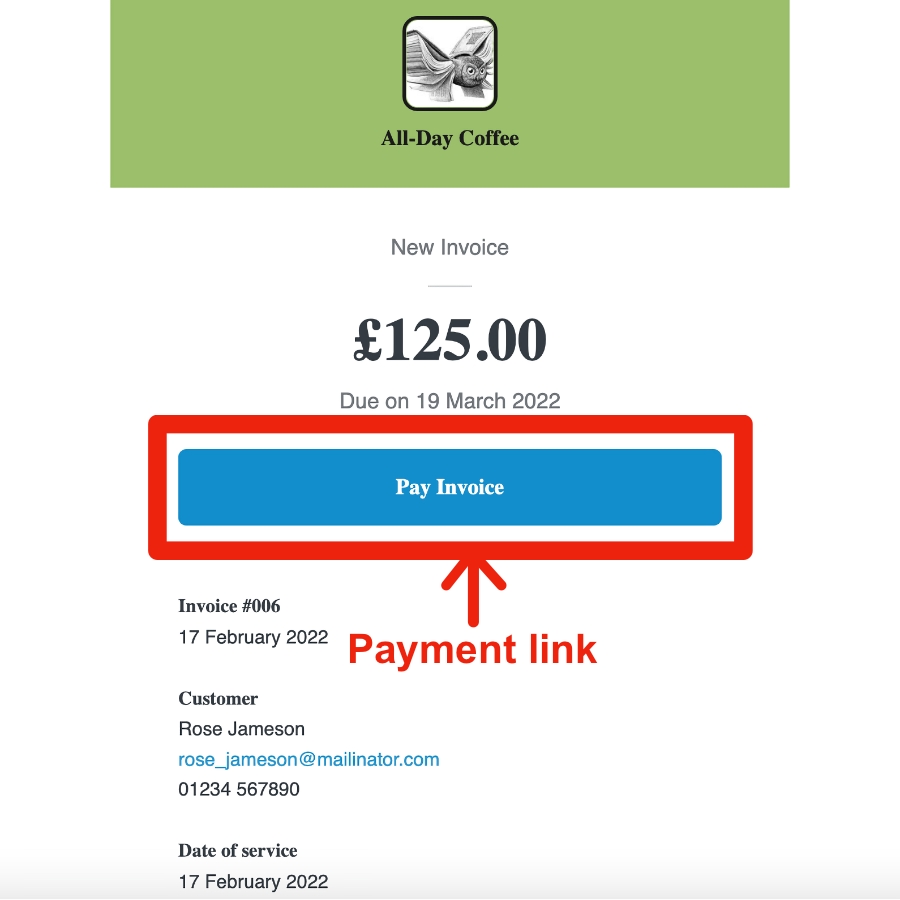

Email invoices typically contain a payment link in the body of the email, in which case you can click that link and pay online. In this scenario, the invoicing software would mark the invoice as ‘paid’ when the transaction is completed via the link. Many businesses use these so-called e-invoices (electronic invoices) to better track their payment statuses.

Payment link on a Square email invoice.

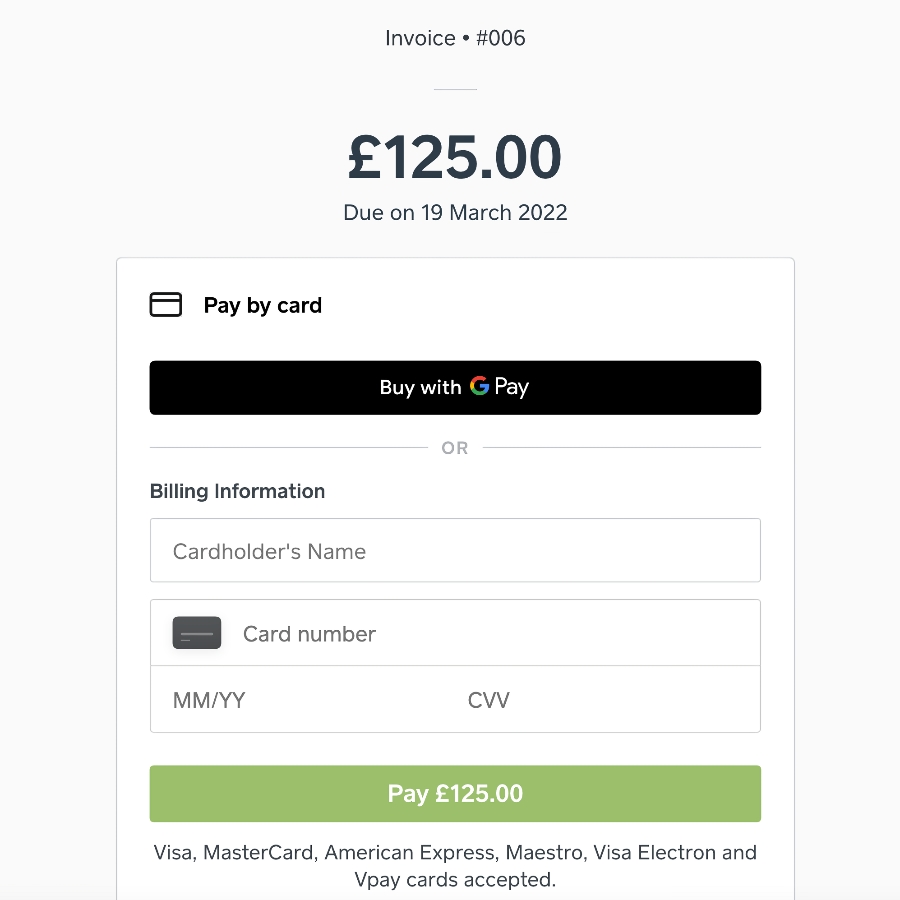

The link goes to a web checkout page.

In a similar way, payment links can be added in different contexts to track payments online, but they are not, on their own, a legal demand for payment like an invoice is.

When to use them

Invoices are typically used when a business or sole trader has provided a service or goods and needs to request payment for them. They are most common in B2B scenarios, for example when a web designer builds a website for a business and needs to bill that business.

Since an invoice legally binds the recipient to pay the total bill, it’s the official way for many professionals and companies to request payment for a service. Before a business issues an invoice, the customer must agree to the purchase since you cannot just cancel it. This can be done with a proforma invoice, which is amendable until the customer agrees to the purchase.

You can issue an invoice in person when you’re with the customer, send it via email or post, or include it in a parcel with your delivered products. If you’re providing a service, it’s a good idea to check with the client that they’re satisfied with the job before issuing one.

If a contractor is working on a long-term project, they may issue recurring monthly invoices or schedule them at specific milestones to ensure a consistent cashflow. This has to be agreed in advance with the client to avoid issues.

Payment links, on the other hand, do not come with terms and conditions, and the customer can decide not to use it without consequence. This has its advantages in contexts like:

These are by no means the only uses of payment links. Depending on the payment provider, there may be limitations on the settings and types of links you can use.