Square was long the superior EFTPOS provider for small businesses, but newer company Zeller threatens to knock it off its peg.

In the past couple of years, the companies have added more products and features to their repertoire.

In fact, they’re now both leading EFTPOS companies in Australia because:

- it’s easy to be their customers

- fees are competitive

- they have tons of useful services and payment tools

- it’s quick to sign up with them

Still, each company has its strengths and weaknesses.

Companies with links to each other

American Square was launched over a decade ago by Twitter-founder Jack Dorsey, while Zeller is an Australian company by Ben Pfisterer who used to lead Square in Australia. You can tell, as Zeller shares Square’s values of accessible, easy features and affordability.

Although similar small businesses would go for either, some benefit more from Square’s wider solutions and instant payouts, while others prefer Zeller’s lower fixed rate and online account.

Key differences and similarities

Let’s discuss the main differences between Square and Zeller.

|

|

|

|---|---|---|

| Terminal price | $99 – $199 incl. GST | $65 – $259 incl. GST |

| Website | ||

| Transaction fee | 1.4% | 1.6% |

| Monthly cost | None | None |

| Commitment | None | None |

| Payouts |

|

|

| Surcharging | Yes, including on Tap to Pay | Yes, with optional weekend-only setting |

| Accepted payments | Buy now, pay later: Afterpay, Zip |

Buy now, pay later: Afterpay |

Their core difference lies in focus. Square is a global platform with strong POS, ecommerce, marketing and employee tools – ideal for multichannel sellers. Zeller aims to replace traditional banking by offering a free business account and Mastercard, helping merchants manage funds without a separate bank.

“We recommend Zeller and Square equally to businesses, as they have different strengths. And I can vouch for the quality of their EFTPOS machines – good all-round payment processing speeds.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Both provide modern touchscreen EFTPOS terminals, but Square offers more hardware options including POS registers. Zeller’s single-terminal approach is ideal for mobile or service-based businesses wanting simplicity, but recently-added POS features make it increasingly versatile.

The companies charge no monthly fee for the EFTPOS machines, just an upfront price. Zeller’s fixed rate for transactions is lower than Square’s, but that’s because Square’s rate covers a wider range of business tools. For an extra fee, Square offers instant payouts too, which is unique in Australia.

Zeller’s “zero-cost” EFTPOS feature allows merchants to pass on transaction fees, even on Tap to Pay transactions (where a phone accepts contactless). Square also has a surcharge function and optional setting to automatically turn on surcharging on weekends only.

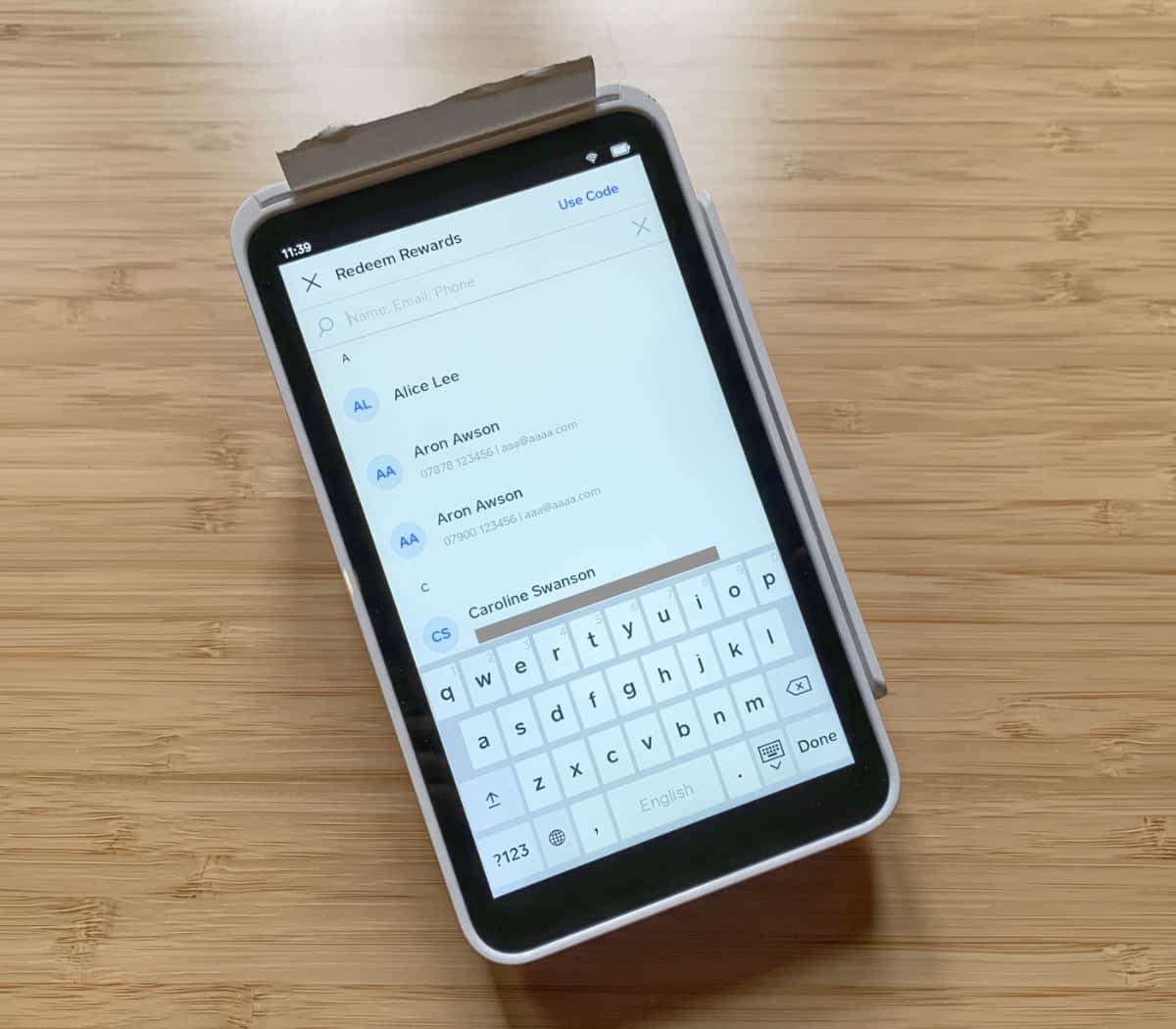

Photo: Mobile Transaction

Square has long included POS features, like this customer loyalty list on our Square Terminal.

EFTPOS terminals: Zeller’s are ace, Square has more choice

In all honesty, Square and Zeller each have worthwhile advantages when it comes to their EFTPOS products – let’s see how.

First off, Zeller only offers two card machines:

- Zeller Terminal 1: Standalone with receipt printer and simple payment software

- Zeller Terminal 2: Freestanding with POS and payment software

In contrast, Square has more EFTPOS machines, if checkout registers are included:

- Square Reader: Tiny card reader that works with a phone or tablet app

- Square Terminal: Freestanding WiFi terminal with on-screen POS software

- Square Stand: iPad holder with card readers built in

- Square Register: All-in-one tablet register with detachable card terminal

- Square Kiosk: Self-ordering checkout tablet with card readers built in

Inevitably, you can rely on Square to offer complete checkout solutions directly, if not integrating with external POS systems (a possibility). With Zeller, you only have the card machines, but can still integrate with external POS systems to build any type of checkout.

Zeller’s complete EFTPOS packages are a simpler solution overall

We like Zeller’s standalone touchscreen terminals the most as a simple, out-of-the-box payment solution. They come in a box with a business debit Mastercard linked to an online account.

Zeller Terminal 2 has an impressive design with a pleasing, user-friendly POS app installed.

The terminals are unique, portable touchscreen devices with a day-long battery life. They accept contactless and chip card payments through WiFi, but if you purchase a SIM card (not included), they work anywhere via 4G.

The machines differ most around software and receipt printing.

Zeller Terminal 1 has a built-in receipt printer and basic card payment software, plus a few more functions to enhance it. This includes tipping, split payments, surcharging and your very own screensaver to impress at the checkout.

Although Zeller Terminal 2 has no receipt printer, its ‘POS Lite’ software has more features like a product library, discounts, modifiers and sales analytics.

Photo: Zeller

The original Zeller Terminal is a popular EFTPOS machine that works independently.

Square’s card machines are smaller, more adaptable

Although Square doesn’t come with a business account and card (yet), their terminals are smaller and connected with a broad payment platform with many features to run a business.

“Our Square Reader has a much longer battery life than Square Terminal, and given the size, it’s perfect for the road. For a countertop, though, we prefer Square Terminal which can be screwed to a desk and has rubber dots underneath so it stands firmly.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Pocketable Square Reader only works when connected with an app on your smartphone or tablet. The apps lets you create itemised transactions with products or amounts and connects with the card reader over Bluetooth to process chip and contactless cards.

Square Terminal, in contrast, is a mix between Zeller Terminal 1 and 2. It has a large touchscreen with a receipt printer (like Zeller Terminal 1) and POS features (like Zeller Terminal 2), but arguably comes with more point of sales features than Zeller, because it adapts to Square’s specialised POS systems.

Photo: Mobile Transaction

Square Reader fits in your palm.

Photo: Mobile Transaction

Square Terminal has a big touchscreen.

However, Square Terminal only works with WiFi, not mobile networks – so Zeller has that edge over it.

There’s also a complete checkout bundle called Square Register with a tablet card reader attached and large touchscreen display that only works with Square POS systems. This is a classy piece of equipment that we loved using in our tests, and it only needs a receipt printer and cash drawer – if cash acceptance and paper receipts are required.

Square Stand is an alternative register setup, where you place an iPad inside for the POS software. It has built-in card reading capabilities so you don’t need a separate EFTPOS reader. The latest Square Kiosk is also one of the most affordable self-ordering checkouts merchants can get.

Zeller Terminal 2 vs Square Terminal

Zeller Terminal 2 comes with simple, general POS software, a business account, built-in receipt printer, WiFi and mobile SIM connectivity.

Square Terminal has a receipt printer, but only works with WiFi/LAN (no SIM). It can use Square’s general, restaurant, retail or appointment POS.

What about contactless payments on a smartphone?

Over the last year, we’ve seen the payment companies launch a new alternative to card readers: Tap to Pay on iPhone or Android devices. This is the option for cardholders to tap their card or mobile wallet on the back of the merchant’s phone to pay without a dedicated card machine.

Zeller can enable Tap to Pay on iPhone or Android for 1.4% per transaction. Unlike other tap-to-phone payments we’ve seen in Australia, Zeller allows merchants to surcharge these transactions (normally, this is reserved for EFTPOS machines).

Square also accepts contactless payments on both Android and iPhone, but for the higher rate of 1.6%. This option is available in the Point of Sale app that’s more elaborate in features than Zeller’s app.

Pricing: both pay-as-you-go, but Zeller cheaper

Zeller and Square have an equal approach to pricing: neither requires a lock-in contract or monthly fees for the use of an EFTPOS terminal. Instead, you purchase a card machine upfront to own outright. Then there’s only a pay-as-you-go fee per transaction. If you don’t process cards, there’s no cost.

The transaction fee is 1.4% through Zeller, the lowest fixed rate for any EFTPOS provider in Australia without a monthly fee. Square charges a bit more: 1.6% for any card.

Square and Zeller pricing compared:

|

|

|

|---|---|---|

| Terminal price* | Zeller Terminal 1: $99 incl. GST Zeller Terminal 2: $199 incl. GST + SIM card and data for 4G (optional) |

Square Reader: $65 incl. GST Square Terminal: $259 incl. GST Square Register: $799 incl. GST |

| Latest deals | ||

| Delivery | Free | Free |

| Contract | No lock-in, no minimum sales requirement | No lock-in, no minimum sales requirement |

| EFTPOS transactions | 1.4% (any card) | 1.6% (any card) |

| Online/keyed transactions | Keyed on Zeller Terminal: 1.7% Virtual Terminal/Pay by Link: 1.75% + $0.25 Invoice: 1.7% + $0.25 (AU cards) 2.9% + $0.25 (non-AU cards) |

2.2% (all keyed & online) |

| Monthly fee | None | None |

| Payouts | Free | Next day: Free Instant: 1.5% |

| Refunds | Free | Transaction fee is retained |

| Chargebacks | Free | Free |

Even Zeller’s terminals are cheaper ($99 for Terminal 1, $199 for Terminal 2 incl. GST) than Square Terminal ($259 incl. GST).

Yet Square Reader is still one of the cheapest card readers in Australia for $65 incl. GST – a price point Zeller does not match.

Zeller Terminal is also reliant on a SIM card you pay extra for, unless you’re just using its WiFi connection. Zeller sells its own for $15 monthly, but any SIM card will do.

There’s no minimum monthly sales volume required on either platform, so you’re free to use it as much or little as you like without additional fees. Payouts and chargebacks are also free at both companies, but refunds cost the original transaction fee in Square’s case.

Subscriptions and free tools included

What about additional services apart from an EFTPOS reader? Zeller doesn’t yet have paid subscriptions of any sort, whereas Square has a plethora of extras:

- Square for Restaurants POS software: $0-$129 per month

- Square for Retail POS software: $0-$109 per month

- Square Appointments POS software: $0-$79 per month

- Square Online ecommerce software: $0-$85 per month

- Square Loyalty: $49-$149 per month

- Square Team Management: $0-$35 per month

Many Square features are totally free, though, including a virtual terminal for keyed transactions, payment links, QR code ordering, a basic online store, the entry-level POS software, email invoices and gift cards.

Zeller also has a free virtual terminal, email invoicing and savings account, but charges $9 monthly per active corporate expense card.

Square transfers fastest, but Zeller has an online account

A big advantage for the unbanked: Zeller comes with an online transaction account with a physical Mastercard. It receives payouts the morning after you accept a payment through the EFTPOS machine, bypassing the need for a conventional bank account.

Square does not yet have an online account with a card, but settles transactions the following day (weekends too) in your bank account. For an extra 1.5% fee, Square payouts can reach the bank account immediately.

For an extra 1.5% fee, Square payouts can reach the bank account immediately. This a popular feature that Zeller can’t yet match.

![]() Emily Sorensen, Senior Editor at Mobile Transaction

Emily Sorensen, Senior Editor at Mobile Transaction

The Zeller account can transfer money to Australian bank accounts (to pay staff wages etc.), and the card can be used online and in-store where Mastercard is accepted. Still, you cannot withdraw cash at an ATM, nor receive bank transfers from other people.

Alternatively, Zeller can settle EFTPOS transactions directly in your Australian bank account the next business day.

Reporting: more analytics vs spending controls

Both Square and Zeller allow you to monitor transactions remotely from an online dashboard.

In Zeller’s case, this is also where you manage the transactions account and spending controls if you opt for corporate expense cards for employees.

Square has many more options to filter and customise reporting to analyse sales, products sold, staff performance and more. And it connects with major accounting platforms like Xero, QuickBooks and MYOB and many apps for e.g. marketing, booking systems and delivery services.

Zeller only integrates with Xero accounting software, but at least it means analytics are not limited to Zeller’s own basic reports.

Square has more POS solutions, Zeller more integrations

When it comes to point of sale (POS) systems, Square is the winner.

Zeller integrates with over 600 POS providers like Impos and Erply, so the EFTPOS machine can form part of a wider checkout with a cash drawer and other equipment. If you just want a simple POS solution, Zeller Terminal 2 has software to meet that need.

Square’s card machines work with a similarly general POS app (Square Point of Sale) and the specialised POS systems for restaurants, retail and appointment-scheduling.

Photo: Mobile Transaction

Square Register looks minimal on a coffee shop countertop, as seen here where we visited.

The general, free POS app is similar to the software on Zeller Terminal 2, but I’d say Square has slightly more features in the app. Additionally, all of Square’s EFTPOS machines and POS registers work with Square’s specialised POS systems too, so they can fit into most types of businesses.

Square directly integrates with cash drawers, receipt printers, kitchen printers and barcode scanners, allowing you a full POS setup in whichever type of business you run. Zeller can do this via the point of sale system you choose to integrate it with.

Zeller Terminal 2 is designed to work as an independent POS system on the go.

Remote payments: many options with Square

A glaring difference between Square and Zeller is the range of online payment options.

Zeller has basic but efficient email invoicing, but also a virtual terminal for Mail Order and Telephone Order (MOTO) transactions in a web browser or on the EFTPOS machines via keyed entry. The virtual terminal includes the option to send payment links too.

Still, Square includes more complimentary options for all merchants:

Online and remote payment options

- Invoicing via email

- Virtual terminal for telephone payments

- Payment links sent via email, SMS, etc.

- Invoicing via email

- Virtual terminal for telephone transactions

- Payment links to send via email, SMS, etc.

- Payment buttons to embed on websites

- QR code payments

- Online store with checkout, delivery and pickup options

- Electronic gift cards

All of these options are available without monthly fees from both companies.

Square is still the only one to integrate with ecommerce platforms like Wix, OpenCart, Magento and many more.

Business loans, savings and expense management

Zeller has an edge over Square with its business Mastercard debit card, optional business savings account and corporate cards to make it easier to allocate expenses among staff.

If you’re a newly started business, Zeller could therefore save you time with the business account and expense management sorted at the same time of sign-up.

Square has a different financial edge: business loans. Square Loans are actually cash advances, which are not like conventional bank loans. The maximum loan amount is based on your Square card sales (no outside sales history is considered), transactions frequency and type of business.

A fixed pay-back percentage is then calculated, which included a fixed loan fee, and this will then be deducted from your sales through Square until it is fully repaid. This way, the speed of your repayment is determined by your sale volume. No interest or other charges are added to the cost of the loan.

Alternatives? Compare other EFTPOS solutions for small businesses

Service and reviews: more support with Zeller

What about customer service? Zeller offers a helpline and email support every day of the week between 9 AM – 1 AM Australian Eastern Time (AET). Square only has customer support via email and phone on business days between 9 AM – 5 PM (AET).

Both companies offer a help section online where you can find answers to many questions, though Square’s help guides are more comprehensive.

“Since day one of dealing with Zeller, we have had a positive experience of their service. They’re responsive and seem to have a genuine eagerness to help small businesses. Square is not as responsive, but is really on the ball with software updates.”

– Emily Sorensen, Senior Editor, Mobile Transaction

Zeller takes small businesses seriously and have therefore received lots of positive reviews online. A few negative user reviews relate to issues during onboarding, where the application needed more documents or wasn’t accepted.

Similarly, Square has received lots of positive reviews from small businesses about the ease of use, simplicity and convenience of the products. A few negative reviews highlight that not all mobile devices work with Square Reader, so you should check in advance that it works with your setup.

Verdict: geared towards different needs

If you’re just looking for a standalone, affordable EFTPOS machine with a low card rate and convenient payouts, Zeller is probably your best choice. The online account and Mastercard are especially handy to avoid the hassle and cost of setting up a business bank account.

Square, on the other hand, offers a greater amount of POS systems, terminals and features for payments, billing, ecommerce and business management. It gives you more flexibility to stay within Square, rather than rely on integrations with external software which Zeller often does.

Both have pretty good surcharging choices now. Neither requires a monthly fee for the card machines, but can activate surcharging to recoup the otherwise only ongoing cost: the fixed transaction rate. Square takes a step further with its auto-weekend surcharge option.

If fast transfers are important, Square again takes first place with its next-day (incl. weekends) or instant transfers (for a fee) to your chosen bank account. Zeller, in contrast, settles transactions the next business day in the online Zeller account linked to a debit card.

Overall, we think Zeller works well for mobile businesses or as a high-quality, freestanding payment terminal for simple transactions anywhere. The latest EFTPOS terminal with a simple POS system adds value to retailers who need a bit more than that.

Square’s card machines can easily be upgraded to complete POS checkouts that work easily out-of-the-box. I’d be less concerned about choice with Square, though Zeller has shown promising proactiveness in adding new products like invoicing, POS software and more integrations.

At the end of the day: Square has been around for longer so has more to offer, but Zeller’s focused solution is perfect for many merchants who need banking too.