As your small business grows in size and resource demands, adhering to all regulatory frameworks in Australia is even more important – with any oversights being all the more costly.

Specifically, tax invoices for sales are one area that demands particular attention to detail. These invoices not only ensure accurate reporting for businesses across the country but also help facilitate a seamless tax compliance process when you’re reporting to the Australian Taxation Office (ATO).

Why tax invoices matter

Tax invoices might appear no different from your ordinary receipt at first glance, but their importance in the legal system shouldn’t go overlooked. Essentially, these documents are issued by sellers or suppliers, like yourself, to buyers or any other recipients of goods or services.

In the Australian taxation system, these serve as the tangible form of evidence that a taxable sale has actually happened, allowing your business to claim goods and service tax credits and remain generally compliant with the law.

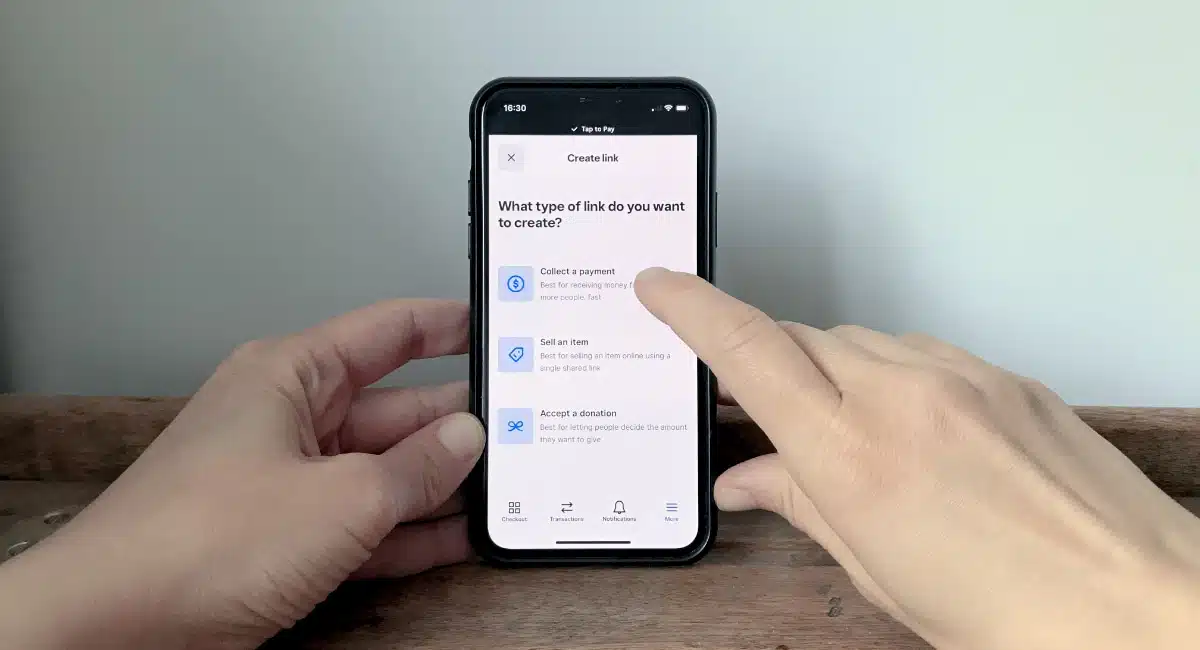

Make invoicing easier:

View the best invoice apps in Australia

The power of evidence

When it comes to taxation, being able to provide evidence is typically paramount. Aside from acting as irrefutable proof for the taxable sales, they contain other vital information, such as:

- The seller’s and buyer’s names

- ABNs (Australian Business Numbers)

- A small note of the goods or services provided, including quantities and prices

- Goods and Services Tax (GST) amount charged

Why is it so crucial for small businesses to provide tax invoices, though? Essentially, the Australian Tax Office (ATO) greatly appreciates accurate records, and that’s exactly what a valid tax invoice provides when well-organised.

Essential information on a tax invoice

You can roughly divide the invoice details into three categories: information about the seller, buyer and order details.

Firstly, the words “tax invoice” must be prominently displayed when you’re a GST-registered business. If you are are not GST-registered, just the word “invoice” is required. This is important to distinguish tax invoices from regular, so-called “simple invoices” that don’t require all the same information.

Let’s now dig into the other core points you need to include.

Seller’s information

As the seller, gathering these details should be fairly simple as you likely already have them to hand.

ABN/ACN (Australian Business Number/Australian Company Number): Any GST tax invoices need to include a unique identification number for the seller, which can be either their ABN or ACN, so they can be properly identified for any taxation purposes.

Name and address of the seller: The invoice should also state the seller’s full name and address so that the buyer can confidently identify who they’re dealing with.

Buyer’s information

Next, we have a few details from the buyer that must be included.

Buyer’s name or business name: It’s essential to add the buyer’s name or their registered business name (if they have one) on the tax invoice template so everyone involved is confident that the invoice is addressed correctly.

Buyer’s address or ABN (if applicable): Make sure the buyer’s address is also included. Not every buyer will, but if they’re a registered business, and have an ABN, be sure to ask for it because it generally smoothens the process for tax reporting and credit claims.

Invoice details

Next, we have the general details describing the billed items, pricing and order identification.

Tax invoice date: When you issue tax invoices, clearly state the date it was actually issued so both you and the buyer are able to make an accurate record of your individual tax obligations and business records.

Unique invoice number: As the seller, you are responsible for assigning a unique identification number for managing invoices. This provides a systematic way of keeping track of them for any record-keeping or auditing purposes.

Description and quantity of goods/services: Add concise information about the nature of any of the items you’ve sold, like their name, model or specifications. Additionally, the total amount of items you sold should also be specified so there’s no room for misinterpretation.

Price per item (including GST): The invoice should specify the purchase price per item and the goods and services tax if it’s an invoice for GST-registered customers (this amount should be clearly shown separately to avoid any confusion and properly reflect the amount of tax being charged).

Total amount payable: State the total amount that’s payable by the buyer, including the GST too. Essentially, this is the sum of the prices of all purchased items plus any applicable GST, providing a clear reference of the sale to the buyer.

Simplified invoices

The above list is for taxable sales above $1,000 where the business is GST-registered. For taxable sales below $1,000, there are simpler requirements for issuing tax invoices.

Though slightly more basic, these simplified tax invoices should include:

- “Tax invoice” written in the title

- Invoice’s date of issue

- Seller’s identify and Australian business number (ABN)

- Quantity, price and brief description of items paid for

- GST amounts

- Extent to which each item sold is a taxable sale

For sales over $1,000, tax invoices must also include the buyer’s identity or ABN. Invoices with those details are also fine for sales below $1,000.

Recipient-created tax invoices

Though slightly rarer, it’s also worth understanding how recipient-created tax invoices work.

In essence, these are just tax invoices that the customer generates, not the supplier. These are typically used in many business-to-business transactions when there’s already an agreement between the recipient and supplier.

So, any larger businesses making frequent or recurring transactions with the same buyer may want to consider using a recipient-created tax invoice for any GST-registered customers.

While scarcely, these are typically used by anyone involved in consignment sales to save themselves time and administrative effort.

Can you issue tax invoices electronically in Australia?

The Australian Taxation Office allows you to send and receive tax invoices electronically but only if specific criteria are met.

This includes ensuring things like the integrity and legibility of the document and providing the recipient with a copy that can be stored and retrieved in an acceptable format.