There’s no such thing as the “best invoicing app in Australia” for everyone, because it depends on your industry, goals and – frankly – preferences.

Still, not many brands of invoicing software suit a small business on a limited budget.

Costs matter when you sign up for a monthly fee and online card processing rates that vary from 1.7% to over 3% plus a fixed fee.

And many other things matter in invoicing apps:

- Does it send payment reminders, overdue alerts, receipts and recurring invoices?

- Can you customise the layout with colours, logo and taxes?

- Can you send unlimited invoices or just a few per month?

- Does it send quotes, estimates and terms and conditions?

Except for two standalone invoicing platforms (Invoice2go and Billdu), the below invoice apps are from accounting or payment companies. Most of them also integrate with other business software that could be relevant in your sector.

Compare the best invoice software in Australia for a small business:

| Invoice app | Costs | Best for | To site |

|---|---|---|---|

|

$0 or $30/mo 2.2% /transaction |

Free all-in-one invoicing app | |

|

Free feature 1.7%-2.9% + $0.25 /transaction |

Attractive rate for domestic cards | |

|

$35-$115/mo 1.7%-3.5% + $0.30 /transaction |

Those relying on Xero for accounting | |

|

$6.67-$49.99*/mo 1.9%-2.4% + $0.30 /transaction |

Dedicated, modern invoicing app | |

|

$11-$177*/mo 1.8% + $0.25 /transaction |

MYOB devotees or solopreneurs | |

|

US$4.99-US$27.99*/mo 1.75%-2.25% + $0.30 /transaction |

Uncomplicated invoicing from app | |

|

Free feature From 2.6% + $0.30 /transaction |

Sole traders looking for convenience |

*Excluding GST.

| Invoice app | Costs | Best for | To site |

|---|---|---|---|

|

$0 or $30/mo 2.2% /transaction |

Free all-in-one invoicing app | |

|

Free feature 1.7%-2.9% + $0.25 /transaction |

Attractive rate for domestic cards | |

|

$35-$115/mo 1.7%-3.5% + $0.30 /transaction |

Those relying on Xero for accounting | |

|

$6.67-$49.99*/mo 1.9%-2.4% + $0.30 /transaction |

Dedicated, modern invoicing app | |

|

$11-$177*/mo 1.8% + $0.25 /transaction |

MYOB devotees or solopreneurs | |

|

US$4.99-US$27.99*/mo 1.75%-2.25% + $0.30 /transaction |

Uncomplicated invoicing from app | |

|

Free feature From 2.6% + $0.30 /transaction |

Sole traders looking for convenience |

*Excluding GST.

How we reviewed the invoice apps

MobileTransaction tests and researches the products we’re writing about, with certain criteria for invoicing software.

We rate these areas: product features, costs, sign-up and sales transparency, value-added services, support and reviews, and contractual commitment.

Higher rankings go to apps that make it easy for a small business to create, send and manage invoices. We also like when there are:

- Payment reminders – important for getting clients to pay

- Integrated payments options – makes it more likely clients pay right away

- GST information for tax invoices – to comply with Australian tax laws

- Invoice customisations – for a professional look

- Customer and product library – for itemised invoices and repeat clients

- Wide breadth of features – tradies have different needs

If an invoice app is overpriced for its service and features, we rank it lower.

Best invoicing software according to our research

To summarise, these are the leading invoice apps by category.

Best free invoice app: Square has the best app with many decent features you won’t find elsewhere for free. Over years of testing it, the user-friendly interface, frequently-updated software and varied features have won our hearts.

Best for tradies: Square, Billdu and MYOB Solo are cheap and perfectly geared towards sole traders. They don’t overwhelm with too many features, yet allow you to customise templates and send unlimited invoices.

Cheapest: Zeller has the lowest transaction fees for domestic cards and no cost for the invoice software.

Best for accounting integration: MYOB and Xero are both excellent for accounting and invoicing in the same system.

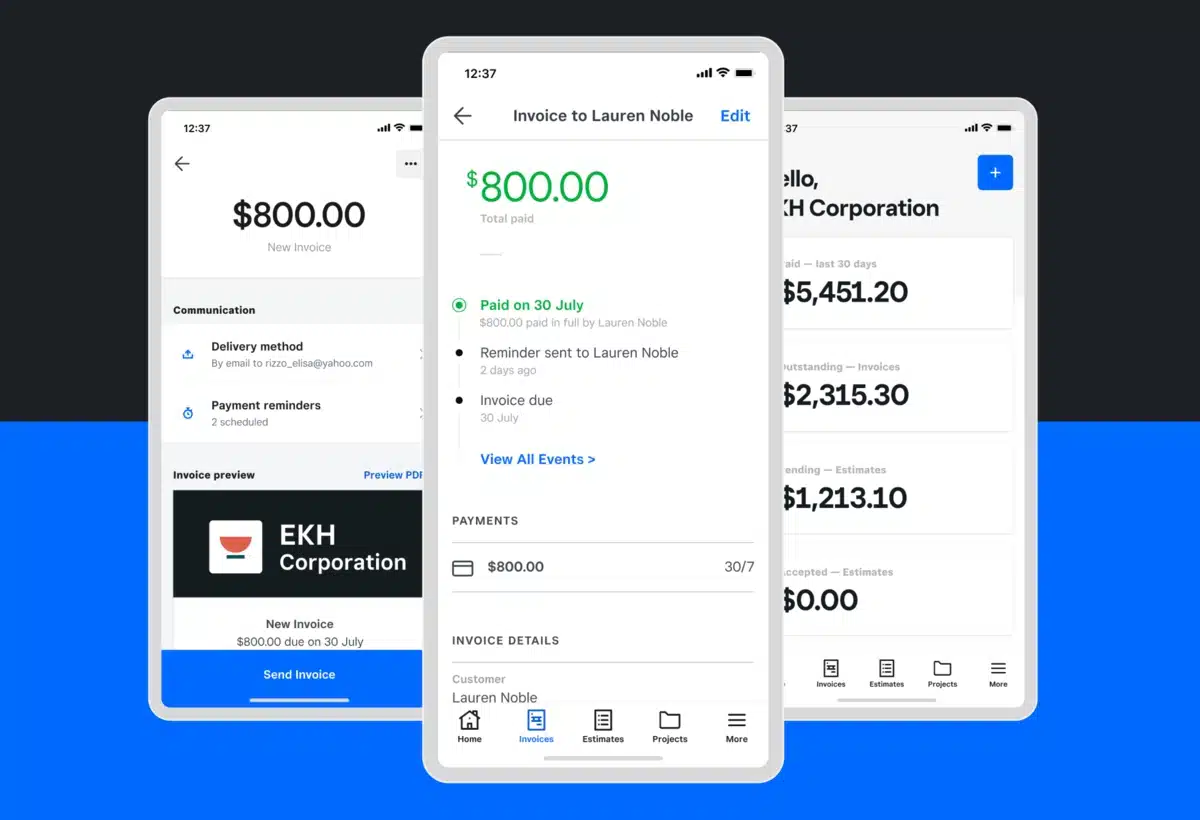

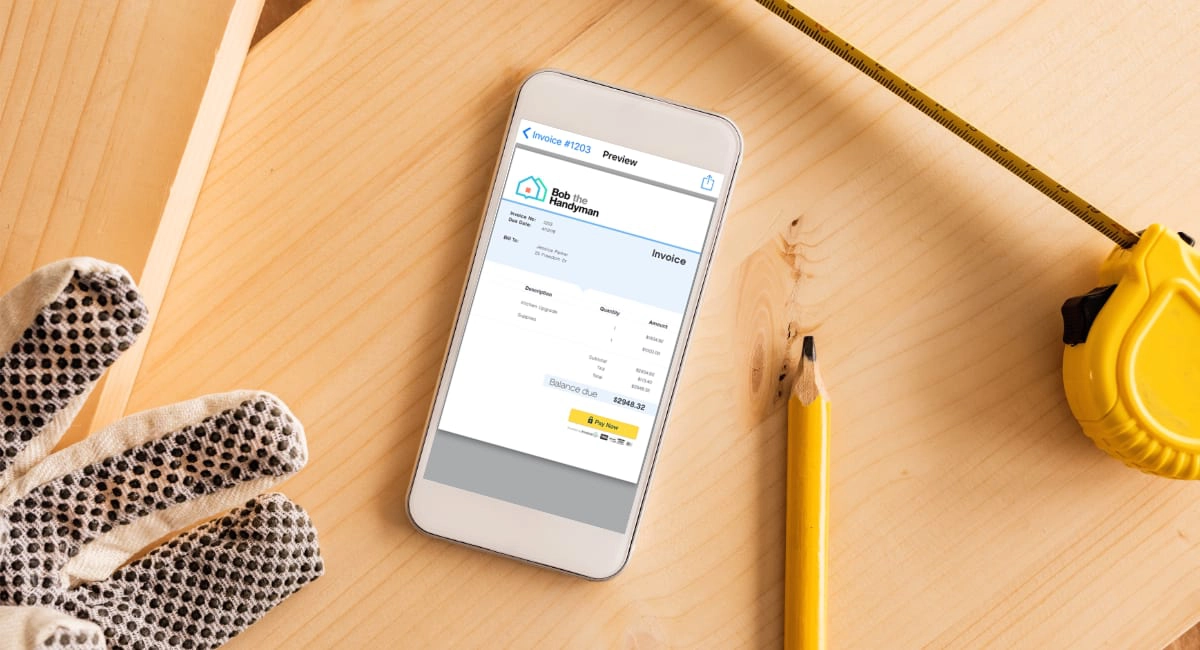

Square – best free app in Australia for all business types

Square Invoices takes the prize for being the best free invoice app in Australia.

It’s easy to use, and you can accept cards directly through the invoice for 2.2% per transaction or 6% + 30¢ + GST if Afterpay (buy now, pay later) is used.

It’s free to use the basic app features, including unlimited invoices. You only pay when the client pays online through the link in the email invoice.

The paid subscription has additional features, like custom layouts and organising project files into folders.

Square Invoices has more features than other free invoicing apps.

Payments are deposited in your bank account the next day (even on weekends), or sooner with Instant Transfers for an extra 1.5% fee.

After registering via the simple online form, Square performs identification checks to verify your business and bank account.

It can take a few business days for your bank account to link up, but invoices can be sent straight away.

On the paid plan, the app allows you to send estimates converting into invoices when the client accepts the quote. You can also set up recurring invoices, tracking and deposit requests. If the client does not pay directly through the invoice link, you can mark it as paid with cash, gift card, bank transfer or another method.

Pricing

Monthly cost: $0 (Free plan) or $30 (Plus plan)

2.2% per card transaction

6% + 30¢ + GST per Afterpay transaction

Existing users of Square Reader can already send invoices through the Square Point of Sale app. You can even accept payments directly through the invoice app with the card reader for the lower fee of 1.6%.

Integrated payments: Square (Visa, Mastercard, JCB, eftpos, American Express), Afterpay

Best for: Most accessible invoicing software for tradies who want fast payments in their bank account.

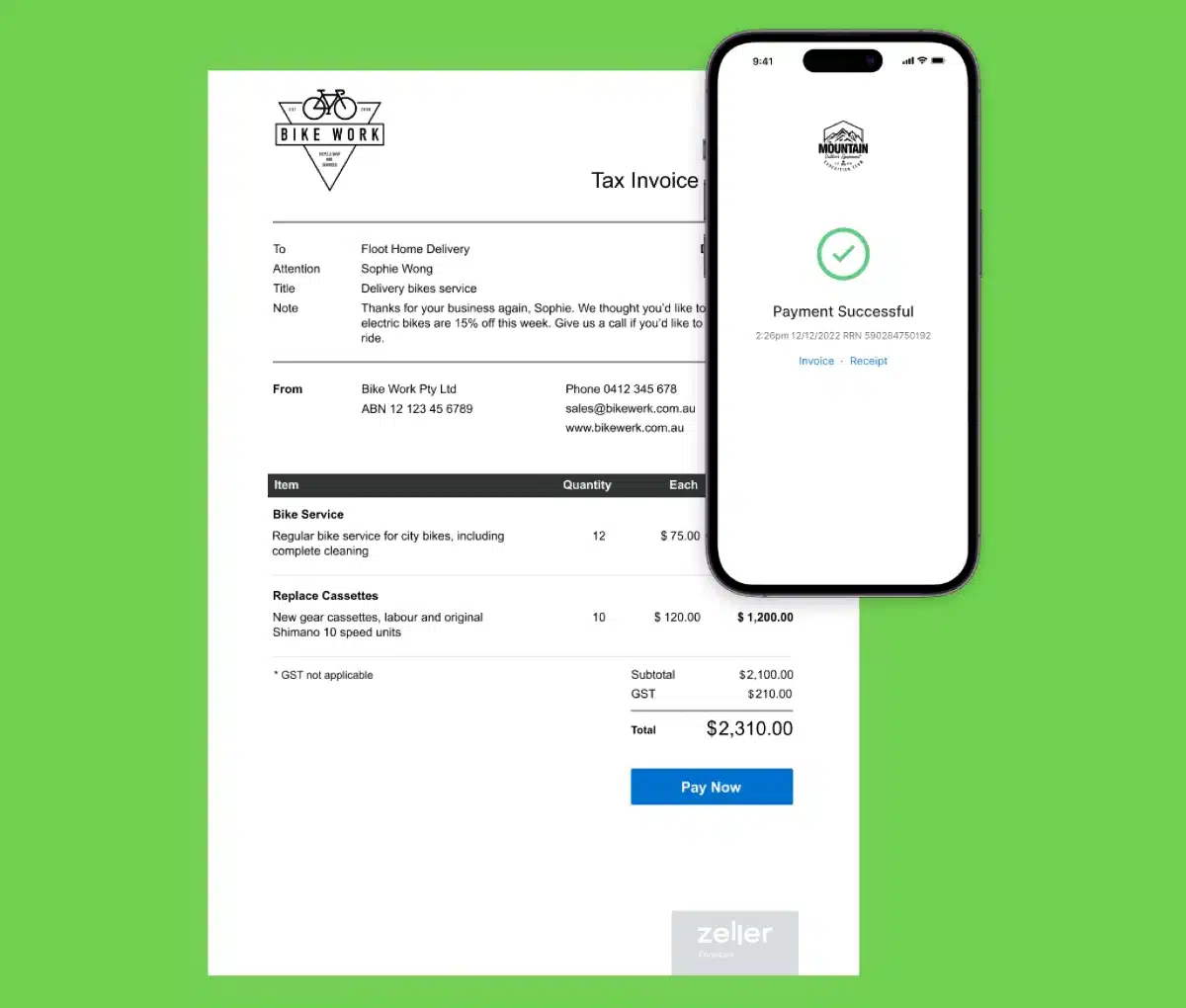

Zeller – low domestic rate, but still only web-based app

Known for its affordable EFTPOS terminal, Zeller also offers email invoicing from its web account. The Zeller App can’t yet send invoices from a phone, only monitor invoices already sent.

Zeller users can send unlimited invoices and only be charged the low rate of 1.7% + $0.25 per domestic card transaction, deducted from the transaction amount. International cards cost 2.9% + $0.25 to accept, all without a subscription or contract.

Zeller Invoices are currently sent via a web app, but customers can pay on their phones.

Features include basic customisations (like adding a logo), payment reminders, tracking payment statuses and adding customers or suppliers to each invoice. The platform also integrates with Xero and accepts different currencies, not just Australian Dollars.

Funds settle nightly in the complimentary Zeller Transaction account, which can be your main business account for income and expenses. It comes with a free Mastercard so you can spend funds directly after receiving them.

Alternatively, you can opt to receive transactions in your bank account the following (or so) business day. Either way, transfers are free to process.

Pricing

Monthly fee: Free

Card payments: 1.7% + $0.25 for domestic cards, 2.9% + $0.25 for international cards

It’s very simple to sign up for Zeller – you just complete a form on their website in a few minutes. Customer service is available for any queries or support on business days between 9AM-1AM (AET).

Integrated payments: Zeller (Visa, Mastercard, eftpos, American Express, JCB)

Best for: Merchants using Zeller Terminal who need an easy way to bill clients remotely.

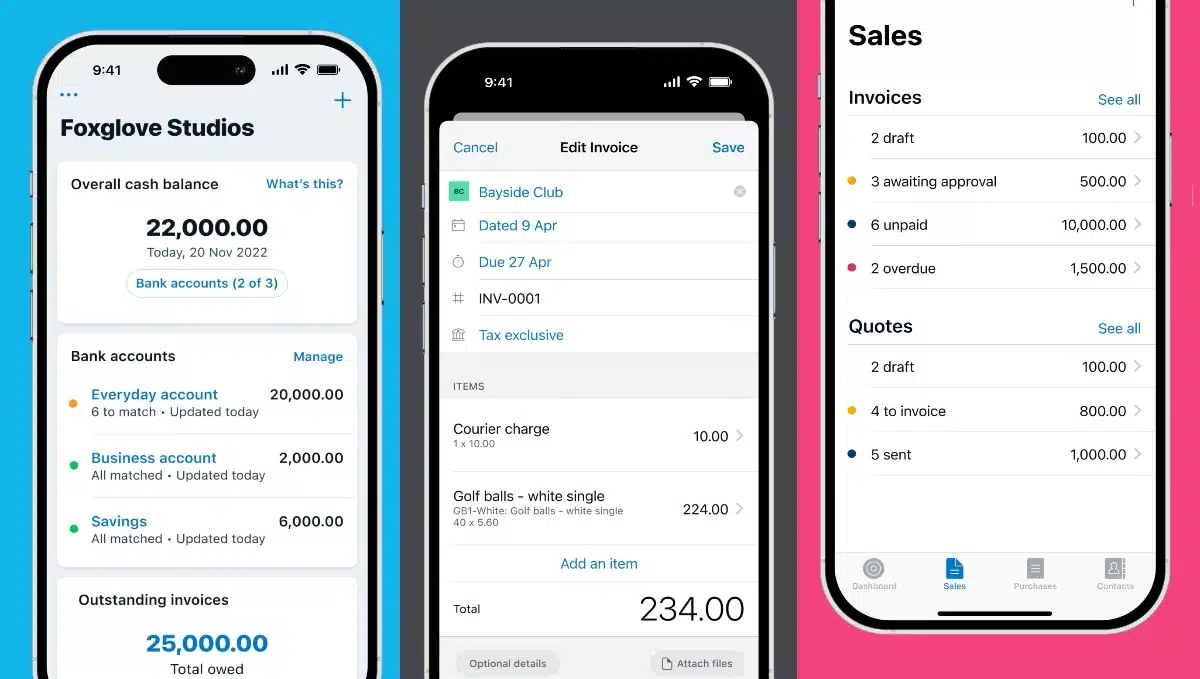

Xero – trusted by bigger businesses

Better known for its advanced bookkeeping software, Xero’s invoicing app (actually the main Xero Accounting app) is approachable for all business types, including non-profits.

The app works on iPhone and Android devices, but it’s expensive because the plans include accounting functions. You can’t just pay for invoicing for a lower price.

The main Xero Accounting app doubles as an invoicing app.

The cheapest plan, Ignite ($35/month), lets you send quotes and up to 20 invoices per month from the app, and enter 5 bills monthly. The higher plans Grow ($70/month), Comprehensive ($90/month) and Ultimate 10 ($115/month) give you unlimited invoices, quotes and bills.

Regardless of the plan, you get accounting reports, Hubdoc receipt capture and reconciliation of bank transactions. Grow reconciles transactions in bulk, while Comprehensive also works in multiple currencies.

You can add a button to invoices for accepting card payments via Stripe and bank account-to-account payments via GoCardless.

Pricing

Monthly fee: $35-$115 incl. GST

Stripe card payments: 1.7% + 30¢ (incl. GST) for domestic cards, 3.5% + 30¢ (incl. GST) for international cards, 2% + GST currency conversion fee

GoCardless direct debits: Fees via GoCardless

Accepted card payments or direct debit transfers incur a cost via Stripe or GoCardless, not Xero. It’s possible to add a payment button on invoices that’s handled by another card processor – Xero is flexible like that.

We know the system has a steep learning curve that some only tolerate if they use it for a large company. But the interface has improved over the years, and it’s generally a solid system for keeping the books in order.

Integrated payments: Stripe (Visa, Mastercard, Apple Pay, Google Pay), GoCardless bank transfers

Best for: Xero users who’d like their invoices integrated with bookkeeping.

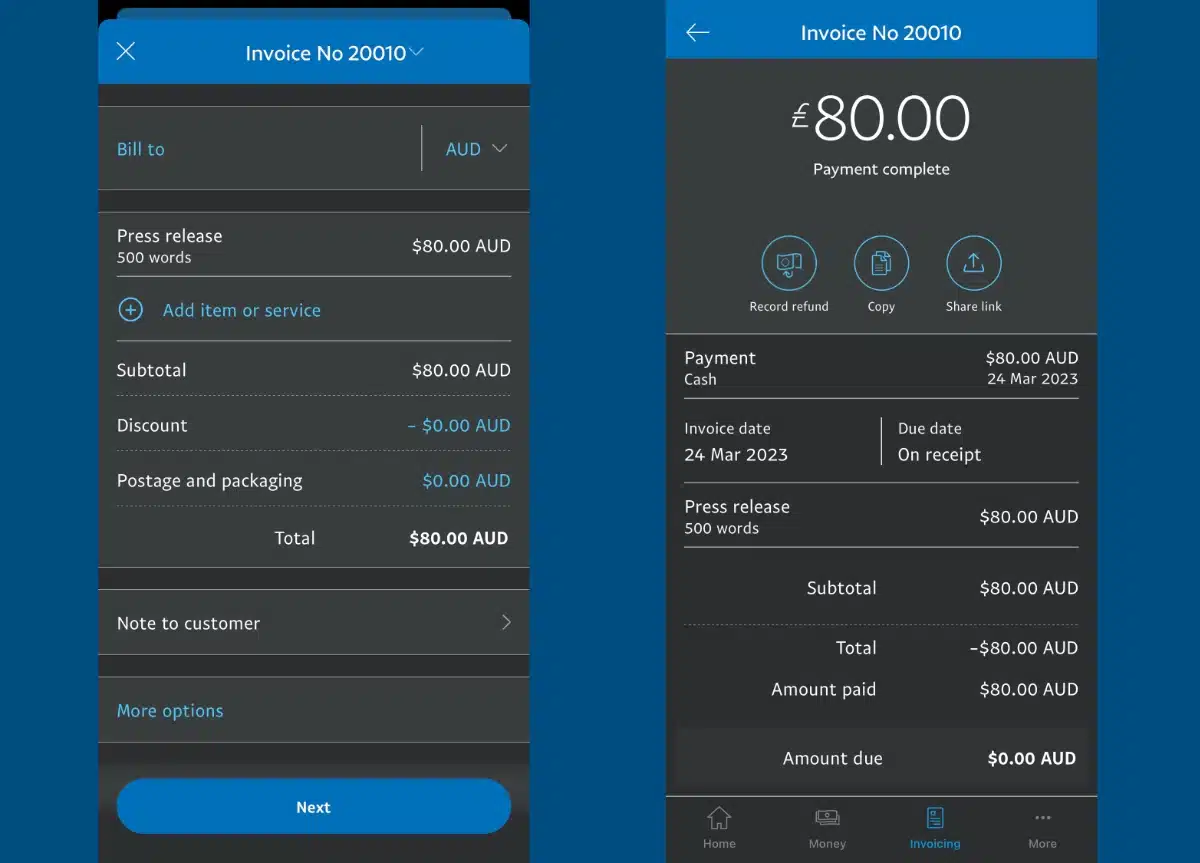

Invoice2go – dedicated invoice software

Invoice2go is a specialised invoicing system founded in Australia. With its sleek looks and branding, of course it also has an app for iPhone, iPad and Android devices.

The software includes invoice templates, invoice tracking, multi-currency support, customisations, recurrent billing and estimate-to-invoice conversion.

The invoice templates in Invoice2go have several customisation options.

Invoice2go has three plans that can be paid upfront monthly or annually (which is 16% cheaper). The cheapest, Starter, includes 30 invoices for the whole year on an annual plan ($6.67 + GST/month) or 2 invoices per month for $7.99 + GST monthly.

The annual Professional plan ($10.83 + GST/month) includes 100 invoices per year or 5 invoices per month when paying $12.99 + GST per month. If you noticed, annual plans come with more invoices when calculated per month.

Premium ($49.99 + GST monthly or $499.99 + GST annually) includes unlimited invoices.

All the subscriptions allow you to have unlimited clients, team members and projects and send unlimited estimates.

The system integrates with Stripe for card processing, taking around 3-5 business days to reach your bank account (or up to 7 business days in some cases – quite slow!).

Pricing

Monthly fee: $6.67-$41.67/month for annual plan, $7.99-$49.99/month for monthly plan (excl. GST)

Card payments (Stripe): 1.9%-2.4% + 30¢ per transaction

PayPal: 2.9% + 30¢ per transaction

Higher plans get lower transaction fees through Stripe. You can expect additional fees for cross-border payments and currency exchanges both through Stripe and PayPal.

On the plus side, Invoice2go specialises in invoicing, not the general accounting tools that QuickBooks and Xero offer along with invoicing.

But many users have said the app is cumbersome, features and saved data may disappear and that the price is too high for an increasingly problematic user experience.

Integrated payments: PayPal, Stripe (Visa, Mastercard, American Express)

Best for: Those who don’t mind paying more for a reputable, dedicated invoice app.

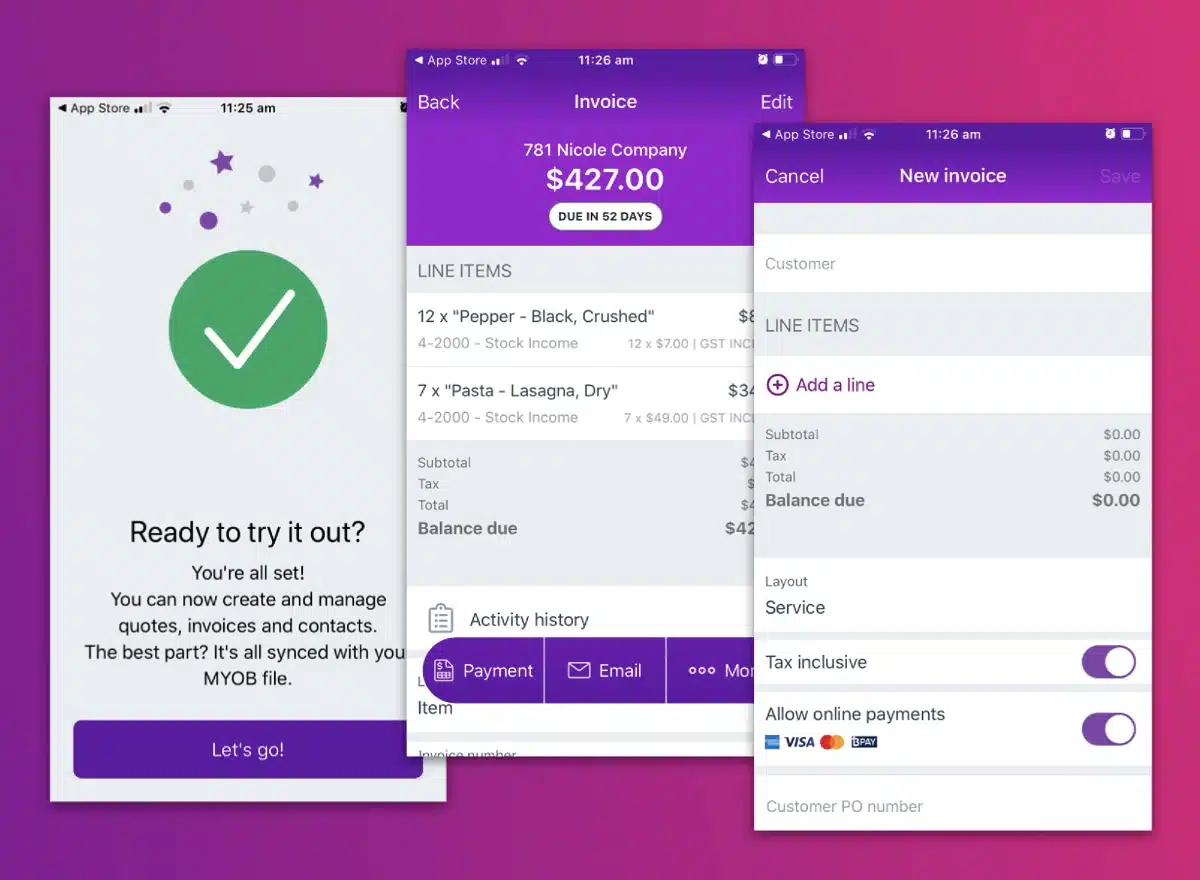

MYOB – nice invoicing apps for tradies and companies

Preferred by many accountants, Australian accounting platform MYOB offers a decent invoicing system via web browser or a mobile app.

Only paid subscribers to one of the accounting plans can use MYOB’s advanced invoicing tools.

The MYOB Invoice app works on Android and iOS phones.

The MYOB Invoice app is downloaded free on your iOS or Android smartphone after subscribing to a MYOB Business plan.

Lite ($31 + GST monthly) includes a good range of bookkeeping features like expense and income tracking, receipt capture and GST tracking.

The invoicing and quotation tools are the same on this and the higher plan, Pro ($58 + GST monthly), including unlimited invoices. Payroll can be added to all plans, which is great news for business teams.

It’s only when you upgrade to AccountRight Plus ($141 + GST monthly) or AccountRight Premier ($177 + GST monthly) that you benefit from certain advanced billing tools.

That is, the AccountRight plans include the ability to bill by time or job, and Premier adds multi-currency features. But you must download special software to activate these on a PC computer only, not Mac, MacBook or mobile device. Billing by time or project through MYOB’s mobile app is not possible.

Pricing

Monthly fee: From $11 + GST monthly for Solo app, or from $31 + GST for accounting plan with advanced invoicing

Transaction fee: 1.8% + 25¢ for cards and BPAY

Tradies might prefer the new all-in-one MYOB Solo app, a light version of invoicing and bookkeeping, for $11 + GST per month – no accounting subscription required. It handles expenses and accepts contactless payments too.

There’s no commitment on any of the plans, and the transaction fee is fair at 1.8% + $0.25 incl. GST for any credit or debit card payments and BPAY. Invoicing apps don’t usually have BPAY integrated, so that’s a key advantage.

Customer support is available all days of the week, and the sign-up is easy to do online.

Integrated payments: Visa, Mastercard, American Express, Apple Pay, Google Pay, BPAY

Best for: MYOB accounting users with access to a PC (for hourly and job-based billing), or individual tradies who want an uncomplicated, cheap app for invoicing.

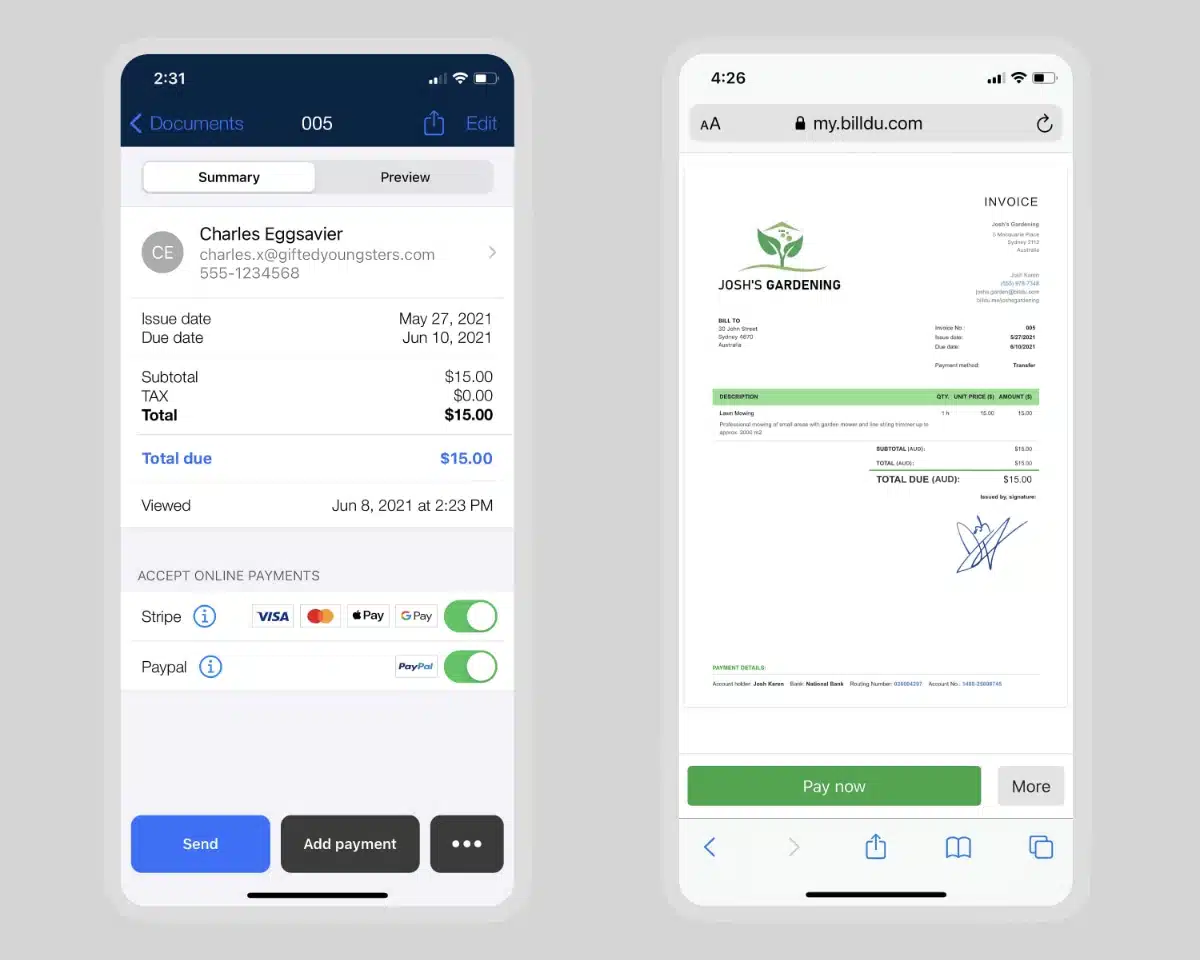

Billdu – uncomplicated invoice app for sole traders

Billdu is a British invoicing app that’s expanded its reach across the world to Australia. The invoice app can be downloaded on iPhone, iPad and Android devices and is built for ease to use.

The Billdu app has the essential features most professionals need.

All Billdu plans allow users to send unlimited invoices. Note that costs are in USD, not AUD, since this an internationally-minded software platform.

The cheapest plan, Lite (US$4.99-$7.99 + GST/month), only lets you send invoices to 10 clients and has limited features.

So we think the next plan up, Standard (US$9.99-$14.99 + GST/month), is better with its 50 client limit and payment receipts, reminders and quote requests.

To be honest, we think payment reminders are such an important feature, as it significantly increases the chance of on-time payments. The higher price for that is a bit of a stretch.

Pricing

Monthly fee: US$4.99-$19.99/month for annual plan, US$7.99-$27.99/month for monthly plan (excl. GST)

Card payments (Stripe): 1.75%-2.25% + 30¢ per transaction

PayPal: 2.9% + 30¢ per transaction

The highest plan, Premium (US$19.99-$27.99 + GST/month), has invoices for unlimited clients, recurring invoices and expenses, high-priority support and Xero integration.

Most of Billdu’s positive reviews appear to be fake. Those that appear genuine are a mixed bag of positives and plenty of negative experiences like a lack of customer service and buggy app.

We still think Billdu is worth a look as it has so many users that seem to like it.

Integrated payments: Stripe (Visa, Mastercard, Apple Pay, Google Pay), PayPal

Best for: Sole traders and individual professionals who want an easy, inexpensive invoice app.

PayPal – convenient and effective, but high rates

Honed over decades, PayPal Business is a globally popular payment account with a host of online tools.

Its PayPal Business app for iPhone and Android includes reliable invoicing features for drafting, sending and managing invoicing on the go.

Image: MobileTransaction

PayPal invoices are easily customised, sent and managed in the PayPal Business app.

To use the app and account for payment acceptance, you sign up online for a PayPal Business account. If you already have a personal account, this can be converted into a Business account, which adds online payment tools to the browser dashboard.

Having personally used PayPal Business to send invoices, we can confirm it’s easy to customise and manage them. Clients like the familiar PayPal brand, and the merchant can keep funds in their online business account along with other PayPal transactions received online.

Quotations can be sent and turned into invoices when accepted, and payment reminders are easily sent from the app if the client hasn’t paid.

Pricing

Monthly cost: None

Transaction fees: 2.6% + 30¢, plus 1% for non-Australian cards, plus 3% for currency conversion

Many merchants use PayPal for online payments because of its brand recognition/trust, Seller Protection, reliable app and – importantly – lack of monthly fee.

These are good aspects, but the transaction fee is eye-watering (2.6% + $0.30) if a client pays with a foreign card for an extra 1% fee.

You can choose to charge clients in many currencies, ideal for cross-border business – if you can afford the additional 3% cost of currency conversion. Other fees may be added depending on the type of transaction.

And beware: if you ever need customer support, it can be very difficult to get any helpful answers from PayPal.

Integrated payments: Visa, Mastercard, American Express, PayPal, others

Best for: Merchants already using PayPal for ecommerce.

Alternative invoicing apps

Various invoicing solutions are available in Australia, but many have flaws like only being accessible in a browser.

Aussie bookkeeping company Rounded has an accounting app rated highly by users, but its freelancer-focused invoicing is not as comprehensive as leading alternatives.

InvoiceBerry is another option that some tradies in Australia use, but its user base is small, and the product isn’t as honed as our top choices.

Of all accounting software, QuickBooks, FreshBooks, Zoho Books and Sage remain competitive also for invoicing. If you have an accountant or bookkeeper, it’s fair to ask them which they prefer and see if its invoice features align with your needs.

Many have heard about Wave, a low-cost, Canadian invoice solution, but this is no longer open to Australian customers.

Certain payment platforms also compete. For example, EFTPOS company Tyro has a basic invoice option confusingly called an “ecommerce feature”, but this is only available in a browser.

Stripe‘s invoices are more developed in the web portal, while its mobile app is more limited.

Alternatively, you can sign up for a business current account with invoicing. One such option is CommBank, but their invoicing is only accessible through its browser-based NetBank portal.