- Highs: No monthly fees. No long-term commitment. Immediate fund availability.

- Lows: High transaction fees, especially for currency conversion. Fee for payouts. eftpos cards not accepted.

- Buy if: You already use PayPal for online transactions and would like to manage everything in one place.

Note: PayPal Here is no longer offered to merchants. For similar options, check our overview of the best EFTPOS readers.

What is PayPal Here?

PayPal is an online payments veteran operating for over 20 years in the business of online payments.

Apart from online transfers, ecommerce and other remote payments, PayPal offers a card reader service called PayPal Here. This is aimed at Australian merchants looking for an easy solution for accepting in-person card payments.

PayPal Here Card Reader accepts debit and credit cards by Visa, Mastercard and American Express and the mobile wallets Apple Pay and Google Pay, but not eftpos cards.

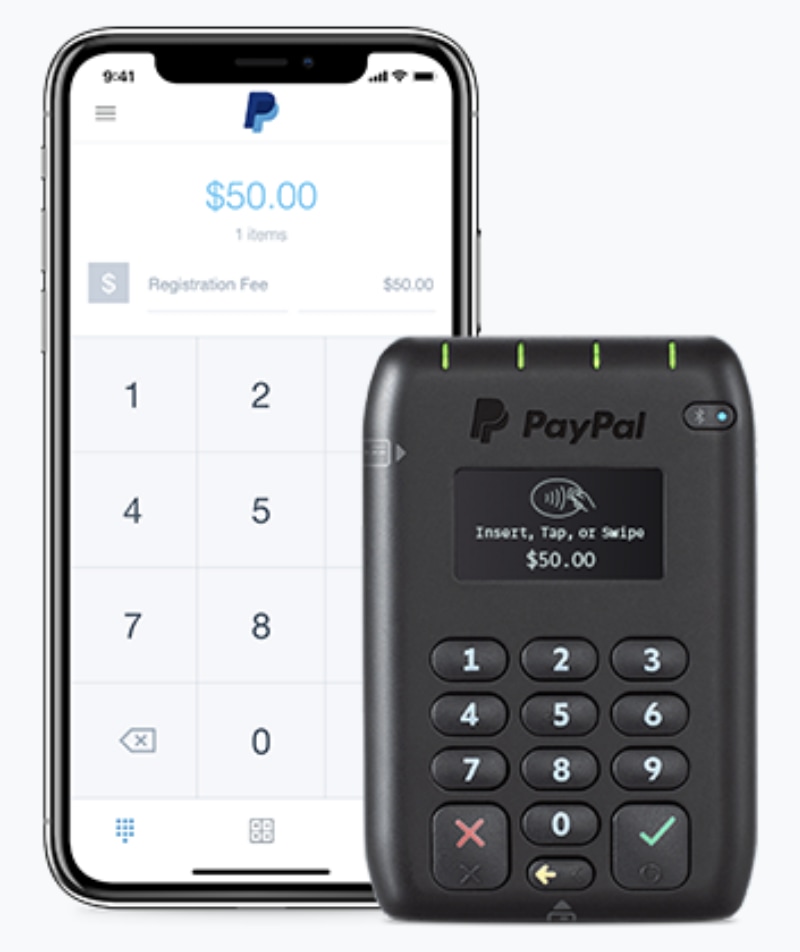

PayPal Here iOS app with card reader.

The card reader uses Bluetooth to connect to the free PayPal Here app on your iOS or Android device.

Your PayPal Here card reader and account are linked to your existing PayPal Business account (it’s free to create one if you haven’t already). From here, you can simply apply for your new POS service and order card reader.

Payments can be also accepted using only the app (no terminal required) if the customer has a PayPal account. Fees for such payments are considerably higher than standard card transactions.

All transactions are charged on a pay-as-you-go basis.

PayPal currently offers only one card reader to businesses — the Miura M010. It is officially called “PayPal Here Card Reader”. The model is essentially the same as the Mint mPOS reader, but hardcoded to work with PayPal only.

The terminal has a PIN pad for chip and PIN cards, swipe slot for magnetic stripe cards and NFC function for contactless cards and mobile wallets like Google Pay and Apple Pay.

The swipe slot is mainly for cards from the US where magstripe is still used. Australian cards will use the chip and contactless technology.

Credit: PayPal

The PayPal Here card reader.

How much does it cost?

The card reader costs $99 and ships for free.

As for transaction fees, this is where things start to get a little bit expensive. Each Visa or Mastercard transaction costs 1.95% – higher than Square’s rate of 1.6%. This applies to both domestic and foreign cards.

Manuel-entry payments in the app are also more expensive than Square with a fee of 2.9% + $0.30 per transaction in AUD. If the payment was made in a currency different from AUD, the fixed fee will be the equivalent to $0.30 in that currency.

If you receive payments in a foreign currency and withdraw that money to your bank account, you pay a 3% fee above the base conversion rate for the currency conversion to Australian dollars.

Transferring money from the online PayPal account to your bank account will also incur a fee. This comes in at 1% of the transfer total.

Advantages: quick cash flow and no monthly fee or lock-in

So what are some of the major advantages of PayPal Here?

PayPal is one of the largest and most trusted payment companies operating today. As such, you are dealing with a reputed company with a strong reputation for upholding high levels of security in its operations.

You can therefore sleep better knowing that PayPal will be around for the foreseeable future.

Secondly, there are no monthly fees with PayPal Here – you only pay for processed transactions.

Thirdly, funds from card payments are generally available immediately in your PayPal account, offering a strong cash flow advantage.

If you are already using PayPal for ecommerce or online transactions, PayPal Here is the convenient next step for your POS needs. PayPal’s dashboard is user-friendly and makes it simple to transfer money between any associated accounts — all from one place. This way, you don’t have to deal with multiple payment providers.

In addition, there are no long-term contracts and no cancellation fees. This is a significant advantage considering certain other competitors charge hefty amounts for leaving their services.

That being said, since Square arrived in Australia, PayPal Here is not the only provider of contract-free payment solutions with simple fees. This means PayPal is not necessarily the best option.

Looking for the best ecommerce? We’ve reviewed Shopify Australia

Fees and lack of eftpos support are large downsides

PayPal’s transaction fees might feel like quite a big con when weighing up your POS service. It’s something that comes with the territory of paying for a well-established name. If you trust the brand and have used their services before, this might be easy to overlook.

PayPal Here has one other large drawback. It does not accept eftpos cards.

Credit and contactless cards have seen a huge uprise in Australia of late but many people still use their cheque or savings account via an eftpos card. This cuts off a large chunk of customers from paying in-person.

Keep in mind that eftpos transactions are inexpensive for businesses when compared to cards from Visa, Mastercard and American Express. If customers are forced to use their credit cards, retailers will pay more in fees.

Compare with alternatives: Best 5 EFTPOS readers in Australia

Verdict: solid offering, but could be cheaper

PayPal Here is generally a reliable solution for processing card transactions.

Merchants will have to pay more in fees as a trade-off for this well-known brand name. And the lack of eftpos acceptance seems odd when operating in the Australian market. But with the low entry cost and no monthly fees, there are some great upsides for small businesses.

As a mobile payment solution with no lock-in contracts, a simple interface — and all from a trusted brand — PayPal Here is definitely worth a look.