PayPal was a trailblazer in online payments, and Square was one of the first to sell mobile card readers. They are still top-of-the-line solutions for many small businesses and independent merchants, but for different reasons.

Some of their services are similar in that both offer online payment solutions. But only Square sells EFTPOS terminals and point of sale (POS) systems for in-person payments.

A PayPal Here card reader used to be sold, but new customers are no longer accepted for that. You might still see some of these card readers in use, but they are old. PayPal acquired Zettle to launch the popular Zettle Reader under its own brand, but this is still only offered by PayPal in Europe and the US, not Australia.

So how do the products, services and fees of Square and PayPal compare?

Overview of PayPal and Square products:

| Product |  |

|

|---|---|---|

| Card machines | Yes, choice of 2 | None |

| Point of sale apps | Yes, choice of 4 | None |

| Online payment methods | Payment links, QR codes, invoicing, virtual terminal, online payment gateway, recurring payments | Payment links, QR codes, invoicing, virtual terminal, online payment gateway, recurring payments |

| Business account | None | Yes, online account |

EFTPOS terminals: only Square competes here

Square sells two card terminals in Australia:

- Square Reader that works with an app on iPhone, iPad or Android device

- Square Terminal, a standalone WiFi terminal with built-in POS software

PayPal used to sell one EFTPOS reader in Australia – the PayPal Here Card Reader. It worked with a payment app downloaded on a compatible iPhone, iPad or Android phone or tablet, similar to Square Reader.

Here’s how the two app-based card readers compared:

| Square Reader | PayPal Here Card Reader | |

|---|---|---|

|

|

|

| Withdrawn from market | ||

| Technology | EMV (chip), NFC (contactless) | EMV (chip), NFC (contactless), magnetic stripe (swipe) |

| Price | $65 incl. GST | $99 incl. GST |

| Transaction fee | 1.6% | 1.95% (+ other fees) |

| Monthly fee | None | None |

| Commitment | No contract | No contract |

| Deposits | Instantly or 1-2 business days to bank account | Immediate in PayPal account |

| Accepted cards | ||

| Contactless |

| Square Reader |

PayPal Here Card Reader |

|---|---|

|

|

| Withdrawn from market | |

| Accepts chip, contactless | Accepts chip, contactless, swipe |

| $65 incl. GST | $99 incl. GST |

| 1.6% per transaction | 1.95% per transaction (+ other fees) |

| No contract, no monthly fees | No contract, no monthly fees |

| Instantly or 1-2 business days to bank account | Immediate transfers to PayPal account |

Both card readers connect with the associated mobile device via Bluetooth, utilising the phone’s or tablet’s internet connection over 3G, 4G or WiFi. None of the card readers have an inbuilt receipt printer. Only PayPal Here accepted swipe as well as the chip and contactless cards that Square Reader does.

Square Reader is quite small at 56 g and 66 x 66 x 10 mm. With no PIN pad or swipe functionality, this isn’t really a surprise.

With Square Reader, PIN entry is a little different, but nonetheless deemed secure by the payment industry.

Payment begins by first entering an amount or adding products to the cart in the Square Point of Sale app. The card payment option is then chosen, and the app communicates with the card reader over Bluetooth which is then ready to accept the card or mobile wallet.

After inserting or tapping the card, a virtual PIN pad will appear on the mobile phone’s or tablet’s screen where the customer enters their PIN code. This means you need to be ready to pass or turn the mobile device towards the customer at the point of payment, not just the card reader.

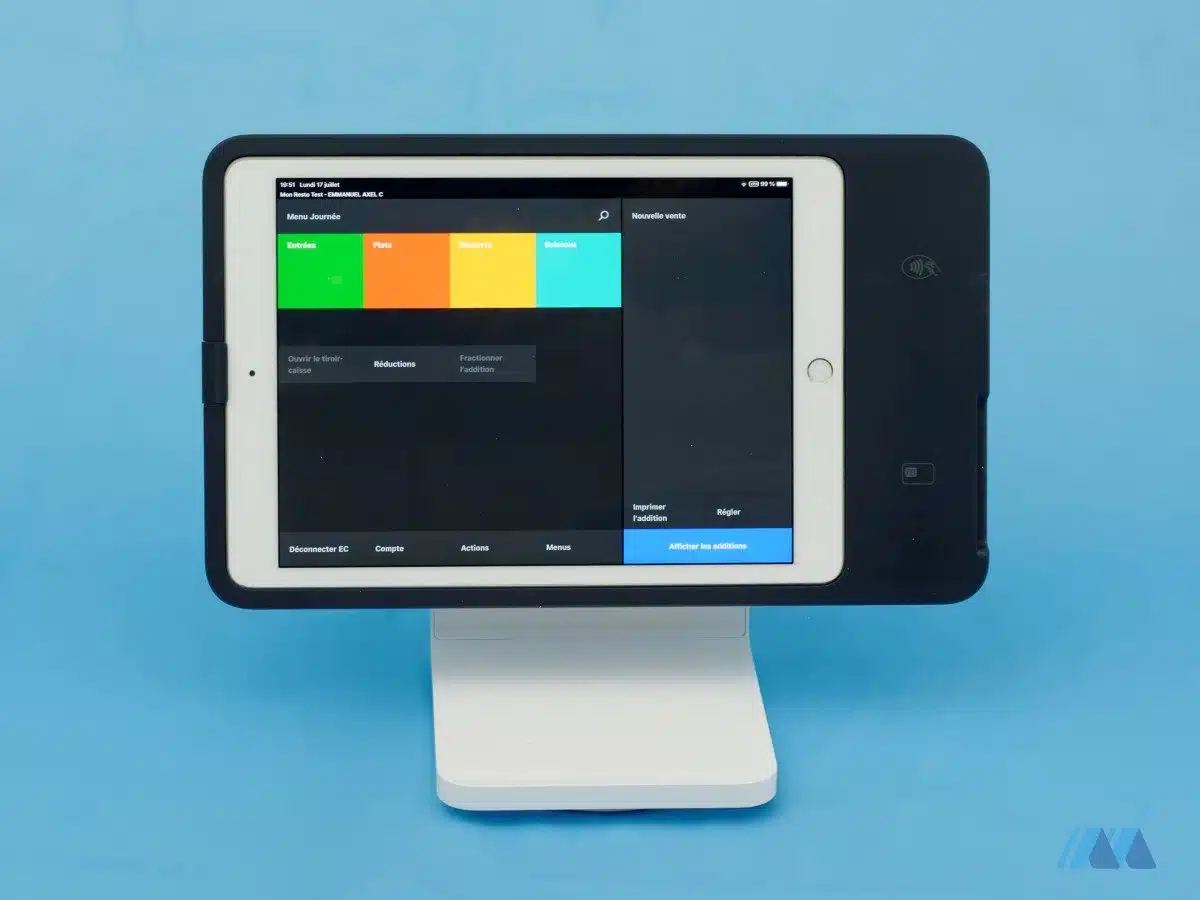

Photo: MobileTransaction

Square Terminal and Square Reader are the two EFTPOS terminals sold by Square in Australia.

Square Terminal is more expensive, since it connects directly with the internet, has a large touchscreen with POS features and prints receipts. Since it does not work on mobile networks (4G, GPRS, etc.), only secured WiFi connections, it is better suited for fixed premises. It is wireless, so it’s perfect for table service.

So is PayPal going to release a new card reader to compete with Square? Zettle Reader (below photo) was expected to be launched in Australia under the Zettle by PayPal brand, but that has not yet happened. We cannot say with certainty when or if PayPal will still do that.

Photo: MobileTransaction

Zettle Reader is sold in the US and Europe and has so far not arrived in Australia.

More charges with PayPal than Square

Firstly, it’s free to create an account with PayPal and Square, and there is no contract lock-in with either of them. The main costs incurred are for the EFTPOS equipment (in Square’s case), some of the software products, transactions and bank account transfers.

Let’s start with online payments. Square’s transaction fee for keyed payments (virtual terminal, payment links, invoice payments, etc.) is only 2.2% compared with PayPal’s standard fee of 2.6% + $0.30.

And that’s not the whole story. If you need money in your bank account, use currency conversion, refund payments regularly or get more chargebacks than the average merchant, PayPal can be significantly pricier.

|

|

|

|---|---|---|

| Commitment | No contract lock-in, no termination fee | No contract lock-in, no termination fee |

| Fixed monthly fees | None | None |

| EFTPOS terminals | $65–$259 incl. GST | n/a |

| Chip and contactless fee | 1.6%–1.6% | n/a |

| Keyed and online transaction fee | 2.2% | 2.6% + $0.30, or variable |

| Extra fee for foreign cards | None | 1% |

| Currency conversion fee | None | 3%-4% above base conversion rate |

| Transfers to bank account | 1-2 business days: Free Instant: 1.5% fee |

1% of transfer total |

| Refund fee | Transaction fee is retained | Transaction fee is retained |

| Chargebacks | Free | $15 each |

|

|

|

|---|---|---|

| Commitment | No contract lock-in, no termination fee | No contract lock-in, no termination fee |

| Fixed monthly fees | None | None |

| EFTPOS terminals | $65–$259 incl. GST | n/a |

| Chip and contactless fee | 1.6%–1.6% | n/a |

| Keyed and online transaction fee | 2.2% | 2.6% + $0.30, or variable |

| Extra fee for foreign cards | None | 1% |

| Currency conversion fee | None | 3%-4% above base conversion rate |

| Transfers to bank account | 1-2 business days: Free Instant: 1.5% fee |

1% of transfer total |

| Refund fee | Transaction fee is retained | Transaction fee is retained |

| Chargebacks | Free | $15 each |

PayPal transfers payments directly to your online PayPal account. From here, you can manually withdraw the balance to your connected bank account for a 1% fee of the transfer total. This transfer fee is a minimum of $0.25 and maximum of $10 if transferring in AUD.

Square doesn’t charge for payouts to your linked bank account when receiving transfers within 1-2 business days. There is, however, a 1,5% fee for instant transfers to a bank account, which many merchants like to make use of.

What’s more, PayPal adds a 3%-4% currency conversion fee if the customer pays with a foreign currency and you then withdraw that money to a bank account in AUD. There is also a 1% charge for accepting a non-Australian card. Square doesn’t charge for foreign cards or currency conversion (the customer’s bank processes any such fees).

For refunds, PayPal and Square keep the fees applied during the original transaction.

Chargebacks do not incur a fee with Square, but the disputed payment amount would be on hold until the case is resolved. PayPal also holds the disputed payment amount until the case is resolved, charging $15 on top of that.

As for card readers, Square Reader costs $65 and Square Terminal costs $259 including GST. There’s no delivery or setup fee for any of the options and no ongoing cost.

The transaction fee for chip and contactless payments is a fixed rate of 1.6% through Square Reader and 1.6% through Square Terminal.

Online and remote payments: similar options

The companies offer a similar range of online and remote payment methods. Here’s how they compare:

Email invoices: Both offer email invoicing in an app. With Square, there’s actually a dedicated invoice app where merchants can send, track and manage different kinds of invoices, estimates and projects. The most advanced features require a subscription. PayPal’s invoicing is free, but also less feature-rich.

Virtual terminal: A virtual terminal for over-the-phone payments comes free with Square, while PayPal charges a monthly fee for this. They’re used in a browser, with good features to cover most remote payment scenarios. Square also lets you accept keyed transactions in the mobile POS app. PayPal accepts different currencies, though.

Payment links: Both have a range of different payment link options including QR code payments, pay buttons to embed on a website, and donation links.

Recurring payments: You can set up recurring transactions, but PayPal’s option for this costs extra.

Online payment gateway: Both have options to set up an online checkout on a compatible ecommerce website, but only Square offers an online store builder too.

What about the types of payment methods accepted? Square accepts more card brands in general; eftpos and JCB, as well as Samsung Pay and Afterpay. PayPal only accepts Visa, Mastercard, American Express, Apple Pay and Google Pay – all accepted by Square.

Payouts in bank account vs online account

Unless you use PayPal for everything, Square is arguably more convenient for transfers.

PayPal transfers transactions (minus payment fees) directly to your PayPal account, which is an online e-money account. Then you can manually “withdraw” the balance to a connected bank account, which can take about two hours to clear and costs a 1% transfer fee per withdrawal.

Square doesn’t have an e-money account. Instead, transactions clear automatically in your connected bank account within 1-2 business days at no cost, or within minutes with Instant Transfers switched on for an added 1.5% fee.

If it’s easier for you – for bookkeeping purposes perhaps – the payout settings can be changed to manual transfers. Square would then hold the money until you manually transfer it to your bank account.

Square’s POS features and add-ons are better

If you’re selling in person, Square definitely has the edge with its selection of free and paid point of sale (POS) software and hardware. PayPal Australia has nothing of that sort any more.

The free Square Point of Sale app is the go-to app for general use in a small business. In it, you can manage a product library (complete with photos), send email invoices, show sales reports and allow for multiple user accounts. It works reliably when we’ve tested it many times and can be used with Square Reader.

Photo: MobileTransaction

Square Stand for iPad accepts contactless and chip cards without a separate card reader.

Food-and-drink businesses can upgrade to Square’s POS apps for restaurants, retail or appointments (with a booking system) for free or a monthly cost.

Other add-on features are available such as Square Appointments, Online Store, Team Management, Loyalty and a separate Invoices app. Square also integrates with many different platforms too, e.g. accounting and booking systems.

With all of these additional features, Square proves to be highly customisable and can adapt to your ever-changing business needs. Especially as you can add a cash drawer, receipt printer and other hardware to form an easy-to-use checkout.

Credit: App Store

The PayPal Here app had important checkout features like Square, but it wasn’t as good or comprehensive.

PayPal is only really for ecommerce, since it discontinued PayPal Here. It integrates with many website platforms and accounting, but so does Square.

PayPal has more complaints in Australia

A look at PayPal’s customer reviews is not for the faint-hearted. Many users have reported funds being held without good reason, frozen accounts and downright poor support responses to issues.

A lot of this can be attributed to PayPal’s very strict security protocols. These are great for reassuring your own customers, but can make life difficult for some merchants. This is mainly a risk if you perform what PayPal considers a suspicious-looking transaction, or if your business falls under a “high risk” category.

Square also has some complaints about account verification issues. These can occur if the merchant trades in a high-risk area and Square fails to see this during the verification process.

Our verdict

Many have found it easier to go with Square since it offers plenty of features for brick-and-mortar retailers, cafés, freelance professionals and online shops – and all with no monthly cost and few fees to worry about.

PayPal mainly caters to online businesses and tradies who send invoices, but its features can easily be more expensive. That being, its online payments are appealing to customers who recognise and trust the PayPal brand.

Although PayPal has been around for longer, Square is an expert on what face-to-face merchants want in a card reader service. It’s what they do best. PayPal tends to have more obstacles compared with Square’s transparent fees and direct transfers to a bank account.