- Highs: Competitive transaction fees. Reward points for accepting cards. No monthly fee for virtual terminal. AFTA payments partner.

- Lows: Outdated software. 12-month contract. Fees for account closure and early termination. Limited user reviews.

- Choose if: You’re a travel agent or you need a basic in-person and online payment solution for at least a year.

How Mint Payments works

Mint Payments has competed in the Australian payment market since 2007 as a public company.

Note: Mint’s recent delisting from the Australian Securities Exchange (ASX) in September 2020 is indicative of changes within the company, but its payment services are still active among its merchants in Australia and New Zealand.

The payment solutions offered by Mint include a mobile EFTPOS machine, card reader connected to a phone app, virtual terminal for telephone sales and online payments. Prospective merchants can sign up for an offer through the website, after which you will be contacted by a sales rep.

Payment processing is managed purely by Fiserv (previous called First Data), so you actually sign a separate acquiring contract on top of a Mint Payments agreement.

Businesses get access to a web portal for managing their terminal fleet, users, transactions, online payments and more. You can integrate the terminals with compatible point of sale (POS) software and request tailored solutions for online payments.

Mint is the official payments partner of Australian Federation of Travel Agents (AFTA). Pre-COVID, this meant that Mint could easily facilitate the AFTA Chargeback Scheme (ACS), but coronavirus has put ACS on hold since May 2020.

Other than that, Mint is suitable for retailers, the food-and-drink sector and a variety of other businesses, small to big.

Pricing and contract

From the outside, it looks like Mint Payments have simple fees without strings, but reality is a little different when you check terms up close.

The three services prominently advertised are:

- Virtual Terminal & Online Payments

- EFTPOS – Move 5000 (card machine)

- Mobile EFTPOS – mPOS (app-based card reader)

The EFTPOS terminals come with monthly fees as standard. You can avoid these with Mint mPOS if transacting for over $2,000 a month – plus you get the mPOS reader supplied at no additional cost.

| Mint mPOS | Costs* |

|---|---|

| Card reader | Supplied free of charge |

| Monthly fee | $11/mo if turnover is less than $2k/mo No monthly fee if turnover is over $2k/mo |

| Monthly minimum charge | $22 when transacting less than $22 a month |

| Visa & Mastercard transactions | From 1.86% per transaction Custom fees with $20k+ monthly turnover |

| eftpos transactions | From $0.33 per transaction Custom fees with $20k+ monthly turnover |

| American Express transactions | Negotiated directly with Amex |

*Pricing includes GST.

| Mint mPOS | Costs* |

|---|---|

| Card reader | Supplied free of charge |

| Monthly fee | $11/mo if turnover is less than $2k/mo No monthly fee if turnover is over $2k/mo |

| Monthly minimum charge | $22 when transacting less than $22 a month |

| Visa & Mastercard transactions | From 1.86% per transaction Custom fees with $20k+ monthly turnover |

| eftpos transactions | From $0.33 per transaction Custom fees with $20k+ monthly turnover |

| American Express transactions | Negotiated directly with Amex |

*Pricing includes GST.

The Move 5000 EFTPOS machine costs a monthly rental fee of $39 incl. GST with any turnover of less than $20,000 per month.

On the EFTPOS/Move 5000 and mPOS plans, you can get lower fees if transacting for over $20,000 per month. In fact, you can get interchange++ pricing above this threshold, which is often the cheapest option for high-volume merchants, but other custom pricing is also available.

On top of the EFTPOS or mPOS monthly fee, there is also a $22 monthly minimum charge if you transact for less than $22 during a month.

| EFTPOS machine (Move 5000) | Costs* |

|---|---|

| Monthly rental fee | $39/mo |

| Monthly minimum charge | $22 when transacting less than $22 a month |

| Visa & Mastercard transactions | From 1.25% per transaction Custom fees with $20k+ monthly turnover |

| eftpos transactions | From $0.25 per transaction Custom fees with $20k+ monthly turnover |

| American Express transactions | Negotiated directly with Amex |

*Pricing includes GST.

| EFTPOS machine (Move 5000) |

Costs* |

|---|---|

| Monthly rental fee | $39/mo |

| Monthly minimum charge | $22 when transacting less than $22 a month |

| Visa & Mastercard transactions | From 1.25% per transaction Custom fees with $20k+ monthly turnover |

| eftpos transactions | From $0.25 per transaction Custom fees with $20k+ monthly turnover |

| American Express transactions | Negotiated directly with Amex |

*Pricing includes GST.

The virtual terminal does not have monthly fees or a lock-in contract. Merchants with virtual terminal and online sales volumes higher than $90,000 a month can negotiate lower fees. Using a virtual terminal also requires PCI compliance, which may incur extra fees.

Regardless of sales channel, you need to set up an additional card acceptance contract directly with American Express to accept this card, which has higher transaction fees and other charges. The Amex account can then be connected with Mint Payments to accept American Express.

| Mint Payments services | Costs* |

|---|---|

| Virtual terminal & online payments | No monthly fee 1.5%+ per Visa & Mastercard transaction Custom fees with $90k+ monthly turnover |

| American Express acceptance | Contract & fees are negotiated directly with Amex |

| Merchant account contract (Fiserv) | 12 months’ commitment minimum $110 account closure fee Other fees may apply |

| Early termination fee | 80% of average monthly fees so far have to be paid for the remaining months of contract term |

*Pricing includes GST.

| Mint Payments services |

Costs* |

|---|---|

| Virtual terminal & online payments | No monthly fee 1.5%+ per Visa & Mastercard transaction Custom fees with $90k+ monthly turnover |

| American Express acceptance | Contract & fees are negotiated directly with Amex |

| Merchant account contract (Fiserv) | 12 months’ commitment minimum $110 account closure fee Other fees may apply |

| Early termination fee | 80% of average monthly fees so far have to be paid for the remaining months of contract term |

*Pricing includes GST.

All of Mint’s payment solutions require a minimum of 12 months’ card processing contract from Fiserv. To avoid auto-renewing the contract, you need to give 60 days’ written notice of cancellation. If you want to terminate the contract before the end of the 12 months, you will have to pay the equivalent of 80% of your total monthly costs for every month remaining in the current contract term. No matter when you cancel the contract, a $110 account closure fee applies.

Additional fees may apply, such as the $25 chargeback fee. Refunding transactions costs the transaction fee originally charged for the payment. You also rent the Move 5000 terminal, meaning it has to be returned upon termination of the contract. Other hardware costs may apply, particularly if there’s a technical issue requiring urgent servicing or hardware replacement.

The system does not use least-cost routing, which automatically chooses the cheapest card network for transactions. Neither does Mint Payments accept other currencies than Australian Dollars – though you can accept foreign cards.

Payouts are automatically processed to your bank account within 1-2 business days.

Mint users can also sign up for Mint Rewards to earn points for spending at participating shops online or in person. Alternatively, the rewards can be converted into cash, Velocity Points for flights or reductions in your Mint Payments costs.

Card reader with app

Mint mPOS is a handheld, mobile card reader that only works in connection with a mobile app to accept card payments. The Mint mPOS app is compatible with most new iPhones, iPads and Android smartphones.

The card reader is the Miura M010 model – the same as PayPal Here’s card reader – which is older than Square Reader, but better than other Australian EFTPOS readers that tend to be pretty outdated.

The card reader only accepts payments while connected to the Mint mPOS app.

The card reader connects to your phone via Bluetooth, using the SIM card of your mobile device to connect with the internet in order to process the credit or debit card in the EFTPOS reader. The terminal accepts chip, contactless and swipe cards.

The mPOS app allows you to enter transaction totals, accept payments, send email or SMS receipts, view transaction history and refund payments – pretty essential stuff.

Unfortunately, the app hasn’t been updated in two years – a telltale sign that Mint does not fix bugs or develop features in line with changing business demands. Any apps, even if running smoothly to begin with, typically require ongoing maintenance updates to combat bugs that inevitably arise from phone updates.

Portable EFTPOS terminal

Mint also offers a traditional, portable EFTPOS machine for a monthly cost. The terminal model is Ingenico Move 5000, a popular mobile card machine in several countries around the world. It has a colour display, accepts tap and go, chip and swipe cards, and works on its own or with a POS system.

The terminal can be integrated with a limited choice of POS systems including Hike, Kounta, Abacus, OrderMate, posBoss and Impos.

Photo: First Data

Ingenico Move/5000 terminal.

Mint recommends this EFTPOS machine for hospitality, retail and events. It is ideal for table-side transactions in restaurants or queue-busting away from a stationary point of sale, since it is handheld and works independently without wires.

You can accept tips and surcharges on this machine. If WiFi connectivity drops, you can still accept cards offline as a fallback method or through the 3G network.

The card machine is supplied by Fiserv, not Mint. This means that technical support will likely have to go through Fiserv rather than Mint Payments.

Virtual terminal and online payments

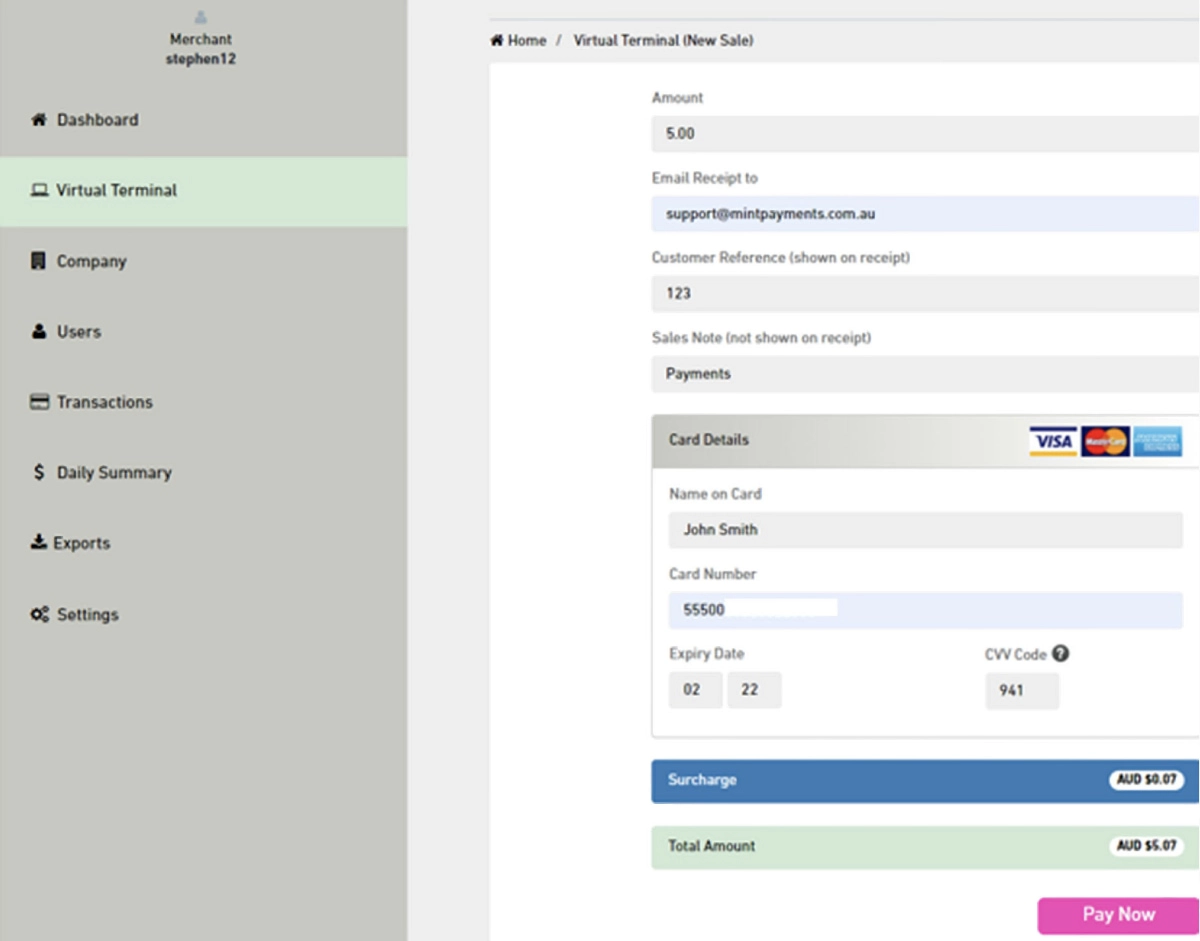

Mint takes pride in allowing both in-person and remote payments. For a start, there’s a virtual terminal in the Mint Merchant Portal that allows you to manually enter card transactions through a web browser. This is ideal for taking orders over the phone or mail ordering.

Mint Virtual Terminal is quite basic, though. Apart from adding card details, basic customer information, a customer reference (shown on receipt), sales note (shown on receipt) and surcharge, there aren’t other fields to complete for e.g. an itemised receipt or shipping address. This means you need to keep separate records of orders if handling large sales volumes remotely.

Image: Mint

Mint Virtual Terminal works fine, but it is a bit basic.

Alternatively, you can copy and paste a payment URL to include in emails. This allows the customer to click the payment link and pay on a web page themselves, rather than your staff members entering sensitive card information on behalf of the customer. You can use payment links for email invoices, embedded on your website or sending via messages.

Apart from that, you can integrate (‘Mintegrate’, as Mint likes to call it) the payment system with other software platforms such as TabSquare for online food ordering. Mint has “easy-to-integrate APIs” to connect payments with other business software, but the question is whether your business might still need technical know-how to deal with that kind of coding.

Reporting

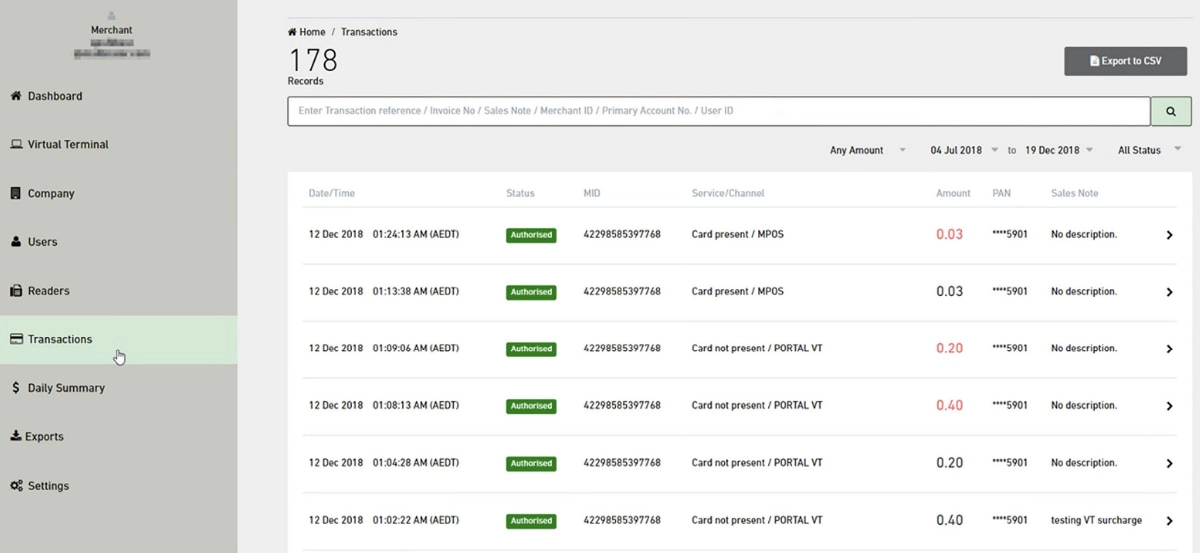

Regardless of how you accept card payments, merchants can access sales data and transactions in the Mint Merchant Portal through a web browser.

There, you can view individual card transactions, change company settings and export/print sales reports. You can also add multiple user accounts to track individual sales performance.

Image: Mint

Transactions overview in Mint Merchant Portal.

Refunds can be completed in the Merchant Portal if the transaction was done via the virtual terminal. You need to process refunds through the EFTPOS terminal for in-person payments.

The Merchant Portal does not have that many other features. The design is very basic, but some merchants might prefer this due to its lack of complexity.

Customer service and reviews

Mint customer support is only available on weekdays between 9am-5pm (AEDT). You may be able to get help from Fiserv if the issue is related to card payments, since they have their own support staff.

Strangely, there are hardly any customer reviews online about the quality of Mint Payments’ service, despite having been around for over ten years. Most customer reviews are several years old. Reviews about Mint Payments in general are also rare, and news about the company imply that Mint are more interested in large partnership opportunities than small businesses trying to get an affordable EFTPOS solution.

Furthermore, Mint hasn’t updated the mPOS app for two years, which is a bad sign in fintech products. To compare with a bigger company, Square updates their card reader app multiple times a month so you can trust that bugs get fixed and new features are added over time.

Verdict: who is Mint Payments for?

On the surface, Mint Payments looks attractive for small businesses: the pricing seems simple, maybe even cheap, and remote payment methods is a draw on top of the EFTPOS offering. Those selling more than $20k monthly via EFTPOS or $90k monthly online can apply for better pricing, and larger firms can discuss tailored products with Mint Payments. This makes Mint a scalable solution for high-growth businesses. However, the lack of recent, genuine-looking customer reviews online is a cause for concern.

For Mint mPOS to be worthwhile, you should make at least $2k monthly to avoid a monthly fee – otherwise, there are better EFTPOS readers in Australia without a contract and monthly fees. The Move 5000 EFTPOS machine could work well for a variety of businesses in food and drink, retail and events spaces, but you do always sign up for a contract of at least a year with the prospect of paying $110 for closing the account. As for remote payments, the virtual terminal and online payments are no better than the competition.

As a company with strong ties to the travel industry, though, travel agents might easily prefer Mint Payments. The Mint loyalty points are ideal for frequent flyer redemption, and being the official choice of AFTA is bound to be a pull. Perhaps Mint didn’t pick the best industry to rely on at this time, but at least the Mint Rewards can be redeemed by any Mint merchant regardless of industry. Whether that’s a serious draw for most businesses is another question.

Bottom line: Mint Payments does have lower fees for some small businesses, but the core offering is limited.